Annual Report 2005-2006 - pilch

Annual Report 2005-2006 - pilch

Annual Report 2005-2006 - pilch

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

25<br />

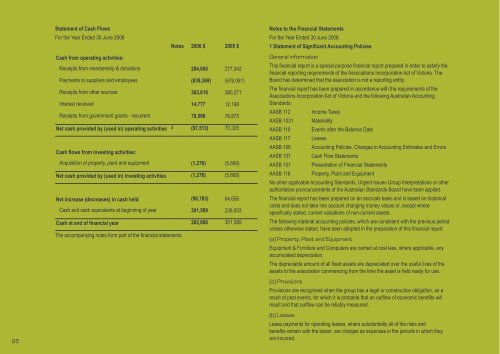

Statement of Cash Flows<br />

For the Year Ended 30 June <strong>2006</strong><br />

Notes <strong>2006</strong> $ <strong>2005</strong> $<br />

Cash from operating activities:<br />

Receipts from membership & donations 284,695 277,042<br />

Payments to suppliers and employees (839,369) (676,061)<br />

Receipts from other sources 363,818 380,271<br />

Interest received 14,777 12,198<br />

Receipts from government grants - recurrent 78,566 76,875<br />

Net cash provided by (used in) operating activities 4 (97,513) 70,325<br />

Cash flows from investing activities:<br />

Acquisition of property, plant and equipment (1,270) (5,669)<br />

Net cash provided by (used in) investing activities (1,270) (5,669)<br />

Net increase (decreases) in cash held (98,783) 64,656<br />

Cash and cash equivalents at beginning of year 301,589 236,933<br />

Cash at end of financial year 202,806 301,589<br />

The accompanying notes form part of the financial statements.<br />

Notes to the Financial Statements<br />

For the Year Ended 30 June <strong>2006</strong><br />

1 Statement of Significant Accounting Policies<br />

General information<br />

This financial report is a special purpose financial report prepared in order to satisfy the<br />

financial reporting requirements of the Associations Incorporation Act of Victoria. The<br />

Board has determined that the association is not a reporting entity.<br />

The financial report has been prepared in accordance with the requirements of the<br />

Associations Incorporation Act of Victoria and the following Australian Accounting<br />

Standards:<br />

AASB 112<br />

AASB 1031<br />

AASB 110<br />

AASB 117<br />

AASB 108<br />

AASB 107<br />

AASB 101<br />

AASB 116<br />

Income Taxes<br />

Materiality<br />

Events after the Balance Date<br />

Leases<br />

Accounting Policies, Changes in Accounting Estimates and Errors<br />

Cash Flow Statements<br />

Presentation of Financial Statements<br />

Property, Plant and Equipment<br />

No other applicable Accounting Standards, Urgent Issues Group Interpretations or other<br />

authoritative pronouncements of the Australian Standards Board have been applied.<br />

The financial report has been prepared on an accruals basis and is based on historical<br />

costs and does not take into account changing money values or, except where<br />

specifically stated, current valuations of non-current assets.<br />

The following material accounting policies, which are consistent with the previous period<br />

unless otherwise stated, have been adopted in the preparation of this financial report.<br />

(a) Property, Plant and Equipment<br />

Equipment & Furniture and Computers are carried at cost less, where applicable, any<br />

accumulated depreciation.<br />

The depreciable amount of all fixed assets are depreciated over the useful lives of the<br />

assets to the association commencing from the time the asset is held ready for use.<br />

(a) Provisions<br />

Provisions are recognised when the group has a legal or constructive obligation, as a<br />

result of past events, for which it is probable that an outflow of economic benefits will<br />

result and that outflow can be reliably measured.<br />

(b) Leases<br />

Lease payments for operating leases, where substantially all of the risks and<br />

benefits remain with the lessor, are charges as expenses in the periods in which they<br />

are incurred.