the most influential investors in global macro - IIR

the most influential investors in global macro - IIR

the most influential investors in global macro - IIR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

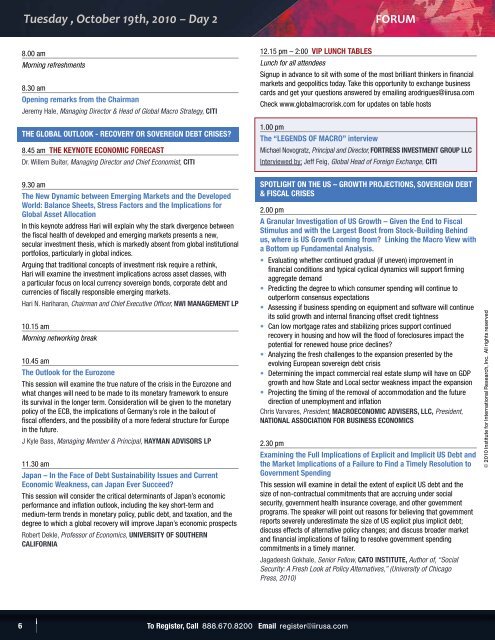

Tuesday , October 19th, 2010 – Day 2<br />

FORUM<br />

8.00 am<br />

Morn<strong>in</strong>g refreshments<br />

8.30 am<br />

Open<strong>in</strong>g remarks from <strong>the</strong> Chairman<br />

Jeremy Hale, Manag<strong>in</strong>g Director & Head of Global Macro Strategy, CITI<br />

THE GLOBAL OUTLOOK - RECOVERY OR SOVEREIGN DEBT CRISES?<br />

8.45 am THE KEYNOTE ECONOMIC FORECAST<br />

Dr. Willem Buiter, Manag<strong>in</strong>g Director and Chief Economist, CITI<br />

12.15 pm – 2:00 VIP LUNCH TABLES<br />

Lunch for all attendees<br />

Signup <strong>in</strong> advance to sit with some of <strong>the</strong> <strong>most</strong> brilliant th<strong>in</strong>kers <strong>in</strong> f<strong>in</strong>ancial<br />

markets and geopolitics today. Take this opportunity to exchange bus<strong>in</strong>ess<br />

cards and get your questions answered by email<strong>in</strong>g arodrigues@iirusa.com<br />

Check www.<strong>global</strong><strong>macro</strong>risk.com for updates on table hosts<br />

1.00 pm<br />

The “LEGENDS OF MACRO” <strong>in</strong>terview<br />

Michael Novogratz, Pr<strong>in</strong>cipal and Director, FORTRESS INVESTMENT GROUP LLC<br />

Interviewed by: Jeff Feig, Global Head of Foreign Exchange, CITI<br />

9.30 am<br />

The New Dynamic between Emerg<strong>in</strong>g Markets and <strong>the</strong> Developed<br />

World: Balance Sheets, Stress Factors and <strong>the</strong> Implications for<br />

Global Asset Allocation<br />

In this keynote address Hari will expla<strong>in</strong> why <strong>the</strong> stark divergence between<br />

<strong>the</strong> fiscal health of developed and emerg<strong>in</strong>g markets presents a new,<br />

secular <strong>in</strong>vestment <strong>the</strong>sis, which is markedly absent from <strong>global</strong> <strong>in</strong>stitutional<br />

portfolios, particularly <strong>in</strong> <strong>global</strong> <strong>in</strong>dices.<br />

Argu<strong>in</strong>g that traditional concepts of <strong>in</strong>vestment risk require a reth<strong>in</strong>k,<br />

Hari will exam<strong>in</strong>e <strong>the</strong> <strong>in</strong>vestment implications across asset classes, with<br />

a particular focus on local currency sovereign bonds, corporate debt and<br />

currencies of fiscally responsible emerg<strong>in</strong>g markets.<br />

Hari N. Hariharan, Chairman and Chief Executive Officer, NWI MANAGEMENT LP<br />

10.15 am<br />

Morn<strong>in</strong>g network<strong>in</strong>g break<br />

10.45 am<br />

The Outlook for <strong>the</strong> Eurozone<br />

This session will exam<strong>in</strong>e <strong>the</strong> true nature of <strong>the</strong> crisis <strong>in</strong> <strong>the</strong> Eurozone and<br />

what changes will need to be made to its monetary framework to ensure<br />

its survival <strong>in</strong> <strong>the</strong> longer term. Consideration will be given to <strong>the</strong> monetary<br />

policy of <strong>the</strong> ECB, <strong>the</strong> implications of Germany’s role <strong>in</strong> <strong>the</strong> bailout of<br />

fiscal offenders, and <strong>the</strong> possibility of a more federal structure for Europe<br />

<strong>in</strong> <strong>the</strong> future.<br />

J Kyle Bass, Manag<strong>in</strong>g Member & Pr<strong>in</strong>cipal, HAYMAN ADVISORS LP<br />

11.30 am<br />

Japan – In <strong>the</strong> Face of Debt Susta<strong>in</strong>ability Issues and Current<br />

Economic Weakness, can Japan Ever Succeed?<br />

This session will consider <strong>the</strong> critical determ<strong>in</strong>ants of Japan’s economic<br />

performance and <strong>in</strong>flation outlook, <strong>in</strong>clud<strong>in</strong>g <strong>the</strong> key short-term and<br />

medium-term trends <strong>in</strong> monetary policy, public debt, and taxation, and <strong>the</strong><br />

degree to which a <strong>global</strong> recovery will improve Japan’s economic prospects<br />

Robert Dekle, Professor of Economics, UNIVERSITY OF SOUTHERN<br />

CALIFORNIA<br />

SPOTLIGHT ON THE US – GROWTH PROJECTIONS, SOVEREIGN DEBT<br />

& FISCAL CRISES<br />

2.00 pm<br />

A Granular Investigation of US Growth – Given <strong>the</strong> End to Fiscal<br />

Stimulus and with <strong>the</strong> Largest Boost from Stock-Build<strong>in</strong>g Beh<strong>in</strong>d<br />

us, where is US Growth com<strong>in</strong>g from? L<strong>in</strong>k<strong>in</strong>g <strong>the</strong> Macro View with<br />

a Bottom up Fundamental Analysis.<br />

• Evaluat<strong>in</strong>g whe<strong>the</strong>r cont<strong>in</strong>ued gradual (if uneven) improvement <strong>in</strong><br />

f<strong>in</strong>ancial conditions and typical cyclical dynamics will support firm<strong>in</strong>g<br />

aggregate demand<br />

• Predict<strong>in</strong>g <strong>the</strong> degree to which consumer spend<strong>in</strong>g will cont<strong>in</strong>ue to<br />

outperform consensus expectations<br />

• Assess<strong>in</strong>g if bus<strong>in</strong>ess spend<strong>in</strong>g on equipment and software will cont<strong>in</strong>ue<br />

its solid growth and <strong>in</strong>ternal f<strong>in</strong>anc<strong>in</strong>g offset credit tightness<br />

• Can low mortgage rates and stabiliz<strong>in</strong>g prices support cont<strong>in</strong>ued<br />

recovery <strong>in</strong> hous<strong>in</strong>g and how will <strong>the</strong> flood of foreclosures impact <strong>the</strong><br />

potential for renewed house price decl<strong>in</strong>es?<br />

• Analyz<strong>in</strong>g <strong>the</strong> fresh challenges to <strong>the</strong> expansion presented by <strong>the</strong><br />

evolv<strong>in</strong>g European sovereign debt crisis<br />

• Determ<strong>in</strong><strong>in</strong>g <strong>the</strong> impact commercial real estate slump will have on GDP<br />

growth and how State and Local sector weakness impact <strong>the</strong> expansion<br />

• Project<strong>in</strong>g <strong>the</strong> tim<strong>in</strong>g of <strong>the</strong> removal of accommodation and <strong>the</strong> future<br />

direction of unemployment and <strong>in</strong>flation<br />

Chris Varvares, President, MACROECONOMIC ADVISERS, LLC, President,<br />

NATIONAL ASSOCIATION FOR BUSINESS ECONOMICS<br />

2.30 pm<br />

Exam<strong>in</strong><strong>in</strong>g <strong>the</strong> Full Implications of Explicit and Implicit US Debt and<br />

<strong>the</strong> Market Implications of a Failure to F<strong>in</strong>d a Timely Resolution to<br />

Government Spend<strong>in</strong>g<br />

This session will exam<strong>in</strong>e <strong>in</strong> detail <strong>the</strong> extent of explicit US debt and <strong>the</strong><br />

size of non-contractual commitments that are accru<strong>in</strong>g under social<br />

security, government health <strong>in</strong>surance coverage, and o<strong>the</strong>r government<br />

programs. The speaker will po<strong>in</strong>t out reasons for believ<strong>in</strong>g that government<br />

reports severely underestimate <strong>the</strong> size of US explicit plus implicit debt;<br />

discuss effects of alternative policy changes; and discuss broader market<br />

and f<strong>in</strong>ancial implications of fail<strong>in</strong>g to resolve government spend<strong>in</strong>g<br />

commitments <strong>in</strong> a timely manner.<br />

Jagadeesh Gokhale, Senior Fellow, CATO INSTITUTE, Author of, “Social<br />

Security: A Fresh Look at Policy Alternatives,” (University of Chicago<br />

Press, 2010)<br />

© 2010 Institute for International Research, Inc. All rights reserved<br />

6 To Register, Call 888.670.8200 Email register@iirusa.com