AMLAC & Fraud - IIR

AMLAC & Fraud - IIR

AMLAC & Fraud - IIR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

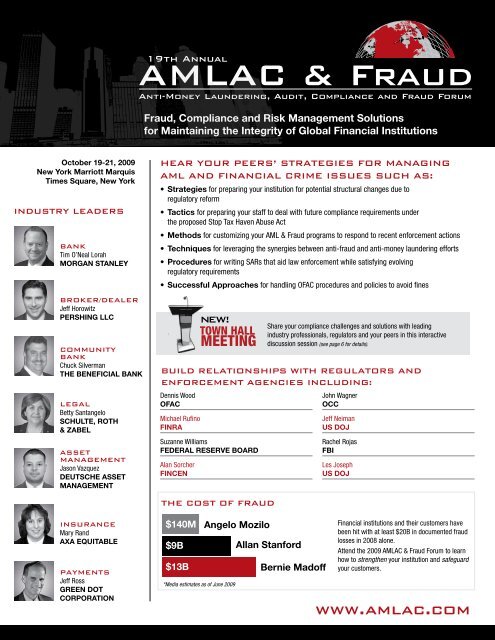

<strong>AMLAC</strong><br />

19th Annual<br />

& <strong>Fraud</strong><br />

Anti-Money Laundering, Audit, Compliance and <strong>Fraud</strong> Forum<br />

<strong>Fraud</strong>, Compliance and Risk Management Solutions<br />

for Maintaining the Integrity of Global Financial Institutions<br />

October 19-21, 2009<br />

New York Marriott Marquis<br />

Times Square, New York<br />

Industry Leaders<br />

Bank<br />

Tim O’Neal Lorah<br />

MORGAN STANLEY<br />

Broker/dealer<br />

Jeff Horowitz<br />

Pershing LLC<br />

Community<br />

Bank<br />

Chuck Silverman<br />

The Beneficial Bank<br />

Legal<br />

Betty Santangelo<br />

Schulte, Roth<br />

& Zabel<br />

Asset<br />

management<br />

Jason Vazquez<br />

Deutsche Asset<br />

Management<br />

Hear your peers’ strategies for managing<br />

AML and financial crime issues such as:<br />

• Strategies for preparing your institution for potential structural changes due to<br />

regulatory reform<br />

• Tactics for preparing your staff to deal with future compliance requirements under<br />

the proposed Stop Tax Haven Abuse Act<br />

• Methods for customizing your AML & <strong>Fraud</strong> programs to respond to recent enforcement actions<br />

• Techniques for leveraging the synergies between anti-fraud and anti-money laundering efforts<br />

• Procedures for writing SARs that aid law enforcement while satisfying evolving<br />

regulatory requirements<br />

• Successful Approaches for handling OFAC procedures and policies to avoid fines<br />

New!<br />

TOWN HALL<br />

MEETING<br />

Share your compliance challenges and solutions with leading<br />

industry professionals, regulators and your peers in this interactive<br />

discussion session (see page 6 for details).<br />

BUILD RELATIONSHIPS WITH REGULATORS AND<br />

ENFORCEMENT TOWN AGENCIES HALL INCLUDING:<br />

MEETING<br />

Dennis Wood<br />

<strong>AMLAC</strong><br />

19th Annual<br />

& <strong>Fraud</strong><br />

OFAC<br />

Michael Rufino<br />

FINRA<br />

Anti-Money Laundering, Audit, Compliance and <strong>Fraud</strong> Forum<br />

Suzanne Williams<br />

Federal Reserve Board<br />

Alan Sorcher<br />

FinCEN<br />

The Cost of <strong>Fraud</strong><br />

John Wagner<br />

OCC<br />

Jeff Neiman<br />

US DOJ<br />

Rachel Rojas<br />

FBI<br />

Les Joseph<br />

US DOJ<br />

Insurance<br />

Mary Rand<br />

AXA Equitable<br />

Payments<br />

Jeff Ross<br />

Green Dot<br />

Corporation<br />

$140M<br />

$9B<br />

$13B<br />

*Media estimates as of June 2009<br />

Angelo Mozilo<br />

Allan Stanford<br />

Bernie Madoff<br />

Financial institutions and their customers have<br />

been hit with at least $20B in documented fraud<br />

losses in 2008 alone.<br />

Attend the 2009 <strong>AMLAC</strong> & <strong>Fraud</strong> Forum to learn<br />

how to strengthen your institution and safeguard<br />

your customers.<br />

www.amlac.com

19th Annual<br />

<strong>AMLAC</strong> & <strong>Fraud</strong><br />

Anti-Money Laundering, Audit, Compliance and <strong>Fraud</strong> Forum<br />

Welcome to the 19th Annual <strong>AMLAC</strong> & <strong>Fraud</strong> Forum!<br />

Bernie Madoff. Allan Stanford. Angelo Mozilo. These names alone highlight the<br />

breadth, depth and notoriety of financial fraudulent activity that has occurred over<br />

the past few years in the US alone. With the increasing visibility of financial crime,<br />

institutions must revisit and revise their anti-fraud and AML practices to safeguard<br />

their institutions, their customers, and satisfy more stringent regulations.<br />

I invite you to join me and more than 150 key compliance, risk management and fraud professionals at<br />

the 19th Annual <strong>AMLAC</strong> & <strong>Fraud</strong> Forum to find the most effective solutions for protecting your<br />

institution from illicit activity while complying with AML/BSA regulations, the USA PATRIOT ACT, and various<br />

industry-specific regulations.<br />

The <strong>AMLAC</strong> & <strong>Fraud</strong> Forum has been restructured to provide you with unparalleled access to key<br />

regulatory officials, industry practice leaders, and law enforcement professionals to help you strengthen<br />

your compliance programs and protect your institution from future fraudulent activity.<br />

Here are some of the key law enforcement and regulatory agencies that are scheduled to provide their<br />

insight, knowledge, and real-world case studies:<br />

US Department of Justice<br />

Internal Revenue Service<br />

Federal Bureau of Investigation<br />

Internal Revenue Service CI<br />

Financial Crimes Enforcement Network<br />

Office of the Comptroller of the Currency<br />

Federal Reserve Board of Governors<br />

Office of Foreign Assets Control<br />

FINRA<br />

Securities and Exchange Commission<br />

Perhaps most importantly, the <strong>AMLAC</strong> & <strong>Fraud</strong> Forum is your place to collaborate with your industry<br />

peers, not only in the sessions themselves, but through our Industry Roundtable Sessions, and in our<br />

interactive, in-depth workshops. We have also introduced our “Town Hall” meeting, which is designed to<br />

allow participants to raise and discuss issues that are most important to them, rather than issues deemed<br />

important by speakers or the conference organizer.<br />

It is imperative to seek out new strategies and solutions lest you suffer financial loss from criminal activity,<br />

fines for non-compliance, and significant damage to your firm’s reputation by letting illicit activity go<br />

unchecked.<br />

Reserve your place today to connect with more than 150 leaders from the world of compliance<br />

and security.<br />

I look forward to seeing you in October!<br />

Sincerely,<br />

Who Should Attend<br />

THE <strong>AMLAC</strong> & <strong>Fraud</strong><br />

Forum?<br />

• Broker/Dealers and Securities Firms<br />

• Global, Private, and Foreign Banks<br />

• Life Insurance Carriers<br />

• Mutual Funds and Investment Companies<br />

• Money Service Businesses<br />

• Hedge Funds and their Administrators<br />

• Investment Managers<br />

• Investment Advisors<br />

• Trust Companies and Savings Banks<br />

• Private Equity Firms<br />

• Commodity Dealers and Exchanges<br />

• Credit Card Companies<br />

• Law Firms<br />

• Surveillance and Data Base Specialists<br />

• Software Providers<br />

• Consultants and Training Companies<br />

• Accountants and Auditors<br />

• Federal Government Agents and Analysts<br />

• Federal and State Regulators<br />

• Enforcement Agencies<br />

• AML and <strong>Fraud</strong> Departments<br />

Earn up to 19 CPE<br />

CREDITS<br />

This is a Group-live event. Courses are intermediate<br />

to advanced level, no prerequisites required.<br />

This event qualifies<br />

for up to 15 CAMS<br />

credits<br />

Keith Kirkpatrick<br />

Executive Director<br />

The 19th Annual <strong>AMLAC</strong> & <strong>Fraud</strong> Forum<br />

For more information visit www.ACAMS.org<br />

or contact us at +1 786.871.3073.<br />

Why Attend the <strong>AMLAC</strong> & FRAUD FORUM?<br />

• Attend the most relevant sessions for you, broken into AML and anti-fraud tracks<br />

• Hear the latest regulatory updates and how they are applied to prevent your institution from<br />

being fined millions for noncompliance<br />

• Get practical training from compliance officers, fraud professionals, regulators and law<br />

enforcement through our hands-on workshops<br />

• Share your experiences and insights with your peers from around the world during<br />

dedicated networking and relationship building time<br />

“This was a great<br />

conference. The program<br />

was spot on.”<br />

– William Voorhees, BSA Compliance Manager,<br />

Silicon Valley Bank<br />

2 |<br />

TO REGISTER: Call +1 888.670.8200 or +1 941.951.7885 ■ Email: register@iirusa.com

PRE-CONFERENCE WORKSHOPS<br />

MONDAY, OCTOBER 19, 2009<br />

8:00 Workshop Registration/Morning Coffee 9:00 Workshops Begin 12:00 Lunch for Workshop Attendees Only<br />

A<br />

Strengthening Customer Due Diligence<br />

Processes Amid Increased Regulatory and Law<br />

Enforcement Scrutiny<br />

9:00-12:00 Choose one<br />

B<br />

Global Strategies for AML Compliance and<br />

<strong>Fraud</strong> Prevention<br />

In this workshop, you’ll hear from experienced AML, fraud and security experts,<br />

who will provide strategies for creating a cost-effective customer due diligence<br />

program, utilizing a combination of fee-based and free resources.<br />

• Analyzing techniques for conducting effective customer due diligence<br />

• Interviewing methods for identifying red flags that indicate information may<br />

not be legitimate or truthful<br />

• Identifying electronic and physical resources used by criminals to lie or evade<br />

detection during the due diligence process<br />

• The operational impact of, and liability associated with, outsourcing due<br />

diligence functions<br />

• Incorporating proper due diligence strategies for investigating fraudulent<br />

activity to find the account’s beneficial owner and source of wealth<br />

• Best practices for ensuring efficient and lawful information sharing between<br />

departments and institutions under Section 314(b) of the USA PATRIOT ACT<br />

Leaders:<br />

John Wagner, Director, BSA and AML Compliance,<br />

OFFICE OF THE COMPTROLLER OF THE CURRENCY<br />

Linda Busby, AML Officer, RAYMOND JAMES FINANCIAL<br />

Kevin Taylor, VP, Compliance, PERSHING ADVISOR SOLUTIONS LLC<br />

For institutions with customers located around the world, the importance of<br />

understanding money laundering regulations – as well as common transactions<br />

and business practices – in different regions is of paramount importance.<br />

In this workshop, participants will hear an overview of the major regulatory and<br />

fraud activity occurring in each region.<br />

Then, small roundtable groups will be set up so that each region can be<br />

discussed in an informal setting conducive to best-practice information sharing<br />

and exchange.<br />

Table 1: Canada<br />

Table 2: UK & Western Europe<br />

Table 3: Russia & Eastern Europe<br />

Table 4: Africa<br />

Table 5: Asia/Pacific<br />

Table 6: Latin America/Caribbean<br />

Leaders:<br />

Zoe Lester, St. George Group AML/CTF Compliance Officer, Financial Crimes<br />

Management, WESTPAC BANKING CORP.<br />

Stephanie Lowy, SVP, Global AML Risk Management and Policy Director,<br />

CITI PRIVATE BANK<br />

Erik Wilgenhof Plante, Senior Compliance Officer, COMMERZBANK AG<br />

Stella Aku Attakpah, AML/CFT Consultant, IAEA<br />

MAIN CONFERENCE DAY ONE<br />

MONDAY, OCTOBER 19, 2009<br />

© 2009 Institute for International Research, Inc. All rights reserved<br />

12:00 Registration for Main Conference<br />

1:00-1:15<br />

Opening Remarks from the Conference Chairs<br />

1:15-2:15<br />

Understanding the Latest Law Enforcement Initiatives for<br />

Identifying Trends and Preventing <strong>Fraud</strong><br />

The key to stopping financial crime often lies with understanding the<br />

environmental trends at large which can create a fertile ground for criminal<br />

activity. In this session, you’ll hear about the latest trends in AML, fraud and other<br />

criminal activity from law enforcement professionals. You’ll also gain insight into<br />

how enforcement agencies are working with industry professionals to effectively<br />

identify financial crime across a variety of institutions. Finally, the panel will<br />

discuss the best ways for you to identify and deter crime within your organization,<br />

based on the most current trends and data.<br />

John Caruso, Managing Director, Head of AML Compliance,<br />

DEUTSCHE BANK<br />

Lester Joseph, Principal Deputy Chief- Asset Forfeiture & Money Laundering,<br />

US DEPARTMENT OF JUSTICE<br />

Rachel Rojas, Supervisory Special Agent, FBI<br />

Tom Fleming, Asst. Director, Office of Compliance, Regulatory Policy<br />

and Programs Division, FINCEN<br />

2:15-3:15<br />

REGULATOR INSIGHTS — Avoid Penalties and Optimize<br />

Your Firm’s Defenses by Complying with the Latest AML<br />

and <strong>Fraud</strong> Regulations<br />

• Dissecting the latest trends with enforcement actions, and what they mean<br />

for institutional compliance departments<br />

• Updates on Red Flag Rule compliance strategies for creditors and financial<br />

institutions<br />

• Methods for implementing the latest FinCEN guidance on the CTR reporting<br />

exemption for depository institutions<br />

• Clarification on institution’s obligations under FINRA’s Notice to Members<br />

09-05 governing unregistered resales of restricted securities<br />

• Strategies for AML compliance with derivatives and Forex exchange transactions<br />

• Analysis and updates on the impact of the <strong>Fraud</strong> Enforcement & Recovery Act of<br />

2009 on AML and fraud prevention<br />

• AML compliance for managing wash sales, cross trades and market domination<br />

Moderator:<br />

Betty Santangelo, Partner, SCHULTE, ROTH & ZABEL<br />

John Wagner, Director, BSA and AML Compliance, OFFICE OF THE<br />

COMPTROLLER OF THE CURRENCY<br />

Michael Rufino, SVP, Member Regulation, Sales Practice Review, FINRA<br />

Alan Sorcher, Sr. Advisor for Cross-Sector Regulatory Strategies, FINCEN<br />

3:15-3:45 Networking Break<br />

www.amlac.com<br />

| 3

MAIN CONFERENCE DAY ONE<br />

MONDAY, OCTOBER 19, 2009<br />

3:45-4:45<br />

Incorporating Effective OFAC Compliance Strategies to<br />

Avoid Costly Fines<br />

• Analyzing the differences between administrative and criminal enforcement, and<br />

how that will impact your institution<br />

• Understanding how foreign entities can be held liable for OFAC violations if the<br />

transactions occur between anyone defined as a “US Person” or within the US<br />

• Methods for managing foreign account monitoring, takeovers and escalating<br />

issues of concern<br />

• Confirming that the company has provided appropriate training on the OFAC<br />

compliance requirements<br />

• Dealing with third-party payment processor risks<br />

• Ensuring effective controls are in place for holding frozen assets until they’re<br />

permitted to be released by OFAC<br />

Moderator:<br />

Steve Shine, Chief Regulatory Counsel, PRUDENTIAL FINANCIAL<br />

Dennis Wood, Assistant Director, OFFICE OF FOREIGN ASSETS<br />

CONTROL<br />

Judith C. Gruenbaum, Compliance Managing Director, SVP,<br />

JPMORGAN CHASE<br />

Steve Ganis, Of Counsel, MINTZ, LEVIN<br />

Irwin Nack, SVP, Head BSA/AML Compliance, Compliance Division for the<br />

Americas, BANK OF TOKYO-MITSUBISHI UFJ, LTD.<br />

4:45 End of Day 1<br />

Interested in<br />

Sponsoring<br />

or Exhibiting<br />

at this<br />

event?<br />

Sponsored Events and Table Top Exhibits: Are you looking for a creative way to reach top-level<br />

decision-makers? Why not consider sponsoring a luncheon, cocktail party or refreshment break? Maybe you’re<br />

looking for the perfect forum to showcase your products and services or an onsite communication center.<br />

For information on sponsorship opportunities please contact Andrew Borowiec at +1 646.895.7468 or<br />

aborowiec@iirusa.com.<br />

Exhibitions: Exhibit space will be available at this conference offering you the perfect forum to showcase your<br />

products and services.<br />

This is your chance to make valuable contacts and have your tabletop display serve as your communications center.<br />

Please call Ashley Chiplock at +1 646.895.7481 or achiplock@iirusa.com.<br />

MAIN CONFERENCE DAY Two<br />

TuesDAY, OCTOBER 20, 2009<br />

8:30 Morning Coffee<br />

9:00-<br />

9:50<br />

A<br />

For AML Officers & Departments<br />

Writing SARs that Aid Law Enforcement and Satisfy<br />

Regulatory Requirements<br />

• Balancing the need to provide law enforcement with relevant information<br />

vs. limiting defensive filings<br />

• Best practices for filing a SAR on multiple subjects or accounts related to<br />

the same suspicious activity<br />

• Guidance on whether SARs should be filed on regular fraudulent activity,<br />

based on industry exceptions<br />

• Managing 314(b) requests from within your corporate entity and from<br />

external institutions<br />

Moderator:<br />

Tim O’Neal Lorah, Executive Director, Global Head of AML, MORGAN<br />

STANLEY<br />

Panelists:<br />

Suzanne Williams, Manager of the BSA/AML Risk Section of the Division of<br />

Banking Supervision and Regulation, BOARD OF GOVERNORS OF<br />

THE FEDERAL RESERVE SYSTEM<br />

Steve Ganis, Of Counsel, MINTZ, LEVIN<br />

Rachel Rojas, Supervisory Special Agent, FBI<br />

Tom Fleming, Asst. Director, Office of Compliance, Regulatory Policy and<br />

Programs Division, FINCEN<br />

B<br />

For <strong>Fraud</strong> Professionals &<br />

Departments<br />

Complying with Changing Regulations for MSBs<br />

• Understanding the potential changes defined in FinCEN‘s amendments to<br />

the MSB definition<br />

• Identifying effective, lower-cost agent training solutions for MSB<br />

sales agents<br />

• Strategies for banks to communicate their expectations on due diligence,<br />

agent training & supervision, and transaction monitoring and reporting<br />

• Developing an appropriate operational structure that complies with<br />

regulations while maintaining profitable relationships with MSBs<br />

David Landsman, Executive Director, NATIONAL MONEY<br />

TRANSFER ASSOCIATION<br />

Juan Llanos, Chief Compliance Officer, UNIDOS FINANCIAL<br />

SERVICES<br />

Kevin Favreau, VP, Global AML Compliance, WESTERN UNION<br />

4 |<br />

TO REGISTER: Call +1 888.670.8200 or +1 941.951.7885 ■ Email: register@iirusa.com

9:50-<br />

10:40<br />

For AML Officers & Departments<br />

Implementing Proper Compliance Procedures to<br />

Prevent Money Laundering and Other Financial<br />

Crimes from Occurring at Your Gaming Venue<br />

• Understanding the expectations of the DOJ and the IRS relative to a Title<br />

31 program exam<br />

• Steps for identifying internal and external threats for fraud and<br />

misconduct<br />

• Methods for managing regulations (BSA, OFAC, AML) in an era of reduced<br />

revenue and increased scrutiny of institutions<br />

• Best practices for training casino staff to implement proper KYC protocols<br />

and identify potentially illegal or fraudulent behavior<br />

Karen L. Brown-Wichman, Director of Internal Audit, ACEP, LLC<br />

Donna Mayer, BSA Technical Advisor, IRS<br />

10:40 Morning Break<br />

11:15-<br />

12:00<br />

12:00-<br />

1:30<br />

A<br />

Deploying Real-World Tactics for Managing AML<br />

Regulations for Insurance Firms<br />

• Understanding beneficial ownership and strategies for OFAC<br />

name checking<br />

• Tools for flagging ‘suspicious’ or abnormal activity on an account<br />

• Tactics for working with third-parties that handle KYC due diligence to<br />

satisfy compliance requirements and protect your institution<br />

• Best practices for eliciting and verifying information from customers<br />

Mary Rand, AVP, Anti-Money Laundering, AXA EQUITABLE<br />

Albert DeLeon, Head of Compliance Advisory, Monitoring & Reporting-OCNA,<br />

ZURICH FINANCIAL SERVICES<br />

Stephanie Mitchell Hoyte, Audit Manager, AIG Internal Audit Division,<br />

AIG (invited)<br />

Roundtable Discussion – Luncheon<br />

Sign up at the Registration Desk to take part in these informal, peer-led discussion groups where you can<br />

share your challenges, ideas and solutions with your peers. Space is limited to 10 participants per table,<br />

so sign up early to reserve your place!<br />

❶ Broker-Dealers<br />

❷ Insurance Firms<br />

Mary Rand, AXA Equitable<br />

❸ AML& <strong>Fraud</strong> Department Operations for Smaller<br />

Institutions<br />

Chuck Silverman, Beneficial Bank<br />

❹ Mutual Funds<br />

Jason Vazquez, Deutsche Asset Management<br />

B<br />

For <strong>Fraud</strong> Professionals &<br />

Departments<br />

Managing the Compliance Requirements Under the<br />

Anticipated “Stop Tax Haven Abuse Act” and other<br />

Rulings Affecting Dealings with Offshore Financial<br />

Centers<br />

• Updates on the scope and depth of the new provisions of the bill<br />

• Determining ownership and beneficiaries of PFICs/shell companies to<br />

comply with new tax reporting requirements<br />

• Strategies for conducting due diligence on foreign entities that will be<br />

treated as domestic companies for income tax purposes<br />

• Identifying steps required to provide the adequate level of transparency<br />

for regulators<br />

Jason Vazquez, Head of AML Compliance, DEUTSCHE ASSET<br />

MANAGEMENT<br />

Strategies for Managing the Detection, Analysis and<br />

Development of Technology-Based <strong>Fraud</strong><br />

• Designing an appropriate platform for managing and technology red flags<br />

& other indicators of illicit activity, based on the FTC’s “red flags rule”<br />

• Techniques for identifying inside jobs and intrusions<br />

• Methods for defending against internal and external security threats,<br />

including cyber-attacks, inside jobs, and other account intrusions<br />

• Strategies for managing e-money transactions to prevent fraud and<br />

ensure proper monitoring<br />

• Steps for quickly detecting and identifying market manipulation activity<br />

Alma Angotti, Senior Counsel, FINRA<br />

Kevin Taylor, VP, Compliance, PERSHING ADVISOR SOLUTIONS LLC<br />

Tammy Hurst, SVP, Corporate Security Investigative Services – Domestic,<br />

BANK OF AMERICA<br />

❺ MSBs<br />

Juan Llanos, Unidos<br />

Financial Services<br />

❻ Large Institutions<br />

❼ FCPA Compliance Issues<br />

❽ Prepaid Issuers & Providers<br />

Jeff Ross, Green Dot<br />

Corporation<br />

MAIN CONFERENCE DAY Two<br />

TuesDAY, OCTOBER 20, 2009<br />

© 2009 Institute for International Research, Inc. All rights reserved<br />

1:30-<br />

2:20<br />

Procedures for Regulatory Compliance for<br />

Prepaid Cards<br />

• Strategies for implementing industry-driven best practices for prepaid<br />

cards, including the NBPCA Recommended Practices Document<br />

• Identifying proper agent training procedures to ensure compliance with<br />

AML regulations and anti-fraud best practices<br />

• Understanding how the latest regulatory changes, including the CARD<br />

Act of 2009, may affect money laundering activity and fraud prevention<br />

efforts, including cost and enforcement trends<br />

Suzanne Williams, Manager of the BSA/AML Risk Section of the Division of<br />

Banking Supervision and Regulation, BOARD OF GOVERNORS OF<br />

THE FEDERAL RESERVE SYSTEM<br />

Jeff Ross, Chief Compliance Officer, GREEN DOT CORPORATION<br />

2:20 Afternoon Break<br />

Leveraging the Synergies between Anti-<strong>Fraud</strong><br />

and Anti-Money Laundering: The Challenges and<br />

Opportunities<br />

• Assessing the current institutional landscape of merged AML/<strong>Fraud</strong> units<br />

in the US and abroad<br />

• Identifying cost savings and increasing transparency via leveraging IT<br />

solutions<br />

• Managing the challenges and/or limitations of a single system to handle<br />

disparate AML/fraud issues<br />

• Analyzing the benefits, challenges and opportunities of merging people,<br />

processes and procedures to handle both AML and fraud activities<br />

Zoe Lester, St. George Group AML/CTF Compliance Officer, Financial Crimes<br />

Management, WESTPAC BANKING CORP.<br />

Grady Williams, VP, Chief Compliance Officer, NATIONWIDE BANK<br />

www.amlac.com<br />

| 5

MAIN CONFERENCE DAY two (cont.)<br />

Tuesday, OCTOBER 20, 2009<br />

2:50-3:45<br />

Managing Compliance Requirements for Clearing and<br />

Introducing Firms in an Era of Increased Scrutiny and<br />

Reduced Resources<br />

Key Takeaways:<br />

• Understanding the regulatory requirements and CIP obligations for each firm<br />

• Strategies for ensuring BSA compliance when a US broker-dealer establishes a<br />

clearing relationship with a foreign financial institution<br />

• Techniques and questions to ask when relying on a Registered Investment<br />

Advisor to handle CIP duties<br />

• Managing OFAC compliance obligations to avoid costly penalties<br />

Panelists:<br />

Jeffrey D. Weiss, Managing Director, Anti-Money Laundering, KNIGHT EQUITY<br />

MARKETS, L.P.<br />

Jeff Horowitz, Managing Director, Chief AML Officer, PERSHING LLC<br />

Elizabeth Paige Baumann, Deputy AML, FIDELITY INVESTMENTS<br />

Michael Rufino, SVP, Member Regulation, Sales Practice Review, FINRA<br />

MAIN CONFERENCE DAY three<br />

Wednesday, OCTOBER 21, 2009<br />

8:15-8:45 Morning Coffee<br />

8:45-9:45<br />

Q&A with the Department of Justice<br />

In February 2009, UBS entered into a historic deferred prosecution agreement with<br />

the US government in which UBS admitted to helping U.S. taxpayers hide accounts<br />

from the IRS. As part of the DPA, UBS agreed to provide the U.S. government with<br />

the identities of, and account information for, certain United States customers of<br />

UBS’s cross-border business. This case is likely to have significant repercussions<br />

for institutions with private client groups, especially with respect to privacy,<br />

confidentiality, tax evasion and money laundering statutes, and could mark a<br />

significant change in the way “private accounts” are administered. Although the<br />

prosecutors can’t discuss the specifics of the UBS case, they will be on hand to<br />

provide details on the types of strategies the Department of Justice is employing<br />

to prosecute cross-border tax evasion and money laundering activity. Participants<br />

also will get the opportunity to directly address their questions to the presenters.<br />

Jeffrey A. Neiman, AUSA<br />

Kevin M. Downing, Senior Litigation Consultant<br />

9:45-10:45<br />

Industry Roundtable: Techniques for Customizing your<br />

AML & <strong>Fraud</strong> Program Based on Your Business Model<br />

and Recent Enforcement Actions and Fines<br />

Institutions have realized that the most effective anti-money laundering programs<br />

and anti-fraud programs are specifically designed to manage the unique risks and<br />

customer types within a specific institution.<br />

In this discussion session, participants will be able to question a panel of bank<br />

and broker/dealer industry compliance and fraud professionals on the strategies<br />

they’ve used to develop a robust and compliant AML program.<br />

Banks:<br />

Judith C. Gruenbaum, Compliance Managing Director, SVP, JPMORGAN CHASE<br />

Chuck Silverman, AML Program Director, BENEFICIAL BANK<br />

Emily Borowski, AVP, Risk & Compliance, NOTRE DAME FEDERAL<br />

CREDIT UNION<br />

Broker/Dealers:<br />

Jeffrey D. Weiss, Managing Director, AML, KNIGHT EQUITY MARKETS, L.P.<br />

Katherine M. Sikora Nelson, Global Compliance - AML, Chair, Broker-Dealer AML<br />

Committee, BANK OF NEW YORK MELLON<br />

3:45-4:45<br />

Understanding the Latest Financial Crime Trends to<br />

Better Protect Your Institution<br />

Key Takeaways:<br />

• Hear real-world data from recent case studies describing the techniques used<br />

to perpetrate fraud<br />

• Analyze the clues or marks indicating transactional anomalies or behavioral<br />

patterns that could have identified illicit activity before it occurred<br />

• Techniques for setting your security and monitoring systems to ‘red flag’<br />

suspicious activity<br />

• Strategies for properly setting up accounts, surveillance programs, and<br />

reporting protocols to aid in early fraud detection<br />

Panelists:<br />

Rachel Rojas, Supervisory Special Agent, FBI<br />

David Chaves, Supervisory Special Agent, FBI<br />

4:45 End of Day 2<br />

10:45-11:15 Networking Break<br />

11:15-12:15<br />

Identifying Solutions for Emerging<br />

TOWN HALL<br />

AML & <strong>Fraud</strong> Issues<br />

MEETING<br />

In this interactive discussion, panelists and the<br />

audience will have the opportunity to address<br />

outstanding issues that are expected to receive significant attention from<br />

regulators and law TOWN enforcement HALL over the coming months. The moderator will open<br />

the discussion by raising MEETING topical issues of the day, and then ask the facilitators to<br />

provide their insights.<br />

Participants will be asked to bring their questions, issues and concerns, and are<br />

encouraged to seek out their peers for suggestions and solutions.<br />

• Strategies for dealing with examination requests for granular information<br />

• Dealing with new regulations relating to cross-border ACH transfers<br />

• Understanding changes in regulatory jurisdiction and how it affects compliance<br />

structures and strategy<br />

• The impact of Internet gaming regulations on due diligence requirements for<br />

financial institutions<br />

• New regulations covering senior issues, unregistered offerings, business<br />

continuity planning, and internal controls against potential business corruption<br />

(including FCPA issues)<br />

• Transition to the new regulatory structure and environment in a post-Madoff world<br />

Facilitators:<br />

Jack Sonnenschein, VP, Enterprise Compliance Risk Management,<br />

AMERICAN EXPRESS<br />

Linda Busby, AML Officer, RAYMOND JAMES FINANCIAL<br />

Meg Zucker, Executive Director, MORGAN STANLEY<br />

Irwin Nack, SVP, Head BSA/AML Compliance, Compliance Division for the<br />

Americas, BANK OF TOKYO-MITSUBISHI UFJ, LTD<br />

Kevin Favreau, VP, Global AML Compliance, WESTERN UNION<br />

12:15 End of Main Conference<br />

6 |<br />

TO REGISTER: Call +1 888.670.8200 or +1 941.951.7885 ■ Email: register@iirusa.com

Post-CONFERENCE Workshop<br />

Wednesday, OCTOBER 21, 2009<br />

Administrative Details<br />

© 2009 Institute for International Research, Inc. All rights reserved<br />

12:15-1:15 Lunch<br />

12:15pm-4:00pm<br />

Tactics for Developing an Interactive <strong>Fraud</strong> & Risk<br />

Assessment Program<br />

The development of an effective risk assessment program is largely<br />

dependent upon the thorough understanding of three specific aspects of<br />

compliance: the specific risk factors affecting your firm, the regulations<br />

specific to your line(s) of business, and the expectations of your regulators.<br />

In this interactive workshop session, you’ll hear from compliance<br />

professionals, auditors and regulators on the best practices for setting up an<br />

appropriate risk matrix.<br />

The workshop leaders and participants will then collaborate on a<br />

comprehensive AML & <strong>Fraud</strong> Prevention Program Document, which can be<br />

used as a best-practices guide for developing a risk assessment strategy.<br />

After the workshop, participants will be given a USER ID and Password to<br />

access the document which they will be able to download and customize to<br />

their particular business model.<br />

Leaders:<br />

David MacNair, Director, AML & <strong>Fraud</strong> Department, BARCLAYS CAPITAL<br />

Jack Sonnenschein, VP Enterprise Compliance Risk Management,<br />

AMERICAN EXPRESS<br />

Emily Borowski, AVP, Risk & Compliance, NOTRE DAME FEDERAL<br />

CREDIT UNION<br />

Grady Williams, VP, Chief Compliance Officer, NATIONWIDE BANK<br />

Russell Cronan, Sr., National Bank Examiner, BSA/AML Specialist,<br />

Compliance Policy, OCC<br />

4:00 Workshop Concludes<br />

Dates and Venue<br />

October 19-21, 2009<br />

New York Marriott Marquis<br />

1535 Broadway, New York, NY 10036<br />

Accommodations: A block of rooms will be held for a limited period of<br />

time at the New York Marriott Marquis. All hotel bookings must be made through our<br />

travel partner at the etouches internet booking site. Please visit www.etouches.com/iir<br />

to make your reservations. If you do not have web access, or need additional assistance,<br />

please call etouches at (800) 516.4265 or +1 (203) 431.8950. You can also send them<br />

an email at conf@etouches.com or fax them at +1 (203) 431.9305. The hotel will not<br />

accept individual calls for room reservations at the <strong>IIR</strong> negotiated group rate.<br />

DISCOUNTed CONFERENCE AIRFARE:<br />

For discount information on JetBlue flights please visit:<br />

www.iirusa.com/<strong>AMLAC</strong>/amlac-venue.xml<br />

Any disabled individual desiring an auxiliary aid for this conference should<br />

notify <strong>IIR</strong> at least 3 weeks prior to the conference in writing by faxing<br />

+1 (212) 661.6045.<br />

Complaint Resolution Policy: For more information regarding<br />

administrative policies such as complaint and refund, please contact our offices at<br />

(888) 670.8200 or +1 (941) 951.7885.<br />

CPE Sponsors<br />

Institute for International Research is registered with the National<br />

Association of State Boards of Accountancy (NASBA) as a sponsor of<br />

continuing professional education on the national Registry of CPE<br />

Sponsors. State boards of accountancy have final authority on the<br />

acceptance of individual courses for CPE credit. Complaints regarding registered<br />

sponsors may be addressed to the National Registry of CPE Sponsors, 150 Fourth<br />

Avenue, Nashville, TN 37219-2417. Web site: www.nasba.org. For further information<br />

regarding <strong>IIR</strong>’s financial hardship policy, please contact Elizabeth Birnbaum at<br />

+1 (646) 895.7456 or via email at ebirnbaum@iirusa.com.<br />

Easy<br />

Ways to<br />

3Register<br />

Register<br />

Before<br />

7/17/09<br />

Call:<br />

Email:<br />

Web:<br />

<strong>AMLAC</strong><br />

Before<br />

8/21/09<br />

+1 888.670.8200 or<br />

+1 941.951.7885<br />

register@iirusa.com<br />

www.amlac.com<br />

Before<br />

9/25/09<br />

After<br />

9/25/09<br />

Conference Only $2,095 $2,295 $2,395 $2,495<br />

Conference + 1<br />

Workshop<br />

$2,495 $2,695 $2,795 $2,895<br />

Conference + 2<br />

Workshops<br />

$2,695 $2,895 $2,995 $3,095<br />

Special rates for MSB/Small Institution<br />

& Government*<br />

Conference Only $1,466 $1,607 $1,677 $1,747<br />

Conference + 1<br />

Workshop<br />

$1,747 $1,887 $1,957 $2,027<br />

Conference + 2<br />

Workshops<br />

$1,887 $2,027 $2,097 $2,167<br />

*Government Discounts:<br />

Must work for a government agency or regulatory authority, subject to <strong>IIR</strong> approval. No two discounts may<br />

be combined. Small Institutions/MSBs. Must work for a licensed money services business or at an institution<br />

with less than $500 million in assets. Subject to <strong>IIR</strong> approval<br />

Group Discounts Available: Please contact Dan Harju at<br />

+1 646.895.7439 for details. No two discounts can be combined.<br />

Group Rates available for Banks & Financial Institution Teams - Register 4 or more people<br />

at the same time to each receive 25% off of standard pricing.<br />

Can not be combined with any other discounts must register by phone. Not available to web registrations.<br />

Fee: The standard fee for attending <strong>IIR</strong>’s <strong>AMLAC</strong> and <strong>Fraud</strong> Forum is outlined on the<br />

registration form. This includes the luncheon and refreshments, and the conference<br />

documentation and materials submitted by the speakers. You may enclose payment with<br />

your registration or we will send an invoice. Payment is due within 30 days of registering.<br />

If registering within 30 days of the event, payment is due immediately. Payments can<br />

be made by check, Visa, MasterCard, Discover, Diners Club or American Express. Please<br />

make all checks payable to the “Institute for International Research, Inc.” and write the<br />

name of the delegate(s) on the face of the check, as well as our reference code: U2402.<br />

If payment has not been received prior to registration the morning of the conference, a<br />

credit card hold will be required.<br />

Cancellation Policy: If you need to make any changes or have any<br />

questions, please feel free to contact us via email at register@iirusa.com. Cancellations<br />

must be in writing and must be received by <strong>IIR</strong> prior to 10 business days before the start of<br />

the event. Upon receipt of a timely cancellation notice, <strong>IIR</strong> will issue a credit voucher for the<br />

full amount of your payment, which may be applied towards registration fees at any future<br />

<strong>IIR</strong> event held within 6 months after issuance (the “Expiration Date”). All credit vouchers<br />

shall automatically expire on the Expiration Date and shall thereupon become void.<br />

In lieu of issuance of a credit voucher, at your request, <strong>IIR</strong> will issue a refund less a $795<br />

processing fee per registration. Registrants are advised that no credit vouchers or refunds<br />

will be issued for cancellations received less than ten business days prior to start of the<br />

event, including cancellations due to weather or other causes beyond the Registrant’s<br />

control. <strong>IIR</strong> therefore recommends that registrants allow for unexpected delays in making<br />

travel plans. Substitutions are welcome at any time. If for any reason <strong>IIR</strong> decides to cancel<br />

this conference, <strong>IIR</strong> accepts no responsibility for covering airfare, hotel or other costs<br />

incurred by registrants, including delegates, sponsors, speakers and guests.<br />

Documentation Order: If you are unable to attend the program, or<br />

would simply like to order additional sets of documentation for your colleagues, they are<br />

available for $395 per set, including taxes, postage and shipping in the U.S. Please fill out<br />

the order form on the back of the brochure. The documentation is available two weeks<br />

after the conference takes place. CREDIT CARD PAYMENT ONLY.<br />

www.amlac.com<br />

U2402<br />

| 7

19th Annual<br />

<strong>AMLAC</strong> & <strong>Fraud</strong><br />

Anti-Money Laundering, Audit, Compliance and <strong>Fraud</strong> Forum<br />

Institute for International Research<br />

708 Third Avenue, 4th Floor<br />

New York, NY 10017-4103<br />

October 19-21, 2009 • New York Marriott Marquis • Times Square, New York<br />

Alma Angotti, FINRA<br />

Stella Attakpa, IAEA<br />

Elizabeth Paige Baumann, FIDELITY<br />

INVESTMENTS<br />

Emily Borowski, NOTRE DAME FEDERAL<br />

CREDIT UNION<br />

Karen Brown-Wichman, ACEP LLC<br />

Linda Busby, RAYMOND JAMES FINANCIAL<br />

John Caruso, DEUTSCHE BANK<br />

David Chaves, FBI<br />

Russell Cronan, OCC<br />

Sterling Daines, GOLDMAN SACHS<br />

Albert DeLeon, ZURICH FINANCIAL<br />

SERVICES<br />

Kevin Downing, DEPARTMENT OF JUSTICE<br />

Donna Mayer, IRS<br />

Stephanie Mitchell Hoyte, AIG (invited)<br />

Irwin Nack, BANK OF TOKYO-MITSUBISHI<br />

UFJ, LTD.<br />

Jeff Neiman US DEPARTMENT OF JUSTICE<br />

Mary Rand, AXA EQUITABLE<br />

Rachel Rojas, FBI<br />

Jeff Ross, GREEN DOT CORP.<br />

Michael Rufino, FINRA<br />

Betty Santangelo, SCHULTE, ROTH & ZABEL<br />

Steve Shine, PRUDENTIAL FINANCIAL<br />

Katherine Sikora Nelson, BANK OF NEW<br />

YORK MELLON<br />

Chuck Silverman, BENEFICIAL BANK<br />

Jack Sonnenschein, AMERICAN EXPRESS<br />

Alan Sorcher, FINCEN<br />

Kevin 19th Favreau, Annual WESTERN UNION<br />

Thomas Fleming, FINCEN<br />

<strong>AMLAC</strong> Steve Ganis, MINTZ, LEVIN & <strong>Fraud</strong><br />

Kevin Taylor, PERSHING LLC<br />

Jason Vasquez, DEUTSCHE ASSET<br />

Judy Anti-Money Gruenbaum, Laundering, JPMORGAN Audit, CHASECompliance MANAGEMENT<br />

and <strong>Fraud</strong> Forum<br />

Jeff Horowitz, PERSHING LLC<br />

John Wagner, OCC<br />

Tammy Hurst, BANK OF AMERICA<br />

Michael Wassell, GOLDMAN SACHS<br />

Les Joseph, DEPARTMENT OF JUSTICE Jeff Weiss, KNIGHT EQUITY MARKETS<br />

Carol Kelly, IRS (invited)<br />

Erik Wilgenhof Plante, COMMERZBANK<br />

David Landsman, NATIONAL MONEY Suzanne Williams, FEDERAL RESERVE<br />

TRANSMITTERS ASSOCIATION<br />

BOARD OF GOVERNORS<br />

Zoe Lester, WESTPAC BANKING GROUP Grady Williams, NATIONWIDE<br />

Juan Llanos, UNIDOS FINANCIAL SERVICES Dennis Wood, OFAC, US TREASURY<br />

Tim O’Neal Lorah, MORGAN STANLEY Meg Zucker, MORGAN STANLEY<br />

Stephanie Lowy, CITI PRIVATE BANK …and many more to come<br />

David MacNair, BARCLAYS CAPITAL<br />

Please, Do Not Remove Mailing Label<br />

U2402<br />

<strong>AMLAC</strong><br />

19th Annual<br />

& <strong>Fraud</strong><br />

Anti-Money Laundering, Audit, Compliance and <strong>Fraud</strong> Forum<br />

<strong>Fraud</strong>, Compliance and Risk Management Solutions<br />

for Maintaining the Integrity of Global Financial Institutions<br />

“[I liked] the opportunity to meet with counterparts in other industries to<br />

share triumphs and struggles.”<br />

— Valerie Towery, Director, Special Projects, Western Union<br />

www.amlac.com