feasibility analysis feasibility analysis

feasibility analysis feasibility analysis

feasibility analysis feasibility analysis

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

the firm to the point where its cash flow is positive. Showing how a new venture’s start-up<br />

costs will be covered is an important issue. Many entrepreneurial ventures look promising as<br />

ongoing concerns, but have no way of raising the money to get up-and-running, or are never<br />

able to recover from the costs involved. When projecting start-up expenses, it is better to overestimate<br />

rather than underestimate the costs involved. Murphy’s Law is prevalent in the startup<br />

world—things will go wrong. It is a rare start-up that doesn’t have some setbacks getting<br />

up-and-running—whether it involves unanticipated expenses or delays getting to market.<br />

In terms of raising the money needed to start a firm, you will read many anecdotes throughout<br />

this book of savvy and creative ways that entrepreneurs cover their start-up costs. For example,<br />

as we discussed earlier, David Bateman, the founder of Property Solutions, raised $100,000<br />

in cash and in-kind services by winning two prestigious business plan competitions. Similarly,<br />

Derek Gregg and Justin Swick, the entrepreneurs featured at the beginning of Chapter 10,<br />

raised over $250,000 through business plan competitions and grants to get their firm, Vandalia<br />

Research, off the ground. While participating in business plan competitions and applying for<br />

grants is hard work, in many instances these and similar types of efforts make the difference<br />

between a successful start-up and an idea that has to be dropped because of lack of funding.<br />

Financial Performance of Similar Businesses. The second component of financial<br />

<strong>feasibility</strong> <strong>analysis</strong> is estimating a proposed start-up’s potential financial performance by<br />

comparing it to similar, already established businesses. Obviously, this effort will result in<br />

approximate rather than exact numbers. There are several ways of doing this, all of which<br />

involve a little ethical detective work. First, there are many reports available, some for free and<br />

some that require a fee, offering detailed industry trend <strong>analysis</strong> and reports on thousands of<br />

individual firms. The most promising sources are shown in Table 3.5. Bizstats.com<br />

(www.bizstats.com), for example, provides a wealth of information for free. On the Bizstats<br />

Web site, entrepreneurs can type in the projected revenue of their firm, by industry<br />

classification, and receive a mock income statement in return that shows the average<br />

profitability and expense percentages of U.S. small businesses in the same category. Similarly,<br />

Bizminer.com (www.bizminer.com), which is a for-profit company, sells a wide variety of<br />

industry-related data and statistics. A portion of the company’s Web site is designed specifically<br />

for start-ups and provides information to help entrepreneurs understand how businesses similar<br />

to theirs are doing financially. Substantive reports can be purchased for as little as $99.<br />

There are also ways that entrepreneurs can track sales data, in particular, through simple<br />

observation and reviewing public records. For example, the fictitious firm New Venture<br />

Fitness Drinks, discussed earlier in the chapter, could gauge the type of sales to expect by<br />

estimating the number of people, along with the average purchase per visit, who patronize<br />

similar restaurants, like smoothie shops, in their area. A very basic way of doing this is to<br />

CHAPTER 3 • FEASIBILITY ANALYSIS 87<br />

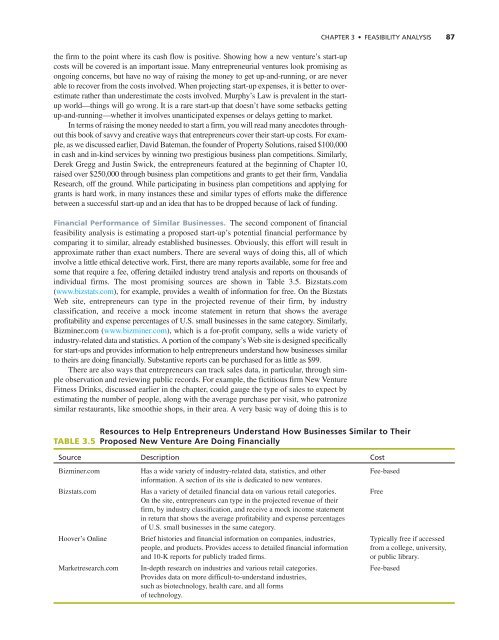

TABLE 3.5<br />

Resources to Help Entrepreneurs Understand How Businesses Similar to Their<br />

Proposed New Venture Are Doing Financially<br />

Source Description Cost<br />

Bizminer.com Has a wide variety of industry-related data, statistics, and other Fee-based<br />

information. A section of its site is dedicated to new ventures.<br />

Bizstats.com Has a variety of detailed financial data on various retail categories. Free<br />

On the site, entrepreneurs can type in the projected revenue of their<br />

firm, by industry classification, and receive a mock income statement<br />

in return that shows the average profitability and expense percentages<br />

of U.S. small businesses in the same category.<br />

Hoover’s Online Brief histories and financial information on companies, industries, Typically free if accessed<br />

people, and products. Provides access to detailed financial information from a college, university,<br />

and 10-K reports for publicly traded firms.<br />

or public library.<br />

Marketresearch.com In-depth research on industries and various retail categories. Fee-based<br />

Provides data on more difficult-to-understand industries,<br />

such as biotechnology, health care, and all forms<br />

of technology.