Understanding Emerging Markets

Understanding Emerging Markets

Understanding Emerging Markets

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CAVUMC09_254-283hr 10/15/07 11:23 AM Page 269<br />

Estimating the True Potential of <strong>Emerging</strong> <strong>Markets</strong> 269<br />

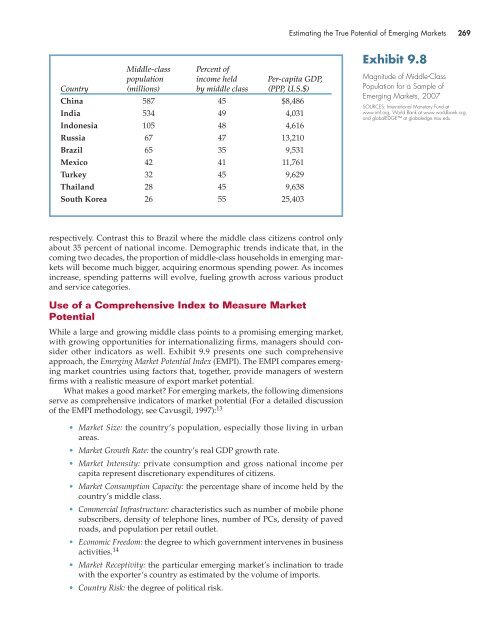

Middle-class Percent of<br />

population income held Per-capita GDP,<br />

Country (millions) by middle class (PPP, U.S.$)<br />

China 587 45 $8,486<br />

India 534 49 4,031<br />

Indonesia 105 48 4,616<br />

Russia 67 47 13,210<br />

Brazil 65 35 9,531<br />

Mexico 42 41 11,761<br />

Turkey 32 45 9,629<br />

Thailand 28 45 9,638<br />

South Korea 26 55 25,403<br />

Exhibit 9.8<br />

Magnitude of Middle-Class<br />

Population for a Sample of<br />

<strong>Emerging</strong> <strong>Markets</strong>, 2007<br />

SOURCES: International Monetary Fund at<br />

www.imf.org, World Bank at www.worldbank.org,<br />

and globalEDGE at globaledge.msu.edu<br />

respectively. Contrast this to Brazil where the middle class citizens control only<br />

about 35 percent of national income. Demographic trends indicate that, in the<br />

coming two decades, the proportion of middle-class households in emerging markets<br />

will become much bigger, acquiring enormous spending power. As incomes<br />

increase, spending patterns will evolve, fueling growth across various product<br />

and service categories.<br />

Use of a Comprehensive Index to Measure Market<br />

Potential<br />

While a large and growing middle class points to a promising emerging market,<br />

with growing opportunities for internationalizing firms, managers should consider<br />

other indicators as well. Exhibit 9.9 presents one such comprehensive<br />

approach, the <strong>Emerging</strong> Market Potential Index (EMPI). The EMPI compares emerging<br />

market countries using factors that, together, provide managers of western<br />

firms with a realistic measure of export market potential.<br />

What makes a good market? For emerging markets, the following dimensions<br />

serve as comprehensive indicators of market potential (For a detailed discussion<br />

of the EMPI methodology, see Cavusgil, 1997): 13<br />

• Market Size: the country’s population, especially those living in urban<br />

areas.<br />

• Market Growth Rate: the country’s real GDP growth rate.<br />

• Market Intensity: private consumption and gross national income per<br />

capita represent discretionary expenditures of citizens.<br />

• Market Consumption Capacity: the percentage share of income held by the<br />

country’s middle class.<br />

• Commercial Infrastructure: characteristics such as number of mobile phone<br />

subscribers, density of telephone lines, number of PCs, density of paved<br />

roads, and population per retail outlet.<br />

• Economic Freedom: the degree to which government intervenes in business<br />

activities. 14<br />

• Market Receptivity: the particular emerging market’s inclination to trade<br />

with the exporter’s country as estimated by the volume of imports.<br />

• Country Risk: the degree of political risk.