Download The Property Handbook - Presbyterian Church of ...

Download The Property Handbook - Presbyterian Church of ...

Download The Property Handbook - Presbyterian Church of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

PAGE ›› 1<br />

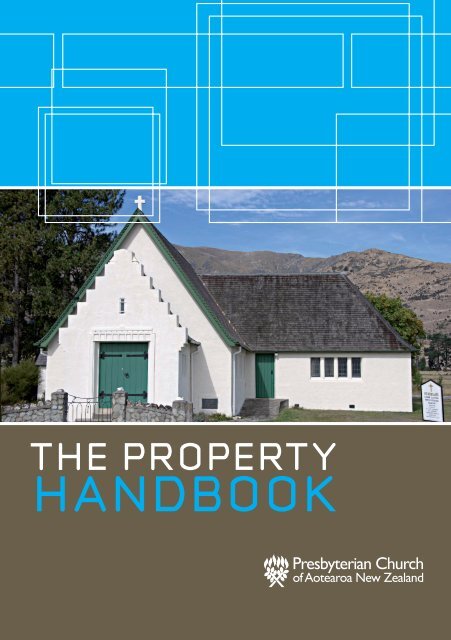

THE PROPERTY HANDBOOK<br />

T H E P R O P E RT Y<br />

H A N D B O O K

PAGE ›› 2<br />

THE PROPERTY HANDBOOK<br />

THE PRESBYTERIAN CHURCH<br />

PROPERTY TRUSTEES<br />

THE PROPERTY<br />

HANDBOOK<br />

A GUIDE<br />

for Parishes, Presbyteries & UDCs<br />

when dealing with property<br />

2nd edition 2010

PAGE ›› 3<br />

THE PROPERTY HANDBOOK<br />

TABLE OF CONTENTS<br />

››<br />

Introduction Legal background, status, explanation <strong>of</strong> terms, 5<br />

important first principles<br />

Section 1 Purchase <strong>of</strong> property 11<br />

›› GST, trustees’ fees,rates<br />

›› Minister housing requirements<br />

Section 2 Borrowing by parishes 19<br />

Section 3 Alterations and extensions or new buildings 21<br />

Section 4 Sale <strong>of</strong> property 22<br />

Section 5 Leasing property 27<br />

Section 6 Use <strong>of</strong> property funds 29<br />

Section 7 Gifting property 31<br />

Section 8 Gifting and loaning <strong>of</strong> congregational funds 33<br />

Section 9 Lottery Grants Board applications 35<br />

Section 10 Duties and responsibilities <strong>of</strong> decision makers 37<br />

›› Presbytery / UDCs<br />

›› <strong>Church</strong> <strong>Property</strong> Trustees

PAGE ›› 4<br />

THE PROPERTY HANDBOOK<br />

Application forms for the following purposes are available on request from the<br />

Secretary to the Trustees, phone (04) 381 8290 or 0800 424 872, or email trustees@<br />

presbyterian.org.nz:<br />

›› Purchase property<br />

›› Sell / lease property<br />

›› Alter / extend / erect building<br />

›› Spend / gift / lend capital (property) funds<br />

›› Borrow funds<br />

›› Apply for a Lottery grant

PAGE ›› 5<br />

THE PROPERTY HANDBOOK<br />

INTRODUCTION<br />

Two trusts<br />

Properties belonging to the <strong>Presbyterian</strong> <strong>Church</strong> in New Zealand are vested in two<br />

separate trusts. <strong>The</strong> Waitaki River (North Otago) is the geographical boundary for the<br />

two trusts.<br />

North <strong>of</strong> the Waitaki River, property is vested in <strong>The</strong> <strong>Presbyterian</strong> <strong>Church</strong> <strong>Property</strong> Trustees.<br />

South <strong>of</strong> the Waitaki River, property is vested in the Otago Foundation Trust Board,<br />

although the Synod <strong>of</strong> Otago & Southland handles property approvals.<br />

This handbook is based on the procedures <strong>of</strong> <strong>The</strong> <strong>Presbyterian</strong> <strong>Church</strong> <strong>Property</strong> Trustees.<br />

Refer to the Synod <strong>of</strong> Otago & Southland for its specific requirements.<br />

<strong>The</strong> legal background<br />

Three Acts <strong>of</strong> Parliament establish the framework and principles <strong>of</strong> operation <strong>of</strong> <strong>The</strong><br />

<strong>Presbyterian</strong> <strong>Church</strong> <strong>Property</strong> Trustees. Under the first Act, <strong>The</strong> <strong>Presbyterian</strong> <strong>Church</strong><br />

<strong>Property</strong> Act 1885, <strong>The</strong> <strong>Presbyterian</strong> <strong>Church</strong> <strong>Property</strong> Trustees (<strong>Church</strong> <strong>Property</strong><br />

Trustees) are the registered owners <strong>of</strong>, and are legally responsible for, all <strong>Presbyterian</strong><br />

<strong>Church</strong> property located north <strong>of</strong> the Waitaki River.<br />

<strong>The</strong> other two acts, <strong>The</strong> Trustee Act 1956 and the Charitable Trusts Act 1957, provide<br />

binding legal principles under which the <strong>Church</strong> <strong>Property</strong> Trustees operate.<br />

All property transactions are managed through the <strong>Church</strong> <strong>Property</strong> Trustees.<br />

Sometimes the Trustees obtain special legal advice on rare and difficult transactions.<br />

<strong>The</strong> Book <strong>of</strong> Order is the <strong>Presbyterian</strong> <strong>Church</strong>’s <strong>of</strong>ficial rule book, and covers all<br />

activities <strong>of</strong> the <strong>Church</strong>. It explains the responsibilities <strong>of</strong> church members, and sets out<br />

the procedures for each area <strong>of</strong> governance and management. Every presbytery, parish<br />

and church member is obliged to comply with it, except for members <strong>of</strong> co-operative<br />

ventures in circumstances where the Guide to Procedures in Co-operative Ventures<br />

applies instead.<br />

Chapter 16 <strong>of</strong> the 2006 Book <strong>of</strong> Order deals with property and finance matters.<br />

<strong>The</strong> Book <strong>of</strong> Order can be viewed on the <strong>Presbyterian</strong> <strong>Church</strong> website, www.<br />

presbyterian.org.nz.<br />

<strong>The</strong> Guide to Procedures in Co-operative Ventures can be viewed on the Uniting<br />

Congregations website, www.ucanz.org.nz.

PAGE ›› 6<br />

THE PROPERTY HANDBOOK<br />

Status <strong>of</strong> this handbook<br />

<strong>The</strong> <strong>Property</strong> <strong>Handbook</strong> is provided for guidance only. <strong>The</strong> formal and binding<br />

requirements <strong>of</strong> property transactions are detailed in the legal documents identified. If<br />

there is any doubt, consult your parish’s solicitor.<br />

Explanation <strong>of</strong> Terms<br />

attestation clause<br />

Certificate <strong>of</strong> Title<br />

church council<br />

<strong>Church</strong> <strong>Property</strong> Trustees<br />

execution<br />

fiduciary duty<br />

instrument <strong>of</strong> transfer<br />

Joint Regional Committee<br />

Formal statement describing the manner in which<br />

a legal document is signed. <strong>The</strong> attestation clause<br />

for documents executed by the <strong>Church</strong> <strong>Property</strong><br />

Trustees reads:<br />

“<strong>The</strong> Common Seal <strong>of</strong> <strong>The</strong> <strong>Presbyterian</strong> <strong>Church</strong><br />

<strong>Property</strong> Trustees was hereunto affixed and these<br />

presents signed by two <strong>of</strong> the said Trustees”.<br />

Record which identifies a specific property by legal<br />

description, registered location, size and the owner.<br />

Records <strong>of</strong> properties are now electronically recorded<br />

by LINZ (Land Information New Zealand).<br />

Governing body <strong>of</strong> a congregation. It may be called a<br />

session or parish council or other name.<br />

Shortened form <strong>of</strong> <strong>The</strong> <strong>Presbyterian</strong> <strong>Church</strong> <strong>Property</strong><br />

Trustees. Often abbreviated to CPT.<br />

Act <strong>of</strong> formally signing a legal document. For<br />

<strong>Church</strong> property matters, this is done by affixing<br />

the Common Seal <strong>of</strong> <strong>The</strong> <strong>Presbyterian</strong> <strong>Church</strong><br />

<strong>Property</strong> Trustees.<br />

Responsibility <strong>of</strong> a trustee to act without personal<br />

gain and independently from personal interest.<br />

Formal document upon which the details <strong>of</strong> a sale<br />

and purchase <strong>of</strong> property is entered for recording in<br />

the Land Transfer Office.<br />

Often called JRC. Regional body that oversees cooperative<br />

ventures on behalf <strong>of</strong> partner <strong>Church</strong>es.

PAGE ›› 7<br />

THE PROPERTY HANDBOOK<br />

LIM<br />

loan agreement<br />

manse<br />

mortgage<br />

Land Information Memorandum. A report issued by<br />

a local authority, which contains information about a<br />

property.<br />

Formal document in which all the terms and<br />

conditions pertaining to the money being borrowed<br />

must be disclosed.<br />

Parish residential property which provides<br />

accommodation for the minister and family.<br />

Legal document which sets out the terms and<br />

conditions upon which the security for any borrowing<br />

is effected against property.<br />

partner <strong>Church</strong>es Other denominations in a co-operative venture –<br />

mainly Methodist and/or Anglican.<br />

presbytery<br />

Regional body <strong>of</strong> the <strong>Presbyterian</strong> <strong>Church</strong> which has<br />

oversight <strong>of</strong> all <strong>Presbyterian</strong> parishes in that area.<br />

sale & purchase agreement Legal document in which all the terms and conditions<br />

<strong>of</strong> sale are recorded, signed by the purchaser and<br />

the vendor at the time <strong>of</strong> agreement. Once signed<br />

by both parties, the agreement becomes a binding<br />

contract, subject only to the conditions stated in<br />

the agreement.<br />

title<br />

<strong>The</strong> Trustees<br />

UDC/UCC<br />

valuation<br />

vendor<br />

Yearbook<br />

See Certificate <strong>of</strong> Title. This identifies ownership <strong>of</strong><br />

a property.<br />

For the purposes <strong>of</strong> this handbook, it means <strong>The</strong><br />

<strong>Presbyterian</strong> <strong>Church</strong> <strong>Property</strong> Trustees.<br />

Union District Council or Uniting <strong>Church</strong> Council: a<br />

council appointed by the <strong>Presbyterian</strong> and Methodist<br />

<strong>Church</strong>es to jointly carry out the equivalent duties <strong>of</strong><br />

a presbytery in an agreed region.<br />

Report from a registered valuer, stating the condition<br />

and current market value <strong>of</strong> the property under<br />

consideration.<br />

Owner <strong>of</strong> the property which is being sold.<br />

Directory containing contact details for every parish,<br />

minister and nationally appointed organisation within<br />

the <strong>Presbyterian</strong> <strong>Church</strong>.

PAGE ›› 8<br />

THE PROPERTY HANDBOOK<br />

Important<br />

First<br />

Principles<br />

Principle 1<br />

Everyone making decisions about property or finance within the <strong>Church</strong> is a “trustee.”<br />

Elders, managers, deacons, presbytery/UDC members and the <strong>Presbyterian</strong> <strong>Church</strong><br />

<strong>Property</strong> Trustees (the Trustees) all have responsibilities under <strong>The</strong> Trustees Act 1956<br />

(Refer page 27).<br />

• We all are required to act with care and prudence, in a trustee capacity.<br />

Principle 2<br />

We are a <strong>Church</strong> – not a collection <strong>of</strong> independent congregations<br />

• Parishes are under the oversight <strong>of</strong> presbyteries/UDCs, and the Trustees.<br />

• <strong>The</strong> necessary approvals must be obtained before action is taken. For co-operative<br />

ventures, the partner <strong>Church</strong>(es) should also be consulted.<br />

Principle 3<br />

Our decisions must keep faith with the long-term interests <strong>of</strong> the whole <strong>Church</strong>.

PAGE ›› 9<br />

THE PROPERTY HANDBOOK<br />

<strong>The</strong> congregations <strong>of</strong> the future will inherit our choices.<br />

<strong>The</strong> 2008 General Assembly endorsed the principle that all property transactions<br />

should serve the purposes <strong>of</strong> God’s mission. <strong>The</strong> Assembly adopted guidelines which<br />

the <strong>Church</strong> <strong>Property</strong> Trustees were asked to take into account when considering<br />

applications in relation to parish property proposals.<br />

All applications to the <strong>Church</strong> <strong>Property</strong> Trustees must now be accompanied by responses<br />

to supplementary questions that are based on the Assembly guidelines.<br />

<strong>The</strong>se requirements apply to all property transactions, including the purchase, sale or<br />

leasing <strong>of</strong> property, and to major building projects.<br />

For any proposal, the congregation is asked to provide evidence <strong>of</strong> its financial<br />

sustainability, to explain how the proposal fits into the congregation’s mission plan,<br />

and to demonstrate how this project will contribute to God’s mission and the growth<br />

<strong>of</strong> the church.<br />

<strong>The</strong> presbytery has to assess how realistic the congregation has been in its responses<br />

to the supplementary questions, and explain how the proposal fits into the regional<br />

mission strategy.

PAGE ›› 10<br />

THE PROPERTY HANDBOOK<br />

››

PAGE ›› 11<br />

THE PROPERTY HANDBOOK<br />

SECTION 01<br />

Purchase <strong>of</strong> property<br />

General guidelines<br />

Ask yourselves how this purchase will fit the mission <strong>of</strong> the congregation.<br />

Once there is a written clear answer to this question, the rest should flow quite easily.<br />

Allow sufficient time, and consult as early as possible with the next people in the chain.<br />

• Allow at least two months to prepare your application, and to obtain the approval <strong>of</strong><br />

the congregation, presbytery and the Trustees.<br />

• Talk early on to your presbytery/UDC and Secretary to the Trustees about your<br />

general plans and time frames. As each step comes closer, it will help to make<br />

early contact (even informally and in confidence) to alert them that decisions are<br />

underway. Challenging or unusual proposals may take extra time.<br />

• Find out from your presbytery clerk when Presbytery’s <strong>Property</strong> Committee<br />

meets, as generally this committee will consider the application and then make<br />

a recommendation to presbytery. Presbyteries normally meet monthly. Some<br />

property and finance committees are authorised to act as a commission <strong>of</strong><br />

presbytery for property transaction applications. You should have your application<br />

to this committee, through the presbytery clerk, at least a week before it meets.<br />

• <strong>The</strong> Trustees generally meet monthly (apart from the Christmas break), and<br />

applications need to be received at least a week before the meeting, in order for the<br />

documentation to be summarised and circulated with the agenda papers. Contact<br />

the Secretary to the Trustees for details.<br />

• It may save time if you can make direct contact with the <strong>Church</strong> Architecture<br />

Reference Group regional convenor (see the Yearbook) before your plans are well<br />

advanced, and before your application goes to Presbytery.<br />

Remember this will be an asset held in trust for the congregation <strong>of</strong> the future as well<br />

as the present.<br />

All parties need to be involved in the decision-making. <strong>The</strong> asset does not belong to<br />

just one little group <strong>of</strong> the congregation. It is an asset, to be held in trust, for the benefit<br />

<strong>of</strong> many others.

PAGE ›› 12<br />

THE PROPERTY HANDBOOK<br />

Do the thinking before you look, and again before you purchase.<br />

Talk through all the issues (purpose, function, location, financing, time frames as well<br />

as structure, price, legal title etc) before you start looking to purchase. It would be<br />

prudent to review these guidelines again as you come to complete a purchase on a<br />

particular property.<br />

Set the necessary authorities in place as you proceed.<br />

Try to obtain approval to act (maybe within constraints) ahead <strong>of</strong> time. You will need<br />

formal approval from the congregation to proceed. It is usual for a congregation to<br />

delegate the purchasing process to a small subcommittee. If you are planning to borrow<br />

money for the purchase, you will also need to follow the borrowing procedures set out<br />

in Section 2 <strong>of</strong> this handbook.<br />

See the checklist at the end <strong>of</strong> this section to help you through the process.<br />

To purchase a property you need the approval <strong>of</strong>:<br />

• <strong>Church</strong> council (session / parish council)<br />

• Congregation<br />

• Presbytery/UDC<br />

• <strong>Church</strong> <strong>Property</strong> Trustees<br />

Ask the Trustees’ Office for the relevant application forms and supplementary<br />

questions. Email trustees@presbyterian.org.nz for electronic copies.<br />

Note: All <strong>Church</strong> <strong>Property</strong> Trustees’ property approvals are valid for six months.<br />

Approval may be extended to 12 months in exceptional circumstances.<br />

Suggested selection criteria<br />

• Is the property within the price band approved by the congregation?<br />

• Is the location suitable for the building’s intended purpose?<br />

• Is it located near the parish <strong>of</strong>fice and main worship centre?<br />

• If this is to be a manse, is it near to schools?<br />

• Is it convenient to public transport?<br />

• Is the property in good condition?<br />

• Are there any deferred maintenance or ongoing maintenance issues?<br />

• Are there any conditions associated with the title?<br />

• Does it have good resale potential (particularly for a manse)?<br />

• Are there any health and safety issues?<br />

• Does the local authority LIM report raise any concerns?

PAGE ›› 13<br />

THE PROPERTY HANDBOOK<br />

If you are looking to purchase a manse, include the requirements on page 12.<br />

Completing Agreement for Sale & Purchase<br />

• Don’t sign anything until you have taken advice from your parish solicitor.<br />

• Name “<strong>The</strong> <strong>Presbyterian</strong> <strong>Church</strong> <strong>Property</strong> Trustees” as the “Purchaser”.<br />

• Include this clause: “conditional on approval <strong>of</strong> <strong>The</strong> <strong>Presbyterian</strong> <strong>Church</strong><br />

<strong>Property</strong> Trustees”.<br />

• Where borrowing is required, insert this clause: “conditional upon approval to<br />

borrowing on terms and conditions acceptable in all respects to the parish”.<br />

• Consult the Secretary to the Trustees about authority to sign the Agreement for<br />

Sale & Purchase.<br />

Follow-up after <strong>Church</strong> <strong>Property</strong> Trustees’ approval<br />

Consult your parish’s solicitor when you start looking for a property. <strong>The</strong> solicitor will<br />

ask the parish to sign a letter <strong>of</strong> engagement. (<strong>The</strong> <strong>Church</strong> <strong>Property</strong> Trustees do not<br />

engage the solicitor.)<br />

• Do not sign anything (especially the sale and purchase agreement) without your<br />

solicitor’s approval. Signing should be done by two authorised parish representatives.<br />

• Your solicitor will ask for the purchase funds in advance <strong>of</strong> the agreed settlement<br />

date. If the funds are held in your <strong>Presbyterian</strong> Investment Fund property account,<br />

ask the Trustees’ Office to transfer the required money to your parish bank account<br />

well before it is needed. If you are borrowing a portion <strong>of</strong> the purchase price,<br />

ensure the lender knows when, and where, to transfer the funds. (If borrowing is<br />

required to fund the purchase, prior approval from the <strong>Church</strong> <strong>Property</strong> Trustees is<br />

essential. Refer to “Section 2: Borrowing by parishes”.)<br />

• All property valuations must be no more than 90 days old at the time <strong>of</strong> signing a<br />

sale and purchase agreement.<br />

• Your solicitor will arrange for the registration <strong>of</strong> the transfer <strong>of</strong> ownership, which<br />

involves sending an Authorisation and Instruction (A & I) legal document to the<br />

<strong>Church</strong> <strong>Property</strong> Trustees for signing under Common Seal. Advise your solicitor that<br />

a copy <strong>of</strong> the signed sale and purchase agreement, and a copy <strong>of</strong> the Certificate <strong>of</strong><br />

Title, must accompany the A & I form.

PAGE ›› 14<br />

THE PROPERTY HANDBOOK<br />

Are there ‘fast track’ possibilities?<br />

Yes. Sometimes a property becomes available in a rush, particularly if there is a<br />

tender deadline. And church court time frames can take ages and ages . . . .<br />

<strong>The</strong> key is preparation, early warning signals, and the earliest possible attention to<br />

written documentation – especially mission statements.<br />

When there is genuine urgency, phone calls, faxes and emails will help<br />

meet deadlines.<br />

It is difficult to ‘fast track’ proposals which are challenging or unusual.<br />

For the <strong>Church</strong> <strong>Property</strong> Trustees contact:<br />

<strong>The</strong> Secretary: ph 04 381 8290 or 0800 424 872<br />

fax 04 801 6001<br />

email trustees@presbyterian.org.nz

PAGE ›› 15<br />

THE PROPERTY HANDBOOK<br />

CHECKLIST FOR ROUTINE<br />

PROPERTY PURCHASES<br />

Note: Keep copies <strong>of</strong> everything for your parish records<br />

p Approval ‘in principle’ by church council.<br />

p Agreement ‘in principle’ by congregation.<br />

p Working party authorised to proceed.<br />

p Congregation mission plan prepared, together with statements relating property<br />

purchase to the mission.<br />

p Application prepared for presbytery/UDC and <strong>Church</strong> <strong>Property</strong> Trustees.<br />

p Criteria checklist prepared, against which to measure potential properties. (This<br />

section <strong>of</strong> the handbook has suggestions. Add to this any other factors special to<br />

your situation.)<br />

p Will you need to borrow money? If so, congregation, presbytery/UDC and the<br />

Trustees all need to give formal approval.<br />

p Engage a registered valuer to provide a market value report on your preferred<br />

property.<br />

p If your preferred property is for sale by tender, be prepared to act quickly to meet<br />

tender deadline.<br />

p Negotiate and settle purchase price.<br />

p Unless you already have confirmed approval from the Trustees, enter into a<br />

conditional agreement for sale and purchase, in consultation with parish solicitor<br />

(see specifications in this section).<br />

p Alert the <strong>Church</strong> <strong>Property</strong> Trustees.<br />

p Unless a small group has delegated authority (preferable), you may need to place a<br />

proposal before congregation, to gain final approval. Ensure the details are recorded<br />

at each stage.<br />

p If not already done, complete an ‘application to purchase’ form (request a printed<br />

or emailed copy from the Trustees’ <strong>of</strong>fice), and forward it together with all other<br />

required documents to the presbytery/UDC. (Presbytery will complete its section<br />

and forward everything to the <strong>Church</strong> <strong>Property</strong> Trustees.)<br />

p Before settlement day, remember to ask the PCANZ insurance administrator to add<br />

the new property to your parish’s property schedule.

PAGE ›› 16<br />

THE PROPERTY HANDBOOK<br />

GST<br />

• No GST implication for sale and purchase <strong>of</strong> residential property e.g. manses.<br />

• GST is involved with all other <strong>Church</strong> property.<br />

For the purposes <strong>of</strong> the Goods and Services Tax Act 1985, the purchaser/seller <strong>of</strong> the<br />

property in question is the Trustees. Ask your solicitor to issue the settlement statement<br />

(and GST invoice) in the name <strong>of</strong> “<strong>The</strong> <strong>Presbyterian</strong> <strong>Church</strong> <strong>Property</strong> Trustees” (not in<br />

the name <strong>of</strong> the parish.)<br />

For a property sale, the Trustees will deal with the actual sale price (but not associated<br />

costs) as an input in their GST return, and the amount involved when paid will be<br />

deducted from the sale proceeds.<br />

<strong>The</strong> sale <strong>of</strong> gifted property is exempt GST pursuant to Section 14(1) (b) <strong>of</strong> the GST<br />

Act 1985. Pro<strong>of</strong> <strong>of</strong> gifting must be provided. Parishes should take care to advise the<br />

Secretary to the Trustees <strong>of</strong> the original price <strong>of</strong> all property so that the correct GST<br />

liability can be calculated.<br />

<strong>The</strong> Trustees’ GST number is 55 228 752.<br />

Trustees’ Costs<br />

Administration costs and legal fees are incurred by the Trustees in handling property<br />

transactions on behalf <strong>of</strong> parishes. Parishes will be invoiced for these as follows:<br />

Sale or purchase <strong>of</strong> property - value over $250,000 $250<br />

Sale or purchase <strong>of</strong> property - value $50,000 - $250,000 $150<br />

Sale or purchase <strong>of</strong> property - value under $50,000 $100<br />

All other routine transactions $100<br />

Where transactions involve extra legal costs, these costs will also be charged to the parish.<br />

In special circumstances, fees may be reduced or waived.<br />

Rates<br />

If you purchase a residential property (such as a manse), you must pay rates on it.<br />

If you purchase a church, or another building which will be used mainly for religious<br />

purposes (such as a hall), the property should be largely exempt from local government<br />

body rates. Don’t assume this will happen automatically. Check with your local body<br />

and, if necessary, apply for an exemption. This should be done as soon as the property<br />

changes hands.<br />

If you need advice on a particular property, contact the Secretary to <strong>The</strong> Trustees.

PAGE ›› 17<br />

THE PROPERTY HANDBOOK<br />

Minister’s housing requirements<br />

<strong>The</strong> <strong>Church</strong>’s regulations on housing for ministers are set out in the Conditions <strong>of</strong> Service<br />

Manual, which is a supplementary provision to the Book <strong>of</strong> Order. Further details are in<br />

the Accommodation for Ministers guidelines. (See the <strong>Presbyterian</strong> website.)<br />

You may provide accommodation for your minister by:<br />

• owning a house <strong>of</strong> an approved standard<br />

• providing an accommodation allowance to the minister *<br />

• leasing a house from an independent owner<br />

• leasing a house from the minister **<br />

<strong>The</strong>re will be taxation implications for the minister in respect <strong>of</strong> the amount paid as rent.<br />

Consult the Secretary to <strong>The</strong> Trustees if you need advice.<br />

* If the minister is to be paid either an accommodation allowance or rent, it should be<br />

the lower <strong>of</strong> the market rental for a suitable property within an appropriate radius <strong>of</strong><br />

the main worship centre or main site <strong>of</strong> the ministry, or the cost <strong>of</strong> the mortgage on a<br />

house owned by the minister. Presbyteries <strong>of</strong>ten set guidelines.<br />

** Leasing a house from the minister is the least preferred option, and there is a risk<br />

that IRD will challenge it. In any event, the rental should be established having regard to<br />

market rental prices in the area.<br />

<strong>The</strong> manse should be within a reasonable radius <strong>of</strong><br />

the main worship centre <strong>of</strong> the congregation.<br />

Exceptions to this must be approved by congregation and presbytery/UDC.<br />

What kind <strong>of</strong> accommodation?<br />

Congregations should provide attractive, appropriate accommodation for their ministers.<br />

Minimum requirements for a manse<br />

• Adequate living space which is separate from the space used for church activities<br />

• Facilities for <strong>of</strong>fering hospitality<br />

• A study/<strong>of</strong>fice with adequate shelving unless this is provided elsewhere<br />

• A washing machine and a refrigerator with adequate freezer space<br />

• Floor coverings in all rooms<br />

• Wardrobes in all bedrooms

PAGE ›› 18<br />

THE PROPERTY HANDBOOK<br />

• Drapes or blinds<br />

• Adequate heating for all living areas and the study<br />

Your manse needs to be safe<br />

Congregations with property (including a manse) have responsibilities and liabilities<br />

for these. All practical steps should be taken to eliminate, isolate and minimise any<br />

potential hazards.<br />

Refer to the Risk Management <strong>Handbook</strong> provided free by the <strong>Church</strong>’s insurers, or call<br />

the <strong>Church</strong> <strong>Property</strong> Trustees.<br />

For further information, see www.presbyterianworkingsafe.org.nz.<br />

Safety checklist<br />

• Fencing, paths, steps, staircases and railings, decking and verandas are sound<br />

and free <strong>of</strong> obstructions.<br />

• Exterior lighting is installed as appropriate.<br />

• Interior wiring, plugs and appliances are safety tested.<br />

• Hot water temperature is appropriate.<br />

• Smoke detectors are installed and working, and emergency exits available.<br />

• Ensure there is an alternative exit from upstairs in the event <strong>of</strong> a fire.<br />

• Secure storage for dangerous substances.<br />

When thinking <strong>of</strong> safety, anticipate that children will visit the manse, even if<br />

the current manse family itself does not have children.

PAGE ›› 19<br />

THE PROPERTY HANDBOOK<br />

SECTION 02<br />

Borrowing by parishes<br />

Trustees’ discretion<br />

All borrowing is at the absolute discretion <strong>of</strong> the <strong>Church</strong> <strong>Property</strong> Trustees. This includes<br />

a capacity to vary the routine conditions in exceptional circumstances, including the<br />

refusal <strong>of</strong> authorisation <strong>of</strong> applications.<br />

Limits on borrowing<br />

• Maximum <strong>of</strong> 50% <strong>of</strong> the cost <strong>of</strong> a project may generally be borrowed.<br />

• Loans on low or nil interest are included in this condition.<br />

• <strong>The</strong> borrowing term is limited to a maximum <strong>of</strong> 15 years.<br />

Why there are limits<br />

• To ensure wide parish buy-in to proposals.<br />

• To ensure current parish members do not overburden future members.<br />

• To prevent over-commitment.<br />

Required approvals<br />

• Whole-hearted congregational support <strong>of</strong> the proposed borrowing, including formal<br />

voting <strong>of</strong> 80% support at the relevant congregational meeting.<br />

• Formal presbytery/UDC endorsement <strong>of</strong> the proposal to borrow.<br />

• Presbytery/UDC assessment <strong>of</strong> the viability <strong>of</strong> the proposal, including capacity to<br />

service the borrowing.<br />

Urgent proposals<br />

In exceptional circumstances, the Trustees will consider urgent proposals, under<br />

stringent conditions. Contact the Secretary to the Trustees for details.<br />

Legal issues<br />

Your solicitor will prepare a Memorandum <strong>of</strong> Mortgage. It will include a clause limiting<br />

liability to the property over which the loan is secured. It should read something like this:<br />

“<strong>The</strong> liability <strong>of</strong> the Trustees under the terms <strong>of</strong> this Memorandum <strong>of</strong> Mortgage shall be<br />

limited to the property as set out in the schedule hereto, and shall not constitute a debt<br />

payable by the Trustees or their successors in <strong>of</strong>fice out <strong>of</strong> any other fund or property.”

PAGE ›› 20<br />

THE PROPERTY HANDBOOK<br />

<strong>Presbyterian</strong> Savings and Development Society<br />

This organisation is a common source <strong>of</strong> mortgage money for churches. If your<br />

application to borrow is approved, and you are using PSDS, a copy <strong>of</strong> the letter <strong>of</strong><br />

approval is sent to PSDS who will arrange the necessary mortgage documents for the<br />

Trustees to execute.<br />

Suspensory loans for pre-schools<br />

Government may advance loans <strong>of</strong> up to 90% <strong>of</strong> the cost <strong>of</strong> a preschool project, but<br />

will require full repayment within five years should the project fail. <strong>The</strong> Trustees will<br />

consider such applications on the following basis:<br />

• Full business case, including assessment <strong>of</strong> neighbourhood preschools.<br />

• Contingency plan for repayment that does not impact on core parish mission.<br />

• Presbytery/UDC approval <strong>of</strong> application, and <strong>of</strong> liabilities incurred.

PAGE ›› 21<br />

THE PROPERTY HANDBOOK<br />

SECTION 03<br />

Alterations and extensions<br />

or new buildings<br />

<strong>The</strong> guidelines for purchasing a property also apply to substantial structural alterations<br />

to a church property, or to erecting a new building on church property.<br />

Refer to Book <strong>of</strong> Order Chapter 16, and its Supplementary Provisions, for the regulations<br />

governing this process. If the building project is a major one, presbytery must obtain<br />

a report from the <strong>Church</strong> Architecture Reference Group before it gives approval. It<br />

may save time if the congregation makes contact with the nearest Reference Group<br />

representative early in the process.<br />

<strong>The</strong> Book <strong>of</strong> Order and its supplementary provisions may be viewed at www.<br />

presbyterian.org.nz.

PAGE ›› 22<br />

THE PROPERTY HANDBOOK<br />

SECTION 04<br />

Sale <strong>of</strong> property<br />

How will the sale <strong>of</strong> this property fit the mission <strong>of</strong> the congregation?<br />

Presbytery/UDC and the Trustees will want to know this, and it will clarify your thinking<br />

if you answer it at the beginning.<br />

Are there any special trusts e.g. bequests attached to the property which may<br />

hinder or prevent its sale?<br />

Remember that the property you have is an asset received ‘in trust’ from the past<br />

congregation.<br />

This means there may be limits on what you can do with it, and with the proceeds<br />

from the sale. If the property was gifted to the congregation, any conditions associated<br />

with the original gift must be fulfilled. Any difficulties should be resolved before the<br />

sale goes ahead.<br />

Sometimes, the wider local community in which a surplus church is sited (particularly<br />

in rural areas) may have strong views about what should happen to it. Appropriate<br />

consultation with the community can help avoid negative publicity. Remember that<br />

church property is a trust from all the past members <strong>of</strong> your congregation, going right<br />

back to its establishment. <strong>The</strong> assets have been given in the expectation they will<br />

continue to be used for the mission <strong>of</strong> the <strong>Presbyterian</strong> <strong>Church</strong>.<br />

<strong>Property</strong> can be sold if:<br />

• it is no longer needed - but there may be limitations on what can be done with the<br />

proceeds. <strong>The</strong>se are set out in Section 6 <strong>of</strong> this handbook.<br />

• you wish to replace it with a property which will better fulfil the mission <strong>of</strong> the<br />

church – in which case you need to consider the objectives <strong>of</strong> both the sale and<br />

the purchase, and comply with the regulations in both this section and the previous<br />

section on purchasing property.<br />

<strong>The</strong> proposal must have the approval <strong>of</strong> the church council, the congregation,<br />

presbytery/UDC and the Trustees.<br />

It pays to consult with, and get approval from, these bodies as early as possible in the<br />

process. Remember: at each decision-making stage there needs to be a formal written<br />

record. (See the application for approval to sell form.)<br />

A check list to guide you through these steps is given at the end <strong>of</strong> this section.

PAGE ›› 23<br />

THE PROPERTY HANDBOOK<br />

Before you sign a contract, you must:<br />

• Either gain conditional approval from the Trustees, based on the valuation before<br />

you start (giving a minimum price you can accept)<br />

• Or make your sale agreement subject to the approval <strong>of</strong> <strong>The</strong> <strong>Presbyterian</strong><br />

<strong>Church</strong> <strong>Property</strong> Trustees.<br />

<strong>The</strong> Trustees prefer the conditional sale method as it allows for rapid action when a<br />

purchaser is found.<br />

You must have a valuation<br />

You will need to submit a recent market valuation <strong>of</strong> the property, undertaken by a<br />

registered valuer, as the Trustees have to be sure a reasonable price is being received.<br />

(Rating valuations or estimates by real estate firms are not sufficient.) It pays to obtain<br />

a valuation early in the process, so that you know the likely sale price band. Valuations<br />

must be no more than 90 days old at the time <strong>of</strong> signing a sale and purchase agreement,<br />

so you may need to ask your valuer to provide an update if there is a lengthy period<br />

between gaining approval to sell and finding a buyer.<br />

A word about real estate agents<br />

Parishes frequently use real estate agents to market the property.<br />

• Most agents want a sole agency. It is prudent to invite several proposals before<br />

making a decision.<br />

• If you do decide to use a sole agency, then your contract (Sole Agency Agreement)<br />

with them should be for a short duration e.g. 60 days. This time limit must be<br />

written into the contract.<br />

• If you sell a property while there is a sole agency agreement in operation, you will<br />

have to pay the agent’s fee even if they had nothing to do with the sale.<br />

• It is good practice to have your parish solicitor approve the proposed agency<br />

agreement before you sign it.<br />

When you find a purchaser<br />

You may sign an agreement to sell BUT it must be conditional on the approval <strong>of</strong> the<br />

Trustees, unless you already have that approval. <strong>The</strong> wording required is “conditional<br />

on the approval <strong>of</strong> <strong>The</strong> <strong>Presbyterian</strong> <strong>Church</strong> <strong>Property</strong> Trustees.”<br />

If you already have conditional approval from the Trustees, then your agreement<br />

must comply with that approval in all respects, otherwise you must sign a conditional<br />

contract and go back to the Trustees for a new approval.<br />

Does the agreed price include GST, or is it plus GST if applicable? Make sure you cross

PAGE ›› 24<br />

THE PROPERTY HANDBOOK<br />

out on the agreement the option which does not apply. (If you overlook this small print,<br />

the agreement will automatically include GST.)<br />

Do not sign anything until your parish solicitor has approved it. Once you have signed,<br />

the contract is binding.<br />

After the sale<br />

• Your parish solicitor will handle the settlement.<br />

• Your solicitor will prepare a Memorandum <strong>of</strong> Transfer and send it to the Secretary<br />

<strong>of</strong> the Trustees for execution.<br />

• Your solicitor will repay any outstanding mortgages, and other costs, then forward<br />

the net sale proceeds to the Trustees. <strong>The</strong>se funds will be held in a <strong>Presbyterian</strong><br />

Investment Fund property account in the congregation’s name.<br />

• If GST is payable on the sale, the Trustees will pay this, from the funds deposited in<br />

your PIF account.<br />

• <strong>The</strong> Trustees will invoice the parish for administration costs. (See page 16.)<br />

• <strong>The</strong>re are limits on what you can use this money for. <strong>The</strong>se are set out in Section 6.

PAGE ›› 25<br />

THE PROPERTY HANDBOOK<br />

Checklist for routine <strong>Property</strong> Sales<br />

p Place proposal before church council. Record the details at all stages.<br />

p Approval by church council.<br />

p Agreement by congregation.<br />

p Sub-committee set up to oversee the sale and to consult parish solicitor. If the<br />

land was gifted to the church, check that there were no conditions in the original<br />

bequest about selling the property.<br />

p Update the congregation’s mission plan and statements <strong>of</strong> how the sale relates to this.<br />

p Ask the Trustees’ Office to send the relevant application forms, and supplementary<br />

questions.<br />

p Have the property valued (by a registered valuer) before placing the property on the<br />

market. Include a copy with your application to sell. Note: Minimum acceptable sale<br />

price is commercially sensitive, and should be kept confidential as far as is possible.<br />

Valuations must be no more than 90 days old at the time a sale and purchase<br />

agreement is signed, so you may need to have it updated if the property does not<br />

sell within a short time.<br />

p Approval <strong>of</strong> presbytery and Trustees (in principle, if necessary, although this will<br />

require subsequent final approval.)<br />

p Appoint real estate agent(s) to market the property (if required). A sole agency must<br />

have a definite end date.<br />

p Negotiate and agree sale price and conditions. Consult your solicitor before signing<br />

anything. <strong>The</strong>re should be two parish signatories.<br />

p Enter into a conditional agreement, in consultation with your parish solicitor, unless<br />

the sale complies with the approval already obtained from the Trustees.<br />

p Check the small print relating to GST, to make it clear whether the price includes<br />

GST, or ‘plus GST if applicable’.<br />

p Parish solicitor handles the settlement <strong>of</strong> the sale. (Warn your solicitor to send the land<br />

transfer documents to the Trustees’ Office at least a week before settlement date.)

PAGE ›› 26<br />

THE PROPERTY HANDBOOK<br />

››

PAGE ›› 27<br />

THE PROPERTY HANDBOOK<br />

Leasing property<br />

Leases are involved when a congregation:<br />

• needs to rent additional property for its use<br />

• decides to lease out a property, or part <strong>of</strong> it, for income.<br />

First step<br />

How will this lease fit the mission <strong>of</strong> the congregation?<br />

This is especially important for a lease <strong>of</strong> over one year.<br />

Before you enter into either kind <strong>of</strong> lease you must have approval from<br />

• <strong>Church</strong> council.<br />

• Congregation (if the lease is for more than one year).<br />

• Presbytery/UDC.<br />

• <strong>Church</strong> <strong>Property</strong> Trustees.<br />

Note: Renewals <strong>of</strong> leases require the same approvals as the original lease. Allow time<br />

for these to be obtained.<br />

Application forms are available from the Trustees’ Office. Email trustees@presbyterian.<br />

org.nz or call the Secretary on 04 381 8290.<br />

Legal points<br />

Any lease document must be in writing and prepared (or approved) by your parish solicitor.<br />

<strong>The</strong> lease must include:<br />

• <strong>The</strong> Trustees as lessee (if you are renting additional property) or lessor (if you are<br />

receiving money for renting out your existing property)<br />

• <strong>The</strong> legal description <strong>of</strong> the property<br />

• <strong>The</strong> time-length <strong>of</strong> the lease<br />

• <strong>The</strong> amount <strong>of</strong> the rental<br />

SECTION 05<br />

• Any renewal rights and obligations<br />

• A clause limiting liability <strong>of</strong> the <strong>Church</strong> <strong>Property</strong> Trustees to the property being<br />

leased. (See next page.)

PAGE ›› 28<br />

THE PROPERTY HANDBOOK<br />

• An inventory <strong>of</strong> chattels<br />

• It may include a bond payment.<br />

If the lease is a residential tenancy, you must also ensure you understand your obligations,<br />

and abide by the Residential Tenancies Act. Copies are widely available together with<br />

standard tenancy agreements e.g. at PostShops, or online at www.dbh.govt.nz/tenancy.<br />

“Limitation <strong>of</strong> liability” clause<br />

This clause is inserted because the Trustees legally own a great deal <strong>of</strong> property on behalf<br />

<strong>of</strong> the <strong>Presbyterian</strong> <strong>Church</strong> – most <strong>of</strong> it property being held for other congregations. It<br />

is important that liability is restricted to the actual property involved.<br />

<strong>The</strong> clause should read something like this (consult your solicitor):<br />

“<strong>The</strong> liability <strong>of</strong> the Trustees under the terms <strong>of</strong> this Deed <strong>of</strong> Lease shall be limited<br />

to the property as set out in the schedule (attached) and shall not constitute a debt<br />

payable by the Lessee (or Lessor as appropriate) or their successors in <strong>of</strong>fice out <strong>of</strong> any<br />

other fund or property.”<br />

It is the congregation’s responsibility to ensure any conditions attached to leases<br />

are fulfilled. <strong>The</strong> church council must give the required notice to renew a lease<br />

that has a “right <strong>of</strong> renewal” clause.<br />

Insurance <strong>of</strong> leased property<br />

• Leasing part <strong>of</strong> your property may affect your insurance cover.<br />

• It may be prudent to also require the lessee to carry their own insurance e.g. public<br />

liability<br />

• Ask the <strong>Church</strong>’s insurance brokers (AON) for advice.<br />

Keeping records<br />

Make sure that you keep a careful record <strong>of</strong> all leases and other property transactions.<br />

This record keeping is important:<br />

• for successors in <strong>of</strong>fice<br />

• for charting exactly what has to be done in the future<br />

• the date/time for follow up.

PAGE ›› 29<br />

THE PROPERTY HANDBOOK<br />

Use <strong>of</strong> property funds<br />

Why are there limits on the use <strong>of</strong> money raised by selling property?<br />

Your parish property is in the nature <strong>of</strong> a trust which you have received from the past<br />

members <strong>of</strong> your congregation. <strong>The</strong> General Assembly has decided that money raised<br />

by selling property is, in general, ‘ring-fenced’, because it was from a property trust.<br />

What can’t the capital be used for?<br />

<strong>The</strong> proceeds <strong>of</strong> sale <strong>of</strong> property cannot be used for the running costs <strong>of</strong> the current<br />

congregation:<br />

• minister’s stipend or staff salaries<br />

• administration costs<br />

• heat, light, power, insurances etc.<br />

• worship materials e.g. hymn books, projectors<br />

• vehicles<br />

• <strong>of</strong>fice equipment, appliances, sound systems etc<br />

• routine maintenance.<br />

What can the capital be used for?<br />

<strong>The</strong> proceeds <strong>of</strong> sale <strong>of</strong> property can be used for adding to your property through:<br />

• buying or building property<br />

• buying land<br />

• repaying mortgages<br />

• growth projects.<br />

SECTION 06<br />

What else might it be used for?<br />

You might be allowed to use property money for major maintenance items, or for<br />

adding to the value <strong>of</strong> your existing property, providing certain conditions are met. Such<br />

approval is at the Trustees’ discretion. <strong>The</strong> main criteria are<br />

• How necessary is the expenditure?<br />

• Why is the parish unable do this from current income?<br />

• How will this expenditure benefit the future mission <strong>of</strong> the church?

PAGE ›› 30<br />

THE PROPERTY HANDBOOK<br />

<strong>The</strong>se types <strong>of</strong> expenditure might be approved<br />

• extensions and major maintenance <strong>of</strong> buildings<br />

• painting the existing buildings<br />

• major refurbishments <strong>of</strong> the interior, including carpeting<br />

• purchase or repair <strong>of</strong> the principal musical instrument used in services<br />

• costs associated with fulfilling legal requirements e.g. building warrant <strong>of</strong> fitness<br />

• security and fire protection installations<br />

How do we apply to use the proceeds <strong>of</strong> the sale <strong>of</strong> property?<br />

Any application to use capital funds needs to be approved by:<br />

• Board <strong>of</strong> managers/ deacons court/ parish council<br />

• Congregation<br />

• Presbytery/UDC<br />

• <strong>Church</strong> <strong>Property</strong> Trustees<br />

<strong>The</strong> Trustees’ approval must be received before you commit to spending the money.<br />

Application forms, together with supplementary questions, are available from the Secretary<br />

to the Trustees. Depending on what you propose, presbytery/UDC and the Trustees may<br />

ask for your parish accounts, valuations <strong>of</strong> the property, and plans and costings.<br />

If you are planning to use property money, check early<br />

with the Secretary to the Trustees as to whether your<br />

proposal is likely to be within the <strong>Church</strong> <strong>Property</strong> Trustees’ discretion.<br />

What happens to property money we aren’t spending?<br />

<strong>Property</strong> capital funds which you are not using must be held in the <strong>Presbyterian</strong><br />

Investment Fund. Interest earned in the parish’s account is credited quarterly. <strong>The</strong><br />

interest may be used to meet the running costs <strong>of</strong> the parish.<br />

Synod <strong>of</strong> Otago & Southland authority<br />

Parishes located south <strong>of</strong> the Waitaki River must apply to the Synod <strong>of</strong> Otago &<br />

Southland (not to the <strong>Church</strong> <strong>Property</strong> Trustees) for any approvals relating to relating to<br />

property, and the use <strong>of</strong> property proceeds.<br />

<strong>The</strong> Synod’s regulations vary in some respects from those <strong>of</strong> the <strong>Church</strong> <strong>Property</strong><br />

Trustees. Southern parishes should contact the Executive Officer, Synod <strong>of</strong> Otago<br />

& Southland, P O Box 1131, Dunedin. Phone 0800 76 22 22 or email synod.otago.<br />

southland@xtra.co.nz.

PAGE ›› 31<br />

THE PROPERTY HANDBOOK<br />

Gifting property<br />

Rather than sell, can we gift the property, or discount its price, to a worthy cause?<br />

Occasionally, congregations prefer not to sell their property, but to have it used in some<br />

worthy manner (or sold at below market rates to a cause which cannot afford the full<br />

value <strong>of</strong> the property).<br />

Yes and No.<br />

SECTION 07<br />

<strong>The</strong> main distinction is the status <strong>of</strong> the congregation concerned. If the congregation<br />

is continuing its ministry in the area, it is appropriate to place such a proposal, after<br />

careful consideration, before the presbytery/UDC. If, however, the parish is closing<br />

down, only the presbytery/UDC can make such decisions.<br />

Is such a proposal the best use <strong>of</strong> the property to fulfil the mission <strong>of</strong> your local,<br />

regional and national church?<br />

<strong>The</strong> wider proposal will also need the specific approval <strong>of</strong> your church courts,<br />

presbytery/UDC and the Trustees.<br />

This can take a lot <strong>of</strong> talking through – so allow plenty <strong>of</strong> time for the process, and<br />

don’t promise the property when you are not the only people who have a say.<br />

Remember that church property is a trust from all the past members <strong>of</strong> your<br />

congregation, going right back to its establishment. <strong>The</strong> assets have been given in the<br />

expectation they will continue to be used for the mission <strong>of</strong> the <strong>Presbyterian</strong> <strong>Church</strong>. It<br />

is important that any gifting fulfils this trust.<br />

In some circumstances, if all the approvals have been given, sales can be arranged at<br />

a discount to the real value <strong>of</strong> the property. This may include the nominal sum <strong>of</strong> $1,<br />

though the tax implications <strong>of</strong> such gifting need to be checked out.<br />

Proceeds from the sale <strong>of</strong> a property may gifted to another congregation. <strong>The</strong> Trustees<br />

Office has details.<br />

Closure <strong>of</strong> a parish<br />

When a congregation is dissolved i.e. the parish closes, it is not the end <strong>of</strong> the<br />

<strong>Presbyterian</strong> <strong>Church</strong>’s mission in that area. Presbytery/UDC will ensure that mission<br />

<strong>of</strong> the church continues, <strong>of</strong>ten by amalgamating the area into one or more <strong>of</strong> the<br />

neighbouring parishes. <strong>The</strong> beneficial ownership <strong>of</strong> the assets <strong>of</strong> the parish will be<br />

transferred to the presbytery/UDC, and responsibility for determining the future <strong>of</strong>

PAGE ›› 32<br />

THE PROPERTY HANDBOOK<br />

these assets belongs with the presbytery/UDC. <strong>The</strong> closing parish may express its<br />

wishes on the matter, but it does not have the right to make the final decision.<br />

When a union or co-operating parish is considering closure, the other partner <strong>Church</strong>es<br />

must be consulted, through the Joint Regional Committee. A proportion <strong>of</strong> the closed<br />

parish’s assets will go to the partner <strong>Church</strong>es involved. It is important that the schedule<br />

<strong>of</strong> assets, which accompanied the original agreement to unite, is kept up to date.

PAGE ›› 33<br />

THE PROPERTY HANDBOOK<br />

SECTION 08<br />

Gifting and loaning <strong>of</strong><br />

congregational funds<br />

Introduction<br />

<strong>The</strong> 2008 General Assembly wished to make it easier for the <strong>Church</strong>’s financial resources<br />

to be shared more widely. In response, the <strong>Church</strong> <strong>Property</strong> Trustees, in consultation<br />

with the Council <strong>of</strong> Assembly, developed a process to encourage congregations and<br />

presbyteries to gift or lend funds to another congregation or presbytery. Through Press<br />

Go, the <strong>Church</strong> can collectively evaluate and fund promising growth projects, and<br />

parishes are urged to gift or loan funds through Press Go.<br />

Gifting <strong>of</strong> non-capital funds<br />

No external approvals are needed if a parish wishes to gift any <strong>of</strong> its surplus funds<br />

that have not come from the sale <strong>of</strong> a church property. However, the <strong>Church</strong> <strong>Property</strong><br />

Trustees and the Council <strong>of</strong> Assembly expect that proposals to gift funds, particularly<br />

over $20,000, will first be discussed in principle with the Press Go Board.<br />

<strong>The</strong> donor church council should develop a formal proposal, to be put to the congregation<br />

for approval. Once approved, the funds can be gifted directly to the Press Go Board, or<br />

to the selected recipient parish or presbytery.<br />

Loans from non-capital funds<br />

<strong>The</strong> donor congregation does not need external approval to lend non-capital funds<br />

but, if the loan is more than $5,000, the recipient parish must seek the approval <strong>of</strong><br />

presbytery and the <strong>Church</strong> <strong>Property</strong> Trustees to borrow funds. (See flowchart on next<br />

page.) A formal agreement, with clear terms and conditions, should be drawn up, with<br />

legal advice, and signed by both congregations.<br />

Gifting or loans from capital funds<br />

If a congregation has surplus funds from the sale <strong>of</strong> a property, the approval <strong>of</strong><br />

presbytery and the <strong>Church</strong> <strong>Property</strong> Trustees is required before the funds can be<br />

transferred to another congregation or to a presbytery.<br />

Information on the detailed requirements for gifting or lending capital funds is available<br />

from the Trustees’ Office. <strong>The</strong> donor congregation, the recipient congregation and the<br />

presbyteries concerned must all answer a range <strong>of</strong> questions about the proposal, and<br />

how it will further the church’s mission.

PAGE ›› 34<br />

THE PROPERTY HANDBOOK<br />

Parishes can also gift to Press Go a proportion <strong>of</strong> the interest earned on their <strong>Presbyterian</strong><br />

Investment Fund accounts each quarter. Contact the Trustees’ Office for details.<br />

Steps in process for gifting or lending capital funds<br />

<strong>Church</strong> council agrees to<br />

explore gifting or lending<br />

surplus capital funds.<br />

(Minimum $5,000 in total)<br />

<strong>Church</strong> council discusses<br />

proposal in principle with<br />

both presbytery and Press<br />

Go Board.<br />

<strong>Church</strong> council develops<br />

formal proposal and puts to<br />

congregation for approval.<br />

Congregation seeks<br />

presbytery approval to<br />

gift or loan surplus capital<br />

funds to another<br />

congregation.<br />

If the funds are to be a<br />

loan, the recipient<br />

congregation seeks<br />

presbytery approval to<br />

borrow.<br />

Presbytery assesses<br />

application to use capital<br />

funds, then forwards it to<br />

<strong>Church</strong> <strong>Property</strong><br />

Trustees.<br />

Presbytery assesses<br />

application to borrow<br />

funds, then forwards it to<br />

<strong>Church</strong> <strong>Property</strong><br />

Trustees.<br />

1. CPT gives approval<br />

in principle.<br />

2. Both congregations<br />

sign agreement (with<br />

terms and conditions<br />

drawn up on legal advice)<br />

and send it to CPT for<br />

formal approval, and<br />

lodging with CPT.

PAGE ›› 35<br />

THE PROPERTY HANDBOOK<br />

SECTION 09<br />

Lottery Grants Board applications<br />

Conditions to be met before making an application for a Lottery Board grant<br />

<strong>The</strong> <strong>Presbyterian</strong> <strong>Church</strong> has long-standing objections to gambling, particularly to large<br />

scale gambling as promoted by the Lotteries Commission. <strong>The</strong> General Assembly has<br />

endorsed the following criteria for parish applications for Lottery grants.<br />

• Benefits <strong>of</strong> the grant must be wider than the congregation e.g. for community projects.<br />

• Grants can’t be used for regular parish running.<br />

• Applications for grants for property development, including building alterations, will<br />

only be considered when most <strong>of</strong> the use <strong>of</strong> the property will be for groups or<br />

organisations which are not part <strong>of</strong> the congregation.<br />

• <strong>The</strong> congregation will be able to sustain the project financially during its life.<br />

• <strong>The</strong> congregation has sufficient realisable assets, either financial or in property,<br />

to cover the restitution <strong>of</strong> any grant which the <strong>Church</strong> <strong>Property</strong> Trustees may be<br />

required to make in terms <strong>of</strong> the agreement with the Lottery Grants Board.<br />

• <strong>The</strong> congregation has specifically agreed that should restitution be required, it will<br />

be funded from these specific assets.<br />

• Presbytery has undertaken to ensure that the conditions <strong>of</strong> the grant are met, and<br />

has processes in place to fulfil this.<br />

Congregations must apply to the <strong>Church</strong> <strong>Property</strong> Trustees for approval to apply to<br />

the Lottery Grants Board. <strong>The</strong>se approvals are required:<br />

• Board <strong>of</strong> managers / deacons’ court or parish council finance committee.<br />

• Congregation, including an undertaking to repay the grant if the conditions attached<br />

to it are not met.<br />

• Presbytery/UDC, which must undertake to monitor the project to ensure any<br />

conditions attached to the grant are met.<br />

• <strong>Church</strong> <strong>Property</strong> Trustees (Synod <strong>of</strong> Otago & Southland, for parishes south <strong>of</strong> the<br />

Waitaki River).<br />

<strong>The</strong> church approvals application form is available from the <strong>Church</strong> <strong>Property</strong> Trustees<br />

Office. Email trustees@presbyterian.org.nz for an electronic copy.

PAGE ›› 36<br />

THE PROPERTY HANDBOOK<br />

<strong>The</strong> Trustees will assess applications using the above criteria.<br />

Note: Local Lottery Commission Offices have discretion to make grants <strong>of</strong> up to $5,000<br />

to unincorporated societies. Where a parish has a specific need, and the use is for<br />

community purposes, an application for less than $5,000 may be submitted without<br />

the prior approval <strong>of</strong> the Trustees. <strong>The</strong> approval <strong>of</strong> presbytery is still required in such<br />

circumstances.<br />

Approval requirements:<br />

• Before any expenditure is made from a Lottery Board grant, or any contract made<br />

which would require disbursement from the grant, the recipient church council must<br />

first obtain the approval <strong>of</strong> the presbytery/UDC property and finance committee<br />

• <strong>The</strong> church council must set up a special bank account with four trustee signatories<br />

(two church council and two presbytery property and finance committee members),<br />

into which the grant must be paid. Withdrawals from the account must be<br />

signed by one church council signatory and one presbytery signatory.<br />

If these conditions are satisfied, the Trustees may authorise a grant application, on<br />

the basis that any restitution will be limited to the property specified above, and the<br />

acceptance <strong>of</strong> the grant does not place any liability on any other church property or fund.<br />

<strong>The</strong> Lottery Grants Board has a number <strong>of</strong> schemes which vary between regions,<br />

and change over time. Enquire at your nearest local Community Development<br />

Group Office (see www.cdgo.govt.nz or call 0800 824 824) to check if your<br />

proposal will fit their current criteria, and whether a scheme exists under which<br />

your proposal might get a grant. You may find no money is available for proposals<br />

like yours.<br />

<strong>The</strong> Trustees have absolute discretion in this area, and they are likely to decline any<br />

applications that they judge marginal.<br />

If you get <strong>Church</strong> approval, then you still have to be successful with the NZ Lottery<br />

Grants Board. <strong>The</strong> Client Application form will not be accepted unless it has been<br />

countersigned by the Trustees.

PAGE ›› 37<br />

THE PROPERTY HANDBOOK<br />

SECTION 10<br />

Duties and responsibilities<br />

<strong>of</strong> decision makers<br />

• All members <strong>of</strong> church courts who manage the assets <strong>of</strong> a parish are in a ‘trustee<br />

relationship’.<br />

• <strong>The</strong>y have responsibilities as trustees in keeping with <strong>The</strong> Trustee Act 1956.<br />

• <strong>The</strong> most important responsibility is to exercise ‘care and prudence’ in all decisions<br />

that are made.<br />

• <strong>The</strong>re is a legal accountability to the parish for this responsibility.<br />

• If you are ever in doubt about whether any decision is likely to breach this duty,<br />

seek legal advice first.<br />

This is what we mean by ‘good stewardship’.<br />

Responsibilities <strong>of</strong> presbytery/UDC<br />

Presbyteries/UDCs play a pivotal role in property matters.<br />

<strong>The</strong> Book <strong>of</strong> Order places responsibility on Presbyteries/UDCs for the oversight <strong>of</strong> all<br />

property dealings with parishes. While the Trustees have the final legal authority over<br />

property, the Trustees do not know the local situation.<br />

<strong>The</strong> Trustees expect the presbytery/UDC to give careful scrutiny to property proposals<br />

before endorsing them. Presbytery/UDC approval carries considerable weight.<br />

Presbytery should consider whether a property proposal before it:<br />

• is consistent with the mission strategy <strong>of</strong> the parish and <strong>of</strong> the presbytery<br />

• is a wise use <strong>of</strong> resources<br />

• complies with the requirements <strong>of</strong> the Book <strong>of</strong> Order and its supplementary provisions<br />

• has sufficient support within the parish<br />

• will not over-commit the parish<br />

• will not put undue pressure on the congregation.

PAGE ›› 38<br />

THE PROPERTY HANDBOOK<br />

Chapter 16.4 <strong>of</strong> the 2006 Book <strong>of</strong> Order defines the property and finance<br />

responsibilities and duties <strong>of</strong> a presbytery as follows:<br />

1. A presbytery has the following functions in relation to church buildings:<br />

a) approval <strong>of</strong> sites and plans for new buildings<br />

b) approval <strong>of</strong> the erection <strong>of</strong> new buildings for the purposes <strong>of</strong> the <strong>Church</strong><br />

c) oversight <strong>of</strong> building proposals submitted by congregations<br />

d) approval <strong>of</strong> plans for re-erection or renovation <strong>of</strong>, and alterations and additions to,<br />

the buildings in excess <strong>of</strong> a sum determined by the Council <strong>of</strong> Assembly and specified<br />

in the supplementary provisions and<br />

e) approve the purchase <strong>of</strong> existing buildings.<br />

2. A presbytery must not approve any building proposals in excess <strong>of</strong> a sum determined<br />

by the Council <strong>of</strong> Assembly and specified in the supplementary provisions<br />

unless it is satisfied that any person or persons engaged in drawing up plans and<br />

specifications for such buildings is or are competent and recognised by the appropriate<br />

industry body.<br />

3. A presbytery must ensure that a registered architect, registered clerk <strong>of</strong> works or<br />

other competent person acceptable to presbytery carries out inspections at regular<br />

intervals <strong>of</strong> building proposals involving expenditure in excess <strong>of</strong> a sum determined<br />

by the Council <strong>of</strong> Assembly and specified in the supplementary provisions.<br />

4. A presbytery must approve all purchases, sales, exchanges, leases and other transactions<br />

affecting <strong>Church</strong> property (including <strong>Church</strong> campsites where appropriate)<br />

within the area for which it has responsibility and in doing so must have regard to<br />

the requirements <strong>of</strong> the supplementary provisions relating to value and terms <strong>of</strong><br />

leases.<br />

5. Before approving any building proposal subject to the requirements <strong>of</strong> the Trustees,<br />

whether by way <strong>of</strong> new building, alteration, addition, or purchase <strong>of</strong> existing buildings<br />

(but not including maintenance), the presbytery must obtain and be satisfied<br />

with the report <strong>of</strong> the <strong>Church</strong> Architecture Reference Group on the proposal.<br />

6. Subsection (5) does not apply to any proposal for maintenance <strong>of</strong> buildings.<br />

7. In exercising its responsibilities for worship and mission through the purchase, development<br />

and sale <strong>of</strong> sites, the presbytery must consult with the negotiating partners<br />

through the Joint Regional Committee in their region.

PAGE ›› 39<br />

THE PROPERTY HANDBOOK<br />

8. For parishes south <strong>of</strong> the Waitaki river, subsections (1) to (7) must be read subject<br />

to the requirement that any application by a congregation or <strong>Church</strong> campsites to<br />

purchase, sell, build, dismantle, remove, lease, subdivide, or borrow on the security<br />

<strong>of</strong> anything over $5000 must be approved by the Synod <strong>of</strong> Otago and Southland.<br />

Such applications must be made through presbyteries, which may recommend but<br />

cannot decide on such applications.<br />

<strong>The</strong> Supplementary Provisions to Chapter 16 contain further details.<br />

<strong>The</strong> Book <strong>of</strong> Order and its supplementary provisions may viewed on the national <strong>Church</strong><br />

website, www.presbyterian.org.nz<br />

<strong>Property</strong> held in the name <strong>of</strong> Presbytery<br />

If a parish closes without amalgamating with another parish, ownership <strong>of</strong> its assets<br />

are transferred to the presbytery.<br />

If a presbytery wishes to sell a property held in its name, or undertake material work<br />

on such property, then the presbytery must apply to a Commission <strong>of</strong> Assembly, which<br />

will then forward the application to the <strong>Church</strong> <strong>Property</strong> Trustees for final approval.<br />

<strong>The</strong> standard application form may still be used, and modified to suit.

PAGE ›› 40<br />

THE PROPERTY HANDBOOK<br />

THE PRESBYTERIAN CHURCH PROPERTY TRUSTEES<br />

<strong>The</strong> Trustees are a group <strong>of</strong> up to 20 people who administer the property and financial<br />

assets <strong>of</strong> the <strong>Presbyterian</strong> <strong>Church</strong>.<br />

You can find who the Trustees are by contacting the Secretary to the Trustees.<br />

In addition to their general accountabilities as Trustees, <strong>The</strong> <strong>Presbyterian</strong> <strong>Church</strong><br />

<strong>Property</strong> Trustees are required to keep the rules set out in Acts <strong>of</strong> Parliament which are<br />

specific to <strong>Presbyterian</strong> <strong>Church</strong> property. <strong>The</strong>se Acts are listed below. <strong>The</strong> Trustees are<br />

also guided by decisions made at General Assembly.<br />

<strong>The</strong> Trustees are:<br />

• appointed by the General Assembly<br />

• must be members <strong>of</strong> the <strong>Presbyterian</strong> <strong>Church</strong><br />

• must be <strong>of</strong> ‘full age and good fame’<br />

• must be resident in New Zealand.<br />

<strong>The</strong> Trustees are usually appointed because <strong>of</strong> their skills and experience. As <strong>The</strong><br />

Trustees meet <strong>of</strong>ten, most live in the wider Wellington region.<br />

<strong>The</strong> Acts <strong>of</strong> Parliament under which <strong>The</strong> Trustees work:<br />

<strong>The</strong> <strong>Presbyterian</strong> <strong>Church</strong> <strong>Property</strong> Act 1885<br />

<strong>The</strong> <strong>Presbyterian</strong> <strong>Church</strong> <strong>Property</strong> Amendment Act 1914<br />

<strong>The</strong> <strong>Presbyterian</strong> <strong>Church</strong> <strong>Property</strong> Amendment Act 1930<br />

<strong>The</strong> <strong>Presbyterian</strong> <strong>Church</strong> <strong>Property</strong> Trustees Empowering Act 1957<br />

<strong>The</strong> <strong>Presbyterian</strong> <strong>Church</strong> <strong>Property</strong> Amendment Act 1963<br />

<strong>The</strong> <strong>Presbyterian</strong> <strong>Church</strong> <strong>Property</strong> Amendment Act 1970<br />

<strong>The</strong> <strong>Presbyterian</strong> <strong>Church</strong> <strong>Property</strong> Amendment Act 1974<br />

<strong>The</strong> <strong>Presbyterian</strong> <strong>Church</strong> <strong>Property</strong> Amendment Act 1996<br />

Other <strong>Church</strong> <strong>Property</strong> Acts <strong>of</strong> interest are:<br />

<strong>The</strong> <strong>Presbyterian</strong> <strong>Church</strong> <strong>of</strong> New Zealand Act 1901<br />

<strong>The</strong> Otago <strong>Church</strong> Board <strong>of</strong> <strong>Property</strong> Act 1962<br />

<strong>The</strong> Otago Foundation Trust Board Amendment Act 1968<br />

<strong>The</strong> Otago Foundation Trust Board Act 1992

PAGE ›› 41<br />

THE PROPERTY HANDBOOK<br />

››

PAGE ›› 42 THE PROPERTY HANDBOOK

PAGE ›› 43 THE PROPERTY HANDBOOK

PAGE ›› 44<br />

THE PROPERTY HANDBOOK<br />