Investor Presentation - Proactive Investors

Investor Presentation - Proactive Investors

Investor Presentation - Proactive Investors

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

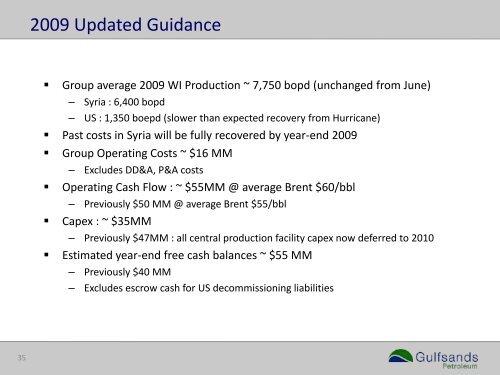

2009 Updated Guidance<br />

• Group average 2009 WI Production ~ 7,750 bopd (unchanged from June)<br />

– Syria : 6,400 bopd<br />

– US : 1,350 boepd (slower than expected recovery from Hurricane)<br />

• Past costs in Syria will be fully recovered by year‐end 2009<br />

• Group Operating Costs ~ $16 MM<br />

– Excludes DD&A, P&A costs<br />

• Operating Cash Flow : ~ $55MM @ average Brent $60/bbl<br />

– Previously $50 MM @ average Brent $55/bbl<br />

• Capex : ~ $35MM<br />

– Previously $47MM : all central production facility capex now deferred to 2010<br />

• Estimated year‐end free cash balances ~ $55 MM<br />

– Previously $40 MM<br />

– Excludes escrow cash for US decommissioning liabilities<br />

35