Longreach Oil & Gas One2One Investor Presentation - Proactive ...

Longreach Oil & Gas One2One Investor Presentation - Proactive ...

Longreach Oil & Gas One2One Investor Presentation - Proactive ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

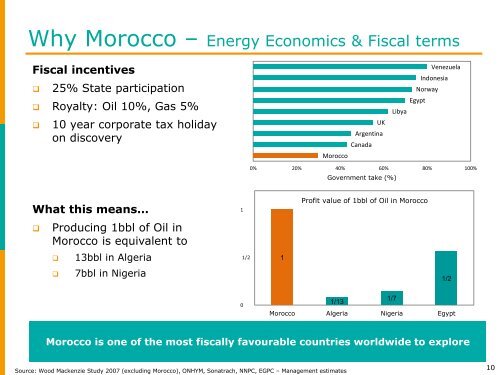

Why Morocco – Energy Economics & Fiscal terms<br />

Fiscal incentives<br />

<br />

25% State participation<br />

Royalty: <strong>Oil</strong> 10%, <strong>Gas</strong> 5%<br />

<br />

10 year corporate tax holiday<br />

on discovery<br />

Argentina<br />

Canada<br />

UK<br />

Venezuela<br />

Indonesia<br />

Norway<br />

Egypt<br />

Libya<br />

Morocco<br />

0% 20% 40% 60% 80% 100%<br />

Government take (%)<br />

What this means…<br />

1<br />

Profit value of 1bbl of <strong>Oil</strong> in Morocco<br />

<br />

Producing 1bbl of <strong>Oil</strong> in<br />

Morocco is equivalent to<br />

<br />

13bbl in Algeria<br />

1/2<br />

1<br />

<br />

7bbl in Nigeria<br />

1/2<br />

0<br />

1/13<br />

1/7<br />

Morocco Algeria Nigeria Egypt<br />

Morocco is one of the most fiscally favourable countries worldwide to explore<br />

Source: Wood Mackenzie Study 2007 (excluding Morocco), ONHYM, Sonatrach, NNPC, EGPC – Management estimates<br />

10