Chairman's - QPAC

Chairman's - QPAC

Chairman's - QPAC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

QUE E NSL A N D PE RFO RM I NG ARTS TRUST<br />

NOTES TO THE FINANCIAL REPORT<br />

QUE E NSL A N D PE RFO RM I NG ARTS TRUST<br />

NOTES TO THE FINANCIAL REPORT<br />

For the Year Ended 30 June 2006<br />

For the Year Ended 30 June 2006<br />

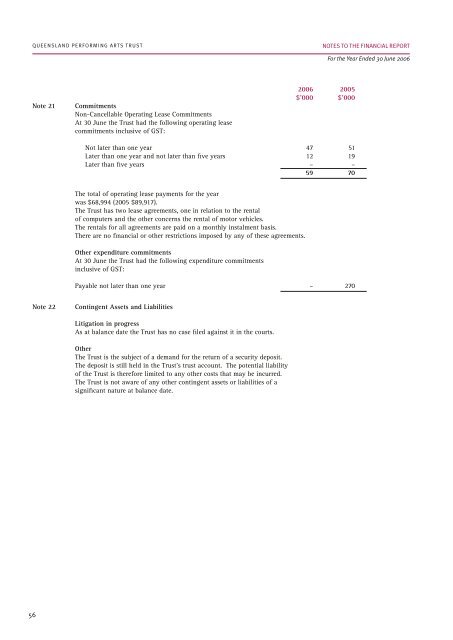

Note 21<br />

Commitments<br />

Non-Cancellable Operating Lease Commitments<br />

At 30 June the Trust had the following operating lease<br />

commitments inclusive of GST:<br />

2006 2005<br />

$’000 $’000<br />

Note 23<br />

(a)<br />

Financial Instruments<br />

Interest rate risk<br />

The exposure to interest rate risks and the effective interest rates of financial assets and financial liabilities,<br />

both recognised and unrecognised at balance date are as follows:<br />

Note 22<br />

Not later than one year 47 51<br />

Later than one year and not later than five years 12 19<br />

Later than five years – –<br />

59 70<br />

The total of operating lease payments for the year<br />

was $68,994 (2005 $89,917).<br />

The Trust has two lease agreements, one in relation to the rental<br />

of computers and the other concerns the rental of motor vehicles.<br />

The rentals for all agreements are paid on a monthly instalment basis.<br />

There are no financial or other restrictions imposed by any of these agreements.<br />

Other expenditure commitments<br />

At 30 June the Trust had the following expenditure commitments<br />

inclusive of GST:<br />

Payable not later than one year – 270<br />

Contingent Assets and Liabilities<br />

Litigation in progress<br />

As at balance date the Trust has no case filed against it in the courts.<br />

Other<br />

The Trust is the subject of a demand for the return of a security deposit.<br />

The deposit is still held in the Trust’s trust account. The potential liability<br />

of the Trust is therefore limited to any other costs that may be incurred.<br />

The Trust is not aware of any other contingent assets or liabilities of a<br />

significant nature at balance date.<br />

(b)<br />

Floating Non Weighted<br />

Interest 1 Year Interest Average<br />

Rate or less Bearing Total Rate<br />

2006 2006 2006 2006 2006<br />

$’000 $’000 $’000 $’000 %<br />

Financial Assets<br />

Cash on hand and at bank 55 – 42 97 5.67%<br />

Short term securities – 8,707 – 8,707 5.67%<br />

Receivables – - 2,597 2,597 –<br />

Financial Liabilities<br />

Payables – – 2,262 2,262 0.00%<br />

2005 2005 2005 2005 2005<br />

$’000 $’000 $’000 $’000 %<br />

Financial Assets<br />

Cash on hand and at bank 8 – 27 35 3.52%<br />

Short term securities – 7,952 – 7,952 5.53%<br />

Receivables – – 1,939 1,939 –<br />

Financial Liabilities<br />

Payables – – 1,426 1,426 –<br />

Credit risk<br />

The maximum exposure to credit risk at balance date in relation to each class of recognised financial asset is<br />

represented by the carrying amount of those assets as indicated in the Statement of Financial Position. There<br />

are no concentrations of credit risk.<br />

(c)<br />

Net fair value<br />

It is considered that the net fair value of the financial assets and financial liabilities of the Trust approximate the<br />

book values due to their short term to maturity.<br />

Note 24<br />

Remuneration of Trustees<br />

Remuneration paid or payable to Trustees for attendances at meetings held during 2005-06 was as follows:<br />

$’000<br />

John Hay 1,300<br />

Rob Kelly 3,134<br />

Suellen Maunder 1,579<br />

Henry Smerdon 2,364<br />

Jane Grigg 1,602<br />

Peter Holmes à Court 433<br />

Brian Tucker (donates fees to <strong>QPAC</strong>) 0<br />

Total 10,412<br />

56<br />

57