View sample - Report Buyer

View sample - Report Buyer

View sample - Report Buyer

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Type 1 Diabetes - Drug Pipeline Assessment and<br />

Market Forecasts to 2017<br />

Reference Code: GDHC106PRT Publication Date: June 2010<br />

The Type 1 Diabetes Therapeutics Market is Forecast to<br />

Show Moderate Growth until 2017<br />

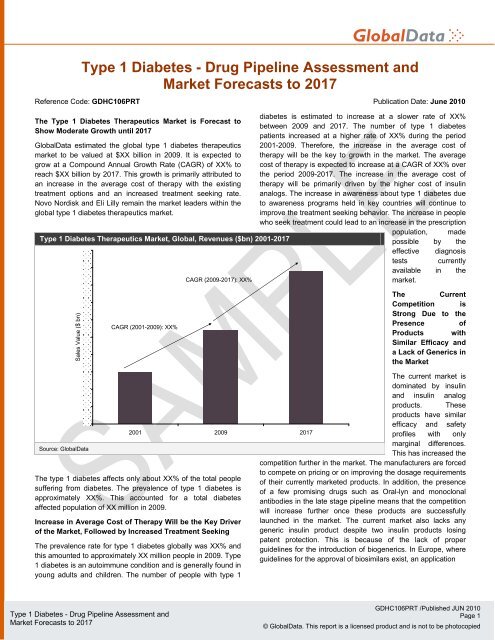

GlobalData estimated the global type 1 diabetes therapeutics<br />

market to be valued at $XX billion in 2009. It is expected to<br />

grow at a Compound Annual Growth Rate (CAGR) of XX% to<br />

reach $XX billion by 2017. This growth is primarily attributed to<br />

an increase in the average cost of therapy with the existing<br />

treatment options and an increased treatment seeking rate.<br />

Novo Nordisk and Eli Lilly remain the market leaders within the<br />

global type 1 diabetes therapeutics market.<br />

Type 1 Diabetes Therapeutics Market, Global, Revenues ($bn) 2001-2017<br />

CAGR (2009-2017): XX%<br />

diabetes is estimated to increase at a slower rate of XX%<br />

between 2009 and 2017. The number of type 1 diabetes<br />

patients increased at a higher rate of XX% during the period<br />

2001-2009. Therefore, the increase in the average cost of<br />

therapy will be the key to growth in the market. The average<br />

cost of therapy is expected to increase at a CAGR of XX% over<br />

the period 2009-2017. The increase in the average cost of<br />

therapy will be primarily driven by the higher cost of insulin<br />

analogs. The increase in awareness about type 1 diabetes due<br />

to awareness programs held in key countries will continue to<br />

improve the treatment seeking behavior. The increase in people<br />

who seek treatment could lead to an increase in the prescription<br />

population, made<br />

possible by the<br />

effective diagnosis<br />

tests currently<br />

available in the<br />

market.<br />

Sales Value ($ bn)<br />

CAGR (2001-2009): XX%<br />

The Current<br />

Competition is<br />

Strong Due to the<br />

Presence of<br />

Products with<br />

Similar Efficacy and<br />

a Lack of Generics in<br />

the Market<br />

Source: GlobalData<br />

2001 2009 2017<br />

The type 1 diabetes affects only about XX% of the total people<br />

suffering from diabetes. The prevalence of type 1 diabetes is<br />

approximately XX%. This accounted for a total diabetes<br />

affected population of XX million in 2009.<br />

Increase in Average Cost of Therapy Will be the Key Driver<br />

of the Market, Followed by Increased Treatment Seeking<br />

The prevalence rate for type 1 diabetes globally was XX% and<br />

this amounted to approximately XX million people in 2009. Type<br />

1 diabetes is an autoimmune condition and is generally found in<br />

young adults and children. The number of people with type 1<br />

The current market is<br />

dominated by insulin<br />

and insulin analog<br />

products. These<br />

products have similar<br />

efficacy and safety<br />

profiles with only<br />

marginal differences.<br />

This has increased the<br />

competition further in the market. The manufacturers are forced<br />

to compete on pricing or on improving the dosage requirements<br />

of their currently marketed products. In addition, the presence<br />

of a few promising drugs such as Oral-lyn and monoclonal<br />

antibodies in the late stage pipeline means that the competition<br />

will increase further once these products are successfully<br />

launched in the market. The current market also lacks any<br />

generic insulin product despite two insulin products losing<br />

patent protection. This is because of the lack of proper<br />

guidelines for the introduction of biogenerics. In Europe, where<br />

guidelines for the approval of biosimilars exist, an application<br />

Type 1 Diabetes - Drug Pipeline Assessment and<br />

Market Forecasts to 2017<br />

GDHC106PRT /Published JUN 2010<br />

Page 1<br />

© GlobalData. This report is a licensed product and is not to be photocopied

1 Table of contents<br />

1 Table of contents................................................................................................................................... 3<br />

1.1 List of Tables .................................................................................................................................. 5<br />

1.2 List of Figures ................................................................................................................................. 5<br />

2 Type 1 Diabetes Therapeutics Market: Market Characterization........................................................... 6<br />

2.1 Overview......................................................................................................................................... 6<br />

2.2 Type 1 Diabetes Market Size.......................................................................................................... 6<br />

2.3 Type 1 Diabetes Therapeutics Market Forecast and CAGR........................................................... 7<br />

2.4 Drivers and Barriers for the Type 1 Diabetes Therapeutics Market ................................................ 8<br />

2.4.1 Drivers for the Type 1 Diabetes Therapeutics Market ........................................................... 8<br />

2.4.2 Restraints for the Type 1 Diabetes Therapeutics Market....................................................... 9<br />

2.5 Opportunity and Unmet Need ........................................................................................................10<br />

2.6 Key Takeaway ...............................................................................................................................11<br />

3 Type 1 Diabetes Therapeutics Market: Competitive Assessment ........................................................12<br />

3.1 Overview........................................................................................................................................12<br />

3.2 Strategic Competitor Assessment..................................................................................................12<br />

3.3 Product Profile for the Major Marketed Products in the Type 1 Diabetes Disease Market.............13<br />

3.3.1 Lantus (Insulin Glargine) ......................................................................................................13<br />

3.3.2 Humulin (Human Insulin) ......................................................................................................16<br />

3.3.3 Humalog (Insulin Lispro).......................................................................................................17<br />

3.3.4 Novolog (Insulin Aspart) .......................................................................................................19<br />

3.3.5 Novolin (Human Insulin) .......................................................................................................20<br />

3.3.6 Apidra (Insulin Glulisine).......................................................................................................21<br />

3.3.7 Levemir (Insulin Detemir)......................................................................................................23<br />

3.4 Key Takeaway ...............................................................................................................................25<br />

4 Type 1 Diabetes Therapeutics Market: Pipeline Assessment ..............................................................26<br />

4.1 Overview........................................................................................................................................26<br />

4.2 Strategic Pipeline Assessment ......................................................................................................26<br />

4.2.1 Technology Trends Analytic Framework ..............................................................................26<br />

4.3 Type 1 Diabetes Therapeutics – Promising Drugs under Clinical Development............................27<br />

4.4 Molecule Profile for Promising Drugs under Clinical Development................................................28<br />

4.4.1 rhGAD65 (Diamyd) ...............................................................................................................28<br />

4.4.2 DiaPep277............................................................................................................................28<br />

4.4.3 Otelixizumab.........................................................................................................................29<br />

4.4.4 Oral-lyn.................................................................................................................................30<br />

4.5 Type 1 Diabetes Therapeutics Market – Clinical Pipeline by Mechanism of Action.......................31<br />

4.6 Type 1 Diabetes Pipeline – Pipeline by Clinical Phases of Development ......................................32<br />

4.6.1 Type 1 Diabetes Therapeutics – Filed and Approved Drugs ................................................32<br />

4.6.2 Type 1 Diabetes Therapeutics – Phase III Clinical Pipeline .................................................33<br />

4.6.3 Type 1 Diabetes Therapeutics – Phase II Clinical Pipeline ..................................................33<br />

4.6.4 Type 1 Diabetes Therapeutics – Phase I Clinical Pipeline ...................................................35<br />

4.6.5 Type 1 Diabetes Therapeutics – Preclinical-Discovery Pipeline...........................................35<br />

4.7 Key Takeaway ...............................................................................................................................36<br />

5 Type 1 Diabetes Market: Implications for Future Market Competition..................................................37<br />

6 Type Diabetes Therapeutics Market: Future Players in the Type 1 Diabetes Therapeutics Market .....39<br />

6.1 Introduction....................................................................................................................................39<br />

6.2 Novo Nordisk .................................................................................................................................39<br />

6.2.1 Business Description ............................................................................................................39<br />

6.2.2 Metabolic Disorders Portfolio................................................................................................40<br />

6.2.3 Type 1 Diabetes Pipeline Portfolio........................................................................................41<br />

6.3 GlaxoSmithKline ............................................................................................................................42<br />

6.3.1 Business Description ............................................................................................................42<br />

6.3.2 Metabolic Disorders Portfolio................................................................................................43<br />

6.3.3 Type 1 Diabetes Pipeline Portfolio........................................................................................43<br />

6.4 Eli Lilly ...........................................................................................................................................44<br />

6.4.1 Business Description ............................................................................................................44<br />

6.4.2 Metabolic Disorders Portfolio................................................................................................45<br />

6.4.3 Type 1 Diabetes Pipeline Portfolio........................................................................................45<br />

6.5 Sanofi-Aventis................................................................................................................................46<br />

6.5.1 Business Description ............................................................................................................46<br />

Type 1 Diabetes - Drug Pipeline Assessment and<br />

Market Forecasts to 2017<br />

GDHC106PRT /Published JUN 2010<br />

Page 3<br />

© GlobalData. This report is a licensed product and is not to be photocopied

6.5.2 Metabolic Disorders Portfolio................................................................................................47<br />

6.5.3 Type 1 Diabetes Pipeline Portfolio........................................................................................47<br />

7 Type 1 Diabetes Therapeutics Market: Appendix.................................................................................48<br />

7.1 Definitions......................................................................................................................................48<br />

7.2 Scope of Pipeline Research ..........................................................................................................48<br />

7.3 Abbreviations.................................................................................................................................48<br />

7.4 Research Methodology..................................................................................................................49<br />

7.4.1 Coverage..............................................................................................................................50<br />

7.4.2 Secondary Research ............................................................................................................50<br />

7.4.3 Forecasting...........................................................................................................................50<br />

7.4.4 Primary Research.................................................................................................................52<br />

7.4.5 Expert Panel Validation ........................................................................................................53<br />

7.5 Contact Us.....................................................................................................................................53<br />

7.6 Disclaimer......................................................................................................................................53<br />

7.7 Sources .........................................................................................................................................54<br />

Type 1 Diabetes - Drug Pipeline Assessment and<br />

Market Forecasts to 2017<br />

GDHC106PRT /Published JUN 2010<br />

Page 4<br />

© GlobalData. This report is a licensed product and is not to be photocopied

1.1 List of Tables<br />

Table 1: Type 1 Diabetes Therapeutics Market, Global, Revenues ($bn), 2001-2009 ............................ 7<br />

Table 2: Type 1 Diabetes Therapeutics Market, Global, Revenue Forecasts ($bn), 2009-2017 ............. 8<br />

Table 3: Type 1 Diabetes Therapeutics Market, Lantus, Clinical Studies Outcome for Efficacy, 2010...14<br />

Table 4:<br />

Type 1 Diabetes Therapeutics Market, Lantus, Adverse Events in 28-Week Clinical Trials of<br />

Adults and Children With Type 1 Diabetes, 2010 .....................................................................14<br />

Table 5: Type 1 Diabetes Therapeutics Market, Lantus, Clinical Studies Outcome for Safety, 2010 .....15<br />

Table 6: Humulin - Glycemic Parameters at the End of Treatment Period in Randomized Patients in<br />

Three Months Cross-Over Studies for Type 1 Diabetes, 2010 .................................................16<br />

Table 7: Humulin – Results of Three Month Cross-Over Studies Comparing Humulin with Humalog in<br />

Type 1 Diabetes, 2010..............................................................................................................17<br />

Table 8: Type 1 Diabetes Therapeutics Market, Humalog, Glycemic Parameters at the End of<br />

Treatment Period in Randomized Patients in Three Months Cross-Over Studies, 2010 ..........18<br />

Table 9: Humalog – Results of a Two Month Study Comparing the Use of Humalog and Humulin With<br />

Sulfonyluria (SU) Therapy, 2010...............................................................................................19<br />

Table 10: Type 1 Diabetes Therapeutics Market, Novolog, Glycemic Parameters at the End of 24 Week<br />

Study, 2010...............................................................................................................................20<br />

Table 11: Apidra – Efficacy Result of 26-Week Study Comparing Apidra with Insulin Lispro, 2010 .........22<br />

Table 12: Apidra – Efficacy Result of 26-Week Study Comparing Apidra with Regular Insulin ................22<br />

Table 13: Apidra – Adverse Reactions Observed in Pooled Studies in Type 1 Diabetic Adults, 2010......22<br />

Table 14: Levemir – Efficacy Result in 16-Week Non Blinded Study, 2010..............................................23<br />

Table 15: Major Marketed Products Comparison in the Type 1 Diabetes Therapeutics Market, 2010.....24<br />

Table 16: Type 1 Diabetes Therapeutics – Most Promising Drugs Under Clinical Development, 2010....27<br />

Table 17: Type 1 Diabetes Therapeutics – Filed and Approved Drugs, 2010...........................................32<br />

Table 18: Type 1 Diabetes Therapeutics – Phase III Clinical Pipeline, 2010............................................33<br />

Table 19: Type 1 Diabetes Therapeutics – Phase II Clinical Pipeline, 2010.............................................33<br />

Table 20: Type 1 Diabetes Therapeutics – Phase I Clinical Pipeline, 2010..............................................35<br />

Table 21: Type 1 Diabetes Therapeutics – Preclinical-Discovery Pipeline, 2010 .....................................35<br />

Table 22: Genzyme – Metabolic Disorders Marketed Products, 2010 ......................................................40<br />

Table 23: Novo Nordisk - Metabolic Disorders Pipeline Products, 2010...................................................41<br />

Table 24: GlaxoSmithKline – Metabolic Disorders Marketed Products, 2010...........................................43<br />

Table 25: GlaxoSmithKline - Metabolic Disorders Pipeline Products, 2010..............................................43<br />

Table 26: Eli Lilly – Metabolic Disorders Marketed Products, 2010 ..........................................................45<br />

Table 27: Eli Lilly – Metabolic Disorders Pipeline Products, 2010 ............................................................45<br />

Table 28: Sanofi-Aventis – Metabolic Disorders Marketed Products, 2010 ..............................................47<br />

Table 29: Sanofi-Aventis – Metabolic Disorders Pipeline Products, 2010 ................................................47<br />

1.2 List of Figures<br />

Figure 1: Type 1 Diabetes Therapeutics Market, Global, Revenues ($bn), 2001-2009 ............................ 7<br />

Figure 2: Type 1 Diabetes Therapeutics Market, Global, Revenue Forecasts ($bn), 2009-2017 ............. 8<br />

Figure 3: Opportunity and Unmet Need in the Type 1 Diabetes Therapeutics Market, 2010 ...................10<br />

Figure 4: Strategic Competitor Assessment of the Major Marketed Products in Type 1 Diabetes<br />

Therapeutics, 2010 ...................................................................................................................13<br />

Figure 5: Technology Trends Analytic Framework of the Type 1 Diabetes Therapeutics Pipeline, 2010.26<br />

Figure 6: Technology Trends Analytic Framework of the Type 1 Diabetes Therapeutics<br />

Pipeline – Description, 2010 .....................................................................................................27<br />

Figure 7: Type 1 Diabetes Therapeutics Market – Clinical Pipeline by Mechanism of Action, 2010 ........31<br />

Figure 8: Type 1 Diabetes Therapeutics Pipeline by Phase of Clinical Development, 2010 ....................32<br />

Figure 9: Implications for Future Market Competition in the Type 1 Diabetes Market, 2010....................37<br />

Figure 10: Type 1 Diabetes Therapeutics Market – Clinical Pipeline by Company, 2010 ..........................39<br />

Figure 11: GlobalData Methodology, 2010 ................................................................................................49<br />

Figure 12: GlobalData Market Forecasting Model, 2010............................................................................52<br />

Type 1 Diabetes - Drug Pipeline Assessment and<br />

Market Forecasts to 2017<br />

GDHC106PRT /Published JUN 2010<br />

Page 5<br />

© GlobalData. This report is a licensed product and is not to be photocopied

2.3 Type 1 Diabetes Therapeutics Market Forecast and CAGR<br />

GlobalData expects the type-1 diabetes therapeutics market to grow at a CAGR of XX% from $XXX billion<br />

in 2009 to $XX billion in 2017.<br />

Figure 1: Type 1 Diabetes Therapeutics Market, Global, Revenues ($bn), 2001-2009<br />

CAGR (2001-2009): XX%<br />

Sales Value ($ bn)<br />

2001 2002 2003 2004 2005 2006 2007 2008 2009<br />

Source: GlobalData<br />

Table 1: Type 1 Diabetes Therapeutics Market, Global, Revenues ($bn), 2001-2009<br />

Year 2001 2002 2003 2004 2005 2006 2007 2008 2009<br />

Sales Value ($bn)<br />

Growth Rate (%)<br />

Source: GlobalData<br />

CAGR 2001-2009<br />

(%)<br />

Type 1 Diabetes - Drug Pipeline Assessment and<br />

Market Forecasts to 2017<br />

GDHC106PRT /Published JUN 2010<br />

Page 7<br />

© GlobalData. This report is a licensed product and is not to be photocopied

4.5 Type 1 Diabetes Therapeutics Market – Clinical Pipeline by Mechanism of<br />

Action<br />

In terms of the drugs currently under development, insulin products dominated the type 1 diabetes<br />

therapeutics pipeline. This is because type 1 diabetes is dependent on insulin intake due to the body’s<br />

inability to produce insulin. Insulin acts in the body to help in glucose metabolism. Insulin attaches to<br />

insulin receptors in cells to enable the absorption of glucose in cells. Insulin analogs accounted for XX%<br />

of the total number of pipeline products. Together insulin and insulin analogs account for XX% of the total<br />

number of pipeline products. Together, anti-CD3 monoclonal antibodies was the second largest category<br />

and accounted for XX% of the total type 1 diabetes pipeline. Interleukin-1 (IL-1) receptor antagonists, antiinflammatories<br />

and islet implants formed XX% of the total number of pipeline products.<br />

Figure 7: Type 1 Diabetes Therapeutics Market – Clinical Pipeline by Mechanism of Action, 2010<br />

Insulin<br />

Anti-CD3 mABs<br />

Islet Implant<br />

Antigen-Specific Immune Modulators<br />

T-lymphocyte Inhibitors<br />

New Islet Formation Inducers<br />

Miscellaneous<br />

Interleukin-1 (IL-1) Receptor Antagonist<br />

Anti-Inflammatory<br />

Insulin Analog<br />

IL12 and STAT 4 Activators<br />

Stem Cell Therapy<br />

SGLT 2 Inhibitor<br />

Source: GlobalData<br />

Type 1 diabetes is an autoimmune disorder and anti-CD3 monoclonal antibodies aim to work by<br />

protecting the insulin-producing pancreatic cells from autoimmune attacks. The drugs in development for<br />

type 1 diabetes can be divided into three major categories of mechanism of action. First, some drugs help<br />

the body’s glucose metabolism by supplying the body with the required insulin. Second, some drugs help<br />

in the generation of new islet cells. Islet cells in the pancreas are primarily responsible for the generation<br />

of insulin. A third category protects the insulin producing islets from autoimmune attacks. The therapies<br />

related to islet implants accounted for XX% of the total products in the pipeline. Antigen-specific immune<br />

modulators, IL12 and STAT 4 activators, t-lymphocyte inhibitors, stem cell therapies, sodium-glucose cotransporter<br />

(SGLT 2) inhibitors and new islet formation inducers each accounted for XX% of the total<br />

pipeline. The rest of the pipeline has products that help to reduce blood glucose level by targeting the<br />

glucose metabolism at different steps, to reduce the destruction of beta cells in the pancreas or induce the<br />

production of healthy insulin producing cells. These products are under the miscellaneous category. It<br />

includes amylinomimetic agents, anti-CD20, anti-IL-1β monoclonal antibodies, products that destructs β<br />

cell and increase insulin levels, granulocyte colony-stimulating factor (G-CSF) receptor inhibitors,<br />

products that convert hepatic glycogen to glucose, DPP-4 inhibitors, enzyme transketolase activators,<br />

GLP1-analogs, glucagon receptors, human LFA-3/IGG1 fusion proteins, CD4+CD25+foxp3+ regulatory T<br />

cells inducers, NF-kB inhibitors, PPAR agonists, products that preserve beta cell functioning, selective costimulation<br />

modulators, CD80 and CD86 blockers, combination products that inhibits 3-hydroxy-3-<br />

methylglutaryl-coenzyme A (HMG-CoA) reductase and reduce LDL cholesterol, Syk kinase inhibitors, and<br />

tumor necrosis factor inhibitors. Some products stimulate intestinal calcium and phosphorus absorption<br />

and bone mineralization and target disease-specific autoagressive T-cells. All these products form part of<br />

the miscellaneous category of mechanisms of action and account for XX% of the total products in the<br />

pipeline.<br />

Type 1 Diabetes - Drug Pipeline Assessment and<br />

Market Forecasts to 2017<br />

GDHC106PRT /Published JUN 2010<br />

Page 31<br />

© GlobalData. This report is a licensed product and is not to be photocopied

7 Type 1 Diabetes Therapeutics Market: Appendix<br />

7.1 Definitions<br />

Type 1 Diabetes Disorders Market: The type 1 diabetes disorders market is primarily formed of ten<br />

products – Lantus, Symlin, Levemir, CDM1103, NovoMix, Apidra, Humalog, Humulin, Novolin and<br />

Novolog. These products come under the category of insulin, insulin analogs and amylinomimetic agents.<br />

Pipeline analysis: The pipeline candidates fall in the major therapeutic categories such as insulin, anti-<br />

CD3 mABs, interleukin-1 (IL-1) receptor antagonists, anti-inflammatories, islet implants, insulin analogs,<br />

antigen-specific immune modulators, IL12 and STAT 4 activators, T-lymphocyte inhibitors, stem cell<br />

therapies, new islet formation inducers and SGLT 2 inhibitors.<br />

7.2 Scope of Pipeline Research<br />

Pipeline products covered within the report are sourced from;<br />

<br />

<br />

<br />

<br />

Top 200 companies (by number of molecules in pipeline)<br />

Clinical trial.gov<br />

WHO registry, which is covering around 6 different registries such as<br />

India, Australia, Germany and Japan<br />

7.3 Abbreviations<br />

CAGR: Compound Annual Growth Rate<br />

CDC:<br />

CNS:<br />

EBV:<br />

Centers for Disease Control and Prevention<br />

Central Nervous System<br />

Epstein-Barr virus<br />

EMEA: Europe by European Medicines Agency<br />

FPG:<br />

GAD:<br />

Fasting Plasma Glucose<br />

Glutamic Acid Decarboxylase<br />

G-CSF: Granulocyte Colony-Stimulating Factor<br />

GHb:<br />

GSK:<br />

Glycated Hemoglobin<br />

GlaxoSmithKline<br />

HbA1c: Glycosylated Haemoglobin<br />

HMG-CoA: 3-Hydroxy-3-Methylglutaryl-Coenzyme A<br />

Hsp60: Human Heat Shock Protein 60<br />

IDMC:<br />

IL:<br />

Independent Data Monitoring Committee<br />

Interleukin<br />

LADA: Latent Autoimmune Diabetes in Adults<br />

OAD:<br />

NAID:<br />

Oral Anti-Diabetic products<br />

National Institute of Allergy and Infectious Diseases<br />

NCRR: National Center for Research Resources<br />

NIAID: National Institute of Allergy and Infectious Diseases<br />

NICHD: Eunice Kennedy Shriver National Institute of Child Health and Human Development<br />

NIDDK: National Institute of Diabetes and Digestive and Kidney Diseases<br />

Type 1 Diabetes - Drug Pipeline Assessment and<br />

Market Forecasts to 2017<br />

GDHC106PRT /Published JUN 2010<br />

Page 48<br />

© GlobalData. This report is a licensed product and is not to be photocopied

NIH:<br />

NPH:<br />

National Institutes of Health<br />

Neutral Protamine Hagedorn<br />

mABs: Monoclonal Antiobodies<br />

R&D:<br />

rDNA:<br />

Research and Development<br />

recombinant DNA<br />

rhGAD65: Recombinant Human Glutamic Acid Decarboxylase<br />

SGLT 2: Sodium-Glucose Co-Transporter<br />

SIBA:<br />

SU:<br />

VLD:<br />

WHO:<br />

Soluble Insulin Basal Analog<br />

Sulfonyluria<br />

Very Low Dose<br />

World Health Organization<br />

7.4 Research Methodology<br />

GlobalData’s dedicated Research and Analysis Teams consist of experienced professionals with a<br />

pedigree in marketing, market research, consulting backgrounds in the pharmaceutical industry and<br />

advanced statistical expertise.<br />

GlobalData adheres to the Codes of Practice of the Market Research Society (www.mrs.org.uk) and the<br />

Society of Competitive Intelligence Professionals (www.scip.org).<br />

All GlobalData databases are continuously updated and revised. The following research methodology is<br />

followed for all databases and reports.<br />

Figure 11: GlobalData Methodology, 2010<br />

Data Update<br />

Taxonomy<br />

Update<br />

Expert<br />

Panel<br />

Validation<br />

Secondary<br />

Research<br />

Forecasts<br />

Primary<br />

Research<br />

Source: GlobalData<br />

Modeling and<br />

benchmarking<br />

Type 1 Diabetes - Drug Pipeline Assessment and<br />

Market Forecasts to 2017<br />

GDHC106PRT /Published JUN 2010<br />

Page 49<br />

© GlobalData. This report is a licensed product and is not to be photocopied

7.4.1 Coverage<br />

The objective of updating GlobalData’s coverage is to ensure that it represents the most up to date vision<br />

of the industry possible.<br />

Changes to the industry taxonomy are built on the basis of extensive research of company, association<br />

and competitor sources.<br />

Company coverage is based on three key factors: Revenues, products and media attention/innovation/<br />

market potential.<br />

<br />

<br />

The estimated revenues of all major companies, including private and governmental, are gathered<br />

and used to prioritize coverage; and<br />

Companies which are making the news, or which are of particular interest due to their innovative<br />

approach are prioritized.<br />

GlobalData aims to cover all major news events and deals in the pharmaceutical industry, updated on a<br />

daily basis.<br />

The coverage is further streamlined and strengthened with additional inputs from GlobalData’s Expert<br />

Panel (see below).<br />

7.4.2 Secondary Research<br />

The research process begins with exhaustive secondary research on internal and external sources being<br />

carried out to source qualitative and quantitative information relating to each market.<br />

The secondary research sources that are typically referred to include, but are not limited to:<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Company websites, annual reports, financial reports, broker reports, investor presentations and SEC<br />

filings;<br />

Industry trade journals, scientific journals and other technical literature;<br />

Internal and external proprietary databases;<br />

Relevant patent and regulatory databases;<br />

National government documents, statistical databases and market reports;<br />

Procedure registries; and<br />

News articles, press releases and web-casts specific to the companies operating in the market.<br />

7.4.3 Forecasting<br />

GlobalData uses an epidemiology-based treatment flow model to forecast the market size for therapeutic<br />

indications. GlobalData reports cover seven major geographies namely the US, the UK, Germany,<br />

France, Spain, Italy and Japan.<br />

7.4.3.1 Epidemiology-based Forecasting<br />

The forecasting model used at GlobalData makes use of epidemiology data gathered from research<br />

publications and primary interviews with physicians to represent the treatment flow patterns for individual<br />

diseases and therapies. The market for any disease segment is directly proportional to the volume of units<br />

sold and the price per unit.<br />

Sales = Volume of Units sold X Price per Unit<br />

The volume of units sold is calculated on the average dosage regimen for that disease, the duration of<br />

treatment and the number of patients who are prescribed drug treatment (prescription population). The<br />

prescription population is calculated as a percentage of the population diagnosed with a disease<br />

(diagnosis population). The diagnosis population is the population diagnosed with a disease expressed as<br />

a percentage of the population that is seeking treatment (treatment seeking population). The prevalence<br />

of a disease (disease population) is the percentage of the total population who suffer from a<br />

disease/condition.<br />

Type 1 Diabetes - Drug Pipeline Assessment and<br />

Market Forecasts to 2017<br />

GDHC106PRT /Published JUN 2010<br />

Page 50<br />

© GlobalData. This report is a licensed product and is not to be photocopied

Data on the treatment seeking rate, diagnosis rate and prescription rate, if unavailable from research<br />

publications, are gathered from interviews with physicians and are used to estimate the patient volumes<br />

for the disease under consideration. Therapy uptake and compliance data are fitted in the forecasting<br />

model to account for patient switching and compliance behavior.<br />

To account for differences in patients’ ability to afford drugs across various geographies, macroeconomic<br />

data such as inflation and GDP and healthcare indicators such as healthcare spending, insurance<br />

coverage and average income per individual are used.<br />

The average cost of treatment is calculated using product purchase frequency and the average price of<br />

the therapy. The product purchase frequency is calculated from the dosage data available for the<br />

therapies and drug prices are gathered from public sources.<br />

The epidemiology-based forecasting model uses a bottom-up methodology and it makes use of<br />

estimations in the absence of data from research publications. Such estimations may result in a final<br />

market value different from the actual value. To correct this ‘gap’ the forecasting model uses ‘triangulation’<br />

with the help of base year sales data (from company annual reports, internal and external databases) and<br />

sales estimations.<br />

Analogous Forecasting Methodology<br />

An analogous forecasting methodology is used to account for the introduction of new products, the patent<br />

expiries of branded products and the subsequent introduction of generics. Historic data for new product<br />

launches and generics penetration are used to arrive at robust forecasts. The increase or decrease of the<br />

prevalence rate, treatment seeking rate, diagnosis rate and prescription rate are fitted into the forecasting<br />

model to estimate market growth rate.<br />

The proprietary model enables GlobalData Research to account for the impact of individual drivers and<br />

restraints in the growth of the market. The year of impact and the extent of impact are quantified in the<br />

forecasting model to provide close-to-accurate data sets.<br />

Diseased Population<br />

The diseased population for any indication is the prevalence rate. The prevalence rates are usually<br />

obtained from various journals, online publications, sources such as World Health Organization (WHO) or<br />

associations and foundation websites for that particular disease.<br />

Treatment Seeking Population<br />

The treatment seeking population is always calculated as a percentage of the prevalence population. The<br />

number denotes the actual number of patients who are going to hospitals to get diagnosis for any<br />

disease. The treatment seeking population is primarily driven by the onset of symptoms, patient<br />

awareness and the severity of the disease.<br />

Diagnosis Population<br />

Of the patients who undergo diagnostic tests to confirm a disease, only a few people get diagnosed with<br />

the disease. This number as a percentage of the treatment seeking population is the diagnosis rate. The<br />

diagnosis population is primarily driven by the sensitivity of the diagnostic tests, state-of-the-art<br />

technology, patient access to these diagnostic tests and cost of the diagnostic tests.<br />

Prescription Population<br />

For any disease, multiple treatment options exist. For example, in cancer treatment various treatment<br />

options such as surgery, radiation therapy, and drug therapy are available. The prescription population is<br />

defined as the number of patients who are prescribed drug therapy. This is calculated as a percentage of<br />

the diagnosis population. The prescription population is primarily driven by the age at which the disease is<br />

diagnosed, the disease stage, patient health and the cost of drug treatment.<br />

Type 1 Diabetes - Drug Pipeline Assessment and<br />

Market Forecasts to 2017<br />

GDHC106PRT /Published JUN 2010<br />

Page 51<br />

© GlobalData. This report is a licensed product and is not to be photocopied

Forecasting Model for Therapeutic Areas<br />

Figure 12: GlobalData Market Forecasting Model, 2010<br />

GlobalData Market Sizing Model<br />

Disease Population<br />

General Population 743,535,048<br />

Qualifying condition 1<br />

Qualifying condition 2<br />

Prevalence neuropathic pain 2.7% 19,926,739<br />

Qualifying condition (complication, severity)<br />

DISEASED POPULATION 19,926,739<br />

Treatment Flow Patterns<br />

Treatment Seeking Rate (Symptoms/Dis Awareness) 90%<br />

Diagnosis Rate (Clinical and Diagnostic Tests)<br />

Prescription Rate (Physician Perception, Treatment Effectiveness)<br />

CVS Disease 78%<br />

Other Treatments for Valve (Surg/Med/None)<br />

Fulfillment<br />

Availability<br />

NA<br />

Willingness to Use (Patient Perceptions)<br />

NA<br />

Ready to Use (Surgery eligibility, Reuse etc)<br />

NA<br />

Affordability at Price<br />

HE as % of GDP spend<br />

Average US Income (per capita)<br />

Patient Out-of-pocket Budget (Annual)<br />

Budget allocation to one-time surgery<br />

Budget allocation to other health needs<br />

Average Payor Coverage<br />

Patient Liability<br />

Target Price (@20% pat liab)<br />

ASP for Cost of Therapy<br />

TOTAL PATIENT VOLUMES<br />

Product Purchase Frequency<br />

TOTAL UNIT VOLUMES<br />

Pricing per Unit<br />

Inflation<br />

Price Decrease due to competition<br />

Market Value<br />

Source: GlobalData<br />

7.4.4 Primary Research<br />

GlobalData conducts hundreds of primary interviews a year with industry participants and commentators<br />

in order to validate its data and analysis. A typical research interview fulfills the following functions:<br />

<br />

<br />

<br />

It provides first-hand information on the market size, market trends, growth trends, competitive<br />

landscape, future outlook etc;<br />

Helps in validating and strengthening the secondary research findings; and<br />

Further develops the Analysis Team’s expertise and market understanding.<br />

Primary research involves E-mail correspondence, telephone interviews as well as face-to-face interviews<br />

for each market, category, segment and sub-segment across geographies.<br />

Type 1 Diabetes - Drug Pipeline Assessment and<br />

Market Forecasts to 2017<br />

GDHC106PRT /Published JUN 2010<br />

Page 52<br />

© GlobalData. This report is a licensed product and is not to be photocopied

The participants who typically take part in such a process include, but are not limited to:<br />

<br />

<br />

<br />

<br />

Industry participants: CEOs, VPs, marketing/product managers, market intelligence managers and<br />

national sales managers;<br />

Hospital stores, laboratories, pharmacies, distributors and paramedics;<br />

Outside experts: investment bankers, valuation experts, research analysts specializing in specific<br />

pharmaceutical markets; and<br />

Key opinion leaders: physicians and surgeons specializing in different therapeutic areas<br />

corresponding to different kinds of pharmaceuticals.<br />

7.4.5 Expert Panel Validation<br />

GlobalData uses a panel of experts to cross verify its databases and forecasts.<br />

GlobalData expert panel comprises marketing managers, product specialists, international sales<br />

managers from pharmaceutical companies; academics from research universities, KOLs from hospitals,<br />

consultants from venture capital funds and distributors/suppliers of pharmaceuticals and supplies.<br />

Historic data and forecasts are relayed to GlobalData’s Expert Panel for feedback and adjusted in<br />

accordance with their feedback.<br />

7.5 Contact Us<br />

If you have any queries about this report or would like further information, please contact at the below<br />

given telephone numbers or email address.<br />

North America: +1 646 395 5460<br />

Europe: +44 207 753 4298 (OR) +44 161 227 0666<br />

Asia Pacific: +91 40 6616 6700<br />

Email: info@globaldata.com<br />

7.6 Disclaimer<br />

All Rights Reserved.<br />

No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form by<br />

any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of<br />

the publisher, GlobalData.<br />

The facts of this report are believed to be correct at the time of publication but cannot be guaranteed.<br />

Please note that the findings, conclusions and recommendations that GlobalData delivers will be based<br />

on information gathered in good faith from both primary and secondary sources, whose accuracy we are<br />

not always in a position to guarantee. As such GlobalData can accept no liability whatever for actions<br />

taken based on any information that may subsequently prove to be incorrect.<br />

Type 1 Diabetes - Drug Pipeline Assessment and<br />

Market Forecasts to 2017<br />

GDHC106PRT /Published JUN 2010<br />

Page 53<br />

© GlobalData. This report is a licensed product and is not to be photocopied

7.7 Sources<br />

http://dialogpro.dialog.com/<br />

www.who.com<br />

http://www.rxlist.com/script/main/hp.asp<br />

www.pharmacychecker.com<br />

www.drugstore.com<br />

http://www.medicinpricer.dk/Default.aspk?Ing=2<br />

http:/www.ic.nhs.uk/statistics-and-data-collections/primary-care/prescriptions<br />

www.medicalnewstoday.com<br />

http://www.accessdata.fda.gov/scripts/cder/ob/default.cfm<br />

www.drugs.com<br />

http://www.fiercepharma.com/<br />

http://www.nice.org.uk/<br />

Type 1 Diabetes - Drug Pipeline Assessment and<br />

Market Forecasts to 2017<br />

GDHC106PRT /Published JUN 2010<br />

Page 54<br />

© GlobalData. This report is a licensed product and is not to be photocopied