Zambia ICT Sector Performance Review 2010 - Research ICT Africa

Zambia ICT Sector Performance Review 2010 - Research ICT Africa

Zambia ICT Sector Performance Review 2010 - Research ICT Africa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Zambia</strong> <strong>ICT</strong> <strong>Sector</strong> <strong>Performance</strong> <strong>Review</strong> 2009/<strong>2010</strong><br />

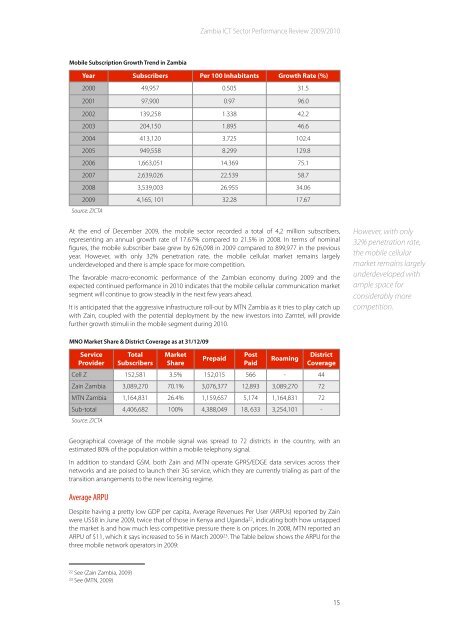

Mobile Subscription Growth Trend in <strong>Zambia</strong><br />

Year Subscribers Per 100 Inhabitants Growth Rate (%)<br />

2000 49,957 0.505 31.5<br />

2001 97,900 0.97 96.0<br />

2002 139,258 1.338 42.2<br />

2003 204,150 1.895 46.6<br />

2004 413,120 3.725 102.4<br />

2005 949,558 8.299 129.8<br />

2006 1,663,051 14.369 75.1<br />

2007 2,639,026 22.539 58.7<br />

2008 3,539,003 26.955 34.06<br />

2009 4,165, 101 32.28 17.67<br />

Source: Z<strong>ICT</strong>A<br />

At the end of December 2009, the mobile sector recorded a total of 4,2 million subscribers,<br />

representing an annual growth rate of 17.67% compared to 21.5% in 2008. In terms of nominal<br />

figures, the mobile subscriber base grew by 626,098 in 2009 compared to 899,977 in the previous<br />

year. However, with only 32% penetration rate, the mobile cellular market remains largely<br />

underdeveloped and there is ample space for more competition.<br />

The favorable macro-economic performance of the <strong>Zambia</strong>n economy during 2009 and the<br />

expected continued performance in <strong>2010</strong> indicates that the mobile cellular communication market<br />

segment will continue to grow steadily in the next few years ahead.<br />

It is anticipated that the aggressive infrastructure roll-out by MTN <strong>Zambia</strong> as it tries to play catch up<br />

with Zain, coupled with the potential deployment by the new investors into Zamtel, will provide<br />

further growth stimuli in the mobile segment during <strong>2010</strong>.<br />

However, with only<br />

32% penetration rate,<br />

the mobile cellular<br />

market remains largely<br />

underdeveloped with<br />

ample space for<br />

considerably more<br />

competition.<br />

MNO Market Share & District Coverage as at 31/12/09<br />

Service<br />

Provider<br />

Total<br />

Subscribers<br />

Market<br />

Share<br />

Prepaid<br />

Post<br />

Paid<br />

Roaming<br />

District<br />

Coverage<br />

Cell Z 152,581 3.5% 152,015 566 - 44<br />

Zain <strong>Zambia</strong> 3,089,270 70.1% 3,076,377 12,893 3,089,270 72<br />

MTN <strong>Zambia</strong> 1,164,831 26.4% 1,159,657 5,174 1,164,831 72<br />

Sub-total 4,406,682 100% 4,388,049 18, 633 3,254,101 -<br />

Source: Z<strong>ICT</strong>A<br />

Geographical coverage of the mobile signal was spread to 72 districts in the country, with an<br />

estimated 80% of the population within a mobile telephony signal.<br />

In addition to standard GSM, both Zain and MTN operate GPRS/EDGE data services across their<br />

networks and are poised to launch their 3G service, which they are currently trialing as part of the<br />

transition arrangements to the new licensing regime.<br />

Average ARPU<br />

Despite having a pretty low GDP per capita, Average Revenues Per User (ARPUs) reported by Zain<br />

were US$8 in June 2009, twice that of those in Kenya and Uganda 22 , indicating both how untapped<br />

the market is and how much less competitive pressure there is on prices. In 2008, MTN reported an<br />

ARPU of $11, which it says increased to $6 in March 2009 23 . The Table below shows the ARPU for the<br />

three mobile network operators in 2009:<br />

22 See (Zain <strong>Zambia</strong>, 2009)<br />

23 See (MTN, 2009)<br />

15