You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Rofin</strong>-<strong>Sinar</strong><br />

(CDAX, Technology)<br />

<strong>Hold</strong><br />

<strong>EUR</strong> <strong>16.15</strong> (USD 22.00)<br />

Price <strong>EUR</strong> 15.52<br />

Upside 4.0 %<br />

Value Indicators: <strong>EUR</strong> Share data: Description:<br />

DCF: 23.13<br />

FCF-Value Potential: 16.20<br />

Bloomberg:<br />

Reuters:<br />

ISIN:<br />

RSI GR<br />

RSTI<br />

US7750431022<br />

<strong>Rofin</strong>-<strong>Sinar</strong> is one of two worldleading<br />

manufacturers of industrial<br />

laser equipment<br />

Market Snapshot: <strong>EUR</strong> m Shareholders: Risk Profile (WRe): 2012/13e<br />

Market cap: 498 Freefloat 100.0 % Beta: 1.1<br />

No. of shares (m): 29<br />

Price / Book:<br />

1.1 x<br />

EV: 455<br />

Equity Ratio: 77 %<br />

Freefloat MC: 498<br />

Net Fin. Debt / EBITDA: -1.7 x<br />

Ø Trad. Vol. (30d):<br />

3.72 m<br />

Net Debt / EBITDA:<br />

-1.4 x<br />

Q4 better than expected; Flat sales, better result expected in FY 12/13<br />

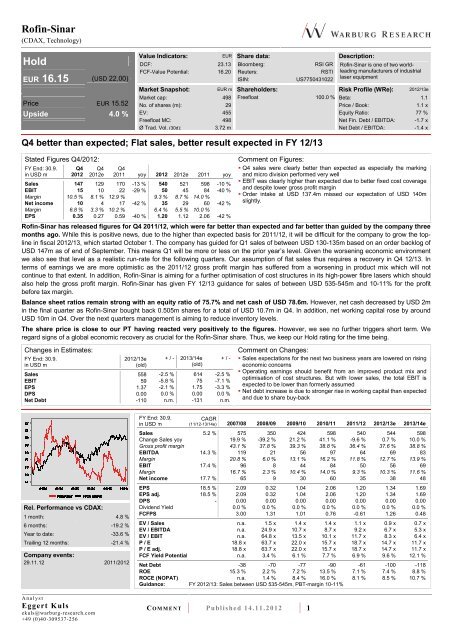

Stated Figures Q4/2012:<br />

FY End: 30.9.<br />

in USD m<br />

Q4<br />

2012<br />

Q4<br />

2012e<br />

Q4<br />

2011 yoy 2012 2012e 2011 yoy<br />

Sales 147 129 170 -13 % 540 521 598 -10 %<br />

EBIT 15 10 22 -29 % 50 45 84 -40 %<br />

Margin 10.5 % 8.1 % 12.9 % 9.3 % 8.7 % 14.0 %<br />

Net income 10 4 17 -42 % 35 29 60 -42 %<br />

Margin 6.8 % 3.3 % 10.2 % 6.4 % 5.5 % 10.0 %<br />

EPS 0.35 0.27 0.59 -40 % 1.20 1.12 2.06 -42 %<br />

Comment on Figures:<br />

Q4 sales were clearly better than expected as especially the marking<br />

and micro division performed very well<br />

EBIT was clearly higher than expected due to better fixed cost coverage<br />

and despite lower gross profit margin<br />

Order intake at USD 137.4m missed our expectation of USD 140m<br />

slightly.<br />

<strong>Rofin</strong>-<strong>Sinar</strong> has released figures for Q4 2011/12, which were far better than expected and far better than guided by the company three<br />

months ago. While this is positive news, due to the higher than expected basis for 2011/12, it will be difficult for the company to grow the topline<br />

in fiscal 2012/13, which started October 1. The company has guided for Q1 sales of between USD 130-135m based on an order backlog of<br />

USD 147m as of end of September. This means Q1 will be more or less on the prior year’s level. Given the worsening economic environment<br />

we also see that level as a realistic run-rate for the following quarters. Our assumption of flat sales thus requires a recovery in Q4 12/13. In<br />

terms of earnings we are more optimistic as the 2011/12 gross profit margin has suffered from a worsening in product mix which will not<br />

continue to that extent. In addition, <strong>Rofin</strong>-<strong>Sinar</strong> is aiming for a further optimisation of cost structures in its high-power fibre lasers which should<br />

also help the gross profit margin. <strong>Rofin</strong>-<strong>Sinar</strong> has given FY 12/13 guidance for sales of between USD 535-545m and 10-11% for the profit<br />

before tax margin.<br />

Balance sheet ratios remain strong with an equity ratio of 75.7% and net cash of USD 78.6m. However, net cash decreased by USD 2m<br />

in the final quarter as <strong>Rofin</strong>-<strong>Sinar</strong> bought back 0.505m shares for a total of USD 10.7m in Q4. In addition, net working capital rose by around<br />

USD 10m in Q4. Over the next quarters management is aiming to reduce inventory levels.<br />

The share price is close to our PT having reacted very positively to the figures. However, we see no further triggers short term. We<br />

regard signs of a global economic recovery as crucial for the <strong>Rofin</strong>-<strong>Sinar</strong> share. Thus, we keep our <strong>Hold</strong> rating for the time being.<br />

Changes in Estimates:<br />

FY End: 30.9.<br />

in USD m<br />

2012/13e<br />

(old)<br />

+ / - 2013/14e<br />

(old)<br />

Sales 558 -2.5 % 614 -2.5 %<br />

EBIT 59 -5.8 % 75 -7.1 %<br />

EPS 1.37 -2.1 % 1.75 -3.3 %<br />

DPS 0.00 0.0 % 0.00 0.0 %<br />

Net Debt -110 n.m. -131 n.m.<br />

+ / -<br />

Comment on Changes:<br />

Sales expectations for the next two business years are lowered on rising<br />

economic concerns<br />

Operating earnings should benefit from an improved product mix and<br />

optimisation of cost structures. But with lower sales, the total EBIT is<br />

expected to be lower than formerly assumed<br />

Net debt increase is due to stronger rise in working capital than expected<br />

and due to share buy-back<br />

Rel. Performance vs CDAX:<br />

1 month: 4.8 %<br />

6 months: -19.2 %<br />

Year to date: -33.6 %<br />

Trailing 12 months: -21.4 %<br />

Company events:<br />

29.11.12 2011/2012<br />

A n a l y s t<br />

Eggert Kuls<br />

ekuls@warburg-research.com<br />

+49 (0)40-309537-256<br />

FY End: 30.9.<br />

in USD m<br />

CAGR<br />

(11/12-13/14e) 2007/08 2008/09 2009/10 2010/11 2011/12 2012/13e 2013/14e<br />

Sales 5.2 % 575 350 424 598 540 544 598<br />

Change Sales yoy 19.9 % -39.2 % 21.2 % 41.1 % -9.6 % 0.7 % 10.0 %<br />

Gross profit margin 43.1 % 37.8 % 39.3 % 38.8 % 36.4 % 37.6 % 38.8 %<br />

EBITDA 14.3 % 119 21 56 97 64 69 83<br />

Margin 20.8 % 6.0 % 13.1 % 16.2 % 11.8 % 12.7 % 13.9 %<br />

EBIT 17.4 % 96 8 44 84 50 56 69<br />

Margin 16.7 % 2.3 % 10.4 % 14.0 % 9.3 % 10.3 % 11.6 %<br />

Net income 17.7 % 65 9 30 60 35 38 48<br />

EPS 18.5 % 2.09 0.32 1.04 2.06 1.20 1.34 1.69<br />

EPS adj. 18.5 % 2.09 0.32 1.04 2.06 1.20 1.34 1.69<br />

DPS - 0.00 0.00 0.00 0.00 0.00 0.00 0.00<br />

Dividend Yield 0.0 % 0.0 % 0.0 % 0.0 % 0.0 % 0.0 % 0.0 %<br />

FCFPS 3.00 1.31 1.01 0.76 -0.61 1.26 0.48<br />

EV / Sales n.a. 1.5 x 1.4 x 1.4 x 1.1 x 0.9 x 0.7 x<br />

EV / EBITDA n.a. 24.9 x 10.7 x 8.7 x 9.2 x 6.7 x 5.3 x<br />

EV / EBIT n.a. 64.8 x 13.5 x 10.1 x 11.7 x 8.3 x 6.4 x<br />

P / E 18.8 x 63.7 x 22.0 x 15.7 x 18.7 x 14.7 x 11.7 x<br />

P / E adj. 18.8 x 63.7 x 22.0 x 15.7 x 18.7 x 14.7 x 11.7 x<br />

FCF Yield Potential n.a. 3.4 % 6.1 % 7.7 % 6.9 % 9.6 % 12.1 %<br />

Net Debt -38 -70 -77 -90 -61 -100 -118<br />

ROE 15.3 % 2.2 % 7.2 % 13.5 % 7.1 % 7.4 % 8.8 %<br />

ROCE (NOPAT) n.a. 1.4 % 8.4 % 16.0 % 8.1 % 8.5 % 10.7 %<br />

Guidance: FY 2012/13: Sales between USD 535-545m, PBT-margin 10-11%<br />

C O M M E N T Published 14.11.2012 1

<strong>Rofin</strong>-<strong>Sinar</strong><br />

Sales development<br />

in <strong>EUR</strong> m<br />

Sales by regions<br />

2011; in %<br />

EBIT development<br />

in <strong>EUR</strong> m<br />

Source: Warburg Research<br />

Source: Warburg Research<br />

Source: Warburg Research<br />

Company Background<br />

Laser technology company <strong>Rofin</strong>-<strong>Sinar</strong> was founded in 1975. In 1996 the company was listed on the American technology stock<br />

exchange, Nasdaq, as the first 100% spin-off of Siemens AG.<br />

The company has production sites in the USA, Germany, UK, Finland, Sweden, Spain, Singapore and China. The two operating<br />

headquarters are based in Plymouth (Michigan, USA) and Hamburg.<br />

<strong>Rofin</strong>-<strong>Sinar</strong> develops and produces laser sources and laser-based system solutions. The technology basis includes CO2 laser, lamp<br />

and diode-pumped solid-state lasers as well as fibre and diode lasers.<br />

In addition to its main customer industries, automotive, machine tools as well as semiconductors and electronics, <strong>Rofin</strong>-<strong>Sinar</strong> supplies<br />

various other industries.<br />

Competitive Quality<br />

With a world market share of ca. 23% <strong>Rofin</strong>-<strong>Sinar</strong> is the clear world market leader in industrial lasers together with the non-listed<br />

Trumpf (Germany).<br />

The most important competitors in macro applications are Trumpf, Fanuc, Coherent and Synrad for CO2 lasers and Laserline and<br />

Jenoptik for diode lasers.<br />

In the Micro and Marking segments the main competitors are Trumpf, GSI Group, Unitek Miyachi, Lasag, IPG and Control Laser.<br />

IPG Photonics is market leader in the field of fibre lasers. This technology in part has advantages over the common laser technologies<br />

such as improved energy efficiency. <strong>Rofin</strong>-<strong>Sinar</strong> is the No. 2 here.<br />

In the past the sector generally grew by ca. 10% p.a. and more over an economic cycle. Growth in the laser industry benefits from a<br />

continuous expansion of the application possibilities.<br />

EBT development<br />

in <strong>EUR</strong> m<br />

Sales by segments<br />

2011; in %<br />

Net income development<br />

in <strong>EUR</strong> m<br />

Source: Warburg Research<br />

Source: Warburg Research<br />

Source: Warburg Research<br />

C O M M E N T Published 14.11.2012 2

<strong>Rofin</strong>-<strong>Sinar</strong><br />

DCF model<br />

Detailed forecast period Transitional period Term. Value<br />

Figures in USD m 12/13e 13/14e 14/15e 15/16e 16/17e 17/18e 18/19e 19/20e 20/21e 21/22e 22/23e 23/24e 24/25e<br />

Sales 544 598 646 698 754 814 879 949 1,025 1,107 1,196 1,256 1,319<br />

Sales change 0.7 % 10.0 % 8.0 % 8.0 % 8.0 % 8.0 % 8.0 % 8.0 % 8.0 % 8.0 % 8.0 % 5.0 % 5.0 % 2.5 %<br />

EBIT 56 69 78 84 90 98 105 114 123 133 144 151 158<br />

EBIT-margin 10.3 % 11.6 % 12.0 % 12.0 % 12.0 % 12.0 % 12.0 % 12.0 % 12.0 % 12.0 % 12.0 % 12.0 % 12.0 %<br />

Tax rate (EBT) 33.0 % 32.0 % 32.0 % 32.0 % 32.0 % 32.0 % 32.0 % 32.0 % 32.0 % 32.0 % 32.0 % 32.0 % 32.0 %<br />

NOPAT 37 47 53 57 61 66 72 77 84 90 98 102 108<br />

Depreciation 14 14 16 17 18 20 21 23 25 27 29 29 30<br />

in % of Sales 2.5 % 2.3 % 2.4 % 2.4 % 2.4 % 2.4 % 2.4 % 2.4 % 2.4 % 2.4 % 2.4 % 2.3 % 2.3 %<br />

Changes in provisions 1 1 1 0 0 0 0 0 0 0 0 0 0<br />

Change in Liquidity from<br />

- Working Capital -11 19 19 23 25 27 29 32 34 37 40 27 28<br />

- Capex 17 18 19 20 21 23 25 27 29 31 33 34 36<br />

Capex in % of Sales 3.1 % 3.0 % 2.8 % 2.8 % 2.8 % 2.8 % 2.8 % 2.8 % 2.8 % 2.8 % 2.8 % 2.7 % 2.7 %<br />

Other 0 0 0 0 0 0 0 0 0 0 0 0 0<br />

Free Cash Flow (WACC<br />

Model)<br />

46 25 31 31 33 36 39 42 45 49 53 71 74 82<br />

PV of FCF 46 23 26 24 24 23 23 23 23 23 22 27 27 461<br />

share of PVs 11.97 % 30.05 % 57.98 %<br />

Model parameter<br />

Valuation (m)<br />

Derivation of WACC: Derivation of Beta: Present values 2024/25e 334<br />

Terminal Value 461<br />

Debt ratio 15.00 % Financial Strength 1.00 Financial liabilities 23<br />

Cost of debt 4.2 % Liquidity 1.00 Pension liabilities 18<br />

Market return 9.00 % Cyclicality 1.50 Hybrid capital 0<br />

Risk free rate 4.00 % Transparency 1.00 Minority interest 5<br />

Others 1.20 Market val. of investments 0<br />

Liquidity 101 No. of shares (m) 28.3<br />

WACC 8.88 % Beta 1.14 Equity Value 851 Value per share (USD) 30.07<br />

Sensitivity Value per Share (USD)<br />

Terminal Growth<br />

Delta EBIT-margin<br />

Beta (WACC) 1.75 % 2.00 % 2.25 % 2.50 % 2.75 % 3.00 % 3.25 % Beta (WACC) -1.5 pp -1.0 pp -0.5 pp 0.0 +0.5 pp +1.0 pp +1.5 pp<br />

1.38 (9.9 %) 24.63 24.99 25.38 25.79 26.24 26.71 27.22 1.38 (9.9 %) 21.39 22.86 24.32 25.79 27.26 28.73 30.20<br />

1.26 (9.4 %) 26.36 26.80 27.27 27.77 28.31 28.89 29.52 1.26 (9.4 %) 23.02 24.60 26.19 27.77 29.35 30.93 32.51<br />

1.20 (9.1 %) 27.32 27.80 28.32 28.87 29.47 30.12 30.82 1.20 (9.1 %) 23.94 25.58 27.23 28.87 30.52 32.16 33.81<br />

1.14 (8.9 %) 28.36 28.89 29.46 30.07 30.74 31.46 32.24 1.14 (8.9 %) 24.93 26.64 28.36 30.07 31.78 33.50 35.21<br />

1.08 (8.6 %) 29.47 30.05 30.69 31.37 32.11 32.92 33.80 1.08 (8.6 %) 26.00 27.79 29.58 31.37 33.16 34.95 36.74<br />

1.02 (8.4 %) 30.67 31.32 32.02 32.79 33.62 34.52 35.52 1.02 (8.4 %) 27.18 29.05 30.92 32.79 34.66 36.53 38.40<br />

0.90 (7.9 %) 33.39 34.19 35.07 36.03 37.08 38.25 39.53 0.90 (7.9 %) 29.86 31.92 33.98 36.03 38.09 40.14 42.20<br />

The industrial laser sector has grown by some 10% p.a. over a cycle during the last decades.<br />

We expect CAGR of 8% over the next 10 years due to the higher basis reached meanwhile<br />

Capex at below 3% of sales is due to a low vertical integration for an Engineering company<br />

C O M M E N T Published 14.11.2012 3

<strong>Rofin</strong>-<strong>Sinar</strong><br />

Free Cash Flow Value Potential<br />

Warburg Research's valuation tool "FCF Value Potential" reflects the ability of the company to generate sustainable free cash flows. It is based on the<br />

"FCF potential" - a FCF "ex growth" figure - which assumes unchanged working capital and pure maintenance capex. A value indication is derived by<br />

discounting the “FCF potential” of a given year with the weighted costs of capital. The fluctuating value indications over time add a timing element to the<br />

DCF model (our preferred valuation tool).<br />

in USD m 2007/08 2008/09 2009/10 2010/11 2011/12 2012/13e 2013/14e<br />

Net Income before minorities n.a. 10 30 61 35 39 49<br />

+ Depreciation + Amortisation n.a. 13 12 13 14 14 14<br />

- Net Interest Income n.a. 0 0 0 0 0 0<br />

- Maintenance Capex n.a. 5 6 9 8 8 9<br />

+ Other n.a. 0 0 0 0 0 0<br />

= Free Cash Flow Potential n.a. 18 36 65 41 44 54<br />

Free Cash Flow Yield Potential n/a 3.4 % 6.1 % 7.7 % 6.9 % 9.6 % 12.1 %<br />

WACC 8.88 % 8.88 % 8.88 % 8.88 % 8.88 % 8.88 % 8.88 %<br />

= Enterprise Value (EV) n.a. 524 593 846 591 463 445<br />

= Fair Enterprise Value n.a. 198 407 732 458 500 608<br />

- Net Debt (Cash) n.a. -79 -79 -79 -79 -119 -138<br />

- Pension Liabilities n.a. 18 18 18 18 19 20<br />

- Other n.a. 0 0 0 0 0 0<br />

- Market value of minorities n.a. 5 5 5 5 5 5<br />

+ Market value of investments n.a. 0 0 0 0 0 0<br />

= Fair Market Capitalisation n.a. 254 463 788 514 596 721<br />

No. of shares (total) (m) 29 29 29 29 29 29 29<br />

= Fair value per share (USD) n.a. 8.81 16.08 27.47 17.89 20.69 25.04<br />

premium (-) / discount (+) in % 4.9 % 26.9 %<br />

Sensitivity Fair value per Share (USD)<br />

11.88 % n.a. 7.20 12.73 21.32 14.06 16.59 20.05<br />

10.88 % n.a. 7.68 13.72 23.10 15.17 17.81 21.53<br />

9.87 % n.a. 8.26 14.90 25.24 16.51 19.27 23.30<br />

WACC 8.88 % n.a. 8.97 16.36 27.86 18.15 21.06 25.48<br />

7.88 % n.a. 9.85 18.19 31.14 20.20 23.30 28.20<br />

6.87 % n.a. 11.00 20.55 35.38 22.85 26.20 31.72<br />

5.88 % n.a. 12.53 23.71 41.07 26.40 30.08 36.44<br />

FCF value potential going forward is mainly driven by the expectaion of rising results<br />

Maintenance capex is expected to be at 1.5% p.a. only due to a low vertical integration and thus fixed asset base<br />

C O M M E N T Published 14.11.2012 4

<strong>Rofin</strong>-<strong>Sinar</strong><br />

Valuation<br />

2007/08 2008/09 2009/10 2010/11 2011/12 2012/13e 2013/14e<br />

Price / Book 3.0 x 1.4 x 1.6 x 1.9 x 1.3 x 1.1 x 1.0 x<br />

Book value per share ex intangibles 9.82 10.73 10.75 12.94 13.05 14.01 15.44<br />

EV / Sales n.a. 1.5 x 1.4 x 1.4 x 1.1 x 0.9 x 0.7 x<br />

EV / EBITDA n.a. 24.9 x 10.7 x 8.7 x 9.2 x 6.7 x 5.3 x<br />

EV / EBIT n.a. 64.8 x 13.5 x 10.1 x 11.7 x 8.3 x 6.4 x<br />

EV / EBIT adj.* n.a. 64.8 x 13.5 x 10.1 x 11.7 x 8.3 x 6.4 x<br />

P / FCF 66.2 x 12.4 x 23.6 x 33.0 x 105.8 x n.a. n.a.<br />

P / E 18.8 x 63.7 x 22.0 x 15.7 x 18.7 x 14.7 x 11.7 x<br />

P / E adj.* 18.8 x 63.7 x 22.0 x 15.7 x 18.7 x 14.7 x 11.7 x<br />

Dividend Yield 0.0 % 0.0 % 0.0 % 0.0 % 0.0 % 0.0 % 0.0 %<br />

Free Cash Flow Yield Potential n.a. 3.4 % 6.1 % 7.7 % 6.9 % 9.6 % 12.1 %<br />

*Adjustments made for: -<br />

C O M M E N T Published 14.11.2012 5

<strong>Rofin</strong>-<strong>Sinar</strong><br />

Consolidated profit and loss<br />

In USD m 2007/08 2008/09 2009/10 2010/11 2011/12 2012/13e 2013/14e<br />

Sales 575 350 424 598 540 544 598<br />

Change Sales yoy 19.9 % -39.2 % 21.2 % 41.1 % -9.6 % 0.7 % 10.0 %<br />

COGS 327 218 257 366 344 339 366<br />

Gross profit 248 132 166 232 196 205 232<br />

Gross margin 43.1 % 37.8 % 39.3 % 38.8 % 36.4 % 37.6 % 38.8 %<br />

Research and development 41 32 30 38 43 45 49<br />

Sales and marketing 0 0 0 0 0 0 0<br />

Administration expenses 104 89 90 108 101 102 111<br />

Other operating expenses 0 0 0 0 0 0 0<br />

Other operating income 0 0 0 0 0 0 0<br />

Unfrequent items 0 0 0 0 0 0 0<br />

EBITDA 119 21 56 97 64 69 83<br />

Margin 20.8 % 6.0 % 13.1 % 16.2 % 11.8 % 12.7 % 13.9 %<br />

Depreciation of fixed assets 16 9 9 10 11 11 12<br />

EBITA 103 12 n.a. n.a. n.a. n.a. n.a.<br />

Amortisation of intangible fixed assets 7 4 2 3 2 2 2<br />

Goodwill amortization 0 0 0 0 0 0 0<br />

EBIT 96 8 44 84 50 56 69<br />

Margin 16.7 % 2.3 % 10.4 % 14.0 % 9.3 % 10.3 % 11.6 %<br />

EBIT adj. 96 8 44 84 50 56 69<br />

Interest income 5 1 1 1 n.a. n.a. n.a.<br />

Interest expenses 2 2 1 1 n.a. n.a. n.a.<br />

Other financial income (loss) -1 7 2 3 2 2 2<br />

EBT 98 14 46 86 52 57 70<br />

Margin 17.1 % 4.1 % 10.8 % 14.4 % 9.6 % 10.4 % 11.8 %<br />

Total taxes 33 5 15 26 17 19 22<br />

Net income from continuing operations 64 10 30 61 35 39 49<br />

Income from discontinued operations (net of tax) 0 0 0 0 0 0 0<br />

Net income before minorities 64 10 30 61 35 39 49<br />

Minority interest 1 0 -1 -1 -1 -1 -1<br />

Net income 65 9 30 60 35 38 48<br />

Margin 11.3 % 2.6 % 7.0 % 10.0 % 6.4 % 7.0 % 8.0 %<br />

Number of shares, average 30 29 29 29 29 28 28<br />

EPS 2.09 0.32 1.04 2.06 1.20 1.34 1.69<br />

EPS adj. 2.09 0.32 1.04 2.06 1.20 1.34 1.69<br />

*Adjustments made for:<br />

Guidance: FY 2012/13: Sales between USD 535-545m, PBT-margin 10-11%<br />

Financial Ratios<br />

2007/08 2008/09 2009/10 2010/11 2011/12 2012/13e 2013/14e<br />

Total Operating Costs / Sales n.a. n.a. n.a. n.a. n.a. n.a. n.a.<br />

Operating Leverage 0.7 x 2.3 x 21.0 x 2.2 x 4.1 x 15.3 x 2.4 x<br />

EBITDA / Interest expenses 51.2 x 12.0 x 57.0 x 131.9 x n.a. n.a. n.a.<br />

Tax rate (EBT) 34.0 % 36.2 % 33.6 % 30.3 % 33.2 % 33.0 % 32.0 %<br />

Dividend Payout Ratio 0.0 % 0.0 % 0.0 % 0.0 % 0.0 % 0.0 % 0.0 %<br />

Sales per Employee 338,399 200,103 241,902 303,125 263,474 261,491 279,576<br />

Sales, EBITDA<br />

in <strong>EUR</strong> m<br />

Operating Performance<br />

in %<br />

Performance per Share<br />

Source: Warburg Research<br />

Source: Warburg Research<br />

Source: Warburg Research<br />

C O M M E N T Published 14.11.2012 6

<strong>Rofin</strong>-<strong>Sinar</strong><br />

Consolidated balance sheet<br />

In USD m 2007/08 2008/09 2009/10 2010/11 2011/12 2012/13e 2013/14e<br />

Assets<br />

Goodwill and other intangible assets 103 105 100 103 128 128 128<br />

thereof other intangible assets 11 11 10 12 25 25 25<br />

thereof Goodwill 92 94 90 91 103 103 103<br />

Property, plant and equipment 56 56 53 66 60 65 71<br />

Financial assets 0 0 0 0 0 0 0<br />

Other long-term assets 6 15 18 18 25 24 29<br />

Fixed assets 166 175 171 187 213 217 228<br />

Inventories 153 136 152 189 202 190 203<br />

Accounts receivable 118 79 98 119 108 109 117<br />

Liquid assets 116 119 116 130 101 142 161<br />

Other short-term assets 19 20 22 29 28 27 25<br />

Current assets 406 355 387 467 440 468 506<br />

Total Assets 584 540 558 654 653 684 734<br />

Liabilities and shareholders' equity<br />

Subscribed capital 0 0 0 0 0 0 0<br />

Capital reserve 189 196 205 218 223 228 233<br />

Retained earnings 294 304 333 394 428 466 514<br />

Other equity components -82 -82 -125 -138 -149 -166 -173<br />

Shareholder's equity 402 418 414 474 502 524 565<br />

Minority interest 2 3 4 5 5 5 8<br />

Total equity 405 422 417 479 507 529 572<br />

Provisions 75 63 80 101 96 103 107<br />

thereof provisions for pensions and similar obligations 12 17 18 18 18 19 20<br />

Financial liabilites (total) 67 31 21 23 23 23 23<br />

thereof short-term financial liabilities 55 19 5 8 17 17 17<br />

Accounts payable 21 13 23 27 27 27 29<br />

Other liabilities 18 10 17 24 13 7 11<br />

Liabilities 181 118 141 175 159 160 169<br />

Total liabilities and shareholders' equity 584 540 558 654 653 684 734<br />

Financial Ratios<br />

2007/08 2008/09 2009/10 2010/11 2011/12 2012/13e 2013/14e<br />

Efficiency of Capital Employment<br />

Operating Assets Turnover n.a. n.a. n.a. n.a. n.a. n.a. n.a.<br />

Capital Employed Turnover 1.6 x 1.0 x 1.2 x 1.5 x 1.2 x 1.3 x 1.3 x<br />

ROA 39.2 % 5.2 % 17.5 % 32.2 % 16.2 % 17.6 % 21.0 %<br />

Return on Capital<br />

ROCE (NOPAT) n.a. 1.4 % 8.4 % 16.0 % 8.1 % 8.5 % 10.7 %<br />

ROE 15.3 % 2.2 % 7.2 % 13.5 % 7.1 % 7.4 % 8.8 %<br />

Adj. ROE 15.3 % 2.2 % 7.2 % 13.5 % 7.1 % 7.4 % 8.8 %<br />

Balance sheet quality<br />

Net Debt -38 -70 -77 -90 -61 -100 -118<br />

Net Financial Debt -50 -88 -96 -108 -79 -119 -138<br />

Net Gearing -9.3 % -16.7 % -18.6 % -18.8 % -12.0 % -19.0 % -20.6 %<br />

Net Fin. Debt / EBITDA -41.7 % -415.7 % -172.0 % -111.2 % -123.1 % -172.3 % -165.5 %<br />

Book Value / Share 13.2 14.3 14.2 16.5 17.5 18.5 19.9<br />

Book value per share ex intangibles 9.8 10.7 10.7 12.9 13.0 14.0 15.4<br />

ROCE Development<br />

Net debt<br />

in <strong>EUR</strong> m<br />

Book Value per Share<br />

in <strong>EUR</strong><br />

Source: Warburg Research<br />

Source: Warburg Research<br />

Source: Warburg Research<br />

C O M M E N T Published 14.11.2012 7

<strong>Rofin</strong>-<strong>Sinar</strong><br />

Consolidated cash flow statement<br />

In USD m 2007/08 2008/09 2009/10 2010/11 2011/12 2012/13e 2013/14e<br />

Net income 64 9 30 61 35 39 49<br />

Depreciation of fixed assets 16 9 9 10 11 11 12<br />

Amortisation of goodwill 0 0 0 0 0 0 0<br />

Amortisation of intangible assets 7 4 2 3 2 2 2<br />

Increase/decrease in long-term provisions 1 -17 18 18 -5 7 4<br />

Other non-cash income and expenses -2 22 -14 -15 -22 -10 -10<br />

Cash Flow 86 27 47 77 22 50 57<br />

Increase / decrease in inventory -15 21 -21 -28 -13 12 -13<br />

Increase / decrease in accounts receivable -12 39 -23 -23 11 -1 -8<br />

Increase / decrease in accounts payable 2 -9 11 3 0 0 2<br />

Increase / decrease in other working capital positions -28 -22 24 21 0 0 0<br />

Increase / decrease in working capital (total) -53 28 -10 -27 -2 11 -19<br />

Net cash provided by operating activities 33 55 37 50 22 52 32<br />

Investments in intangible assets 0 0 0 0 0 0 0<br />

Investments in property, plant and equipment 14 8 9 22 16 17 18<br />

Payments for acquisitions 30 12 1 11 27 0 0<br />

Financial investments 129 2 11 9 0 9 10<br />

Income from asset disposals 225 4 13 13 10 10 10<br />

Net cash provided by investing activities -52 18 8 29 39 16 18<br />

Change in financial liabilities 25 -36 -10 -3 0 0 0<br />

Dividends paid 0 0 0 0 0 0 0<br />

Purchase of own shares -120 0 -19 -9 -11 0 0<br />

Capital measures 5 0 3 7 5 5 5<br />

Other 0 0 0 0 -4 0 0<br />

Net cash provided by financing activities -90 -36 -27 -5 -10 5 5<br />

Change in liquid funds -6 2 2 17 -27 41 19<br />

Effects of exchange-rate changes on cash 2 0 -7 0 1 0 0<br />

Cash and cash equivalent at end of period 114 116 111 127 101 142 161<br />

Financial Ratios<br />

2007/08 2008/09 2009/10 2010/11 2011/12 2012/13e 2013/14e<br />

Cash Flow<br />

Free Cash Flow 85 37 29 21 -17 36 14<br />

Free Cash Flow / Sales 3.1 % 13.6 % 6.7 % 4.7 % 1.1 % 6.4 % 2.3 %<br />

Free Cash Flow Potential n.a. 18 36 65 41 44 54<br />

Free Cash Flow / Sales 3.1 % 13.6 % 6.7 % 4.7 % 1.1 % 6.4 % 2.3 %<br />

Free Cash Flow / Net Profit 27.9 % 519.6 % 94.6 % 47.0 % 17.7 % 91.3 % 28.5 %<br />

Interest Received / Avg. Cash 3.1 % 1.2 % 0.5 % 0.7 % n.a. n.a. n.a.<br />

Interest Paid / Avg. Debt 4.3 % 3.6 % 3.7 % 3.4 % n.a. n.a. n.a.<br />

Management of Funds<br />

Investment ratio -2.5 % -2.2 % -2.0 % -3.6 % -3.0 % -3.1 % -3.0 %<br />

Maint. Capex / Sales n.a. 1.5 % 1.5 % 1.5 % 1.5 % 1.5 % 1.5 %<br />

Capex / Dep -62.6 % -60.0 % -74.0 % -167.2 % -118.5 % -125.9 % -128.6 %<br />

Avg. Working Capital / Sales n.a. n.a. n.a. n.a. n.a. n.a. n.a.<br />

Trade Debtors / Trade Creditors 556.8 % 603.7 % 421.3 % 440.9 % 405.1 % 403.7 % 403.4 %<br />

Inventory Turnover 2.1 x 1.6 x 1.7 x 1.9 x 1.7 x 1.8 x 1.8 x<br />

Receivables collection period (days) 75 83 84 73 73 73 71<br />

Payables payment period (days) 24 22 33 27 28 29 29<br />

Cash conversion cycle (Days) n.a. n.a. n.a. n.a. n.a. n.a. n.a.<br />

CAPEX and Cash Flow<br />

in <strong>EUR</strong> m<br />

Free Cash Flow Generation<br />

Working Capital<br />

Source: Warburg Research<br />

Source: Warburg Research<br />

Source: Warburg Research<br />

C O M M E N T Published 14.11.2012 8

<strong>Rofin</strong>-<strong>Sinar</strong><br />

LEGAL DISCLAIMER<br />

This research report was prepared by the Warburg Research GmbH, a subsidiary of the M.M.Warburg & CO KGaA and is passed on<br />

by the M.M.Warburg & CO KGaA. It contains selected information and does not purport to be complete. The report is based on<br />

publicly available information and data ("the information") believed to be accurate and complete. Warburg Research GmbH neither<br />

does examine the information to be accurate and complete, nor guarantees its accuracy and completeness. Possible errors or<br />

incompleteness of the information do not constitute grounds for liability of M.M.Warburg & CO KGaA or Warburg Research GmbH for<br />

damages of any kind whatsoever, and M.M.Warburg & CO KGaA and Warburg Research GmbH are not liable for indirect and/or direct<br />

and/or consequential damages. In particular, neither M.M.Warburg & CO KGaA nor Warburg Research GmbH are liable for the<br />

statements, plans or other details contained in these analyses concerning the examined companies, their affiliated companies,<br />

strategies, economic situations, market and competitive situations, regulatory environment, etc. Although due care has been taken in<br />

compiling this research report, it cannot be excluded that it is incomplete or contains errors. M.M.Warburg & CO KGaA and Warburg<br />

Research GmbH, their shareholders and employees are not liable for the accuracy and completeness of the statements, estimations<br />

and the conclusions derived from the information contained in this document. Provided a research report is being transmitted in<br />

connection with an existing contractual relationship, i.e. financial advisory or similar services, the liability of M.M.Warburg & CO KGaA<br />

and Warburg Research GmbH shall be restricted to gross negligence and wilful misconduct. In case of failure in essential tasks,<br />

M.M.Warburg & CO KGaA and Warburg Research GmbH are liable for normal negligence. In any case, the liability of M.M.Warburg &<br />

CO KGaA and Warburg Research GmbH is limited to typical, expectable damages. This research report does not constitute an offer or<br />

a solicitation of an offer for the purchase or sale of any security. Partners, directors or employees of M.M.Warburg & CO KGaA,<br />

Warburg Research GmbH or affiliated companies may serve in a position of responsibility, i.e. on the board of directors of companies<br />

mentioned in the report. Opinions expressed in this report are subject to change without notice. All rights reserved.<br />

COPYRIGHT NOTICE<br />

This work including all its parts is protected by copyright. Any use beyond the limits provided by copyright law without permission is<br />

prohibited and punishable. This applies, in particular, to reproductions, translations, microfilming, and storage and processing on<br />

electronic media of the entire content or parts thereof.<br />

DISCLOSURE ACCORDING TO § 34B OF THE GERMAN SECURITIES TRADING ACT AND FINANV<br />

The valuation underlying the rating of the company analysed in this report is based on generally accepted and widely used methods of<br />

fundamental valuation, such as the DCF model, Free Cash Flow Value Potential, peer group comparison and – where applicable – a<br />

sum-of-the-parts model.<br />

M.M.Warburg & CO KGaA and Warburg Research GmbH have set up internal organisational and administrative arrangements to<br />

prevent and avoid possible conflicts of interest and, where applicable, to disclose them.<br />

Valuations, ratings and price targets for the companies analysed by Warburg Research GmbH are subject to constant reviews and<br />

may therefore change, if any of the fundamental factors underlying these items do change.<br />

All share prices given in this equity analysis are closing prices on the date given in the analysis, except where stated otherwise.<br />

Neither Warburg Research GmbH’s analysts nor M.M.Warburg & CO KGaA’s analysts do receive any payments directly or indirectly<br />

from any investment banking activity of M.M.Warburg Bank or an affiliated company.<br />

M.M.Warburg & CO KGaA and Warburg Research GmbH are under supervision of the BaFin – German Federal Financial Supervisory<br />

Authority.<br />

SOURCES<br />

All data and consensus estimates have been obtained from FactSet except where stated otherwise.<br />

C O M M E N T Published 14.11.2012 9

<strong>Rofin</strong>-<strong>Sinar</strong><br />

Section 34b of the German Securities Trading Act in combination with the FinAnV requires an enterprise preparing a<br />

securities analysis to point out possible conflicts of interest with respect to the company that is the subject of the analysis.<br />

A conflict of interest is assumed, in particular, when the enterprise preparing the analysis …<br />

-1- … or companies affiliated with this enterprise holds 5% or more of the share capital of the analysed company<br />

-2-<br />

-3-<br />

-4-<br />

… or companies affiliated with this enterprise was a member in a consortium which acquired the shares of the<br />

analysed company within the last twelve months<br />

… or companies affiliated with this enterprise manages the securities of the analysed company on the basis of<br />

an existing contract<br />

… or companies affiliated with this enterprise over the previous 12 months has been providing investment<br />

banking services for the analysed company for which a compensation has been or will be paid<br />

-5- … effected an agreement with the analysed company for the preparation of the financial analysis<br />

-6- … or companies affiliated with this enterprise regularly trade in shares or derivatives of the analysed company<br />

-7-<br />

… or the analyst responsible for this company has other important financial interests in relation to the analysed<br />

company such as e.g. the performance of mandates for the analysed company<br />

Company Disclosure Link to the historical price targets and rating changes (last 12 months)<br />

<strong>Rofin</strong>-<strong>Sinar</strong> 3, 6 http://www.mmwarburg.com/disclaimer/disclaimer_en/US7750431022.htm<br />

C O M M E N T Published 14.11.2012 10

<strong>Rofin</strong>-<strong>Sinar</strong><br />

INVESTMENT RECOMMENDATION<br />

Investment recommendation: expected direction of the share price development of the financial instrument up to the given price target<br />

in the opinion of the analyst who covers this financial instrument.<br />

-B- Buy: The price of the analysed financial instrument is expected to rise over the next 12 months.<br />

-H-<br />

<strong>Hold</strong>:<br />

The price of the analysed financial instrument is expected to remain mostly flat over the<br />

next 12 months.<br />

-S- Sell: The price of the analysed financial instrument is expected to fall over the next 12 months.<br />

“-“ Rating suspended: The available information currently does not permit an evaluation of the company.<br />

WARBURG RESEARCH GMBH – RESEARCH UNIVERSE BY RATING<br />

Rating Number of stocks % of Universe<br />

Buy 111 58<br />

<strong>Hold</strong> 67 35<br />

Sell 11 6<br />

Rating suspended 3 2<br />

Total 192 100<br />

WARBURG RESEARCH GMBH – ANALYSED RESEARCH UNIVERSE BY RATING …<br />

… Looking only at companies for which a disclosure according to § 34b of the Germany Securities Trading Act and the<br />

FinAnV has to be made.<br />

Rating Number of stocks % of Universe<br />

Buy 96 60<br />

<strong>Hold</strong> 55 35<br />

Sell 6 4<br />

Rating suspended 2 1<br />

Total 159 100<br />

PRICE AND RATING HISTORY ROFIN-SINAR AS OF 14.11.2012<br />

The chart has markings if Warburg Research GmbH<br />

changed its rating in the last 12 months. Every marking<br />

represents the date and closing price on the day of the<br />

rating change.<br />

C O M M E N T Published 14.11.2012 11

<strong>Rofin</strong>-<strong>Sinar</strong><br />

RESEARCH<br />

Christian Bruns +49 40 309537-253 Henner Rüschmeier +49 40 309537-270<br />

Head of Research cbruns@warburg-research.com Head of Research hrueschmeier@warburg-research.com<br />

Christian Cohrs +49 40 309537-175 Roland Rapelius +49 40 309537-220<br />

Engineering, Logistics ccohrs@warburg-research.com Engineering, Logistics rrapelius@warburg-research.com<br />

Felix Ellmann +49 40 309537-120 Jochen Reichert +49 40 309537-130<br />

Software, IT fellmann@warburg-research.com Telco, Internet, Media jreichert@warburg-research.com<br />

Jörg Philipp Frey +49 40 309537-258 Christopher Rodler +49 40 309537-290<br />

Retail, Consumer Goods jfrey@warburg-research.com Utilities crodler@warburg-research.com<br />

Ulrich Huwald +49 40 309537-255 Malte Schaumann +49 40 309537-170<br />

Health Care, Pharma uhuwald@warburg-research.com Technology mschaumann@warburg-research.com<br />

Thilo Kleibauer +49 40 309537-257 Susanne Schwartze +49 40 309537-155<br />

Retail, Consumer Goods tkleibauer@warburg-research.com Telco, Internet, Media sschwartze@warburg-research.com<br />

Torsten Klingner +49 40 309537-260 Oliver Schwarz +49 40 309537-250<br />

Real Estate tklingner@warburg-research.com Chemicals oschwarz@warburg-research.com<br />

Eggert Kuls +49 40 309537-256 Marc-René Tonn +49 40 309537-259<br />

Engineering ekuls@warburg-research.com Automobiles, Car Suppliers mtonn@warburg-research.com<br />

Frank Laser +49 40 309537-235 Björn Voss +49 40 309537-254<br />

Construction, Industrials flaser@warburg-research.com Steel, Car Suppliers bvoss@warburg-research.com<br />

Andreas Pläsier +49 40 309537-246 Andreas Wolf +49 40 309537-140<br />

Banks, Financial Services aplaesier@warburg-research.com Software, IT awolf@warburg-research.com<br />

Malte Räther +49 40 309537-185 Stephan Wulf +49 40 309537-150<br />

Technology, Telco, Internet mraether@warburg-research.com Utilities swulf@warburg-research.com<br />

SALES<br />

SALES TRADING<br />

Holger Nass +49 40 3282-2669 Oliver Merckel +49 40 3282-2634<br />

Head of Equity Sales, USA hnass@mmwarburg.com Head of Sales Trading omerckel@mmwarburg.com<br />

Klaus Schilling +49 40 3282-2664 Gudrun Bolsen +49 40 3282-2679<br />

Dep. Head of Equity Sales, GER kschilling@mmwarburg.com Sales Trading gbolsen@mmwarburg.com<br />

Christian Alisch +49 40 3282-2667 Bastian Quast +49 40 3282-2701<br />

Scandinavia, Spain calisch@mmwarburg.com Sales Trading bquast@mmwarburg.com<br />

Robert Conredel +49 40 3282-2633 Patrick Schepelmann +49 40 3282-2700<br />

Germany rconredel@mmwarburg.com Sales Trading pschepelmann@mmwarburg.com<br />

Matthias Fritsch +49 40 3282-2696 Thekla Struve +49 40 3282-2668<br />

United Kingdom mfritsch@mmwarburg.com Sales Trading tstruve@mmwarburg.com<br />

Marie-Therese Grübner +49 40 3282-2630 Jörg Treptow +49 40 3262-2658<br />

France mgruebner@mmwarburg.com Sales Trading jtreptow@mmwarburg.com<br />

Michael Kriszun +49 40 3282-2695<br />

United Kingdom mkriszun@mmwarburg.com Support<br />

Marc Niemann +49 40 3282-2660 Katharina Bruns +49 40 3282-2694<br />

Germany mniemann@mmwarburg.com Roadshow/Marketing kbruns@mmwarburg.com<br />

Dirk Rosenfelder +49 40 3282-2692<br />

Austria, Switzerland<br />

drosenfelder@mmwarburg.com<br />

Julian Straube +49 40 3282-2666<br />

Small & Mid Caps<br />

jstraube@mmwarburg.com<br />

Philipp Stumpfegger +49 40 3282-2635<br />

Australia, United Kingdom<br />

pstumpfegger@mmwarburg.com<br />

MACRO RESEARCH<br />

Carsten Klude +49 40 3282-2572<br />

Macro Research<br />

cklude@mmwarburg.com<br />

Matthias Thiel +49 40 3282-2401<br />

Macro Research<br />

mthiel@mmwarburg.com<br />

Dr. Christian Jasperneite +49 40 3282-2439<br />

Investment Strategy<br />

cjasperneite@mmwarburg.com<br />

Our research can be found under:<br />

Warburg Research research.mmwarburg.com/en/index.html Thomson www.thomson.com<br />

Bloomberg MMWA GO Reuters www.knowledge.reuters.com<br />

FactSet www.factset.com Capital IQ www.capitaliq.com<br />

For access please contact:<br />

Andrea Carstensen +49 40 3282-2632 Kerstin Muthig +49 40 3282-2703<br />

Sales Assistance acarstensen@mmwarburg.com Sales Assistance kmuthig@mmwarburg.com<br />

C O M M E N T Published 14.11.2012 12