Superbrands 2004 - Brand Autopsy

Superbrands 2004 - Brand Autopsy

Superbrands 2004 - Brand Autopsy

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Superbrands</strong> METHODOLOGY<br />

magic and, in a way, the brand becomes<br />

secondary to the marketer. So, it’s fair to<br />

ask: Are these the best marketers for a particular<br />

job, or are they best at marketing<br />

themselves? Ries noted that marketers who<br />

manage to get a job at a high-profile company<br />

get noticed whether they’re good or<br />

bad—and no matter how long they stay. On<br />

the other hand, the trademarks that topped<br />

Interbrand’s top 100 global brands list—<br />

Coca-Cola, Microsoft, IBM, GE and<br />

Intel—aren’t associated with a super CMO,<br />

save for Garrity, who left IBM more than<br />

a decade ago.<br />

Jeff Swystun, global director at Interbrand,<br />

New York, said it’s probably better<br />

to go with a mediocre marketer who is willing<br />

to put ample time in at a brand than<br />

a hotshot who flees after a year. “Rapid<br />

switching is not good for the brand and<br />

not good for the company,” he said. “Anyone<br />

who’s in the role three years or less<br />

doesn’t have time to absorb the nuances.”<br />

Greg Welch of Spencer Stuart has a<br />

solution: contracts. “Can you imagine how<br />

different it would be if new marketers had<br />

to sign a 60-month contract?” he asked.<br />

On a grander scale, an argument<br />

against star CMOs is an argument against<br />

stars in general. As Martinez noted in The<br />

Hard Road to the Softer Side, Young & Rubicam’s<br />

team came up with the “Softer Side”<br />

campaign. Costello basically had the sense<br />

to use the idea, but he did not create it.<br />

As Ries noted, marketers get a halo effect<br />

from being around a good team.<br />

The fact is, individuals rarely create new<br />

ideas on their own. In the history of philosophy,<br />

there were only three major<br />

thinkers who appeared to do just that:<br />

Taoist metaphysician Wang Ch’ung, Zen<br />

mystic Bassui Tokusho and Arabic<br />

philosopher Ibn Khaldun. All the<br />

others came from various existing schools<br />

and movements.<br />

In that sense, a CMO may better be<br />

considered a manager than a marketer. Creativity<br />

doesn’t even make the cut among<br />

Spencer Stuart’s list of key CMO attributes.<br />

Instead, important traits include<br />

adaptability, a thick skin and even a history<br />

of overcoming some type of adversity,<br />

whether personal or professional.<br />

Geoffrey Frost, CMO of Motorola and<br />

formerly of Nike, argues that the X factor<br />

for a star marketer has more to do with leadership<br />

than creativity. “Why are some<br />

groups smarter than their smartest member<br />

and others dumber than their dumbest?”<br />

he asked. “You have to be smart enough<br />

to know the limits of your own intelligence,<br />

so you can magnetize that talent. It’s basic<br />

stuff, but it’s hard to do.” B<br />

S18 JUNE 21, <strong>2004</strong><br />

A Look Behind the Numbers<br />

The annual <strong>Superbrands</strong> report is presented<br />

in two parts. As in past years,<br />

marketplace analysis by <strong>Brand</strong>week<br />

reporters and brand rankings in 25 categories<br />

are based on 2003 sales. The Top 2000 list<br />

(beginning on page 70) ranks full-year media<br />

expenditures as tallied by TNS/CMR.<br />

Consumer perceptions of brands from<br />

Harris Interactive’s EquiTrend® study<br />

round out the package. This year’s report<br />

contains even more comprehensive diagnostic<br />

results for evaluating brand equity.<br />

To begin, “Familiarity” replaces “Salience”<br />

as a more sensitive measure of a consumer’s<br />

ability to rate a brand. Respondents then<br />

ranked brands with which they were “somewhat,”<br />

“very” or “extremely” familiar on<br />

their propensity to purchase that brand to<br />

better gauge its vitality in the marketplace.<br />

“Purchase intent has a huge correlation to<br />

actual use, said Deanna Wert, vp-brand<br />

and reputation strategy at Harris.<br />

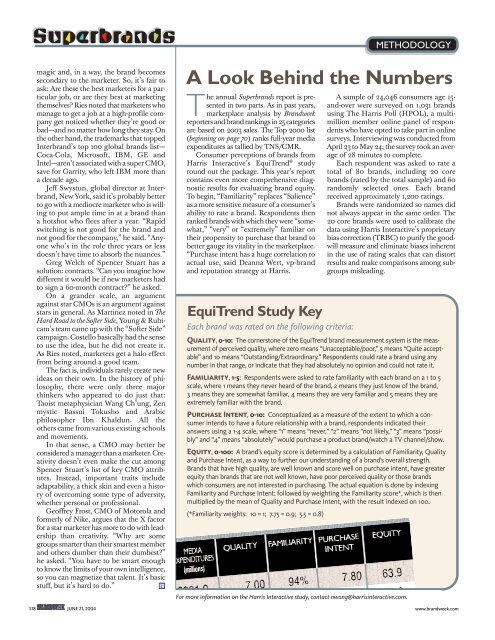

EquiTrend Study Key<br />

Each brand was rated on the following criteria:<br />

A sample of 24,046 consumers age 15and-over<br />

were surveyed on 1,031 brands<br />

using The Harris Poll (HPOL), a multimillion<br />

member online panel of respondents<br />

who have opted to take part in online<br />

surveys. Interviewing was conducted from<br />

April 23 to May 24; the survey took an average<br />

of 28 minutes to complete.<br />

Each respondent was asked to rate a<br />

total of 80 brands, including 20 core<br />

brands (rated by the total sample) and 60<br />

randomly selected ones. Each brand<br />

received approximately 1,200 ratings.<br />

<strong>Brand</strong>s were randomized so names did<br />

not always appear in the same order. The<br />

20 core brands were used to calibrate the<br />

data using Harris Interactive’s proprietary<br />

bias correction (TRBC) to purify the goodwill<br />

measure and eliminate biases inherent<br />

in the use of rating scales that can distort<br />

results and make comparisons among subgroups<br />

misleading.<br />

Quality, 0-10: The cornerstone of the EquiTrend brand measurement system is the measurement<br />

of perceived quality, where zero means “Unacceptable/poor,” 5 means “Quite acceptable”<br />

and 10 means “Outstanding/Extraordinary.” Respondents could rate a brand using any<br />

number in that range, or indicate that they had absolutely no opinion and could not rate it.<br />

Familiarity, 1-5: Respondents were asked to rate familiarity with each brand on a 1 to 5<br />

scale, where 1 means they never heard of the brand, 2 means they just know of the brand,<br />

3 means they are somewhat familiar, 4 means they are very familiar and 5 means they are<br />

extremely familiar with the brand.<br />

Purchase Intent, 0-10: Conceptualized as a measure of the extent to which a consumer<br />

intends to have a future relationship with a brand, respondents indicated their<br />

answers using a 1-4 scale, where “1” means “never,” “2” means “not likely,” “3” means “possibly”<br />

and “4” means “absolutely” would purchase a product brand/watch a TV channel/show.<br />

Equity, 0-100: A brand’s equity score is determined by a calculation of Familiarity, Quality<br />

and Purchase Intent, as a way to further our understanding of a brand’s overall strength.<br />

<strong>Brand</strong>s that have high quality, are well known and score well on purchase intent, have greater<br />

equity than brands that are not well known, have poor perceived quality or those brands<br />

which consumers are not interested in purchasing. The actual equation is done by indexing<br />

Familiarity and Purchase Intent; followed by weighting the Familiarity score*, which is then<br />

multiplied by the mean of Quality and Purchase Intent, with the result indexed on 100.<br />

(*Familiarity weights: 10 = 1; 7.75 = 0.9; 5.5 = 0.8)<br />

For more information on the Harris Interactive study, contact nwong@harrisinteractive.com.<br />

www.brandweek.com