Prepayable NHA MBS - Securitization.Net

Prepayable NHA MBS - Securitization.Net

Prepayable NHA MBS - Securitization.Net

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

10<br />

13<br />

16<br />

19<br />

22<br />

25<br />

28<br />

31<br />

34<br />

37<br />

40<br />

43<br />

46<br />

49<br />

52<br />

55<br />

For this study,<br />

we have<br />

eliminated<br />

pools with<br />

economically<br />

motivated<br />

refinancings in<br />

order to<br />

examine core<br />

prepayment<br />

patterns<br />

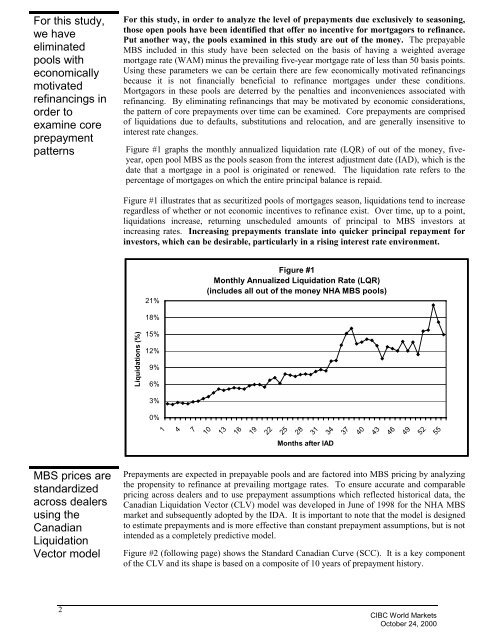

For this study, in order to analyze the level of prepayments due exclusively to seasoning,<br />

those open pools have been identified that offer no incentive for mortgagors to refinance.<br />

Put another way, the pools examined in this study are out of the money. The prepayable<br />

<strong>MBS</strong> included in this study have been selected on the basis of having a weighted average<br />

mortgage rate (WAM) minus the prevailing five-year mortgage rate of less than 50 basis points.<br />

Using these parameters we can be certain there are few economically motivated refinancings<br />

because it is not financially beneficial to refinance mortgages under these conditions.<br />

Mortgagors in these pools are deterred by the penalties and inconveniences associated with<br />

refinancing. By eliminating refinancings that may be motivated by economic considerations,<br />

the pattern of core prepayments over time can be examined. Core prepayments are comprised<br />

of liquidations due to defaults, substitutions and relocation, and are generally insensitive to<br />

interest rate changes.<br />

Figure #1 graphs the monthly annualized liquidation rate (LQR) of out of the money, fiveyear,<br />

open pool <strong>MBS</strong> as the pools season from the interest adjustment date (IAD), which is the<br />

date that a mortgage in a pool is originated or renewed. The liquidation rate refers to the<br />

percentage of mortgages on which the entire principal balance is repaid.<br />

Figure #1 illustrates that as securitized pools of mortgages season, liquidations tend to increase<br />

regardless of whether or not economic incentives to refinance exist. Over time, up to a point,<br />

liquidations increase, returning unscheduled amounts of principal to <strong>MBS</strong> investors at<br />

increasing rates. Increasing prepayments translate into quicker principal repayment for<br />

investors, which can be desirable, particularly in a rising interest rate environment.<br />

21%<br />

Figure #1<br />

Monthly Annualized Liquidation Rate (LQR)<br />

(includes all out of the money <strong>NHA</strong> <strong>MBS</strong> pools)<br />

18%<br />

Liquidations (%)<br />

15%<br />

12%<br />

9%<br />

6%<br />

3%<br />

0%<br />

1<br />

4<br />

7<br />

Months after IAD<br />

<strong>MBS</strong> prices are<br />

standardized<br />

across dealers<br />

using the<br />

Canadian<br />

Liquidation<br />

Vector model<br />

Prepayments are expected in prepayable pools and are factored into <strong>MBS</strong> pricing by analyzing<br />

the propensity to refinance at prevailing mortgage rates. To ensure accurate and comparable<br />

pricing across dealers and to use prepayment assumptions which reflected historical data, the<br />

Canadian Liquidation Vector (CLV) model was developed in June of 1998 for the <strong>NHA</strong> <strong>MBS</strong><br />

market and subsequently adopted by the IDA. It is important to note that the model is designed<br />

to estimate prepayments and is more effective than constant prepayment assumptions, but is not<br />

intended as a completely predictive model.<br />

Figure #2 (following page) shows the Standard Canadian Curve (SCC). It is a key component<br />

of the CLV and its shape is based on a composite of 10 years of prepayment history.<br />

2<br />

CIBC World Markets<br />

October 24, 2000