Södra annual report 2012

Södra annual report 2012

Södra annual report 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Note 22<br />

Financial risk management<br />

The international and capital-intensive nature of its operations means Södra<br />

is constantly exposed to financial risks, such as market risk, credit risk and<br />

liquidity and financing risk. There are correlations between certain risk variables.<br />

According to the hedging strategy, focus shall be on hedging net exposures.<br />

The Group’s financial policy for handling financial risks is adopted by<br />

the Board and provides a framework of guidelines and rules in the form of<br />

risk mandates and limits for financial operations. Hedging measures are<br />

approved when the situation for such a measure is judged to be financially<br />

beneficial. Consideration is also taken to the current access to commercially<br />

acceptable hedging terms.<br />

Södra’s financial risk management is centralised to the Treasury function<br />

in the Parent Company. This enables economies of scale and synergy effects<br />

to be utilised and helps minimise handling risks. The overall objective is to<br />

provide cost-effective financing and liquidity administration while minimising<br />

the negative effects on consolidated income that arise from market risks.<br />

The financial risks are continuously measured and compliance with the<br />

financial policy is monitored. The key aspects of financial risk management<br />

within the Group are described below.<br />

Market risk<br />

Market risk involves the risk of the fair value of, or future cash flow from, a<br />

financial instrument changing due to fluctuating market prices. Market risk<br />

consists of foreign exchange risk, interest risk and other price risks. The<br />

market risks that primarily affect the Group are foreign exchange risk and<br />

raw material price risk.<br />

Foreign exchange risk<br />

Södra is exposed to different types of foreign exchange risk. The primary<br />

exposure arises from the Group’s sales and purchases in foreign currencies.<br />

These foreign exchange risks consist partly of the risk of fluctuations in the<br />

value of financial instruments and trade receivables and payables, and partly<br />

of foreign exchange risk in anticipated or contracted payment flows (transaction<br />

exposure).<br />

There are also foreign exchange risks in translation of the assets and liabilities<br />

of foreign subsidiaries to the functional currency of the Group (translation<br />

exposure). The Group is also exposed to foreign exchange risks attributable<br />

to investments in foreign currency (financial exposure).<br />

Consolidated income includes foreign exchange differences of negative<br />

SEK 53 million (neg: 16) in operating profit and of negative SEK 8 million<br />

(pos: 8) in finance income and expenses.<br />

Transaction exposure<br />

A substantial part of revenue is related to customers outside Sweden and most<br />

of the company’s products are invoiced in local currency or USD. Input goods<br />

are largely imported in foreign currency. These factors mean that changing foreign<br />

exchange rates have a major impact on Södra. To manage Södra’s net<br />

transaction exposure, forecast currency flow can be hedged using currency<br />

derivatives.<br />

Currency exposure is hedged in accordance with the financial policy. Temporarily<br />

attractive levels or specific factors can make it desirable to deviate<br />

from the hedging norms. The hedging interval determines the risk mandate<br />

that Södra Treasury has to follow for deviations from hedging norms. The currency<br />

hedging component of pulp hedges is included in the overall foreign<br />

exchange mandate. Under the policy, standardised forward contracts, currency<br />

swaps and acquired foreign exchange options may be used for hedging purposes.<br />

Hedge <strong>report</strong>ing is used when the demands for this are met.<br />

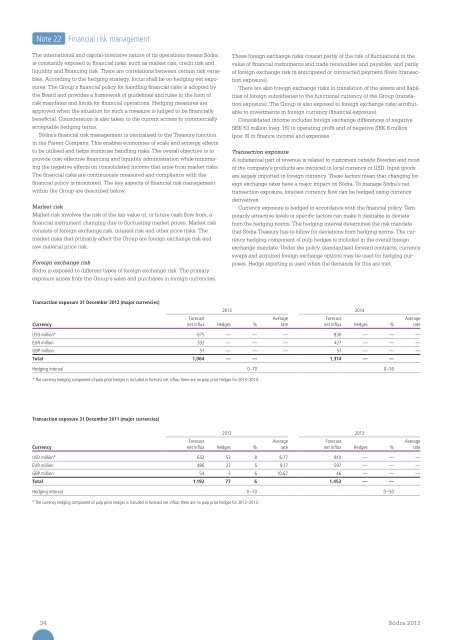

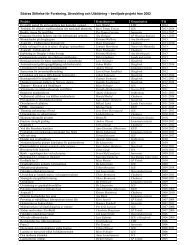

Transaction exposure 31 December <strong>2012</strong> (major currencies)<br />

Currency<br />

Forecast<br />

net influx Hedges %<br />

2013 2014<br />

Average<br />

rate<br />

Forecast<br />

net influx Hedges %<br />

Average<br />

rate<br />

USD million* 675 — — — 830 — — —<br />

EUR million 332 — — — 427 — — —<br />

GBP million 57 — — — 57 — — —<br />

Total 1,064 — — 1,314 — —<br />

Hedging interval 0–70 0–50<br />

* The currency hedging component of pulp price hedges is included in forecast net influx; there are no pulp price hedges for 2013–2014.<br />

Transaction exposure 31 December 2011 (major currencies)<br />

Currency<br />

Forecast<br />

net influx Hedges %<br />

<strong>2012</strong> 2013<br />

Average<br />

rate<br />

Forecast<br />

net influx Hedges %<br />

Average<br />

rate<br />

USD million* 652 52 8 6.77 810 — — —<br />

EUR million 486 22 5 9.17 597 — — —<br />

GBP million 54 3 6 10.67 46 — — —<br />

Total 1,192 77 6 1,453 — —<br />

Hedging interval 0–70 0–50<br />

* The currency hedging component of pulp price hedges is included in forecast net influx; there are no pulp price hedges for <strong>2012</strong>–2013.<br />

34<br />

Södra <strong>2012</strong>