Managed Futures - Schindler Trading

Managed Futures - Schindler Trading

Managed Futures - Schindler Trading

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Evaluating Risk from an Investor’s Perspective<br />

Investors should understand that there are risks<br />

associated with trading futures and options on futures.<br />

The Commodity <strong>Futures</strong> <strong>Trading</strong> Commission (CFTC)<br />

requires that prospective customers be provided with<br />

risk-disclosure statements which should be carefully<br />

reviewed. Past performance is not necessarily an<br />

indicator of future results.<br />

Potential investors will want to become familiar<br />

with industry definitions for evaluating the risk-return<br />

element of managed futures performance. The following<br />

equations, with some variations, are often used.<br />

Measure of Volatility<br />

Standard Deviation: The dispersion (distance) of<br />

observations (performance data) from the mean (or<br />

average) observation. This measure is often expressed<br />

as a percentage on an annualized basis.<br />

Measure of Capital Loss<br />

Largest Cumulative Decline or Maximum Drawdown:<br />

The largest cumulative percentage (peak-to-valley)<br />

decline in capital of a trading account or portfolio. This<br />

measure of risk identifies the worst-case scenario for a<br />

managed futures investment within a given time period.<br />

Measure of Risk-Adjusted Return<br />

Sharpe Ratio: A ratio that represents a rate of return<br />

adjusted for risk, calculated as follows:<br />

Annual rate of return - Risk-free rate of return<br />

Annualized standard deviation<br />

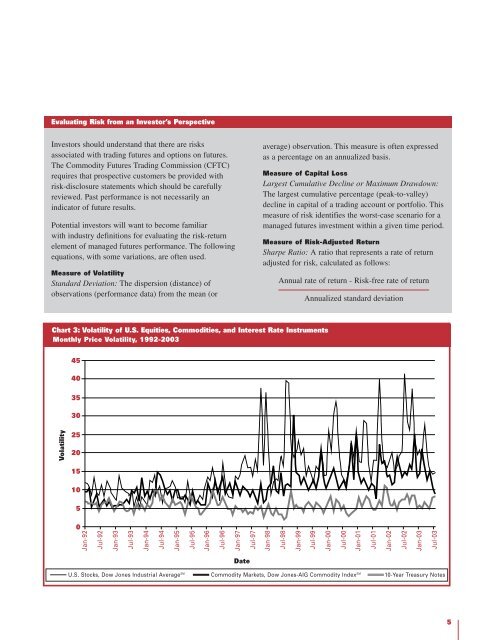

Chart 3: Volatility of U.S. Equities, Commodities, and Interest Rate Instruments<br />

Monthly Price Volatility, 1992-2003<br />

45<br />

40<br />

35<br />

30<br />

Volatility<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

Jan-92<br />

Jul-92<br />

Jan-93<br />

Jul-93<br />

Jan-94<br />

Jul-94<br />

Jan-95<br />

Jul-95<br />

Jan-96<br />

Jul-96<br />

Jan-97<br />

Jul-97<br />

Jan-98<br />

Jul-98<br />

Jan-99<br />

Jul-99<br />

Jan-00<br />

Jul-00<br />

Jan-01<br />

Jul-01<br />

Jan-02<br />

Jul-02<br />

Jan-03<br />

Jul-03<br />

Date<br />

U.S. Stocks, Dow Jones Industrial Average SM Commodity Markets, Dow Jones-AIG Commodity Index SM 10-Year Treasury Notes<br />

5

![Definitions & Concepts... [PDF] - Cycles Research Institute](https://img.yumpu.com/26387731/1/190x245/definitions-concepts-pdf-cycles-research-institute.jpg?quality=85)