MOU 2012-13 - CCL

MOU 2012-13 - CCL

MOU 2012-13 - CCL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MEMORANDUM OF UNDERSTANDING<br />

BETWEEN<br />

CENTRAL COALFIELDS LTD.<br />

AND<br />

COAL INDIA LTD.<br />

<strong>2012</strong>-<strong>13</strong>

PART-I : VISION / MISSION & OBJECTIVES<br />

1.1<br />

VISION<br />

To emerge as a global player in the primary energy sector, committed to provide energy<br />

security to the country, by attaining environmentally and socially sustainable growth,<br />

through best practices from mine to market.<br />

MISSION<br />

The Mission of Central Coalfields Limited (<strong>CCL</strong>) is to produce and market the planned<br />

quantity of coal and coal products efficiently and economically with due regard to safety,<br />

conservation and quality.<br />

1.2 OBJECTIVES<br />

Major objectives of Central Coalfields Limited (<strong>CCL</strong>) are:<br />

1. To optimize generation of internal resources by improving productivity of resources,<br />

prevent wastage and to mobilize adequate external resources to meet investment need.<br />

2. To maintain high standards of safety and strive for an accident free mining of coal<br />

3. To lay emphasis on afforestation, protection of environment and control of pollution.<br />

4. To undertake detailed exploration and plan for new projects to meet the future coal<br />

demand.<br />

5. To modernize existing mines.<br />

6. To develop technical know-how and organization capability of coal mining as well as<br />

coal beneficiation and undertake, wherever necessary, applied research and<br />

development work related to scientific exploration for greater extraction of coal.<br />

7. To improve the quality of life of employees and to discharge the corporate obligations<br />

to society at large and the community around the coalfields in particular.<br />

To provide adequate number of skilled manpower to run the operations and impart technical and<br />

managerial training for up gradation of skill

2 <strong>CCL</strong>_<strong>MOU</strong>_<strong>2012</strong>-<strong>13</strong>_55.55MT.xls<br />

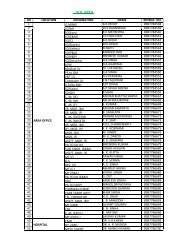

MEMORANDUM OF UNDERSTANDING <strong>2012</strong>-<strong>13</strong> BETWEEN <strong>CCL</strong> & CIL<br />

SUBSIDIARY: CENTRAL COALFIELDS LTD<br />

Annexure - III<br />

Unit<br />

Weigh<br />

t ( in<br />

%)<br />

MoU Target<br />

Excellent Very Good Good Fair Poor<br />

Means of<br />

verification<br />

1 2 3 4 5<br />

1<br />

Static / Financial Parameters<br />

Annual Report<br />

including<br />

Annual<br />

Accounts,<br />

Director's<br />

Report &<br />

Auditor's<br />

report<br />

(a) Financial Indicators - Profit related ratios<br />

(i) Gross Margin / Gross Block 2 0.4278 0.4237 0.4025 0.3824 0.3633<br />

(ii) Net Profit / Net Worth 10 0.3739 0.3703 0.3518 0.3342 0.3175<br />

(iii) Gross Profit / Capital Employed 10 0.4007 0.3960 0.3762 0.3574 0.3395<br />

(b) Financial Indicators -Size related<br />

(i) Gross Margin Rs Crs 8 2295.39 2273.12 2159.46 2051.49 1948.92<br />

(ii) Net Sales Rs Crs 4 7863.92 7828.44 7437.02 7065.17 6711.91<br />

( c) Financial Returns- Productivity related<br />

(i) PBDIT / Total Employment 7 0.0498 0.0493 0.0468 0.0445 0.0423<br />

(ii) Added Value / Net Sales 9 0.2269 0.2250 0.2<strong>13</strong>8 0.2031 0.1929<br />

Sub Total 50

2 <strong>CCL</strong>_<strong>MOU</strong>_<strong>2012</strong>-<strong>13</strong>_55.55MT.xls<br />

MEMORANDUM OF UNDERSTANDING <strong>2012</strong>-<strong>13</strong> BETWEEN <strong>CCL</strong> & CIL<br />

SUBSIDIARY: CENTRAL COALFIELDS LTD<br />

Annexure - III<br />

Unit<br />

Weigh<br />

t ( in<br />

%)<br />

MoU Target<br />

Excellent Very Good Good Fair Poor<br />

Means of<br />

verification<br />

1 2 3 4 5<br />

2 Dynamic Parameters<br />

(d)&(e)<br />

(d) Quality & Customer Satisfaction 2.5<br />

(i)<br />

(ii)<br />

(iii)<br />

(iv)<br />

Quality<br />

Despatch of Coal to power sector by rail<br />

Despatch covered under agreed sampling to power<br />

sector<br />

Sized coal Despatch to power sector by Rail<br />

Establishing mechanism through publicised web site<br />

for handling of consumers complain and no complain<br />

should be kept pending for more than three month<br />

Offering of Model FSA for New Power Plants having<br />

PPA as per Govt. decisions<br />

% 0.5 99.00 97.00 96.00 95.00 94.00<br />

(%) 0.5 98.50 98.00 97.00 96.00 95.00<br />

(%) 0.5 90.00 80.00 70.00 60.00 50.00<br />

Date 1<br />

(f) Human Resource Management 5<br />

07.05.12 22.05.12 07.06.12 22.06.12 07.07.12<br />

Annual<br />

Report /<br />

Independent<br />

Expert<br />

Committee<br />

Independent<br />

Expert<br />

Committee /<br />

Annual Report<br />

(i) As per annexure XIV (%) 3<br />

(ii) Certified Training in Contract Management<br />

No. of<br />

Executives 1<br />

(iii)<br />

Certified Training in Project Management<br />

No. of<br />

Executives 1<br />

(g)&(h) R & D / Adoption of Innovative Practices 5<br />

(i & j) Project Implementation 9.5<br />

11<br />

Capacity creation through approval of new/ Expansion<br />

projects<br />

As per annexure XIV - Enclosed<br />

6 5 4 3 2<br />

6 5 4 3 2<br />

As per Annexure XII - Enclosed<br />

Stage- I Approval ( "in principle" approval) of PRs Mt 2 12.0 11.8 11.2 10.6 10.1<br />

Annual<br />

Report /<br />

Independent<br />

R&D<br />

Advisory<br />

Committee<br />

Annual<br />

Report /<br />

Independent<br />

Expert<br />

Committee<br />

Copy of<br />

Approval

2 <strong>CCL</strong>_<strong>MOU</strong>_<strong>2012</strong>-<strong>13</strong>_55.55MT.xls<br />

MEMORANDUM OF UNDERSTANDING <strong>2012</strong>-<strong>13</strong> BETWEEN <strong>CCL</strong> & CIL<br />

SUBSIDIARY: CENTRAL COALFIELDS LTD<br />

Annexure - III<br />

Unit<br />

Weigh<br />

t ( in<br />

%)<br />

MoU Target<br />

Excellent Very Good Good Fair Poor<br />

Means of<br />

verification<br />

1 2 3 4 5<br />

(I) Koed Manatu OC - 10 MTY 1.6 10.0 9.83 9.33 8.83 8.41<br />

(Ii) Hesalong OC - 1.0 MTY 0.2 1.0 0.980 0.93 0.88 0.84<br />

(Iii) Aswa OC - 1.0 MTY 0.2 1.0 0.980 0.93 0.88 0.84<br />

12 Commissioning /Completion of on going projects ** 2<br />

(I) AMLO OC - 2.5 MTY Month Oct '12 Nov ' 12 Dec ' 12 Jan ' <strong>13</strong> Feb ' <strong>13</strong><br />

** Completion of Ashok & Purnadih OC could not be done on schedule due to- (a) Ashok OC - RLS/ Railway Siding could not be constructed due to delay in<br />

physical possession of tenancy land.<br />

(b) Purnadih OC- PR envisaged working in 3 quarries. But working could be started only in Q-II due to delay in obtaining tenancy land required for other quarries<br />

due to resistance from the villagers and their demand beyond R&R Policy of CIL.<br />

<strong>13</strong> (I) Acquisition of land - Notification u/s 9 of CBA Act. Ha 1 818 801.8 762 724 687<br />

Notification u/s 11 of CBA Act.<br />

Ha<br />

14<br />

15<br />

(ii) Possession of Land Ha 1 91 86.5 82 78 74<br />

(i)<br />

(ii)<br />

(iii)<br />

(iv)<br />

(v)<br />

(vi)<br />

(vii)<br />

(viii<br />

Utilization of Capital Expenditure of AP <strong>2012</strong>-<strong>13</strong> Rs Crs 1 425.00 382.50 361.25 340.00 318.75<br />

Other major activities/ Milestones<br />

Approval of Implementation Plan for 5 years for Magadh<br />

OCP in view of delay due to non construction of Tori-<br />

Shivpur_Hazaribag Rly Line.<br />

Commissioning of HEMMs ordered during 2011-12<br />

of Tapin OC ( 1 Shovel - 5 Cum )<br />

Finalisation of Initial alignment of Railway Siding for<br />

North Urimari OC by P&P Department<br />

Signing of Agreement between <strong>CCL</strong> & EC Railway<br />

for Railway Siding of Ashok OC<br />

Floating EOI for engaging agency for scientific study<br />

for finalisation of site of low level bridge at Rajrappa<br />

OCP<br />

Commissioning of Diesel Excavator (1 No. ) of<br />

Purnadih OCP<br />

Date 0.25 July ' 12 Aug ' 12 Sept ' 12 Oct ' 12 Nov ' 12<br />

Date 0.5 Oct ' 12 Nov ' 12 Dec ' 12 Jan ' <strong>13</strong> Feb ' <strong>13</strong><br />

Date 0.25 Aug ' 12 Sept ' 12 Oct ' 12 Nov ' 12<br />

Date 0.25 Jan ' <strong>13</strong> Feb ' <strong>13</strong> Mar ' <strong>13</strong><br />

Date 0.25 Oct ' 12 Nov ' 12 Dec ' 12<br />

Date 0.5 Jan ' <strong>13</strong> Feb ' <strong>13</strong> Mar ' <strong>13</strong><br />

Supply Order for HEMMs for Karma OCP ( 1 No. Dumper ) Date 0.25 Jan ' <strong>13</strong> Feb ' <strong>13</strong> Mar ' <strong>13</strong><br />

Holding Pre NIT meeting for Churi UG mine for<br />

deployment of CM<br />

Date 0.25 Jan ' <strong>13</strong> Feb ' <strong>13</strong> Mar ' <strong>13</strong><br />

Annual<br />

Report /<br />

Independent<br />

Expert<br />

Committee

2 <strong>CCL</strong>_<strong>MOU</strong>_<strong>2012</strong>-<strong>13</strong>_55.55MT.xls<br />

MEMORANDUM OF UNDERSTANDING <strong>2012</strong>-<strong>13</strong> BETWEEN <strong>CCL</strong> & CIL<br />

SUBSIDIARY: CENTRAL COALFIELDS LTD<br />

Annexure - III<br />

Unit<br />

Weigh<br />

t ( in<br />

%)<br />

MoU Target<br />

Excellent Very Good Good Fair Poor<br />

Means of<br />

verification<br />

1 2 3 4 5<br />

(k) Extent of Globalization<br />

NOT APPLICABLE<br />

(l) Corporate Social Responsibility 5<br />

(i)<br />

Corporate Social Responsibility 4<br />

As per annexure XI - Enclosed<br />

(ii)<br />

%<br />

Expenditure on CSR (0.5% of PAT of 2011-12)<br />

1 100 90 80 70 60<br />

Annual<br />

Report /<br />

Independent<br />

Expert<br />

Committee<br />

(m) Sustainable Development 5<br />

(n) Corporate Governance 5<br />

As per annexure XIII - Enclosed<br />

Annual<br />

Report /<br />

Independent<br />

Expert<br />

Committee<br />

(i)<br />

(ii)<br />

Grading on the basis of compliance with<br />

guidelines on Corporate Governance issued<br />

by DPE (Enclosued)<br />

Date of Submission to DPE of completed Data<br />

sheet for PE Survey<br />

(%) 4<br />

Date 1<br />

3 Sector Specific Parameters: 6<br />

85 and<br />

above<br />

15th Sept<br />

<strong>2012</strong><br />

75 - 84 60 - 74 50 - 59

2 <strong>CCL</strong>_<strong>MOU</strong>_<strong>2012</strong>-<strong>13</strong>_55.55MT.xls<br />

MEMORANDUM OF UNDERSTANDING <strong>2012</strong>-<strong>13</strong> BETWEEN <strong>CCL</strong> & CIL<br />

SUBSIDIARY: CENTRAL COALFIELDS LTD<br />

Annexure - III<br />

Unit<br />

Weigh<br />

t ( in<br />

%)<br />

MoU Target<br />

Excellent Very Good Good Fair Poor<br />

Means of<br />

verification<br />

1 2 3 4 5<br />

4-d Safety<br />

FATALITY RATE<br />

(I)<br />

(ii)<br />

(iii)<br />

(iv)<br />

Reduction in fatality rate (fatalities/ Mcum. of total<br />

material excavated) w. r. t previous FY. % 0.25 4 3 2 1<br />

Reduction in fatality rate (fatality/ MT of UG Coal) w.<br />

r. t previous FY. % 0.25 4 3 2 1<br />

SERIOUS INJURY RATE<br />

Reduction in Serious injury rate (serious Injuries/ MT<br />

of Coal excavated from UG) w. r. t previous FY. % 0.25 4 3 2 1<br />

Reduction in Serious injury rate (serious Injuries/<br />

Mcum. of total material excavated from OC) w. r. t<br />

% 0.25 4 3 2 1<br />

i FY<br />

No<br />

reduction<br />

No<br />

reduction<br />

No<br />

reduction<br />

No<br />

reduction<br />

5 Compliance of DPE Guidelines 4 Annual Report<br />

Date<br />

(I) Issue of Bonus shares<br />

Not applicable as per guideline<br />

(ii) Reservations for SC/ST/OBCs in appointments Y/N 1.00 Yes No<br />

(iii) Posting of deputationists Y/N 0.50 Yes No<br />

(iv) Implementation of 2007 pay revision<br />

No. of<br />

Paramete<br />

r<br />

1.00 10 9 8 7 6<br />

Implemen<br />

(v) Switching over from CDA to IDA pattern of pay scales<br />

No. of<br />

Paramete<br />

r<br />

1.00 4 3 2 1<br />

Implemen<br />

(vi) Submission of compliance of DPE Giudelines Date 0.50<br />

30th 31st Aug'12 30th Sep'12 31st 30th Nov<br />

June'12<br />

Oct'12 ' 12<br />

Grand Total 100<br />

Chairman cum Managing Director

Points relating to financial parameters of <strong>MOU</strong> <strong>2012</strong>-<strong>13</strong>:<br />

1. Net sales have been calculated based on GCV method of pricing (Pricing as appearing in CIL Website is attached). Impact of any revision in pricing will<br />

be excluded from Net Sales, Gross Margin, Gross Profit, Net profit and its effect in Balance Sheet, at the time of evaluation.<br />

2. Salaries and Wages of Rs. 3333.12 Cr (VG) and Rs. 3333.12 Cr (Exc.) has been considered while calculating Gross Margin, Gross Profit and Net Profit.<br />

Any decrease in Salaries and Wages upto 3% will only be accepted. Decrease beyond 3% will not be accepted in calculating Gross Margin, Gross Profit,<br />

Net Profit and its effect in Balance Sheet at the time of evaluation.<br />

3. Other Expenses (as mentioned in Annexure-7 but excluding OBR as indicated in point 4) of Rs. 1523.00 Cr (VG) and Rs. 1526.83 Cr (Exc.) has been<br />

considered while calculating Gross Margin, Gross Profit and Net Profit. Any decrease in other expenses (excluding OBR) upto 3% will only be accepted.<br />

Decrease beyond 3% will not be accepted in calculating Gross Margin, Gross Profit, Net Profit and its effect in Balance Sheet at the time of evaluation.<br />

4. Over Burden Removal (OBR): OBR adjustment of Rs. 129.64 Cr (VG) and Rs. <strong>13</strong>9.08 Cr (Exc.) has been considered as normal expense. Any variation in<br />

OBR adjustment upto 7% will only be considered for evaluation. Variation beyond 7% will be disallowed in Gross Margin, Gross Profit, Net Profit and<br />

its effect in Balance sheet at the time of evaluation.<br />

5. Other Income of Rs. 397.94 Cr. (VG) and Rs. 409.89 Cr. (Exc.) have been considered in <strong>MOU</strong> target. It includes Surface Transportation Charges<br />

recovery, Interest, Stowing Subsidy and Dividend from Mutual Fund. This income over and above Rs. 397.94 Cr. (VG) and Rs. 409.89 Cr. (Exc.) will be<br />

excluded from Gross Margin, Gross Profit, Net Profit and its effect in Balance Sheet.<br />

6. Financial Parameters and Statements have been calculated as per Revised Schedule VI.<br />

7. Financial Parameters and Statements may undergo change in case DTC / IFRS is implemented.<br />

8. Impact of MMDR bill if becomes an Act and implemented, its impact will be excluded.<br />

9. Impact of Presidential directive to Coal India Ltd to supply at least 80% of the quantity committed to Power Houses has not been considered.

MINISTRY : COAL<br />

COMPANY: CENTRAL COALFIELDS<br />

LIMITED<br />

INCOME-EXPENDITURE STATEMENT<br />

(as on 31st March)<br />

ANNEX VII<br />

4 Annex VII & IX 55.55 MT.xls<br />

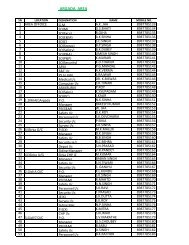

2010-11 RE(8.12.11) 2011-12 BE BE<br />

S. No. Particulars Audited 2011-12 Audited <strong>2012</strong>-<strong>13</strong> <strong>2012</strong>-<strong>13</strong><br />

Unit (49.0 Mt) (Upto Dec'11) (55.5Mt) (55.0Mt)<br />

Excellent V.Good<br />

(1) (2) (3)<br />

1 Total Income Rs. Cr 6714.61 7403.37 5023.01 8166.56 8120.46<br />

1.1 Gross Sales '' 7083.<strong>13</strong> 8066.88 6224.94 9144.36 9102.55<br />

1.2 Less: Excise duties & Others '' 1041.43 1116.19 1153.94 1280.44 1274.11 16.28252 16.27543<br />

1.3 Net sales/Operating Income '' 6041.70 6950.69 5071.00 7863.92 7828.44<br />

1.4<br />

Accretion/Depletion to<br />

finished stocks to works-inprogress<br />

'' 281.33 0.00 -401.03 -107.24 -105.92<br />

1.5 Other Income '' 391.59 452.68 353.04 409.89 397.94<br />

2 Total Expenditure '' 4592.82 5646.42 3517.89 5871.18 5847.34<br />

2.1 Raw Materials/Purchase of pr '' 533.22 562.97 387.59 565.07 561.20<br />

2.2<br />

Manufacturing<br />

expenses/Direct<br />

Expenses/Operational<br />

Expenses<br />

''<br />

2.3 Power,Fuel, Water etc '' 234.40 295.<strong>13</strong> 204.23 307.08 300.38<br />

2.4 Salaries & Wages '' 2587.16 3163.32 2149.09 3333.12 3333.12<br />

2.5 Other Expenses '' 1238.03 1625.00 776.98 1665.91 1652.64<br />

3 Gross Margin (PBDIT) '' 2121.79 1756.95 1505.12 2295.38 2273.12<br />

3.1 Depreciation/DRE '' 242.54 242.94 160.70 246.48 246.48<br />

3.2 Gross Profit (Operating Incom '' 1879.25 1514.01 <strong>13</strong>44.42 2048.90 2026.64<br />

4 Profit/Loss on Sale of Assets ''<br />

5 Prior Period Adjustments '' -10.08<br />

6 Extra-ordinary Items (Net) ''<br />

7 Interest '' 8.96 1.60 1.29 1.75 1.75<br />

8 Provision for tax (including def '' 6<strong>13</strong>.39 460.88 434.64 634.70 627.47<br />

9 Net Profit '' 1246.83 1051.53 908.49 1412.45 <strong>13</strong>97.42<br />

10 Dividend Paid '' 748.10 630.91 847.47 838.44<br />

11 Tax on Dividend '' 121.36 104.79 140.76 <strong>13</strong>9.26<br />

12 Retained Profit '' 377.37 315.82 908.49 424.22 419.72<br />

<strong>13</strong> Return to Capital Employed @ '' 427.92 456.22 490.39 511.34 511.83<br />

14 Added Value (3-<strong>13</strong>) '' 1693.88 <strong>13</strong>00.73 1014.73 1784.04 1761.29<br />

15 No. of Employees 52285 48475 50496 46071 46071<br />

377.37 315.81 908.49 424.24 419.72<br />

0.00 0.00 0.00 -0.02 0.00<br />

4 Annex VII & IX 55.55 MT.xls

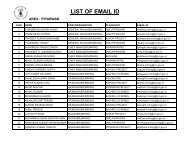

4 Annex VII & IX 55.55 MT.xls<br />

Central Coalfields Limited Ranchi<br />

Details of other income<br />

Rs.Cr<br />

Particulars 2010-11 RE 2011-12 Upto BE <strong>2012</strong>-<strong>13</strong> BE <strong>2012</strong>-<strong>13</strong><br />

Dec'11 Excellent V.Good<br />

1 Coal Transport-Reimbursement 173.57 173.68 <strong>13</strong>6.62 196.89 194.94 Abnormal income in 2010-11<br />

2 Interest on Tax free Bond 4.61 4.00 2.90 3.00 3.00 Refund of corporate tax 10.33<br />

3 Interest on surplus fund 149.83 230.00 183.22 160.00 150.00<br />

4 Others 63.58 45.00 30.30 50.00 50.00<br />

Total 391.59 452.68 353.04 409.89 397.94<br />

Details Other Expenditure<br />

Social OH 86.55 105.00 77.26 115.00 115.00 103.0<strong>13</strong>3 1.99<br />

Repairs 149.59 128.12 58.12 158.01 158.19 77.49333 50.63 68 150 82 120.5882<br />

Contractual Exp 396.34 450.00 327.41 495.00 495.00 436.5467 <strong>13</strong>.45 70.08588<br />

Other Exp*** 342.6 602.<strong>13</strong> 260.76 480.82 476.81 347.68 254.45<br />

OBR 100.63 116.87 -10.34 <strong>13</strong>9.08 129.64 -<strong>13</strong>.7867 <strong>13</strong>0.66<br />

Debtor's provision 114.93 100.00 54.26 100.00 100.00 72.34667 27.65<br />

Prov.for Mine Closure & Others 47.39 100.00 76.63 100.00 100.00 102.1733 -2.17<br />

Repair of Rly Siding 30.00 30.00 30.00<br />

Spl Repair of Querters 30.00 30.00 30.00<br />

OEM Repair 12.00<br />

Service Chgs for e-auction 18.00 18.00 18.00<br />

Total 1238.03 1692.12 844.10 1665.91 1652.64<br />

Prov.Write back 67.12 67.12 0.00 0.00<br />

1238.03 1625.00 776.98 1665.91 1652.64<br />

1238.03 1625.00 776.98 1665.91 1652.64<br />

0.00 0.00 0.00 0.00 0.00<br />

Other Exp***<br />

CISF Induction in NK/Piparwar 59 85 40.57 102 102<br />

CMPDIL Exp 57 50 36 65 65<br />

under loading 33 55 40 70 70<br />

Incentive 40 40<br />

Hire charges of vehicle 19 22 16 30 30<br />

Rehab.Exp-ECL & BCCl 28 30 21 34 33<br />

CIL Chgs 26 25 16 29 28<br />

loss on Exchng Variation 6 29 23 35 35<br />

Other Misc.Exp 114.6 306.<strong>13</strong> 68.19 75.82 73.81<br />

Total 342.6 602.<strong>13</strong> 260.76 480.82 476.81<br />

4 Annex VII & IX 55.55 MT.xls

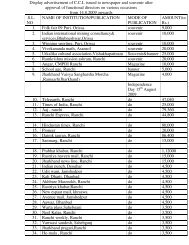

MINISTRY : COAL<br />

Company : CENTRAL COALIELDS LIMITED<br />

MANAGEMENT DATA RATIOS FOR <strong>MOU</strong> ( as on 31st MARCH)<br />

Annex IX<br />

2008-09 2009-10 2010-11 RE BE <strong>2012</strong>-<strong>13</strong><br />

Actual Actual 2011-12 <strong>2012</strong>-<strong>13</strong> BE-New<br />

Sl. No. Particulars Unit as per Excellent V.Good<br />

Accounts 49/49 55/.55/57.17 55/56<br />

(1) (2) (3) (11)<br />

Production- U/Ground Lakh Te 15.579 14.712 12.737 12.950 <strong>13</strong>.500 <strong>13</strong>.50<br />

Opencast Lakh Te 416.777 456.119 462.478 477.050 542.000 536.50<br />

Total Lakh Te 432.356 470.831 475.215 490.000 555.500 550.00<br />

OBR Lakh CuM 556.281 560.479 625.216 630.000 680.000 680.000<br />

1 Gross Sales Rs Crs 5978.37 6291.92 7083.<strong>13</strong> 8066.88 9144.36 9102.55<br />

2 Gross Margin Rs Crs 1048.06 1936.42 2121.80 1756.95 2295.38 2273.12<br />

3 Profit before Tax Rs Crs 763.80 1533.05 1860.22 1512.41 2047.15 2024.89<br />

4 Gross Block Rs Crs 4484.91 4659.00 4590.<strong>13</strong> 4940.<strong>13</strong> 5365.<strong>13</strong> 5365.<strong>13</strong><br />

5 Less Depreciation Rs Crs 3038.01 3142.81 3204.05 3446.99 3693.47 3693.47<br />

6 Net Block Rs Crs 1446.90 1516.19 <strong>13</strong>86.08 1493.14 1671.66 1671.66<br />

7 Share Capital of CPSE Rs Crs 940.00 940.00 940.00 940.00 940.00 940.00<br />

8 Reserves & Surplus of CPSE Rs Crs 1206.83 1720.64 2098.01 24<strong>13</strong>.83 2838.05 2833.54<br />

9 Less Defferred Revenue Exp / Rs Crs<br />

pre acquisition loss<br />

10 Less Profit & Loss a\c Rs Crs<br />

11 Net Worth of CPSE Rs Crs 2146.83 2660.64 3038.01 3353.83 3778.05 3773.54<br />

12 Investment Rs Crs 65.96 56.54 47.12 37.70 28.28 28.28<br />

Sundry Debtors 745.26 512.45 941.64 992.96 1021.29 1016.68<br />

<strong>13</strong> Sundry Debtors / Sales Rs Crs 0.12 0.08 0.<strong>13</strong> 0.12 0.11 0.11<br />

15 Inventory Rs Crs 968.06 1177.18 1446.99 <strong>13</strong>77.52 <strong>13</strong>71.79 <strong>13</strong>66.74<br />

16 Total Current Assets Rs Crs 6270.<strong>13</strong> 5666.44 6643.57 6593.23 6654.62 6630.79<br />

17 Total Current liabilities & provision Rs Crs 6218.54 5316.80 3750.48 3524.19 3212.89 3184.12<br />

18 Net Current assets Rs Crs 51.59 349.64 2893.09 3069.04 3441.73 3446.67<br />

19 Capitl Employed (Net Block + Net Rs Crs 1498.49 1865.83 4279.17 4562.18 51<strong>13</strong>.39 5118.33<br />

current assets)<br />

20 Total debt (loan funds) Rs Crs 293.98 112.05 90.91 83.71 69.77 69.77<br />

21 Total assets Rs Crs 1564.45 1922.37 4326.29 4599.88 5141.67 5146.60<br />

22 No of Employees of CPSE 56553 54057 52285 48475 46071 46071<br />

23 Dividend Paid Rs Crs 195.97 386.32 748.10 630.91 847.47 838.44<br />

24 Added Value ( gross margin less Rs Crs 898.21 1749.84 1693.88 <strong>13</strong>00.73 1784.04 1761.29<br />

capital recovery factor @ 10%)<br />

Ratio<br />

25 Debt/Equity 0.14 0.04 0.03 0.02 0.02 0.02<br />

26 Return on Net Worth (% age) 22.82% 36.30% 41.04% 31.35% 37.39% 37.03%<br />

27 PBDIT/Total employment of CPSE 0.02 0.04 0.04 0.04 0.05 0.05<br />

28 Earning per Share (Rs.10 each) 521.20 1027.43 <strong>13</strong>26.42 1118.65 1502.61 1486.62<br />

29 Dividend pay out (% of Net Profit) 40.00% 40.00% 60.00% 60.00% 60.00% 60.00%<br />

30 Added Value/Gross Sales (% age) 0.15 0.28 0.24 0.16 0.20 0.19<br />

31 Net Profit / Net Worth (% age) 0.23 0.36 0.41 0.31 0.37 0.37<br />

32 Working of gross margin<br />

33 Net Profit Rs Crs 489.93 965.79 1246.83 1051.53 1412.45 <strong>13</strong>97.42<br />

34 Tax Rs Crs 273.87 567.26 6<strong>13</strong>.39 460.88 634.70 627.47<br />

35 Net Profit before tax Rs Crs 763.80 1533.05 1860.22 1512.41 2047.15 2024.89<br />

36 add Prior Period Rs Crs -21.29 -1.06 10.08<br />

37 add Extra ordinary income Rs Crs<br />

38 Profit before prior period Rs Crs 742.51 1531.99 1870.30 1512.41 2047.15 2024.89<br />

39 add Interest Rs Crs 43.51 17.39 8.96 1.60 1.75 1.75<br />

40 Gross Profit Rs Crs 786.02 1549.38 1879.25 1514.01 2048.90 2026.64<br />

41 add Depreciation & DRE (OBR Adj) Rs Crs 262.04 387.05 242.54 242.94 246.48 246.48<br />

42 Misc. Expenditure written off Rs Crs<br />

43 Gross Margin before Interest, Rs Crs 1048.06 1936.42 2121.80 1756.95 2295.38 2273.12

Annexure XIV<br />

Template for HRM Performance Evaluation under Memorandum of Understanding<br />

HRM performance Indicators<br />

---------------Performance Rating--------------------<br />

Weight<br />

Executives-2686 Non Executives- 47340 Unit<br />

(in %) Excellent Very Good Good Fair Poor<br />

as on 01.04.12<br />

1 2 3 4 5<br />

2(A)<br />

Dynamic Parameters<br />

A1 Competency and Leadership development 20<br />

1<br />

2<br />

3<br />

4<br />

% actualization of Training Plan & Training days per<br />

employee per year<br />

Developing critical mass of leaders through a system<br />

of career planning & development<br />

% fulfillment &<br />

days/employee/year<br />

% fulfillment of planned<br />

leadership development<br />

programmes<br />

5<br />

15 &<br />

0 .075<br />

10 & 0.050 8 & 0.025<br />

5 &<br />

0.020<br />

1 &<br />

0.010<br />

5 1.5 1 0.8 0.5 0.1<br />

Training Budget as % of employee cost % of employee cost 5 0.15% 0.147% 0.140% 0.<strong>13</strong>3% 0.126%<br />

% fulfillment of Training Plan for Multi skilling / Skill<br />

upgradation of Non executives<br />

% 5 20 15 10 5 1<br />

Optional (out of below five , one is to be taken in the <strong>MOU</strong>)<br />

5<br />

A2<br />

Training interventions in new/advanced technology - %<br />

fulfillment of training plan in new technology % 5 10 8 5 3 1<br />

7<br />

B Performance Management 10<br />

Linkage of Developmental plan of Executives with<br />

Yes<br />

Yes/NO 5<br />

Performance Management System<br />

11<br />

No<br />

12 Implementation of PRP linked to PMS Yes/NO 5 Yes No

HRM performance Indicators<br />

Executives-2686 Non Executives- 47340<br />

as on 01.04.12<br />

Unit<br />

Weight<br />

(in %)<br />

C Recruitment, Retention & Talent Management 20<br />

Manpower rationalization through :<br />

<strong>13</strong><br />

---------------Performance Rating--------------------<br />

Excellent Very Good Good Fair Poor<br />

1 2 3 4 5<br />

Voluntary Retirements<br />

%<br />

5<br />

1 0.97 0.8 0.7 0.6<br />

Redeployment 6 5.5 5 4.5 4<br />

Any other<br />

14<br />

15<br />

Attrition as % of total employees % 5 0.2 0.5 0.6 0.7 1<br />

Presence of Mentorship Development Programme-<br />

Nos of Mentors and Mentees<br />

Yes/No; Numbers 5<br />

Yes. No of mentors<br />

24/every new<br />

executive who<br />

joins co.<br />

Yes. No of mentors<br />

18/every new<br />

executive who joins<br />

co.<br />

Yes. No of mentors<br />

15/every new<br />

executive who joins<br />

co.<br />

Yes. No of mentors<br />

10/every new<br />

executive who joins<br />

co.<br />

Yes. No of mentors<br />

05/every new<br />

executive who joins<br />

co.<br />

16<br />

Formulation / Implementation of systems for<br />

Management of Talent such as – Job rotation system, Schemes/Initiatives &<br />

reward system, sponsoring Sr executives for advanced their details<br />

Management Programme, growth opportunities<br />

5 100% 50% 25% 20% 5%<br />

D Enabling Creativity & Innovation 15<br />

17<br />

No. of nominations/entrirs submitted for National<br />

Awards (PM Shram Awards, Vishwakarma Rashtriya<br />

Puraskar)<br />

No of Nominations/<br />

entries submitted for<br />

national awards<br />

5<br />

5<br />

4<br />

3 2<br />

1<br />

18<br />

19<br />

Number of suggestions generated per employee per<br />

year<br />

% of Quality Circle projects completed against total<br />

Quality Circle projects under taken in a year<br />

No per employee 5 0.002 0.001 0.0005 0.0004 0.0003<br />

% fulfilment 5 30 20 15 10 5

HRM performance Indicators<br />

Executives-2686 Non Executives- 47340<br />

as on 01.04.12<br />

Unit<br />

Weight<br />

(in %)<br />

E Employee Relation and Welfare 20<br />

20<br />

21<br />

Effectiveness of grievances settled vis-à-vis received<br />

during the year<br />

Pension, Medicare, Yoga classes to reduce stress<br />

where job is stressful, setting up of wellness centre<br />

such as Gym etc<br />

---------------Performance Rating--------------------<br />

Excellent Very Good Good Fair Poor<br />

1 2 3 4 5<br />

% settelment 4 80 60 50 40 20<br />

No of<br />

programmes/date of<br />

implementation of<br />

scheme<br />

4<br />

4 programmes by<br />

Mar-20<strong>13</strong><br />

3 Programmes by<br />

Mar-20<strong>13</strong><br />

2 programmes by<br />

Mar-20<strong>13</strong><br />

1 programmes by<br />

Mar-20<strong>13</strong><br />

0 Programme by<br />

Mar-20<strong>13</strong><br />

Employee satisfaction survey ESI measure in % % 4 50 40 30 20 10<br />

22<br />

23<br />

24<br />

Formulation / Implementation of social security<br />

scheme<br />

No of structured meetings with employees<br />

representatives<br />

Yes/No<br />

4<br />

In ti,me<br />

Implementation<br />

50%<br />

In ti,me<br />

Implementation<br />

40%<br />

In ti,me<br />

Implementation<br />

30%<br />

In ti,me<br />

Implementation<br />

20%<br />

In ti,me<br />

Implementation<br />

10%<br />

No of meetings 4 12 10 8 7 6

HRM performance Indicators<br />

Executives-2686 Non Executives- 47340<br />

as on 01.04.12<br />

HR Branding & Excellence – Indicate achievement<br />

in this field for Initiatives such as :<br />

Unit<br />

Weight<br />

(in %)<br />

10<br />

---------------Performance Rating--------------------<br />

Excellent Very Good Good Fair Poor<br />

1 2 3 4 5<br />

F<br />

25<br />

Benchmarking projects undertaken in area of HR<br />

Details regarding<br />

initiatives to be<br />

given along with<br />

attachments<br />

Hard Coding<br />

Culture of <strong>CCL</strong> with<br />

creativity &<br />

Innovation to<br />

generate 25 raw<br />

suggestions in<br />

every quarter & at<br />

least spot 10<br />

nomination for<br />

awarding at <strong>CCL</strong><br />

level & 5 at<br />

national level 100%<br />

80% 70% 60% 50%<br />

Grand Total 100

Annexure-XII<br />

R & D / Adoption of Innovative Practices Performance Target Setting cum Evaluation Template<br />

1. To be Filled and Submitted by each CPSE to the<br />

Task Force prior to Annual Target Setting as well as<br />

Performance Evaluation of MoU.<br />

2. Circuit Breaker: Any CPSE which has not got<br />

its Specific R&D Plan and R&D Budget passed by its<br />

Board will automatically be rated as “Poor” in R& D of<br />

MoU.<br />

3. CPSE, while submitting self- evaluation report to<br />

DPE, will not fill up score allotted for each Table and the<br />

Total Score, as the same will be awarded by the Task<br />

Force at the time of performance evaluation of the MoU.<br />

Table 1- Mandatory Parameter- Total R& D Expenditure as a percentage of PAT *<br />

Unit Weightage Performance Target<br />

Achievement<br />

Excellent V. Good Good Fair Poor<br />

1 2 3 4 5 6 7 8 9 10<br />

1 Total R&D Expenditure<br />

as % of PAT 2011-12<br />

% 2.5 0.50 0.45 0.40 0.35 0.30<br />

Total Score for this Table 2.5<br />

Score allotted by the Task Force

Table 2 - Projects chosen by CPSE<br />

At the time of draft MoU : Every year, CPSEs shall submit R&D projects ( Maharatna & Navratna -Five Projects, Miniratna- I&II and other CPSEs below– Three Projects along with one<br />

most important / vital/key Performance Indicator to Task Force at the time of draft MoU. The Task Force will approve the same or add any other R&D projects alongwith performance<br />

indicator(s).<br />

At the time of MoU Evaluation : The verification of achievement in respect of approved performance indicator (s) and evaluation / rating of each R&D project will be done by Independent<br />

Expert/Research Advisory Committee of CPSE. Such evaluation / rating will be considered / accepted by Task Force during evaluation for allotting MoU score on R&D.<br />

Target Value<br />

1 2 3 4 5 6 7 8 9 10<br />

S. No. Projects Chosen (Annexure - Performance Weightage Excellent V. Good Good Fair Poor Actual<br />

I)<br />

Indicator<br />

(Annexure-II)<br />

2.1 Improvement of Powder Month 0.833 15-Feb-<strong>13</strong> 28-Feb-<strong>13</strong> 15-Mar-<strong>13</strong> 31-Mar-<strong>13</strong><br />

factor in one mine of <strong>CCL</strong><br />

2.2 Improvement of Power factor<br />

in one mine of <strong>CCL</strong><br />

Month 0.833 15-Feb-<strong>13</strong> 28-Feb-<strong>13</strong> 15-Mar-<strong>13</strong> 31-Mar-<strong>13</strong><br />

2.3 Improvement of specific<br />

HSD consumption in one<br />

mine of <strong>CCL</strong><br />

Month 0.834 15-Feb-<strong>13</strong> 28-Feb-<strong>13</strong> 15-Mar-<strong>13</strong> 31-Mar-<strong>13</strong><br />

Total Score for this Table 2.5<br />

Score allotted by the Task Force<br />

Total Score on R&D 5<br />

Total allotted Score for both Tables

TEMPLATES FOR CSR REVIEW<br />

TABLE - I<br />

Annexure XI<br />

DETAILS OF 5 CHOSEN PROJECTS<br />

Sl.No. Name of Project<br />

Starting<br />

date<br />

Completion<br />

Date<br />

Amt<br />

Allotted<br />

with 0.5%<br />

of<br />

PAT(Rs<br />

<strong>13</strong>03 Cr)<br />

of 2011-<br />

12 i.e Rs.<br />

6.5 Cr<br />

Date of<br />

compln. of<br />

need<br />

assessment/<br />

Baseline<br />

survey &<br />

name of<br />

agency<br />

Name of<br />

Implementing<br />

Agency and<br />

Date of Apptt<br />

Name of<br />

Monitoring<br />

Agency<br />

Means of<br />

verification<br />

(1) (2) (3) (4) (5) (6) (7) (9)<br />

1 Medical Camps (No of June'12 Feb ' <strong>13</strong> 1.75 Cr May ' 12 Area Medical CMS, Ranchi<br />

Beneficiaries- 35000)<br />

Officers<br />

2 Facility of Drinking<br />

water in 10 villages<br />

May ' 12 Feb ' <strong>13</strong> 1.8 Cr May ' 12 CSR Committee<br />

of Areas &<br />

Compny.HQ<br />

Area GM &<br />

CSR Dept. of<br />

Compny. HQ<br />

3 Construction of<br />

Community Mandap in<br />

10 Villages<br />

4 Training of PAPs for<br />

Self Employment - 50<br />

Nos<br />

May ' 12 Feb ' <strong>13</strong> 1.70 Cr June ' 12 CSR Committee<br />

of Areas &<br />

Compny.HQ<br />

July'12 Feb ' <strong>13</strong> 0.25 Cr June ' 12 CSR Committee<br />

of Areas &<br />

Compny.HQ<br />

Area GM &<br />

CSR Dept. of<br />

Compny. HQ<br />

Area GM &<br />

CSR Dept. of<br />

Compny. HQ<br />

Independent<br />

Expert<br />

Committee /<br />

Annual Report<br />

5 Providing Solar<br />

Lanterns in 10 villages<br />

July'12 Feb ' <strong>13</strong> 1.00 Cr June ' 12 CSR Committee<br />

of Areas &<br />

Compny.HQ<br />

Area GM &<br />

CSR Dept. of<br />

Compny. HQ

TEMPLATES FOR CSR REVIEW<br />

TABLE - I<br />

EVALUATION TEMPLATE, DETAILS OF 5 CHOSEN PROJECTS<br />

Annexure XI<br />

Sl.No. Name of Project Amount Unit<br />

Allocated<br />

with year<br />

Weight MoU Target<br />

Means of<br />

verificatio<br />

n<br />

(Rs.)<br />

Excellent Very Good Good Fair Poor<br />

(1) (2) (3) (4) (5) ,(6) ,(7) ,(8) ,(9)<br />

1 Medical Camps (No of 1.75 Cr No. of<br />

0.8 35000 34300 32550 31150 29400<br />

Beneficiaries- 35000)<br />

Beneficiares<br />

2 Facility of Drinking water 1.8 Cr No. of Villages 0.8 10 Villages 9 Villages 8 Villages 7 Villages 6 Villages<br />

in 10 villages<br />

3 Construction of<br />

Community Mandap in 10<br />

Villages<br />

4 Training of PAPs for Self<br />

Employment - 50 Nos<br />

1.70 Cr No. of<br />

Constructions<br />

0.25 Cr No. of PAPs to<br />

be trained<br />

0.8 10 Villages 9 Villages 8 Villages 7 Villages 6 Villages<br />

0.8 50 49 47 45 42<br />

Independen<br />

t Expert<br />

Committee<br />

/ Annual<br />

Report<br />

5 Providing Solar Lanterns<br />

in 10 villages<br />

1.00 Cr No. of Villages 0.8 10 Villages 9 Villages 8 Villages 7 Villages 6 Villages

TABLE 2<br />

*Format for List of All Projects/Activities Reported to TISS HUB<br />

Annexure – XI<br />

Sl.<br />

No.<br />

Name of the CSR<br />

Project/Activity<br />

Date of Reporting of Details to<br />

TISS Database<br />

Date of Acceptance<br />

Conveyed by TISS<br />

(1) (2) (3) (4)<br />

TABLE 3<br />

Details of CSR Expenditure<br />

Sl.No Item Amount in Crores or Percentage<br />

(1) (2) (3)<br />

1. PAT for the year under review<br />

2. CSR expenditure<br />

3. CSR expenditure as percentage of<br />

PAT<br />

4. CSR expenditure as percentage<br />

of minimum prescribed<br />

5. Training expenditure on CSR (to<br />

be treated as CSR expenditure)<br />

6. Unspent Balance amount of CSR<br />

Budget rolled over to the<br />

following year<br />

7 Contribution to CSR HUB as<br />

percentage of CSR Budget<br />

0.5 % of PAT of Previous year as per DPE<br />

Guidelines

Annexure – XIII<br />

SD Performance Target Setting Cum Evaluation Template<br />

1. To be Filled and Submitted by each CPSE to the Task Force prior to Annual Target Setting as well as prior to Performance Evaluation of MoU.<br />

2 Circuit Breaker: Any CPSE which has not got its Specific SD plan and SD Budget passed by its Board or its Designated Committee will automatically be rated as ‘Poor’ in SD<br />

of MoU.<br />

3 CPSE, while submitting self-evaluation report to DPE, will not fill up score allotted for each table and the total score, as the same will be awarded by the Task force at the<br />

time of performance evaluation of the MoU.<br />

S.No.<br />

Activity<br />

1 Whether Specific SD Plan and Budget passed by Yes / No<br />

Board or its Designated Committee<br />

Yes and Date of Board Resolution<br />

1 2<br />

Yes<br />

1 st<br />

SD Committee Meeting held on 27.03.12<br />

SD Plan and budget will be passed by Board .<br />

Table 1. SD Committee details<br />

Board level Designated Committee Chairman of Board level Designated Committee Number of regular meetings held Key decisions during the year<br />

Name<br />

1 2 3 4<br />

Board Level SD Committee Shri G.Basu, Independent Director, <strong>CCL</strong> Board one<br />

Total Score for this Table 0.5<br />

Score allotted by the Task Force

Table 2 Total SD Expenditure as a percentage of PAT (Evaluation sheet)<br />

*Target Value as % of PAT<br />

(on a five-point scale: Para<br />

6.5.2 of Guidelines)<br />

Weightage Target Value<br />

Excellent Very Good Good Fair poor<br />

1 2 3 4 5 6 7<br />

50 Lakhs + 0.1% of PAT<br />

exceeding 100 Cr<br />

1.0 50 Lakhs + 0.11%<br />

of PAT exceeding<br />

100 Cr<br />

50 Lakhs + 0.1%<br />

of PAT exceeding<br />

100 Cr<br />

50 Lakhs + 0.09%<br />

of PAT exceeding<br />

100 Cr<br />

50 Lakhs + 0.08%<br />

of PAT exceeding<br />

100 Cr<br />

Total Score for this Table 1.0<br />

50 Lakhs + 0.07%<br />

of PAT exceeding<br />

100 Cr<br />

Score allotted by the Task Force

TABLE 3 PROJECTS CHOSEN BY CPSE<br />

Sr<br />

No.<br />

Schedule A/B<br />

Project/Activity (Please<br />

refer Annex-1)<br />

Performance<br />

indicator<br />

(Please refer<br />

Annex-II &<br />

Para 6.5.3 of<br />

Guideline)<br />

Total<br />

expenditure on<br />

Project<br />

/Activity (Rs<br />

Lakhs)<br />

Duration<br />

S/M/L<br />

Target Set<br />

(on a five point scale : Para 6.5.3 of Guidelines)<br />

1 2 3 4 5 6 7 8 9 10 11 12<br />

Excellent Very Good Good Fair Poor<br />

1 A Bio –Diversiy<br />

(Eco restoration)<br />

90.0<br />

S 1.25 1.23 1.17 1.11 1.050<br />

2 A Water Management<br />

(Recycling of sewage<br />

system)<br />

3 B Tranining<br />

( Training / Workshop<br />

on Sustainable<br />

No. of tres<br />

planted (In<br />

lakhs)+Eco<br />

park<br />

No. of projects<br />

completed<br />

No. of<br />

programmes<br />

conducted<br />

Development)<br />

4 A Rainwater harvesting No. of<br />

schemes<br />

completed<br />

5 B SD<br />

Reporting(Appointment<br />

of External<br />

Independent<br />

Consultant, study of<br />

baseline parameters,<br />

monitoring and<br />

reporting)<br />

Total Expenditure<br />

Rs Lakhs<br />

Completion<br />

date<br />

20.0<br />

20.0 S 2 1<br />

2.0 S 2 1<br />

9.0 S 2 1<br />

30.0 S Feb’<strong>13</strong> Mar’<strong>13</strong><br />

171.0<br />

Target<br />

achieved<br />

REMARKS : 1. Profit after Tax (2011-12) will be considered as per DPE guidelines for the year <strong>2012</strong>-<strong>13</strong>.<br />

Total Score for this Table 2.5<br />

Score allotted by the Task Force

Table 4- Evaluation of Projects<br />

No. of projects ( table 3) evaluated by an Independent External Agency/ Expert/ Consultant,<br />

etc.<br />

MoU Target<br />

Excellent Very Good Good Fair Poor<br />

5 4 3 2 1<br />

Total Score for this Table 0.5<br />

Score allotted by the Task Force

Table 5 -<br />

Publication of SD Performance Report<br />

Activity Yes /<br />

Mode of SD Report<br />

No<br />

1 2 3<br />

SD performance<br />

Report<br />

Will be available in Web Site. Report will be either Stand alone or part of<br />

Annual Report.<br />

Total Score for this Table 0.5<br />

Score allotted by the Task Force<br />

Total Score of all Tables 5<br />

Total allotted Score for all Tables

Format for grading Central Public Sector Enterprises (CPSEs) on the<br />

basis of their compliance of Guidelines on Corporate Governance<br />

Name of CPSE _______________________________________________<br />

Name of Ministry/Department ___________________________________<br />

Listed/Unlisted ____________Year _____________ Quarter_____________<br />

1.1 Composition of Board (2 Marks)<br />

Sl.No. Indicator Prescribed<br />

Marks<br />

i. Does the Board have an<br />

optimum combination of<br />

functional, nominee and<br />

independent directors?<br />

(The optimum number of<br />

members in the board may<br />

be decided by the DPE)<br />

ii. Does the number of<br />

functional directors in the<br />

company (including<br />

CMD/MD) constitute 50%<br />

of the actual strength of the<br />

board?<br />

Criteria for<br />

Measurement<br />

1 Yes=1<br />

No=0<br />

1 Yes=1<br />

No=0<br />

Awarded<br />

Marks<br />

1.2 Non-official Directors (5 Marks)<br />

Sl.No. Indicator Prescribed<br />

Marks<br />

i. Is the number of Nominee<br />

Directors appointed by<br />

Government/other CPSE as<br />

per the DPE Guidelines.<br />

ii Is the number of<br />

Independent Directors at<br />

least 50% of Board Members<br />

(in the case of listed CPSE<br />

with an executive chairman)<br />

and at least one-third (in the<br />

case of listed but without an<br />

executive chairman or not<br />

listed CPSE).<br />

Criteria for<br />

Measurement<br />

1 Yes=1<br />

No=0<br />

4<br />

Yes = 4<br />

No = 0<br />

Awarded<br />

Marks<br />

1.3 Part-time Directors’ Compensation and Disclosure (1 Marks)<br />

Sl.No. Indicator Prescribed Criteria for<br />

Marks Measurement<br />

i Is the fee/compensation of Yes = 1<br />

Awarded<br />

Marks

part-time Directors<br />

including Independent<br />

Directors fixed by Board as<br />

per the DPE Guidelines and<br />

Companies Act, 1956<br />

1 No = 0<br />

1.4 Board Meetings (2 Marks)<br />

Sl.No. Indicator Prescribed<br />

Marks<br />

i Over the last 12 months, did<br />

the Board meet at least 4 1<br />

times without exceeding the<br />

time gap of three months<br />

between two meetings?<br />

ii Over the last 12 months, did<br />

all members of the Board 1<br />

receive notification of Board<br />

meetings with meeting<br />

agenda at least 7 working<br />

days in advance of<br />

meetings?<br />

1.5 Review of Compliance of Laws (5 Marks)<br />

Sl.No. Indicator Prescribed<br />

Marks<br />

i Does the management<br />

certify to the Board that all 5<br />

laws and statutes as<br />

applicable to the company<br />

have been obeyed and<br />

complied with?<br />

1.6 Code of Conduct (2 Marks)<br />

Criteria for<br />

Measurement<br />

Yes = 1<br />

No = 0<br />

Yes = 1<br />

No = 0<br />

Criteria for<br />

Measurement<br />

Yes = 5<br />

No = 0<br />

Awarded<br />

Marks<br />

Awarded<br />

Marks<br />

Sl.No. Indicator Prescribed<br />

Marks<br />

i Does the company have a<br />

manual on Corporate<br />

Governance approved by the<br />

Board applicable to<br />

directors and senior<br />

management of the<br />

company?<br />

ii<br />

Do the members of the<br />

Board having conflict of<br />

interest abstain from<br />

participating in the agenda<br />

item in which he/she has<br />

Criteria for<br />

Measurement<br />

1 Yes = 1<br />

No = 0<br />

1 Yes = 1<br />

No = 0<br />

Awarded<br />

Marks

personal interest?<br />

1.7 Risk Management (4 Marks)<br />

Sl.No. Indicator Prescribed<br />

Marks<br />

i Does the company have risk<br />

management plan approved<br />

by the full Board?<br />

ii<br />

Does the Board review and<br />

take remedial action to<br />

implement the risk<br />

management plan?<br />

Criteria for<br />

Measurement<br />

2 Yes = 2<br />

No = 0<br />

2 Yes = 2<br />

No = 0<br />

Awarded<br />

Marks<br />

1.8 Training of New Board Members (4 Marks)<br />

Sl.No. Indicator Prescribed<br />

Marks<br />

i Does the Board have a policy<br />

specifying training<br />

requirements for board<br />

members?<br />

ii Did the Board members<br />

receive institutional training<br />

of one week per year after<br />

appointment to the Board?<br />

Criteria for<br />

Measurement<br />

2 Yes = 2<br />

No = 0<br />

2 Yes = 2<br />

No = 0<br />

Awarded<br />

Marks<br />

2.1 Constitution of Audit Committee (4 Marks)<br />

Sl.No. Indicator Prescribed<br />

Marks<br />

i Does the Board of Directors<br />

have a qualified and<br />

independent Audit<br />

Committee with a Terms of<br />

Reference?<br />

ii Does the Audit Committee<br />

have Minimum three<br />

directors as members and<br />

two-third of its members as<br />

Independent Directors?<br />

iii Is the Audit Committee<br />

chaired by an Independent<br />

Director?<br />

iv<br />

Do all members of the Audit<br />

Committee have knowledge<br />

of financial matters of the<br />

company and at least one<br />

member has expertise in<br />

accounting and financial<br />

Criteria for<br />

Measurement<br />

1 Yes = 1<br />

No = 0<br />

1 Yes = 1<br />

No = 0<br />

1 Yes = 1<br />

No = 0<br />

1 Yes = 1<br />

No = 0<br />

Awarded<br />

Marks

management?<br />

2.2 Audit Committee Role (6 Marks)<br />

Sl.No. Indicator Prescribed<br />

Marks<br />

I Do the procedures<br />

governing the Audit<br />

Committee specify that the<br />

Audit Committee is<br />

responsible for the oversight<br />

of the company’s financial<br />

reporting process and the<br />

disclosures of its financial<br />

information?<br />

ii Do the procedures<br />

governing the Audit<br />

Committee specify that it<br />

can recommend to the<br />

Board the fixation of audit<br />

fees?<br />

iii Do the procedures<br />

governing the Audit<br />

Committee specify that it<br />

can approve the payment to<br />

statutory auditors for any<br />

other services rendered by<br />

them?<br />

iv Do the procedures<br />

governing the Audit<br />

Committee specify that the<br />

Audit Committee is<br />

responsible for reviewing<br />

with the management and<br />

ensuring that the company’s<br />

annual financial statements<br />

and audits are in compliance<br />

with applicable laws,<br />

regulations, and company<br />

policies before submission<br />

to the Board for approval?<br />

v Do the procedures<br />

governing the Audit<br />

Committee specify that the<br />

Audit Committee is<br />

responsible for reviewing<br />

with the management the<br />

performance of internal<br />

auditors and adequacy of<br />

the internal control systems.<br />

Criteria for<br />

Measurement<br />

1 Yes = 1<br />

No = 0<br />

1 Yes = 1<br />

No = 0<br />

1 Yes = 1<br />

No = 0<br />

1 Yes = 1<br />

No = 0<br />

1 Yes = 1<br />

No = 0<br />

vi Are the procedures and 1 Yes = 1<br />

Awarded<br />

Marks

ules governing the Audit<br />

Committee approved by the<br />

full Board?<br />

No = 0<br />

2.3 Audit Committee Powers (5 Marks)<br />

Sl.No. Indicator Prescribed<br />

Marks<br />

i Is the Audit Committee<br />

empowered to seek<br />

information on and from<br />

any employee of the CPSE?<br />

ii<br />

iii<br />

Does the Audit Committee<br />

have powers to secure help<br />

of outside legal or any other<br />

experts when necessary?<br />

Does the Audit Committee<br />

have powers to mitigate<br />

conflicts of interest by<br />

strengthening auditor<br />

independence?<br />

iv Is the Audit Committee<br />

empowered to ensure the<br />

effectiveness of internal<br />

controls and risk<br />

management?<br />

v Is there a system of<br />

protection for employees<br />

and others who report<br />

infractions to the internal<br />

audit function or the<br />

external auditors (to protect<br />

“whistle blowers”)?<br />

Criteria for<br />

Measurement<br />

1 Yes = 1<br />

No = 0<br />

1 Yes = 1<br />

No = 0<br />

1 Yes = 1<br />

No = 0<br />

1 Yes = 1<br />

No = 0<br />

1 Yes = 1<br />

No = 0<br />

Awarded<br />

Marks<br />

2.4 Meeting of Audit Committee (5 Marks)<br />

Sl.No. Indicator Prescribed<br />

Marks<br />

I Did the Audit Committee<br />

meet at least four times<br />

during the last 12 months?<br />

ii<br />

iii<br />

Did the frequency of the<br />

Audit Committee meetings<br />

as per the norms (i.e not<br />

more than four months shall<br />

elapse between two<br />

meetings)?<br />

Did the minimum of two<br />

Independent Directors<br />

attend the meeting of the<br />

Criteria for<br />

Measurement<br />

1 Yes = 1<br />

No = 0<br />

2 Yes = 2<br />

No = 0<br />

2 Yes = 2<br />

No = 0<br />

Awarded<br />

Marks

Audit Committee?<br />

2.5 Review of Information by Audit Committee ( 5 Marks)<br />

Sl.No. Indicator Prescribed<br />

Marks<br />

i Does the Audit Committee<br />

review the management<br />

discussion and analysis of<br />

financial condition and<br />

results of operations?<br />

ii.<br />

Does the Audit Committee<br />

review the statement of<br />

related party transactions<br />

submitted by management?<br />

iii. Does the internal audit<br />

department report relating<br />

to internal control<br />

weaknesses reviewed by the<br />

Audit Committee?<br />

iv.<br />

Is the information regarding<br />

appointment and/or<br />

removal of Chief Internal<br />

Auditor placed before the<br />

Audit Committee?<br />

v. Does the Audit Committee<br />

review the declaration of<br />

financial statements by the<br />

CEO/CFO?<br />

Criteria for<br />

Measurement<br />

1 Yes = 1<br />

No = 0<br />

1 Yes = 1<br />

No = 0<br />

1 Yes = 1<br />

No = 0<br />

1 Yes = 1<br />

No = 0<br />

1 Yes = 1<br />

No = 0<br />

Awarded<br />

Marks<br />

3.1 Constitution of Remuneration Committee (5 Marks)<br />

Sl.No. Indicator Prescribed<br />

Marks<br />

Criteria for<br />

Measurement<br />

i. Does the Board have 1 Yes = 1<br />

Remuneration Committee?<br />

No = 0<br />

ii Does the remuneration 2 Yes = 2<br />

committee comprise of at<br />

No = 0<br />

least 3 directors who are all<br />

part-time directors<br />

(Nominee or Independent)?<br />

iii Is the remuneration<br />

committee chaired by an<br />

Independent Director?<br />

2 Yes = 2<br />

No = 0<br />

Awarded<br />

Marks<br />

4.1 Board of Subsidiary Companies (3 Marks)<br />

Sl.No. Indicator Prescribed<br />

Marks<br />

i. Does the Board of<br />

Subsidiary company include<br />

Criteria for<br />

Measurement<br />

1 Yes = 1<br />

No = 0<br />

Awarded<br />

Marks

at least one independent<br />

director of the holding<br />

company as a director?<br />

ii Are the minutes of meetings<br />

of Board of Directors of<br />

subsidiary company placed<br />

in the Board meetings of the<br />

holding company?<br />

iii Does the number of<br />

functional directors<br />

(including CMD/MD)<br />

constitute 50% of the actual<br />

strength of the board?<br />

1 Yes = 1<br />

No = 0<br />

1 Yes = 1<br />

No = 0<br />

4.2 Review of Financial Statement of Subsidiary by Audit Committee (1<br />

Marks)<br />

Sl.No. Indicator Prescribed<br />

Marks<br />

i. Does the Audit Committee<br />

of the holding company<br />

review the financial<br />

statements of the subsidiary<br />

company?<br />

Criteria for<br />

Measurement<br />

1 Yes = 1<br />

No = 0<br />

Awarded<br />

Marks<br />

4.3 Review of Performance of Subsidiary by Board (1 Marks)<br />

Sl.No. Indicator Prescribed<br />

Marks<br />

i. Does the Board of Directors<br />

of the holding company<br />

review the performance of<br />

the subsidiary company as<br />

per the DPE Guidelines?<br />

Criteria for<br />

Measurement<br />

1 Yes = 1<br />

No = 0<br />

Awarded<br />

Marks<br />

5.1 Transactions (3 Marks)<br />

Sl. Indicator<br />

No.<br />

i. Is the summary of<br />

transactions with related<br />

parties in the normal and<br />

ordinary course of business<br />

placed the Audit Committee of<br />

the Board?<br />

ii. Are the details of material<br />

individual transactions with<br />

related parties undertaken in<br />

extraordinary circumstances<br />

of business placed before the<br />

Prescribed Criteria for<br />

Marks Measurement<br />

1 Yes=1<br />

No=0<br />

1 Yes=1<br />

No=0<br />

Awarded<br />

Marks

iii.<br />

Audit Committee?<br />

Are the details of material<br />

individual transactions with<br />

related parties or others,<br />

which are not on an arm’s<br />

length basis placed before the<br />

Audit Committee along with<br />

Management’s Justification<br />

for the same?<br />

1 Yes=1<br />

No=0<br />

5.2 Accounting Standards (3 Marks)<br />

Sl. Indicator<br />

No.<br />

i. Do the company’s accounting<br />

procedures comply with the<br />

Accounting Standards adopted<br />

by ICAI?<br />

ii. Is the deviation form the<br />

prescribed Accounting<br />

Standards disclosed and<br />

explained in the financial<br />

statements and in the<br />

Corporate Governance Report<br />

of the Company?<br />

Prescribed Criteria for<br />

Marks Measurement<br />

2 Yes=2<br />

No=0<br />

1 Yes=1<br />

No=0<br />

Awarded<br />

Marks<br />

5.3 Consolidated Financial Statements (3 Marks)<br />

Sl. Indicator<br />

No.<br />

i. Are the Consolidated Financial<br />

Statements of the Company<br />

prepared in accordance with<br />

the Accounting Standards,<br />

namely, AS21, AS23, and AS27<br />

issued by ICAI.<br />

Prescribed Criteria for<br />

Marks Measurement<br />

3 Yes=3<br />

No=0<br />

Awarded<br />

Marks<br />

5.4 Segment-wise Profit and Loss Statement (3 Marks)<br />

Sl. Indicator<br />

No.<br />

i. Does the company disclose<br />

segment-wise profit & loss as<br />

per Accounting Standard 17<br />

issued by ICAI?<br />

Prescribed Criteria for<br />

Marks Measurement<br />

3 Yes=3<br />

No=0<br />

Awarded<br />

Marks<br />

5.5 Board Disclosures – Risk Management (3 Marks)<br />

Sl.<br />

No.<br />

Indicator<br />

Prescribed<br />

Marks<br />

Criteria for<br />

Measurement<br />

Awarded<br />

Marks

i. Do the company’s latest<br />

Annual Report include<br />

management’s assessment of<br />

the company’s outlook for the<br />

future and identify important<br />

risks that the company may<br />

face in future?<br />

ii. Has the company included in<br />

its latest Annual Report a<br />

statement of its corporate<br />

objectives (Mission) and does<br />

it periodically update this<br />

statement?<br />

2 Yes=2<br />

No=0<br />

1 Yes=1<br />

No=0<br />

5.6 Remuneration of Directors (3 Marks)<br />

Sl. Indicator<br />

No.<br />

i. Does the company’s latest<br />

Annual Report disclose all<br />

pecuniary relationship or<br />

transactions of the part-time<br />

directors vis-à-vis the<br />

company?<br />

ii. Does the company disclose in<br />

its latest Annual Report the<br />

details on remuneration of<br />

Directors?<br />

Prescribed Criteria for<br />

Marks Measurement<br />

2 Yes=2<br />

No=0<br />

1 Yes=1<br />

No=0<br />

Awarded<br />

Marks<br />

5.7 Management Discussion and Analysis (1 Markss)<br />

Sl. Indicator<br />

No.<br />

i. Does the Management<br />

Discussion and Analysis<br />

Report include<br />

(a) Industry structure and<br />

developments;<br />

(b) Strength and weakness;<br />

(c) Opportunities and<br />

threats;<br />

(d) Outlook for the future;<br />

(e) Risks and concerns;<br />

(f) Internal control systems<br />

and their adequacy;<br />

(g) Analysis of finances and<br />

operations;<br />

(h) Human resources,<br />

industrial relations, and<br />

talent management<br />

Prescribed Criteria for<br />

Marks Measurement<br />

1 Yes=1<br />

No=0<br />

Awarded<br />

Marks

issues;<br />

(i) Environmental<br />

conservation, renewal<br />

energy use and R&D<br />

issue; and<br />

(j) Social responsibility<br />

issues for the company<br />

(CSR)<br />

5.8 Disclosures by Senior Management (1 Marks)<br />

Sl. Indicator<br />

No.<br />

i. Does the company’s latest<br />

Annual Report disclose<br />

significant “related party”<br />

transactions of senior<br />

management where they have<br />

personal interest?<br />

Prescribed Criteria for<br />

Marks Measurement<br />

1 Yes=1<br />

No=0<br />

Awarded<br />

Marks<br />

6.1 Report on Corporate Governance (4 Marks)<br />

Sl. Indicator<br />

No.<br />

i. Does the company’s latest<br />

Annual Report have a separate<br />

section on Compliance to<br />

Corporate Governance<br />

Guidelines issued by DPE?<br />

ii. Does the company produce<br />

periodic reports and press<br />

releases to indicate significant<br />

developments impaction on<br />

corporate governance (such as,<br />

legal and environmental<br />

issues; commitment to<br />

workforce, suppliers,<br />

customers and local<br />

communities etc.)?<br />

iii. Does the company have a<br />

dedicated cell responsible for<br />

information sharing with<br />

stakeholders through the use<br />

of information and<br />

communication technologies<br />

(ICT)?<br />

Prescribed Criteria for<br />

Marks Measurement<br />

2 Yes=2<br />

No=0<br />

1 Yes-1<br />

No=0<br />

1 Yes=1<br />

No=0<br />

Awarded<br />

Marks<br />

6.2 Compliance Certificate (4 Marks)<br />

Sl. Indicator Prescribed Criteria for Awarded

No. Marks Measurement Marks<br />

i. Has the company obtained a 2 Yes=2<br />

Certificate from the auditors<br />

and/ or practicing Company<br />

No=0<br />

Secretary<br />

regarding<br />

Compliance of Corporate<br />

Governance Guidelines and<br />

Annexes?<br />

ii.<br />

Does the latest Annual Report<br />

of the company include the<br />

Compliance Certificate along<br />

with the Directors’ Report,<br />

which is also sent to all<br />

shareholders?<br />

2 Yes=2<br />

No=0<br />

6.3 Chairman’s Speech in AGM and Annual Report (4 Marks)<br />

Sl. Indicator<br />

No.<br />

i. Does the Chairman’s speech at<br />

the latest AGM include a<br />

section on compliance with<br />

Corporate Governance<br />

guidelines?<br />

ii. Does the Chairman’s speech at<br />

the latest AGM from part of<br />

Annual Report of the<br />

company?<br />

Prescribed Criteria for<br />

Marks Measurement<br />

2 Yes=2<br />

No=0<br />

2 Yes=2<br />

No=0<br />

Awarded<br />

Marks<br />

6.4 Holding AGM, Adoption of Audited Accounts and Filing of adopted<br />

Accounts with the registrar of Companies within the stipulated time (4<br />

Marks)<br />

Sl. Indicator<br />

No.<br />

i. Did the company hold an<br />

Annual General Meeting<br />

(AGM) at a convenient time<br />

and place that was open to all<br />

shareholders?<br />

ii. Are the year-end Audited<br />

Accounts placed in the AGM<br />

for adoption by the<br />

shareholders of the company?<br />

iii. Are the year-end Audited<br />

Accounts adopted in the AGM<br />

filed with the Registrar of<br />

Companies within the<br />

stipulated time?<br />

Prescribed Criteria for<br />

Marks Measurement<br />

1 Yes=1<br />

No=0<br />

2 Yes=2<br />

No=0<br />

1 Yes=1<br />

No=0<br />

Awarded<br />

Marks

6.5 Timely Submission of Grading Report (4 Marks)<br />

Sl. Indicator<br />

No.<br />

i. Did the company submit<br />

quarterly grading report<br />

regarding DPE Guidelines on<br />

Corporate Governance in the<br />

prescribed format to<br />

respective Administrative<br />

Ministries within 15 days form<br />

the close of each quarter?<br />

Prescribed Criteria for<br />

Marks Measurement<br />

4 Yes=4<br />

No=0<br />

Awarded<br />

Marks<br />

(Signature of Authorized Signatory)<br />

(Name and Designation of Authorized Signatory)<br />

Note :-<br />

1. The grading report in the above format is to be filled for each quarter and total<br />

marks(out of 100) are to be calculated for each quarter. The scores for each of<br />

the four quarters are to be averaged for arriving at annual score.<br />

2. The grading would be awarded as under.<br />

Grade Annual Score<br />

Excellent 85 and above<br />

Very Good 75 – 84<br />

Good 60 – 74<br />

Fair 50 – 59<br />

Poor Below 50<br />

3. In case, a particular indicator is not applicable to a CPSE, the same may be<br />

mentioned in the format along with justification for non-applicability and the<br />

score may be calculated after excluding the marks of that indicator and the<br />

marks may be pro-rata calculated for arriving at total score out of 100.

Enclosure<br />

( Very Good Target )<br />

Month-wise Wagon Loading agreed between CIL & Railways in meeting held on<br />

16 th March’ <strong>2012</strong><br />

(In Rakes /Day)<br />

Month<br />

<strong>CCL</strong><br />

April ‘ 12 31.0<br />

May ’ 12 29.5<br />

June ‘ 12 29.2<br />

Qtr-1 29.9<br />

July ‘ 12 27.9<br />

Aug ‘ 12 27.9<br />

Sept ‘ 12 27.9<br />

Qtr-2 27.9<br />

Oct’ 12 29.2<br />

Nov ‘ 12 29.5<br />

Dec ’12 30.6<br />

Qtr-3 29.8<br />

Jan’ <strong>13</strong> 34.3<br />

Feb ‘ <strong>13</strong> 34.3<br />

Mar ‘ <strong>13</strong> 34.3<br />

Qtr-4 34.3<br />

<strong>2012</strong>-<strong>13</strong> 30.4<br />

Note: quantity for 1 box considered at the rate of actual of 2010-11 for a rake of<br />

59 boxes

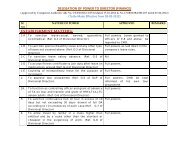

New pricising of non coking coal based on GCV w.e.f. 00:00 hrs of 1.1.12<br />

(wide notification no. : CIL:S&M:GM(F):Pricising:1965 dated 31.1.12)<br />

The prices of the non coking coal produced by the subsidiary company of coal India Limited(CIL)<br />

including NEC fixed on GVC basis and circulated vide price notification no. :<br />

CIL:S&M:GM(F):Pricising:18<strong>13</strong> dated 31.12.11 stands revised . The revised prices corresponding to<br />

different GCV bands are shown in table I below. The price shall be effective retrospectively from 00<br />

hours of 1.1.12<br />

Table I<br />

Pit head run of mine price for non coking coal applicable for all coal producing companies of coal India<br />

Limited including NEC<br />

GCV Bands<br />

Pit head run of mine price for non coking coal<br />

Power ultilities (including<br />

IPPs),fertilizer and defence<br />

sector<br />

Sector other then power utility<br />

(including IPPs ) fertilizer and<br />

defence<br />

(Kcal/KG) (Rs/Te) (Rs/Te)<br />

Exceeding 7000 * *<br />

Exceeding 6700 & not<br />

exceeding 7000<br />

4870 4870<br />

Exceeding 6400 & not<br />

exceeding 6700<br />

Exceeding 6100 & not<br />

exceeding 6400<br />

Exceeding 5800 & not<br />

exceeding 6100<br />

Exceeding 5500 & not<br />

exceeding 5800<br />

Exceeding 5200 & not<br />

exceeding 5500<br />

Exceeding 4900 & not<br />

exceeding 5200<br />

Exceeding 4600 & not<br />

exceeding 4900<br />

Exceeding 4300 & not<br />

exceeding 4600<br />

Exceeding 4000 & not<br />

exceeding 4300<br />

Exceeding 3700 & not<br />

exceeding 4000<br />

Exceeding 3400 & not<br />

exceeding 3700<br />

4420 4420<br />

3970 3970<br />

2800 2800<br />

1450 1960<br />

1270 1720<br />

1140 1540<br />

880 1180<br />

780 1050<br />

640 870<br />

600 810<br />

550 740

GCV Bands<br />

Pit head run of mine price for non coking coal<br />

Power ultilities (including<br />

IPPs),fertilizer and defence<br />

sector<br />

Sector other then power utility<br />

(including IPPs ) fertilizer and<br />

defence<br />

(Kcal/KG) (Rs/Te) (Rs/Te)<br />

Exceeding 3100 & not<br />

500 680<br />

exceeding 3400<br />

Exceeding2800 & not<br />

exceeding 3100<br />

460 620<br />

Exceeding2500 & not<br />

exceeding 2800<br />

Exceeding 2200& not<br />

exceeding 2500<br />

410 550<br />

360 490<br />

All other eliments of the ex-colliery delivered price as are presently applicable interm of the last coal<br />

price notification circulated vide ref. no. S&M:GM(F):Pricising:1907 dated 26.2.11<br />

will continue to remain applicable .<br />

For coal produced by the coal companies of CIL including NEC other other then non coking coal , the<br />

prices as are presently applicable in terms of the coal price notification circulated vide ref. no. .<br />

S&M:GM(F):Pricising:1907 dated 26.2.11<br />

Will continue to remain applicable , shown as under:

COMPANY WISE GRADE WISE COAL PRICES OF CIL FOR POWER UTILITIES (INCLUDING IPPs),<br />

FERTILISERS AND DEFENCE<br />

Table –II<br />

Coking Coal (Run of Mine)<br />

(Rs /Tonne)<br />

Subsidiary Washery Grade I Washery Grade II Washery Grade III Washery Grade IV<br />

<strong>CCL</strong> 1960 1620 1200 1120<br />

Table –V & VI of the price notification NO CIL : S&M :GM(F) : Pricing 1907 dated 26 th February,2011, no<br />

more applicable<br />

COMPANY WISE GRADE WISE COAL PRICES OF CIL FOR CONSUMERS OTHER THAN POWER UTILITIES<br />

(INCLUDING IPPs), FERTILISERS AND DEFENCE<br />

Table –VII<br />

Coking Coal (Run of Mine)<br />

(Rs /Tonne)<br />

Subsidiary Washery Grade I Washery Grade II Washery Grade III Washery Grade IV<br />

<strong>CCL</strong> 2550 2110 1560 1460<br />

Table –X (of the price notification NO CIL : S&M :GM(F) : Pricing 1907 dated 26 th February,2011) no more<br />

applicable