CChhhuuuccckkk SSmmmiiittthh - The Spectrum Magazine ...

CChhhuuuccckkk SSmmmiiittthh - The Spectrum Magazine ...

CChhhuuuccckkk SSmmmiiittthh - The Spectrum Magazine ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>The</strong> <strong>Spectrum</strong> . Redwood City's Monthly <strong>Magazine</strong><br />

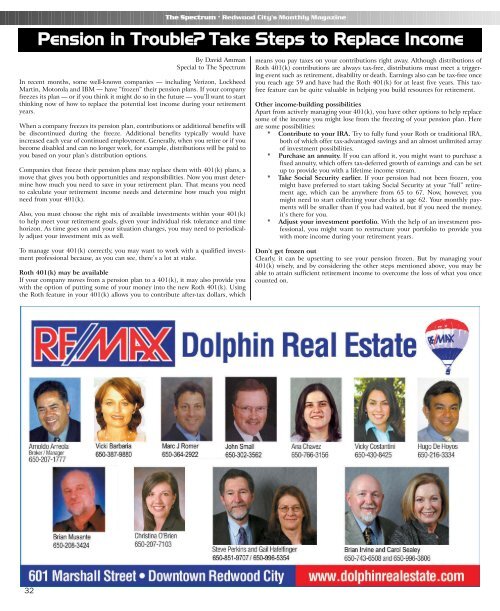

Pension in Trouble? Take Steps to Replace Income<br />

By David Amman<br />

Special to <strong>The</strong> <strong>Spectrum</strong><br />

In recent months, some well-known companies — including Verizon, Lockheed<br />

Martin, Motorola and IBM — have “frozen” their pension plans. If your company<br />

freezes its plan — or if you think it might do so in the future — you’ll want to start<br />

thinking now of how to replace the potential lost income during your retirement<br />

years.<br />

When a company freezes its pension plan, contributions or additional benefits will<br />

be discontinued during the freeze. Additional benefits typically would have<br />

increased each year of continued employment. Generally, when you retire or if you<br />

become disabled and can no longer work, for example, distributions will be paid to<br />

you based on your plan’s distribution options.<br />

Companies that freeze their pension plans may replace them with 401(k) plans, a<br />

move that gives you both opportunities and responsibilities. Now you must determine<br />

how much you need to save in your retirement plan. That means you need<br />

to calculate your retirement income needs and determine how much you might<br />

need from your 401(k).<br />

Also, you must choose the right mix of available investments within your 401(k)<br />

to help meet your retirement goals, given your individual risk tolerance and time<br />

horizon. As time goes on and your situation changes, you may need to periodically<br />

adjust your investment mix as well.<br />

To manage your 401(k) correctly, you may want to work with a qualified investment<br />

professional because, as you can see, there’s a lot at stake.<br />

Roth 401(k) may be available<br />

If your company moves from a pension plan to a 401(k), it may also provide you<br />

with the option of putting some of your money into the new Roth 401(k). Using<br />

the Roth feature in your 401(k) allows you to contribute after-tax dollars, which<br />

means you pay taxes on your contributions right away. Although distributions of<br />

Roth 401(k) contributions are always tax-free, distributions must meet a triggering<br />

event such as retirement, disability or death. Earnings also can be tax-free once<br />

you reach age 59 and have had the Roth 401(k) for at least five years. This taxfree<br />

feature can be quite valuable in helping you build resources for retirement.<br />

Other income-building possibilities<br />

Apart from actively managing your 401(k), you have other options to help replace<br />

some of the income you might lose from the freezing of your pension plan. Here<br />

are some possibilities:<br />

* Contribute to your IRA. Try to fully fund your Roth or traditional IRA,<br />

both of which offer tax-advantaged savings and an almost unlimited array<br />

of investment possibilities.<br />

* Purchase an annuity. If you can afford it, you might want to purchase a<br />

fixed annuity, which offers tax-deferred growth of earnings and can be set<br />

up to provide you with a lifetime income stream.<br />

* Take Social Security earlier. If your pension had not been frozen, you<br />

might have preferred to start taking Social Security at your “full” retirement<br />

age, which can be anywhere from 65 to 67. Now, however, you<br />

might need to start collecting your checks at age 62. Your monthly payments<br />

will be smaller than if you had waited, but if you need the money,<br />

it’s there for you.<br />

* Adjust your investment portfolio. With the help of an investment professional,<br />

you might want to restructure your portfolio to provide you<br />

with more income during your retirement years.<br />

Don’t get frozen out<br />

Clearly, it can be upsetting to see your pension frozen. But by managing your<br />

401(k) wisely, and by considering the other steps mentioned above, you may be<br />

able to attain sufficient retirement income to overcome the loss of what you once<br />

counted on.<br />

32