HR Memo 3/25/2013

HR Memo 3/25/2013

HR Memo 3/25/2013

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

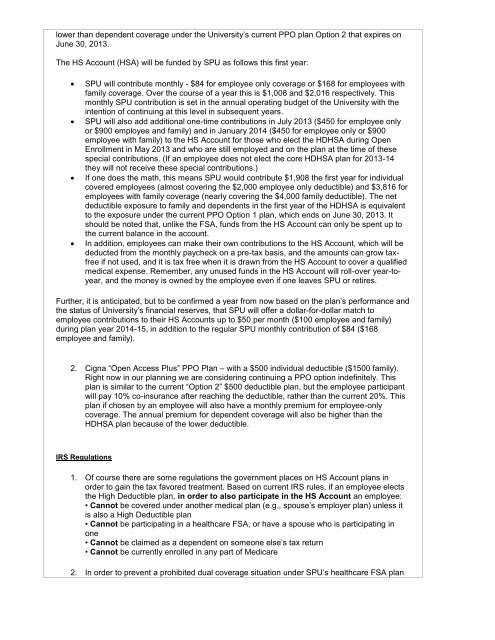

lower than dependent coverage under the University’s current PPO plan Option 2 that expires on<br />

June 30, <strong>2013</strong>.<br />

The HS Account (HSA) will be funded by SPU as follows this first year:<br />

<br />

<br />

<br />

<br />

SPU will contribute monthly - $84 for employee only coverage or $168 for employees with<br />

family coverage. Over the course of a year this is $1,008 and $2,016 respectively. This<br />

monthly SPU contribution is set in the annual operating budget of the University with the<br />

intention of continuing at this level in subsequent years.<br />

SPU will also add additional one-time contributions in July <strong>2013</strong> ($450 for employee only<br />

or $900 employee and family) and in January 2014 ($450 for employee only or $900<br />

employee with family) to the HS Account for those who elect the HDHSA during Open<br />

Enrollment in May <strong>2013</strong> and who are still employed and on the plan at the time of these<br />

special contributions. (If an employee does not elect the core HDHSA plan for <strong>2013</strong>-14<br />

they will not receive these special contributions.)<br />

If one does the math, this means SPU would contribute $1,908 the first year for individual<br />

covered employees (almost covering the $2,000 employee only deductible) and $3,816 for<br />

employees with family coverage (nearly covering the $4,000 family deductible). The net<br />

deductible exposure to family and dependents in the first year of the HDHSA is equivalent<br />

to the exposure under the current PPO Option 1 plan, which ends on June 30, <strong>2013</strong>. It<br />

should be noted that, unlike the FSA, funds from the HS Account can only be spent up to<br />

the current balance in the account.<br />

In addition, employees can make their own contributions to the HS Account, which will be<br />

deducted from the monthly paycheck on a pre-tax basis, and the amounts can grow taxfree<br />

if not used, and it is tax free when it is drawn from the HS Account to cover a qualified<br />

medical expense. Remember, any unused funds in the HS Account will roll-over year-toyear,<br />

and the money is owned by the employee even if one leaves SPU or retires.<br />

Further, it is anticipated, but to be confirmed a year from now based on the plan’s performance and<br />

the status of University’s financial reserves, that SPU will offer a dollar-for-dollar match to<br />

employee contributions to their HS Accounts up to $50 per month ($100 employee and family)<br />

during plan year 2014-15, in addition to the regular SPU monthly contribution of $84 ($168<br />

employee and family).<br />

2. Cigna “Open Access Plus” PPO Plan – with a $500 individual deductible ($1500 family).<br />

Right now in our planning we are considering continuing a PPO option indefinitely. This<br />

plan is similar to the current “Option 2” $500 deductible plan, but the employee participant<br />

will pay 10% co-insurance after reaching the deductible, rather than the current 20%. This<br />

plan if chosen by an employee will also have a monthly premium for employee-only<br />

coverage. The annual premium for dependent coverage will also be higher than the<br />

HDHSA plan because of the lower deductible.<br />

IRS Regulations<br />

1. Of course there are some regulations the government places on HS Account plans in<br />

order to gain the tax favored treatment. Based on current IRS rules, if an employee elects<br />

the High Deductible plan, in order to also participate in the HS Account an employee:<br />

• Cannot be covered under another medical plan (e.g., spouse’s employer plan) unless it<br />

is also a High Deductible plan<br />

• Cannot be participating in a healthcare FSA, or have a spouse who is participating in<br />

one<br />

• Cannot be claimed as a dependent on someone else’s tax return<br />

• Cannot be currently enrolled in any part of Medicare<br />

2. In order to prevent a prohibited dual coverage situation under SPU’s healthcare FSA plan