SURPLUS LINES FAQ - Delaware Insurance Commissioner

SURPLUS LINES FAQ - Delaware Insurance Commissioner

SURPLUS LINES FAQ - Delaware Insurance Commissioner

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

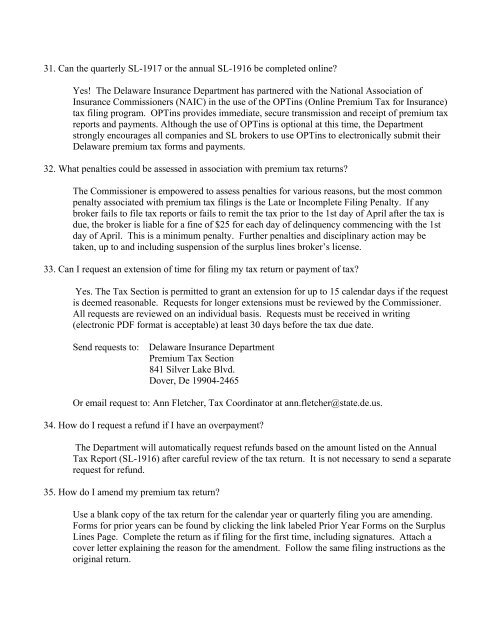

31. Can the quarterly SL-1917 or the annual SL-1916 be completed online?<br />

Yes! The <strong>Delaware</strong> <strong>Insurance</strong> Department has partnered with the National Association of<br />

<strong>Insurance</strong> <strong>Commissioner</strong>s (NAIC) in the use of the OPTins (Online Premium Tax for <strong>Insurance</strong>)<br />

tax filing program. OPTins provides immediate, secure transmission and receipt of premium tax<br />

reports and payments. Although the use of OPTins is optional at this time, the Department<br />

strongly encourages all companies and SL brokers to use OPTins to electronically submit their<br />

<strong>Delaware</strong> premium tax forms and payments.<br />

32. What penalties could be assessed in association with premium tax returns?<br />

The <strong>Commissioner</strong> is empowered to assess penalties for various reasons, but the most common<br />

penalty associated with premium tax filings is the Late or Incomplete Filing Penalty. If any<br />

broker fails to file tax reports or fails to remit the tax prior to the 1st day of April after the tax is<br />

due, the broker is liable for a fine of $25 for each day of delinquency commencing with the 1st<br />

day of April. This is a minimum penalty. Further penalties and disciplinary action may be<br />

taken, up to and including suspension of the surplus lines broker’s license.<br />

33. Can I request an extension of time for filing my tax return or payment of tax?<br />

Yes. The Tax Section is permitted to grant an extension for up to 15 calendar days if the request<br />

is deemed reasonable. Requests for longer extensions must be reviewed by the <strong>Commissioner</strong>.<br />

All requests are reviewed on an individual basis. Requests must be received in writing<br />

(electronic PDF format is acceptable) at least 30 days before the tax due date.<br />

Send requests to: <strong>Delaware</strong> <strong>Insurance</strong> Department<br />

Premium Tax Section<br />

841 Silver Lake Blvd.<br />

Dover, De 19904-2465<br />

Or email request to: Ann Fletcher, Tax Coordinator at ann.fletcher@state.de.us.<br />

34. How do I request a refund if I have an overpayment?<br />

The Department will automatically request refunds based on the amount listed on the Annual<br />

Tax Report (SL-1916) after careful review of the tax return. It is not necessary to send a separate<br />

request for refund.<br />

35. How do I amend my premium tax return?<br />

Use a blank copy of the tax return for the calendar year or quarterly filing you are amending.<br />

Forms for prior years can be found by clicking the link labeled Prior Year Forms on the Surplus<br />

Lines Page. Complete the return as if filing for the first time, including signatures. Attach a<br />

cover letter explaining the reason for the amendment. Follow the same filing instructions as the<br />

original return.