SURPLUS LINES FAQ - Delaware Insurance Commissioner

SURPLUS LINES FAQ - Delaware Insurance Commissioner

SURPLUS LINES FAQ - Delaware Insurance Commissioner

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

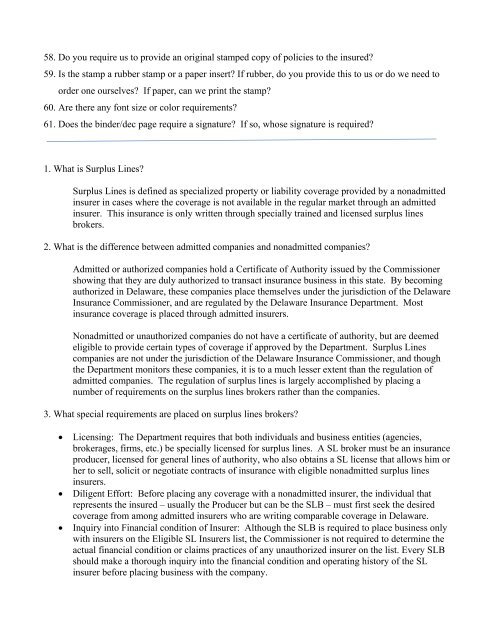

58. Do you require us to provide an original stamped copy of policies to the insured?<br />

59. Is the stamp a rubber stamp or a paper insert? If rubber, do you provide this to us or do we need to<br />

order one ourselves? If paper, can we print the stamp?<br />

60. Are there any font size or color requirements?<br />

61. Does the binder/dec page require a signature? If so, whose signature is required?<br />

1. What is Surplus Lines?<br />

Surplus Lines is defined as specialized property or liability coverage provided by a nonadmitted<br />

insurer in cases where the coverage is not available in the regular market through an admitted<br />

insurer. This insurance is only written through specially trained and licensed surplus lines<br />

brokers.<br />

2. What is the difference between admitted companies and nonadmitted companies?<br />

Admitted or authorized companies hold a Certificate of Authority issued by the <strong>Commissioner</strong><br />

showing that they are duly authorized to transact insurance business in this state. By becoming<br />

authorized in <strong>Delaware</strong>, these companies place themselves under the jurisdiction of the <strong>Delaware</strong><br />

<strong>Insurance</strong> <strong>Commissioner</strong>, and are regulated by the <strong>Delaware</strong> <strong>Insurance</strong> Department. Most<br />

insurance coverage is placed through admitted insurers.<br />

Nonadmitted or unauthorized companies do not have a certificate of authority, but are deemed<br />

eligible to provide certain types of coverage if approved by the Department. Surplus Lines<br />

companies are not under the jurisdiction of the <strong>Delaware</strong> <strong>Insurance</strong> <strong>Commissioner</strong>, and though<br />

the Department monitors these companies, it is to a much lesser extent than the regulation of<br />

admitted companies. The regulation of surplus lines is largely accomplished by placing a<br />

number of requirements on the surplus lines brokers rather than the companies.<br />

3. What special requirements are placed on surplus lines brokers?<br />

� Licensing: The Department requires that both individuals and business entities (agencies,<br />

brokerages, firms, etc.) be specially licensed for surplus lines. A SL broker must be an insurance<br />

producer, licensed for general lines of authority, who also obtains a SL license that allows him or<br />

her to sell, solicit or negotiate contracts of insurance with eligible nonadmitted surplus lines<br />

insurers.<br />

� Diligent Effort: Before placing any coverage with a nonadmitted insurer, the individual that<br />

represents the insured – usually the Producer but can be the SLB – must first seek the desired<br />

coverage from among admitted insurers who are writing comparable coverage in <strong>Delaware</strong>.<br />

� Inquiry into Financial condition of Insurer: Although the SLB is required to place business only<br />

with insurers on the Eligible SL Insurers list, the <strong>Commissioner</strong> is not required to determine the<br />

actual financial condition or claims practices of any unauthorized insurer on the list. Every SLB<br />

should make a thorough inquiry into the financial condition and operating history of the SL<br />

insurer before placing business with the company.