Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>CHOATE</strong><br />

<strong>ROSEMARY</strong> <strong>HALL</strong><br />

DOMESTIC AND<br />

INTERNATIONAL STUDENT<br />

ACCIDENT AND SICKNESS<br />

INSURANCE PLAN<br />

2012-2013<br />

Policy Number: 2012I5A18<br />

1. This Brochure is not the insurance contract. It is a brief<br />

description of the general provisions provided under Master<br />

Policy issued to Choate Rosemary Hall and underwritten by<br />

Niagara Life and Health Insurance Company.<br />

2. Please be sure to retain this brochure as a record of your<br />

insurance benefits. No individual policies are issued. An<br />

identification card will be issued to each insured person after<br />

October 15, 2012, the Waiver deadline.<br />

THIS POLICY MEETS CONNECTICUT MINIMUM STANDARDS<br />

FOR BASIC MEDICAL/SURGICAL EXPENSE INSURANCE. IT<br />

ALSO CONTAINS ADDITIONAL BENEFITS. PLEASE READ THIS<br />

BROCHURE CAREFULLY.<br />

THIS LIMITED HEALTH BENEFITS PLAN (PLAN A) DOES NOT<br />

PROVIDE COMPREHENSVE MEDICAL COVERAGE. IT IS A<br />

BASIC OR LIMITED BENEFITS POLICY AND IS NOT INTENDED<br />

TO COVER ALL MEDICAL EXPENSES. THIS PLAN IS NOT<br />

DESIGNED TO COVER THE COSTS OF SERIOUS OR<br />

CHRONIC ILLNESS. IT CONTAINS SPECIFIC DOLLAR LIMITS<br />

THAT WILL BE PAID FOR MEDICAL SERVICES WHICH MAY<br />

NOT BE EXCEEDED. IF THE COST OF SERVICES EXCEEDS<br />

THOSE LIMITS, THE BENEFICIARY AND NOT THE INSURER IS<br />

RESPONSIBLE FOR PAYMENT OF THE EXCESS AMOUNTS.<br />

THE SPECIFIC DOLLAR LIMITS ARE AS FOLLOWS IN THE<br />

PLAN BENEFIT SECTION.<br />

Form #12-I5A18(bro/cert)<br />

ELIGIBILITY<br />

All students attending the school on a full-time basis are eligible<br />

to enroll in this Plan. This coverage is available to Domestic and<br />

International Students that travel abroad while the policy is in<br />

force.<br />

The Company maintains the right to investigate student status<br />

and attendance records to verify that Policy eligibility<br />

requirements have been met. If the Company discovers that the<br />

Policy eligibility requirements have not been met, the<br />

Company’s only obligation is refund of premium.<br />

POLICY TERM<br />

The insurance under Choate Rosemary Hall’s Student Accident<br />

and Sickness Insurance Plan for the Annual Plan is effective<br />

12:01 a.m. on September 1, 2012. You may enroll in this<br />

Insurance Program prior to the start of the School Year, or<br />

during the forty-five (45) day period beginning with the start of<br />

the first semester. This is known as the Open Enrollment<br />

Period. The Annual Plan terminates at 12:01 a.m. on<br />

September 1, 2013 or at the end of the period for which the<br />

premiums are paid.<br />

COST OF COVERAGE<br />

DOMESTIC AND INTERNATIONAL<br />

Plan A: Annual Premium (12 months) ......................... $240*<br />

Domestic Only<br />

Plan B: Accident & Sickness Insurance Plan<br />

(12 months) .................................................................. $979*<br />

Domestic & International Students – International Students are<br />

required to enroll in Plan B<br />

*Plans A and B include a $10.00 administration fee.<br />

REFUND OF PREMIUM<br />

Except for medical withdrawal due to a covered Injury or<br />

Sickness, any student withdrawing from school during the first<br />

31 days of the period for which coverage is purchased will not<br />

be covered under the Policy and a full refund of the premium<br />

will be made. Students withdrawing after such 31 days will<br />

remain covered under the Policy for the full period for which<br />

premium has been paid and no refund will be allowed.<br />

Covered Persons entering the armed forces of any country will<br />

not be covered under the Policy as of the date of such entry. A<br />

pro-rata refund of premium will be made for such person upon<br />

written request received by the Company within 90 days of<br />

withdrawal from school. Refunds for any other reason are not<br />

available.<br />

DEFINITIONS<br />

You, Your or Yours means the insured student.<br />

We, Us or Our means Niagara Life and Health Insurance<br />

Company.<br />

Accident means a sudden, unexpected and unforeseen,<br />

identifiable event causing Injury.<br />

Aggregate Maximum Benefit means the Maximum benefit We<br />

will pay for any one covered Injury or Sickness.<br />

Covered Person means You, the Student while insured under<br />

this Plan.<br />

Physician as used herein means: (a) a legally qualified<br />

physician licensed by the state in which he or she practices; or<br />

(b) a practitioner of the healing arts performing services within<br />

the scope of his or her license as specified by the laws of the<br />

state or residence of such practitioner; or (c) a certified nurse<br />

midwife while acting within the scope of that certification; or (d)<br />

a certified nurse practitioner, which means any registered nurse<br />

licensed in the state in which he or she practices who has<br />

completed a formal educational nurse practitioner program and is<br />

certified by the respective professional nursing association; or (e)<br />

a physician assistant performing services within the scope of his<br />

or her license as specified by the laws of the state of residence of<br />

such practitioner.<br />

Hospital means a facility which meets all of these tests: (a) it<br />

provides inpatient services for the care and treatment of injured<br />

and sick people; and (b) it provides room and board services and<br />

nursing services 24 hours a day; and (c) it has established<br />

facilities for diagnosis and major surgery; and (d) it is supervised<br />

by a Physician; and (e) it is run as a Hospital under the laws of the<br />

jurisdiction in which it is located. Hospital does not include a place<br />

run mainly: (a) for alcoholics or drug addicts; (b) as a<br />

convalescent home; (c) as a nursing or rest home; or (d) as a<br />

hospice facility.<br />

Hospital Confined/Confinement means a stay of 18 or more<br />

consecutive hours as a resident bed-patient in a Hospital.<br />

Loss means medical expense covered by this Plan as a result of<br />

Injury or Sickness as defined in this Plan.<br />

Injury means bodily Injury due to an Accident, which is the sole<br />

cause of the Loss and results solely, directly and independently of<br />

disease, bodily infirmity or any other causes. All injuries sustained<br />

2 3

in any one Accident, including all related conditions and recurrent<br />

symptoms of these injuries are considered a single injury.<br />

Sickness means Illness, disease, and complications of<br />

pregnancy which is the sole cause of the Loss which begin after<br />

the effective date of a Covered Person’s coverage, which are not<br />

a Pre-Existing Condition. All related conditions and recurrent<br />

symptoms of the same or a similar condition will be considered<br />

the same Sickness.<br />

Medical Emergency means the unexpected onset of an Injury or<br />

Sickness which requires immediate or urgent medical attention<br />

which, if not provided, could result in a loss of life or serious<br />

permanent damage to a limb or organ or pain sufficient to warrant<br />

immediate care. A Medical Emergency does not include elective<br />

or routine care.<br />

Medically Necessary means Health care services that a physician,<br />

exercising prudent clinical judgment, would provide to a patient for<br />

the purpose of preventing, evaluating, diagnosing or treating an<br />

illness, injury, disease or its symptoms, and that are: (1) In<br />

accordance with generally accepted standards of medical<br />

practice; (2) clinically appropriate, in terms of type, frequency,<br />

extent, site and duration and considered effective for the<br />

patient's illness, injury or disease; and (3) not primarily for the<br />

convenience of the patient, physician or other health care<br />

provider and not more costly than an alternative service or<br />

sequence of services at least as likely to produce equivalent<br />

therapeutic or diagnostic results as to the diagnosis or<br />

treatment of that patient's illness, injury or disease. For the<br />

purposes of this section, "generally accepted standards of<br />

medical practice" means standards that are based on credible<br />

scientific evidence published in peer-reviewed medical literature<br />

generally recognized by the relevant medical community or<br />

otherwise consistent with the standards set forth in policy<br />

issues involving clinical judgment.<br />

Expense or Covered Charge as used herein means those<br />

charges for Medically Necessary treatment, services or supplies<br />

which are performed or given under the direction of a Physician<br />

which are: (a) not in excess of the charges of the Reasonable and<br />

Customary Expenses therefore; and (b) not in excess of the<br />

charges that would have been made in the absence of this<br />

insurance; and (c) incurred while this Plan is in force as to the<br />

Covered Person.<br />

Reasonable and Customary Charge (R&C) means the usual<br />

amount charged by a Provider for a service or supply, regardless of<br />

insurance coverage, but not more than the amount charged by most<br />

providers in the same area for a similar service.<br />

Pre-existing Condition means a Sickness or Injury for which<br />

medical care, treatment, diagnosis, or advice was received or<br />

recommended within the six months prior to the Covered<br />

Person’s effective date of coverage under the Plan. Routine<br />

follow-up care to determine whether breast cancer has reoccurred<br />

in a person who has been previously determined to be breast<br />

cancer free shall not be considered as medical advice, diagnosis,<br />

care or treatment unless evidence of breast cancer is found<br />

during or as a result of such follow-up. Genetic information shall<br />

not be treated as a condition in the absence of a diagnosis of the<br />

condition related to such information. Pregnancy shall not be<br />

considered as a Pre-Existing Condition.<br />

DESCRIPTION OF BENEFITS<br />

ACCIDENT AND SICKNESS INSURANCE PLAN<br />

DOMESTIC STUDENTS - PLAN A<br />

Plan A is designed for students whose current medical<br />

insurance has a high deductible. This insurance plan provides<br />

coverage from the first dollar of Covered Charges, at 100% of R<br />

& C Charges, up to a maximum of $5,000 per Policy Year.<br />

Accidental Dental Expense Benefit: for Dental treatment as a<br />

result of accidental Injury to sound natural teeth up to a<br />

maximum of $100 per Accident.<br />

Ambulance Expense: Up to the maximum allowable rate<br />

established by the Department of Public Health in accordance<br />

with 19a-177, as amended for Medically Necessary transportation<br />

service to or from a Hospital by an ambulance. This includes<br />

emergency transportation from the place of a covered accident to<br />

a hospital providing the necessary medical care.<br />

DOMESTIC AND INTERNATIONAL STUDENTS - PLAN B<br />

Plan B is designed for those students who have no family<br />

medical insurance. International students are required to enroll<br />

in this plan. This student plan provides coverage from the first<br />

dollar of Covered Charges, at 100% of R & C Charges, up to a<br />

maximum of $200,000 per Injury or Sickness.<br />

When a Covered Injury or Sickness requires: (a) treatment by a<br />

Physician/Surgeon; (b) hospital confinement (room and board<br />

expense should not exceed the semi-private room rate); (c)<br />

services of a licensed nurse practitioner or RN; (d) x-ray<br />

services; (e) use of operating room, anesthesia, laboratory<br />

services; (f) prescribed medicines, plaster casts, surgical<br />

dressings and other Reasonable and Customary Charges<br />

incurred for the treatment of a Covered Injury or Sickness, We<br />

will pay 100% of the Covered Charges incurred for a covered<br />

Accident or Sickness, up to a maximum of $200,000 per Injury<br />

or Sickness.<br />

Accidental Dental Expense Benefit: for Dental treatment as a<br />

result of accidental Injury to sound natural teeth up to a<br />

maximum of $650 per Injury.<br />

Ambulance Expense: Up to the maximum allowable rate<br />

established by the Department of Public Health in accordance<br />

with 19a-177, as amended for Medically Necessary transportation<br />

service to or from a Hospital by an ambulance. This includes<br />

emergency transportation from the place of a covered accident to<br />

a hospital providing the necessary medical care.<br />

REPATRIATION OF REMAINS<br />

FOR DOMESTIC AND INTERNATIONAL STUDENTS<br />

The Company will pay the reasonable covered expenses to return<br />

the Insured Person’s body to his or her home country if he or she<br />

dies. Covered expenses include expenses for embalming,<br />

cremation, coffins, and transportation. The benefit payable may not<br />

exceed $5,000.<br />

STATE MANDATED BENEFITS<br />

Mental Health Conditions Expense Benefit: We will pay benefits<br />

for mental health conditions the same as we would pay for any<br />

other sickness. "Mental Health Conditions" means mental<br />

disorders as defined in the most recent edition of the American<br />

Psychiatric Association's "Diagnostic and Statistical Manual of<br />

Mental Disorders".<br />

Mental Disorders include alcohol dependency and substance<br />

abuse, but do not include mental retardation, learning disorders,<br />

motor skills disorders, communication disorders, caffeine-related<br />

disorders, relational problems, and additional conditions that may be<br />

a focus of clinical attention, that are not otherwise defined as mental<br />

disorders in the most recent edition of the American Psychiatric<br />

Association's "Diagnostic and Statistical Manual of Mental<br />

Disorders”.<br />

In the case of benefits payable for the services of a licensed<br />

physician or psychiatrist, benefits are also payable for the same<br />

services when rendered by the following practitioners or facilities<br />

qualified and licensed in accordance with the requirements of<br />

Chapter 38A Section 488A of the Connecticut General Laws:<br />

psychologist, clinical social worker, marital and family therapist,<br />

alcohol and drug counselor, professional counselor, child guidance<br />

clinic, residential treatment facility, or nonprofit community mental<br />

health center.<br />

4 5 6

Inpatient Mental Health Conditions: If an Insured Person requires<br />

treatment for mental and nervous disorders during Hospital<br />

Confinement, We will pay the Reasonable and Customary Charge<br />

incurred on the same basis as any other Sickness.<br />

Benefits for Partial Hospitalization: Partial Hospitalization means<br />

continuous treatment consisting of not less than four hours and not<br />

more than twelve hours in any twenty-four hour period under a<br />

program based in a hospital or residential treatment facility. Two<br />

Partial Hospitalization days may be substituted for one inpatient day<br />

in a hospital or related institution.<br />

Outpatient Mental & Nervous Conditions: When the Insured<br />

Person is not hospital confined, We will pay the Reasonable and<br />

Customary Charge incurred for Outpatient Services as any other<br />

illness.<br />

Autism Spectrum Disorder Therapies: We will provide coverage<br />

for physical therapy, speech therapy and occupational therapy<br />

services for the treatment of Autism Spectrum Disorders as set forth<br />

in the most recent edition of the American Psychiatric Association’s<br />

“Diagnostic and Statistical Manual of Mental Disorders,” to the<br />

extent such services are a covered benefit for other diseases and<br />

conditions under the policy.<br />

Epidermolysis Bullosa Treatment: We will provide coverage for<br />

wound care supplies that are medically necessary for the treatment<br />

of epidermolysis bullosa and are administered under the direction of<br />

a physician.<br />

Maternity Coverage: Normal pregnancy, complications of<br />

pregnancy, resulting childbirth, miscarriage or termination of<br />

pregnancy (except for elective abortion) on the same basis as a<br />

covered Sickness. Coverage includes a minimum inpatient stay<br />

of 48 hours for a vaginal delivery and 96 hours for a caesarean<br />

delivery. If the mother and newborn are discharged prior to this<br />

timeframe, after consultation with the Physician, this Plan will<br />

cover 2 follow up visits. The first visit must be within 48 hours of<br />

discharge and the second visit within 7 days.<br />

Newborn Children: A child of the insured Student will be<br />

covered by the Policy for 31 days after the moment of birth.<br />

Coverage for a newborn child will be the same as for any other<br />

Insured Person. Coverage will include Medically Necessary<br />

care or treatment of congenital defects, birth abnormalities, or<br />

premature birth. Upon expiration of the 31 days, dependent<br />

coverage is not available under the policy.<br />

Infertility Treatment Benefits: We will pay the medically<br />

necessary expenses incurred in the diagnosis and treatment of<br />

infertility. Such treatment includes, but is not limited to the<br />

following services related to infertility:<br />

1. ovulation induction;<br />

2. intra-uterine insemination;<br />

3. in-vitro fertilization<br />

4. uterine embryo lavage;<br />

5. embryo transfer;<br />

6. gamete intra-fallopian transfer;<br />

7. zygote intra-fallopian transfer; and<br />

8. low tubal ovum transfer.<br />

Coverage under this benefit is limited:<br />

1. to a covered student until the date of the student’s 40 th<br />

birthday;<br />

2. for ovulation induction to a lifetime maximum benefit of 4<br />

cycles;<br />

3. for intrauterine insemination to a lifetime maximum benefit<br />

of 3 cycles;<br />

4. for lifetime benefits to a maximum of 2 cycles, with not<br />

more than 2 embryo implantations per cycle, for IVF,<br />

gamete intra-fallopian transfer, zygote intra-fallopian or low<br />

tubal ovum transfer, provided each such fertilization or<br />

transfer shall be credited toward the maximum as 1 cycle;<br />

5. for IVF, gamete intra-fallopian transfer, zygote intrafallopian<br />

transfer and low tubal ovum transfer, to those<br />

individuals who have been unable to conceive or produce<br />

conception or sustain a successful pregnancy through less<br />

expensive and medically viable infertility treatment or<br />

procedures covered under the policy. Nothing in this<br />

subdivision shall be construed to deny the coverage<br />

required by this section to any individual who foregoes a<br />

particular infertility treatment or procedure if the<br />

individual’s physician determines that such treatment or<br />

procedure is likely to be unsuccessful;<br />

6. to individuals who have maintained coverage under the<br />

policy and any of the schools’ previous policies for at least<br />

12 months.<br />

7. to require disclosure by the student seeking coverage of<br />

any previous fertility treatment or procedures which the<br />

student received under a different health insurance policy.<br />

For the purpose of this benefit, infertility means the condition<br />

of a presumably healthy individual who is unable to conceive or<br />

produce conception or sustain a successful pregnancy during a<br />

one-year period.<br />

Services provided for under this provision must be performed at<br />

facilities that conform to standards and guidelines established<br />

by the American Society of Reproductive Medicine or the<br />

Society of Reproductive Endocrinology and Infertility. The same<br />

co-payments, deductibles and benefit limits will apply to the<br />

diagnosis and treatment of infertility as those applied to other<br />

medical or surgical benefits under the Policy.<br />

Early Intervention Services– When Dependent coverage is<br />

provided under the Policy, we will pay the expenses incurred for<br />

Medically Necessary early intervention services for eligible<br />

Dependent children not to exceed $6,400 per school year.<br />

These benefits are available for Dependent children who are<br />

not eligible for Connecticut special education and related<br />

services and who are from birth to 36 months of age, inclusive.<br />

Such services are needed because a child:<br />

1. Is experiencing a significant developmental delay as<br />

measured by standardized diagnostic instruments and<br />

procedures, including informed clinical opinion, in one or<br />

more of the following areas:<br />

a. Cognitive development;<br />

b. Physical development, including vision and hearing;<br />

c. Communication development;<br />

d. Social or emotional development; or<br />

e. Adaptive skills.<br />

2. Has been diagnosed as having a physical or mental<br />

condition that has a high probability of resulting in<br />

developmental delay.<br />

No payment made under this benefit will be applied against the<br />

Aggregate Maximum Benefit per covered Sickness.<br />

Hearing Aids: We will pay the expenses incurred for the cost<br />

of hearing aids for children 18 years of age and younger. Such<br />

hearing aids will be considered durable medical equipment<br />

under this policy. The maximum benefit payable for any one<br />

child will be limited to $1,000.<br />

Cancer Screening Tests: We will pay for the charges incurred<br />

for the following cancer screening tests.<br />

1. Mammography performed according to following schedule:<br />

a. One or more mammograms per year, as<br />

recommended by a Physician, for any woman at risk<br />

for breast cancer;<br />

b. A baseline mammogram for any woman age 35 to 39,<br />

inclusive, or more frequently if recommended by the<br />

woman’s Physician;<br />

7 8 9

c. A mammogram every year for any woman who is 40<br />

years of age and older; and<br />

d. Comprehensive ultrasound screening of an entire<br />

breast or breasts if such screenings are<br />

recommended by a physician for a woman classified<br />

as category 2, 3, 4 or 5 under the breast Imaging<br />

Reporting and Data System established by the<br />

American College of Radiology.<br />

2. PAP tests for woman 18 years and older as recommended<br />

by a Physician.<br />

3. Prostate cancer screening, including digital rectal<br />

examinations and prostate-specific antigen tests for men<br />

who are symptomatic; whose biological father or brother<br />

has been diagnosed with prostate cancer, and for all men<br />

50 years of age or older.<br />

4. Colorectal Cancer Screening, including but not limited to<br />

an annual fecal occult blood test, and a colonoscopy,<br />

flexible sigmoidoscopy or radiologic imaging, in<br />

accordance with the recommendations established by the<br />

American College of Gastroenterology, after consultation<br />

with the American Cancer Society, based on the ages,<br />

family histories and frequencies provided in the<br />

recommendations.<br />

Home Health Care Expense: Expenses for covered home<br />

health care service in lieu of Hospitalization, except if<br />

diagnosed by a Physician as terminally ill with a prognosis of 6<br />

months or less to live, after a $50 deductible, 75% of the<br />

Expenses incurred, up to a maximum of 80 home health care<br />

visits in any calendar year or in any continuous period of 12<br />

months for each Covered Person. Each 4 hours of home health<br />

aide service will count as one visit. In the case of a terminally ill<br />

Covered Person, no more than $200 for medical social services<br />

for any 12-month period will be paid for covered services.<br />

Accidental Ingestion of Controlled Drugs Expense: Expenses<br />

for a Medical Emergency arising from accidental ingestion or<br />

consumption of a controlled drug limited to:<br />

• Inpatient: While Hospital Confined, Expense incurred, up to<br />

a maximum of 80% of R&C up to 30 days in any calendar<br />

year.<br />

• Outpatient: While not Hospital Confined, Expense paid at<br />

80% of R&C up to a maximum of $500 per calendar year.<br />

Chiropractic Care Expense: Services rendered by a licensed<br />

chiropractor, to the same extent coverage is provided for services<br />

rendered by a Physician, if such chiropractic services (1) treat a<br />

condition covered under this Plan and (2) are within those<br />

services a chiropractor is licensed to perform.<br />

Treatment of Leukemia, Prosthetic Devices, Surgical<br />

Removal of Tumors Expense: Surgical removal of tumors and<br />

treatment of leukemia, including outpatient chemotherapy,<br />

reconstructive surgery, cost of any non-dental prosthesis<br />

including maxillo-facial prosthesis used to replace anatomic<br />

structures lost during treatment for head and neck tumors or<br />

additional appliances essential for the support of such<br />

prosthesis, and outpatient chemotherapy following surgical<br />

procedure in connection with the treatment of tumors. Such<br />

benefits shall be subject to the same terms and conditions<br />

applicable to all other benefits under this Plan. We will pay a<br />

Policy year benefit of: (1) $1,000 each policy year for the costs<br />

of removal of any breast implant; (2) $500 for the surgical<br />

removal of tumors; (3) $500 for reconstructive surgery; (4) $500<br />

for outpatient chemotherapy; and (5) An annual benefit of at<br />

least $350 for a wig and $300 for prosthesis, except that for<br />

purposes of the surgical removal of breast due to tumors, the<br />

policy year benefit shall be at least $300 for each breast.<br />

Hypodermic Needles or Syringes Expense: Physician<br />

prescribed hypodermic needles or syringes for the purpose of<br />

administering medications for medical conditions, provided<br />

such medications are covered under this Plan.<br />

Treatment of Inherited Metabolic Diseases and Medically<br />

Necessary Formulas: We will pay the expenses incurred for<br />

medical foods and low protein modified food products on the same<br />

basis as outpatient prescription drugs for the treatment of inherited<br />

Metabolic Diseases if the medical food or low protein modified food<br />

products are:<br />

a. Prescribed as Medically Necessary for the therapeutic<br />

treatment of inherited metabolic diseases; and<br />

b. Administered under the direction of a Physician.<br />

In so far as this benefit is concerned, the following definitions apply.<br />

Inherited metabolic disease means a disease for which a<br />

newborn screening is required under section 19a-55 (Connecticut),<br />

as amended; and cystic fibrosis<br />

Low Protein Modified Food Product means a food product that is:<br />

a. Specially formulated to have less than 1 gram of protein per<br />

serving; and<br />

b. Intended to be used under the direction of a Physician for<br />

the dietary treatment of an inherited metabolic disease.<br />

Low protein modified food product does NOT include a natural food<br />

that is naturally low in protein.<br />

Amino acid modification preparation means a product intended<br />

for the dietary treatment of an inherited metabolic disease under the<br />

direction of a physician.<br />

Specialized formula means a nutritional formula for children up to<br />

the age twelve (12) that is exempt from the general requirements for<br />

nutritional labeling under the statutory and regulatory guidelines of<br />

the federal Food and Drug Administration and is intended for use<br />

solely under medical supervision in the dietary management of<br />

specific diseases.<br />

Diabetes Treatment Expense: Treatment of insulin-dependent<br />

diabetes, insulin-using diabetes, gestational diabetes and non-<br />

Insulin using diabetes on the same basis as any other Sickness to<br />

include:<br />

1. Medically Necessary equipment, drugs and supplies, when<br />

prescribed by a Doctor.<br />

2. Diabetes outpatient self-management training, including but<br />

not limited to education and medical nutrition therapy.<br />

Benefits shall cover: (a) Initial training visits provided to an<br />

individual after the individual is initially diagnosed with the<br />

diabetes that is medically necessary for the care and<br />

management of diabetes, including but not limited to<br />

counseling in nutrition and the proper use of equipment and<br />

supplies for the treatment of diabetes, totaling a maximum of<br />

ten hours; (b) training and education that is medically<br />

necessary as a result of a subsequent diagnosis by a Doctor<br />

or a significant change in the individual’s symptoms or<br />

condition which requires modification of the individual’s<br />

program of self-management of diabetes, totaling a<br />

maximum of four hours, and (c) training and education that<br />

is medically necessary because of the development of new<br />

techniques and treatment for diabetes totaling a maximum of<br />

four hours.<br />

Treatment of Lyme Disease: We will pay the expenses incurred<br />

for the treatment of Lyme Disease. Such treatment will include:<br />

1. Not less than 30 days of intravenous antibiotic therapy or<br />

sixty days or oral antibiotic, or both, and<br />

2. Further treatment, if recommended by a board certified<br />

rheumatologist, infectious disease specialist or neurologist<br />

who is licensed in accordance with Connecticut statutes or<br />

who is licensed in another state or jurisdiction whose<br />

requirements for practicing in such capacity are substantially<br />

similar to or higher than those of Connecticut.<br />

10 11 12

Mastectomy, Reconstructive Breast Surgery or Lymph Node<br />

Dissection Expense: Benefits for such surgery will be paid under<br />

the Surgery Benefits. Coverage will be provided for at least 48 hours<br />

of inpatient care following a mastectomy or lymph node surgery.<br />

Coverage will be provided for longer periods of inpatient care if it is<br />

recommended by the patient’s treating Physician after conferring<br />

with the patient. We will also provide benefits for the reasonable<br />

costs of reconstructive surgery on each breast on which a<br />

mastectomy has been performed, and reconstructive surgery on a<br />

non-diseased breast to produce a symmetrical appearance. This<br />

benefit is subject to the same terms and conditions applicable to all<br />

other benefits under this Policy.<br />

Occupational Therapy Expense: We will pay a benefit, not to<br />

exceed 80% of Reasonable and Customary Charges, for the<br />

expenses incurred for occupational therapy received by a Covered<br />

Person as the result of a covered Accident.<br />

Care and Treatment of Insured with an Ostomy: We will pay the<br />

expenses for the care and treatment of an Insured who undergoes<br />

ostomy surgery. Such care and treatment includes coverage for<br />

Medically Necessary appliances and supplies relating to an ostomy<br />

including, but not limited to collection devices, irrigation equipment<br />

and supplies, skin barriers and skin protectors. This benefit will be<br />

payable not to exceed $2,500 per school year.<br />

Pain Management Benefit: We will pay the expenses incurred by<br />

a Covered Person for treatment by or under the management of a<br />

pain management specialist if required. We will also pay the<br />

expenses incurred for pain treatment ordered by such specialist.<br />

Such treatment may include all means necessary to make a<br />

diagnosis and develop a treatment Plan including the use of<br />

necessary medications and procedures.<br />

Hospital Dental Services: We will pay the expenses incurred for<br />

general anesthesia; nursing and related Hospital services<br />

provided in conjunction with inpatient, outpatient or one day<br />

dental services if the following conditions are met:<br />

1. The anesthesia, nursing and related Hospital services are<br />

deemed Medically Necessary by the treating dentist or oral<br />

surgeon and the Insured’s Physician; and<br />

2. The patient is either:<br />

a. Determined by a licensed dentist, in conjunction with a<br />

licensed Physician who specializes in primary care, to<br />

have a dental condition of significant dental complexity<br />

that the condition requires certain dental procedures to<br />

be performed in a Hospital; or<br />

b. A person who has a developmental disability, as<br />

determined by a licensed Physician who specializes in<br />

primary care that places the person at serious risk.<br />

c. Part B benefits will be considered a Covered Sickness<br />

the same as any other Sickness and is not subject to any<br />

dental benefit limits under this Policy.<br />

Cancer Clinical Trials: We will pay the expenses incurred for the<br />

routine patient care costs associated with cancer clinical trials. We<br />

will not pay such costs if they are eligible for reimbursement by<br />

any other entity, including the entity sponsoring the cancer clinical<br />

trial.<br />

Craniofacial Disorders: We will pay the expenses incurred for<br />

the Medically Necessary orthodontic processes and appliances<br />

for the treatment of craniofacial disorders for insured person age<br />

18 and younger. Such processes and appliances must be<br />

prescribed by a craniofacial team recognized by the American<br />

Cleft Palate – Craniofacial Association, except that no benefit will<br />

be paid for cosmetic surgery.<br />

Experimental Treatments: We will pay the expenses incurred by<br />

an Insured Person for experimental treatments, including<br />

procedures, treatments or the use of a drug as experimental if such<br />

procedure, treatment or drug, for the Sickness or condition being<br />

treated or for the diagnosis for which it is being prescribed, has<br />

successfully completed a phase III clinical trial of the Federal Food<br />

and Drug Administration. Such expenses will be paid the same as<br />

for any other Sickness under the applicable benefit provisions of this<br />

Policy, e.g. experimental surgical procedures under the surgery<br />

benefits, experimental drugs under the prescriptions benefits, etc.<br />

If an Insured Person has been diagnosed with a condition that<br />

creates a life expectancy in that person of less than two years<br />

and we have denied a benefit because we feel that it does not<br />

fit the above criteria, an Insured Person may request an<br />

expedited appeal of our decision as provided by this policy.<br />

Prescribed Drugs for Treatment of Cancer: When prescription<br />

drugs are covered under the Policy, we will pay the expenses<br />

incurred for treatment of a type of cancer for which the drug has not<br />

been approved by the Food and Drug Administration, provided the<br />

drug is recognized for treatment of the specific type of cancer in one<br />

of the following established reference compendia:<br />

1. The U.S. Pharmacopeia Drug Information Guide for Health<br />

Care Professionals (USP DI);<br />

2. The American Medical Association's Drug Evaluations (AMA<br />

DE); or<br />

3. The American Society of Hospital Pharmacist's American<br />

Hospital Formulary Service Drug Information (HAFS-DI).<br />

This benefit does NOT include coverage for any experimental or<br />

Investigational drugs or any drug which the federal Food and Drug<br />

Administration has determined to be contradicted for treatment of<br />

the specific type of cancer for which the drug has been prescribed.<br />

Neuropsychological Testing – When Dependent Coverage is<br />

part of the Insured Student’s coverage, We will provide<br />

Neuropsychological Testing for a Covered Child diagnosed<br />

with cancer on or after January 1, 2000 when ordered by a<br />

licensed physician to assess the extent of any cognitive or<br />

developmental delays in the Covered Child due to<br />

chemotherapy or radiation treatment.<br />

Isolation Care and Emergency Services– If an Insured<br />

Person requires Medically Necessary isolation care and/or<br />

emergency services that are provided by the state’s mobile field<br />

hospital We will provide coverage for the same services as for<br />

any other Sickness covered by this Policy. We will pay the<br />

same rates paid under the Medicaid program, as determined by<br />

the Connecticut Department of Social Services.<br />

Injuries Sustained While Insured Intoxicated: We will<br />

provide health care services to treat any Injury sustained while:<br />

1. Insured has an elevated blood alcohol content; or<br />

2. Insured is under the influence of intoxicating liquor or any<br />

drug or both.<br />

For the purpose of this benefit elevated blood alcohol content<br />

means a ratio of alcohol in the blood of such person that is<br />

eight-hundredths of one percent (08%) or more of alcohol by<br />

weight.<br />

CONTINUATION OF COVERAGE<br />

Any Insured Student who has been continuously covered under<br />

this Policy and prior student health insurance plans issued to<br />

Choate Rosemary Hall from one year to the next shall be covered<br />

for conditions first manifesting themselves while continuously<br />

insured, except for benefits payable under prior policies in the<br />

absence of this Policy.<br />

SUBROGATION<br />

If claims are incurred as a result of another person's<br />

negligence, the company has the right, as permitted by law, to<br />

seek reimbursement in accordance with the Policy.<br />

13 14 15

TERMINATION OF INSURANCE<br />

Benefits are payable under this Policy only for those Covered<br />

Expenses incurred while the Policy is in effect as to the Insured.<br />

No benefits are payable for expenses incurred after the date<br />

the insurance terminates for the Insured.<br />

EXCLUSIONS AND LIMITATIONS<br />

This Policy does not cover nor provide benefits for:<br />

1. Treatment, services or supplies which: are not Medically<br />

Necessary; are not prescribed by a Physician as necessary<br />

to treat a Sickness or Injury; are received without charge or<br />

legal obligation to pay; would not routinely be paid in the<br />

absence of insurance; are received from any family member.<br />

2. Expenses incurred as a result of loss due to war, or any<br />

action of war, declared or undeclared; service in the armed<br />

forces of any country.<br />

3. Injury or Sickness for which benefits are paid under any<br />

Workers Compensation or Occupational Disease law.<br />

4. Cosmetic surgery other than: Reconstructive surgery<br />

incidental to or following surgery resulting from trauma,<br />

infection, or other diseases of the involved part; or<br />

reconstructive surgery as the result of a congenital disease<br />

or anomaly as provided for dependent newborns during the<br />

first 31 days following birth.<br />

5. Riding as a passenger or otherwise in any vehicle or device<br />

for aerial navigation, except as fare-paying passenger in an<br />

aircraft operated by a commercial scheduled airline.<br />

6. Expenses incurred as a result of dental treatment, except as<br />

specifically stated.<br />

7. Eyeglasses, contact lenses, hearing aids, or prescriptions or<br />

examinations therefore, except as specifically provided<br />

under mandated benefits.<br />

8. Routine physical examinations and routine testing;<br />

preventive testing or treatment; and screening exams,<br />

except as specifically stated.<br />

9. Suicide or attempted suicide; or intentionally self-inflicted<br />

Injury, unless in conjunction with and as the result of a<br />

diagnosed Mental or Nervous Condition as defined and<br />

covered under the Policy.<br />

10. Treatment in a government Hospital, unless there is a<br />

legal obligation for the Covered Person to pay for such<br />

treatment.<br />

11. Injury sustained as the result of a motor vehicle Accident<br />

to the extent that benefits are recovered or recoverable<br />

under no-fault benefits insurance.<br />

PRE-EXISTING CONDITION LIMITATION<br />

Pre-existing Conditions are not covered for the first 12 months<br />

following a Covered Person’s Effective Date of coverage under<br />

the Policy. This limitation will not apply if:<br />

1. The Covered Person has been covered under the Policy<br />

for more than 12 months; or<br />

2. The individual seeking coverage under the Policy was<br />

previously covered under prior Creditable Coverage which<br />

was continuous to a date not less than 120 days prior to<br />

the effective date of coverage under the Policy (150 days<br />

prior to the effective date of coverage under the Policy if<br />

prior Creditable Coverage terminated due to an involuntary<br />

loss of employment) provided the Covered Person applied<br />

for coverage under the Policy within 30 days of initial<br />

eligibility.<br />

Creditable Coverage includes coverage under any of the<br />

following without a break in coverage of 120 days or more: a<br />

group health plan; health insurance coverage; Medicaid or<br />

Medicare; a State Health Benefit Risk Pool; United States<br />

military sponsored health care; Public Health Plan; the Federal<br />

Employees Health benefit plan; a medical care program of the<br />

Indian Health Service or of a tribal organization; a health plan<br />

under the Peace Corp Act. See Policy on file with the school for<br />

a full definition of Creditable Coverage.<br />

CLAIMS PROCEDURES FOR DOMESTIC AND<br />

INTERNATIONAL STUDENTS<br />

In the event of an Injury or Sickness the Insured Student<br />

should:<br />

1. If at Choate Rosemary Hall, report immediately to the<br />

Health Center so that proper treatment can be prescribed<br />

or approved, and obtain a claim form; or<br />

2. If away from Choate Rosemary Hall, or for ob/gyn<br />

treatment, consult a Physician and obtain a claim form<br />

from Willis of CT, LLC or Consolidated Health Plans or at<br />

www.chpstudent.com.<br />

3. Notify the Claims Administrator, Consolidated Health<br />

Plans, within 30 days after the date of the Injury or<br />

commencement of the Sickness, or as soon thereafter as<br />

is reasonably possible.<br />

4. Complete the claim form in full. The completed claim form<br />

should be mailed within 90 days from the date of Injury or<br />

from the date of the first medical treatment for a Sickness,<br />

or as soon as reasonably possible. Retain a copy for your<br />

records and mail a copy to the Claims Administrator,<br />

Consolidated Health Plans, at the address listed on the<br />

following page.<br />

5. Itemized medical bills must be attached to the claim form<br />

at the time of submission. Subsequent medical bills should<br />

be mailed promptly to the Claims Administrator at the<br />

address listed on the following page. No additional claim<br />

forms are needed as long as the Insured Student’s name<br />

and identification number are included on the bill. Direct all<br />

questions regarding benefits available under the Policy,<br />

claim procedures, status of a submitted claim or payment<br />

of a claim to the Claims Administrator, Consolidated<br />

Health Plans at the address below.<br />

REMEMBER THAT EACH INJURY OR SICKNESS IS A<br />

SEPARATE CONDITION AND A SEPARATE CLAIM FORM IS<br />

REQUIRED FOR EACH CONDITION.<br />

HOW TO FILE AN APPEAL<br />

Once a claim is processed and upon receipt of an Explanation<br />

of Benefits (EOB), an insured student who disagrees with how a<br />

claim was processed may appeal that decision. The student<br />

must request an appeal in writing within 60 days of the date<br />

appearing on the EOB. The appeal request must include why<br />

they disagree with the way the claim was processed. The<br />

request must include any additional information they feel<br />

supports their request for appeal, e.g. medical records,<br />

physician records, etc. Please submit all requests to the<br />

following:<br />

Consolidated Health Plans<br />

2077 Roosevelt Avenue<br />

Springfield, MA 01104<br />

The Policy is Underwritten By:<br />

Niagara Life and Health Insurance Company of Columbia, SC<br />

Policy Form: NLH-SH5-12 (CT)<br />

For a copy of the privacy notice you may:<br />

go to<br />

www.consolidatedhealth plan.com/about/hipaa<br />

or<br />

Request one from the Health Office at your School<br />

or<br />

Request one from:<br />

Commercial Travelers Mutual Insurance Company<br />

C/O Privacy Officer<br />

70 Genesee Street<br />

Utica, NY 13502<br />

16 17 18

(Please indicate the school you attend with your written request)<br />

Servicing Agent:<br />

Willis of CT, LLC<br />

185 Asylum Street, 25 th Floor<br />

Hartford, CT 06103<br />

(860) 278-1320 or (800) 843-5404, ext. 45391<br />

Claims Administered By:<br />

Consolidated Health Plans<br />

2077 Roosevelt Avenue<br />

Springfield, MA 01104<br />

(800) 633-7867<br />

www.chpstudent.com<br />

Any provision of the Policy or the brochure which is in conflict<br />

with the statutes of the state in which the Policy is issued, will<br />

be administered to conform to the requirements of the state<br />

statues.<br />

Representations of this plan must be approved by the<br />

Company.<br />

EMERGENCY MEDICAL AND TRAVEL ASSISTANCE<br />

FrontierMEDEX ACCESS services is a comprehensive<br />

program providing You with 24/7 emergency medical and travel<br />

assistance services including emergency security or political<br />

evacuation, repatriation services and other travel assistance<br />

services when you are outside Your home country or 100 or<br />

more miles away from your permanent residence.<br />

FrontierMEDEX is your key to travel security.<br />

For general inquiries regarding the travel access<br />

assistance services coverage, please call Consolidated<br />

Health Plans at 1-800-633-7867.<br />

If you have a medical, security, or travel problem, simply call<br />

FrontierMEDEX for assistance and provide your name, school<br />

name, the group number shown on your ID card, and a<br />

description of your situation. If you are in North America, call<br />

the Assistance Center toll-free at: 1-800-527-0218 or if you are<br />

in a foreign country, call collect at: 1-410-453-6330.<br />

If the condition is an emergency, you should go<br />

immediately to the nearest physician or hospital without<br />

delay and then contact the 24-hour Assistance Center.<br />

FrontierMEDEX will then take the appropriate action to<br />

assist You and monitor Your care until the situation is<br />

resolved.<br />

VISION DISCOUNT PROGRAM<br />

For Vision Discount Benefits please go to:<br />

www.chpstudent.com<br />

<strong>CHOATE</strong> <strong>ROSEMARY</strong> <strong>HALL</strong><br />

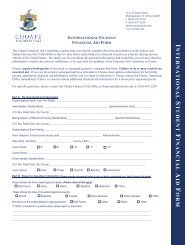

Insurance Election Form<br />

2012-2013<br />

Sickness and Accident Coverage<br />

Students Name: _____________________________________<br />

Date of Birth: _______________<br />

I understand that proof of medical insurance is required for<br />

attendance at Choate Rosemary Hall. The school Student<br />

Insurance Plan underwritten by Niagara Life and Health<br />

Insurance Company will extend from 9/1/2012 – 9/1/2013 and<br />

cover the student while attending school, at home, and while<br />

traveling.<br />

DOMESTIC & INTERNATIONAL STUDENTS<br />

I select one of the following options:<br />

Plan A (Domestic Only): Since I have viable medical<br />

insurance available for my child, I elect this plan, which is<br />

primary over my own insurance. (Please check with your<br />

insurance company to see if benefits will extend to services<br />

rendered in Connecticut. Most HMO’s and PPO Plans do not). I<br />

understand that Plan A is designed for students whose current<br />

medical insurance has a high deductible. The Policy pays<br />

covered expenses up to 100% of R&C to a maximum of<br />

$5,000 per year.<br />

Premium: $240<br />

Plan B (Domestic & International): Since I do not have a<br />

viable medical insurance Policy for my child or I have HMO<br />

coverage, I elect this plan which will serve as his/her primary<br />

insurance. The plan pays up to 100% of R&C of covered<br />

expenses incurred from injury or sickness up to a<br />

maximum of $200,000 for each incident.<br />

Premium: $979<br />

I elect to waive all of the above coverage as I am currently<br />

covered under a U.S. viable medical insurance policy. I will<br />

maintain health Insurance coverage throughout my child’s CHR<br />

career and will provide the Health Center with updated cards as<br />

necessary. Attached is a copy of both sides of my<br />

insurance card.<br />

I am covered by: _________________________________<br />

My Policy # is: ___________________________________<br />

Parent’s Signature: ___________________________________<br />

19 20

The following information is required if ELECTING a<br />

Student Insurance Plan.<br />

STUDENT INFORMATION M F<br />

Are you a U.S. Citizen? Yes No<br />

Student Name: ______________________________________<br />

Date of Birth: _______________<br />

__________________________________________________<br />

HOME Street Address<br />

__________________________________________________<br />

City, State, Zip<br />

__________________________________________________<br />

Parents Signature<br />

Please return this form with your check in the enclosed<br />

envelope by October 15, 2012 to:<br />

Consolidated Health Plans<br />

2077 Roosevelt Avenue<br />

Springfield, MA 01104<br />

OR<br />

You may enroll on-line at: www.chpstudent.com.<br />

We accept both MasterCard and Visa.<br />

For questions, please contact your servicing agent, Willis of CT,<br />

LLC at 1-800-843-5404, ext. 45391.<br />

Form EF-I5A18<br />

19 20