manitou springs city council regular meeting agenda city council

manitou springs city council regular meeting agenda city council

manitou springs city council regular meeting agenda city council

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

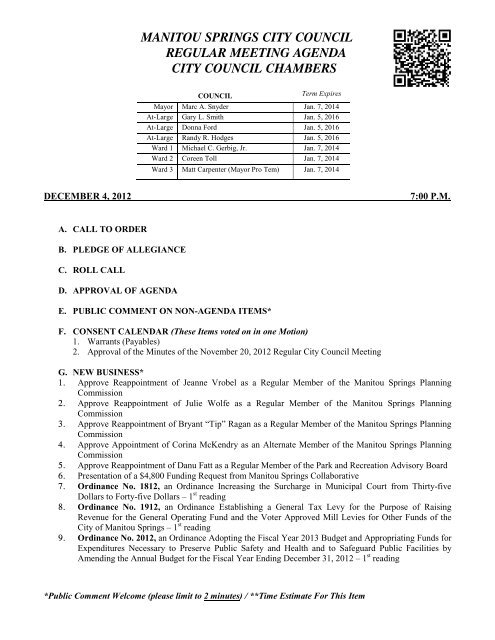

MANITOU SPRINGS CITY COUNCIL<br />

REGULAR MEETING AGENDA<br />

CITY COUNCIL CHAMBERS<br />

COUNCIL<br />

Term Expires<br />

Mayor Marc A. Snyder Jan. 7, 2014<br />

At-Large Gary L. Smith Jan. 5, 2016<br />

At-Large Donna Ford Jan. 5, 2016<br />

At-Large Randy R. Hodges Jan. 5, 2016<br />

Ward 1 Michael C. Gerbig, Jr. Jan. 7, 2014<br />

Ward 2 Coreen Toll Jan. 7, 2014<br />

Ward 3 Matt Carpenter (Mayor Pro Tem) Jan. 7, 2014<br />

DECEMBER 4, 2012<br />

7:00 P.M.<br />

A. CALL TO ORDER<br />

B. PLEDGE OF ALLEGIANCE<br />

C. ROLL CALL<br />

D. APPROVAL OF AGENDA<br />

E. PUBLIC COMMENT ON NON-AGENDA ITEMS*<br />

F. CONSENT CALENDAR (These Items voted on in one Motion)<br />

1. Warrants (Payables)<br />

2. Approval of the Minutes of the November 20, 2012 Regular City Council Meeting<br />

G. NEW BUSINESS*<br />

1. Approve Reappointment of Jeanne Vrobel as a Regular Member of the Manitou Springs Planning<br />

Commission<br />

2. Approve Reappointment of Julie Wolfe as a Regular Member of the Manitou Springs Planning<br />

Commission<br />

3. Approve Reappointment of Bryant “Tip” Ragan as a Regular Member of the Manitou Springs Planning<br />

Commission<br />

4. Approve Appointment of Corina McKendry as an Alternate Member of the Manitou Springs Planning<br />

Commission<br />

5. Approve Reappointment of Danu Fatt as a Regular Member of the Park and Recreation Advisory Board<br />

6. Presentation of a $4,800 Funding Request from Manitou Springs Collaborative<br />

7. Ordinance No. 1812, an Ordinance Increasing the Surcharge in Municipal Court from Thirty-five<br />

Dollars to Forty-five Dollars – 1 st reading<br />

8. Ordinance No. 1912, an Ordinance Establishing a General Tax Levy for the Purpose of Raising<br />

Revenue for the General Operating Fund and the Voter Approved Mill Levies for Other Funds of the<br />

City of Manitou Springs – 1 st reading<br />

9. Ordinance No. 2012, an Ordinance Adopting the Fiscal Year 2013 Budget and Appropriating Funds for<br />

Expenditures Necessary to Preserve Public Safety and Health and to Safeguard Public Facilities by<br />

Amending the Annual Budget for the Fiscal Year Ending December 31, 2012 – 1 st reading<br />

*Public Comment Welcome (please limit to 2 minutes) / **Time Estimate For This Item

H. MAYOR’S REPORT<br />

I. RECEIVE OR ACT ON COUNCIL CORRESPONDENCE<br />

J. CITY COUNCIL LIAISON REPORTS<br />

K. CITY ADMINISTRATOR’S REPORT<br />

L. FUTURE AGENDAS<br />

• December 11, 2012 – Special Meeting<br />

• December 18, 2012 – Regular Meeting<br />

• January 8, 2013 – Worksession<br />

• January 15, 2013 – Regular Meeting<br />

ADJOURNMENT<br />

*Public Comment Welcome (please limit to 2 minutes) / **Time Estimate For This Item

A Regular Meeting of the Manitou Springs City Council was held in the City Council Chambers, 606 Manitou Avenue,<br />

Manitou Springs, Colorado, on November 20, 2012.<br />

COUNCILMEMBERS PRESENT FOR ROLL CALL:<br />

Mayor Pro Tem Matt Carpenter<br />

Councilman Gary L. Smith<br />

Councilman Randy R. Hodges<br />

Councilman Michael Gerbig, Jr.<br />

Councilwoman Coreen Toll<br />

COUNCILMEMBERS NOT PRESENT FOR ROLL CALL:<br />

Mayor Marc A. Snyder<br />

Councilwoman Donna Ford<br />

STAFF PRESENT:<br />

City Administrator Jack Benson<br />

City Attorney Jeff Parker<br />

Planning Director Dan Folke<br />

Public Services Director Bruno Pothier<br />

Police Chief Joe Ribeiro<br />

City Clerk Donna Kast<br />

A. CALL TO ORDER<br />

Mayor Pro Tem Carpenter called the <strong>meeting</strong> to order at 7:01 pm.<br />

B. PLEDGE OF ALLEGIANCE<br />

The <strong>meeting</strong> was opened with the Pledge of Allegiance.<br />

C. ROLL CALL<br />

All members of City Council were present for roll call with the exception of Mayor Snyder, who was excused, and<br />

Councilwoman Ford, who arrived at 7:04 pm.<br />

D. APPROVAL OF AGENDA<br />

Mayor Pro Tem Carpenter noted that the <strong>agenda</strong> had been amended to include Item G.6, “Approval of an eCivis Master<br />

Subscription and Service Agreement.”<br />

Upon a motion by Councilman Smith and a second by Councilman Hodges, the amended <strong>agenda</strong> was unanimously<br />

approved. Motion carried 5-0.<br />

None.<br />

E. PUBLIC COMMENT ON NON-AGENDA ITEMS<br />

Councilwoman Ford arrived at 7:04 pm.<br />

F. CONSENT CALENDAR (These Items voted on in one Motion)<br />

The following items were acted upon by unanimous consent of the members present:<br />

1. Warrants (Payables)<br />

2. Approval of the Minutes of the October 9, 2012 Special City Council Meeting<br />

3. Approval of the Minutes of the October 16, 2012 Regular City Council Meeting

NOVEMBER 20, 2012 Regular City Council Meeting Page 2 of 5<br />

4. Approval of the Minutes of the October 23, 2012 Special City Council Meeting<br />

5. Approval of the Minutes of the October 30, 2012 Special City Council Meeting<br />

6. Approval of the Minutes of the November 13, 2012 Special City Council Meeting<br />

7. Approval of a Noise Variance for a Wedding in Mansions Pavilion from 1:00 pm – 10:00 pm on Saturday,<br />

March 23, 2013 – Michelle Morley, Applicant<br />

8. Approval of a Noise Variance for a Wedding in Seven Minute Spring Gazebo from 3:00 pm – 6:00 pm on<br />

Saturday, September 7, 2013 – Caitlin KcKeown, Applicant<br />

Upon a motion by Councilman Gerbig and a second by Councilwoman Toll, the consent calendar was approved. Motion<br />

carried 6-0.<br />

G. NEW BUSINESS<br />

1. Approval of Appointment of Cylinda Walker as a Regular Member of the Historic Preservation<br />

Commission<br />

Cylinda Walker introduced herself and provided information regarding her background.<br />

Upon a motion by Councilman Hodges and a second by Councilman Gerbig, Cylinda Walker was unanimously approved<br />

as a Regular Member of the Historic Preservation Commission. Motion carried 6-0.<br />

2. Approve Contract with ComPlus Data Innovations for a Handheld Enforcement System<br />

Chief Joe Ribeiro presented this item. He said a committee had been formed to focus on the acquisition of a new system<br />

of handhelds for the Parking Enforcement officers. The committee included Chief Ribeiro, Officer Matthew French,<br />

Planner Michelle Anthony and the members of the Parking Authority Board. ComPlus Data Innovations was chosen<br />

because of their business model, payment methodology, and services provided; all of which the committee believed<br />

provided the best value for the City. Chief Ribeiro said ComPlus is a user-friendly system, with online or in-person<br />

handheld training available.<br />

Dan Wood inquired as to where the additional revenue generated would be used. Jack Benson explained that it would be<br />

put back into the parking program, including using funds for the implementation of a free shuttle and a possible future<br />

parking structure.<br />

Upon a motion by Councilwoman Toll and a second by Councilman Hodges, the contract with ComPlus Data Innovations<br />

for a handheld enforcement system was unanimously approved. Motion carried 6-0.<br />

3. AP 1203 – An appeal of the denial of V 1216 Height Variance, 944 Midland Avenue, Joanne Pearring<br />

for Judith, Jenelle and Jeffrey Pearring, Applicant<br />

4. AP 1204 – An appeal of the denial of V 1217 Height Variance, 946 Midland Avenue, Joanne Pearring<br />

for Judith, Jenelle and Jeffrey Pearring, Applicant<br />

5. AP 1205 – An appeal of the denial of V 1218, Height Variance, 948 Midland Avenue, Joanne Pearring<br />

for Judith, Jenelle and Jeffrey Pearring, Applicant.<br />

Mayor Pro Tem Carpenter called the next three items, stating that all three appeals would be heard together.<br />

Attorney Parker summarized the procedure for the appeal process. He asked the City Council if anyone had any ex parte<br />

communications to disclose. Councilwoman Toll said she had visited the property and asked one of the residents if she<br />

could walk around the property and he gave his permission. Councilwoman Ford said she visited the property and said<br />

hello to a neighbor. Mayor Pro Tem Carpenter disclosed that Pikes Peak Marathon/Ascent rented Ms. Pearring’s property<br />

located at 514 El Paso Boulevard, and he worked closely with Ms. Pearring at the time. Attorney Parker asked Mayor Pro<br />

Tem Carpenter if this interaction would bias him in any way, and he said no. It was determined that none of these<br />

interactions would constitute a conflict of interest.

NOVEMBER 20, 2012 Regular City Council Meeting Page 3 of 5<br />

Ms. Joanne Pearring spoke in behalf of her children. She said that when the property was purchased she was told it was<br />

comprised of three buildable lots. Eventually the family discovered that ten feet of the property was sold to a neighbor,<br />

negating the three lots, which is why they were asking for a minor subdivision. The proposed homes would be five feet<br />

taller, twelve feet deeper and five feet wider than the existing home. Ms. Pearring said she felt the Planning<br />

Commission’s presentation was inaccurate and skewed, which is the basis of her appeal. She outlined the overall design<br />

of the proposed homes. She felt that staff’s calculation of the building being of 60% density on the lot was inaccurate and<br />

explained that by her calculation the density was 25%.<br />

Councilwoman Toll asked if the ten-foot portion of the property had been sold when Ms. Pearring purchased the property,<br />

which was answered in the affirmative. Councilwoman Toll then asked about the work to be done on the property and<br />

whether it would be completed by a licensed contractor. Ms. Pearring said her husband would assist and he has a “B”<br />

contractor’s license.<br />

Councilman Gerbig asked for more details on the methodology behind the current design. Ms. Pearring summarized other<br />

options considered prior to choosing the current design.<br />

Mayor Pro Tem Carpenter asked why Ms. Pearring was asking for a height variance and she explained it was because the<br />

building will be over 25 feet. He also asked for clarification of a statement made in her appeal whereby she stated that it<br />

was impossible for the Planning Commission to hear her presentation above the negative energy of several neighbors who<br />

were present at the <strong>meeting</strong>. Ms. Pearring explained that she did not mean for her statement to be taken literally,<br />

admitting that the Planning Commission was actually able to hear the proceedings. Rather, it was her opinion that a room<br />

filled with the negativity of her neighbors prevented the Planning Commission from rendering a fair decision.<br />

Mr. Folke explained the concept of floor area ratio and how it was used to calculate the square footage of the home,<br />

finished and unfinished, hence its density on the lot. He said this was how the percentages were figured in the staff report<br />

and noted that this was the standard procedure used for all applications.<br />

Councilwoman Toll mentioned the character of the neighborhood, which is comprised of small one or two bedroom<br />

homes, and noted that the size of the proposed house is what is at issue with the neighbors.<br />

Councilman Hodges read from the MS Forward Guide, adopted by Council, and pointed out several passages from the<br />

“Built Environment” section of the guide that he felt were in direct opposition to the Pearring project.<br />

Councilman Gerbig said he felt the criteria City Council should consider should be to allow for the reasonable use of the<br />

property in its current zone in the absence of relief.<br />

Councilwoman Ford said she felt the height restrictions should be adhered to.<br />

Councilman Smith said he was in support of the recommendations made by staff and the Planning Commission.<br />

Councilwoman Toll felt a redesign would be beneficial as there is plenty of room on the lot to build back instead of up.<br />

Councilman Gerbig made a motion, seconded by Councilwoman Toll, to deny AP 1203, AP 1204, and AP 1205 with the<br />

finding that the building height definition adopted by the Planning Commission, and proposed by staff, was the correct<br />

building height definition and application of that definition. In addition with the finding that the conditions of the<br />

Planning Commission hearing did not have such a negative impact so as to influence the decision and therefore is not a<br />

valid basis for appeal. And with the finding that the criteria for granting a variance, as listed in the Code for all three<br />

building sites, have not been met and the Planning Commission did not err in making that decision. Upon a call for the<br />

vote, the motion unanimously carried. Motion passed 6-0.<br />

Councilwoman Toll made a motion, seconded by Councilman Hodges, to direct the City Attorney to draft an order based<br />

upon the decision to be brought back for approval at a future <strong>meeting</strong>. Upon a call for the vote, the motion unanimously<br />

carried. Motion passed 6-0.

NOVEMBER 20, 2012 Regular City Council Meeting Page 4 of 5<br />

Mayor Pro Tem Carpenter called for a break at 8:35 pm. The <strong>meeting</strong> resumed at 8:39 pm.<br />

6. Approval of an eCivis Master Subscription and Service Agreement<br />

Upon a motion by Councilman Gerbig and a second by Councilwoman Toll, an eCivis Master Subscription and Service<br />

Agreement was approved. Motion passed 6-0.<br />

H. EXECUTIVE SESSION<br />

1. An Executive Session Pursuant to Section 5.1(c) of the Manitou Springs City Charter to Hold a Conference<br />

with the City Attorney to Receive Legal Advice on Pending Litigation or Imminent Court Action. The<br />

Following Additional Details are Provided for Informational Purposes: To Discuss Pending Litigation or<br />

Imminent Court Action.<br />

Upon a motion by Councilwoman Toll and a second by Councilman Hodges, the City Council went into executive<br />

session. Motion carried 6-0.<br />

Upon a motion by Mayor Pro Tem Carpenter and a second by Councilwoman Ford, the City Council came out of<br />

executive session and reconvened in <strong>regular</strong> session. Motion carried 6-0.<br />

None.<br />

I. MAYOR’S REPORT<br />

J. RECEIVE OR ACT ON COUNCIL CORRESPONDENCE<br />

Mayor Pro Tem Carpenter said he received a note from Chief Ribeiro stating that Code Enforcement personnel are<br />

addressing the complaints regarding the Red Wing Motel and the property is looking better.<br />

Councilwoman Toll received an email from a teacher at the high school and sponsor of the recycling club. She said the<br />

club is modeling their recycling program after the City’s single-hauler program.<br />

Mayor Pro Tem Carpenter mentioned an email about Memorial Park that Council members should have received. Mr.<br />

Benson suggested a discussion regarding the issue to be held at a future worksession.<br />

K. CITY COUNCIL LIAISON REPORTS<br />

Councilwoman Toll said she met with the Avenue Project group. They have put together a poster and will be putting<br />

together a video about the Avenue Project and the effects of panhandling on the community as a whole. Mr. Benson said<br />

he was interviewed by Channel 5 about the project and he determined to keep the interview positive.<br />

None.<br />

None.<br />

L. PLANNING DIRECTOR REPORT<br />

M. FINANCE DIRECTOR REPORT<br />

N. CITY ADMINISTRATOR REPORT<br />

Mr. Benson commented on the improved fire department report included in the packet.<br />

Councilwoman Toll asked how the El Paso/Beckers Fund money was going to be accounted for following the election and<br />

Mr. Benson explained that the money would stay in the El Paso/Beckers Fund but could be spent on any park.

NOVEMBER 20, 2012 Regular City Council Meeting Page 5 of 5<br />

O. FUTURE AGENDAS<br />

• December 4, 2012 – Regular Meeting<br />

• December 11, 2012 – Special Meeting<br />

• December 18, 2012 – Regular Meeting<br />

ADJOURNMENT<br />

With no further business to conduct, Mayor Pro Tem Carpenter concluded the <strong>meeting</strong>.<br />

__________________________________________________<br />

MAYOR AND CITY COUNCIL<br />

__________________________________________________<br />

CITY CLERK

I would like a new term on the Planning Commission. My current term expires the<br />

end of December. Dan and Michelle asked me to email you regarding being reappointed<br />

for another term.<br />

Thank you,<br />

Jeanne Vrobel

To Manitou Springs City Council and Planning Commission staff:<br />

I am requesting to be re-appointed to another term with the Manitou<br />

Springs Planning Commission. It has been an honor to have the<br />

opportunity this past year to serve on the Commission. I have learned a lot<br />

and have enjoyed the experience. Thank you for considering my request.<br />

Respectfully,<br />

Julie Wolfe

25 November 2012<br />

Dear Colleagues:<br />

It has been very gratifying to participate on the Planning Commission of Manitou<br />

Springs. Witnessing the dedication of the <strong>city</strong>’s planners, staff, and <strong>council</strong><br />

makes me realize how fortunate we are to live in this unique community!<br />

If the City Council and Planning Department would like me to continue to serve<br />

as a member of the Planning Commission, I would be very honored to do so. It<br />

has been a real privilege for me to work with you all. But if you feel that it is time<br />

to bring some “new blood” on to the committee, I understand that as well! I am<br />

good with whatever decision you make! Just let me know either way.<br />

Sincerely,<br />

Bryant “Tip” Ragan

Dear Ms. Kast,<br />

Please accept this e-mail as application for becoming an alternate member of the Manitou Springs Planning<br />

Commission. I have lived in Manitou Springs for a year now and look forward to the opportunity to become<br />

involved in my new town.<br />

In addition to my personal interest in civic involvement, I work as a professor of political science and<br />

environmental politics at Colorado College. Much of my research is on cities, including <strong>city</strong> planning (with an<br />

emphasis on sustainability). I hope that some of my knowledge may be useful to the Planning Commission, as<br />

appropriate and relevant.<br />

Please contact me if I can provide you with any additional information. I can be reached at:<br />

5 Oak Ridge Rd<br />

Manitou Springs, CO 80829<br />

719-291-7850 (cell)<br />

719-389-6788 (work)<br />

Thank you for your time and consideration.<br />

Sincerely,<br />

Corina McKendry

I would like to be reappointed to PARAB.<br />

Danu Fatt<br />

Sent from my iPhone

Manitou Springs Collaborative (MSC)<br />

Implementation Plan for the<br />

Manitou Springs Forward Vision and Planning Guide (MSFVP Guide)<br />

City Council 12/4/12<br />

Objectives:<br />

Note: items in blue are already in progress.<br />

1. Create a working group to achieve the implementation objectives. Manitou Springs<br />

Collaborative (MSC) formed and two <strong>meeting</strong>s already.<br />

MSC purpose:<br />

To champion, inspire, educate, support and promote the use of the MSFVPG in the<br />

community to fulfill the visions in the Guide.<br />

2. Provide a full (209 pages with appendices) and a shortened printed document (50<br />

pages) for City Council, staff and interested community leaders of the MSF Vision and<br />

Planning Guide. Design in progress.<br />

a. Each of the 50 Manitou Springs organizations gets a shortened version of the<br />

MSFVPG.<br />

3. Meet with organizations to monitor, encourage and support the implementation of the<br />

community vision statements. In progress.<br />

a. Organizations take ownership of visions. Keep visions in forefront.<br />

b. Outline for people to use when go to a <strong>meeting</strong>.<br />

c. Work with <strong>city</strong> <strong>council</strong> and smaller boards on particular alignments between <strong>city</strong><br />

<strong>council</strong>/smaller boards.<br />

d. To provide direction for current issues: Parking, City Budget, flooding from<br />

Waldo fire, H. S. Prom…<br />

4. Catalogue and update community organization, boards, commissions, initiatives and<br />

projects. Completed and is being updated.<br />

5. Community Engagement: Every resident and lover of Manitou Springs is exposed to the<br />

10 vision statements. Examples:<br />

a. Pikes Peak Bulletin has an article about each one (monthly)<br />

b. Independent<br />

c. City Newsletter in PPB<br />

d. Displayed in town<br />

e. Celebrate and publicize successes and actions that highlight plan<br />

f. Annual community <strong>meeting</strong> (potluck) to inform and celebrate progress and<br />

successes toward the visions.<br />

g. Annual Visionary Leadership Award to inspire leadership in the community to<br />

bring visions to fruition.<br />

1

6. A clearinghouse of ideas, networking and collaboration to discuss the visions, policies<br />

and strategies for each of the 10 community visions.<br />

a. Use electronic strategies i.e. MSF Facebook page, iManitou website, City of<br />

Manitou Springs website, MSC website, social or other electronic media.<br />

7. Help identify and promote the creation of local, regional and state policies which will<br />

support the community visions.<br />

a. Model/learn from the Pikes Peak Regional plan<br />

b. State Representative-Pete Lee, County – Salle Clarke…<br />

8. Make sure the Guide is used by the City and other organizations during budget<br />

discussions.<br />

9. Identify organizations that can offer funding for vision related projects and connect<br />

existing organizations with these funding sources.<br />

a. For example, recently a Colorado Trust grant has been awarded to fund a Health<br />

and Wellbeing Convening.<br />

City budget request for the above Plan: $4,800<br />

$ 2,400 Printing: # 2 above<br />

5 full MSFVPG’s: $250,<br />

100 shortened versions of the MSFVPG: $2,000<br />

100 one page (cover and 10 vision statements) $150<br />

$ 700 Community Engagement: #5 above.<br />

$1,700 Grant writing fee: # 9 above.<br />

$4,800 Total<br />

2

COUNCIL BILL NO. 4812 ORDINANCE NO. 1812<br />

ORDINANCE<br />

_________________________________________<br />

AN ORDINANCE INCREASING THE SURCHARGE IN MUNCIPAL COURT FROM THIRTY-<br />

FIVE DOLLARS TO FORTY-FIVE DOLLARS.<br />

WHEREAS,<br />

WHEREAS<br />

The surcharge assessed against defendants who either plead guilty or are found to be guilty<br />

has been set at thirty-five dollars for a number of years, and<br />

City <strong>council</strong> finds and determines that it is in the public interested to increase said surcharge<br />

from thirty-five to forty-five dollars;<br />

NOW, THEREFORE, BE IT ORDAINED BY THE CITY COUNCIL OF THE CITY OF MANITOU<br />

SPRINGS, COLORADO, THAT:<br />

Section 1:<br />

Section 1.32.120 of the Code of ordinances of the City of Manitou Springs is hereby amended<br />

by the addition of this sentence which shall be placed between the third and final sentences of<br />

the current text of said Section:<br />

In all such cases except for parking ticket cases, the court shall also assess a surcharge in the<br />

amount of forty-five dollars, and all such surcharges received shall be deposited into the Law<br />

Enforcement Special Revenue Fund.<br />

Section 2:<br />

This Ordinance shall take effect five days after final approval and adoption on second reading.<br />

Passed on First Reading and Ordered Published this 4th day of December, 2012.<br />

______________________________<br />

City Clerk<br />

A Public Hearing on Ordinance No. 1812 will be held at the December 11, 2012, Special City Council<br />

<strong>meeting</strong>. The Council Meeting will be held at 7:00 P.M. at City Hall, 606 Manitou Avenue, Manitou<br />

Springs, Colorado.<br />

Ordinance Published December 4, 2012<br />

City’s Official Website and City Hall

COUNCIL BILL NO. 4912 ORDINANCE NO. 1912<br />

ORDINANCE<br />

AN ORDINANCE ESTABLISHING A GENERAL TAX LEVY FOR THE PURPOSE OF RAISING<br />

REVENUE FOR THE GENERAL OPERATING FUND, AND THE VOTER APPROVED MILL LEVIES<br />

FOR OTHER FUNDS OF THE CITY OF MANITOU SPRINGS.<br />

________________________<br />

WHEREAS,<br />

the City is required by law to levy taxes sufficient to fund the budget adopted for the coming year;<br />

NOW, THEREFORE, BE IT ORDAINED BY THE CITY COUNCIL OF THE CITY OF MANITOU<br />

SPRINGS, COLORADO, THAT:<br />

Section 1:<br />

There is hereby levied upon all real, personal and mixed property within the corporate City limits<br />

of the City of Manitou Springs, Colorado, taxable according to law, for the purpose of raising<br />

revenue for the said City for the year 2013 for the purpose as follows:<br />

GENERAL FUND<br />

Temporary Mill Levy Rate Reduction<br />

CAPITAL IMPROVEMENTS FUND<br />

OPEN SPACE & PARKS (APP 1995)<br />

BECKERS / EL PASO PARK (APP 1997)<br />

10.594 MILLS<br />

(00.88) MILLS<br />

00.556 MILLS<br />

00.800 MILLS<br />

01.000 MILLS<br />

12.070 MILLS<br />

Section 2:<br />

Section 3:<br />

The City Clerk is hereby authorized and directed to notify the Board of County Commissioners to<br />

extend said levy on the tax rolls.<br />

This Ordinance shall be in full force and effect from and after five (5) days following its final<br />

passage and approval.<br />

Passed on First Reading and Ordered Published this 4th day of December 2012.<br />

______________________________<br />

City Clerk<br />

A Public Hearing will be held at the December 11, 2012 Special City Council <strong>meeting</strong>. The Council<br />

Meeting will be held at 7:00 P.M. at City Hall, 606 Manitou Avenue, Manitou Springs, Colorado.<br />

Ordinance Published December 4, 2012 (in full)<br />

City’s Official Website and City Hall

Jack Benson, City Administrator<br />

606 Manitou Avenue<br />

Manitou Springs, Colorado 80829<br />

From the desk of:<br />

Direct: 719-685-2560<br />

Fax: 719-685-5233<br />

E-mail: jbenson@comsgov.com<br />

Website:<br />

www.<strong>manitou</strong><strong>springs</strong>gov.com<br />

Memorandum<br />

To:<br />

From:<br />

Marc Snyder, Mayor<br />

Manitou Springs City Council<br />

Jack Benson, City Administrator<br />

Rebecca Davis, Finance Director<br />

Date: December 4, 2012<br />

Re:<br />

FY2013 Budget Proposal, First Reading<br />

As required by the City’s Home Rule Charter, enclosed is our fiscal plan for FY2013. This plan is a culmination of<br />

several work sessions and a daylong retreat with Council to workout spending requests and fiscal strategies. With a<br />

successful election, the City has been able to address our less than adequate General Fund reserve balance, begin a<br />

phased adjustment to our lagging compensation expenses, particularly in Public safety, and dedicates some monies to<br />

start implementing the <strong>city</strong>’s parking program.<br />

As was highlighted in our preliminary budget plan, this budget came on the heels of what continues to be a very difficult<br />

2012 sale tax season. While the national economy has seen some slow recovery over the past year, our local<br />

economy took a significant hit with the Waldo Canyon Wildfire and the lingering threat of post-fire, flash flooding. All our<br />

tourism based taxing revenues declined after the fire and recovery to expected trends, as of this writing, have yet to be<br />

seen. Given the lingering doubts on how this event will impact <strong>city</strong> revenues over the next several years, the <strong>city</strong>’s<br />

FY2013 budget is taking a very conservative approach on revenues and limiting spending to the FY2012 budget levels.<br />

New spending requests have been addressed in the context of Council’s fiscal policy regarding reserves and strategic<br />

goals they would like to address in the coming year. All other discretionary spending requests have either been<br />

pushed out to future years or denied (see Exhibit A). The priority items addressed in this plan include the following:<br />

1.Maintain fiscal solvency on all funds.<br />

2.Continue incremental Improvement to the General Fund’s Undesignated Reserves.<br />

3.Adjust the <strong>city</strong>’s public safety compensation plan through a phase-in approach.<br />

4.Accommodate a 2% cost of living adjustment to the balance of the <strong>city</strong>’s compensation plan.<br />

5.Set-aside stimulus monies to help with implementing the <strong>city</strong>’s parking program.<br />

6. Adjust the Storm Drainage Enterprise Rate to eliminate long-run accruing deficits.<br />

Budget Summary<br />

Revenue/Expense Summary – All Funds. The City’s FY2013 budget, for all funds, is projected at $8,188,282 and<br />

$8,409,387 for revenues and expenses, respectively. In terms of expenses, this represents a 30.69 percent decrease<br />

(-3,723,051) over FY2012 final amended totals. Most of the reductions in spending are attributable to large capital<br />

projects being completed (Downtown Revitalization), open space acquisition efforts being completed, and debt service<br />

being retired.<br />

1

General Fund. The General Fund<br />

budget is planned at $4,792,750 and<br />

$4,887,233 for revenues and<br />

expenses, respectively. This<br />

represents an increase in spending of<br />

2.72 percent ($129,628) over FY2012<br />

final amended totals. Most of this is<br />

attributable to the following:<br />

Revenues<br />

• Tax Revenues, all resources,<br />

are projected to be flat from<br />

FY2012 Final to FY2013.<br />

Projected growth in Taxes,<br />

Licenses/permits, inter-fund<br />

Transfers, Fines/Forfeitures<br />

Revenue/Expense Summary - All Funds<br />

Description<br />

FY2011 FY2012 FY2012 Final Prelim. FY2013<br />

Actual Budgeted Amendment Budget<br />

Total Revenues 9,061,848 11,177,313 11,511,540 8,188,282<br />

Total Exp. 8,233,860 12,037,642 12,132,438 8,409,387<br />

Exp. - % ∆ to previous Year 46.20% 47.35% -30.69%<br />

Ending Reserves $3,571,694 $2,869,044 3,000,889 2,735,897<br />

Revenue/Expense Summary - General Fund<br />

G. F. Revenues $4,650,147 $4,651,917 $4,961,261 $4,792,750<br />

G. F. Exp. & Transfers $4,544,244 $4,672,976 $4,757,605 $4,887,233<br />

Exp. - % ∆ to previous Year 2.83% 4.70% 2.72%<br />

Ending Unrestricted<br />

Reserves<br />

$354,273 $333,214 $557,929 $463,446<br />

Revenue/Expense - Capital Improvements Fund<br />

Cap. Revenues $331,531 $716,127 $773,257 $402,865<br />

Cap. Exp. & Transfers $348,145 $890,598 $929,555 $401,966<br />

Exp. - % ? to previous Year 155.81% 167.00% -56.76%<br />

Ending Unrestricted<br />

Reserves $160,400 ($14,071) $4,102 $5,000<br />

are offset by losses in Intergovernmental Revenues, Charges for Service, and Miscellaneous Revenues.<br />

• Taxable Sales and other tourism related revenues are tagged to a 5% increase over FY2011 levels, which is a<br />

growth over FY2012 actuals of 3.28%.<br />

Expenditures<br />

• Departmental expenditures are projected down by 1.40% over FY2012 Final Amendment numbers and flat<br />

(.21%) over FY2012 original budgeted levels. This is a mix of growth and reductions in various departments.<br />

This budget zeros out the library departmental expenses.<br />

• Economic Development is up by 1.96% due to URA TIFF adjustments.<br />

• Transfers to the Capital Improvements fund is up 60.21% due to a loss in reserve revenues that were restricted,<br />

but not tied to their expense line, which inflated the amount of carry forward available.<br />

General Fund Undesignated<br />

Reserves. One of the fiscal goals<br />

presented to Council was the need to<br />

incrementally improve on the General<br />

Fund’s Unrestricted Reserves. The<br />

Clifton Gunderson’s Financial Health<br />

Report indicated that the City should<br />

strive to carry 17 percent of its<br />

expected General Fund, net operating<br />

expense, which is equivalent to nine<br />

weeks of operating resources. At the<br />

closing of FY2011, the General Fund<br />

was showing an unrestricted fund<br />

balance (URFB) of $354,273, which<br />

$900,000<br />

$800,000<br />

$700,000<br />

$600,000<br />

$500,000<br />

$400,000<br />

$300,000<br />

$200,000<br />

$100,000<br />

General Fund Unrestricted Reserves<br />

GOFA Recommended G.F. Reserve is 17% or 9<br />

weeks of operating. Current Reserve - 10% or 5<br />

weeks of operating<br />

$0<br />

2005 2006 2007 2008 2009 2010 2011<br />

2012 2012YE<br />

Original Est.<br />

2013 Proj.<br />

GF Fund Balances $408,590 $413,482 $281,872 $128,019 $111,661 $240,367 $354,273 $333,216 $557,929 $463,446<br />

15% Unrestricted Reserve Targets $550,616 $570,688 $610,086 $624,955 $594,563 $625,438 $666,510 $679,798 $713,641 $733,085<br />

17% Unrestricted Reserve Targets $624,031 $646,780 $691,431 $708,282 $673,838 $708,829 $755,377 $770,438 $808,793 $830,830<br />

was a considerable improvement over FY2010 (see G.F. Unreserved Fund Balance to Expense). Council set a goal<br />

for the General Fund’s FY2013 URFB of $450,000 (10%) and adjusted spending to meet that goal. The spike in<br />

FY2012 estimate year-end is due to onetime revenues from grants and fire service reimbursements.<br />

Capital Improvements Fund. The Capital Improvements Fund has $402,865 available funds and $401,966 in<br />

expenses for FY2013, with a reserve of $5,000. While this is a considerable reduction (-56.76%) from the previous<br />

year, the contributions from the General Fund to support this plan is projected to be up to $251,055, which represents a<br />

60.21% increase over FY2012 year-end estimated. The General Fund’s increased contribution to the Capital Fund is<br />

attributable to that fund carrying less of a fund balance due to a restricted State Historical Grant that was being held in<br />

the reserve and not matched up to its intended expense line. This unfortunately has been overstating the Capital<br />

Fund’s available resources. Capital Projects requested to date:<br />

1. Debt service for previous year’s lease purchases - $187,779.<br />

2. FY2013 - A lease purchase for 5 years, consisting of the following equipment: 1 patrol vehicle at $38,588; 700/800 MHz Radios (20<br />

subscriber radios@ $45/radio for police department $20,000; a 4X4 3/4 ton diesel flat bed truck w/snow plow/sander $45,000 and riding<br />

mower $15,000 for public works.<br />

• Page 2

3. A lease purchase in 2013 for 10 years, consisting of the following equipment: a mini excavator, $150,000 for public works.<br />

4. Patrol room remodel for $10,000.<br />

5. Fire station equipment for fire helmets @ $10,000 and bunker gear @ $20,000.<br />

6. A dehumidifier/heater for the pool for $30,000.<br />

7. City computer equipment consists of the purchases of: 11 replacement desk-top computers @ $16,000; UPS equipment for $2,000 and<br />

printers for $7,600.<br />

Fund Summary<br />

1. General Fund - The General Operating Fund covers the town’s core service activities in general administration, public<br />

safety & emergency services, public services, recreation, library, parking & code enforcement, and special projects.<br />

Department heads were asked to curtail spending to FY2012 Original amounts; as such, this summary compares<br />

FY2013 requests to that threshold.<br />

a. Legislative Department (Workbook Ref. # Tab B) - This departmental budget addresses the<br />

Councilmember Stipends, City Attorney, Employee Appreciation, and Council Special Projects. This<br />

spending request decreased 12.49%, from the previous year’s original budget due to reductions in<br />

City Attorney expenses and zeroing out one-time community project requests. (FY12/FY13: $125,858<br />

to $110,140)<br />

b. Judicial Department (Workbook Ref. # Tab C) - The Judicial Department Budget funds the municipal<br />

Court operating expenses and both the judge and the municipal court prosecutor on a contract basis.<br />

The department is requesting a 16.03% increase in expenses for FY2013, which represents an<br />

increase in the prosecuting attorney’s contract. (FY11/FY12: $50,258 to $58,313)<br />

c. Executive Department (Workbook Ref. # Tab D) – This is the operating budget for the Administrator,<br />

Clerk’s functions, and the <strong>city</strong>wide Information Services line-items. This department is requesting a -<br />

9.46% decrease, due primarily to a reorganization of the Code Enforcement program; that program is<br />

now under the police department.<br />

While this budget shows a decrease, there is a request by the City Clerk to adjust her salary due to<br />

her recent certification as a Certified Municipal City Clerk and entry level survey data. With Councils<br />

approval, I have put an entry level of $56,328. (FY12/FY13: $374,034 to $338,635)<br />

This department also carries the City’s Information Services operating line-items and the <strong>city</strong>’s<br />

computer/network capital planning (see FY2013-FY2017 Capital Improvements Fund Requested<br />

Equipment List). In 2012 the Information Services capital budget focused on network’s backbone<br />

infrastructure equipment. In 2013, the capital budget will shift its focus to network disaster recovery<br />

through backup systems and data storage ($38,740). This equipment mainly includes 2 Storage Area<br />

Network (SAN) disk arrays and associated software that will provide local and remote, near real time,<br />

backup of user data. Additionally, through leveraged use of an offline server, this equipment will<br />

support localized GIS data at Public Works and storage of scanned documents, requested by the City<br />

Clerk.<br />

FY2013 - FY2017 Capital Improvements Fund Requested Equipment List<br />

Information Services (Executive Department) Term 2013 2014 2015 2016 2017 Totals<br />

11 replacement desktop computers n 13,772 16,000 16,000 16,000 16,000 77,772<br />

Microsoft Exchange or equivalent technology n 10,000 10,000<br />

UPS equipment n 720 2,000 2,000 2,000 2,000 8,720<br />

Network Backbone equipment (in 2017 y5 lp) n 8,650 30,000 38,650<br />

Printers n 7,600 7,600<br />

Data Storage n 15,598 15,598<br />

wireless solutions and advanced technology n 9,900 9,900<br />

Software y5 30,000 30,000<br />

3 Server replacements or equivalent technology upgrade y5 37,000 37,000<br />

Phone System y10 110,000 110,000<br />

Totals 38,740 135,600 57,900 65,000 48,000 345,240<br />

d. Finance Department (Workbook Ref. # Tab E) – This department is responsible for accounts<br />

receivable, accounts payable, payroll, utility billing, financial management and reporting, business<br />

• Page 3

licensing and tax administration. The department provides accounting for the City's existing 13<br />

general, special, capital improvements and enterprise funds, as well as accounting and financial<br />

management for the Manitou Springs Metropolitan District.<br />

This budget is decreased by -3.22% due to the hiring of our new Finance Director at a lower salary.<br />

(FY12/FT12: $304,475 to $294,663). The department is also looking to refill the vacancy created<br />

when Rebecca Davis took the Finance Director position. This position is scheduled to be hired in April<br />

2013 and will be tasked with the City’s self- collection of sales tax.<br />

e. Community Development Department (Workbook Ref. # Tab F) – This is the operating budget for<br />

the Planning Department. This budget is a 2.59% increase to the previous year. (FY12/FY13:<br />

$221,070 to $226,795)<br />

f. Police Department (Workbook Ref. # Tab G) – This is the<br />

operating budget for law enforcement, which consists of<br />

15.5 FTEs. This department’s budget is an increase of<br />

6.58%. (FY12/FY12: $1,005,162 to $1,071,252). This<br />

increase includes an initial installment, 6.27%, to realign<br />

public safety salaries to market entry level amounts (see<br />

Proposed Public Safety Ranges).<br />

Proposed Public Safety Ranges<br />

Classifications Min Max<br />

Fire.EMT/Patrol Officer $41,184.00 $57,657.60<br />

FF.Paramedic/PD Corporal $47,361.60 $66,306.24<br />

Fire Lieutenant/PD Sergeant $54,465.84 $76,252.18<br />

Fire Captain/PD Lieutenant $62,635.72 $87,690.00<br />

In addition, the department is moving forward with a partnership with School District 14 to provide a<br />

School Resource Officer (SRO) as an additional 0.5 FTE for the Department. The School District has<br />

agreed to provide 50% of the funding for this position in exchange for the SRO services. The PD will<br />

then contribute the prior budgeted “seasonal” 0.5 FTE position salary, which will require another<br />

$8,566 in order to fully fund the position. This officer will provide both SRO services during the school<br />

year as well as Business District Beat officer in the summer when not directly working in the schools.<br />

FY2013 Capital requests for this department Include replacement of 1 patrol vehicle ($38,588), patrol<br />

room remodel ($10K), and replacement of twenty 700/800 MHz subscriber radios spread over 5 years<br />

($16K/year). Chief would like to replace two vehicles every year to address the supervision and<br />

budget oversight for both the parking and Code Enforcement programs. Council has cut one vehicle<br />

in FY2013.<br />

FY2013 - FY2017 Capital Improvements Fund Requested Equipment List<br />

Police Department Term 2013 2014 2015 2016 2017 Totals<br />

Patrol room remodel n 10,000 10,000<br />

Energy efficient lighting for PD n 5,000 5,000<br />

Fire Arm five year Life Cycle (15 pistols-$500 each, 15<br />

long guns $1500) 5% increase per year) n Costs transferred to Law Enforcement Special Revenue Fund<br />

patrol vehicle @ $38,588 (10 units incl PD, Parking & CEO,<br />

5 yr life cycle) 5% increase per year y5 38,588 81,035 85,087 89,341 93,808 387,859<br />

DVD R video camera for interviews y5 10,000 10,000<br />

700/800MhZ Radios (20 units, 5 year life cycle at $4K<br />

each) 5% increase per year y5 16,000 16,800 17,640 18,522 19,448 88,410<br />

Totals 48,588 91,035 90,087 89,341 93,808 412,859<br />

g. Emergency Communications (Workbook Ref. # Tab H) – This is the operating budget for the City’s<br />

emergency 911 center, which dispatches law enforcement, fire, and emergency medical. This<br />

department has an increase of 3.61% over FY2012, due to the 2% cost of living adjustment.<br />

(FY12/FY13: $215,983 to $223772)<br />

We continue to discuss the benefits of combining this function with El Paso County E-911, Colorado<br />

Springs E-911, or Fountain E-911. I anticipate that we will be bringing a proposal to Council for<br />

consideration during the budget review process.<br />

h. Code Enforcement (Workbook Ref. # Tab I) – This service area has typically been embedded in the<br />

Executive Department. I have decided to move supervision of this function under Police Department<br />

and track its expenditures independently. The budget for this service is $60,944, which includes one<br />

Code Enforcement Officer ($48,094) and related operating expenses of $12,850.<br />

• Page 4

i. Fire Department (Workbook Ref. # Tab J) – This is the operating portion of the City’s volunteer fire<br />

department. The Department has 40 volunteer firefighters and 6 paid staff that operate the firehouse<br />

on a 24/7 basis. This department’s budget is showing a 15.20% increase over the previous year.<br />

(FY12/FY13: $547,596 to $630,830)<br />

The increases includes the same initial installment, 6.27%, to realign public safety salaries to market<br />

entry level amounts (see Proposed Public Safety Ranges). In addition, overtime salaries needed to be<br />

adjusted to reflect proper disbursements as required by the Fair Labor Standards Act (FLSA), which<br />

has not been happening. Lastly, I have asked the department to estimate revenues and costs<br />

associated with the wildfire deployments, as this activity has been shown in past budgets as zeros.<br />

This department carries a 5-year capital plan for scheduled replacement vehicles, emergency<br />

services equipment and end-of-life radio replacements. FY2013 initially requested a new item under<br />

“Fire Station Equipment” for a security card door lock reader ($6,000). As this was a new item added<br />

to the plan, Council asked to move this out to FY2014 and explore other options.<br />

FY2013 - FY2017 Capital Improvements Fund Requested Equipment List<br />

Fire Department Term 2013 2014 2015 2016 2017 Totals<br />

Bunker Gear n 20,000 20,000 20,000 60,000<br />

Helmets n 10,000 10,000<br />

HazMat Supplies n 25,000 25,000<br />

Carpet n -<br />

Fire Station Equipment - Card Reader Lock n 6,000 6,000<br />

Extrication Equpment y5 40,000 40,000<br />

Pumper - Urban interface y10 400,000 400,000 800,000<br />

Brush Truck Y10 150,000 0<br />

Totals 30,000 556,000 60,000 25,000 420,000 1,091,000<br />

j. Public Services Department (Workbook Ref. # Tab K) – This is the operating budget for both streets<br />

and parks. This department is planning a 0.75% decrease over FY2012. (FY12/FY13: $762,839 to<br />

$759,308<br />

This department carries a 5-year capital plan for scheduled equipment replacements based on<br />

industry standards, age of equipment, and maintenance history. The only new request for FY2013 is<br />

a security gate and security system for the Public Works facility, which is not currently in the<br />

preliminary budget.<br />

FY2013 - FY2017 Capital Improvements Fund Requested Equipment List<br />

Public Works Term 2013 2014 2015 2016 2017 Totals<br />

4x4 3/4 ton diesel flat bed w/snowplow/sander y5 45,000 50,000 95,000<br />

riding mower 60" 24 hp y5 15,000 20,000 20,000 55,000<br />

4x4 3/4 ton diesel ext cab truck y5 35,000 35,000<br />

4x4 3/4 ton diesel flat bed w/snowplow y5 42,000 42,000<br />

4x43/4 ton diesel ext cab truck y5 40,000 45,000 85,000<br />

wood chipper y5 40,000 40,000<br />

Motor grader (Used - new $320,000) y10 200,000 200,000<br />

mini excavator (2013 expense moved to FY2015) y10 150,000 150,000<br />

Backhoe y10 160,000 160,000<br />

Totals 60,000 77,000 350,000 315,000 60,000 862,000<br />

Public Services also prepared a 7-year Street Capital Improvement plan, which is included in its<br />

entirety in the enclosed budget. For FY2013, the department is anticipating to spend the following<br />

from the RTA and Public Works funds for these repairs:<br />

FY2013 Street Repairs<br />

Street Condition # Length (ft) Width (ft) ft 2 From To Estimated Cost<br />

Deneta Dr 4 775 25 19,375 All All $ 43,593.75<br />

Fairview Ave 4 1,109 12 13,308 Ruxton Ave End $ 29,943.00<br />

Sutherland Rd 4 1,725 25 43,125 Oak Ridge Sutherland Pl (top) $ 97,031.25<br />

Washington Ave 5 850 25 21,250 Washington Bypass Washington Bypass $ 47,812.50<br />

Lovers Ln 5 1,584 16 25,344 Canon Ave El Paso Blvd $ 57,024.00<br />

Estimated Total $ 275,404.50<br />

• Page 5

k. Aquatics Department (Workbook Ref. # Tab L) – This is the operating budget of the <strong>city</strong>’s pool. This<br />

department is requesting a 6.91% increase over the previous year, due to the hiring of additional<br />

seasonal lifeguards to meet Red Cross requirements and operating supplies for the new weight room.<br />

(FY12/FY13: $315,921 to 337,747)<br />

The Aquatics Department is also recommending a 13 percent increase in fees. Mr. Chaney reported<br />

that “…the pool has some of the lowest rates in the area and much of Colorado. This has been a<br />

good thing in a troubled economy; however, with the weight room addition and the success of the pool<br />

programming, we do need additional funds to help offset the cost of maintenance and staffing needs.<br />

I am suggesting a 13% increase in daily fees, punch cards and memberships. This increase will still<br />

put us at the lowest fees in the area and most of the state.”<br />

This department’s 5-year capital plan for FY2013 is requesting upgrades to the mechanical systems<br />

($30K) and ADA repairs to the Baby Pool ($14K), the latter of which is not currently in the FY2013<br />

budget. In addition, the 5-year plan from last year had $60K dedicated to weight room equipment,<br />

which Mr. Chaney wanted to reallocate to an expansion to the baby pool. The expansion is expected<br />

to cost $125,000. Due to issues with our capital fund reserve, I have moved the $60K for expansion<br />

and the $14K for ADA repairs out to FY2015 and will require a grant match of to cover most of this<br />

request.<br />

FY2013 - FY2017 Capital Improvements Fund Requested Equipment List<br />

Aquatics 2013 2014 2015 2016 2017 Totals<br />

Paint beams n 25,000 25,000<br />

Weight Room Equipment Replacement n 20,000 20,000<br />

Building Upgrades (lights, bathrooms, Roof, etc.) n 60,000 12,000 20,000 92,000<br />

Dehumidifyer/heater n 30,000 30,000<br />

Remodel desk area n 6,000 6,000<br />

Pool equipment (ADA lift &Repairs to baby pool) n 74,000 74,000<br />

Totals 30,000 91,000 86,000 20,000 227,000<br />

l. Public Library (Workbook Ref. # Tab M) – With the successful election to include the Manitou<br />

Springs Public Library into the Pikes Peak Library District, all related operating and capital expenses<br />

have been zeroed out for the coming year. (FY12/FY13: $189,381 to $0)<br />

m. Parking Enforcement (Workbook Ref. # Tab N) – This is the operating budget of the <strong>city</strong>’s parking<br />

enforcement programs. This budget is showing a 5.97% increase over last year, due primarily to<br />

increased operating expenses (FY12/FY13: $110,386 to $116,979). This department’s 5-year capital<br />

plan has been rolled into the Police Department’s budget.<br />

n. General Miscellaneous Expenditures/Transfers Fund (Workbook Ref. # Tab O) – This budget<br />

captures miscellaneous expenditures for <strong>city</strong> promotions, Council Projects, and interagency/interfund<br />

transfers. This budget is showing a 45.68% increase, due to the Parks and Recreation Advisory<br />

Board (PARAB) asking for $31,150 in related activities, the URA receiving a tax increment payment of<br />

$53,097, and Capital Improvements Fund transfer of $251,055. (FY11/FY12: $450,011 to $655,593)<br />

• The PARAB board envisions the Soda Springs Pavilion being returned to good condition. This<br />

involves replacing and putting in more lighting, repainting, replacing doors, refinishing the stage<br />

and refurbishing the railing and the "green room". In addition, the mini-grant program was left at<br />

the $10,000 level to address the Manitou Springs Art and Cultural Collaborative request for grant<br />

funding to arts and recreational groups.<br />

• The URA Tax Increment Payment has been funded improperly in past years, which required a<br />

catch adjustment in FY2012, and FY2013 is estimating it’s the current payment based on our<br />

Sales Tax estimate of 5% over FY2011.<br />

• Our Capital fund transfer has increased over the previous year by $109,369 (77.19% increase).<br />

This increase has to do with the a revenue of $162,966 (State Historical Fund Grant – Bridges)<br />

that has been carried in our capital reserve, but is a restricted amount for the Canon/Park Avenue<br />

Bridge Restoration Project. In other words, we have been borrowing against this amount and<br />

• Page 6

under GASB 54 this is a restricted amount and must be accounted for separately. Also, the<br />

Bridge Project is drawing from that revenue line and is not available to other capital fund projects.<br />

In compliance with GASB 54 certain funds without a dedicated revenue source must be folded into<br />

existing funds, but their related revenues and expenditures should be kept in assigned, separate fund<br />

balances, within those funds. To accomplish this, a separate accounting ledger titled Restricted<br />

General Fund Revenues/Expenditures for the Barr Trail Parking Lot (Workbook Ref. # Tab P) has<br />

been added to the General Fund budget to track these activities. One activity is currently being<br />

tracked at this time:<br />

i. Barr Trail Parking Activities - Barr Trail Parking lot revenues are restricted for use for<br />

expenditures associated with the Barr Trail Parking lot and trailhead area as per the<br />

Intergovernmental agreement between the City and Colorado Springs Utilities, the<br />

owner of the parking lot.<br />

Activity in this account show assigned revenues of $111,055 and $166,934 for FY2012<br />

and FY2013, respectively. Expenses for both FY2012 and FY2013 include: a portion of<br />

the Residential Parking Program Study; parking kiosk credit card fees, capital project<br />

reimbursement in FY2011, only; the Barr Trail facility maintenance and Barr Trail Shuttle<br />

match for a CMAQ grant of $308,970. The FY2013 year-end fund balance is projected<br />

to be $79,053.<br />

2. Enterprise Funds – These are “Proprietary Funds” that operate in a manner similar to a private business<br />

enterprise. They are, by definition, fee driven activities that account for their own operating and capital<br />

expenses. The City has four such funds: Water, Sewer, Storm Drainage Management and Manitou Springs<br />

Park Authority Funds.<br />

a. Water Fund (Workbook Ref. # Tab 2) - This enterprise accounts for operating revenues and cash<br />

basis expenses of the water utility. The utility services roughly 2,200 customers, repairs 50,000 lineal<br />

feet of water lines, maintains 2 storage tanks and 15 in-town pressure reducing values. The utility<br />

plans to replace a water main on Waltham, replace two treatment plant compressors, update GIS,<br />

and purchase a demolition saw. A request to install a card reader security gate, at the plant, has<br />

been moved out to FY2014. The fund is fiscally sound with a projected “Net Position” for FY2013 of<br />

$1,103,907, which is a decrease of -652,703 from the previous year-end estimates.<br />

This fund carries a 5-year capital plan to replace aging water system infrastructure and equipment:<br />

Water/Sewer FY2013 - FY2017 Equipment and Improvements List (60/40 Split)<br />

Water & Sewer Enterprise Funds Combined Financing<br />

Financing<br />

Terms<br />

2013 2014 2015 2016 2017 Totals<br />

Mobile diesel air compressor 5-year $25,000 $25,000<br />

Video camera mounted vehicle 5-year $95,000 $95,000<br />

4X4 3/4 diesel standard cab 5-year $40,000 $45,000 $85,000<br />

4X4 Water meter SUV 5-year $30,000 $30,000<br />

Vactor truck 10-year $250,000 $250,000<br />

Skid loader 10-year $100,000 $100,000<br />

Truck Excavator 10-year $300,000 $300,000<br />

Totals $25,000 $345,000 $70,000 $100,000 $345,000 $885,000<br />

Capital Purchase Equipment Financing 2013 2014 2015 2016 2017 Totals<br />

Gate+ Security Card Entry System None $3,500 $3,500<br />

GIS Unit upgrade None $2,500 $2,500<br />

2 Compressors (Water Only) None $12,000 $12,000<br />

1 Chainsaw (water Only) None $1,200 $1,200<br />

2 Backwash Blowers (Water Only) None $25,000 $25,000<br />

Demolition Saw None $2,000 $2,000<br />

Totals $15,700 $28,500 $0 $2,000 $0 $46,200<br />

Grand Total $40,700 $373,500 $70,000 $102,000 $345,000 $931,200<br />

• Page 7

The water department has scheduled the following infrastructure projects over the next five years:<br />

Water/Sewer FY2013 - FY2017 Infrastructure Projects<br />

Water Enterprise Only Capital Improvement/Equipment 2013 2014 2015 2016 2017 Totals<br />

Water main Waltham Ave (1,700') None $255,000 $255,000<br />

Water main Washington Ave (1,500') None $225,000 $225,000<br />

Water main Narrows Road (500') None $100,000 $100,000<br />

Water main Oklahoma (2000') None $500,000 $500,000<br />

Water main Fountain Pl(1200') None $200,000 $200,000<br />

Totals $255,000 $225,000 $100,000 $500,000 $200,000 $1,280,000<br />

b. Sewer Fund (Workbook Ref. # Tab 3) – This enterprise accounts for operating and cash basis<br />

expenses of the sewer utility, which services 2,200 customers and maintains 40,000 lineal feet of<br />

sewer lines. Residential Sewer volume charges a flat fee, calculated on customers’ average water<br />

usage during the months of January and February. For Commercial (anything that is not a single<br />

family dwelling unit) volume charges are based on the water volume charges per month. An additional<br />

connection fee to the <strong>city</strong> sewer system is, also, charged per account. For FY2013, the utility will costshare<br />

in the equipment list mentioned in the previous water section, is planning on replacing the<br />

sewer main on Waltham, and upgrading the GIS system at the public works facility. The previously<br />

mentioned security gate has been moved out to FY2014. Infrastructure projects over the next five<br />

years are summarized in the table, below:<br />

Water/Sewer FY2013 - FY2017 Infrastructure Projects<br />

Sewer Enterprise Only Capital Improvement/Equipment 2013 2014 2015 2016 2017 Totals<br />

Sewer main Waltham Ave (1,000) None $150,000 $150,000<br />

Sewer main El Monte Place (900') None $135,000 $135,000<br />

Sewer main Geneva Trail to Glenn Rd (2,000') None $400,000 $400,000<br />

Sewer main Oklahoma to Deer Pass (1,600') None $300,000 $300,000<br />

Sewer main Ruxton at Winter to Pilot Knob Ave None $200,000 $200,000<br />

Totals $150,000 $135,000 $400,000 $300,000 $200,000 $1,185,000<br />

The fund is fiscally sound with a projected “Net Position” for FY2013 of $406,950, which is an increase<br />

of $71,421 from the previous year-end position. Water and Sewer share much of the same<br />

equipment, so both funds purchase equipment and allocate out debt service on 60/40 percentage<br />

split, respectively (see Water/Sewer FY2013-FY2017 Equipment and Improvements List (60/40)<br />

Table, above).<br />

Storm Drainage & Flood Management Fund (Workbook Ref. # Tab 4) - This budget is funded<br />

through a drainage flat-fee charged to all water/sewer utility customers. The fund pays for<br />

maintenance of storm water facilities and the <strong>city</strong>'s mandatory EPA storm water monitoring program.<br />

At the close of FY2012, this fund will retire debt payments on the Canon Avenue Storm Drainage<br />

Project, which was initiated in 2002, to address flooding from Williams Canyon.<br />

In FY2007, the flat fee was raised from $6.40/month to $9.40/month to fund a limited capital program.<br />

Given its current revenues, the fund is projected to incur a deficit balance of $44,287 by the close of<br />

FY2012 and will continue to grow, if a rate increase is not considered. To offset this, Staff is<br />

recommending a rate increase from its current level to $11/month/account (see Rate Sensitivity<br />

Analysis). This increase will remove the deficit and grow the balance to an appropriate level.<br />

Rate Sensitivity Analysis<br />

Rates @: Year: 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021<br />

Ending Asset Balance $9.40 (44,287) (8,504) (6,496) (10,170) (32,513) (53,700) (79,336) (103,527) (134,305) (171,866)<br />

Ending Asset Balance $10.00 (44,287) 6,708 23,927 35,465 28,334 22,358 11,935 2,955 (12,611) (34,961)<br />

Ending Asset Balance $10.50 (44,287) 19,384 49,280 73,495 79,040 85,741 87,993 91,690 88,800 79,127<br />

Ending Asset Balance $11.00 (44,287) 32,061 74,633 111,524 129,746 149,123 164,052 180,425 190,212 193,215<br />

Ending Asset Balance $11.50 (44,287) 44,737 99,986 149,553 180,451 212,505 240,111 269,160 291,623 307,303<br />

In terms of infrastructure projects, the program plans drainage improvements for the following:<br />

Minnihaha, 500-block El Paso/Burns Rd, Beckers Lane Bridge, Crystal Park Drainage, General<br />

Repair, Minnehaha manholes (see Storm Drainage Enterprise Infrastructure Improvements).<br />

• Page 8

The fund carries the following 5-year capital plan for both equipment and infrastructure projects:<br />

Storm Drainage FY2012 thru FY2016 Equipment List<br />

Storm Drainage Enterprise Fund<br />

Financing<br />

2013 2014 2015 2016 2017 Total<br />

Equipment Purchases<br />

Terms<br />

Pick up broom attachment 5-year $8,000 $8,000<br />

4X4 3/4 diesel standard cab 5-year $35,000 $35,000<br />

4X4 One ton diesel standard cab dump bed 5-year $55,000 $55,000<br />

Street sweeper 10-year $180,000 $180,000<br />

skid loader 10-year $100,000 $100,000<br />

Totals $188,000 $35,000 $0 $100,000 $55,000 $323,000<br />

Storm Drainage Enterprise Infrastructure Improvements<br />

Storm Drainage Enterprise Fund<br />

Financing<br />

Capital Improvement<br />

Terms<br />

2013 2014 2015 2016 2017 Total<br />

Minnehaha Drainage none $6,000 $6,000<br />

50 Block El Paso Burn Road none $4,000 $4,000<br />

Beckers Lane Bridge none $1,000 $1,000<br />

Crystal Park Drainage none $4,000 $4,000<br />

General Capital improvements none $4,000 $4,000<br />

Minnehaha Manholes none $1,000 $1,000<br />

Lucerne/Alpine Drainage Culvert none $4,000 $4,000<br />

Upper Canon Gabion Maintenance none $2,000 $2,000<br />

South Path/Manitou Avenue Drain head none $1,000 $1,000<br />

General Capital improvements none $5,000 $5,000<br />

Plainview Drainage/Canal none $4,000 $4,000<br />

Crystal Park Drainage none $4,000 $4,000<br />

Burns Road upgrade none $2,000 $2,000<br />

Washington Avenue Canals none $2,000 $2,000<br />

Glenn Road Canals none $6,000 $6,000<br />

General Capital improvements none $10,000 $10,000<br />

General Repairs none $10,000 $10,000<br />

Poplar/Santa Fe Canals none $2,000 $2,000<br />

Crystal Parks Drainage none $4,000 $4,000<br />

300 Block Washington Curb and Gutter south side none $4,000 $4,000<br />

Fountain Place /South Path Drain head none $2,000 $2,000<br />

Canon / Lovers Lane Drain head. 1 North, 1 South. none $4,000 $4,000<br />

Pawnee Detention Structure none $10,000 $10,000<br />

General Capital improvements none $4,000 $4,000<br />

Totals $20,000 $20,000 $20,000 $20,000 $20,000 $100,000<br />

c. Manitou Springs Park Authority (Workbook Ref. # Tab 16) – The Manitou Springs Park Authority<br />

Fund is an Enterprise Fund of the City of Manitou Springs, whose budgetary purpose is to convey<br />

payment for the debt service related to the El Paso/Beckers Lane Park facility. The sales tax<br />

associated with this debt is received into the El Paso Beckers fund and then dispensed in the form of<br />

a lease payment to the Manitou Springs Park Authority. The bonds, in the amount of $765,000, were<br />

issued 12/01/98 for a term of 15 years. Final payment of $70,000 will be made on 6/1/2013.<br />

3. Special Revenue Funds – These are accounts restricted for specific purposes. The City of Manitou Springs<br />

has six such funds:<br />

a. Law Enforcement Special Revenue Fund (Workbook Ref. # Tab 5) – This fund is financed through<br />

grants and court assessments for improving prisoner safety and updating police equipment. This fund<br />

anticipates $34,956 in available funds through an increase in the fine surcharge from its current rate of<br />

$35 to $45. Expenses are projected at $31,580, with an ending fund balance of $3,376 for FY2013.<br />

Capital Purchases – Other will include: Uniforms and equipment @ $12,550, firearms replacement @<br />

$6,000, Ammunition @ $10,000, and TASER Supplies @ $2,000.<br />

b. Conservation Trust Fund (Workbook Ref. # Tab 6) – this fund is financed through lottery proceeds<br />

and can be used for projects as defined under CRS 29-21-101. The fund is under the advisory<br />

purview of the Parks and Recreation Advisory Board. This fund anticipates $176,377 in available<br />

• Page 9

funds and $63,000 in general expenses. No significant projects have been defined at this time,<br />

except for operational expenses of: Mutt Mitts @ $10K, Bench Replacements @ $3K, and weed<br />

mitigation and tree replacement @ $50K.<br />

c. Parks and Recreation Fund (Workbook Ref. # Tab 7) – This fund is now retired per GASB 54 and is<br />

included only as history until the end of FY2013.<br />

d. Structure Stabilization Fund (Workbook Ref. # Tab 9) - This fund is now retired per GASB 54 and is<br />

included only as history until the end of FY2013.<br />

e. Open Space Fund (Workbook Ref. # Tab 11) – This fund is under the advisory purview of the Open<br />

Space Advisory Committee (OSAC). The fund has 0.8 of a property tax mill and 0.1 percent of Sales<br />

Tax as a dedicated revenue source. At the Close of FY2012, OSAC had completed all the purchases<br />

as identified in the Red Mountain Open Space Stewardship Plan.<br />

This fund has $108,538 in revenues and $78,955 in planned expenses and debt service, with a<br />

projected year end fund balance of $29,583. For FY2013, OSAC is requesting contract services to<br />

develop a Site improvement and Management plan for the Iron Mountain properties and mitigation<br />

efforts to control noxious weeds.<br />

f. Mineral Pool Development Fund (Workbook Ref. # Tab 14) – This fund is now retired per GASB 54<br />

and is included only as history until the end of FY2013.<br />

4. Governmental Funds – Manitou Springs has five Special Assessment Use Funds for Capital Improvements and<br />

Debt Service.<br />

a. Capital Improvements Fund (Workbook Ref. # Tab 8) – this fund is dedicated for capital fund<br />

allocations for the capital needs of General Fund operating departments. This fund no longer has a<br />

formulary contribution, but is flexed according to capital needs and resource availability. Equipment<br />

purchases for FY2013 and debt service totals $501,967. The General Fund will be contributing<br />

$251,055 as an Inter-fund transfer. The increase in the General Fund contribution to the previous<br />

year, 60.21%, has to do with a State Historical Fund Revenue for $162,966 that has been held in our<br />

reserve fund, but not tied to any expense. This has overstated the amount of reserves available for<br />

projects. GASB 54 requires the resource to be restricted and matched to its intended expenditure,<br />

which has been done in this budget.<br />

b. Downtown Public Facilities Fund (Workbook Ref. # Tab 10) - This fund is dedicated to the debt,<br />

0.3% Sales Tax revenues and expenditures for the phase 5B downtown revitalization and streetscape<br />

project. The fund has $1,195,980 planned revenues and $1,253,899 in planned expenses for<br />

FY2012. While FY2013 is not expected to have any residual expense, there is a $62,627 deficit<br />

balance that is attributable to the dedicated 0.3% sales tax not keeping up with the debt service and<br />

some expenses that appear to have not been submitted for reimbursement.<br />

For the short term, this fund will be supplemented with a loan from the Water fund. In 2013, staff will<br />

review the invoices and reimbursement reports to see if we can submit overlooked costs for<br />

reimbursement.<br />

c. Rural Transportation Public Facilities Fund (Workbook Ref. # Tab 13) – This fund is used for<br />

authorized roadway maintenance and capital improvements as allowed in the 2004 County-wide<br />

Rural Transportation Authority Ballot Initiative. Maintenance revenues are derived through Sale and<br />

Use Tax estimates and a population allocation formula. Maintenance Revenues for FY2013 are<br />

estimated at $235,914 and the Capital portion is estimated at $115,240.<br />

d. El Paso Blvd/Beckers Park Fund (Workbook Ref. # Tab 15) – This is a special property tax<br />

assessment fund, authorized in 1998 to acquire and maintain the El Paso Blvd. Park. The fund is<br />

under the Manitou Springs Park Authority. The fund’s revenues assessment consists of 3 mills, of<br />

which 2 mills are dedicated to retiring the acquisition debt (scheduled to sunset in 2012) and 1 mil for<br />

maintenance in perpetuity. FY2013 revenues are estimated at $59,662, plus $460,118 in carry-<br />

• Page 10

forward ($519,930) and expenses are projected at $129,301. The fund’s year-end balance is<br />

projected to be $434,419. The <strong>city</strong> was successful with a ballot question to the voters asking<br />

permission to use the fund balance for the benefit of all parks.<br />

e. Public Works Fund (Workbook Ref. # Tab 12) - This fund is a special property tax assessment fund<br />

of 0.8 mils for designated street overlay projects and a Single Hauler Fee. The special assessment<br />

for this fund has expired and the only revenues are now from the Single Hauler Fee. Revenue<br />

estimates for FY2013 are estimated at $48,000 for Single Hauler contribution and $23,058 in prior<br />

year carryover. The <strong>city</strong> plans to spend this money on projects outlined in the Street Capital Project<br />

Plan.<br />

Budget Summary<br />

In October, I presented our preliminary budget tagged to the theme “Cautious Optimism<br />

& a Little Luck.” Clearly, our community has had its share of luck. While the Waldo<br />

Canyon Fire threatened our very community and post fire impacts continue to create a<br />

stiff head wind regarding tourism dependent activities, we still have our community and<br />

that is something to be thankful for.<br />

Additional good fortune came with the community’s support of the Library merger with<br />

the Pikes Peak Library District, which will be a benefit both to the library and the City. The Library is assured of a brighter<br />

future and the <strong>city</strong> has a little more money to fund its business of government. In addition, the successful ballot question<br />

allowing the El Paso Beckers Fund Reserve to be used for the benefit of all parks is another benefit afforded the <strong>city</strong> by a<br />

supportive community. For all this, we are equally thankful.<br />

However, the challenge of funding local government<br />

services is always in the forefront. Taxes are our main<br />

source of revenue and tax revenues and fees are just not<br />

sufficient to cover all the program requests being asked of<br />

the <strong>city</strong>, in addition to keeping up with our own escalating<br />

operational costs (see Where our General Fund<br />

Revenues Come From). When we started this budget<br />

planning process, we had planned expenses exceeding<br />

revenues by nearly $300,000 and additional unfunded<br />

requests of $562,166 (see Exhibit A). Council has had to<br />

make some hard choices to get the City’s spending plan<br />

to its current state.<br />

Respectfully – Jack Benson, Manitou Springs City<br />

Administrator<br />

• Page 11

EXHIBIT A<br />

Funding Request Summary<br />

The funding list is summary of requests that were not in the preliminary budget plan presented to Council on October 2,<br />

2012. In parentheses is a notation as to these requests at first reading.<br />

1. Citywide cost-of-living compensation adjustment, including entry-level, compensation classification increases<br />

to public safety- $252,011. If approved, this will most likely be phased-in over three installments, which is<br />

dependent on the a successful Library ballot question and consolidation of the City’s communications center<br />

with another agency (Public Safety Partially Funded @ $45K and a 2% cost of living to the balance of<br />

<strong>city</strong> pay plan).<br />

2. Baby Pool Repairs - $14,000 (Pushed out to FY2014).<br />

3. City Clerk request for salary reconsideration based on salary survey and certification – $9,928 (Funded).<br />

4. Capital – Energy Savings projects - $10,000 (withdrawn).<br />

5. Disaster Recovery Plan Capital Request – incremental increase $13,140 (Funded).<br />

6. Fire Station Security Card Reader Lock - $6,000 (Unfunded).<br />

7. iManitou’s request to increase Business Promotions & Tourism, Discretionary Increase - $30,000 (Unfunded.<br />

The City currently passes thru $216,977 per City’s Municipal Code provisions for attracting visitors<br />

and business activity to the <strong>city</strong> and $33,023 in added discretionary funding for the same).<br />

8. Library Director’s Sick Leave Payout if ballot initiative is successful - $11,689.61 (Unfunded, per City<br />

Policy).<br />

9. Manitou Springs Arts Council donation to cover insurance expenses - $1,400 (Unfunded).<br />

10. Manitou Springs Art and Cultural Collaborative - $50,000 (Partial funding, $10K, under Parks and<br />

Recreation Mini Grant program).<br />

11. Manitou Spring Collaborative print expenses for the <strong>city</strong>’s vision plan - $5,000 (Unfunded).<br />

12. Municipal Court Prosecutor’s contract increase from $8,400 to $14,000 - $5,600 (Funded).<br />

13. New Deputy City Clerk FTE request - $43,243 (Unfunded).<br />

14. Parking – Implementation of RPP and downtown paid parking – $50,000 to $100,000 (Funded @ $60K).<br />

15. Police Department Requesting an additional vehicle for FY2013 - $38,588 (Unfunded).<br />

16. Police Department Fire Arms Replacement – $6,000 (Funded under Law Enforcement Special Revenue<br />

fund, with an increase to the surcharge assessed against defendants who either plead guilty or are<br />

found to be guilty from $35 to $45).<br />

17. Police School Resource Officer Incremental increase - $8,566. School has agreed to pay ½ the FTE cost<br />

(Funded).<br />