PrimeResi.com - Editorial Highlights

A few selected highlights from last month on the journal of prime property, www.PrimeResi.com.

A few selected highlights from last month on the journal of prime property, www.PrimeResi.com.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

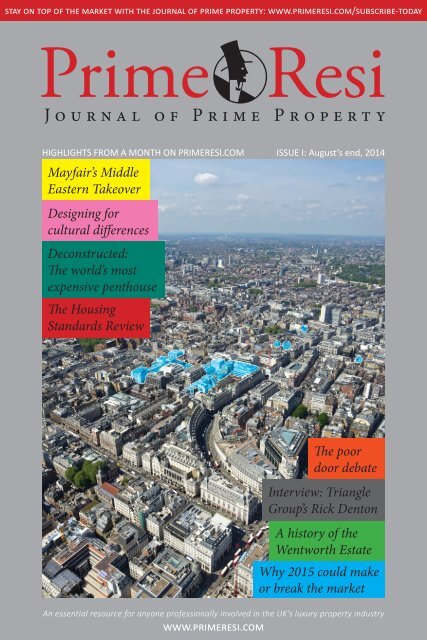

stay on top of the market with the journal of prime property: www.primeresi.<strong>com</strong>/subscribe-today<br />

PrimeQResi<br />

Journal of Prime Property<br />

HIGHLIGHTS FROM A MONTH ON PRIMERESI.COM<br />

Mayfair’s Middle<br />

Eastern Takeover<br />

Designing for<br />

cultural differences<br />

Deconstructed:<br />

The world’s most<br />

expensive penthouse<br />

The Housing<br />

Standards Review<br />

ISSUE I: August’s end, 2014<br />

The poor<br />

door debate<br />

Interview: Triangle<br />

Group’s Rick Denton<br />

A history of the<br />

Wentworth Estate<br />

Why 2015 could make<br />

or break the market<br />

An essential resource for anyone professionally involved in the UK’s luxury property industry<br />

www.primeresi.<strong>com</strong>

NEWS: PEOPLE & BUSINESS<br />

Bradman &<br />

Lipton back<br />

together for<br />

major resi<br />

play<br />

Uber-developers<br />

Godfrey Bradman<br />

and Sir Stuart Lipton<br />

are reportedly<br />

back in business<br />

and making a significant<br />

play on the<br />

UK’s private rented<br />

sector. Q<br />

Countrywide<br />

sells Sotheby’s<br />

franchise and<br />

two branches;<br />

others to be<br />

rebranded<br />

Countrywide has<br />

decided to sell its<br />

exclusive Sotheby’s<br />

International Realty<br />

licence, just four<br />

years into the 25<br />

year term. Q<br />

Oaktreebacked<br />

Anthology<br />

<strong>com</strong>pletes<br />

senior team<br />

New Oaktree Capital<br />

Management-backed<br />

property developer<br />

Anthology has <strong>com</strong>pleted<br />

its senior team<br />

by hiring former<br />

Mount Anvil man<br />

David Clark. Q<br />

Hamptons<br />

taps into<br />

short let<br />

boom<br />

Hamptons International<br />

has<br />

decided to launch<br />

a dedicated Short<br />

Lets Department<br />

in response to a<br />

‘significant rise in<br />

demand’. Q<br />

JLL research<br />

team hires<br />

high-profile<br />

property<br />

journalist<br />

JLL has made a<br />

strong signing<br />

to its Residential<br />

Research department,<br />

snapping up<br />

the former News<br />

Editor of Estates<br />

Gazette. Q<br />

Cluttons<br />

recruits digital<br />

guru<br />

Cluttons has hired a<br />

new digital marketing<br />

manager from<br />

Property Week<br />

magazine. Q<br />

Subscribe to <strong>PrimeResi</strong>.<strong>com</strong><br />

to get full access to daily<br />

prime property news & views<br />

New Exec Director for City<br />

& Westminster Property<br />

Associations<br />

The City and Westminster Property Associations<br />

– which look after the interests<br />

of over 400 of prime central London’s<br />

property owners, developers, investors<br />

and advisors – has appointed a new Executive<br />

Director. Q<br />

Read these stories<br />

and more in full at<br />

www.<strong>PrimeResi</strong>.<strong>com</strong>/news<br />

Peace to chair TTA<br />

Liz Peace – the outgoing Chief Exec of<br />

the British Property Federation – is joining<br />

PR agency TTA Property. Q<br />

Bouygues appoints new<br />

Commercial Director<br />

Bouygues UK has promoted Colin<br />

Whitfield to the Group Commercial<br />

Director seat with immediate effect. Q<br />

Images, from top: Westminster Property Association, The British Property Federation, Cluttons<br />

p.2<br />

this is just a small selection of highlights from August’s news on <strong>PrimeResi</strong>.<strong>com</strong><br />

read the full stories here: www.primeresi.<strong>com</strong>/people

MARKETWATCH<br />

- New housebuilding starts: 0% change<br />

(Quarterly), u +22% (Annual) – HMRC<br />

NEWS: THE MARKET<br />

Middle Eastern buyers<br />

account for 50% of<br />

Mayfair’s super-prime deals<br />

Image courtesy of Wetherell<br />

uHouse price annual inflation: +19.3%<br />

in London, +10.7% in England, +3.5%<br />

in Wales, +6.0% in Scotland, +4.9% in<br />

Northern Ireland – ONS<br />

dAsking prices: England & Wales -2.9%;<br />

London -5.9% (Monthly) – Rightmove<br />

uPCL prices +11.3%; uPCL transactions<br />

+19.3%; uGreater London prices<br />

+12.1%; uGreater London transactions<br />

+20.1%; uEngland & Wales prices<br />

+5.9%; uEngland & Wales transactions<br />

+30.9% (Annual, Q2 on Q2) – Land<br />

Registry / LCP<br />

- London prices +0.3% (Monthly);<br />

dAnnual increase down from +8.1% to<br />

+7.9%; dnew prospective buyers -25%;<br />

dviewings -10%, uexchanges +3%<br />

(Annual); - London rents +0.5%; unew<br />

tenant registrations +17%; utenant<br />

viewings +25% (Annual) – Knight Frank<br />

uCapital values +15.9% (Annual);<br />

daverage gross yield down to 3.19% –<br />

Cluttons<br />

dTransaction levels -8% <strong>com</strong>pared to<br />

average (Quarterly) – Strutt & Parker<br />

uNew instructions +26%;<br />

dTransactions -9.9%; uPSF prices for<br />

NEWS: THE MARKET<br />

Appetite for<br />

Construction:<br />

New house<br />

building starts<br />

up by a fifth<br />

There’s been no<br />

change in the number<br />

of new house<br />

building starts over<br />

the last quarter,<br />

although the number’s<br />

up by nearly a<br />

fifth year-on-year,<br />

according to the<br />

latest Government<br />

stats. Q<br />

The Big<br />

Summer Sale:<br />

Record drop<br />

in August<br />

asking prices<br />

The average asking<br />

price of newly-marketed<br />

property<br />

across England and<br />

Wales is down by<br />

2.9% this month<br />

<strong>com</strong>pared to last,<br />

according to Rightmove.<br />

Q<br />

Resi yields<br />

drop but<br />

investor activity<br />

accelerates<br />

The pace of growth for<br />

residential investments<br />

slowed up in Q2, leaving<br />

capital values 15.9%<br />

up on the year, says<br />

Cluttons. Q<br />

‘The financial<br />

crisis no<br />

longer<br />

dominates<br />

the fortunes<br />

of the prime<br />

London<br />

residential<br />

market’<br />

A looming General<br />

Election and<br />

expectations of an<br />

interest rate rise<br />

have eclipsed the<br />

global economic<br />

meltdown as the<br />

primary factors affecting<br />

the top end<br />

of London’s property<br />

market, says<br />

Knight Frank.Q<br />

London<br />

house prices<br />

have risen<br />

by 19.3% in<br />

the last 12<br />

months -<br />

ONS<br />

While still strong,<br />

the pace of annual<br />

house price growth<br />

in the UK has<br />

dropped a smidge,<br />

from +10.4% in<br />

the year to May<br />

to +10.2% in the<br />

year to June 2014,<br />

according to the<br />

latest batch of stats<br />

from the ONS. Q<br />

Read these stories<br />

and more in full at<br />

www.<strong>PrimeResi</strong>.<strong>com</strong>/news<br />

House price expectations<br />

‘substantially lower’ than<br />

May’s high point<br />

“The price exuberance seen in some corners<br />

of the market is easing,” says Knight<br />

Frank’s Gráinne Gilmore, as the agency’s<br />

monthly House Price Sentiment Index<br />

shows another drop. Q<br />

50% of new applicants made<br />

an offer in July – D&G<br />

There seem to be some pretty motivated<br />

househunters out there this Summer,<br />

with Douglas & Gordon reporting that<br />

nearly half of its new applicants actually<br />

made an offer on a property last month.Q<br />

Caution, Plateau: London’s<br />

new prime sales landscape<br />

There’s been “a distinct change in<br />

attitude on the part of both buyers and<br />

vendors” in prime London through<br />

this year’s second quarter, says Chestertons.Q<br />

London Uberground:<br />

Housing markets along the<br />

‘ginger line’ outperform<br />

One of London’s least-celebrated transport<br />

links – the ‘ginger line’ – has actually<br />

had a profound effect on the property<br />

markets it passes through, according to<br />

Hamptons International. Q<br />

Graph by Knight Frank<br />

p.4<br />

this is just a small selection of highlights from August’s news on <strong>PrimeResi</strong>.<strong>com</strong><br />

read the full stories here: www.primeresi.<strong>com</strong>/the-market

Images, from top: The Crown Estate, Heron International, villaforsale-spain.<strong>com</strong>, Brimelow McSweeney<br />

Church sells chunk of<br />

Mayfair to Crowns for £381m<br />

The Church has offloaded its 64% stake in<br />

the Pollen Estate - that four acre square of<br />

Mayfair between Conduit Street, Regent<br />

Street, Burlington Gardens and Bond<br />

Street – for £381m. Q<br />

Heron Plaza site sells to<br />

Singapore’s UOL Group<br />

Singapore-based UOL Group has bought<br />

the Heron Plaza site on Bishopsgate from<br />

Gerald Ronson’s Heron International for<br />

£97m, with plans for luxury residential<br />

apartments, a hotel and retail units. It’s<br />

UOL’s first major London play. Q<br />

Subscribe to <strong>PrimeResi</strong>.<strong>com</strong><br />

to read these stories in full<br />

Nod for Brimelow<br />

McSweeney’s Soho scheme<br />

Brimelow McSweeney has bagged planning<br />

permission for its residential designs<br />

on 181-185 Wardour Street. Q<br />

NEWS: DEALS & DEVELOPMENTS<br />

‘Heroic’<br />

rescue of<br />

Brontë’s muse<br />

wins top<br />

restoration<br />

award<br />

A late medieval<br />

house in North<br />

Yorkshire that’s<br />

thought to have<br />

inspired the setting<br />

for Jane Eyre has<br />

walked away with<br />

this year’s coveted<br />

HHA & Sotheby’s<br />

Restoration<br />

Award.Q<br />

Hadley<br />

<strong>com</strong>pletes<br />

Chelsea<br />

Island<br />

acquisition<br />

with £48m<br />

bridge<br />

Luxury developer<br />

Hadley Property<br />

Group has <strong>com</strong>pleted<br />

the acquisition of<br />

a development site<br />

in Chelsea Harbour<br />

with a chunky<br />

bridging loan from<br />

Omni Capital. Q<br />

Lift off for<br />

government<br />

property<br />

search engine<br />

It’s just got a whole<br />

lot easier to find underused<br />

and empty<br />

government land and<br />

property. Q<br />

Construction<br />

firms battle it<br />

out over £600m<br />

Battersea<br />

Power Station<br />

contract<br />

It sounds like things<br />

are heating up in the<br />

battle for the £600m<br />

contract to redevelop<br />

the main Battersea<br />

Power Station building.<br />

Q<br />

Free<br />

Lamborghini<br />

Diablo: Spanish<br />

villa offered<br />

with supercar<br />

sweetener<br />

A villa on the Costa<br />

del Sol is being offered<br />

for sale with a free<br />

Lamborghini Diablo<br />

thrown in to sweeten<br />

the deal. Q<br />

Tough love for<br />

Candy’s Sugar<br />

Quay S106 plea<br />

Planners are “sticking<br />

to their guns” over<br />

a £15m affordable<br />

housing contribution<br />

requirement for Candy<br />

& Candy’s Sugar Quay<br />

development. Q<br />

this is just a small selection of highlights from August’s news on <strong>PrimeResi</strong>.<strong>com</strong><br />

read the full stories here: www.primeresi.<strong>com</strong>/news<br />

p.5

NEWS<br />

Here’s what the first new-build for over a century on<br />

Britain’s most expensive street, Kensington Palace Gardens, will look like.<br />

Designed by Colwyn Foulkes & Partners and revealed on <strong>PrimeResi</strong> back in<br />

Millionaires’ Rows 2014:<br />

Britain’s most expensive streets, towns and areas<br />

The value of Britain’s most expensive streets is rising at nearly twice the national average,<br />

meaning that the number of “property millionaires” – with homes worth more than £1m<br />

– is nearly 50% higher than it was last year.<br />

Property prices on the the UK’s ten most expensive streets have increased by 12.9% over<br />

the last 12 months, while Zoopla’s stats show a national average price rise of 6.6% over the<br />

same period.<br />

The portal’s annual Property Richlist shows that there are now 484,081 £1m+ homeowners<br />

in Britain – up 49% on last year – and that there are 10,613 streets in Britain with an<br />

average property value of £1m+, up 29% on 2013. 3,744 of those “Millionaires’ Rows” –<br />

just shy of a third of the total and all the top 20 – are in London.<br />

12 streets claim an average house prices over £10m. Kensington Palace Gardens again<br />

tops the table, with an average price of £42,730,760 (62 times the £263,705 value of the<br />

average British home, says Zoopla). The Boltons in SW10 takes second place with average<br />

house prices standing at £26,570,341, and Grosvenor Crescent in SW1 rounds out the top<br />

three with average property prices of £22,293,470.<br />

Outside of the capital, the most expensive street in Britain is Sunninghill Road in Surrey,<br />

where the average home is currently worth £5,605,067. The two most expensive towns<br />

outside London are both in Surrey, with average house prices in Virginia Water at<br />

£1,186,262 and Cobham at £1,003,400.<br />

W8 (Kensington) remains London’s most pricey postcode, with average property prices<br />

in the area of £2.78m. Neighbouring SW7 (Knightsbridge), the next most expensive area<br />

in the capital, has average values of £2.48m, while property values in third-placed SW3<br />

(Chelsea) stand at £2.37m. The rest of the top 10 is dominated by areas in South West,<br />

West and North West London. Q<br />

p.6<br />

this is just a small selection of highlights from August’s news on <strong>PrimeResi</strong>.<strong>com</strong><br />

read the full stories here: www.primeresi.<strong>com</strong>/the-market

Britain’s Top 10<br />

Most Expensive Streets<br />

1. Kensington Palace Grdns, London W8<br />

2. The Boltons, London SW10<br />

3. Grosvenor Crescent, London SW1X<br />

4. Courtenay Avenue, London N6<br />

5. Ilchester Place, London W14<br />

6. Frognal Way, London NW3<br />

7. Carlyle Square, London SW3<br />

8. Montrose Place, London SW1X<br />

9. Cottesmore Gardens, London W8<br />

10. Manresa Road, London SW3<br />

Average<br />

Property Value<br />

£42,730,706<br />

£26,570,341<br />

£22,293,470<br />

£16,877,746<br />

£11,853,515<br />

£10,974,043<br />

£10,846,481<br />

£10,683,611<br />

£10,631,829<br />

£10,362,420<br />

Annual %<br />

Increase<br />

12.11%<br />

13.64%<br />

12.43%<br />

13.67%<br />

16.02%<br />

8.38%<br />

14.14%<br />

12.43%<br />

12.11%<br />

14.14%<br />

Britain’s Top 10<br />

Most Expensive Towns<br />

1. Virginia Water, Surrey<br />

2. Cobham, Surrey<br />

3. Keston, London<br />

4. Esher, Surrey<br />

5. Richmond, Surrey<br />

6. Beaconsfield, Buckinghamshire<br />

7. Chalfont St. Giles, Buckinghamshire<br />

8. Gerrards Cross, Buckinghamshire<br />

9. Radlett, Hertfordshire<br />

10. Weybridge, Surrey<br />

Average<br />

Property Value<br />

£1,186,262<br />

£1,003,400<br />

£947,955<br />

£931,669<br />

£906,770<br />

£897,872<br />

£836,434<br />

£815,222<br />

£794,569<br />

£785,400<br />

Annual %<br />

Increase<br />

5.91%<br />

6.94%<br />

10.81%<br />

10.08%<br />

12.47%<br />

4.79%<br />

0.47%<br />

9.38%<br />

14.21%<br />

6.96%<br />

Source: Zoopla.co.uk<br />

this is just a small selection of highlights from August’s news on <strong>PrimeResi</strong>.<strong>com</strong><br />

read the full stories here: www.primeresi.<strong>com</strong>/news<br />

p.7

VIEWS<br />

Why 2015 could make or break<br />

the UK’s property market<br />

For homeowners – especially those in the South East and London – it has never been<br />

more important who wins the next general election, says Trevor Abrahmsohn…<br />

In the past, whether it be New Labour or Conservative who won an election, it mattered<br />

little. Neither party were advocating any particular alarming legislation as it applies to<br />

property ownership and therefore there was no predictable downturn or upturn before or<br />

after the Election. It was a case of ‘same old’. I will admit, there has always been a hiatus a<br />

few weeks before and after an Election where the market has moved sideways for a short<br />

while but no real change has manifested itself.<br />

The spring Budget and the Autumn Statement have an effect particularly where Stamp<br />

Duty rises have been leaked beforehand and then there has been a real crescendo of activity<br />

in the weeks, days and hours before the Budget announcement where buyers accelerate<br />

and precipitate their activities in advance of rises in SDLT (Stamp Duty).<br />

The out<strong>com</strong>e of the May Election in 2015 will be different. With the Lib-Dems making<br />

Mansion Tax a main plank of their Manifesto and Ed Balls, of the Labour Party, aping<br />

their sentiments, the spectre of this draconian tax is having a very profound effect on the<br />

London property market particularly above £5-10million. Frankly, you can’t blame anyone<br />

since in London £2million will not buy you a mansion and it is a mischievous plot to<br />

describe what is otherwise a tax on London’s wealthy.<br />

By way of illustration, a person living in say a £5million house will be facing a gross tax<br />

of £60,000 per annum which is probably a third to a half of their gross in<strong>com</strong>e. A widow,<br />

for instance, who bought their family home many years ago and does not have a huge<br />

in<strong>com</strong>e will be distressed at this scurrilous and punitive tax. Even if they roll up the tax<br />

with interest, until such time as the widow dies or sells, the benefit that she would like to<br />

pass to her family (after death duties) will be soaked up by the Mansion Tax process.<br />

It is therefore no wonder that buyers and householders are so vexed about this and it is<br />

already having a profound effect on sentiments where people are delaying decisions until<br />

the out<strong>com</strong>e of the Election is better known. This negative sentiment has been getting<br />

gradually worse over the last 18 months from the obscene rises in SDLT since the Budget<br />

of 2012 where non-corporate tax has gone up by 40% and corporate by 300%.<br />

In addition the Chancellor (egged on by the Lib-Dems) has changed the taxation<br />

arrangements on Capital Gains and there is a “posse of the press” who consider ‘Jonny<br />

Foreigner’ buying property in the UK as being thoroughly ‘undesirable’ soaking up our<br />

limited supply of private housing.<br />

The net effect of all this is that the market outside the Central London area, particularly<br />

along the north west London corridor over £5-10million pounds has been conspicuously<br />

p.8<br />

this is just a small selection of highlights from August’s views on <strong>PrimeResi</strong>.<strong>com</strong><br />

there’s more at www.<strong>PrimeResi</strong>.<strong>com</strong>/views

affected by fewer transactions. In fact the turnover of properties in<br />

this price range for estate agents is down by 60/70%. Even central<br />

London is now affected where prices are relatively stable (with no<br />

growth) and foreign buyers are markedly fewer.<br />

The Russians have local difficulties with a declining economy, a<br />

falling Rouble and a shrinking economy quite apart from the threat<br />

of sanctions on key individuals but other foreigners are being put<br />

off by this self-inflicted problem.<br />

Prices at the top end are generally down in the suburbs by 10-15%<br />

and I see no growth at all in Central London apart from the few hot<br />

spots where, at the best of times, there is no supply whatsoever.<br />

A telling sign of this malaise is that key roads in north west London have a number of<br />

un-sold properties whereas under usual circumstances there is just no supply.<br />

Very recently, as sellers grasp the reality of this new circumstance, they are being more<br />

realistic with prices and this is triggering some sales – which is very wel<strong>com</strong>e.<br />

The market up to £2million (the threshold for Stamp Duty and coincidently Mansion<br />

Tax) has been very busy of late across London and the rest of the UK with growth of between<br />

8-10% but even this is slowing down and we will see what happens in September, a<br />

seasonally busy month, if sentiments have changed over the summer.<br />

In the lower price ranges I see 5% growth on an annualised basis since the shortage of<br />

private housing will always keep prices moving upwards. Buyers are concerned about<br />

rises in interest rates and its effect on mortgage rates which will happen at the end of this<br />

year and if not next year. Mortgagees are taking an inordinate amount of time to process<br />

mortgage applications and that is having an effect on the speed of the conveyancing<br />

process.<br />

Above £2million the cost of sales to trade upwards is 10% of the new purchase and this<br />

is having an effect on sentiments where householders are preferring to spend the money<br />

extending their properties either through loft conversions, ground floor extensions or<br />

basements since there could be a tangible tax free taxable gain when the enlarged property<br />

is sold rather than giving it to the taxman by way of SDLT.<br />

Prices between £1-2million, after the election, will probably remain similar i.e. 5% in<br />

growth but the real changes could be above this level where if a Mansion Tax is imposed<br />

by either a Labour Party or a coalition with the Lib-Dems I see prices dropping by 25%<br />

or more. There are some wel<strong>com</strong>e conciliatory sounds <strong>com</strong>ing from Danny Alexander<br />

(Chief Secretary to the Treasury) and even Ed Balls regarding the alternative proposals to<br />

Mansion Tax i.e. an extension to Council Tax Bands.<br />

If this is the case and the ‘devil is not in the detail’ then this will have a far less deleterious<br />

effect on the market. In fact if the council tax bands are extended in a sensible and<br />

progressive fashion, in line with the existing arrangements, there will be a sigh of relief<br />

all around and probably a spike in activity and prices once the first Budget of the new<br />

government is announced.<br />

Markets and sentiments hate uncertainty and frankly it has never<br />

been more important which party is elected in May 2015.<br />

If there is a Conservative government the markets will do very<br />

well indeed but a Labour Party with old Labour socialist instincts<br />

will not bode well for this sector. Q<br />

It is a<br />

mischievous<br />

plot to describe<br />

what is<br />

otherwise a tax<br />

on London’s<br />

wealthy<br />

Trevor Abrahmsohn is<br />

Managing Director of<br />

Glentree Estates<br />

glentree.co.uk<br />

this is just a small selection of highlights from August’s views on <strong>PrimeResi</strong>.<strong>com</strong><br />

there’s more at www.<strong>PrimeResi</strong>.<strong>com</strong>/views<br />

p.9

VIEWS<br />

Drivers, Divas & Dictators: A<br />

history of The Wentworth Estate<br />

Surrey’s Wentworth Estate is one of the most valuable residential<br />

enclaves in Britain. It has, as you might expect, had its fair share<br />

of savoury residents since Thomas Telford began developing it in<br />

the 1920s: lifetime local James Wyatt of Barton Wyatt shares his<br />

memories of the Estate’s evolution, from saluting Diana Dors and<br />

Barry Gibb to managing General Pinochet’s cess pit…<br />

Wentworth has been called many things over the years: ‘Exclusive’<br />

‘Estate of the stars’ ‘World renowned’ and so on, but the<br />

story of Wentworth has changed over the years, since it was first developed<br />

by Walter Tarrant in the early 1920’s. Wentworth continues<br />

to evolve today with nearly 50 new houses currently under development,<br />

it’s clear that Wentworth has lost none of its appeal.<br />

Tarrant has often been called a visionary, as the first developer to<br />

construct golf courses with houses dotted around them. His marketing<br />

was aimed at City gentlemen looking for weekend homes not<br />

too far from London with the added lure of a golf club close to your<br />

house. This recipe has since been repeated all over the World.<br />

St George’s Hill in Weybridge which he started developing in 1911<br />

was a resounding success and Tarrant set his eyes on an even larger<br />

prize by purchasing Wentworth in the early 1920’s. The Wentworth<br />

Estate covers 1,750 acres – almost twice as big as St George’s Hill<br />

and Tarrant set about instructing Harry Colt to design the first golf<br />

course – now the East Course and started building houses, albeit<br />

slightly smaller than some of the enormous piles he had built in<br />

Weybridge.<br />

Tarrant also designed and constructed the early parade of shops<br />

in Virginia Water where my office is now. The original plans which<br />

I have show the bank to be where Barclays Bank is, a furniture<br />

shop where Barton Wyatt is, an estate agent where the Wentworth<br />

Patisserie is now, a butcher where the Viceroy Indian restaurant is, a<br />

fishmonger where the Glasshouse is now and beyond that, a greengrocer<br />

which is now an estate agents. All of these modest sized<br />

shops came with residential ac<strong>com</strong>modation behind and above the<br />

shop.<br />

p.10<br />

this is just a small selection of highlights from August’s views on <strong>PrimeResi</strong>.<strong>com</strong><br />

there’s more at www.<strong>PrimeResi</strong>.<strong>com</strong>/views

Image courtesy of Waterfords<br />

Indeed, when my grandfather bought the old estate agency<br />

practice of Gosling and Milner in 1965, the offices still had a two<br />

bedroom flat above it which my parents moved into. My bedroom<br />

as a small baby is my office today!<br />

Tarrant went on to construct the West Course, often known as<br />

the Burma Road, which is now used for the BMW PGA Championship<br />

in May.<br />

War time bought a huge change to Wentworth with the Clubhouse<br />

being requisitioned at the outbreak of the war. Soon after,<br />

the infamous but little known tunnels were constructed underground<br />

next to the Clubhouse, for the General Headquarters<br />

(GHQ) Signals. The tunnels were constructed in cast iron in the<br />

same style as the London Underground and were designed to be<br />

the Signals headquarters if there had been a devastating invasion<br />

of London. At the same time, the Clubhouse was occupied as the<br />

GHQ Home Forces who also lived in many of the houses around<br />

the estate. I do wonder whether golf matches carried on as normal?<br />

The tunnels are well guarded these days, although in the 1970’s<br />

my friends and I would often visit them as someone had thoughtfully<br />

chiselled out a hole in the back of the concrete entrance. It<br />

is rather fitting given Wentworth’s story during the war that our<br />

current local MP is the Rt. Hon. Phillip Hammond who was until<br />

recently Secretary of State for Defence.<br />

The estate has seen various changes in the type of homeowner<br />

over the years that I have lived here. In the 70’s glamour, pop stars<br />

and entertainers poured into the estate with Elton John, a couple<br />

of Bee Gee’s, Bruce Forsyth, Chris Squire of the rock band Yes and<br />

Diana Dors all living on the estate. A frequent sight was seeing the<br />

blonde bombshell of Diana Dors driving through the village in her<br />

open top azure blue Rolls Royce with the flowing locks of Barry<br />

Gibb next to her. Similarly, I would think nothing of bumping<br />

VIEWS<br />

A frequent<br />

sight was<br />

seeing the<br />

blonde<br />

bombshell<br />

of Diana<br />

Dors driving<br />

through the<br />

village in her<br />

open top azure<br />

blue Rolls<br />

Royce with the<br />

flowing locks<br />

of Barry Gibb<br />

next to her.<br />

this is just a small selection of highlights from August’s views on <strong>PrimeResi</strong>.<strong>com</strong><br />

there’s more at www.<strong>PrimeResi</strong>.<strong>com</strong>/views<br />

p.11

VIEWS<br />

into Elton John in film producer’s Brian Forbes’ book shop in the<br />

shopping parade. Yes, it was perhaps a strange place to grow up.<br />

During the 1980’s the estate filled with a large number of Scandinavian<br />

buyers – particularly Swedish families who had been<br />

hounded out of their country through high taxes. Another resident<br />

was pop star Gary Numan who was fond of shag pile carpet<br />

in his house, not only on the floor but up the walls too. He also<br />

had a private plane that he had crashed parked on his driveway.<br />

During the 1990’s Wentworth was taken over by a number of<br />

golfers, Nick Faldo – who had the slightly unnerving practice of<br />

standing at the far end of the Wentworth driving range with his<br />

instructor David Leadbetter, firing golf balls towards us less able<br />

golfers at the correct end.<br />

Other golfing residents included multiple major winner Sandy<br />

Lyle, Ernie Els, Thomas Bjorn, Wentworth Pro and Ryder Cup<br />

Captain Bernard Gallagher and Sam Torrance.<br />

In the late 1990’s, Chile’s ex-dictator General Pinochet found<br />

himself under house arrest on Wentworth in a house I managed.<br />

By that time, he was a doddery old chap, but could still manage a<br />

game of badminton. The modest four bedroom house was occupied<br />

by at least 12 people – mainly police on three shifts, 24 hours<br />

a day, so it isn’t surprising that our main management issue was<br />

the cess-pit which struggled a bit!<br />

After 2000, we saw the inexorable rise of the overseas buyer<br />

with Wentworth be<strong>com</strong>ing ever more highly sought after. The<br />

Clubhouse itself had been transformed by property tycoon Elliot<br />

Bernard with a new tennis, health, indoor swimming pool and spa<br />

<strong>com</strong>plex being built ensuring that Wentworth was fast be<strong>com</strong>ing<br />

the place to live. Larger houses were built and we saw the first<br />

inflow of the oligarchs from Eastern Europe particularly Russian,<br />

Ukrainian and Kazakhstanis. At the same time, a second international<br />

school opened locally which boosted the number of American’s<br />

living locally by 100%. We also saw a number of Far Eastern<br />

royal families buying locally, drawn not only by the golf but by the<br />

Guards Polo Club and the nearby Farnborough Private Airport.<br />

However, it is worth pointing out that of the less than 600 houses<br />

that line the private roads of Wentworth, the vast majority are UK<br />

owned and occupied.<br />

Today, Wentworth has a wide variety of property in varying sizes<br />

of gardens from well under half an acre to over 10 acres – the<br />

houses being worth anything from £500,000 to over £50,000,000.<br />

The area has a vibrant shopping parade with all the shops currently<br />

occupied – not a scenario that applies to many high streets around<br />

the country at the moment.<br />

This is all a far cry from the days in the early 1920’s when Walter<br />

Tarrant had his vision, and we have him to thank for that. Q<br />

Chile’s exdictator<br />

General<br />

Pinochet found<br />

himself under<br />

house arrest<br />

on Wentworth<br />

in a house I<br />

managed. By<br />

that time, he<br />

was a doddery<br />

old chap,<br />

but could<br />

still manage<br />

a game of<br />

badminton.<br />

James Wyatt is a Partner<br />

in Virginia Water estate<br />

agency Barton Wyatt.<br />

www.bartonwyatt.co.uk<br />

p.12<br />

this is just a small selection of highlights from August’s views on <strong>PrimeResi</strong>.<strong>com</strong><br />

there’s more at www.<strong>PrimeResi</strong>.<strong>com</strong>/views

ONLY ON PRIMERESI.COM<br />

The Language<br />

of Luxury:<br />

Designing<br />

for cultural<br />

differences<br />

Understanding and anticipating cultural<br />

differences is a huge part of gaining<br />

a true insight into a client. Only when<br />

these are fully understood, can a home<br />

be created to exceed all their aspirations,<br />

explains Joe Burns… Q<br />

read the full stories on<br />

www.<strong>PrimeResi</strong>.<strong>com</strong><br />

p.13

VIEWS<br />

Letter From the Home Counties:<br />

Turning the wheel on a tanker<br />

There is no doubt that the Home Counties market remains buoyant, says Garry<br />

Collins. The appetite to buy is certainly out there and vendors which bring their<br />

properties to the market at a sensible price are achieving the desired out<strong>com</strong>e, but the<br />

message of ‘adjustment’ seems to be taking its time to filter to ground level…<br />

simple imbalance of supply and demand, as well as factors including vendor expectations,<br />

agents <strong>com</strong>peting for instructions in a challenging market and of course,<br />

A<br />

bullish media reports, all <strong>com</strong>bined to create a somewhat ‘superficial’ first quarter.<br />

This saw prices pushed beyond many vendor and agent expectations. Year on year,<br />

prices in London rose by as much as 18% in some parts, and this had a ripple effect on<br />

prices here in the Home Counties.<br />

However, it would appear that London buyers are starting to feel that enough is<br />

enough. Over the last month, we have started to see prices stabilise, echoed most recently<br />

by figures released from the Land Registry revealing average house prices held steady<br />

between May and June.<br />

This suggests recent moves to tighten mortgage lending rules, perhaps <strong>com</strong>bined with<br />

the anticipation of an interest rate hike at the end of the year, could have started to cool<br />

the market.<br />

Just like turning the wheel on a tanker, it takes a while for everything to catch up<br />

This is no bad thing; the property market is very adept at coping with periods of<br />

adjustment but, just like turning the wheel on a tanker, it takes a<br />

while for everything to catch up. At present, vendors are still being<br />

influenced by reports of rising property prices and so naturally<br />

want to achieve the best possible price for their home. However,<br />

even in the current market where demand is high, over-ambitious<br />

pricing will only achieve viewings; these won’t necessarily convert<br />

into sales, particularly at the top end of the market where price<br />

rises haven’t been as steep as the middle-market.<br />

There has, however, been a slight rise in sale of properties over<br />

£1million which can be partly attributed to rising prices over the<br />

last six months, pushing more properties over this price bracket. It<br />

could also be linked to more people moving out of the capital after<br />

achieving a top price for their city home. Those buyers looking in<br />

the £1m and above bracket are less likely to rely on financing, and<br />

those that do tend to, have substantial equity, say 50%, therefore<br />

are less affected by the recent Mortgage Market Review. Q<br />

Just like<br />

turning the<br />

wheel on a<br />

tanker, it takes<br />

a while for<br />

everything to<br />

catch up<br />

Garry Collins is Manager<br />

of Waterfords Sunningdale<br />

and Chobham<br />

www.waterfords.co.uk<br />

p.14<br />

this is just a small selection of highlights from August’s views on <strong>PrimeResi</strong>.<strong>com</strong><br />

there’s more at www.<strong>PrimeResi</strong>.<strong>com</strong>/views

SUBSCRIBE NOW<br />

PrimeQResi<br />

Journal of Prime Property<br />

WWW.PRIMERESI.COM/SUBSCRIBE-TODAY<br />

The only news & views resource dedicated to the<br />

top-end of the UK’s residential property sector<br />

Breaking News updated<br />

throughout the working day.<br />

IMAGE CREDITS: Inside Cambridge House, Wetherell; Old Queen St, Galliard Homes; RICS; Hamilton Bradshaw Real Estate<br />

Deals, developments<br />

& instructions<br />

Intelligence<br />

Q Daily Sales & Rental Stats<br />

from Lonres: the latest market<br />

intel from London’s leading realtime<br />

data provider.<br />

Q <strong>PrimeResi</strong> Intelligence<br />

Library: a searchable archive of<br />

residential research reports, data<br />

and reference briefings.<br />

Views & Opinions from some of<br />

the most opinionated, informed &<br />

and authoritative characters in the<br />

prime property industry.<br />

Market trends &<br />

analysis<br />

Briefings<br />

www.<strong>PrimeResi</strong>.<strong>com</strong><br />

People moves &<br />

career opportunities<br />

Q Daily Breakfast Briefing<br />

Emails: all the latest stories<br />

straight to your inbox in time for<br />

coffee and porridge.<br />

Q Weekly Bulletin Emails: a<br />

handy digest of the week’s biggest<br />

and most read stories, delivered<br />

every Monday.<br />

p.15

REQUIRED READING<br />

The Housing Standards Review:<br />

What can developers expect?<br />

In a drive to simplify the myriad of standards, guidance and<br />

codes that apply to the construction of new homes in the UK, the<br />

government announced in March that current housing standards<br />

are to be reduced by 90% from 100 to around 10 by early next<br />

year. Shelia McCusker explains what the changes could potentially<br />

mean for prime resi developers…<br />

This move – the result of the 2013 Housing Standards Review<br />

consultation – <strong>com</strong>es as wel<strong>com</strong>e news for the sector, which<br />

hasn’t seen a shift of this scale in decades.<br />

Details won’t be available until the draft regulations and technical<br />

standards are published at some point this summer, but in the<br />

meantime we can chew on the promise that technical standards are<br />

to be consolidated into the Building Regulations and ac<strong>com</strong>panying<br />

Approved Documents. Assessing the technical requirements<br />

will fall to building control – effectively meaning that planning<br />

permission will be granted conditional to <strong>com</strong>pliance.<br />

With the burden of <strong>com</strong>pliance checking migrating to Local<br />

Diagram via DCLG © Crown copyright, 2014. Copyright in the typographical arrangement rests with the Crown<br />

p.16<br />

this is just a small selection of highlights from August’s features on <strong>PrimeResi</strong>.<strong>com</strong><br />

there’s more at www.<strong>PrimeResi</strong>.<strong>com</strong>/required-reading

Authority Building Control (LABC) and Approved Inspectors,<br />

the corresponding increase in workload once the new system is in<br />

place will be considerable.<br />

Voluntary assessments like the Code for Sustainable Homes and<br />

Secured by Design will be dismantled and assimilated into Building<br />

Regulations. In an effort to recognise that one size doesn’t fit<br />

all, the government has suggested that the new system will include<br />

flexibility, with local authorities having limited powers to enable<br />

different levels of performance when local circumstances require<br />

it. Optional standards will also be included in relation to minimum<br />

space requirements, targets for renewables (The Merton Rule),<br />

levels of accessibility and requirements of wheelchair-adaptable<br />

housing.<br />

While there is clearly a need for more rational and intelligible system<br />

of standards, what we don’t know is whether or not the consolidation<br />

of standards will really result in the best new housing. The<br />

review covers access, security, water, energy and space, but doesn’t<br />

include standards for daylight and sunlight, or building materials.<br />

With all this in mind, can we identify potential risks or issues for<br />

residential developers or is it too early to tell?<br />

There is already concern that the revised system will improve<br />

the standard of poorer performing developments, but in so doing<br />

set lower targets for the majority of developments. Considering<br />

the changes from a prime or super-prime residential perspective,<br />

certain major elements such as minimum space standards do not<br />

seem particularly relevant, except where developments are of sufficient<br />

scale to attract an affordable housing provision.<br />

But how will the new system play out once implemented? Will<br />

any alternative assessment processes emerge? Will the shift of<br />

responsibility between planning departments and building control<br />

lead to issues further down the line, beyond planning approval?<br />

We can only speculate at this stage, although one likely out<strong>com</strong>e<br />

is that approved inspectors and building control officers will need<br />

to be<strong>com</strong>e involved at an earlier stage of design development. This<br />

is already the case with many prime residential developments<br />

where independent approved inspectors are concerned, but it<br />

is less typical where building regulations <strong>com</strong>pliance is handled<br />

directly by the local authority building inspectors.<br />

As the implementation of the new system unfolds over the forth<strong>com</strong>ing<br />

months we can expect significant changes in our processes.<br />

From a designer’s perspective we are pleased to see these changes<br />

and believe that, on balance, they will make life more manageable<br />

for the design team. That said, only time will tell whether the<br />

government’s stated objective of consolidating standards without<br />

<strong>com</strong>promising quality, and in particular sustainability targets, has<br />

been achieved. Q<br />

One likely<br />

out<strong>com</strong>e is<br />

that approved<br />

inspectors<br />

and building<br />

control officers<br />

will need<br />

to be<strong>com</strong>e<br />

involved at<br />

an earlier<br />

stage of design<br />

development<br />

Sheila McCusker is a<br />

Founding Director of<br />

MSMR Architects<br />

msmrarchitects.co.uk<br />

this is just a small selection of highlights from August’s features on <strong>PrimeResi</strong>.<strong>com</strong><br />

there’s more at www.<strong>PrimeResi</strong>.<strong>com</strong>/required-reading<br />

p.17

INTERVIEW<br />

Triangle<br />

Group’s<br />

Rick Denton<br />

on buying<br />

Holborn Links<br />

and building<br />

investments<br />

Triangle’s acquisition of the Holborn<br />

Links portfolio – a prized four-acre<br />

swathe of London’s Midtown – has been<br />

one of the biggest deals of 2014 so far.<br />

The development and investment group’s<br />

new CEO Rick Denton talks exclusively<br />

to <strong>PrimeResi</strong> about how it all came about<br />

and why the capital continues to provide<br />

such great investment opportunities…<br />

p.18<br />

this is just a small selection of highlights from August’s features on <strong>PrimeResi</strong>.<strong>com</strong><br />

there are more interviews & profiles at www.<strong>PrimeResi</strong>.<strong>com</strong>/features/interviews

INTERVIEW<br />

Let’s start with the Holborn Links<br />

acquisition in June. Why was this<br />

such an important deal?<br />

At £212.5 million, Holborn Links is the<br />

largest London acquisition we have made<br />

on behalf of our clients to date.<br />

However, more importantly, the site represents<br />

a fantastic investment opportunity<br />

in a part of London that continues to be<br />

underdeveloped and has huge potential.<br />

We were instrumental in scoping the opportunity<br />

and for the strategy to enhance<br />

the quality of the overall site.<br />

The portfolio was acquired on<br />

behalf of Perez International; what<br />

was Triangle’s role and how long<br />

did the process take?<br />

Triangle was responsible for the sourcing<br />

of the investment concept, the scoping<br />

of the development opportunity, the liaison<br />

with investors and for negotiating the<br />

<strong>com</strong>pletion particulars. The process took<br />

in excess of nine months, which included<br />

around a six month time period from<br />

exchange to <strong>com</strong>pletion.<br />

We hear the portfolio’s future<br />

development will be managed by Triangle<br />

Group. Are there any plans to<br />

develop or increase the residential<br />

element?<br />

The portfolio will indeed be managed<br />

and further developed by Triangle Group<br />

on behalf of its investors. The development<br />

plans are currently under review so<br />

at this stage we are quantifying the extent<br />

to which it may include a more substantial<br />

residential element.<br />

At the time, you mentioned; “this<br />

strategic acquisition is a consequence<br />

of our international clients<br />

seeking to grow their presence in<br />

London.” How would you describe<br />

the current international appetite<br />

for London property?<br />

The appetite from international investors<br />

for both residential and <strong>com</strong>mercial<br />

property in London continues to<br />

be strong. London still represents great<br />

investment opportunities that will deliver<br />

excellent long-term value, in a secure<br />

environment.<br />

Will the Group be looking to acquire<br />

any other similarly high-profile<br />

portfolios or resi sites in the<br />

near future?<br />

Yes. We are always on the look-out for<br />

good investment opportunities that meet<br />

our clients’ investment criteria. There<br />

continue to be a lot of exciting opportunities<br />

in the London market, and beyond.<br />

What type of joint ventures can we<br />

expect to see from the Group over<br />

the next few years? What kind of<br />

partners might you be looking for?<br />

They might not always be joint ventures,<br />

but it’s important for Triangle to continue<br />

to build strong partnerships that allow<br />

us to operate at the highest level. We will<br />

continue to seek partners to support us on<br />

future deals particularly in the property,<br />

legal and financial services sectors. The<br />

evolution of profitable long term investment<br />

partnerships is core to the ethics of<br />

Triangle Group.<br />

this is just a small selection of highlights from August’s features on <strong>PrimeResi</strong>.<strong>com</strong><br />

there are more interviews & profiles at www.<strong>PrimeResi</strong>.<strong>com</strong>/features/interviews<br />

p.19

You also moved your HQ to Guernsey;<br />

why did you decide on this<br />

particular spot?<br />

We opened the office in Guernsey to<br />

give our rapidly expanding international<br />

client base greater access to important<br />

foreign markets, and significantly greater<br />

flexibility in structuring their investment<br />

portfolios. Guernsey is a widely-respected<br />

financial centre with a highly sophisticated<br />

legal and regulatory framework. In our<br />

research we also identified that Guernsey<br />

is one of the leading international centres<br />

for the formation of specialist investment<br />

<strong>com</strong>panies and funds.<br />

You’ve headed up some pretty major<br />

operations in the past (Denton’s<br />

former roles have included Head of<br />

International Wealth Advisory for<br />

Barclays Group, Offshore Commercial<br />

Director of Fortis Intertrust<br />

and Executive Vice President for<br />

Bank of Bermuda); where are you<br />

planning to take Triangle Group<br />

over the next five years?<br />

Our strategy is to continue to secure<br />

Triangle’s position as a leading international<br />

investment, development and asset<br />

management group focused on property,<br />

hotels and resorts, and private equity. We<br />

pride ourselves in delivering a unique<br />

partnership with clients to deliver superior<br />

returns from investment projects.<br />

We will always be entrepreneurial in<br />

our approach, and maintain our focus on<br />

client service. In five years’ time Triangle<br />

will still be identifying and converting<br />

the best investment opportunities for its<br />

clients in London; but also we will be operating<br />

in other major international hubs.<br />

Triangle also offers a property<br />

search and acquisition service. Are<br />

you seeing growth in this side of the<br />

business? Where are you seeing most<br />

of the demand originating from?<br />

We’re still seeing strong demand for<br />

property in the residential market,<br />

although not necessarily for pure investment<br />

purposes. This demand is <strong>com</strong>ing<br />

from high net worth individuals from<br />

around the world, and is driven largely<br />

by the <strong>com</strong>mon desire to have a foothold<br />

in London. Our aim is to search for and<br />

create innovative product opportunities<br />

including <strong>com</strong>mercial property, developments<br />

and property funds associated with<br />

our knowledge of the London property<br />

market.<br />

How do you foresee London’s residential<br />

property market changing<br />

over the short and long term?<br />

Over the past 10 years there has been an<br />

influx of investment into residential property<br />

market in Central London which has<br />

had well documented consequences on<br />

house prices across London. We believe<br />

that there may be some small amounts of<br />

volatility in the short term but the longer<br />

term outlook will see continued growth.<br />

This is driven by the continuing demand<br />

for London stock amongst the international<br />

wealthy <strong>com</strong>munity. Q<br />

this is just a small selection of highlights from August’s features on <strong>PrimeResi</strong>.<strong>com</strong><br />

there are more interviews & profiles at www.<strong>PrimeResi</strong>.<strong>com</strong>/features/interviews

ONLY ON PRIMERESI.COM<br />

Crime &<br />

Refurbishment:<br />

How to buy and<br />

develop a former<br />

police site<br />

First image by Leonard Bentley (CC-BY-SA-2.0); second image by Newtown Grafitti (CC-BY-2.0)<br />

Property developers have been paying up<br />

to £10m apiece for ‘under-used’ Met Police<br />

sites like Barnes Green and Connaught<br />

Gardens over the last year, and plenty<br />

more of these are set to hit the market over<br />

the <strong>com</strong>ing months. But how do you turn<br />

such unusual – and often iconic – buildings<br />

into viable apartment schemes? Paul<br />

Reed gives us the lowdown… Q<br />

The ‘Poor Door’ Debate:<br />

Do separate entrances<br />

make practical sense?<br />

There are clearly issues<br />

surrounding how affordable<br />

housing is delivered<br />

in the capital, but the tone<br />

of this ‘poor door’ debate<br />

risks throwing the baby<br />

out with the bathwater,<br />

says Edward Burton… Q<br />

read the full stories on www.<strong>PrimeResi</strong>.<strong>com</strong><br />

p.21

PROPERTIES<br />

Chelsea on Sea<br />

Landmark<br />

Recently confirmed as the UK’s priciest<br />

seaside town, one in three homes in<br />

Sal<strong>com</strong>be is apparently now worth over<br />

£1m. Tiny plots of land on the waterfront<br />

can go for upwards of £2m, so when an<br />

Edwardian number like this <strong>com</strong>es up in<br />

one of the best spots on the Estuary, you<br />

can expect a bunfight.<br />

• Sunny Cliff Hotel, Cliff Road,<br />

Sal<strong>com</strong>be<br />

• Offers Over £4.5m<br />

• Marchand Petit / Primelocation<br />

Images courtesy of agents listed<br />

p.22<br />

get all the latest on luxury properties & developments at<br />

www.<strong>PrimeResi</strong>.<strong>com</strong>/properties

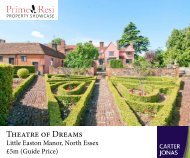

Theatre of Dreams<br />

With a previous owner like legendary actor, film and theatre<br />

director and producer Basil Dean of Ealing Studios and ‘Pearl &<br />

Dean’ fame, there was always going to be more to Little Easton<br />

Manor than meets the eye.<br />

PROPERTIES<br />

• Little Easton Manor<br />

• £5m (Guide Price)<br />

• Carter Jonas<br />

Chelsea Power Show<br />

One of the largest homes in all of Chelsea, this<br />

eighteen-bedroomed beauty stands on the<br />

grounds of the former Coleherne House, the<br />

famed residence owned by the Tattersall family<br />

and later the Victorian actor-playwright-manager<br />

Dion Boucicault.<br />

• 6 The Boltons<br />

• £39.5m<br />

• Russell Simpson<br />

Prime Online<br />

Claiming to be the first country estate to<br />

be marketed through an online agent, this<br />

19th century manor house is causing quite<br />

the stir.<br />

• Coolham Manor<br />

• £5.5m<br />

• Sellmyhome.co.uk<br />

p.23

PROPERTIES<br />

Inside the world’s<br />

most expensive<br />

penthouse<br />

The world’s most expensive penthouse<br />

– £240m – has been unveiled in<br />

Monaco. It has a waterslide to link the<br />

dancefloor to the pool.<br />

Taking over the top five storeys of the<br />

Tour Odeon tower on Av. de l’Annonciade,<br />

the five bed 35,000 sq ft apartment<br />

is one of 73 private residential<br />

units in the first high rise to be built in<br />

the principality since the Eighties.<br />

Prince Albert of Monaco has had more<br />

than a hand in the project, personally<br />

giving the go-ahead to the the 557<br />

foot, 49 and 44-storey towers in 2009,<br />

overturning his papa Prince Rainier’s<br />

embargo on high rises.<br />

Knight Frank is handling the penthouse<br />

sale, and expects to bring in<br />

€300m, which the agency says would<br />

make it the most pricey top floor on<br />

Earth. The Tour Odeon’s developer,<br />

Daniele Marzocco’s Groupe Marzocco<br />

SAM, is confident that”we can get a<br />

little bit more.”<br />

James Price, Knight Frank: “These<br />

duplexes and the penthouse are set to<br />

catch the eye of those looking for the<br />

very best properties across the world’s<br />

leading markets.” Q<br />

All images courtesy of Tour Odeon /<br />

Groupo Marzocco<br />

p.24<br />

get all the latest on luxury properties & developments at<br />

www.<strong>PrimeResi</strong>.<strong>com</strong>/properties

:DECONSTRUCTED:<br />

Tour Odeon, Monaco<br />

• Developer: Groupe Marzocco<br />

PROPERTIES<br />

• Sales Agent: Knight Frank<br />

• Architect: Alexandre Girald<br />

• Interiors: Alberto Pinto Agency<br />

• Construction (general): Vinci<br />

• Finance: SCI Odéon, Claudio<br />

Marzocco<br />

• www.odeon.mc<br />

p.25

PROPERTIES<br />

Amazon builds<br />

Soho portfolio<br />

with office block<br />

acquisition<br />

Luxury residential developer Amazon<br />

Property has bought a 20,500 sq ft office<br />

block in the middle of Soho.<br />

Swan House, 52 Poland Street is currently home to seven floors of offices with Yo!<br />

Sushi and Lucky Voice karaoke bar taking up the ground and basement levels. The<br />

building is just 300 metres from the new Tottenham Court Road Crossrail station.<br />

The developer has some rather good form in office-to-resi conversions, including<br />

turning the old Paramount Studios HQ, round the corner from Poland St on<br />

Wardour St in Soho, into 15 high spec apartments.<br />

Amazon Property in a JV will acquire the freehold of the building at 51% ahead of<br />

the March 2014 book value, at a Net Initial Yield of 2.5%.<br />

CGIs courtesy of Amazon Property;<br />

photograoh courtesy of British Land<br />

p.26<br />

get all the latest on luxury properties & developments at<br />

www.<strong>PrimeResi</strong>.<strong>com</strong>/properties

PROPERTIES<br />

Tim Roberts, Head of Offices, British<br />

Land: “The expiry profile at 52 Poland<br />

Street means there is potential for<br />

vacant possession of upper parts in June<br />

2015. The site attracted very strong interest,<br />

reflecting the strength and depth<br />

of the WE investment market. It is an<br />

opportune time to sell and focus on<br />

projects elsewhere in our portfolio.”<br />

Chris Lanitis, Partner, Amazon Property:<br />

“The acquisition of 52 Poland<br />

Street is an exciting addition to Amazon<br />

Property’s rapidly expanding portfolio<br />

and signifies our wider drive to obtain<br />

well-located London sites. The building’s<br />

trophy address and expansive<br />

internal space presented the perfect<br />

opportunity to deliver more of our<br />

signature, luxury apartments and penthouses<br />

to the market. Amazon Property<br />

has firmly established itself as an office-to-resi<br />

specialist, with a number of<br />

successful schemes across Zones 1 and<br />

2. 52 Poland Street promises to continue<br />

this achievement and we look forward<br />

to securing vacant possession of the first<br />

to seventh floors and starting work in<br />

June next year.”<br />

CBRE and Irwin Mitchell advised<br />

British Land. Amazon Property was<br />

unrepresented. Q<br />

p.27

Q<br />

An essential resource for anyone professionally involved in the UK’s luxury property industry<br />

www.primeresi.<strong>com</strong><br />

stay on top of the market with the journal of prime property: www.primeresi.<strong>com</strong>/subscribe-today