Toivanen v. Electronic Arts (Canada) Inc. (No. 2 ... - Canada.com

Toivanen v. Electronic Arts (Canada) Inc. (No. 2 ... - Canada.com

Toivanen v. Electronic Arts (Canada) Inc. (No. 2 ... - Canada.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

accumulation of the benefit relates to the fact they are working. While they are on an<br />

unpaid leave of absence due to a disability, they are not working and so not entitled to the<br />

benefit accumulation.<br />

[115] The vesting of stock options at EA clearly relates to work. The stock options are<br />

part of the employee <strong>com</strong>pensation package, but are not available to be cashed in until<br />

they are vested, and vesting occurs at 2% for each month that an employee works. As a<br />

result, vesting would not occur when Ms. <strong>Toivanen</strong> was not working and while on LTD.<br />

[116] Ms. <strong>Toivanen</strong> also seeks the stock option benefits she lost after she was<br />

dismissed, but continued on LTD. She says she should be entitled to the same benefits as<br />

similarly situated employees. Relying on the past regular receipt of stock options, Ms.<br />

<strong>Toivanen</strong> argues she should be granted 1000 new options on April 1, 2003. However, the<br />

difficulty with Ms. <strong>Toivanen</strong>’s position is that stock options, like the vesting of stock<br />

options, are <strong>com</strong>pensation benefits relating to work. Because Ms. <strong>Toivanen</strong> was not<br />

working, these benefits are not available to her.<br />

B. Lost Wages and Bonuses<br />

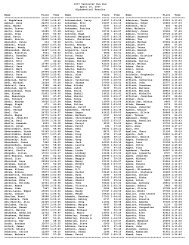

[117] Ms. <strong>Toivanen</strong> seeks an order pursuant to s. 37(2)(d)(ii) of the Code for wage and<br />

bonus loss and stock and other benefits from September 3, 2002 to the date of the<br />

Decision in this case. Ms. <strong>Toivanen</strong> argues that, based on her prior performance reviews<br />

and resulting salary increases and bonuses, for the purposes of calculating the lost wages,<br />

I should assume a 5% annual wage increase and bonus loss of $4,500.00 per year. Based<br />

on Ms. <strong>Toivanen</strong>’s calculations, she is seeking a total wage plus bonus loss of<br />

$232,500.00 (plus interest). However, I must first determine Ms. <strong>Toivanen</strong>’s entitlement<br />

to a wage loss claim.<br />

[118] The Tribunal has not awarded damages for lost wages where a disabled employee<br />

is unable to work. It has awarded an equivalent to LTD benefits where an individual was<br />

deprived access to the benefits as a result their dismissal: Innes v. Re-Con Building<br />

Products, 2006 BCHRT 99. However, Ms. <strong>Toivanen</strong> was not deprived of access to LTD<br />

28