1098-T Frequently Asked Questions - Jamestown Community College

1098-T Frequently Asked Questions - Jamestown Community College

1098-T Frequently Asked Questions - Jamestown Community College

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

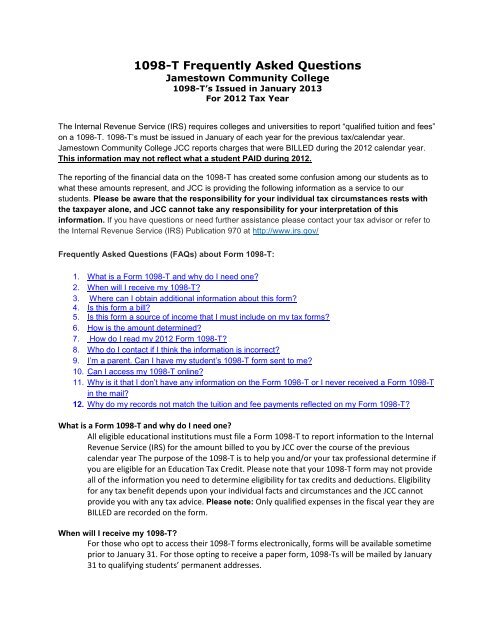

<strong>1098</strong>-T <strong>Frequently</strong> <strong>Asked</strong> <strong>Questions</strong><br />

<strong>Jamestown</strong> <strong>Community</strong> <strong>College</strong><br />

<strong>1098</strong>-T’s Issued in January 2013<br />

For 2012 Tax Year<br />

The Internal Revenue Service (IRS) requires colleges and universities to report “qualified tuition and fees”<br />

on a <strong>1098</strong>-T. <strong>1098</strong>-T’s must be issued in January of each year for the previous tax/calendar year.<br />

<strong>Jamestown</strong> <strong>Community</strong> <strong>College</strong> JCC reports charges that were BILLED during the 2012 calendar year.<br />

This information may not reflect what a student PAID during 2012.<br />

The reporting of the financial data on the <strong>1098</strong>-T has created some confusion among our students as to<br />

what these amounts represent, and JCC is providing the following information as a service to our<br />

students. Please be aware that the responsibility for your individual tax circumstances rests with<br />

the taxpayer alone, and JCC cannot take any responsibility for your interpretation of this<br />

information. If you have questions or need further assistance please contact your tax advisor or refer to<br />

the Internal Revenue Service (IRS) Publication 970 at http://www.irs.gov/<br />

<strong>Frequently</strong> <strong>Asked</strong> <strong>Questions</strong> (FAQs) about Form <strong>1098</strong>-T:<br />

1. What is a Form <strong>1098</strong>-T and why do I need one?<br />

2. When will I receive my <strong>1098</strong>-T?<br />

3. Where can I obtain additional information about this form?<br />

4. Is this form a bill?<br />

5. Is this form a source of income that I must include on my tax forms?<br />

6. How is the amount determined?<br />

7. How do I read my 2012 Form <strong>1098</strong>-T?<br />

8. Who do I contact if I think the information is incorrect?<br />

9. I’m a parent. Can I have my student’s <strong>1098</strong>-T form sent to me?<br />

10. Can I access my <strong>1098</strong>-T online?<br />

11. Why is it that I don’t have any information on the Form <strong>1098</strong>-T or I never received a Form <strong>1098</strong>-T<br />

in the mail?<br />

12. Why do my records not match the tuition and fee payments reflected on my Form <strong>1098</strong>-T?<br />

What is a Form <strong>1098</strong>-T and why do I need one?<br />

All eligible educational institutions must file a Form <strong>1098</strong>-T to report information to the Internal<br />

Revenue Service (IRS) for the amount billed to you by JCC over the course of the previous<br />

calendar year The purpose of the <strong>1098</strong>-T is to help you and/or your tax professional determine if<br />

you are eligible for an Education Tax Credit. Please note that your <strong>1098</strong>-T form may not provide<br />

all of the information you need to determine eligibility for tax credits and deductions. Eligibility<br />

for any tax benefit depends upon your individual facts and circumstances and the JCC cannot<br />

provide you with any tax advice. Please note: Only qualified expenses in the fiscal year they are<br />

BILLED are recorded on the form.<br />

When will I receive my <strong>1098</strong>-T?<br />

For those who opt to access their <strong>1098</strong>-T forms electronically, forms will be available sometime<br />

prior to January 31. For those opting to receive a paper form, <strong>1098</strong>-Ts will be mailed by January<br />

31 to qualifying students’ permanent addresses.

Where can I obtain additional information about this form?<br />

You should refer to IRS tax form 8863 and Publication 970 when completing your forms. If you<br />

are experiencing difficulty completing the form, JCC urges you to contact your accountant, tax<br />

preparer, or the Internal Revenue Service regarding the application of this form to your taxes.<br />

Employees of the JCC cannot provide tax advice<br />

Is this form a bill?<br />

No, it is not a bill nor a request for payment.<br />

Is this form a source of income that I must include on my tax forms?<br />

No, this form is a statement of the amount of qualified expenses BILLED during the 2012<br />

calendar year. However, while not an income reporting form, if scholarships and grants exceed<br />

qualified expenses then this may be considered reportable income. You should consult your tax<br />

advisor to make this determination.<br />

How is the amount determined?<br />

See How do I read a <strong>1098</strong>-T Form – Box 2 below<br />

How do I read my 2012 Form <strong>1098</strong>-T?<br />

Below is a sample form and descriptions for boxes 1-9.<br />

Box 1. Please note Box 1 is intentionally left blank. JCC reports tuition billed and not payments<br />

received. For information regarding total payments made to your student account, please go<br />

https://banner.sunyjcc.edu<br />

Box 2. Shows the total amounts BILLED in 2012 for qualified tuition and related expenses less any<br />

reductions in charges made during 2012 that relate to those amounts billed during 2012.<br />

The following qualified expenses will be included in the 2012 <strong>1098</strong> T:<br />

A. Spring 2012 Summer 2012<br />

B. Fall 2012<br />

C. If you registered and were billed for Spring 2013 BEFORE January 1, 2013<br />

If, on the other hand, you registered for the Spring, 2013 semester ON or AFTER January, 2013,<br />

these expenses will be reported in the 2013 <strong>1098</strong>-T that you will receive in January, 2014.

Decreases in amounts due on a student’s account due to scholarship payments, student payments or<br />

other payments are not included in the Box 2 amount.<br />

Please note that when an Education Tax Credit is taken on the federal income tax return, the calculation<br />

of the credit is based on the amount of qualified educational expenses actually paid by the taxpayer<br />

during the calendar year. The college reports amounts billed to a student’s account. Therefore, the<br />

amount you use to calculate your education credit may not necessarily be the same as the amount that<br />

appears in Box 2.<br />

The following categories of charges are included or not included in qualified tuition and related expenses:<br />

Included<br />

Tuition<br />

General <strong>College</strong> Fees<br />

Special Class Fees<br />

Course/Lab Fees<br />

Technology Fee<br />

Student Activity Fee<br />

Not Included<br />

Fines<br />

Health Insurance Premiums/Health Fee<br />

Credit by Exam/ Prior Learning Credit Fee<br />

Tuition Installment Plan Fee<br />

Room and Board Charges<br />

Course Related Books & Equipment<br />

Registration fees paid for non-credit courses<br />

Phys Ed Lab Fee<br />

Box 3. JCC did not change its method of reporting, therefore this box is left blank<br />

Box 4 of Form <strong>1098</strong>-T reports adjustments made to qualified tuition and related expenses reported on a<br />

prior year Form <strong>1098</strong>-T in Box 2. The amount reported in Box 4 represents a reduction in tuition billed<br />

during a prior calendar year. For example, if you were billed for Spring semester classes in December<br />

and withdrew from classes in January, Box 4 reports the decrease in billed tuition due to the<br />

withdrawal. The amount reported in Box 4 for adjustments to qualified tuition and related expenses<br />

may reduce any allowable education credit you may claim for the prior year. See IRS Form 8863 or IRS<br />

Publication 970 for more information<br />

Box 5. This box contains the sum of all scholarships JCC administered and processed for the student’s<br />

account during the calendar year. Scholarships that pay for tuition (qualified scholarships) as well as for<br />

housing, books, and other expenses (non-qualified scholarships) will be included in this amount. Tuition<br />

waivers and payments received from third parties that are applied to student accounts for educational<br />

expenses are included in this box. The amount of scholarships or grants for the calendar year may<br />

reduce the amount of the education credit you claim for the year.<br />

Box 6 of Form <strong>1098</strong>-T reports adjustments made to scholarships or grants reported on a prior year Form<br />

<strong>1098</strong>-T in Box 4. The amount reported in Box 6 represents a reduction in scholarships or grants<br />

reported for a prior calendar year. The amount reported in Box 6 for adjustments to scholarships or<br />

grants may affect the amount of any allowable tuition and fees deduction or education credit you may<br />

claim for the prior year.<br />

Box 7. This box will be checked if the amount reported in Box 2 includes tuition or qualified amounts<br />

billed to a student account in the current year that pay for a semester beginning in the next calendar<br />

year. For example, tuition billed in December 2012 for Spring 2013 will be reported on a 2012 <strong>1098</strong>-T.<br />

Box 7 will be checked to indicate that this is the case

Box 8. Shows whether you are considered to be carrying at least one-half the normal full-time workload<br />

for your course of study at the reporting institution. If you are at least a half-time student for at least<br />

one academic period that begins during the year, you meet one of the requirements for the American<br />

opportunity credit. You do not have to meet the workload requirement to qualify for the lifetime<br />

learning credit.<br />

Box 9. Shows whether you are considered to be enrolled in a program leading to a graduate degree,<br />

graduate-level certificate, or other recognized graduate-level educational credential. This box will be<br />

blank.<br />

Box 10. Shows the total amount of reimbursements or refunds of qualified tuition and related expenses<br />

made by an insurer. This box will be blank<br />

Who do I contact if I think the information is incorrect?<br />

It is important to remember that the amount on this form consists of charges assessed by JCC in<br />

a calendar year. Contact the Business Office at (716) 338-1000.<br />

I’m a parent. Can I have my student’s <strong>1098</strong>-T form sent to me?<br />

Students must make all information requests. The student is responsible for providing<br />

information to other parties in accordance with FERPA (Family Education Right to Privacy Act).<br />

http://www.ed.gov/policy/gen/guid/fpco/ferpa/index.html.<br />

Can I access my <strong>1098</strong>-T online?<br />

To retrieve your <strong>1098</strong>-T electronically:<br />

- Launch a web browser and go to http://tra.vangent.com (note: Internet Explorer 9 users may<br />

need to use “Compatibility View”)<br />

- Click the “First Time Students” Button.<br />

- Enter your full First and Last names and the last 5 digits of your Social Security Number.<br />

- Click Submit.<br />

- If records are present for you, you will be instructed to create an account. Follow the<br />

instructions on the website to create a free account and retrieve your <strong>1098</strong>-T. If records are<br />

not found for you or you have difficulty creating account, use the “Help” link in the left menu.<br />

If you cannot access your <strong>1098</strong>-T online, then please call Vangent Customer Service at 800-223-<br />

0043<br />

Remember, by acknowledging that you are receiving this form electronically, a hard copy form will<br />

not be mailed to you. However, you can go to the website as often as needed to retrieve a copy.<br />

Why is it that I don’t have any information on the Form <strong>1098</strong>-T or I never received a Form <strong>1098</strong>-T in<br />

the mail?<br />

JCC is not required to file Form <strong>1098</strong>-T or furnish a statement for:<br />

If your billed amounts consisted of only non-credit courses, even if the student is otherwise<br />

enrolled in a degree program.<br />

International (foreign) students who are not U.S. residents for tax purposes (who have<br />

not been in the U.S. less than 5 years)

Students classified as non-resident aliens.<br />

If you paid for your enrollment fees, but dropped all your classes and received a<br />

refund during that calendar year, then you would not receive a Form <strong>1098</strong>-T.<br />

JCC does not have your Social Security Number - this information is required for Form <strong>1098</strong>-<br />

T reporting (make sure you provide us with this information).<br />

If your address on record is out-of-date, your Form <strong>1098</strong>-T may have been returned.<br />

Why do my records not match the tuition and fee payments reflected on my Form <strong>1098</strong>-T?<br />

When reviewing your records, please take into consideration actual registration dates in order<br />

to reconcile your records in the amounts on the form. The <strong>1098</strong>-T form reflects charges<br />

and refunds made in the calendar year. Charges made in previous or future years are not<br />

included (see “How do I read my <strong>1098</strong>-T, Box 2). The following expenses do not qualify as tuition<br />

and related expenses (Box 2) for community colleges: 1) Remote Registration Fee; 2) books; 3)<br />

parking permits.