Form 990 - Susquehanna University

Form 990 - Susquehanna University

Form 990 - Susquehanna University

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

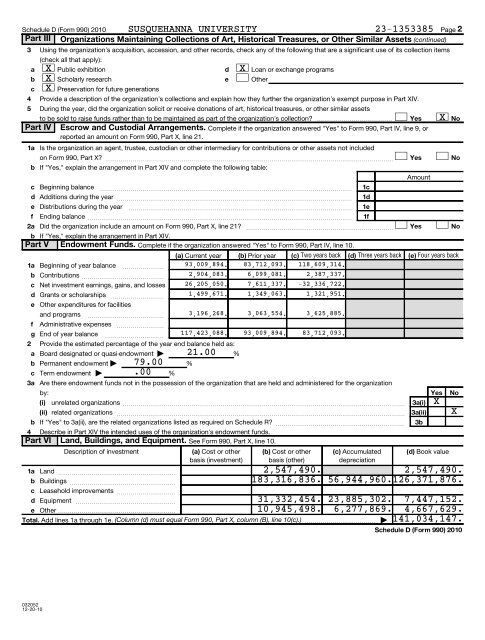

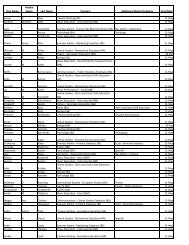

Schedule D (<strong>Form</strong> <strong>990</strong>) 2010 SUSQUEHANNA UNIVERSITY 23-1353385 Page 2<br />

Part III Organizations Maintaining Collections of Art, Historical Treasures, or Other Similar Assets (continued)<br />

3 Using the organization’s acquisition, accession, and other records, check any of the following that are a significant use of its collection items<br />

4<br />

5<br />

a<br />

b<br />

c<br />

b<br />

c<br />

d<br />

e<br />

f<br />

b If "Yes," explain the arrangement in Part XIV.<br />

Part V Endowment Funds. Complete if the organization answered "Yes" to <strong>Form</strong> <strong>990</strong>, Part IV, line 10.<br />

2<br />

b<br />

c<br />

d<br />

e<br />

f<br />

g<br />

a<br />

b<br />

c<br />

b<br />

(i)<br />

(ii)<br />

4 Describe in Part XIV the intended uses of the organization’s endowment funds.<br />

Part VI Land, Buildings, and Equipment. See <strong>Form</strong> <strong>990</strong>, Part X, line 10.<br />

1a<br />

b<br />

(check all that apply):<br />

X Public exhibition<br />

X Scholarly research<br />

X Preservation for future generations<br />

d<br />

e<br />

Loan or exchange programs<br />

Provide a description of the organization’s collections and explain how they further the organization’s exempt purpose in Part XIV.<br />

During the year, did the organization solicit or receive donations of art, historical treasures, or other similar assets<br />

to be sold to raise funds rather than to be maintained as part of the organization’s collection? Yes<br />

Part IV Escrow and Custodial Arrangements. Complete if the organization answered "Yes" to <strong>Form</strong> <strong>990</strong>, Part IV, line 9, or<br />

reported an amount on <strong>Form</strong> <strong>990</strong>, Part X, line 21.<br />

1a<br />

Is the organization an agent, trustee, custodian or other intermediary for contributions or other assets not included<br />

on <strong>Form</strong> <strong>990</strong>, Part X? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

(a) Current year (b) Prior year (c) Two years back (d) Three years back (e) Four years back<br />

93,009,894. 83,712,093. 118,609,314.<br />

2,904,083. 6,099,081. 2,387,337.<br />

26,205,050. 7,611,337. -32,336,722.<br />

1,499,671. 1,349,063. 1,321,951.<br />

1c<br />

1d<br />

1e<br />

1f<br />

Yes<br />

Yes<br />

Yes<br />

3a(i) X<br />

3a(ii)<br />

(a) Cost or other (b) Cost or other (c) Accumulated (d) Book value<br />

basis (investment) basis (other)<br />

depreciation<br />

2,547,490. 2,547,490.<br />

183,316,836. 56,944,960.126,371,876.<br />

c Leasehold improvements ~~~~~~~~~~<br />

d Equipment ~~~~~~~~~~~~~~~~~<br />

31,332,454. 23,885,302. 7,447,152.<br />

e Other <br />

10,945,498. 6,277,869. 4,667,629.<br />

Total. Add lines 1a through 1e. (Column (d) must equal <strong>Form</strong> <strong>990</strong>, Part X, column (B), line 10(c).) | 141,034,147.<br />

Other<br />

If "Yes," explain the arrangement in Part XIV and complete the following table:<br />

Beginning balance<br />

Additions during the year ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Distributions during the year<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Ending balance ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

2a<br />

Did the organization include an amount on <strong>Form</strong> <strong>990</strong>, Part X, line 21? ~~~~~~~~~~~~~~~~~~~~~~~~~<br />

1a<br />

Beginning of year balance<br />

Contributions ~~~~~~~~~~~~~~<br />

Net investment earnings, gains, and losses<br />

Grants or scholarships<br />

Other expenditures for facilities<br />

and programs<br />

Administrative expenses<br />

End of year balance<br />

~~~~~~~<br />

~~~~~~~~~<br />

~~~~~~~~~~~~~<br />

~~~~~~~~<br />

~~~~~~~~~~<br />

Provide the estimated percentage of the year end balance held as:<br />

Board designated or quasi-endowment | 21.00 %<br />

Permanent endowment | 79.00 %<br />

Term endowment | .00 %<br />

3a<br />

Are there endowment funds not in the possession of the organization that are held and administered for the organization<br />

by:<br />

unrelated organizations ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

related organizations ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

If "Yes" to 3a(ii), are the related organizations listed as required on Schedule R? ~~~~~~~~~~~~~~~~~~~~~~<br />

Description of investment<br />

Land ~~~~~~~~~~~~~~~~~~~~<br />

Buildings ~~~~~~~~~~~~~~~~~~<br />

X<br />

3,196,268. 3,063,554. 3,625,885.<br />

117,423,088. 93,009,894. 83,712,093.<br />

Amount<br />

3b<br />

X<br />

No<br />

No<br />

No<br />

No<br />

X<br />

Schedule D (<strong>Form</strong> <strong>990</strong>) 2010<br />

032052<br />

12-20-10