Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

INSURE YOUR FARM’S FUTURE<br />

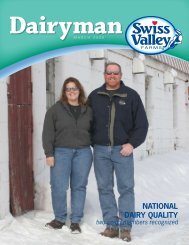

When Matt and Katie<br />

expanded their dairy,<br />

they never dreamed<br />

they’d need the life insurance their<br />

accountant suggested they buy so<br />

soon. Six months after the 400-cow<br />

dairy was up and running, Matt was<br />

killed in a car accident.<br />

Katie was a great cow person,<br />

but she wasn’t comfortable with the<br />

business management side of the<br />

operation. Just as they had planned,<br />

Katie used the life insurance policy<br />

to pay down the farm debt. That<br />

gave the business some much needed<br />

“breathing room,” and gave Katie<br />

your family, your business and your<br />

estate. As with any risk management<br />

tool, the key, he says, is knowing how<br />

much you need to provide protection<br />

without throwing money away.<br />

Use the following steps to<br />

determine how much life insurance<br />

you need.<br />

Decide why you need it<br />

First, define your purpose in<br />

purchasing the life insurance policy,<br />

suggests Dunteman. Life insurance<br />

is not something you buy and forget<br />

about. It’s part of your financial plan.<br />

In order to know how much<br />

life insurance you need, Dunteman,<br />

be costly.<br />

However, life insurance can be<br />

used to cover the cost of estate taxes.<br />

Contact your accountant or lawyer<br />

to help you examine your liquid<br />

assets and to determine the potential<br />

tax consequences. Then, have him<br />

explain how life insurance can be<br />

used to cover this cost.<br />

“Will my heirs need life insurance<br />

to pay off a large farm debt or house<br />

mortgage?”<br />

When a farm business has a<br />

lot of debt - especially right after<br />

an expansion or for a new startup<br />

operation - life insurance can help<br />

time to grow into the management<br />

role.<br />

Ten years later, Katie and her eldest<br />

son - who by the way has become a<br />

great cow person - are expanding the<br />

dairy again. However, without the<br />

life insurance Katie and Matt used as<br />

a risk management tool, she probably<br />

wouldn’t have had time to learn the<br />

job before the business failed.<br />

Life insurance is a risk<br />

management tool, explains Darrell<br />

Dunteman, accountant and<br />

accredited agricultural consultant in<br />

Bushnell, Ill. You can use it to protect<br />

and David Sousa, certified public<br />

accountant in Tulare, Calif.,<br />

recommend that you ask yourself the<br />

following questions:<br />

“Will my heirs need life insurance<br />

to pay estate taxes?”<br />

Most farm families do not have<br />

enough liquid assets readily available<br />

to pay a large estate tax bill. Depending<br />

on how the estate is structured, the<br />

estate tax bill could run as high as<br />

55 percent of the total value of the<br />

estate. Often, as a result, part of the<br />

farm gets sold, or additional loans are<br />

taken out. Both of these scenarios can<br />

reduce the risk for your family should<br />

something happen to you. Depending<br />

on the amount needed to cover the<br />

debt, you can opt to buy insurance<br />

to cover the debt or to pay it down<br />

substantially. This puts the business in<br />

a stronger financial position through<br />

the transition period.<br />

When deciding how much life<br />

insurance you need, don’t forget to<br />

include the cost of hiring a manager to<br />

run the dairy during the transition.<br />

“Do I need life insurance on a<br />

business partner?”<br />

If you farm in partnership with<br />

page 10<br />

SWISS VALLEY FARMS DAIRYMAN