Benchmarking Study Report ENG - 2004-2005 - AMFA

Benchmarking Study Report ENG - 2004-2005 - AMFA

Benchmarking Study Report ENG - 2004-2005 - AMFA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Authors: Nigar Pirmammadova (<strong>AMFA</strong>), Scott Gaul (MIX) 1<br />

May 2007<br />

The Azerbaijan <strong>Benchmarking</strong> Trends <strong>Report</strong> <strong>2004</strong>-<strong>2005</strong> has been prepared<br />

by the Azerbaijan Micro-finance Association (<strong>AMFA</strong>) with MIX<br />

Market, and co-financed by BP and its co-ventures in the Azeri-Chirag-<br />

Guneshli, Shahdeniz, Baku-Tbilisi-Ceyhan and South Caucasus Pipeline<br />

projects and UNDP Azerbaijan.<br />

Note: The views and ideas expressed in this report are those of the<br />

authors and do not necessarily reflect the views and ideas of the project<br />

sponsors.<br />

This trend report presents comparative performance of Azerbaijani<br />

Microfinance Institutions that have reported to MIX Market during<br />

last 2 consecutive years. Illustrated trend lines would allow MFI<br />

managers and board members to monitor their institution's performance<br />

on country scale. It is the second report in industry literature<br />

of Azerbaijan microfinance and should be useful for financial institutions,<br />

donor agencies and investors as well as the government and<br />

other interested parties.<br />

1<br />

ACKNOWLEDGMENTS: Nigar Pirmammadova is Finance Manager of <strong>AMFA</strong> and Scott Gaul is the Lead Analyst, Eastern<br />

Europe and Central Asia at MIX.<br />

<strong>AMFA</strong> is the Azerbaijan Micro-finance Association uniting 19 members. <strong>AMFA</strong> was founded in December 2001 and<br />

officially registered at the Ministry of Justice of Azerbaijan in November <strong>2004</strong>.<br />

40, Jafar Jabbarli Street, Caspian Business Center, 5th floor, Baku-AZ 1065, Azerbaijan<br />

Tel/Fax: (+994 12) 437 1645; 437 2339<br />

www.amfa.az<br />

While developing this report <strong>AMFA</strong> used data and tools provided by Microfinance Information eXchange (MIX). MIX provided<br />

<strong>AMFA</strong> with benchmarking databases and technology, the format for this report and editing support. ACDI/VOCA<br />

MBAEC Consultant Jerrold Smelcer has provided overall review and editing support.

Azerbaijan <strong>Benchmarking</strong> Trends <strong>Report</strong> <strong>2004</strong> - <strong>2005</strong> Prepared May 2007<br />

Executive Summary<br />

The microfinance sector in Azerbaijan experienced<br />

rapid development in <strong>2005</strong>. The outstanding<br />

portfolio of MFIs crossed $50 million<br />

USD in <strong>2005</strong> and has reached over $200 million<br />

USD by the time of this writing in early<br />

2007. The number of active borrowers reached<br />

60,000 in <strong>2005</strong>, then 86,000 by June 2006 and<br />

has now approached 167,000 in 2007. 1<br />

In<br />

order to look at the nature of this growth more<br />

concretely, this report explores performance<br />

changes in the microfinance sector of<br />

Azerbaijan from <strong>2004</strong> - <strong>2005</strong>. Although the<br />

accelerated growth has necessitated expansion<br />

into new regions, management has maintained<br />

efficiency and increased profitability. The flow<br />

of investor and donor funds to MFIs in<br />

Azerbaijan has also increased, supported by the<br />

high level of transparency within the sector and<br />

demonstrated most strongly by several MFIs<br />

which have carried out external rating evaluations.<br />

Five institutions - CredAgro NBCO,<br />

Findev, Viator LLC, Normicro and Azercredit -<br />

have been qualified on MIX Market with 5<br />

diamonds, the highest level. 2<br />

The rating reports<br />

confirm management's respect for financial<br />

transparency as MFIs grow, mature, and expand<br />

their products/services to harder to reach<br />

clients.<br />

The activity and growth experienced in<br />

Azerbaijan today is a direct reflection of<br />

effective management decisions made by MFIs<br />

during the <strong>2005</strong> year. All performance<br />

improved in each of the following areas:<br />

outreach/scale, financial structure, profitability/<br />

sustainability, revenue/expense, efficiency/productivity,<br />

and portfolio risk. MFIs improved<br />

loan distribution techniques, efficiently<br />

managed expenses, increased profits, attracted<br />

more investors and provided greater service to<br />

their clients. The following sections break down<br />

each ratio measurement category and<br />

summarizes the highlights.<br />

1<br />

As reported on 31 March, 2007.<br />

2<br />

www.mixmarket.org<br />

1

AZERBAIJAN BENCHMARKING TRENDS REPORT <strong>2004</strong> - <strong>2005</strong><br />

Outreach and Scale<br />

RATIO ANALYSIS<br />

The gross loan portfolio (GLP) of MFIs in<br />

Azerbaijan grew by 36.4%, which is also<br />

reflected in the increased number of borrowers<br />

and greater rural outreach. The GLP was<br />

$12,825,763 with 25,832 active clients in<br />

2003, increasing to $19,826,193 and 41,502<br />

active borrowers in <strong>2004</strong> and finally to a<br />

portfolio of $53,043,458 with 61,758 clients 3 in<br />

<strong>2005</strong>. Average loan balances remained roughly<br />

constant over the two years, increasing from<br />

$351 to $372 USD per borrower or from 37%<br />

to 39% of GNI per capital.<br />

Branches opened in 10 new regions, as<br />

revealed in the <strong>AMFA</strong> Matrix -- a report produced<br />

by <strong>AMFA</strong> that continuously updates MFI<br />

statistical information (number of clients,<br />

amount of outstanding loans, size of loans<br />

every quarter, etc.) for MFIs in Azerbaijan. The<br />

Financial Structure<br />

MFIs in Azerbaijan have gradually increased<br />

their access to debt financing and have<br />

leveraged this debt to fund their growth.<br />

Commercial lenders have provided additional<br />

loan capital to several MFIs, which allowed<br />

them to expand their field of activities<br />

accordingly. The median debt/equity ratio for<br />

Azerbaijani MFIs increased from 0.3 to 0.44 in<br />

<strong>2005</strong> - an increase of almost 50%, while the<br />

median commercial funding liabilities ratio<br />

Chart 1: Growth in microcredit portfolio in Azerbaijan<br />

Source: <strong>AMFA</strong> Matrix <strong>Report</strong>, <strong>2005</strong>.<br />

Matrix states that FINCA opened new branches<br />

in Xanlar and Hajiqabul; Micro Finance Bank of<br />

Azerbaijan opened branches in Ganja and<br />

Shamakhi; CredAgro opened branches in<br />

Agstafa, Shamkir and Bilasuvar; and Agroinvest<br />

opened branches in Masalli, Jalilabad and Saatli<br />

regions.<br />

increased from 1.2% in <strong>2004</strong>, to 8.7% in <strong>2005</strong>.<br />

This corresponds to a dollar increase in commercial<br />

debt outstanding from $2.2M USD to<br />

over $13.8M USD within the year <strong>2005</strong> alone.<br />

The ratio of overall gross loan portfolio to total<br />

assets increased by 5.2% year on year, to<br />

90.2% overall, as the maturing microfinance<br />

sector also began to allocate more assets to the<br />

credit portfolio.<br />

3<br />

The percent of women borrowers among the total number of clients increased by 6.1% in <strong>2005</strong> (Gender Ratio: female - 37%; male - 63%)<br />

2

AZERBAIJAN BENCHMARKING TRENDS REPORT <strong>2004</strong> - <strong>2005</strong><br />

Profitability and Sustainability<br />

Profitability & sustainability ratios measure<br />

the ability of an MFI to continue operations and<br />

develop in the future. The trend analysis<br />

indicates that all profitability and sustainability<br />

indicators improved in comparison with <strong>2004</strong>.<br />

However, overall profitability was still low as<br />

these rapidly growing institutions continued to<br />

expand operations, and the majority of institutions<br />

still had negative adjusted returns.<br />

Nevertheless, return on assets (ROA) and return<br />

on equity (ROE) each grew in <strong>2005</strong>. ROA<br />

increased from -4.6% in <strong>2004</strong> to -0.1% in<br />

<strong>2005</strong>, while ROE increased from -6.3% in <strong>2004</strong><br />

to -0.6% in <strong>2005</strong>. Moreover, <strong>2005</strong> marked the<br />

first time that self-sufficiency ratios reached<br />

levels above the breakeven point of 100%.<br />

Operational self-sufficiency (OSS) increased<br />

from 119.8% in <strong>2004</strong> to 129.7% in <strong>2005</strong>, while<br />

financial self-sufficiency (FSS) increased from<br />

81.3% in <strong>2004</strong> to 104.5% in <strong>2005</strong>. The<br />

increase in FSS reflects that <strong>2005</strong> is the first<br />

year in which the majority of Azerbaijan MFIs<br />

have been able to cover all adjusted financial,<br />

operating and provisioning costs.<br />

Revenue and Expenses<br />

Yield is an indicator of the ability of an MFI<br />

to generate revenue for operations from the<br />

gross loan portfolio (GLP). Yield levels also<br />

closely track the effective interest rates charged<br />

on credit by MFIs. In <strong>2005</strong>, nominal yields<br />

increased by 1.5%, to a median level of 34.5%,<br />

which may be due to the increased cost of<br />

commercial financing. However, after adjustments<br />

for inflation are made, real yields actually<br />

decreased by 1.8% year to year. Expenses<br />

Efficiency and Productivity<br />

also saw a slight overall decrease across the<br />

years <strong>2004</strong> - <strong>2005</strong>. Operating expenses,<br />

composed of personnel and administrative<br />

expenses, remained roughly constant while<br />

loan loss expenses decreased slightly. At the<br />

same time however, financial expenses saw a<br />

slight increase - from a median of 7.0% to 8.5%<br />

(of total assets). This reflects a higher cost of<br />

funding, again due to inflation and the<br />

increased presence of commercial lenders.<br />

Efficiency and productivity ratios indicate how<br />

well an MFI utilizes its resources, particularly in<br />

regards to assets and personnel. Operating<br />

expense/loan portfolio and personnel<br />

expense/loan portfolio both decreased during<br />

the year despite strong inflation, and this<br />

decrease can be partly explained by the small<br />

increase in loan balances. In terms of personnel<br />

capacity, borrowers per loan officer decreased<br />

from 174 in <strong>2004</strong> to 151 in <strong>2005</strong>, while borrowers<br />

per staff member increased from 84 in<br />

<strong>2004</strong> to 88 in <strong>2005</strong>. This could indicate that<br />

MFIs increased the number of loan officers to<br />

handle the increased lending and borrower<br />

volume, but kept the general staff levels steady.<br />

It could also reflect the increased presence of<br />

MFIs in more sparsely populated rural regions<br />

of Azerbaijan, with lower productivity levels at<br />

newer branches.<br />

3

AZERBAIJAN BENCHMARKING TRENDS REPORT <strong>2004</strong> - <strong>2005</strong><br />

Portfolio Quality<br />

In <strong>2005</strong>, all portfolio quality ratios improved in<br />

comparison with <strong>2004</strong> figures which is an indication<br />

that management is performing proper<br />

due diligence throughout the lending and collection<br />

process. In terms of ratio analysis, portfolio<br />

at risk (PAR) indicates the potential for<br />

future losses based on late payments from the<br />

gross loan portfolio. PAR > 30 days decreased<br />

from 1.2% in <strong>2004</strong> to 0.6% in <strong>2005</strong>; while PAR<br />

> 90 days decreased to 0.3%. In both cases,<br />

these levels are well below global medians. To<br />

complement the decline in PAR, the write-off<br />

ratio also decreased from 0.7% to 0.3% year on<br />

Summary<br />

This <strong>2005</strong> Performance Trend Analysis has<br />

revealed that improvements occurred in every<br />

measurement category for Azerbaijan MFIs<br />

since the last <strong>Benchmarking</strong> <strong>Report</strong> in <strong>2004</strong>.<br />

Indicators such as gross loan portfolio, number<br />

of active borrowers, yield on gross portfolio<br />

(real), profit margin, operational self-sufficiency,<br />

return on assets, portfolio at risk, write-offs, and<br />

the number of personnel each improved<br />

year. 4<br />

Risk coverage indicates an MFI's ability<br />

to absorb loan losses if all loans payments overdue<br />

by longer than 30 days were to be written<br />

off. A decline in the risk coverage ratio of<br />

26.2%, coupled with reduced loan loss provision<br />

expenses indicates that MFIs adopted less<br />

conservative provisioning policies to reflect the<br />

low delinquency levels. The reduction in PAR<br />

and write-offs helped alleviate the need to<br />

reserve capital for risk coverage, which gave<br />

management a greater ability to focus funds on<br />

operational issues.<br />

between <strong>2004</strong> and <strong>2005</strong>. Despite the fact that<br />

non-banking credit organizations were not<br />

allowed to accept deposits, 5<br />

management also<br />

strengthened outreach into more rural areas.<br />

<strong>2005</strong> was a year of change and accomplishments<br />

that helped provide the foundation on<br />

which the MFI community continues to build<br />

today.<br />

4<br />

MFI write-off policies in Azerbaijan are dependent on the individual MFI management or on Court decision.<br />

5<br />

The microfinance activities in Azerbaijan are regulated by the Civil Code and the Law on Banks and Banking Activities. Current legislation in<br />

Azerbaijan does not allow non-banking credit institutes to accept deposits or receive tax-exempt status. Therefore, deposit taking ratios are not<br />

provided in this report<br />

4

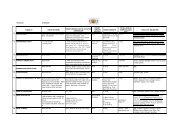

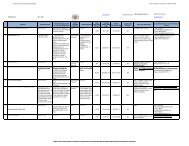

2 Performance Trend Analysis Azerbaijan<br />

6

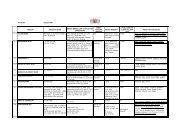

Azerbaijan<br />

Performance Trend Analysis 3<br />

7

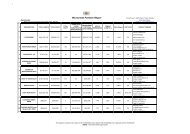

AZERBAIJAN BENCHMARKING TRENDS REPORT <strong>2004</strong> - <strong>2005</strong><br />

APPENDIX<br />

Inflation and Exchange Rate Indicators<br />

Inflation Rate Indicators<br />

Exchange Rates Indicators<br />

8