Annual Report 2010–2011, Part 2: Financial (1.8 ... - Tourism Victoria

Annual Report 2010–2011, Part 2: Financial (1.8 ... - Tourism Victoria

Annual Report 2010–2011, Part 2: Financial (1.8 ... - Tourism Victoria

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

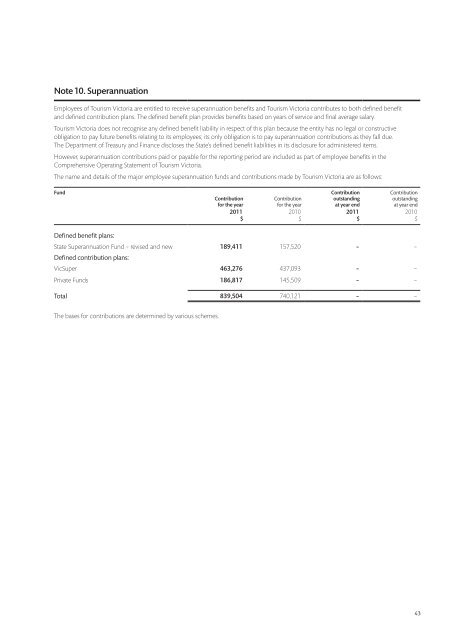

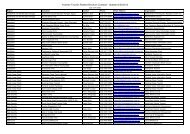

Note 10. Superannuation<br />

Employees of <strong>Tourism</strong> <strong>Victoria</strong> are entitled to receive superannuation benefits and <strong>Tourism</strong> <strong>Victoria</strong> contributes to both defined benefit<br />

and defined contribution plans. The defined benefit plan provides benefits based on years of service and final average salary.<br />

<strong>Tourism</strong> <strong>Victoria</strong> does not recognise any defined benefit liability in respect of this plan because the entity has no legal or constructive<br />

obligation to pay future benefits relating to its employees; its only obligation is to pay superannuation contributions as they fall due.<br />

The Department of Treasury and Finance discloses the State’s defined benefit liabilities in its disclosure for administered items.<br />

However, superannuation contributions paid or payable for the reporting period are included as part of employee benefits in the<br />

Comprehensive Operating Statement of <strong>Tourism</strong> <strong>Victoria</strong>.<br />

The name and details of the major employee superannuation funds and contributions made by <strong>Tourism</strong> <strong>Victoria</strong> are as follows:<br />

Fund<br />

Contribution<br />

for the year<br />

Contribution<br />

for the year<br />

Contribution<br />

outstanding<br />

at year end<br />

Contribution<br />

outstanding<br />

at year end<br />

2011 2010 2011 2010<br />

$ $ $ $<br />

Defined benefit plans:<br />

State Superannuation Fund – revised and new 189,411 157,520 – –<br />

Defined contribution plans:<br />

VicSuper 463,276 437,093 – –<br />

Private Funds 186,817 145,509 – –<br />

Total 839,504 740,121 – –<br />

The bases for contributions are determined by various schemes.<br />

43