Statutory Budget 2013 - 2014 - City of Stirling

Statutory Budget 2013 - 2014 - City of Stirling

Statutory Budget 2013 - 2014 - City of Stirling

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

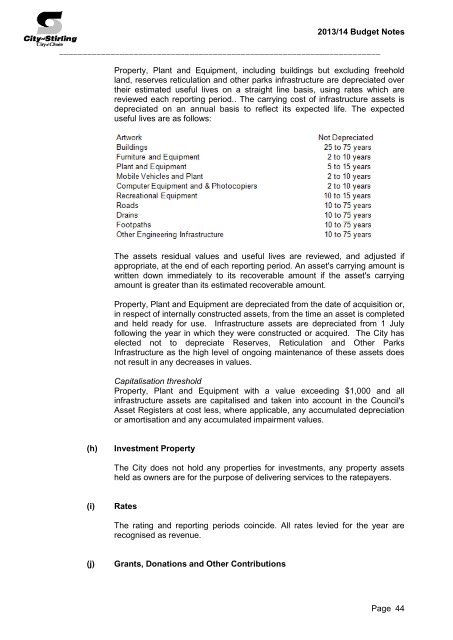

<strong>2013</strong>/14 <strong>Budget</strong> Notes<br />

_____________________________________________________________________<br />

Property, Plant and Equipment, including buildings but excluding freehold<br />

land, reserves reticulation and other parks infrastructure are depreciated over<br />

their estimated useful lives on a straight line basis, using rates which are<br />

reviewed each reporting period.. The carrying cost <strong>of</strong> infrastructure assets is<br />

depreciated on an annual basis to reflect its expected life. The expected<br />

useful lives are as follows:<br />

The assets residual values and useful lives are reviewed, and adjusted if<br />

appropriate, at the end <strong>of</strong> each reporting period. An asset's carrying amount is<br />

written down immediately to its recoverable amount if the asset's carrying<br />

amount is greater than its estimated recoverable amount.<br />

Property, Plant and Equipment are depreciated from the date <strong>of</strong> acquisition or,<br />

in respect <strong>of</strong> internally constructed assets, from the time an asset is completed<br />

and held ready for use. Infrastructure assets are depreciated from 1 July<br />

following the year in which they were constructed or acquired. The <strong>City</strong> has<br />

elected not to depreciate Reserves, Reticulation and Other Parks<br />

Infrastructure as the high level <strong>of</strong> ongoing maintenance <strong>of</strong> these assets does<br />

not result in any decreases in values.<br />

Capitalisation threshold<br />

Property, Plant and Equipment with a value exceeding $1,000 and all<br />

infrastructure assets are capitalised and taken into account in the Council's<br />

Asset Registers at cost less, where applicable, any accumulated depreciation<br />

or amortisation and any accumulated impairment values.<br />

(h)<br />

Investment Property<br />

The <strong>City</strong> does not hold any properties for investments, any property assets<br />

held as owners are for the purpose <strong>of</strong> delivering services to the ratepayers.<br />

(i)<br />

Rates<br />

The rating and reporting periods coincide. All rates levied for the year are<br />

recognised as revenue.<br />

(j)<br />

Grants, Donations and Other Contributions<br />

Page 44