South Belfast Sectoral Study 2006 - Northern Ireland Housing ...

South Belfast Sectoral Study 2006 - Northern Ireland Housing ...

South Belfast Sectoral Study 2006 - Northern Ireland Housing ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

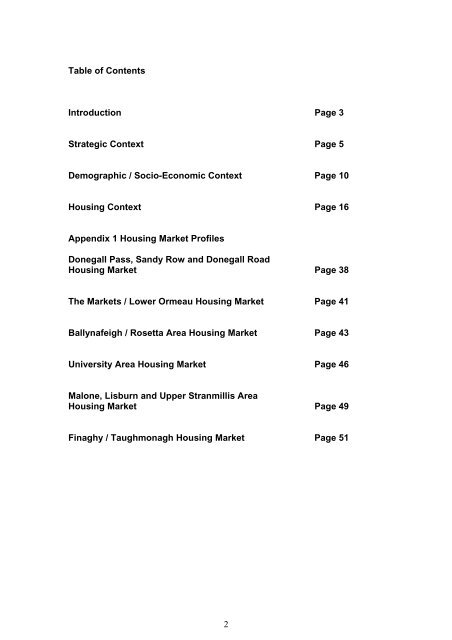

Table of Contents<br />

Introduction Page 3 <br />

Strategic Context Page 5 <br />

Demographic / Socio-Economic Context<br />

Page 10 <br />

<strong>Housing</strong> Context Page 16 <br />

Appendix 1 <strong>Housing</strong> Market Profiles <br />

Donegall Pass, Sandy Row and Donegall Road <br />

<strong>Housing</strong> Market Page 38 <br />

The Markets / Lower Ormeau <strong>Housing</strong> Market<br />

Page 41 <br />

Ballynafeigh / Rosetta Area <strong>Housing</strong> Market<br />

Page 43 <br />

University Area <strong>Housing</strong> Market Page 46 <br />

Malone, Lisburn and Upper Stranmillis Area <br />

<strong>Housing</strong> Market Page 49 <br />

Finaghy / Taughmonagh <strong>Housing</strong> Market<br />

Page 51 <br />

2

1.0 Introduction<br />

1.1 Aims and Purpose of <strong>Study</strong><br />

The <strong>South</strong> <strong>Belfast</strong> <strong>Sectoral</strong> <strong>Study</strong> is the fifth such housing study undertaken<br />

by the <strong>Housing</strong> Executive in <strong>Belfast</strong>. Previous studies have been completed<br />

for East, West, North and the Greater Shankill areas.<br />

The approach is to examine the housing market and its relationship with the<br />

wider strategic planning, physical, social and demographic context.<br />

This study will be used as a framework for consultation and the promotion of<br />

debate with interested parties which will lead to the formation of an agreed<br />

housing strategy for <strong>South</strong> <strong>Belfast</strong>.<br />

The study area covers eleven of the city’s electoral wards. These are:<br />

• Ballynafeigh<br />

• Blackstaff<br />

• Botanic<br />

• Finaghy<br />

• Malone<br />

• Musgrave<br />

• Rosetta<br />

• Shaftesbury<br />

• Stranmillis<br />

• Upper Malone<br />

• Windsor<br />

Although local government ward boundaries changed in 1992, the overall<br />

study area boundary has changed only very slightly and will still allow for<br />

meaningful intercensal comparisons.<br />

While the electoral wards are useful for demographic analyses, they do not<br />

reflect the distinct housing sub areas which exist in <strong>South</strong> <strong>Belfast</strong>. Six<br />

separate housing markets were identified and are used in the report. These<br />

are:<br />

• Donegall Pass/Sandy Row/Donegall Road<br />

• Markets/Lower Ormeau<br />

• Ballynafeigh/Rosetta<br />

• University Area<br />

• Malone/Upper Stranmillis<br />

• Finaghy/Taughmonagh<br />

Comprehensive maps of the study area and market profiles of the six housing<br />

areas are found in Appendix 1 of this report.<br />

3

2.0 Strategic Context<br />

2.1 Background<br />

<strong>South</strong> <strong>Belfast</strong> is often perceived as being the most affluent sector of the city.<br />

This perception is understandable and is largely reflected in higher property<br />

prices than other sectors of the city. Queen’s University and <strong>Belfast</strong> City<br />

Hospital, major employers in the area, have added to its popularity in<br />

residential terms.<br />

However, this perception masks areas of disadvantage where the sector<br />

norms, in terms of property price and condition, do not apply. Two <strong>South</strong><br />

<strong>Belfast</strong> wards, Shaftesbury and Blackstaff are ranked in the top 50 most<br />

deprived wards in <strong>Northern</strong> <strong>Ireland</strong>, while significant portions of Botanic ward<br />

are also ranked high in deprivation terms.<br />

Areas of <strong>South</strong> <strong>Belfast</strong> exhibit religious characteristics similar to other parts of<br />

the city, i.e. areas where at least 90% of the population is from one of the two<br />

main religious traditions. However, large parts of the study area contain<br />

“mixed areas” which have remained relatively free of the sectarian tensions<br />

which have blighted other parts of <strong>Belfast</strong>.<br />

<strong>South</strong> <strong>Belfast</strong> remains a popular place to live and its population reflects<br />

cultural and traditional diversity as significant numbers of people from ethnic<br />

minority backgrounds live in <strong>South</strong> <strong>Belfast</strong>. These factors have had a major<br />

impact on the demographic profile and housing market throughout <strong>South</strong><br />

<strong>Belfast</strong>. This is examined in more detail in Sections 3 and 4.<br />

2.2 Planning Context<br />

The Regional Development Strategy “Shaping our Future” established the<br />

planning framework for <strong>Northern</strong> <strong>Ireland</strong> up to 2025. It aims to create a<br />

thriving metropolitan area focused on <strong>Belfast</strong> by maintaining its current level of<br />

population and promoting housing within existing urban areas.<br />

The recently published <strong>Belfast</strong> Metropolitan Area Plan (BMAP) sets out<br />

detailed land use proposals for the Greater <strong>Belfast</strong> area. This plan envisages<br />

the provision of 77,500 new dwellings within the <strong>Belfast</strong> Urban Area with a<br />

target set of developing at least 60% of new development within the urban<br />

footprint.<br />

An urban capacity study was carried out as part of the BMAP process to<br />

determine the potential housing output from sites within the urban area. Very<br />

few development sites were identified in <strong>South</strong> <strong>Belfast</strong>; this has major<br />

implications for the area as its population continues to increase. Future<br />

residential development in <strong>South</strong> <strong>Belfast</strong> will be largely dependant upon<br />

“windfall sites”, i.e. sites which had not previously been identified in the urban<br />

capacity study. This lack of sites will exacerbate land and property prices in<br />

5

<strong>South</strong> <strong>Belfast</strong>, already the highest in the city. This issue is dealt with further in<br />

Section 4.<br />

2.3 Transport<br />

The Department for Regional Development has produced the <strong>Belfast</strong><br />

Metropolitan Transport Plan (BMPT) which sets out transport proposals for the<br />

<strong>Belfast</strong> Metropolitan Area (BMA) for the period to 2015. An essential element<br />

of the Transport Plan is an efficient, safe, environmentally acceptable and<br />

sustainable transport system. The Plan outlines proposals to create a<br />

network of Quality Bus Corridors where a fleet of modern accessible buses<br />

will provide more frequent services on existing routes and also on new routes<br />

which will provide access to new development nodes.<br />

In addition to specific road and rail infrastructure improvements, the Plan<br />

proposes to reduce the level of long stay commuter parking in <strong>Belfast</strong> City<br />

Centre and the City Centre Fringe area (defined as one kilometre from the<br />

City Centre boundary). In <strong>South</strong> <strong>Belfast</strong> commuter parking in areas such as<br />

Sandy Row, the<br />

Markets, Donegall<br />

Pass and the<br />

University area is<br />

already recognised<br />

as a problem and<br />

could be expected<br />

to become worse<br />

once restrictions on<br />

long stay parking in<br />

the city centre are<br />

implemented.<br />

Lisburn Road<br />

It is therefore proposed to control commuter parking in these City Centre<br />

Fringe areas by introducing control over all on-street parking. Time-limited<br />

parking bays and resident-only parking will be introduced, with a system of<br />

parking permits available to local residents and businesses. The precise<br />

number of spaces for use as residents-only parking will be determined<br />

following a detailed needs assessment and consultation.<br />

In a further attempt to reduce car dependency and use in the city, the Plan<br />

proposes to limit the provision of parking spaces in future residential<br />

developments in the City Centre and Fringe areas.<br />

6

2.4 Regeneration Context<br />

There are a number of current and historic regeneration strategies,<br />

programmes and initiatives which impact on <strong>South</strong> <strong>Belfast</strong>.<br />

Urban Regeneration and Neighbourhood Renewal<br />

The Department for Social Development, through its <strong>Belfast</strong> Regeneration<br />

Office, is responsible for driving urban regeneration in greater <strong>Belfast</strong>. In the<br />

past twenty years a number of initiatives and instruments such as Making<br />

<strong>Belfast</strong> Work, Comprehensive Development Schemes, Environmental<br />

Improvement and Urban Development Grant were used to promote<br />

regeneration throughout the city.<br />

In addition the Department’s Laganside Initiative has impacted on <strong>South</strong><br />

<strong>Belfast</strong>, particularly in relation to the Gasworks site which has been developed<br />

for industrial, commercial and office space. Laganside has facilitated<br />

appropriate training for local people to access jobs in the Gasworks site<br />

through its support for the GEMS (Gasworks Employment Matching Service)<br />

initiative.<br />

Following a review of its urban regeneration policy the Department has now<br />

adopted Neighbourhood Renewal as the basis of most of its urban renewal<br />

activity. Its strategy - ‘People and Place’ - was launched in 2003 and aims to<br />

regenerate and improve the quality of life in those communities and<br />

neighbourhoods experiencing the worst deprivation and disadvantage.<br />

The Strategy has four interlinking strategic objectives:<br />

• Community Renewal - develop confident communities that are able and<br />

committed to improving the quality of life in their areas.<br />

• Economic Renewal - develop economic activity in the most deprived<br />

neighbourhoods and connect them to the wider urban economy<br />

• Social Renewal - improve social conditions for the people who live in<br />

the most deprived neighbourhoods through better co-ordinated public<br />

services and the creation of safer environments<br />

• Physical Renewal - help create attractive, safe, sustainable <br />

environments in the most deprived neighbourhoods. <br />

Thirty-two Neighbourhood Renewal Areas (NRAs) have been identified across<br />

<strong>Northern</strong> <strong>Ireland</strong>. Two NRAs have been designated in <strong>South</strong> <strong>Belfast</strong><br />

• <strong>South</strong> West <strong>Belfast</strong> - Sandy Row, Donegall Road, Village and Roden<br />

Street<br />

• Inner <strong>South</strong> <strong>Belfast</strong> – Donegall Pass, Markets and Lower Ormeau<br />

Neighbourhood Partnerships are currently being established in these areas to<br />

drive the planning and delivery of a wide ranging regeneration agenda for the<br />

next 7-10 years. The intention is that they will be in a position later this year<br />

to produce the visions and strategies for their areas.<br />

7

The Department is also responsible for the implementation of the Peace 2<br />

Programme’s Measure 2.11 Area-Based Regeneration which aims to tackle<br />

area decline caused by the civil unrest. Two of the twelve areas targeted by<br />

this measure are in <strong>South</strong> <strong>Belfast</strong>:<br />

• The Westlink/Roden Street interface area<br />

•Donegall Pass/Markets/Lower Ormeau.<br />

Sandy Row and the Village area of Donegall Road were recently used as pilot<br />

areas to evaluate the provision and effectiveness of a range of public services<br />

in working class Protestant areas. A series of recommendations emerged<br />

from the report, a number of which refer to housing related issues. The<br />

recommendations largely refer to the need for specific initiatives in relation to<br />

access to employment, skills training, adult literacy and youth intervention as<br />

well as identifying measures to promote community development and civic<br />

leadership. The recommendations are likely to be examined by the<br />

Neighbourhood Renewal Partnership.<br />

<strong>Belfast</strong> City Council<br />

<strong>Belfast</strong> City Council has taken the lead in creating a collaborative Arterial<br />

Routes Partnership. The partnership consists of the <strong>Belfast</strong> Area Partnership<br />

Boards, <strong>Belfast</strong> Regeneration Office, City Council and the <strong>Housing</strong> Executive.<br />

It is recognised that the arterial routes are the key gateways for the social and<br />

economic functioning of the city. The Arterial Routes Partnership seeks to<br />

enhance the vitality of the main routes by developing and implementing<br />

integrated regeneration plans for designated nodes within the arterial routes.<br />

These areas were previously thriving locations which supported their<br />

surrounding neighbourhoods but which now require targeted support to<br />

reverse the economic, social, physical and environmental decline.<br />

The focus of the arterial routes programme in <strong>South</strong> <strong>Belfast</strong> is the mid<br />

Donegall Road, stretching from Daphne Street to the Broadway Roundabout<br />

which is in Phase 1 of the programme and the Lower Ormeau Road from<br />

Cromac Street to the Ormeau Bridge which is in Phase 2.<br />

A series of environmental enhancements are planned on these routes<br />

including tree planting, public art provision and anti litter campaigns. Local<br />

community regeneration bodies will take the lead in designing and<br />

implementing these projects.<br />

In addition, in 2004 <strong>Belfast</strong> City Council produced a Masterplan for the city to<br />

stimulate debate on the challenges facing the city in the period up to 2020.<br />

The Plan has no formal status and its implementation will require co operation<br />

from Government Departments and statutory agencies.<br />

8

2.5 Community Infrastructure and Participation<br />

There is an extensive community network in <strong>South</strong> <strong>Belfast</strong>. The <strong>Housing</strong><br />

Executive participates fully in community development issues throughout the<br />

sector and is represented on the <strong>South</strong> <strong>Belfast</strong> Area Partnership Board which<br />

acts as a support mechanism for the community sector throughout the area.<br />

The <strong>South</strong> <strong>Belfast</strong> Partnership Board has produced a number of strategies<br />

dealing with key themes such as Health, Employment and Regeneration.<br />

The <strong>Housing</strong> Executive has established a District <strong>Housing</strong> Community<br />

Network (formerly referred to as the District Consumer Panel) in <strong>South</strong> <strong>Belfast</strong><br />

which acts as the focus for local consultation on the <strong>Housing</strong> Executive’s<br />

policies, programmes and services. The <strong>Housing</strong> Executive also participates<br />

in and offers practical support to a number of initiatives, for example, <strong>South</strong><br />

<strong>Belfast</strong> Surestart, the <strong>South</strong> <strong>Belfast</strong> Racism Roundtable, Domestic Violence<br />

Forum, Annadale Crimewatch and a Tidy Lagan Initiative in Lower Ormeau .<br />

In addition to participation in various inter-agency programmes, the <strong>Housing</strong><br />

Executive jointly funds a number of posts in the community and also has plans<br />

to expand its neighbourhood warden service in conjunction with <strong>Belfast</strong> City<br />

Council.<br />

9

3.0 Demographic/Socio-Economic Context<br />

3.1 Population<br />

The population of the <strong>South</strong> <strong>Belfast</strong> study area increased by 12% from 58,402<br />

to 65,330 between 1991 and 2001. This trend differs from that for the other<br />

sectors in the city and <strong>Belfast</strong> as a whole, which saw small declines in<br />

population in the same period.<br />

The wards closest to the city centre have experienced the most acute<br />

population variations:<br />

• The population of Blackstaff ward (Village/Donegall Road area) fell in the<br />

1991-2001 period by over 21% from 5,005 to 3,943, a significant decline<br />

reflecting an area in considerable transition.<br />

• The rate of population increase has been most marked in Botanic and<br />

Windsor wards with rises of 74% and 39% respectively; Stranmillis,<br />

Shaftesbury and Ballynafeigh experienced lower increases ranging from<br />

13% to 6%. The rise in population in these wards has seen a<br />

corresponding change in both the age profile of residents and the housing<br />

tenure patterns.<br />

The most striking aspect of the intercensal population change is the significant<br />

increase in the 18-44 age group, as illustrated in the table below.<br />

1991 2001 1991-2001 Var.<br />

No. % No. % No. %<br />

0-17 12569 21.6% 11661 17.9% -908 -7.2%<br />

18-44 24173 41.4% 33231 50.9% +9058 +37.5%<br />

45-59 8418 14.4% 9084 13.9% +666 +7.9%<br />

60+ 13164 22.6% 11324 17.3% -1840 -14.0%<br />

Total 58324 65300 +6976 +12.0%<br />

Table 1 Population Age Structure (2001 Census)<br />

The 18-44 age group now comprises 50.9% of the total population of the<br />

study area, up from 41.4% in 1991, and compares to a city-wide average of<br />

40%. The growth in this age group is particularly pronounced in those wards<br />

closest to the University and hospital area, and at the 2001 Census it<br />

accounted for 77% of the population in Botanic ward (which has the largest<br />

population of any ward in <strong>Belfast</strong>) 71% in Windsor and 59% in Stranmillis.<br />

Within the 18-44 age group it is the 18-29 age group population which has<br />

increased most dramatically. In <strong>South</strong> <strong>Belfast</strong> it has risen by 63% overall, but<br />

in Botanic the increase was 177%, in Windsor 126% and 110% in Stranmillis.<br />

10

What is also noteworthy is the population decline in both the very young (0-<br />

17) and elderly (60+) age groups. They account for 17.9% and 17.3%<br />

respectively of the <strong>South</strong> <strong>Belfast</strong> population compared to figures of 25% and<br />

20% of the citywide population.<br />

Map 2 Distribution of 18-44 Age Group in <strong>Study</strong> Area<br />

3.2 Household Analysis<br />

The number of households in the study area increased from 24,816 to 27,084<br />

in the 1991-2001 period, a rate of increase of 9% compared with a <strong>Belfast</strong>wide<br />

increase of 6% in the same period.<br />

The trend towards smaller household size, evident in all other sectors of the<br />

city and in the city as a whole, was reversed in <strong>South</strong> <strong>Belfast</strong>. While the<br />

average household size across the city fell from 2.53 persons to 2.43 persons<br />

in 1991-2001, in <strong>South</strong> <strong>Belfast</strong> it rose slightly from 2.35 to 2.42.<br />

The variation in numbers of households was not consistent across the eleven<br />

wards in the study area. Those wards which had an increase in population -<br />

Botanic, Ballynafeigh, Windsor and Shaftesbury - also had an increase in the<br />

number of households ranging from almost 29% in Botanic to over 12% in<br />

Windsor.<br />

Stranmillis Ward is the exception to the rule that an increase in population is<br />

matched by an increase in households. While its population increased by<br />

almost 13% from 6742 to 7616, the number of households fell by 14% from<br />

2800 to 2400. Stranmillis has the largest average household size of any ward<br />

in the city with 3.17 persons per household. This area is very popular with<br />

young professionals and is reflected in the high price of property in the area.<br />

11

Estate Agents operating in Stranmillis have confirmed that most of the<br />

property purchases in the area are made by single people who need to sub-let<br />

a room/rooms to help with mortgage payments. This is dealt with in more<br />

detail in Section 4.<br />

The most<br />

significant<br />

variation in the<br />

household<br />

composition of<br />

<strong>South</strong> <strong>Belfast</strong> is a<br />

much lower<br />

number of family<br />

households than<br />

other sectors of<br />

the city,<br />

particularly in<br />

those wards close<br />

to the University<br />

area. These<br />

areas have also Strandview Street<br />

experienced a<br />

decline, both in actual numbers and proportionally, in their elderly population<br />

in the 1991-2001 period, suggesting that a major change has occurred in the<br />

housing market during that period. This is examined in more detail in Section<br />

4.<br />

The outer wards of Finaghy, Malone, Upper Malone and Musgrave have not<br />

had the same level of household or population shift and remain primarily<br />

areas where owner-occupied family housing predominates. The household<br />

composition of the study area, based on the 2001 Census is detailed in the<br />

table below.<br />

Ward Singles Couples Families Elderly Other * Total<br />

H/H<br />

Ballynafeigh 786 264 649 430 398 2527<br />

Blackstaff 585 217 594 460 169 2025<br />

Botanic 1141 303 613 344 1307 3708<br />

Finaghy 241 251 896 416 45 1849<br />

Malone 325 303 897 486 128 2139<br />

Musgrave 273 222 1153 468 74 2190<br />

Rosetta 466 240 754 640 110 2210<br />

Shaftesbury 956 223 850 724 187 2940<br />

Stranmillis 467 290 731 541 371 2400<br />

Upr. Malone 343 229 846 656 60 2134<br />

Windsor 881 295 417 546 1023 3162<br />

Total 6464 2837 8400 5711 3872 27284<br />

12

* Mostly households living in shared accommodation-Houses in Multiple<br />

Occupation (HMOs)<br />

Table 2 Household Type (2001 Census)<br />

3.3 Ethnic Minorities<br />

The 2001 Census was the first to determine the ethnic composition of the<br />

population. Previous estimates were based on academic studies or figures<br />

produced by organisations representing ethnic minority groups. These<br />

estimates varied a great deal, with the most considered view being produced<br />

in 2000 by the Multi Cultural Resource Centre (MCRC) which gauged the<br />

ethnic minority population of <strong>Northern</strong> <strong>Ireland</strong> to be in excess of 16,250.<br />

The 2001 Census determined that there were over 14,000 people from ethnic<br />

minority backgrounds in <strong>Northern</strong> <strong>Ireland</strong>. It is argued that these census<br />

figures may not be accurate as it is thought that language and literacy<br />

difficulties, allied to suspicion and mistrust of official information gathering may<br />

have led to non-completion of the forms. It is therefore probable that the true<br />

ethnic minority population was higher in 2001 and is likely to have increased<br />

further in the period since then, given the acknowledged influx since 2001 of<br />

people seeking political asylum and migrant workers from eastern Europe.<br />

Using the results of the MCRC study as a basis for analysis of the nature and<br />

extent of ethnic minorities living in <strong>Northern</strong> <strong>Ireland</strong>, it is estimated that<br />

approximately 5,000 people in <strong>Belfast</strong> come from a minority ethnic<br />

background. <strong>South</strong> <strong>Belfast</strong> is the most popular sector of the city for this<br />

group, housing more than 50% of the total <strong>Belfast</strong> ethnic minority population.<br />

The <strong>Housing</strong><br />

Executive has<br />

begun to collect<br />

basic information on<br />

the ethnic origin of<br />

applicants for the<br />

Common Selection<br />

Scheme for<br />

allocating social<br />

housing. The<br />

<strong>Housing</strong> Executive’s<br />

<strong>Belfast</strong> District 7,<br />

which covers <strong>South</strong><br />

<strong>Belfast</strong>, has the<br />

largest number of<br />

Hong Ling Gardens Sheltered Scheme<br />

ethnic minority<br />

applicants on its<br />

waiting list, although the actual number making applications is quite low. This<br />

underscores the prevailing view that the ethnic minority population is<br />

predominantly established in the private sector, with social housing operating<br />

as a last resort when private ownership or rental is no longer an option.<br />

13

November 2004 saw the opening of the first social housing scheme designed<br />

specifically for minority ethnic residents, the Chinese Elders Scheme in the<br />

Markets area of <strong>South</strong> <strong>Belfast</strong>. This scheme was developed in partnership by<br />

BIH <strong>Housing</strong> Association, <strong>Housing</strong> Executive, the Chinese Welfare<br />

Association and the Markets Development Association. The collection of<br />

ethnic information will enable the need for future schemes to be more<br />

effectively determined.<br />

3.4 Socio-Economic/Deprivation<br />

As noted in Section 2.1, the popular perception of <strong>South</strong> <strong>Belfast</strong> is of a largely<br />

affluent area. However, successive deprivation studies have consistently<br />

indicated a significant concentration of deprivation across the inner city part of<br />

the sector.<br />

The 1994 Robson Report, the 2001 Noble Report and the recently published<br />

<strong>Northern</strong> <strong>Ireland</strong> Multiple Deprivation Measure 2005 all indicate that the<br />

neighbourhoods in the inner area of <strong>South</strong> <strong>Belfast</strong> (The Village, Sandy Row,<br />

Donegall Pass, The Markets and Lower Ormeau) are in the top 10% most<br />

deprived/disadvantaged areas in <strong>Northern</strong> <strong>Ireland</strong>.<br />

The 2005 Report also indicated a smaller pocket of deprivation focused on the<br />

Finaghy and Taughmonagh social housing estates in the outer part of the<br />

sector.<br />

The 2005 Report in common with the earlier Noble Report, is based on the<br />

premise that multiple deprivation is made up of separate ‘domains’, each of<br />

which reflects a different aspect of deprivation and is measured using a<br />

number of indicators. Inner <strong>South</strong> <strong>Belfast</strong> ranked highly in the Health,<br />

Education and Crime and Disorder domains.<br />

3.5 Key Points<br />

• The area around Queens University and the City Hospital has undergone<br />

significant demographic and community transition. The change in these<br />

neighbourhoods from traditional family centred residential communities to<br />

areas dominated by a young, often transitory population is demonstrated<br />

by the striking falls in the number of families, children and elderly and their<br />

replacement by the people in the 18-29 age group.<br />

• Shaftesbury Ward (Donegall Pass, Markets and Sandy Row) has retained<br />

a relatively stable population base with a high number of families and<br />

younger people (0-17). The area also has experienced a significant<br />

increase in the number of single person households. It remains an area of<br />

significant multiple deprivation, the most disadvantaged in the study area.<br />

14

• Blackstaff Ward (Donegall Road/Village) has experienced significant<br />

population decline encompassing all age groups and household types with<br />

the exception of 18-29 year olds. The decline has been most pronounced<br />

in the very young (0-9) age group. It is also an area of considerable<br />

disadvantage, particularly in regard to environmental conditions.<br />

• Ballynafeigh is an area in transition, affected by the same market forces<br />

operating in the University area. Family and elderly households are<br />

declining, being replaced by single persons and sharing households.<br />

• The other areas in the sector, i.e. Malone, Upper Malone, Upper<br />

Stranmillis, Finaghy, Musgrave and Rosetta are stable mainly family<br />

centred housing areas, albeit with a significant growth in single person<br />

households.<br />

15

4.0 <strong>Housing</strong> Context<br />

4.1 <strong>Housing</strong> Stock<br />

Data from the Rates Collection Agency indicates that <strong>South</strong> <strong>Belfast</strong> had a<br />

housing stock of 30,762 dwellings in 2004, an increase of 9.2% since 1995.<br />

The rate of increase in <strong>Belfast</strong> as a whole over the same period was 4.5%.<br />

The higher rate of increase in <strong>South</strong> <strong>Belfast</strong> can be attributed to a number of<br />

large scale apartment developments in the sector.<br />

Table 3 illustrates that <strong>South</strong> <strong>Belfast</strong> has a higher proportion of detached<br />

houses, purpose built flats and apartments and converted/shared houses than<br />

the remainder of the city.<br />

Detached<br />

houses &<br />

bungalows<br />

Semi-Det<br />

houses &<br />

bungalows<br />

Terraced<br />

houses &<br />

bungalows<br />

Purpose<br />

built flats&<br />

apartments<br />

Converted<br />

or shared<br />

houses<br />

<strong>South</strong><br />

<strong>Belfast</strong> 13.4% 22.0% 43.1% 14.4% 6.7%<br />

Remainder<br />

<strong>Belfast</strong> 10.4% 30.8% 47.1% 10.1% 1.3%<br />

Table 3 : Dwelling Types (2001 Census)<br />

4.2 <strong>Housing</strong> Conditions<br />

The <strong>Housing</strong> Executive’s Urban Renewal Programme has transformed<br />

housing conditions in many parts of <strong>South</strong> <strong>Belfast</strong>’s inner and middle city<br />

since its adoption in 1982.<br />

This strategy expanded the 1960s slum clearance and redevelopment<br />

programmes and produced a swathe of new social housing around the inner<br />

city in Sandy Row, the Markets, parts of Donegall Road/The Village, Lower<br />

Ormeau and Donegall Pass. In the latter area land was made available to<br />

facilitate one of the first inner city private housing schemes at Salisbury Court.<br />

Outside the inner city a number of small redevelopment areas were<br />

implemented at Cussick Street, Ferndale/Marlborough and<br />

Somerset/Parkmore Streets, while the post-war pre-fabricated Taughmonagh<br />

estate was completely renewed in the 1980s.<br />

However, housing renewal in the middle city was primarily driven by a<br />

combination of rehabilitation, private sector grants availability and small infill<br />

new build schemes in a number of <strong>Housing</strong> Action Areas (HAAs) and Private<br />

Investment Priority Areas (PIPAs) along the Lisburn, Ormeau and Donegall<br />

Roads. The majority of these were successful in improving housing and<br />

environmental conditions, reflecting the popularity, confidence and willingness<br />

of households to invest in property in many <strong>South</strong> <strong>Belfast</strong> market areas.<br />

16

The 1982 Renewal Strategy was updated in 1996 in the <strong>Belfast</strong> City <strong>Housing</strong><br />

Strategy, which saw a change in emphasis away from direct housing provision<br />

to a more enabling and facilitatory role where housing was promoted as part<br />

of wider regeneration. Since then the main focus of the <strong>Housing</strong> Executive’s<br />

housing activities in <strong>South</strong> <strong>Belfast</strong> have been:<br />

• redeveloping Essex Street in Lower Ormeau in partnership with BIH<br />

<strong>Housing</strong> Association.<br />

• reviewing previous activity in former HAAs and PIPAs where markets have<br />

failed. Part of the former Roden Street HAA is currently being renewed in<br />

partnership with Fold <strong>Housing</strong> Association, and the <strong>Housing</strong> Executive is<br />

currently carrying out an Urban Renewal assessment on options for future<br />

intervention in the former Donegall/Ebor PIPA, the largest remaining<br />

concentration of housing unfitness in <strong>South</strong> <strong>Belfast</strong>.<br />

• assisting Clanmil <strong>Housing</strong> Association to purchase the North Cricket<br />

Ground to provide social housing.<br />

• implementing environmental improvement strategies in Sandy Row and<br />

the Markets in partnership with the local communities and other agencies<br />

such as Groundwork NI.<br />

• continuing to bring forward improvement and maintenance programmes for<br />

its own housing stock.<br />

In addition the <strong>Housing</strong> Executive has continued to invest in the privatelyowned<br />

housing stock in <strong>South</strong> <strong>Belfast</strong> through the Private Sector Grants<br />

Scheme. In the last five years over £20 million of grant expenditure has been<br />

directed at <strong>South</strong> <strong>Belfast</strong>, an average of £4 million per year, reflecting the high<br />

numbers of qualifying HMO properties. Excluding HMO grants, an average of<br />

£1.75 million<br />

is invested<br />

annually in<br />

<strong>South</strong><br />

<strong>Belfast</strong>.<br />

The <strong>Housing</strong><br />

(NI) Order<br />

2003<br />

changed the<br />

<strong>Housing</strong><br />

Executive’s<br />

Grant<br />

Scheme from<br />

an essentially<br />

mandatory<br />

one to one<br />

that is mainly<br />

discretionary.<br />

Holyland Conversion<br />

17

The new scheme was introduced in December 2003. Targeting of grant aid is<br />

an essential element of the new discretionary scheme which will concentrate<br />

scarce resources on dwellings and individuals in greatest need. The key<br />

changes in respect of the main types of grant applicable in <strong>South</strong> <strong>Belfast</strong> are<br />

as follows:<br />

• Renovation Grant continues to be aimed at reducing unfitness but is now<br />

discretionary. Landlord contributions are now based on a percentage of<br />

eligible costs rather than on the level of rental income.<br />

• Houses in Multiple Occupation (HMO) Grants continue to be directed at<br />

making HMOs fit for habitation and for the number of people living in them.<br />

The grants are no longer mandatory and are only available for existing<br />

HMO properties within designated HMO Action areas or for properties<br />

capable of housing ten or more people.<br />

• Disabled Facilities Grant continues to be available on the recommendation<br />

of an Occupational Therapist, reflecting the <strong>Housing</strong> Executive’s<br />

continuing emphasis on providing support to people with disabilities.<br />

• Repair Grants continue to be available to landlords following the service of<br />

a Certificate of Disrepair or Public Health Notices<br />

4.3 <strong>Housing</strong> Tenure<br />

The table below illustrates the changes in tenure and the restructuring of the<br />

housing market in <strong>South</strong> <strong>Belfast</strong> in recent years.<br />

1991 2001 1991-2001 Var.<br />

No. % No. % No. %<br />

Owner Occ. 14275 57.5% 14769 54.5% +494 +3.5%<br />

NIHE 5335 21.5% 4592 17.0% -743 -13.9%<br />

H. Assoc 896 3.6% 1084 4.0% +188 +21.0%<br />

Priv. Rent. 4117 16.6% 5888 21.7% +1771 +43.0%<br />

Other 199 0.8% 745 2.8% +546 +274%<br />

Total 24822 27078 +2256 +9.1%<br />

Table 4 <strong>Housing</strong> Tenure (1991 & 2001 Census)<br />

The owner-occupied sector is the dominant tenure in <strong>South</strong> <strong>Belfast</strong>. However,<br />

what is particularly noteworthy from the table is that this area has not followed<br />

the almost universal trend in recent years of significant growth in owneroccupation.<br />

18

However, although <strong>South</strong> <strong>Belfast</strong> has experienced a minimal increase in the<br />

number of owner-occupied dwellings, its level of owner-occupation has<br />

declined from 57.5% in 1991 to 54.5% in 2001. This has occurred even as<br />

<strong>Housing</strong> Executive dwellings have continued to move into the private sector<br />

(2,500 since 1981) through the House Sales Scheme.<br />

This indicates that there are different factors affecting the <strong>South</strong> <strong>Belfast</strong><br />

market. In broad terms the market is being driven by an increase in the<br />

private rented sector, a factor examined in greater detail in Section 4.4.<br />

Owner occupied Social Rented Private Rented<br />

<strong>Belfast</strong> All 57% 32% 11%<br />

<strong>South</strong> <strong>Belfast</strong> * 55% 21% 22%<br />

Table 5 <strong>Housing</strong> tenure analysis (2001 Census)<br />

(* Figures do not total 100% - 2% of households live in “Other Rented”<br />

property)<br />

The Household tenure analysis of the study area based on the 2001 Census<br />

is set out in table 6 below:<br />

Ward<br />

Owner<br />

Occ.<br />

Social<br />

Rented<br />

Private<br />

Rented<br />

Other<br />

Rented*<br />

All H/Hs<br />

Ballynafeigh 1418 551 494 75 2538<br />

Blackstaff 911 639 434 52 2036<br />

Botanic 807 727 1967 162 3663<br />

Finaghy 1681 90 57 23 1851<br />

Malone 1761 22 296 58 2137<br />

Musgrave 1554 283 124 37 1998<br />

Rosetta 1641 318 201 52 2212<br />

Shaftesbury 682 1946 274 50 2952<br />

Stranmillis 1797 22 517 67 2403<br />

Upper Malone 1343 705 72 21 2141<br />

Windsor 1174 373 1452 148 3147<br />

Total 14769 5676 5888 745 27078<br />

(* Includes renting from an employer, relative or friend)<br />

Table 6 Household Tenure (2001 Census)<br />

19

4.4 Social <strong>Housing</strong><br />

The total social housing stock in the <strong>South</strong> <strong>Belfast</strong> <strong>Sectoral</strong> <strong>Study</strong> area is<br />

currently<br />

approximately<br />

5,000 units,<br />

3700 <strong>Housing</strong><br />

Executive and<br />

1300 <strong>Housing</strong><br />

Association.<br />

Markets Area <strong>Housing</strong> Association Newbuild<br />

The<br />

Shaftesbury<br />

ward has the<br />

largest<br />

proportion of social housing in the study area at 66% of all stock.<br />

Ballynafeigh, Botanic, Blackstaff and Upper Malone have sizeable proportions<br />

of social housing ranging from 20% to 33% of all stock.<br />

There were 282 allocations of social housing in the year to March 2005- a<br />

slight increase on 273 in the previous year - representing approximately 5.7%<br />

of total available stock.<br />

Social <strong>Housing</strong> Demand/Need. The number of applicants on the social<br />

housing waiting lists for the <strong>South</strong> <strong>Belfast</strong> area - including those in housing<br />

stress - has remained fairly stable since 2001 following the introduction of the<br />

new Common Selection Scheme in November 2000. The trends are<br />

illustrated in the graph below.<br />

20

Chart 1 <strong>South</strong> <strong>Belfast</strong> Social <strong>Housing</strong> Waiting List 2001-2005<br />

The table and Chart 2 below illustrate the break-down of housing applicants<br />

by household type.<br />

Ward Singles Couples Families Elderly<br />

Total <strong>Housing</strong> 909 60 311 242<br />

Applicants<br />

<strong>Housing</strong> Stress 500 24 214 124<br />

Applicants<br />

Total Allocations 133 12 74 63<br />

Year to March 05<br />

Table 7 <strong>South</strong> <strong>Belfast</strong> Social <strong>Housing</strong> Waiting List March 2005<br />

21

Chart 2 Household Composition <strong>South</strong> <strong>Belfast</strong> Waiting List Mar 2005<br />

<strong>Housing</strong> Stress Applicants<br />

As is evident from the figures above, single person households comprise the<br />

largest group by far with 58% of <strong>Housing</strong> Stress applicants (the corresponding<br />

figure for <strong>Belfast</strong> city is 40%), a slight increase from 53% in 2001. There has<br />

been a corresponding decrease in the proportion of elderly applicants in <strong>South</strong><br />

<strong>Belfast</strong> from 20% in 2001 to 14% in 2005.<br />

Local housing demand/need. At a local level there is considerable variation in<br />

housing demand and stress in areas within <strong>South</strong> <strong>Belfast</strong>. Waiting List figures<br />

for each of the Common Landlord Areas 1 in <strong>South</strong> <strong>Belfast</strong> is set out below:<br />

1 In common with the other sectors in the city, <strong>South</strong> <strong>Belfast</strong> is sub-divided<br />

into a number of distinct housing areas - called Common Landlord Areas - for<br />

the purpose of administering the Common Selection Scheme for allocating<br />

social housing. Applicants are allowed to nominate two CLAs as areas of<br />

choice as to where they would like to live. A single waiting list now embraces<br />

all housing and transfer applicants requesting <strong>Housing</strong> Executive or <strong>Housing</strong><br />

Association accommodation in each area.<br />

22

CLA Name Applicants <strong>Housing</strong> Stress Allocations<br />

P.A.<br />

Annadale 69 36 20<br />

Cromac(Markets) 92 77 52 *<br />

Donegall Pass 63 33 24<br />

Donegall Road 168 68 62<br />

Finaghy 157 87 25<br />

Flush Park 59 33 9<br />

Lower Ormeau 146 98 11<br />

Sandy Row 47 26 30<br />

Stranmillis 43 20 2<br />

Taughmonagh 28 17 23<br />

Ulsterville(Lisburn Rd.) 408 216 10<br />

Upper Ormeau 242 151 14<br />

<strong>South</strong> <strong>Belfast</strong> Total 1,522 862 282<br />

(* Includes New Build Handovers at McAuley Street)<br />

Table 8 <strong>South</strong> <strong>Belfast</strong> Waiting List and Allocations March 2005<br />

In those areas where the waiting list is relatively low compared to the available<br />

stock - i.e. Annadale, Donegall Pass, Donegall Road, Sandy Row and<br />

Taughmonagh - the demand and need for social housing is being met through<br />

relets in existing stock.<br />

However, there are several areas where demand/need outstrips turnover in<br />

the stock i.e. Cromac (Markets), Finaghy, Lower Ormeau, Upper Ormeau and<br />

Ulsterville (Lisburn Road). Future new social housing provision is likely to be<br />

concentrated in these areas, in areas undergoing redevelopment or<br />

regeneration, or in schemes designed for specialist need groups.<br />

A five year Social <strong>Housing</strong> Programme to meet social housing need is<br />

published annually by the Department for Social Development. The current<br />

programme for <strong>South</strong> <strong>Belfast</strong> aims to deliver approximately 700 units of<br />

accommodation across a number of locations and catering for a range of<br />

client groups. This number is in line with the social housing need projection<br />

carried out for <strong>South</strong> <strong>Belfast</strong> as part of the BMAP process.<br />

However, the provision of many of these schemes is dependent upon success<br />

in site acquisition. The popularity of <strong>South</strong> <strong>Belfast</strong> and consequent<br />

competition from the private sector means that housing associations are<br />

finding it increasingly difficult to acquire suitable and financially viable<br />

development sites in the sector. Furthermore, the urban capacity study which<br />

was undertaken prior to the publication of BMAP did not identify sufficient<br />

sites to meet the projected social housing requirement for <strong>South</strong> <strong>Belfast</strong>.<br />

The lack of sites is already having an adverse impact on waiting lists in some<br />

areas. In particular this is most acute in the Ulsterville (Lisburn Road) area<br />

23

which has one of the biggest waiting lists in <strong>Northern</strong> <strong>Ireland</strong> (and which<br />

continues to increase) and a rapidly declining social housing stock.<br />

Homelessness. Chart 3 below illustrates the trend of homeless presenters in <br />

<strong>South</strong> <strong>Belfast</strong> and the number of those presenters awarded Full Duty Status <br />

during the period 1999-2004 <br />

Chart 3 Homeless Applications <strong>South</strong> <strong>Belfast</strong> 2000-2005<br />

The considerable rise in recent years – a trend throughout <strong>Northern</strong> <strong>Ireland</strong> -<br />

has largely been attributed to increasing incidences of breakdown in marriage,<br />

relationship and sharing arrangements.<br />

24

4.5 Owner-Occupation<br />

<strong>South</strong> <strong>Belfast</strong> continues to be an exceptionally popular housing area and this<br />

is reflected in average house prices which, though fluctuating in recent years,<br />

have traditionally been the highest in the city and amongst the highest in<br />

<strong>Northern</strong> <strong>Ireland</strong>.<br />

Ave Price 2003<br />

Quarter 2<br />

Ave Price 2004<br />

Quarter 2<br />

Ave Price<br />

2005<br />

Quarter 2<br />

Change<br />

<strong>Northern</strong> <strong>Ireland</strong> £101,759 £112,806 £131,529 +29.3%<br />

<strong>Belfast</strong> £100,647 £112,077 £130,567 +29.7%<br />

North <strong>Belfast</strong> £80,310 £76,486 £98,304 +22.4%<br />

<strong>South</strong> <strong>Belfast</strong> £126,532 £141,727 £164,890 +30.3%<br />

East <strong>Belfast</strong> £109,867 £129,153 £146,452 +33.3%<br />

West <strong>Belfast</strong> £83,905 £90,769 £106,441 +26.9%<br />

Table 9 Average House Prices ( University of Ulster )<br />

There is no reason to believe that this will not continue to be the case, even<br />

though prices in other sectors particularly East and West <strong>Belfast</strong> have<br />

increased<br />

markedly in the<br />

past 3 years.<br />

The Donegall<br />

Road area does<br />

not conform to<br />

this overall<br />

sectoral trend,<br />

with prices here<br />

among the<br />

lowest in the city.<br />

There are<br />

considerable<br />

variations in<br />

price<br />

Lagan Village Apartments<br />

performance and<br />

volume of sales between different property types. This is set out in the table<br />

below:-<br />

Property Type Ave Price 2004<br />

Quarter 2<br />

Ave Price 2005<br />

Quarter 2<br />

Terrace £136,544 £150,547<br />

Semi Detached £153,151 £169,393<br />

Detached £203,639 £306,654<br />

Bungalow<br />

As Detached<br />

Apartment £101,380 £131,327<br />

Table 10 Average House Price (University of Ulster)<br />

25

Levels of owner-occupation vary across the study area, ranging from 24% in<br />

Shaftesbury to over 90% in Musgrave and Finaghy. Rosetta, Stranmillis and<br />

Malone have owner-occupation levels of over 75% of total stock.<br />

Ballynafeigh, Blackstaff, Botanic, Windsor and Stranmillis wards have<br />

experienced static or declining levels of owner-occupation in the past ten year<br />

period. These wards are also the most popular areas of choice for renting<br />

privately and demonstrate the trend and extent of drift from owner occupation<br />

to renting privately.<br />

The <strong>Housing</strong> Executive’s House Sales Scheme has made a significant<br />

contribution to widening home ownership in <strong>South</strong> <strong>Belfast</strong> and promoting<br />

tenure choice amongst households that otherwise would have had little<br />

opportunity to purchase. Since 1981, 2,500 former <strong>Housing</strong> Executive<br />

dwellings have been sold to sitting tenants within the study area, almost 1,000<br />

of these in the last five years alone.<br />

The average market value of former <strong>Housing</strong> Executive properties sold in<br />

<strong>South</strong> <strong>Belfast</strong> in 2004/2005 was £65,000, much lower than the sector’s<br />

average resale price. In addition to sales to sitting tenants, the re-sale of<br />

former <strong>Housing</strong> Executive properties has therefore provided an important<br />

route into home ownership, particularly for first time buyers.<br />

Partly as a result of a <strong>Housing</strong> Executive research project into the operation of<br />

the House Sales Scheme and its impact on the wider housing market, and<br />

partly in response to growing concerns that the generous nature of the<br />

scheme mitigated against the capability of social housing providers to meet<br />

growing levels of urgent housing need, the Department for Social<br />

Development approved a series of significant amendments to the scheme<br />

effective from May 2004.<br />

The result of the new provisions will reduce the number of properties for sale<br />

at hitherto affordable prices, thus reducing a source of affordable housing and<br />

making it even more difficult for potential first time buyers to enter the <strong>South</strong><br />

<strong>Belfast</strong> market.<br />

Private sector market perspective. In compiling this sectoral study a number<br />

of estate agents were asked a series of structured questions to determine the<br />

state of the market in <strong>South</strong> <strong>Belfast</strong>. Their analysis and views are<br />

summarised in the points below:<br />

• The middle and upper end of the market in <strong>South</strong> <strong>Belfast</strong> is very healthy,<br />

with more properties priced over £250k than in any other area in <strong>Northern</strong><br />

<strong>Ireland</strong>. Most properties in this bracket are purchased by people already<br />

living in <strong>South</strong> <strong>Belfast</strong>, with evidence of vendors trading up and taking<br />

advantage of the large capital gain accrued from the sale of terrace<br />

property in Stranmillis, Lisburn Road and Ormeau Road, all of which are<br />

areas popular with investors buying to rent.<br />

26

• There are several market ‘hot spots’ in <strong>South</strong> <strong>Belfast</strong> where selling prices<br />

regularly exceed asking prices; for example, Stranmillis, Lisburn Road and<br />

the Holyland are the highest priced areas for terrace property in <strong>Northern</strong><br />

<strong>Ireland</strong>, with prices often exceeding £150k for two-storey terraced houses<br />

(the agents reported that prices paid for terrace property in the Lisburn<br />

Road rose by 25% in the last year). These price levels virtually exclude<br />

first time buyers, and most traditionally constructed properties bought in<br />

these areas are purchased by investors.<br />

• The Ballynafeigh market has appreciated considerably since 2001, with<br />

one agent calling it “the new Stranmillis”. Vendors in Ballynafeigh are<br />

trading up to Four Winds, Rosetta and Mount Merrion, attracted by<br />

gardens, secure car-parking and the fact that prices in these outer areas<br />

have increased at a much more gradual rate than the inner areas.<br />

Ballynafeigh, which had been popular with first time buyers in the 1980s<br />

and 1990s, is now out of financial reach for most of this potential group.<br />

• The dramatic impact of significantly increased prices on the number of first<br />

time buyers entering the market in <strong>South</strong> <strong>Belfast</strong> is illustrated by the<br />

agents’ views that, in most areas in the sector, first time buyers account for<br />

less than 10% of all residential transactions (by way of comparison, in<br />

2001 60% of house sales in <strong>Northern</strong> <strong>Ireland</strong> went to first time buyers,<br />

falling to 33% in 2004).<br />

• The trends noted above are not replicated in the Donegall Road area<br />

where property prices are static. There is a large number of properties for<br />

sale in this area, many of which have been on the market for several<br />

years. The estate agents reported that there is no confidence in the area<br />

and that left to market forces it would continue to deteriorate (as noted<br />

above, the <strong>Housing</strong> Executive is currently undertaking an Urban Renewal<br />

Assessment of over 1200 properties in the Donegall/Ebor area of the<br />

Village, in consultation with the local community, to determine the future of<br />

its housing stock).<br />

• The apartment market in <strong>South</strong> <strong>Belfast</strong> has been stagnant for the past<br />

several years, although there is evidence of an upturn in prices as the<br />

number of new build developments decreases. High turnkey specifications<br />

and financial inducements had been masking falling prices. All agents<br />

reported an oversupply of overpriced apartments throughout <strong>South</strong> <strong>Belfast</strong><br />

(and the City Centre) and it is assessed that prices fail to appreciate at the<br />

same rate as other property types.<br />

• Co-Ownership has had a very limited impact in <strong>South</strong> <strong>Belfast</strong> as there are<br />

very few properties for sale within the value limits that apply. These limits<br />

were raised in April 2005 from £102k to £115k but will continue to have<br />

minimal impact as property prices continue to rise.<br />

Investors are targeting traditional property rather than apartments, and<br />

investors from the Republic of <strong>Ireland</strong> have all but disappeared from <strong>South</strong><br />

<strong>Belfast</strong> as the expected capital gains did not accrue and rental income is<br />

27

lower than expected. Large numbers of apartments are vacant,<br />

particularly in the larger complexes, and agents reported that many<br />

investor purchasers who bought prior to completion or at the top of the<br />

price cycle are now either sitting on empty properties or are trying to let<br />

them at £350-£400 per month. Many of these investors are prepared to<br />

hold onto their property rather than increasing the volume of resales which<br />

may further depress prices.<br />

A number of factors have had a significant impact on the apartment<br />

market. The demonstrations surrounding the Whitehall Square complex<br />

during 2004 had an effect not only within that complex but also in the wider<br />

area. In addition, the estate agents reported that growing scepticism over<br />

service charges of £1000 per year and car-parking spaces costing £15k in<br />

some apartment complexes has also done little to increase investor<br />

confidence.<br />

4.6 Private Rented Sector<br />

In most of <strong>Northern</strong> <strong>Ireland</strong> the private rented sector declined in importance<br />

throughout the last century as the combined effect of rent control, large scale<br />

redevelopment, particularly in <strong>Belfast</strong>, and the growth in owner-occupation<br />

dramatically affected tenure patterns. In 1990 there were fewer than 20,000<br />

privately rented dwellings in<br />

<strong>Northern</strong> <strong>Ireland</strong>, 3.5% of the<br />

total stock.<br />

The 1990s saw a recovery in<br />

the private rented sector<br />

throughout <strong>Northern</strong> <strong>Ireland</strong><br />

and since 1996 there has<br />

been year-on-year growth. In<br />

<strong>Belfast</strong>, for example, the level<br />

of privately rented housing<br />

rose from 8% in 1991 to 11%<br />

in 2001.<br />

Melrose Street<br />

<strong>South</strong> <strong>Belfast</strong> has traditionally<br />

had a large number of<br />

privately rented properties; in<br />

1990 25% of the total private<br />

rented stock in <strong>Northern</strong><br />

<strong>Ireland</strong> was located in <strong>South</strong><br />

<strong>Belfast</strong>. The popularity of<br />

private renting in this area<br />

has continued and the recent<br />

province-wide rate of growth<br />

28

in the sector has been more pronounced in <strong>South</strong> <strong>Belfast</strong>, with private rented<br />

properties accounting for almost 22% of stock in 2001, up from 17% in 1991.<br />

Anecdotal evidence from estate agents and preliminary results from the 2004<br />

House Condition Survey suggest that the rate of expansion in <strong>South</strong> <strong>Belfast</strong><br />

has accelerated rapidly in the last three years. The number of private tenants<br />

claiming housing benefit in <strong>South</strong> <strong>Belfast</strong> has risen by 9% since 2001 which<br />

also suggests that the sector is continuing to expand.<br />

In particular the area around Queens University and the City Hospital has<br />

historically had a significant concentration of privately rented properties. The<br />

private rented sector is now the dominant tenure in both Botanic (53%) and<br />

Windsor (46%) wards, together accounting for almost 60% of the <strong>South</strong><br />

<strong>Belfast</strong> total for this sector. Both wards have increased their proportion of<br />

privately rented property at the expense of owner-occupied stock. There is<br />

increasing evidence that this trend will continue as demand for property in<br />

these areas pushes prices up to a level where vendors can purchase larger<br />

property outside the area for similar prices or less in some instances.<br />

Map 3 Distribution of Privately Rented Property in <strong>Study</strong> Area<br />

Private sector market perspective. The views of the estate agents surveyed<br />

on the private rented sector are summarised below:<br />

• The rental market in <strong>South</strong> <strong>Belfast</strong> is dominated by landlords with two to<br />

three properties, mostly from outside the BMA, although there is evidence<br />

that large players are becoming increasingly active in building up<br />

significant property portfolios.<br />

29

• Poor Stock Market performance and low investment returns since<br />

2001/2002 have made investment in property a safer option for many<br />

people. This is particularly relevant in <strong>South</strong> <strong>Belfast</strong> where there is a large<br />

pool of people willing to rent privately.<br />

• The extent of private renting may be understated as there is evidence of<br />

parents buying property for sons or daughters attending university who in<br />

turn let a room to friends. 2<br />

• Estate Agents reported that market forces are driving prices of terrace<br />

property up and are also the most important factor in determining rental<br />

levels. Increasing numbers of properties becoming available for private<br />

letting allows people choice, the better maintained properties attract a<br />

premium and are easier to let.<br />

• Private letting of apartments is not as buoyant as in terrace property, and<br />

most agents have a large number of apartments for sale or rent. There is<br />

evidence that many investors who purchased apartments are prepared to<br />

keep them vacant in the hope of an upturn in prices, there is little incentive<br />

letting the property as rent levels are low.<br />

• The rental market in the Donegall Road has virtually collapsed in the past<br />

two years in the wake of incidences of intimidation. All agents reported<br />

that it was virtually impossible to rent property to people from outside the<br />

area itself.<br />

• Some estate agents offer an all in service whereby they will buy, furnish<br />

and let a property for landlords at arms length, guaranteeing income and<br />

property management. This is becoming an increasingly important aspect<br />

of the market for terrace property, particularly for investors from outside<br />

the <strong>Belfast</strong> Metropolitan Area.<br />

2<br />

As students do not qualify for <strong>Housing</strong> Benefit there are no formal records by<br />

which to check this.<br />

30

Houses in Multiple Occupation (HMOs). Houses in Multiple Occupation i.e.<br />

houses occupied by persons who do not form a single household, are an<br />

important element of the private rented sector. The most recent figures<br />

suggest that<br />

there are more<br />

than 10,000<br />

HMOs in<br />

<strong>Northern</strong><br />

<strong>Ireland</strong>, half of<br />

which are in<br />

<strong>South</strong> <strong>Belfast</strong><br />

alone.<br />

Purpose Built H.M.O.<br />

table shows the location of HMOs throughout the study area.<br />

The following<br />

Ward HMO Properties HMO Grants<br />

Ballynafeigh 685 35<br />

Blackstaff 159 10<br />

Botanic 1,715 588<br />

Finaghy 14 0<br />

Malone 104 3<br />

Musgrave 10 2<br />

Rosetta 96 3<br />

Shaftesbury 212 9<br />

Stranmillis 437 42<br />

Upper Malone 8 0<br />

Windsor 1,366 184<br />

Total 4,806 876<br />

Table 11 Distribution of HMOs in <strong>Study</strong> Area (NIHE)<br />

In May 2004 the <strong>Housing</strong> Executive introduced a statutory registration scheme<br />

for HMOs designed to target properties deemed to represent the greatest risk<br />

to occupants. An area-based approach is being taken in order to make best<br />

use of limited resources; five areas have been selected and two of these,<br />

Fitzroy and Eglantine, are within the study area.<br />

31

All HMO<br />

properties in<br />

these areas<br />

will be<br />

registered with<br />

the <strong>Housing</strong><br />

Executive and<br />

brought up to<br />

standard with<br />

the assistance<br />

of grant aid.<br />

Outside these<br />

areas only<br />

properties<br />

capable of<br />

occupation by<br />

Holyland HMO’s<br />

more than ten<br />

people will<br />

require registration and qualify for grant aid. The <strong>Housing</strong> Executive will<br />

continue to specify properties for registration in a rolling programme over the<br />

coming years.<br />

Registration places a duty on the property owner or manager to prevent either<br />

the existence of the house or the behaviour of its residents from adversely<br />

affecting the amenity or character of the area in which the house is situated.<br />

These provisions have proved unpopular with landlords and a judicial review<br />

of this aspect of the scheme is currently underway.<br />

In November 2004, following concern about the proliferation of HMOs in<br />

certain areas and the alleged incidence of associated anti-social behaviour,<br />

the Planning Use Classes Order (NI) was amended so that anyone proposing<br />

to change the use of a house occupied by a single person or family to a HMO<br />

needs to obtain planning permission. Calls from <strong>Belfast</strong> City Council for a<br />

moratorium on development of existing HMOs in the Holyland area were<br />

rejected by Planning Service which stated that it was legally bound to process<br />

applications to their conclusion.<br />

An inter-agency group comprising representatives from Planning Service,<br />

<strong>Belfast</strong> City Council, <strong>Housing</strong> Executive, PSNI and the city’s two universities<br />

has been established to examine the problems associated with high<br />

concentrations of HMOs in certain areas and make recommendations for the<br />

future management of these areas.<br />

The outworking of the amendment still has to be determined but it is unlikely<br />

to prevent the spread of HMOs as market forces will drive the supply chain<br />

operating outside the legislation. BMAP did not specify a maximum number<br />

or percentage of HMO properties permitted in an individual area, thus making<br />

enforcement more uncertain in the short/medium term.<br />

32

Private Rented Sector Strategy. The rapid growth and strategic importance of<br />

the private rented sector led the <strong>Housing</strong> Executive and the Department for<br />

Social Development to produce a strategy to promote the sector and improve<br />

the quality of accommodation and its management. The strategy, “Renting<br />

Privately: A Strategic Framework”, was published in May 2004. The strategy<br />

has 6 core objectives, these are:-<br />

• To create a legislative structure for the sector which addresses<br />

inequities and targets unfitness through repair enforcement and rent<br />

control.<br />

• To clarify and promote the rights and responsibilities of private rented<br />

sector landlords and tenants.<br />

• To improve housing conditions in the private rented sector.<br />

• To facilitate housing choice, by promoting the private rented sector as<br />

a viable and affordable housing option.<br />

• To influence the levels of supply of accommodation available for<br />

private renting.<br />

• To promote high standards of management within the private rented<br />

sector.<br />

The <strong>Housing</strong> Executive has commissioned a major research project on the<br />

private rented sector to be undertaken by the University of Ulster which will<br />

examine the housing choices exercised by those living in the sector and their<br />

longer term intentions.<br />

Underpinning this research is a realisation that its popularity is related to ease<br />

of access with no lengthy list in areas of high demand, and also its desirable<br />

location and proximity to centres of education, employment and<br />

entertainment, factors which are particularly relevant in <strong>South</strong> <strong>Belfast</strong>. The<br />

research is due to be completed in late 2005 and will be published separately<br />

by the <strong>Housing</strong> Executive.<br />

33

Key <strong>Housing</strong> Issues<br />

• Affordability<br />

The <strong>Housing</strong> Executive continues to monitor affordability throughout <strong>Northern</strong><br />

<strong>Ireland</strong>. A model on affordability has been developed which uses a typical<br />

Building Society annuity formula to calculate the maximum price a household<br />

with a median household income can afford to pay over a 25 year repayment<br />

period.<br />

Continued double digit house price inflation has resulted in affordability gaps<br />

across <strong>Northern</strong> <strong>Ireland</strong>. In <strong>South</strong> <strong>Belfast</strong>, traditionally the least affordable<br />

area of <strong>Belfast</strong>, the affordability gap has increased year on year to such an<br />

extent that only 4% of dwellings were affordable to a household with a median<br />

income in 2004.<br />

Co-ownership has had little impact on <strong>South</strong> <strong>Belfast</strong> as the price limits are too<br />

low for the vast majority of properties on the market. First time buyers have<br />

been excluded from most <strong>South</strong> <strong>Belfast</strong> markets, accounting for less than<br />

10% of total transactions according to estate agents.<br />

• Growth of private rented sector<br />

The growth of the private rented sector in <strong>South</strong> <strong>Belfast</strong> can be attributed to a<br />

number of factors, most notably market forces. More property is made<br />

available for private renting as the pool of people wishing to live there<br />

expands. There is relatively easy access into the privately rented market, with<br />

the more desirable locations and facilities in many of the properties dictating<br />

rental levels. Demand for properties, particularly terrace property in the<br />

University and Lisburn Road areas has pushed prices to unprecedented<br />

levels, making then inaccessible for many potential owner occupiers.<br />

There is evidence that the spread of private rental is spreading outward from<br />

the University with Ballynafeigh now experiencing rapid growth. This area<br />

which had traditionally been popular with first time buyers, but who are now<br />

finding prices here beyond their budget. Poor stock market performance since<br />

2001 has made this market popular with investors who in addition to obtaining<br />

decent rental levels are also benefiting from annual double digit capital<br />

appreciation. Private rental is now the dominant tenure in Botanic and<br />

Windsor wards and Stranmillis and Ballynafeigh are also undergoing major<br />

tenure change from owner occupation to private rental.<br />

• Spread of HMOs<br />

Houses in Multiple Occupation (HMOs) are an important element of the<br />

private rented sector. The most recent figures suggest that there are more<br />

than 10,000 HMOs in <strong>Northern</strong> <strong>Ireland</strong>, with approximately half of these in<br />

<strong>South</strong> <strong>Belfast</strong>. In November 2004, following concern over the proliferation of<br />

34

HMOs in certain areas, legislation was introduced requiring landlords wishing<br />

to convert a family dwelling to a HMO to seek planning approval. In many<br />

areas of <strong>South</strong> <strong>Belfast</strong>, particularly around Queen’s University the majority of<br />

properties are HMOs and the legislation will have little effect. BMAP is<br />

examining the possibility of introducing a ceiling on the number of HMOs in a<br />

given area and has recently published a Consultation Document.<br />

The <strong>Housing</strong> Executive will continue to raise standards in HMOs through a<br />

combination of inspection, grant aid and enforcement.<br />

• Donegall Road<br />

The <strong>Housing</strong> Executive has hitherto been unable to obtain agreement on how<br />

to determine the future housing requirements of a large part of the Donegall<br />

Road, the Village area. A large scale Urban Renewal Assessment has been<br />

completed and is currently being consulted upon within the area. It is hoped to<br />

obtain agreement on a way forward for the area. The private market in this<br />

area is stagnant with many properties vacant or for sale. House prices are the<br />

lowest throughout <strong>South</strong> <strong>Belfast</strong>.<br />

• Oversupply of apartments<br />

There is recent evidence that the apartment market in <strong>South</strong> <strong>Belfast</strong> is picking<br />

up following several years of stagnation which saw high turnkey specifications<br />

masking falling prices. There was an oversupply of apartments coming onto<br />

the market, decreasing overall confidence and keeping prices down. Investors<br />

are still more prepared to purchase traditional terrace property as there have<br />

been better returns both in rental and capital values. Large scale apartment<br />

complexes have proved less popular and there is widespread concern about<br />

service charges and car parking costs.<br />

• Land Supply<br />

The continued popularity of <strong>South</strong> <strong>Belfast</strong> as a residential location and lack of<br />

development land in most areas means that there is limited potential to<br />

increase the overall housing stock. Competition from the private sector for the<br />

best sites is acute and has had an obvious effect on prices. In addition<br />

<strong>Housing</strong> Associations are having difficulty in obtaining sites, thus increasing<br />

pressure on waiting lists. Clanmil <strong>Housing</strong> Association’s acquisition of the<br />

North Sports Ground has been a notable exception.<br />

The oversupply of new apartments, apparent for several years, has slowed<br />

down as developers move toward more traditional house types in response to<br />

market demands. The dramatic increase in house prices in <strong>South</strong> <strong>Belfast</strong> in<br />

the last year looks set to continue as demand for property, particularly in the<br />

middle and upper ends of the market, rises.<br />

35

• Declining social stock/rising demand<br />

The <strong>Housing</strong> Executive’s House Sales policy has been very effective in<br />

widening home ownership throughout <strong>Northern</strong> <strong>Ireland</strong>. In <strong>South</strong> <strong>Belfast</strong><br />

almost 2,500 former tenants have purchased their homes from the<br />

<strong>Housing</strong> Executive . In addition a number of former <strong>Housing</strong> Association<br />

tenants have purchased under the voluntary schemes operated by the<br />

Associations and the extension of the Right to Buy to most <strong>Housing</strong><br />

Association properties will result in more social dwellings being sold,<br />

further reducing the available lettable stock. Replacement of stock in areas<br />

of demand is difficult due to lack of suitable sites. One effect of this is an<br />

overall loss of housing choice in certain areas, leading to more people<br />

renting privately, for example the Lisburn Road Waiting List has 216<br />

applicants in housing stress, and only 10 relets per year.<br />

36

APPENDIX 1 <br />

<strong>Housing</strong> Market <br />

Profiles <br />

37

Appendix 1 <strong>Housing</strong> Market Profiles<br />

Donegall Pass, Sandy Row and Donegall Road <strong>Housing</strong> Market<br />

This area comprises the inner city housing areas of Donegall Pass, Sandy<br />