Problem Set 5, Jeremy Lise - UCL

Problem Set 5, Jeremy Lise - UCL

Problem Set 5, Jeremy Lise - UCL

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

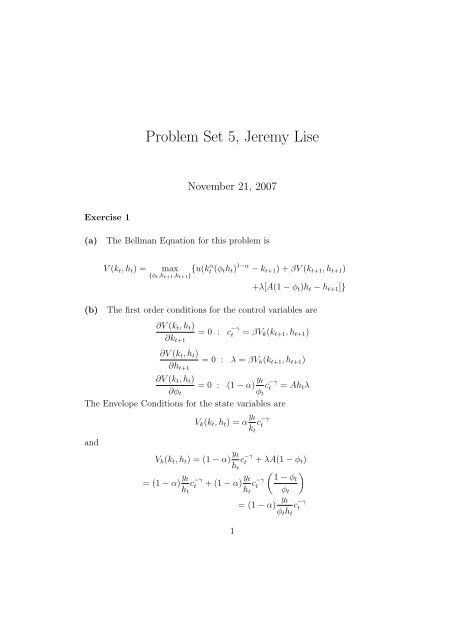

<strong>Problem</strong> <strong>Set</strong> 5, <strong>Jeremy</strong> <strong>Lise</strong><br />

November 21, 2007<br />

Exercise 1<br />

(a)<br />

The Bellman Equation for this problem is<br />

(b)<br />

V (k t , h t ) =<br />

max<br />

{φ t,h t+1 ,k t+1 } {u(kα t (φ t h t ) 1−α − k t+1 ) + βV (k t+1 , h t+1 )<br />

+λ[A(1 − φ t )h t − h t+1 ]}<br />

The first order conditions for the control variables are<br />

∂V (k t , h t )<br />

∂k t+1<br />

= 0 : c −γ<br />

t = βV k (k t+1 , h t+1 )<br />

∂V (k t , h t )<br />

= 0 : λ = βV h (k t+1 , h t+1 )<br />

∂h t+1<br />

∂V (k t , h t )<br />

= 0 : (1 − α) y t<br />

c −γ<br />

t = Ah t λ<br />

∂φ t φ t<br />

The Envelope Conditions for the state variables are<br />

and<br />

V k (k t , h t ) = α y t<br />

c −γ<br />

t<br />

k t<br />

V h (k t , h t ) = (1 − α) y t<br />

c −γ<br />

t + λA(1 − φ t )<br />

h t<br />

= (1 − α) y t<br />

c −γ<br />

t + (1 − α) y ( )<br />

t 1 −<br />

c −γ φt<br />

t<br />

h t h t φ t<br />

1<br />

= (1 − α) y t<br />

c −γ<br />

t<br />

φ t h t

Use the Envelope Condition for k t in the first order condition for consumption<br />

to get the standard consumption Euler Equation<br />

( )<br />

c −γ yt+1<br />

t = αβ c −γ<br />

t+1 (1)<br />

k t+1<br />

Combine the first order conditions for φ t and h t+1 and use the Envelope<br />

Condition for h t to get the Euler Equation for human capital<br />

y t+1<br />

(1 − α) y t<br />

c −γ<br />

t = Ah t β(1 − α) c −γ<br />

φ t φ t+1 h t+1<br />

c −γ<br />

t<br />

= Aβ<br />

(<br />

yt+1<br />

y t<br />

t+1<br />

) (<br />

φt<br />

φ t+1<br />

) (<br />

ht<br />

h t+1<br />

)<br />

c −γ<br />

t+1 (2)<br />

(c) Along a balanced growth path (BGP) human capital h t grows at a<br />

constant rate g h . From the production function for human capital we have<br />

1 + g h = A(1 − φ t )<br />

But as the left hand side of the equation is constant, so is the right hand<br />

side. It follows that along a BGP, φ t = φ is constant.<br />

(d) First consider equation (1)<br />

( ) γ ct+1<br />

= (1 + g c ) γ = αβ<br />

c t<br />

(<br />

yt+1<br />

k t+1<br />

)<br />

For g c to be constant along a BGP, the ratio y t+1 /k t+1 has to be constant.<br />

But this implies g y = g k .<br />

Now divide the resource constraint by k t<br />

c t<br />

k t<br />

= y t<br />

k t<br />

− k t+1<br />

k t<br />

= y t<br />

k t<br />

− (1 + g k )<br />

Along a BGP the right hand side has to be constant, so the ratio c t /k t has<br />

to be constant, i.e. g c = g k .<br />

Finally, divide the consumption goods production function by k t<br />

( ) α ( ) 1−α ( ) 1−α<br />

y t kt<br />

= φ 1−α ht<br />

= φ 1−α ht<br />

k t k t k t k t<br />

2

As g y = g k , it follows from this equation that g h = g k .<br />

This establishes that g h = g k = g h = g.<br />

In a last step we will solve for g. Take (2) along the BGP<br />

( ) ( )<br />

φ 1<br />

(1 + g) γ = Aβ(1 + g)<br />

= Aβ<br />

φ 1 + g<br />

It follows that<br />

Exercise 3<br />

g = (Aβ) 1/γ − 1<br />

(a) As only households can hold bonds, in equilibrium aggregate bonds<br />

need to be zero, i.e. households’ demand for bonds has to be equal to households’<br />

supply of bonds. However given that all households are the same and<br />

they all face the same aggregate shock, at given prices they all either want to<br />

sell bonds or buy bonds. So in equilibrium (!) for the bond market to clear,<br />

individual bond holdings have to be zero ( B t = 0 ) in ever period. But this<br />

implies that the transversality condition for bonds holds trivially.<br />

(a) Let’s solve the household problem first. The households will chose<br />

current and future consumption and labor supply in order to maximize its<br />

intertemporal utility function subject to its budget constraint, taking prices<br />

as given.<br />

The Bellman equation for the households problem is<br />

[ c<br />

1−θ<br />

]<br />

t<br />

V (B t ) = max<br />

C t,L t 1 − θ − φ L1+η t<br />

1 + η + e−ρ V (W t L t + R t−1 B t−1 − C t )<br />

The first order conditions are<br />

and by the Envelope Condition<br />

C −θ<br />

t = e −ρ V ′ (B t )<br />

φL η t = W t e −ρ V ′ (B t )<br />

V ′ (B t−1 ) = R t−1 e −ρ V ′ (B t ) = R t−1 C −θ<br />

t<br />

3

where I have used the first order condition for consumption.<br />

Combining these three equation we get a labor supply equation for the household<br />

φL η t = W t Ct −θ<br />

(3)<br />

and a consumption Euler Equation<br />

C −θ<br />

t<br />

Together with the household’s budget constraint<br />

= e −ρ R t C −θ<br />

t+1 (4)<br />

W t L t + R t−1 B t−1 = C t + B t (5)<br />

these two equations describe optimal household behavior at given prices.<br />

Now let’s turn to the firm. The firm will maximize profits taking prices<br />

as given. The firm’s profit function is<br />

Π t = e zt N t − W t N t = (e zt − W t )N t<br />

For a given W t the firm’s labor demand is as follows<br />

N t = ∞ for W t < e zt<br />

N t = [0, ∞) for W t = e zt<br />

N t = 0 for W t > e zt<br />

In equilibrium households and the firm will behave optimally given prices,<br />

and all markets clear. We have three markets, the consumption goods market,<br />

the bond market, and the labour market. By Walras’ Law we can ignore<br />

one market clearing condition. Let’s take the consumption goods market.<br />

As seen in (a), bond market clearing requires<br />

Labor market clearing requires<br />

B t = 0 (6)<br />

N t = HL t (7)<br />

But from the firm’s labor demand curve we can see that this immediately<br />

implies<br />

W t = e zt . (8)<br />

Equations (3) to (8) characterize the competitive equilibrium of this economy.<br />

4

(c) Now assume z t = 0 and derive the steady states for W, Y, C, N and R.<br />

First, from (8) we have<br />

W = 1<br />

Using this and B t = 0 we get from (5) that<br />

L = C<br />

Now by (3)<br />

φL η = L −θ ⇒ L =<br />

( 1<br />

φ) 1<br />

η+θ<br />

But this together with the labor market clearing condition (7) gives us steady<br />

state output<br />

( 1<br />

1<br />

η+θ<br />

Y = H<br />

φ)<br />

Finally from the consumption Euler Equation (4) we have<br />

R = e ρ<br />

(d) Now let’s log-linearize equations (3) to (8).<br />

Equation (3) is<br />

φ(e lt L) η = e wt W (e ct C) −θ = φL η e ηlt = W C −θ e wt−θct<br />

Using the steady state definition and taking logs on both sides we get<br />

Equation (4):<br />

l t = 1 η (w t − θc t ) (9)<br />

(e ct C) −θ = e −ρ e rt R(e c t+1<br />

C) −θ<br />

Again using the steady state of R we get<br />

c t+1 − c t = 1 θ (r t − ρ) (10)<br />

Equation (5): Use the equilibrium condition B t = 0. Then<br />

e wt W e lt L = e ct C<br />

5

Equation (7):<br />

Equation (8):<br />

Finally output is<br />

c t = w t + l t<br />

e nt N = He lt L<br />

n t = l t (11)<br />

e wt W = e zt<br />

w t = z t (12)<br />

e y t Y = e zt Ne nt<br />

y t = z t + n t (13)<br />

(e)<br />

Using the budget constraint and w t = z t we have<br />

c t = z t + l t<br />

Now plug this into the labor supply equation<br />

ηl t = z t − θ(z t + l t )<br />

It follows that labor is<br />

l t =<br />

( ) 1 − θ<br />

z t (14)<br />

θ + η<br />

Now use the budget constraint again to get c t<br />

( ) 1 + η<br />

c t = z t (15)<br />

θ + η<br />

Output in this model has to be equal to consumption as there is no investment<br />

( ) 1 + η<br />

y t = z t (16)<br />

θ + η<br />

Finally the interest rate is<br />

[ ] θ(1 + η)<br />

r t = ρ + θ(c t+1 − c t ) = ρ +<br />

(z t+1 − z t )<br />

θ + η<br />

6

where<br />

[ ] θ(1 + η)<br />

r t = ρ +<br />

e t+1 −<br />

θ + η<br />

z t+1 = αz t + e t+1<br />

1<br />

[ θ(1 + η)(1 − α)<br />

θ + η<br />

]<br />

z t (17)<br />

To derive the variances, note that Var(z t ) = σ 2 /(1 − α 2 ). So<br />

Var(w t ) =<br />

σ2<br />

1 − α 2<br />

( ) 2 1 − θ σ 2<br />

Var(l t ) =<br />

θ + η 1 − α 2<br />

( ) 2 1 + η σ 2<br />

Var(c t ) = Var(y t ) =<br />

θ + η 1 − α 2<br />

{ [θ(1 ] 2 [ ] 2 ( ) } + η) θ(1 + η)(1 − α) 1<br />

Var(r t ) =<br />

+<br />

σ 2<br />

θ + η<br />

θ + η 1 − α 2<br />

(f) Real wage are procyclical in the model whereas they a acyclical in the<br />

data.<br />

Hours worked and productivity ( here z t ) are positively correlated in the<br />

model, but are uncorrelated or slightly negatively correlated in the data.<br />

Hours worked fluctuate less than output and consumption in the model (<br />

−θ < η ), but are as volatile as output in the data, and more volatile than<br />

consumption.<br />

Output is as volatile as consumption in the model, but is more volatile than<br />

consumption in the data.<br />

1 I have changed notation here so as not to confound the persistence of the shock with<br />

the time discount factor.<br />

7