october/november 2001 - Australian Automotive Aftermarket Magazine

october/november 2001 - Australian Automotive Aftermarket Magazine

october/november 2001 - Australian Automotive Aftermarket Magazine

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

EXCLUSIVE<br />

From Repco<br />

to PacAuto<br />

and now APG<br />

New<br />

Top<br />

Player<br />

After months of speculation, the newly<br />

formed <strong>Automotive</strong> Parts Group has<br />

become the owner of the previous Pacific<br />

<strong>Automotive</strong> business which was sold by Pacific<br />

Dunlop for $251m.<br />

The new company is now the owner of<br />

Repco Australia and New Zealand,<br />

Motospecs, Appco, Ashdown, Carparts and<br />

the Distribution Centres.<br />

The <strong>Automotive</strong> Parts Group (APG) is<br />

owned by a consortium which includes<br />

Gresham Private Equity, GS Private Equity<br />

and Macquarie Direct Investment. The majority<br />

of the equity is split between those<br />

investors with an additional equity being held<br />

by the existing management team. The directors<br />

are: Peter Mummery (Managing<br />

Director), Michael Brown (Non-Executive<br />

Chairman), Paul Evans (Gresham), Greg<br />

Minton (GS), Robert Backwell (Macquarie)<br />

and another from the current APG management<br />

team (t.b.a.).<br />

The APG management team is Peter<br />

Mummery (MD), Peter Cooper (Chief<br />

Financial Officer), Gary West (GM, Strategy &<br />

Business Development), Catherine Saunders<br />

(GM Human Resources), Bob Wyeth (GM<br />

Merchandise & Marketing), Jeff Taylor (GM,<br />

Repco NZ), Brendan Redmond (GM, Repco<br />

Australia), Les Healey (GM, Ashdown),<br />

Trevor Garrard (GM, Motospecs), Neil<br />

McBain (GM, Carparts), Mike Bergin (GM,<br />

Distribution & Logistics) and Rod McKenzie<br />

(GM, Property).<br />

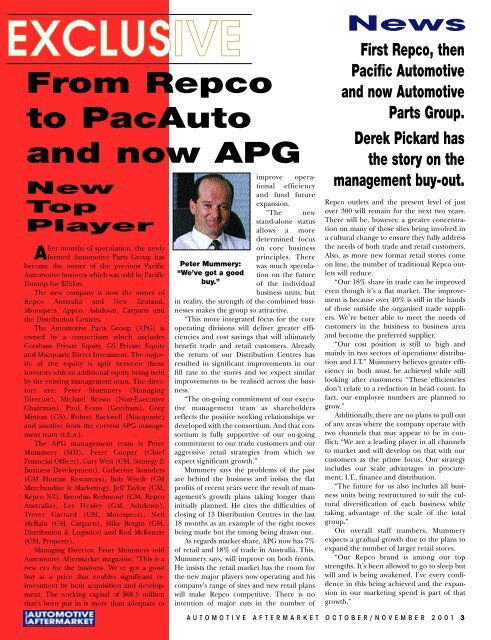

Managing Director, Peter Mummery told<br />

<strong>Automotive</strong> <strong>Aftermarket</strong> magazine: “This is a<br />

new era for the business. We’ve got a good<br />

buy at a price that enables significant reinvestment<br />

by both acquisition and development.<br />

The working capital of $68.5 million<br />

that’s been put in is more than adequate to<br />

Peter Mummery:<br />

“We’ve got a good<br />

buy.”<br />

improve operational<br />

efficiency<br />

and fund future<br />

expansion.<br />

“The new<br />

stand-alone status<br />

allows a more<br />

determined focus<br />

on core business<br />

principles. There<br />

was much speculation<br />

on the future<br />

of the individual<br />

business units, but<br />

in reality, the strength of the combined businesses<br />

makes the group so attractive.<br />

“This more integrated focus for the core<br />

operating divisions will deliver greater efficiencies<br />

and cost savings that will ultimately<br />

benefit trade and retail customers. Already<br />

the return of our Distribution Centres has<br />

resulted in significant improvements in our<br />

fill rate to the stores and we expect similar<br />

improvements to be realised across the business.<br />

“The on-going commitment of our executive<br />

management team as shareholders<br />

reflects the positive working relationships we<br />

developed with the consortium. And that consortium<br />

is fully supportive of our on-going<br />

commitment to our trade customers and our<br />

aggressive retail strategies from which we<br />

expect significant growth.”<br />

Mummery says the problems of the past<br />

are behind the business and insists the flat<br />

profits of recent years were the result of management’s<br />

growth plans taking longer than<br />

initially planned. He cites the difficulties of<br />

closing of 13 Distribution Centres in the last<br />

18 months as an example of the right moves<br />

being made but the timing being drawn out.<br />

As regards market share, APG now has 7%<br />

of retail and 18% of trade in Australia. This,<br />

Mummery says, will improve on both fronts.<br />

He insists the retail market has the room for<br />

the new major players now operating and his<br />

company’s range of sites and new retail plans<br />

will make Repco competitive. There is no<br />

intention of major cuts in the number of<br />

News<br />

First Repco, then<br />

Pacific <strong>Automotive</strong><br />

and now <strong>Automotive</strong><br />

Parts Group.<br />

Derek Pickard has<br />

the story on the<br />

management buy-out.<br />

Repco outlets and the present level of just<br />

over 300 will remain for the next two years.<br />

There will be, however, a greater concentration<br />

on many of those sites being involved in<br />

a cultural change to ensure they fully address<br />

the needs of both trade and retail customers.<br />

Also, as more new format retail stores come<br />

on line, the number of traditional Repco outlets<br />

will reduce.<br />

“Our 18% share in trade can be improved<br />

even though it’s a flat market. The improvement<br />

is because over 40% is still in the hands<br />

of those outside the organised trade suppliers.<br />

We’re better able to meet the needs of<br />

customers in the business to business area<br />

and become the preferred supplier.<br />

“Our cost position is still to high and<br />

mainly in two sectors of operations: distribution<br />

and I.T.” Mummery believes greater efficiency<br />

in both must be achieved while still<br />

looking after customers: “These efficiencies<br />

don’t relate to a reduction in head count. In<br />

fact, our employee numbers are planned to<br />

grow.”<br />

Additionally, there are no plans to pull out<br />

of any areas where the company operate with<br />

two channels that may appear to be in conflict:<br />

“We are a leading player in all channels<br />

to market and will develop on that with our<br />

customers as the prime focus. Our strategy<br />

includes our scale advantages in procurement,<br />

I.T., finance and distribution.<br />

“The future for us also includes all business<br />

units being restructured to suit the cultural<br />

diversification of each business while<br />

taking advantage of the scale of the total<br />

group.”<br />

On overall staff numbers, Mummery<br />

expects a gradual growth due to the plans to<br />

expand the number of larger retail stores.<br />

“Our Repco brand is among our top<br />

strengths. It’s been allowed to go to sleep but<br />

will and is being awakened. I’ve every confidence<br />

in this being achieved and the expansion<br />

in our marketing spend is part of that<br />

growth.”<br />

AUTOMOTIVE AFTERMARKET OCTOBER/NOVEMBER <strong>2001</strong> 3