Spotlight on Student Loan ABS Issuers - Institute for Higher ...

Spotlight on Student Loan ABS Issuers - Institute for Higher ...

Spotlight on Student Loan ABS Issuers - Institute for Higher ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

BARCAP_RESEARCH_TAG_FONDMI2NBUR7SWED<br />

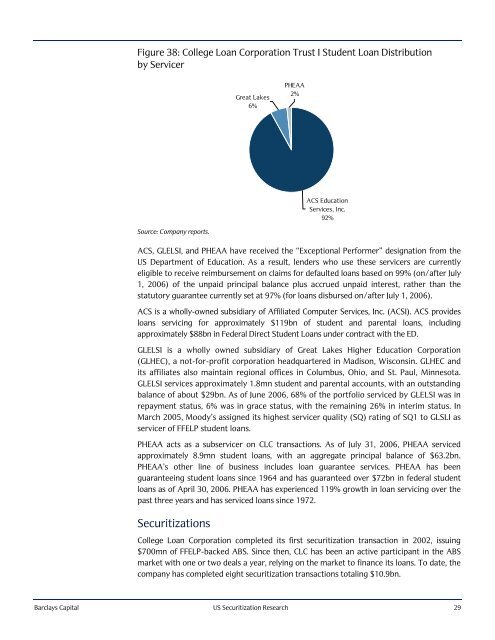

Figure 38: College <strong>Loan</strong> Corporati<strong>on</strong> Trust I <strong>Student</strong> <strong>Loan</strong> Distributi<strong>on</strong><br />

by Servicer<br />

Great Lakes<br />

6%<br />

PHEAA<br />

2%<br />

ACS Educati<strong>on</strong><br />

Services, Inc.<br />

92%<br />

Source: Company reports.<br />

ACS, GLELSI, and PHEAA have received the “Excepti<strong>on</strong>al Per<strong>for</strong>mer” designati<strong>on</strong> from the<br />

US Department of Educati<strong>on</strong>. As a result, lenders who use these servicers are currently<br />

eligible to receive reimbursement <strong>on</strong> claims <strong>for</strong> defaulted loans based <strong>on</strong> 99% (<strong>on</strong>/after July<br />

1, 2006) of the unpaid principal balance plus accrued unpaid interest, rather than the<br />

statutory guarantee currently set at 97% (<strong>for</strong> loans disbursed <strong>on</strong>/after July 1, 2006).<br />

ACS is a wholly-owned subsidiary of Affiliated Computer Services, Inc. (ACSI). ACS provides<br />

loans servicing <strong>for</strong> approximately $119bn of student and parental loans, including<br />

approximately $88bn in Federal Direct <strong>Student</strong> <strong>Loan</strong>s under c<strong>on</strong>tract with the ED.<br />

GLELSI is a wholly owned subsidiary of Great Lakes <strong>Higher</strong> Educati<strong>on</strong> Corporati<strong>on</strong><br />

(GLHEC), a not-<strong>for</strong>-profit corporati<strong>on</strong> headquartered in Madis<strong>on</strong>, Wisc<strong>on</strong>sin. GLHEC and<br />

its affiliates also maintain regi<strong>on</strong>al offices in Columbus, Ohio, and St. Paul, Minnesota.<br />

GLELSI services approximately 1.8mn student and parental accounts, with an outstanding<br />

balance of about $29bn. As of June 2006, 68% of the portfolio serviced by GLELSI was in<br />

repayment status, 6% was in grace status, with the remaining 26% in interim status. In<br />

March 2005, Moody’s assigned its highest servicer quality (SQ) rating of SQ1 to GLSLI as<br />

servicer of FFELP student loans.<br />

PHEAA acts as a subservicer <strong>on</strong> CLC transacti<strong>on</strong>s. As of July 31, 2006, PHEAA serviced<br />

approximately 8.9mn student loans, with an aggregate principal balance of $63.2bn.<br />

PHEAA’s other line of business includes loan guarantee services. PHEAA has been<br />

guaranteeing student loans since 1964 and has guaranteed over $72bn in federal student<br />

loans as of April 30, 2006. PHEAA has experienced 119% growth in loan servicing over the<br />

past three years and has serviced loans since 1972.<br />

Securitizati<strong>on</strong>s<br />

College <strong>Loan</strong> Corporati<strong>on</strong> completed its first securitizati<strong>on</strong> transacti<strong>on</strong> in 2002, issuing<br />

$700mn of FFELP-backed <strong>ABS</strong>. Since then, CLC has been an active participant in the <strong>ABS</strong><br />

market with <strong>on</strong>e or two deals a year, relying <strong>on</strong> the market to finance its loans. To date, the<br />

company has completed eight securitizati<strong>on</strong> transacti<strong>on</strong>s totaling $10.9bn.<br />

Barclays Capital US Securitizati<strong>on</strong> Research 29