Spotlight on Student Loan ABS Issuers - Institute for Higher ...

Spotlight on Student Loan ABS Issuers - Institute for Higher ...

Spotlight on Student Loan ABS Issuers - Institute for Higher ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

BARCAP_RESEARCH_TAG_FONDMI2NBUR7SWED<br />

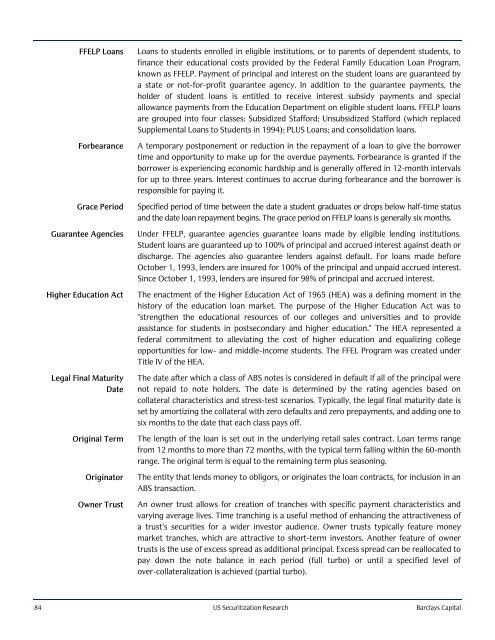

FFELP <strong>Loan</strong>s<br />

Forbearance<br />

Grace Period<br />

Guarantee Agencies<br />

<strong>Higher</strong> Educati<strong>on</strong> Act<br />

Legal Final Maturity<br />

Date<br />

Original Term<br />

Originator<br />

Owner Trust<br />

<strong>Loan</strong>s to students enrolled in eligible instituti<strong>on</strong>s, or to parents of dependent students, to<br />

finance their educati<strong>on</strong>al costs provided by the Federal Family Educati<strong>on</strong> <strong>Loan</strong> Program,<br />

known as FFELP. Payment of principal and interest <strong>on</strong> the student loans are guaranteed by<br />

a state or not-<strong>for</strong>-profit guarantee agency. In additi<strong>on</strong> to the guarantee payments, the<br />

holder of student loans is entitled to receive interest subsidy payments and special<br />

allowance payments from the Educati<strong>on</strong> Department <strong>on</strong> eligible student loans. FFELP loans<br />

are grouped into four classes: Subsidized Staf<strong>for</strong>d; Unsubsidized Staf<strong>for</strong>d (which replaced<br />

Supplemental <strong>Loan</strong>s to <strong>Student</strong>s in 1994); PLUS <strong>Loan</strong>s; and c<strong>on</strong>solidati<strong>on</strong> loans.<br />

A temporary postp<strong>on</strong>ement or reducti<strong>on</strong> in the repayment of a loan to give the borrower<br />

time and opportunity to make up <strong>for</strong> the overdue payments. Forbearance is granted if the<br />

borrower is experiencing ec<strong>on</strong>omic hardship and is generally offered in 12-m<strong>on</strong>th intervals<br />

<strong>for</strong> up to three years. Interest c<strong>on</strong>tinues to accrue during <strong>for</strong>bearance and the borrower is<br />

resp<strong>on</strong>sible <strong>for</strong> paying it.<br />

Specified period of time between the date a student graduates or drops below half-time status<br />

and the date loan repayment begins. The grace period <strong>on</strong> FFELP loans is generally six m<strong>on</strong>ths.<br />

Under FFELP, guarantee agencies guarantee loans made by eligible lending instituti<strong>on</strong>s.<br />

<strong>Student</strong> loans are guaranteed up to 100% of principal and accrued interest against death or<br />

discharge. The agencies also guarantee lenders against default. For loans made be<strong>for</strong>e<br />

October 1, 1993, lenders are insured <strong>for</strong> 100% of the principal and unpaid accrued interest.<br />

Since October 1, 1993, lenders are insured <strong>for</strong> 98% of principal and accrued interest.<br />

The enactment of the <strong>Higher</strong> Educati<strong>on</strong> Act of 1965 (HEA) was a defining moment in the<br />

history of the educati<strong>on</strong> loan market. The purpose of the <strong>Higher</strong> Educati<strong>on</strong> Act was to<br />

"strengthen the educati<strong>on</strong>al resources of our colleges and universities and to provide<br />

assistance <strong>for</strong> students in postsec<strong>on</strong>dary and higher educati<strong>on</strong>." The HEA represented a<br />

federal commitment to alleviating the cost of higher educati<strong>on</strong> and equalizing college<br />

opportunities <strong>for</strong> low- and middle-income students. The FFEL Program was created under<br />

Title IV of the HEA.<br />

The date after which a class of <strong>ABS</strong> notes is c<strong>on</strong>sidered in default if all of the principal were<br />

not repaid to note holders. The date is determined by the rating agencies based <strong>on</strong><br />

collateral characteristics and stress-test scenarios. Typically, the legal final maturity date is<br />

set by amortizing the collateral with zero defaults and zero prepayments, and adding <strong>on</strong>e to<br />

six m<strong>on</strong>ths to the date that each class pays off.<br />

The length of the loan is set out in the underlying retail sales c<strong>on</strong>tract. <strong>Loan</strong> terms range<br />

from 12 m<strong>on</strong>ths to more than 72 m<strong>on</strong>ths, with the typical term falling within the 60-m<strong>on</strong>th<br />

range. The original term is equal to the remaining term plus seas<strong>on</strong>ing.<br />

The entity that lends m<strong>on</strong>ey to obligors, or originates the loan c<strong>on</strong>tracts, <strong>for</strong> inclusi<strong>on</strong> in an<br />

<strong>ABS</strong> transacti<strong>on</strong>.<br />

An owner trust allows <strong>for</strong> creati<strong>on</strong> of tranches with specific payment characteristics and<br />

varying average lives. Time tranching is a useful method of enhancing the attractiveness of<br />

a trust’s securities <strong>for</strong> a wider investor audience. Owner trusts typically feature m<strong>on</strong>ey<br />

market tranches, which are attractive to short-term investors. Another feature of owner<br />

trusts is the use of excess spread as additi<strong>on</strong>al principal. Excess spread can be reallocated to<br />

pay down the note balance in each period (full turbo) or until a specified level of<br />

over-collateralizati<strong>on</strong> is achieved (partial turbo).<br />

84 US Securitizati<strong>on</strong> Research Barclays Capital