Specification Document Template - MyUI Employer

Specification Document Template - MyUI Employer

Specification Document Template - MyUI Employer

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>MyUI</strong> <strong>Employer</strong><br />

User Guide<br />

Version 2.1<br />

November 12, 2013<br />

Date: 11/12/2013 1/53

Table of Contents<br />

MYUI EMPLOYER .................................................................................................................................... 1<br />

TABLE OF CONTENTS ................................................................................................................................ 2<br />

1 REGISTER A NEW ACCOUNT ............................................................................................................... 5<br />

1.1 REGISTRATION INFORMATION ............................................................................................................. 5<br />

Instructions to register a new account: ............................................................................................. 5<br />

1.2 DELETED YOUR EMAIL? ..................................................................................................................... 9<br />

1.3 MISSING PIN ................................................................................................................................. 9<br />

2 LOGIN ......................................................................................................................................... 10<br />

2.1 LOGGING ON ................................................................................................................................ 10<br />

Login Instructions: ......................................................................................................................... 10<br />

2.2 FORGOT USERNAME ....................................................................................................................... 11<br />

Forgot Username Instructions: ........................................................................................................ 11<br />

2.3 FORGOT PASSWORD ....................................................................................................................... 12<br />

Forgot Password for Account Administrator Instructions: .................................................................. 12<br />

Forgot Password for Account Users-Instructions: ............................................................................. 13<br />

Forgotten both your Username and Password? ................................................................................ 13<br />

3 MANAGE ACCOUNT USERS ............................................................................................................... 14<br />

3.1 MANAGING ACCOUNT USERS ............................................................................................................ 14<br />

Instructions for authorizing User access: ......................................................................................... 14<br />

4 CHANGING ACCOUNT INFORMATION ................................................................................................. 16<br />

4.1 CHANGE EMAIL ADDRESS ................................................................................................................. 16<br />

Change Email Address Page Instructions: ........................................................................................ 16<br />

4.2 CHANGE SECURITY QUESTIONS & ANSWERS PAGE ................................................................................. 17<br />

Change Security Questions & Answers Instructions: ......................................................................... 17<br />

4.3 CHANGE PASSWORD ....................................................................................................................... 18<br />

Change Password Instructions Page: ............................................................................................... 18<br />

5 EMPLOYER ACCOUNT OVERVIEW PAGE .............................................................................................. 19<br />

5.1 ACCOUNT OVERVIEW PAGE .............................................................................................................. 19<br />

Account Overview Page Details: ...................................................................................................... 19<br />

6 MAKING A PAYMENT....................................................................................................................... 20<br />

6.1 PAYMENT PAGE: ............................................................................................................................ 20<br />

Payment Page Instructions: ............................................................................................................ 20<br />

6.2 ADD A BANK ACCOUNT PAGE ............................................................................................................ 22<br />

Add a Bank Account Instructions: ................................................................................................... 22<br />

6.3 REMOVE A BANK ACCOUNT ............................................................................................................... 23<br />

Remove a Bank Account Instructions: ............................................................................................. 23<br />

6.4 PAYMENT VERIFICATION .................................................................................................................. 24<br />

Payment Verification Instructions: ................................................................................................... 24<br />

6.5 CONFIRMATION OF PAYMENT ............................................................................................................ 25<br />

Confirmation of Payment page instructions: ..................................................................................... 25<br />

7 PAYMENT HISTORY ........................................................................................................................ 26<br />

Payment History Instruction page: .................................................................................................. 26<br />

A. Account Payment History: ...................................................................................................... 26<br />

B. Electronic Payments: .............................................................................................................. 26<br />

8 QUARTERLY WAGE AND PREMIUM REPORTING ................................................................................... 28<br />

8.1 ONLINE FILING: GETTING STARTED .................................................................................................... 28<br />

Instruction for Completing the Quarterly Reports through <strong>MyUI</strong> <strong>Employer</strong>: ........................................ 28<br />

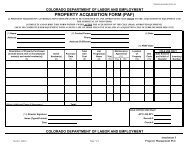

8.2 WAGE INPUT FORM ........................................................................................................................ 29<br />

Entering your Wage Report Instructions: ......................................................................................... 29<br />

If wage fields are locked: ............................................................................................................... 30<br />

Date: 11/12/2013 2/53

Saving and Correcting: ................................................................................................................... 30<br />

Step-by step instructions for Zero Wage Report: .............................................................................. 31<br />

8.3 QUARTERLY PREMIUM INPUT PAGE ..................................................................................................... 32<br />

Premium Input Page Instructions: ................................................................................................... 32<br />

Detailed descriptions for Premium Report ........................................................................................ 33<br />

8.4 CONFIRMATION PAGE ..................................................................................................................... 36<br />

Printing the Payment Coupon: ........................................................................................................ 36<br />

8.5 SAVE & PRINT OPTIONS PAGE .......................................................................................................... 38<br />

8.6 PRIOR PREMIUM INFORMATION DETAIL ............................................................................................... 40<br />

Prior Premium Report not entered using <strong>MyUI</strong> <strong>Employer</strong> .................................................................. 40<br />

Prior Premium Report entered using <strong>MyUI</strong> <strong>Employer</strong> ........................................................................ 41<br />

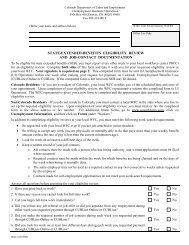

9 ISSUES AND APPEALS ..................................................................................................................... 42<br />

9.1 WHAT YOU CAN DO IN THE ISSUES AND APPEALS TAB .............................................................................. 42<br />

9.2 WHAT YOU CAN’T DO IN THE ISSUES AND APPEALS TAB ............................................................................ 42<br />

9.3 ISSUE STATUS: WHAT DOES IT MEAN? ................................................................................................ 42<br />

9.4 WHAT TO EXPECT WHEN AN ONLINE APPEAL IS AVAILABLE ........................................................................ 43<br />

9.5 FINDING ISSUES: ........................................................................................................................... 44<br />

9.6 SEARCH RESULTS AND VIEWING UIB-6 DECISION DOCUMENTS ................................................................. 45<br />

Search Results ............................................................................................................................... 45<br />

Viewing the UIB-6 Decision document ............................................................................................. 45<br />

9.7 FILING A LATE APPEAL .................................................................................................................... 46<br />

9.8 FILE APPEAL ................................................................................................................................. 47<br />

9.9 WITHDRAW APPEAL ....................................................................................................................... 48<br />

10 FAQS .......................................................................................................................................... 49<br />

10.1 REGISTRATION: ............................................................................................................................ 49<br />

What will happen if my Federal <strong>Employer</strong> Identification Number (FEIN) is all zeros? .......................... 49<br />

I entered my account number on the registration and the system gives me a message like “You have entered an<br />

incorrect value in the business name, account number, or Federal <strong>Employer</strong> Identification Number field”. How<br />

can I create an account if I can’t start the process? ......................................................................... 49<br />

I have not received my PIN what do I do? ....................................................................................... 49<br />

I deleted or cannot find the email I received after I registered, what do I do? ................................... 49<br />

I received an error message when trying to complete my registration stating that this account is already<br />

registered but when I try to log in it tells me that this account does not exist, why? .......................... 49<br />

I started a registration but I never received anything so I tried to register again, now it’s telling me that the<br />

account either already exists or something doesn’t match, why? ....................................................... 49<br />

I am a Third Party Administrator, should I register the employers which I represent? ........................ 50<br />

What happens when a Third Party Administrator or Leasing Company registers for an employer that they<br />

represent, and then their representation of the employer is terminated? ........................................... 50<br />

Can there be more than one administrator on a <strong>MyUI</strong> <strong>Employer</strong> account? ......................................... 50<br />

10.2 LOG IN: ...................................................................................................................................... 50<br />

How many users can log into a single account? ............................................................................... 50<br />

10.3 PAYMENTS: .................................................................................................................................. 50<br />

May I make a payment using a bank outside of the United States? ................................................... 50<br />

I would like to change my bank account number, how do I do this? .................................................. 50<br />

May I verify my payment I submitted online today went through? .................................................... 50<br />

How long from when I submit payment online before it posts to your system? .................................. 51<br />

When does my online payment have to be submitted online in order to be considered timely? ........... 51<br />

May I make a future payment? ....................................................................................................... 51<br />

Why am I receiving a billing statement if my payment went through on time? ................................... 51<br />

10.4 OTHER QUESTIONS: ....................................................................................................................... 51<br />

What happens if the administrator of an employer leaves the business or dies? ................................. 51<br />

Should I use my <strong>MyUI</strong> <strong>Employer</strong> password and username when I am logging in to the FTP site? ........ 51<br />

Why can I only see information for a few years on <strong>MyUI</strong> <strong>Employer</strong>? .................................................. 51<br />

Date: 11/12/2013 3/53

How long from when I submit a report online before it posts to your system? ................................... 51<br />

11 GLOSSARY/DEFINITIONS ................................................................................................................ 52<br />

Date: 11/12/2013 4/53

1 REGISTER A NEW ACCOUNT<br />

Registering for your <strong>MyUI</strong> <strong>Employer</strong> account is done in two major pieces: the initial online registration and completing the<br />

registration after receiving your PIN. During the process you will receive an email and a PIN letter in the mail. Please save<br />

both items until you complete the registration process.<br />

Here are step-by-step instructions to register a new Colorado Department of Labor & Employment, My UI <strong>Employer</strong><br />

account online.<br />

1.1 Registration Information<br />

Instructions to register a new account:<br />

1. Go to the <strong>MyUI</strong> <strong>Employer</strong> home page.<br />

https://myuiemployer.coworkforce.com/<br />

2. Click on the Register button.<br />

Date: 11/12/2013 5/53

3. Complete the <strong>Employer</strong> Registration page<br />

by providing the requested information and<br />

select the Submit button.<br />

4. After you press submit, you will be<br />

returned to the <strong>MyUI</strong> <strong>Employer</strong> home page.<br />

5. We will send you a registration email to<br />

the email address you provided. Please save<br />

this email, to complete your registration.<br />

6. We will mail a PIN letter to the address we<br />

have on file for your account. This PIN<br />

should arrive within 5-7 business days<br />

depending on where your address is<br />

located. We do this as a security precaution<br />

to insure that your information is kept<br />

secure.<br />

Psuedocorp USA LLC<br />

555555.00-5<br />

84-555555<br />

grock@psuedocorp.com<br />

grock@psuedocorp.com<br />

12345 S MAIN ST<br />

DENVER, CO 80202-0000<br />

Please verify that the address which<br />

displays on the page is a valid<br />

mailing address for your business. If<br />

the address is not a correct mailing<br />

address for your business you will<br />

need to change it using the link<br />

provided before you can proceed<br />

with your registration.<br />

Date: 11/12/2013 6/53

7. When you receive the PIN letter, open the<br />

email you saved to complete the<br />

registration.<br />

8. In the email, click on the link to the <strong>MyUI</strong><br />

<strong>Employer</strong> Registration Confirmation in the<br />

second paragraph. This will open the<br />

Complete Registration page.<br />

9. Enter the PIN from the PIN mailer (you<br />

will only use this PIN once to complete the<br />

registration).<br />

10. Put in a Username and Password that will<br />

identify you each time you log onto the<br />

system.<br />

11. Finally choose three questions and put in<br />

answers you will remember. These are<br />

used to verify your identity during some<br />

future processes.<br />

Username: Every user must have a unique Username.<br />

Once established, the Username for the Account<br />

Administrator cannot be changed.<br />

Password<br />

o Must be 8 characters or more.<br />

o Must contain three of the following: uppercase letters,<br />

lowercase letters, numbers, and special characters.<br />

12. Read and confirm your acceptance of the<br />

Terms and Conditions of using the website<br />

by clicking I Agree.<br />

Date: 11/12/2013 7/53

13. As the Account Administrator of your<br />

account you will be brought to the <strong>Employer</strong><br />

Profile page each time you log on.<br />

Note: the addresses you have on file with the<br />

department can all be viewed from this page.<br />

For this user there are several options:<br />

Owner/Officer, Location, Books and records,<br />

<strong>Employer</strong>’s bank, Mailing. Clicking the<br />

appropriate words will slide the window open<br />

to show the address on file.<br />

Date: 11/12/2013 8/53

Notes:<br />

The person completing the registration process for your <strong>MyUI</strong> <strong>Employer</strong> account will be the Account Administrator<br />

and will have access to all information available for the account. This means that the account administrator will<br />

be able to view information, make changes, complete transactions, and enable online access to other users of the<br />

account allowing a unique login for each user. Therefore, the person chosen to register your online account<br />

should be trusted to handle sensitive and confidential information.<br />

Only employers with a current Unemployment Insurance Account with the state of Colorado may use the <strong>MyUI</strong><br />

<strong>Employer</strong> application.<br />

If you have a Future account, you cannot register with My UI <strong>Employer</strong> until your account has qualified to pay<br />

unemployment premiums.<br />

1.2 Deleted Your Email?<br />

1. If you have lost your email with the<br />

registration activation link, click the link on<br />

the home page and the email will be resent<br />

to you.<br />

1<br />

1.3 Missing PIN<br />

2. Your PIN is to be mailed to your address<br />

on file with CDLE. That address was<br />

displayed below the security questions<br />

when you registered.<br />

a. If you have not received your PIN in the<br />

mail, go back to your email and click the<br />

second link (as shown in example here).<br />

b. You will get a confirmation that the<br />

system has generated a new PIN for you<br />

to use to complete the registration. The<br />

PIN should arrive in the mail in 5-7<br />

business days. You must wait for this new<br />

PIN as the old PIN is no longer valid.<br />

2b<br />

2a<br />

Date: 11/12/2013 9/53

2 LOGIN<br />

After you have completed the registration process for the <strong>MyUI</strong> <strong>Employer</strong> website, you gain access each time by going to<br />

the <strong>MyUI</strong> <strong>Employer</strong> Home Page and putting in the username and password you created for either the account<br />

administrator or designated user.<br />

2.1 Logging On<br />

Login Instructions:<br />

1. Go to the <strong>MyUI</strong> <strong>Employer</strong> home page.<br />

https://myuiemployer.coworkforce.com/<br />

2. Enter your Username and Password. Press<br />

Submit.<br />

3. Administrators will be taken to the<br />

<strong>Employer</strong> Profile page.<br />

4. Account users will be taken to the Account<br />

Overview page (after their initial login<br />

where they must change their password).<br />

Date: 11/12/2013 10/53

2.2 Forgot Username<br />

This screen allows you the ability to request your username via email, simply enter the requested information.<br />

Only the Administrator of the account can request their username through this option. Account users must contact the<br />

Account Administrator for their username.<br />

Forgot Username Instructions:<br />

1. Go to the <strong>MyUI</strong> <strong>Employer</strong> home page.<br />

https://myuiemployer.coworkforce.com/<br />

2. Click on the “Forgot your username” link.<br />

3. The Forgot Username screen will display.<br />

4. After you complete these first three fields<br />

and press Submit, <strong>MyUI</strong> <strong>Employer</strong> will<br />

validate your information and display a<br />

Security Question from the Registration<br />

process. Complete the answer and press<br />

Submit.<br />

5. With the Password, UI Account Number,<br />

Email address, and Security Question fields<br />

completed, this page will be displayed and<br />

an e-mail is sent to you. Choose the Click<br />

here link in the email to be brought to the<br />

Username display page and see your<br />

Username.<br />

Date: 11/12/2013 11/53

2.3 Forgot Password<br />

This screen allows you to reset a forgotten password. You will receive an email during the password reset process. This<br />

email will allow you to access the New Password page where you can change your password. This email link will only<br />

function for twenty minutes after your request is made. If you do not click the link before that time you will need to<br />

return to the Password Reset page and begin the process again.<br />

Forgot Password for Account Administrator Instructions:<br />

Account Administrators<br />

1. Go to the <strong>MyUI</strong> <strong>Employer</strong> home page.<br />

https://myuiemployer.coworkforce.com/<br />

2. Click on the “Forgot your password” link.<br />

3. The <strong>MyUI</strong> <strong>Employer</strong> Password Reset<br />

screen will display<br />

4. After you put in an Administrator<br />

Username two additional fields (email<br />

address and a security question) will be<br />

presented. Complete all the information and<br />

press Submit. The email address must<br />

match the information stored for the<br />

administrator account.<br />

5. You will receive this screen after<br />

successfully completing the reset page.<br />

6. Open the email and choose the click here<br />

link.<br />

Date: 11/12/2013 12/53

7. Complete the New Password page to<br />

create the new password. When you have<br />

successfully completed this page, you will<br />

be shown a New Password Confirmation<br />

page.<br />

Account Users<br />

Forgot Password for Account Users-Instructions:<br />

1. Go to the <strong>MyUI</strong> <strong>Employer</strong> home page.<br />

https://myuiemployer.coworkforce.com/<br />

2. Click on the “Forgot your password” link.<br />

3. The <strong>MyUI</strong> <strong>Employer</strong> Password Reset<br />

screen will display<br />

4. Put in your username and unemployment<br />

insurance account number, press Submit.<br />

5. You will receive the Password Reset<br />

Confirmation page.<br />

6. The account administrator will be notified<br />

to reset the user password and provide that<br />

temporary password to the user.<br />

7. When the user logs in with this temporary<br />

password, they will be prompted to change<br />

the password.<br />

Forgotten both your Username and Password?<br />

o Account Users-Contact your Account Administrator to change your password and look up your username.<br />

o Account Administrator-Contact customer service at 303-318-9100.<br />

Date: 11/12/2013 13/53

3 MANAGE ACCOUNT USERS<br />

Only the Account Administrator has access to this page. Options from this page include adding users to the account and<br />

establishing access to some or all of the site information. Here you may;<br />

Add an account user<br />

Delete an account user<br />

Review and Change an account user’s page access permissions<br />

3.1 Managing Account Users<br />

Instructions for authorizing User access:<br />

1. From the <strong>Employer</strong> Profile select Account<br />

Users.<br />

1<br />

2. The list of current users with access will<br />

display.<br />

3. If you are adding a user select the +Add a<br />

User link.<br />

4. If you need to make changes you can<br />

select the Edit button next to an existing<br />

user’s name.<br />

5. You may return to this page to make<br />

changes to user permissions at any time.<br />

6. You may also remove a user on this page<br />

by clicking the Delete link on any user<br />

listed. If a user is removed all of their prior<br />

access is removed. The system will not<br />

retain any settings for a user once removed.<br />

2<br />

4 6<br />

3<br />

Date: 11/12/2013 14/53

7. On the next screen you can identify the<br />

user and choose a username and password<br />

for them. You will need to notify the<br />

account user of their username and<br />

password.<br />

8. An account user’s username cannot be<br />

changed without removing the employee<br />

and adding them again. This will require reselecting<br />

all of their page access<br />

permissions.<br />

9. Pick which pages or series of pages you<br />

want to allow the user to be able to view<br />

and submit information from. The “I” next<br />

to each page has a brief description.<br />

9<br />

You are advised to review all the pages<br />

available for authorization to a user<br />

(sub-user) prior to allowing access, so<br />

that you are aware of the information<br />

displayed on each page or series of<br />

pages.<br />

Date: 11/12/2013 15/53

4 CHANGING ACCOUNT INFORMATION<br />

4.1 Change Email Address<br />

This screen allows Account Administrator the ability to change their email address. When you submit an email address<br />

change, an email is sent to the previous email address and to the new email address.<br />

Change Email Address Page Instructions:<br />

1. From the <strong>Employer</strong> Profile select Change<br />

Email Address<br />

2. Update the information and click Submit.<br />

3. You will receive a confirmation for the<br />

change to the email address. 1<br />

2<br />

Date: 11/12/2013 16/53

4.2 Change Security Questions & Answers Page<br />

This screen allows the Account Administrator the ability to change their security questions and/or answers. You must<br />

have three different security questions and their associated answers on file with the Department.<br />

Change Security Questions & Answers Instructions:<br />

1. From the <strong>Employer</strong> Profile select Change<br />

Security Questions & Answers<br />

2. Update the information and click Submit.<br />

3. You will receive a confirmation for the<br />

update of these questions.<br />

1<br />

2<br />

Date: 11/12/2013 17/53

4.3 Change Password<br />

This screen allows you the ability to change your password at any time. It is recommended that the password be changed<br />

occasionally to maintain security.<br />

Change Password Instructions Page:<br />

1. From the <strong>Employer</strong> Profile select Change<br />

Password<br />

2. Update the information and click Submit.<br />

3. You will get a confirmation that the<br />

password has changed.<br />

1<br />

2<br />

Date: 11/12/2013 18/53

5 EMPLOYER ACCOUNT OVERVIEW PAGE<br />

This page provides some basic information about your employer account. This is the default page for all account users<br />

after they login.<br />

5.1 Account Overview Page<br />

Account Overview Page Details:<br />

Account Overview<br />

1. From the <strong>Employer</strong> Profile, click on the<br />

Account Information tab.<br />

A<br />

D<br />

B<br />

E<br />

C<br />

A. Mailing Address: The current mailing address on file for this account. Please verify that this address is correct.<br />

B. Premium Account Balance: This is the total amount due to Colorado Department of Labor and Employment,<br />

which may include older premium reports that are no longer viewable. This balance includes premiums (or<br />

benefits charged for reimbursable employers), assessments, penalties for late reports, interest for late reports,<br />

and applicable surcharges.<br />

a. If the premium account balance is positive, then this account owes premiums to the Department.<br />

b. If the premium account balance is negative, then this account has a credit, which will be applied toward<br />

any future premium amount due to the Department.<br />

C. Premium Report Status:<br />

a. If a premium report is on file the page will display Received.<br />

b. If there are Missing premium reports, the page will display the quarter and year of all missing premium<br />

reports for the current year plus the previous three years.<br />

i. You will need to contact the Department to obtain information on older missing reports.<br />

D. Premium Rate for: the Current Calendar Year. The Rate Information page can show information for previous<br />

years.<br />

E. Liability Date: The liability date is the first date wages are paid in the calendar year in which the employer<br />

meets the qualifying wage threshold.<br />

Date: 11/12/2013 19/53

6 MAKING A PAYMENT<br />

<strong>MyUI</strong> <strong>Employer</strong> provides an online payment option for paying your Unemployment Insurance Accounts.<br />

There are two potential items that can appear on your billing statement from our banking vendor. One or both of these<br />

can appear on your statement. Funds applied to either of these items do not change how your payment will be applied<br />

within our system. We use these ‘products’ internally for accounting purposes.<br />

Emppayments – This product reflects payments for Premium payments.<br />

Empfirp – This product reflects payments for Federal Interest and Bond special assessments.<br />

For more information go to; http://www.colorado.gov/cs/Satellite/CDLE-UnempBenefits/CDLE/1251588740471 and view<br />

Federal Interest Repayment and Bond Repayment<br />

6.1 Payment Page:<br />

Payment Page Instructions:<br />

Make a Payment<br />

1. Click on the Quarterly Reports tab.<br />

2. Choose Make a Payment<br />

Date: 11/12/2013 20/53

Payment Information:<br />

3. Choose where you want the system to apply<br />

payment.<br />

A line will be shown for each<br />

quarter in which there is not a<br />

$0 balance (with the oldest<br />

showing first). There is a<br />

selection at the top with the<br />

text ‘Apply payment according<br />

to the order above’<br />

You may change the way payments are applied by clicking the button<br />

option next to a Quarter/Year for which you would like to apply this<br />

payment.<br />

o If you select to pay one specific quarter, the payment is applied to<br />

that quarter first. After a payment is initially applied any remaining<br />

amount will be applied according to the listed payment order<br />

beginning with the oldest quarter containing a debt.<br />

If you select ‘Apply payment according to the order above’, the<br />

payment is initially applied to the oldest quarter containing a debt<br />

and progresses forward from there.<br />

You may not select a quarter displaying a credit, any credit field is<br />

display only.<br />

o All debts are highlighted in red as a non-negative number. Example:<br />

$25.00<br />

o All credits are highlighted in green as a negative number. Example:<br />

$25.00<br />

Payment Method:<br />

4. Choose or input a bank account to use for<br />

making a payment.<br />

5. Each existing account will display the name<br />

on bank account and **the last four digits<br />

of the account. For example: (Pemberley<br />

Estates **1639)<br />

6. Enter the name of the person who is<br />

completing the payment request in the<br />

Authorized Remitter.<br />

6<br />

6<br />

Bank account information not available<br />

or<br />

Choose bank account information<br />

previously entered by clicking down<br />

arrow<br />

Date: 11/12/2013 21/53

6.2 Add a Bank Account Page<br />

This page collects the information to set up an account to use for making payments:<br />

Add a Bank Account Instructions:<br />

Add a Bank Account<br />

1. From the Payment page, click on the Add a<br />

Bank Account link beneath the Choose<br />

Account field.<br />

2. All fields on this page are required to set up<br />

a new bank account.<br />

3. The person making the payment must have<br />

signature authority on the account.<br />

.<br />

Date: 11/12/2013 22/53

6.3 Remove a Bank Account<br />

This page provides the ability remove an account from your list of bank accounts.<br />

Remove a Bank Account Instructions:<br />

Remove a Bank Account<br />

1. From the Payment page, click on the<br />

Remove Account link beneath the Choose<br />

Account field.<br />

2. Use the drop down list to display the list of<br />

accounts previously entered. Then highlight<br />

an entry to display the name on the page.<br />

Click on Remove to delete the account from<br />

your drop-down list.<br />

Date: 11/12/2013 23/53

6.4 Payment Verification<br />

This page is presented after you have submitted a payment using the online payment system. This page gives you the<br />

opportunity to review the data you entered on the Payment Page and confirm your intentions, or return to the Payment<br />

page to edit the information or cancel the payment.<br />

If any portion of your payment is being applied to a special assessment in the Trust Fund/Bond Payment Amount field,<br />

you will see the breakout on this page.<br />

Payment Verification Instructions:<br />

Payment Verification<br />

From the Payment page;<br />

1. Complete all the fields necessary to submit<br />

a payment.<br />

2. Click on the Submit button.<br />

3. The Payment Verification displays.<br />

4. Review the information, check the I Accept<br />

Box, and select Confirm<br />

5<br />

Date: 11/12/2013 24/53

6.5 Confirmation of Payment<br />

This page is presented after you have verified a payment using the online payment system. This page provides the record<br />

of your transaction showing the confirmation number that uniquely identifies the transaction.<br />

Confirmation of Payment page instructions:<br />

Confirmation of Payment<br />

From the Payment Page, complete all the<br />

fields necessary to submit a payment.<br />

1. Click on the Submit button.<br />

2. The Payment Verification displays.<br />

3. Click on the Confirm button.<br />

4. The Confirmation of Payment displays.<br />

The following fields will display in addition to<br />

data from the Payment Verification.<br />

Confirmation Number:<br />

Confirmation Date/Time (ET):<br />

Date: 11/12/2013 25/53

7 PAYMENT HISTORY<br />

This page displays payments made on an account, either electronically or received in the mail. Only payments made<br />

within the current calendar year and the prior three calendar years are presented. For payments made which are not<br />

displayed, please contact the Department for further details.<br />

Payment Type - There are two possible payments types<br />

• Premium - The payment was applied to premium penalties, premium interest and/or premiums.<br />

• Trust Fund/Bond Assessment – The payment was applied to the Federal Trust Fund Assessment and/or to the<br />

bond interest repayment.<br />

Lines with duplicate Confirmation Numbers indicate the payment was split to pay more than one type of payment. These<br />

will display different names under Payment Type.<br />

Payment History Instruction page:<br />

Payment History<br />

1. From the <strong>Employer</strong> Profile or General<br />

Information page click on the Account<br />

Information tab.<br />

2. Click on Payment History<br />

3. The Payment History displays.<br />

A<br />

B<br />

A. Account Payment History:<br />

When a payment is made online, it may take a few days to appear in the Account Payment History due to the time<br />

involved to process your payment and post it to our system. Rejected payments will not appear here.<br />

Each payment in the Account Payment History is displayed using two dates:<br />

Posting Date - Will display the date the payment was entered into our system.<br />

Transaction Date - Will show the date on which we consider the payment to apply.<br />

It is not uncommon for the Department to post a payment today that transacts on a prior date.<br />

B. Electronic Payments:<br />

Confirmation Number - This is our reference number for transactions.<br />

Date: 11/12/2013 26/53

Transaction Date - The date you submitted payment online.<br />

Status-Payments submitted online will display one of three status conditions.<br />

Pending - The status upon reaching the Confirmation page in the payment process.<br />

Posted - The status after we process your payment and post it to our system.<br />

Rejected - The status if a payment does not clear bank processing.<br />

(It is possible for a payment to reach ‘Posted’ status and later change to a ‘Rejected’ status. This is due to the time delay<br />

in communications between the banks involved.<br />

Please verify that your payment has been withdrawn from your bank account before reducing the fund balance below an<br />

amount necessary to complete a premium payment or the payment may not complete. Do not rely on the ‘Posted’ status<br />

as a measure of a completed transaction).<br />

Date: 11/12/2013 27/53

8 QUARTERLY WAGE AND PREMIUM REPORTING<br />

The Quarterly Reports section of the My UI <strong>Employer</strong> site provides the ability for employers to report and pay the<br />

required premiums for their Unemployment Insurance.<br />

This quarterly reporting process begins on the Unemployment Insurance Quarterly Wage and Premium Reporting page.<br />

You can choose to:<br />

File quarterly wage and/or premium reports for the current period.<br />

File quarterly wage and/or premium reports that are past due.<br />

File a zero (0) wage report.<br />

At this time you cannot file future reports or amend a report already filed.<br />

8.1 Online Filing: Getting started<br />

Instruction for Completing the Quarterly Reports through <strong>MyUI</strong> <strong>Employer</strong>:<br />

Begin Filing<br />

1. From the <strong>Employer</strong> Profile or General<br />

Information page click on the Quarterly<br />

Reports tab.<br />

2. Verify the business information displayed is<br />

for the account you want to complete the<br />

report.<br />

3. To complete an unfiled quarter:<br />

a. Use the drop down to choose the<br />

appropriate quarter for filing.<br />

- Report Due date for quarters past due<br />

will display: Past Due<br />

b. Complete the Preparer information<br />

c. Choose how you will file your wage report.<br />

(If you are returning to complete a wage<br />

report, it will return you to that report.<br />

d. Press Continue.<br />

2<br />

1<br />

3a<br />

Note: if you choose a quarter that is already<br />

entered details for that quarter can be<br />

displayed. Details in Section 8.6<br />

3b<br />

3c<br />

FTP: If you use FTP, you will<br />

continue using your existing FTP<br />

Username and Password.<br />

Date: 11/12/2013 28/53<br />

3d

8.2 Wage Input Form<br />

This page provides an employer the entry form for capturing the wage information for each employee. You are directed<br />

to this page if you choose either “Enter the wage report online” or “No wages were paid for the quarter selected. File a<br />

zero wage report” on the Combined Reports page and press Continue.<br />

Entering your Wage Report Instructions:<br />

Completing Wage Report in <strong>MyUI</strong><br />

<strong>Employer</strong><br />

1. Complete Begin Filing steps on the<br />

Quarterly Wage and Reporting Page choose<br />

- “Enter the wage report online”<br />

2. For employers filing on the <strong>MyUI</strong> <strong>Employer</strong><br />

for the first time, click the Add an Employee<br />

link to begin adding employees.<br />

2<br />

3. Complete the information for each<br />

employee to include in your report. Press<br />

Submit after each employee. All fields must<br />

be completed for each employee.<br />

4<br />

4. Note: the Seasonal indicator is only<br />

available if your business has recognized<br />

seasonal status on the system.<br />

3<br />

Date: 11/12/2013 29/53

5. As you input each employee the screen will<br />

display your results. There are options to<br />

Edit/ Delete rows for any corrections.<br />

6. If you need to take a break during input,<br />

choose Save and Finish Later. You will be<br />

prompted that you are leaving the page and<br />

your information is saved. Note: Your<br />

report is not submitted unless you continue<br />

and complete the Premium Report.<br />

7. When all your employees are entered, press<br />

Continue to Premium Report.<br />

5<br />

Completing input for Previously entered<br />

reports<br />

8. If you have previously entered a Wage<br />

report through <strong>MyUI</strong> <strong>Employer</strong>, when you<br />

return to complete one for a different<br />

quarter, the employee list previously<br />

entered will be displayed. Click the Edit link<br />

by each employee to input their wages for<br />

the quarter.<br />

9. You may also Add an Employee for new<br />

employees and use the Delete link to<br />

remove them from this quarter.<br />

8<br />

If wage fields are locked:<br />

If an employer is inactive all fields are locked if the quarter being reported is after the quarter end following the<br />

inactive date. You will need to contact the Department to reinstate your account if you have wages to report after<br />

the inactive date.<br />

Once a quarterly report has been submitted all data fields will be locked.<br />

Saving and Correcting:<br />

You may save the data which is currently on the form and return at a later time in order to finish the wage report<br />

by selecting the Save and Continue Later button. This data will be retrieved the next time you come to the page<br />

for the same account and quarter/year. Wage reports are not submitted in <strong>MyUI</strong> <strong>Employer</strong> until the Premium<br />

Report for that quarter is submitted.<br />

Currently corrections to any submitted data can only be made through a mailed wage or premium adjustment<br />

form.<br />

Date: 11/12/2013 30/53

Step-by step instructions for Zero Wage Report:<br />

Wage Input Form Zero Wages<br />

1. Complete Begin Filing steps on the<br />

Quarterly Wage and Reporting Page choose<br />

- “No wages were paid for the quarter<br />

selected. File a zero wage report”<br />

2. For a Zero Report, click Continue to<br />

Premium Report.<br />

2<br />

Date: 11/12/2013 31/53

8.3 Quarterly Premium Input Page<br />

This section allows an employer to enter a Premium Report by individual quarter.<br />

Change Wage Report<br />

If you notice an error in the wages of the premium report you may select the Change Wage Report button to<br />

return you to the Wage Input Form where you can make changes.<br />

Premium Input Page Instructions:<br />

1. Complete Begin Filing steps on the<br />

Quarterly Wage and Reporting page<br />

choosing appropriate method for filing<br />

wages.<br />

2. If Wage Report is being submitted online,<br />

complete the steps as detailed in the Wage<br />

Input Form and select Continue to Premium<br />

Report.<br />

3. The Premium Input Page is displayed. If<br />

you have completed your wage report<br />

online, the total wages will be entered for<br />

you.<br />

4. Complete the information for each field, and<br />

select Submit Quarterly Report.<br />

*** See following screens to receive detailed<br />

information on each item on the report. ***<br />

4<br />

Date: 11/12/2013 32/53

Detailed descriptions for Premium Report<br />

The Number of Employees on the 12 th of<br />

each month:<br />

An entry must be made for each field even<br />

if the entry is a zero.<br />

If zero gross wages are reported for a<br />

quarter then all employee fields should be a<br />

zero value.<br />

A. Total Colorado gross wages paid all<br />

workers this quarter:<br />

A<br />

The Grand Total from the Wage Input form<br />

(if completed) is inserted here. If you did<br />

not complete the Wage Input Form then<br />

manually enter the value.<br />

o This value can be changed.<br />

If you clicked the File a Zero Report button<br />

on the Wage Input Form, then the Total<br />

Colorado Gross Wages is populated with a<br />

zero value.<br />

o This value can be changed.<br />

B. Wages in excess of $‘x’ per worker<br />

per year:<br />

The excess value may change periodically.<br />

The value displayed will be the applicable<br />

value for the year being filed for.<br />

This amount is the quarterly total of all<br />

excess wages for all workers paid during<br />

the quarter.<br />

If you clicked the File a Zero Report button<br />

on the Wage Input Form, then the Wages<br />

in Excess is populated with a zero value.<br />

o This value can be changed.<br />

If your account is a political sub-division,<br />

you cannot report any excess wages.<br />

B<br />

Date: 11/12/2013 33/53

C. Total Chargeable Wages:<br />

This is A minus B above.<br />

This value is calculated for you by our<br />

system.<br />

D. Combined Rate, which includes all<br />

applicable surcharges:<br />

This value comes from your rate<br />

information in our system.<br />

E. Premium Due:<br />

This is C multiplied by D. It is the amount<br />

the account owes for the filed quarter.<br />

F. Penalty Charges this Quarter:<br />

The employer account is charged a $50<br />

($10 for employers in the first year of<br />

business) per quarter penalty if a report is<br />

late.<br />

Penalties are assessed per report/per<br />

quarter.<br />

G. Interest Charges this Quarter:<br />

An employer account is charged interest at<br />

the rate of 1.5 percent (0.015) per month<br />

on any late premium payments due if a<br />

quarterly report is filed late and on unpaid<br />

penalties.<br />

H. Potential Debit (+) or Credit (-)<br />

Amount, if any, from previous<br />

quarters:<br />

Any debit amount is the total of all unpaid<br />

premium, penalty and interest charges due<br />

the state.<br />

Any credit amount is the total of all credit<br />

amounts for the account and is usually due<br />

to either premium overpayments or<br />

premium adjustments in prior quarters.<br />

E<br />

G<br />

C<br />

F<br />

D<br />

H<br />

Date: 11/12/2013 34/53

I. Total Amount Due:<br />

This is the total amount that the employer<br />

owes as of this quarter (The total of<br />

Premium, Penalties, Interest, and debit or<br />

credit adjustments from previous quarters.)<br />

J. Enter the Amount You Are Remitting:<br />

The preparer enters the amount the<br />

employer wishes to pay this quarter. Any<br />

amount that the employer decides not to<br />

pay will accrue monthly interest charges<br />

and will appear in Item 8 of the next<br />

quarter’s report.<br />

Validation: In order for the report to be<br />

submitted successfully, the Total Colorado<br />

Gross Wages Paid All Workers This Quarter<br />

minus the Wages in Excess Of [X] Per Worker<br />

per Year must equal the Total Chargeable<br />

Wages.<br />

I<br />

J<br />

Date: 11/12/2013 35/53

8.4 Confirmation Page<br />

This page displays the remittance coupon that confirms the completion of a quarterly premium report. You are presented<br />

this screen when you complete the filing of your Premium Report online with <strong>MyUI</strong> <strong>Employer</strong>. If the payment will be<br />

mailed, print the coupon to serve as the payment coupon. For online payers the coupon can act as proof of transaction.<br />

Printing the Payment Coupon:<br />

1. Complete the steps from Begin Filing and<br />

Wage Report. After you have pushed the<br />

“Submit Quarterly Report” button this<br />

Confirmation Page appears.<br />

2. If you are not completing an online<br />

payment you can click the “Print Coupon”<br />

button.<br />

2<br />

Date: 11/12/2013 36/53

3. A new window will open displaying your<br />

coupon in a PDF. (Note: the report may<br />

take a minute or more to display).<br />

a. Press the Print button to send your<br />

printout to your printer.<br />

b. You can also save this file, using the Save<br />

button<br />

3a<br />

3b<br />

Note: This page can be obtained at any time<br />

after you have submitted your report. See<br />

description in 8.6 Prior Premium Information.<br />

Date: 11/12/2013 37/53

8.5 Save & Print Options Page<br />

The Save & Print Options page gives you the ability to keep a record of the Quarterly Reports pages you complete during<br />

the Quarterly Reports process. The reports include<br />

Quarterly Combined Wage and Premium Report – Business Information: Captures the input from the<br />

first screen in the Quarterly Reports process<br />

Wage Input form: This will show the employees entered during the Wage Input process. If you FTP or send in<br />

your Wage Report then this option will not be displayed<br />

Quarter Premium Input page: Displays the information input on the Premium Report Page.<br />

Confirmation page: This is another way to get the printed Payment Coupon if you choose not to use the online<br />

payment processing.<br />

1. Complete steps 1-4 on each or the Wage<br />

and Premium reports. Push the “Report<br />

Pages Save & Print Options” button.<br />

1<br />

Date: 11/12/2013 38/53

2. The options for reports will be displayed.<br />

Choose a link option for the report that you<br />

want. The report will open in a separate<br />

window in PDF. (Note: the report may take<br />

a minute or more to display).<br />

3. This window shows an example of the<br />

Wage Report. The report is presented in a<br />

PDF.<br />

a. Press the Print button to send your<br />

printout to your printer.<br />

b. You can also save this file, using the<br />

Save button.<br />

3a<br />

3b<br />

Date: 11/12/2013 39/53

8.6 Prior Premium Information Detail<br />

When you are on the Quarterly Wage and Premium Report screen and choose a quarter that has already been filed the<br />

preparer input options disappear and pressing continue brings up information regarding the quarter you have indicated in<br />

the drop down box. After pressing Continue you will be brought to one of two pages based on whether the previous<br />

quarter was filed through <strong>MyUI</strong> <strong>Employer</strong>.<br />

Prior Premium Report not entered using <strong>MyUI</strong> <strong>Employer</strong><br />

1. On the Quarterly Wage and Premium<br />

Reporting page choose a quarter previously<br />

input.<br />

2. The line below the drop down box will<br />

change to display “Original Report on File”<br />

3. Press Continue<br />

4. The Premium Details for that quarter are<br />

displayed.<br />

It is important to remember that this page shows the current status in<br />

our mainframe system of the quarter being viewed, not a complete<br />

history. Example: if interest was assessed and was then subsequently<br />

paid, you will see $0.00 in the interest field.<br />

Note: Any changes to your account are not immediately reflected on this<br />

page, they make take a business day or two to appear.<br />

Date: 11/12/2013 40/53

Prior Premium Report entered using <strong>MyUI</strong> <strong>Employer</strong><br />

1. On the Quarterly Wage and Premium<br />

Reporting page choose a quarter previously<br />

input.<br />

2. The line below the drop down box will<br />

change to display “Original Report on File”<br />

and the preparer information is displayed<br />

(cannot be changed)<br />

3. Press Continue<br />

4. The Confirmation Page is displayed.<br />

Date: 11/12/2013 41/53

9 ISSUES AND APPEALS<br />

9.1 What you can do in the Issues and Appeals tab<br />

The Issues and Appeals Tab gives you the ability to view and appeal issues impacting your Unemployment Insurance<br />

account and file online Appeals.<br />

Specifically you now have access to:<br />

Search for and display issues on your UI account.<br />

Find out the status of a decision.<br />

Display a Notice of Decision (UIB-6).<br />

Submit online the good cause information if your appeal is late.<br />

Submit an online appeal to an issue.<br />

Receive confirmation that you have successfully submitted the Appeal.<br />

Withdraw an Appeal you have previously submitted online.<br />

Grant access to users within your staff to access the Issues and Appeals tab and therefore process online<br />

appeals.<br />

***Note: The online Appeals option does not replace the existing paper appeal process. You should only<br />

submit one appeal for any issue. ***<br />

9.2 What you can’t do in the Issues and Appeals tab<br />

At this time you cannot file an online appeal for any decisions prior to July 22, 2013. Some appeals are manually<br />

processed and not viewable in the system. For these types of Issues, you will need to follow the existing paper<br />

appeal process.<br />

There is no hearing information available through this application.<br />

Appeal Hearing Officer Decisions or ICAO Decisions.<br />

9.3 Issue Status: What does it mean?<br />

As the Issues work through the process the following status designations are possible:<br />

Issue Status<br />

What does it mean?<br />

Pending-Appeal Received Either the Claimant or the <strong>Employer</strong> filed an appeal.<br />

Pending Review<br />

There is an issue requiring the Division to issue a decision.<br />

Resolved<br />

The initial review of the claim has resolved the decision. This decision can be<br />

appealed in this application<br />

Resolved-See decision sent by The Division sent a Notice of Decision regarding this issue.<br />

mail<br />

Resolved-<strong>Employer</strong> appealed The Division mailed a Hearing Officer’s decision regarding the <strong>Employer</strong>’s<br />

loss of right to protest decision appeal of the Division denying the <strong>Employer</strong>’s right to appeal the substantive<br />

decision.<br />

Resolved-See Hearing Officer’s The Division mailed a Hearing Officer’s decision regarding this issue.<br />

Decision<br />

Resolved-See new Decision or The Hearing Officer directed the Division to reconsider the original decision.<br />

Disregard Notice sent by mail<br />

Resolved-The person who A party appealed and did not appear at the hearing.<br />

appealed did not take part in<br />

the hearing<br />

Resolved-The person who The Appeals Division cancelled the appeal at the request of the party who filed<br />

Date: 11/12/2013 42/53

appealed withdrew the appeal<br />

See the Demand for<br />

Repayment Decision or the<br />

Earnings Decision sent by mail<br />

The hearing officer ruled that<br />

a new decision must be sent<br />

it.<br />

The Division mailed a decision regarding an overpayment or unreported<br />

earnings to the Claimant<br />

The Hearing Officer directed the Division to issue a new decision regarding this<br />

issue.<br />

9.4 What to expect when an online Appeal is available<br />

If your Appeal is past the Deadline, you will be prompted to complete the information on the Your Appeal is Past<br />

the Deadline page. See File a Late Appeal Section 9.7<br />

Otherwise, or after completing the Good Cause information, you will be presented the File Appeal page. See File<br />

an Appeal. See File a Late Appeal Section 9.8<br />

Next you will get a Confirmation Page and your Appeal will be submitted to the Appeals unit for processing just as<br />

if it was received in the mail<br />

You can withdraw appeals online that were submitted online. See Withdraw an Appeal Section 9.9.<br />

***Note*** Status Updates are not real time. Staff still need to manually review each appeal which can<br />

take 4-6 weeks.***<br />

Date: 11/12/2013 43/53

9.5 Finding Issues:<br />

1. On the Issues and Appeals tab you are<br />

presented several fields to enter information<br />

to limit your results.<br />

2. Note there are dates in the Resolution Date<br />

Range boxes. If you click the Search button<br />

without entering data in of the open boxes<br />

then the results will show all issues for your<br />

business for the past year.<br />

3. You may choose to add to this date range<br />

by completing data in one or many of these<br />

other ways to find information:<br />

SSN<br />

Claimant first or last name<br />

Choosing from the Issue Type list<br />

Choosing form the Issue Status list<br />

Putting in an Appeal deadline start, end<br />

or range<br />

2<br />

The results of your Search will results that<br />

match all the entered data; i.e.<br />

a. All claims with last name Smith with an<br />

issue of Job Separation. Note, the entire<br />

name is not required – in the example<br />

we typed “smi” for Smith<br />

b. All Resolved items with an Appeal<br />

Deadline between August 12 th and<br />

August 16 th .<br />

Job Separation<br />

smi<br />

3a<br />

4. Click Search to find Issues that match your<br />

results.<br />

4<br />

Note: You may need to remove<br />

the default Resolution start/end<br />

dates if you are having trouble<br />

finding a specific issue. 2<br />

3b<br />

Resolved<br />

08/12/2013<br />

08/16/2013<br />

4<br />

Date: 11/12/2013 44/53

9.6 Search Results and Viewing UIB-6 Decision <strong>Document</strong>s<br />

Search Results<br />

1. Depending on the search criteria you input,<br />

you will get a different view of your Search<br />

results.<br />

This view represents the default view where<br />

all claims are shown.<br />

Here we see all claims with the last name<br />

“Smith” which had an Issue Type “Job<br />

Separation”<br />

And this shows all the claims with an Appeal<br />

Deadline between 8/12-18/16 that are<br />

“Resolved”.<br />

Viewing the UIB-6 Decision<br />

document<br />

2. You can see the UIB-6 decisions online with<br />

a PDF viewer. To access the documents,<br />

use the search function to locate the issue<br />

you are seeking and then click the drop<br />

down arrow next to “View Decision” and<br />

click on the document link shown.<br />

2<br />

Date: 11/12/2013 45/53

9.7 Filing a Late Appeal<br />

1. If the screen displays , then the<br />

deadline for this appealable issue has<br />

passed. You will need to provide “Good<br />

Cause” information for the staff to approve<br />

the request to appeal. You give this<br />

information by clicking the link.The system<br />

presents the Your Appeal is Past the<br />

Deadline page.<br />

2. The rules concerning what consitutes Good<br />

Cause are outlined when you click this link<br />

on the page. This will present a new<br />

window with Regulation 12.1.8.<br />

3. Complete each question with your situation<br />

to explain the reason for a late appeal.<br />

4. The Yes/No questions may slide open to<br />

reveal additional questions that need to be<br />

completed.<br />

5. You are limited to 1000 characters for the<br />

text boxes. If you want to provide additional<br />

information please note that additional<br />

information will be submitted within the text<br />

you enter in these boxes. To send<br />

additional information follow the<br />

instructions in the Hearing Services (found<br />

on the Issues and Appeals: Current Issues<br />

page)<br />

6. Press Submit when you are done.<br />

7. The system will confirm the receipt of you<br />

request to submit a late appeal. Press<br />

Continue to now File the Appeal.<br />

5<br />

2<br />

6<br />

7<br />

Date: 11/12/2013 46/53

9.8 File Appeal<br />

1. You will get to this page if you click a link to<br />

a timely appeal: or if you have<br />

received the receipt confirmation and<br />

pressed continue on the late appeal Thank<br />

you page.<br />

2. Complete each question with to provide the<br />

information to support your appeal.<br />

You will be limited to 1000 characters in<br />

your explanation for your appeal. If you<br />

want to provide additional information<br />

please note that additional information will<br />

be submitted within the text you enter in<br />

this box. To send additional information<br />

follow the instructions in the Hearing<br />

Services (found on the Issues and Appeals:<br />

Current Issues page)<br />

3. The Yes/No questions may slide open to<br />

reveal additional questions that need to be<br />

completed.<br />

4. Please type your name to sign the Appeal.<br />

2<br />

5. A confirmation will be displayed. You may<br />

ask for an e-mail confirmation (to be sent to<br />

the e-mail address on file), and print or<br />

save this page.<br />

Date: 11/12/2013 47/53

9.9 Withdraw Appeal<br />

1. If you have appealed your claim online, you<br />

can also withdraw that appeal through the<br />

application. Click the link and the<br />

Withdraw Appeal page is displayed.<br />

2. Complete the information to explain the<br />

reason for withdrawing this appeal.<br />

You will be limited to 1000 characters in<br />

your explanation for your withdrawel. If you<br />

want to provide additional information<br />

please note that additional information will<br />

be submitted within the text you enter in<br />

this box. To send additional information<br />

follow the instructions in the Hearing<br />

Services (found on the Issues and Appeals:<br />

Current Issues page)<br />

3. Sign by typing the name, an press Submit.<br />

2<br />

4. You will get a Withdrawal confirmation.<br />

*** Note: If you withdraw this appeal, the<br />

decision you are appealing will remain in<br />

effect. ***<br />

Date: 11/12/2013 48/53

10 FAQS<br />

10.1 Registration:<br />

What will happen if my Federal <strong>Employer</strong> Identification Number (FEIN) is all zeros?<br />

If your FEIN is all zeros you will not be able to register for <strong>MyUI</strong> <strong>Employer</strong>. You must update this information by contacting customer<br />

service.<br />

I entered my account number on the registration and the system gives me a<br />

message like “You have entered an incorrect value in the business name, account<br />

number, or Federal <strong>Employer</strong> Identification Number field”. How can I create an account<br />

if I can’t start the process?<br />

For security purposes CDLE needs to make sure only the right users are registering for <strong>MyUI</strong> <strong>Employer</strong>. To ensure this we require<br />

that your business name, account number and FEIN are exactly as we have them on our system. If you received this error make sure<br />

the values you entered are correct. If you can look at one of the forms that CDLE mailed you make sure to enter the data as follows;<br />

Colorado Legal Business Name – Enter is exactly as printed on these forms, we sometimes abbreviate due to space limits. If there is<br />

a misspelling or other error, you should enter it that way (you can send a correction to CDLE later).<br />

Colorado Account Number – Enter the number from your form. Your account number is formatted 123456.00-7. If you have trailing<br />

numbers printed on the form, you must disregard those digits. Only enter the numbers which match the example and omit any<br />

additional numbers that follow.<br />

Federal <strong>Employer</strong> Identification Number – Enter your 9 digit FEIN.<br />

I have not received my PIN what do I do?<br />

You should return to the email that you received after the registration was initiated. There is a link within the text of the email that<br />

will cause our system to mail you a replacement PIN. You will need to wait up to 10 business days to receive the PIN after you have it<br />

resent.<br />

I deleted or cannot find the email I received after I registered, what do I do?<br />

You should return to the <strong>MyUI</strong> <strong>Employer</strong> main page, where the login is located, there is a link beneath the ‘Register’ button that<br />

contains the highlighted word ‘here’. Click on this link and complete the Resend <strong>MyUI</strong> <strong>Employer</strong> Registration Email screen that<br />

appears. This will resend the email to the original email entered. You may only use the original email that was entered at the initial<br />

registration until your registration is completed.<br />

I received an error message when trying to complete my registration stating that<br />

this account is already registered but when I try to log in it tells me that this account<br />

does not exist, why?<br />

The system has actually locked-out this account. You will need to begin registration again.<br />

I started a registration but I never received anything so I tried to register again,<br />

now it’s telling me that the account either already exists or something doesn’t match,<br />

why?<br />

Your registration is actually in a ‘pending’ status, that is, it is waiting for the registration to be completed by selecting the link<br />

contained in the registration email and completing the data requested.<br />

Date: 11/12/2013 49/53

I am a Third Party Administrator, should I register the employers which I<br />

represent?<br />

<strong>MyUI</strong> <strong>Employer</strong> was designed for the individual employers to set up their own accounts. It is possible for many Third Party<br />

Administrators to complete the steps required to register an employer, but, should you discontinue representing an employer the<br />

steps required to transfer ‘ownership’ of the account to the employer will be greater than if the employer had registered<br />

themselves.<br />

What happens when a Third Party Administrator or Leasing Company registers for<br />

an employer that they represent, and then their representation of the employer is<br />

terminated?<br />

<strong>MyUI</strong> <strong>Employer</strong> is intended for employers to use and we advise that anyone other than the employer does not register an account<br />

for someone else. If this situation happens however, there are two methods of resolution; First the representative can just provide<br />

the username and password to the employer, who can then change the password. Second (if the representative is not cooperative) a<br />

staff member with the proper authorization can change the password for the employer. A username may not be changed once it has<br />

been created.<br />

Can there be more than one administrator on a <strong>MyUI</strong> <strong>Employer</strong> account?<br />

No, due to programming limitations there can be only one administrator per <strong>MyUI</strong> <strong>Employer</strong> account.<br />

10.2 Log In:<br />

How many users can log into a single account?<br />

Only one user may log into an account as a system administrator. There is no limit to how many other users an account may have.<br />

Also, all of these different users can be using the system at the same time.<br />

10.3 Payments:<br />

May I make a payment using a bank outside of the United States?<br />

Any bank that is used to make payments through <strong>MyUI</strong> <strong>Employer</strong> must have a U.S. routing number. Many foreign banks have U.S.<br />

routing numbers, so those banks would be acceptable, but any bank that does not have a U.S. routing number will not be allowed to<br />

make payments.<br />

I would like to change my bank account number, how do I do this?<br />

<strong>MyUI</strong> <strong>Employer</strong> does not allow a previously entered bank account number to be modified. If you no longer want to use a specific<br />

bank account number which was entered into <strong>MyUI</strong> <strong>Employer</strong> it should be deleted. You would then need to add the new bank<br />

account number to begin using it.<br />

May I verify my payment I submitted online today went through?<br />

Currently there is not an immediate way for us to see if your payment has gone through. You will be able to see it when it gets<br />

applied to our system of record, which could take a few days depending on when the payment was made.<br />

Date: 11/12/2013 50/53

How long from when I submit payment online before it posts to your system?<br />

Unfortunately there is not a consistent and reliable answer to this. This will depend on what time of day you made your payment,<br />

the day it was made, if there are any bank holidays soon, and how quickly your bank communicates with our bank. A good estimated<br />

time is 3-5 business days.<br />

When does my online payment have to be submitted online in order to be<br />

considered timely?<br />

As long as the payment is submitted before 11:59 p.m. it is considered to be made on that date. For <strong>MyUI</strong> <strong>Employer</strong> the payment<br />

can be accepted on a Sunday or Holiday, and is not affected by postal service limitations.<br />

May I make a future payment?<br />

Currently you are unable to make a future payment. The system was only designed to take payment the day that it is submitted.<br />

Why am I receiving a billing statement if my payment went through on time?<br />

As long as the payment is submitted before 11:59 p.m. it is considered to be made on that date. However, there is a certain period<br />

where our system runs the billing statements. If the payment was not showing in our system (as it can take a few days to post)<br />

when the system ran, it automatically sent a billing notice. You may disregard that notice or contact customer service to ensure the<br />

payment was received timely.<br />

10.4 Other questions:<br />

What happens if the administrator of an employer leaves the business or dies?<br />

If no one at an employer’s business knows the username, password and security answers for an account and cannot log into the<br />

prior system administrator’s email then a staff member with the proper authorization can change the password for the employer<br />

and change the email address for the account. This will allow the new system administrator to receive the username reminder. Now<br />

they may log into the account. A username may not be changed once it has been created.<br />

Should I use my <strong>MyUI</strong> <strong>Employer</strong> password and username when I am logging in to<br />

the FTP site?<br />

No, although we link to the FTP site your <strong>MyUI</strong> <strong>Employer</strong> username and password will only work for the <strong>MyUI</strong><strong>Employer</strong> site.<br />

Continue to use the login information that you have been previously instructed to use to access the FTP site.<br />