CapitalBudgeting_201.. - CITT

CapitalBudgeting_201.. - CITT

CapitalBudgeting_201.. - CITT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

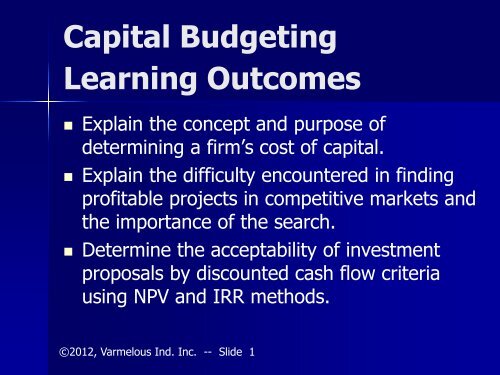

Capital Budgeting<br />

Learning Outcomes<br />

• Explain the concept and purpose of<br />

determining a firm’s cost of capital.<br />

• Explain the difficulty encountered in finding<br />

profitable projects in competitive markets and<br />

the importance of the search.<br />

• Determine the acceptability of investment<br />

proposals by discounted cash flow criteria<br />

using NPV and IRR methods.<br />

©2012, Varmelous Ind. Inc. -- Slide 1

The Concept of the Cost<br />

of Capital<br />

• In capital budgeting there are two<br />

major aspects to be considered:<br />

– The investment decision, and<br />

– The financing decision.<br />

©2012, Varmelous Ind. Inc. -- Slide 2

The Concept of the Cost<br />

of Capital<br />

• The investment decision is the decision to<br />

acquire an asset, a project, or product line,<br />

i.e., to buy, to lease, or not to lease.<br />

– It is partly derived from the management decision<br />

that requires a minimum rate of return<br />

expectation from such an investment. This rate is<br />

called by various names: hurdle rate, cost of<br />

capital, cut-off-rate, discount rate, or required rate<br />

of return (RRR).<br />

©2012, Varmelous Ind. Inc. -- Slide 3

The Concept of the Cost<br />

of Capital<br />

• The financing decision<br />

• The financing decision is a method of raising<br />

capital to make the investment decision, i.e., by<br />

creating debt, i.e. debentures, bank loans, leases,<br />

or by sale of equity, or both.<br />

©2012, Varmelous Ind. Inc. -- Slide 4

The Concept of the Cost<br />

of Capital<br />

• To summarize, the cost of capital is the rate<br />

of return on the firm’s total investments<br />

which earns the average rate of return<br />

needed to satisfy all the sources of longterm<br />

financing:<br />

• Therefore…<br />

©2012, Varmelous Ind. Inc. -- Slide 5

The Concept of the Cost<br />

of Capital<br />

• when the firm's rate of return is the<br />

same as its cost of capital on an<br />

investment project, the price of its<br />

common shares normally remain<br />

unchanged following the acceptance<br />

and implementation of the project,<br />

• and…<br />

©2012, Varmelous Ind. Inc. -- Slide 6

The Concept of the Cost<br />

of Capital<br />

• when the firm earns a greater rate of return than<br />

its cost of capital, the greater return will normally<br />

increase the value of the firm’s common shares and<br />

consequently, an increase in shareholder wealth.<br />

• Important to remember..<br />

– The minimum rate of return that an investment is<br />

expected to provide in order to justify its acquisition is<br />

known as the hurdle rate, cost of capital, cut-off-rate, or<br />

discount rate, or the required rate of return (RRR).<br />

©2012, Varmelous Ind. Inc. -- Slide 7

The Concept of the Cost<br />

of Capital<br />

• It is important to note that investment and<br />

financing decisions should be based on the<br />

investor’s marginal cost of capital. Management<br />

should avoid using subjective criterion when<br />

analyzing investment and financing proposals. The<br />

marginal cost of capital has been determined in the<br />

financial markets. This encourages management to<br />

impose market discipline on its decisions. Finally,<br />

this approach ensures that market or intrinsic value<br />

is added to shareholder wealth.<br />

©2012, Varmelous Ind. Inc. -- Slide 8

Difficulty and importance in<br />

finding profitable projects<br />

• Due to competition, it is difficult to find new project<br />

ideas that are profitable.<br />

• If a company develops a new and profitable<br />

product, it will not be long before other companies<br />

introduce a competitive product at a lower price in<br />

order to capture market share. Such competitive<br />

forces will result in lower profits and it may happen<br />

very quickly, especially if there isn't any barrier to<br />

entry into the market.<br />

©2012, Varmelous Ind. Inc. -- Slide 9

Difficulty and importance in<br />

finding profitable projects<br />

• For companies to remain competitive and survive,<br />

they must practice timely investments in new<br />

profitable projects.<br />

• Putting into practice a strategy of implementing<br />

such investments shall require the use of capital<br />

budgeting techniques.<br />

©2012, Varmelous Ind. Inc. -- Slide 10

Capital Budgeting<br />

• When evaluating a Proposed Capital Expenditure<br />

Net after-tax cash flows, and not accounting net<br />

income, are used to evaluate proposed capital<br />

expenditures.<br />

• Evaluation of a Proposed Capital Expenditure can<br />

be separated into two categories (methods), as<br />

follows:<br />

– Non-discounted cash flow techniques, and<br />

– Discounted cash flow (DCF) techniques<br />

©2012, Varmelous Ind. Inc. -- Slide 11

Capital Budgeting<br />

• The major difference between the two methods of<br />

evaluation is:<br />

– Discounted cash flows recognize the time-valueof-money.<br />

As you may be well aware, a dollar<br />

today is worth more than a dollar tomorrow and<br />

much more than one five years from now.<br />

©2012, Varmelous Ind. Inc. -- Slide 12

Capital Budgeting<br />

• Cash Flows:<br />

– The evaluation of a proposed capital project<br />

involves the use of net after-tax cash flows, (net<br />

meaning cash receipts less cash disbursements),<br />

rather than the concept of accounting net<br />

income. Cash in-flows are receipt of cash and<br />

cash out-flows are those transactions that<br />

require an expenditure of cash.<br />

©2012, Varmelous Ind. Inc. -- Slide 13

Capital Budgeting<br />

• Cash Flow examples:<br />

– The Examples of cash in-flows are new or additional sales and<br />

savings due to lower or eliminated product costs or expenses.<br />

– Examples of cash out-flows are additional purchases of materials,<br />

increased cost for labour or other overheads (indirect expenses),<br />

such as the incremental increase in: rent, utilities, taxes, and<br />

other similar expenses that require a cash disbursement, related<br />

to the project.<br />

• Some expenses do not require a cash out-flow and are not directly<br />

considered in the cash flow analysis. Examples of such expenses are<br />

any form of amortization (depreciation or depletion) of a capital<br />

asset.<br />

©2012, Varmelous Ind. Inc. -- Slide 14

Capital Budgeting<br />

• Discounted Cash Flow example:<br />

• The cash flows in the example presented are<br />

somewhat simplified. Some of the elements of the<br />

cash flow analysis, such as tax shields, which are<br />

the result of depreciation for tax purposes, known<br />

as Capital Cost Allowance, (commonly abbreviated<br />

as CCA) will be provided without supporting detail.<br />

The Finance department of your company would<br />

usually provide such details.<br />

©2012, Varmelous Ind. Inc. -- Slide 15

Discounted Cash Flow –<br />

Net Present Value (NPV)<br />

• Discounted cash flow techniques base the decisions<br />

on the investment’s cash flows after it is adjusted<br />

for the time value of money.<br />

• In this presentation we will ignore the problem of<br />

incorporating risk into capital budgeting decisions.<br />

Also, the appropriate required rate of return<br />

(R.R.R.) will be given.<br />

©2012, Varmelous Ind. Inc. -- Slide 16

Discounted Cash Flow –<br />

Net Present Value (NPV)<br />

• The two most frequently used discounted cash flow<br />

evaluators are:<br />

• Net Present Value (NPV) which measures discounted cash<br />

flows in versus discounted cash flows out, using the stipulated<br />

required rate of return, and<br />

• Internal Rate of Return (IRR) which is the rate of return at<br />

which the discounted cash flows in are equal to the<br />

discounted cash flows out, i.e., net present value is equal to<br />

zero.<br />

• Both of these methods have similar advantages and<br />

disadvantages.<br />

©2012, Varmelous Ind. Inc. -- Slide 17

Discounted Cash Flow –<br />

Net Present Value (NPV)<br />

• The main advantages are:<br />

• All net cash flows over the life of the project are considered in<br />

the evaluation, and<br />

• The time value of money is recognized, i.e., earlier cash flows<br />

are better (worth more) than are later cash flows.<br />

• The main disadvantages are:<br />

• Much detailed information must be identified and gathered,<br />

and<br />

• Calculations can be time consuming and complex.<br />

©2012, Varmelous Ind. Inc. -- Slide 18

Discounted Cash Flow –<br />

Net Present Value (NPV)<br />

• However, modern personal computers with<br />

spreadsheet software have negated much of the<br />

computational complexity and allow for almost<br />

instantaneous what-if scenarios for alternate<br />

consideration in the evaluation process.<br />

• The use of recent integral computing techniques<br />

contained in most spreadsheet programs like Excel,<br />

make the computation of both NPV and IRR<br />

relatively simple. Tools like Goal Seek will facilitate<br />

the computation of IRR once NPV has been<br />

calculated using the requisite data.<br />

©2012, Varmelous Ind. Inc. -- Slide 19

Discounted Cash Flow –<br />

Net Present Value (NPV)<br />

• The project’s NPV is the net value in today’s dollars<br />

of the cash in-flows and out-flows. The TVM factor<br />

is not violated because all of the cash flows are<br />

discounted back to the present. The deciding<br />

criteria are:<br />

• NPV => 0, accept project because the project’s return on<br />

investment (ROI) is equal to or greater than the firm’s<br />

required rate of return (RRR).<br />

• NPV < 0, reject project because the project’s ROI is less<br />

than the firm’s RRR.<br />

• NPV = 0, then the project is returning the firm’s RRR.<br />

©2012, Varmelous Ind. Inc. -- Slide 20

Discounted Cash Flow –<br />

Net Present Value (NPV)<br />

• The reason for the use of the Net Present<br />

Value (NPV) method is quite clear.<br />

– If a firm accepts a project with a positive NPV,<br />

the value of the firm will increase and thus<br />

so will the wealth of the current<br />

shareholders.<br />

– The inverse holds true, if there is a negative<br />

NPV the shareholder wealth will decrease.<br />

©2012, Varmelous Ind. Inc. -- Slide 21

Discounted Cash Flow –<br />

Net Present Value (NPV)<br />

• Guidelines to Capital budgeting<br />

• In order to carry out capital budgeting analysis<br />

properly, we must identify net after-tax cash flows<br />

that are incremental with respect to the project<br />

under consideration and evaluate the attractiveness<br />

of these cash flows relative to the project’s cost.<br />

©2012, Varmelous Ind. Inc. -- Slide 22

Discounted Cash Flow –<br />

Net Present Value (NPV)<br />

• Cash Flows vs. Accounting Profits<br />

• We will use net after-tax cash flows, and not<br />

accounting concepts of income and expense, as our<br />

measurement tool. Because of the accrual method<br />

of accounting, a firm’s accounting profits and cash<br />

flows may not be timed to occur together.<br />

©2012, Varmelous Ind. Inc. -- Slide 23

Discounted Cash Flow –<br />

Net Present Value (NPV)<br />

• Ignore Interest Payments and Financing<br />

Flows<br />

– Because the NPV method uses the Required Rate of<br />

Return (RRR), the financing decision is kept separate from<br />

the investment decision.<br />

– We are assuming for the most part that the firm’s cost of<br />

capital structure, i.e. shares, debentures, debt, etc. will<br />

not change by implementing the new project. Thus,<br />

interest payments and other financial cash flow issues<br />

resulting from raising funds to finance the project are not<br />

considered incremental cash flows.<br />

©2012, Varmelous Ind. Inc. -- Slide 24

Discounted Cash Flow –<br />

Net Present Value (NPV)<br />

• Income Tax<br />

– When a corporation earns an income, it is required to pay<br />

taxes on that income to both the federal and provincial<br />

government. In the converse, if a corporation spends<br />

money to earn the income, they can deduct the expenses<br />

from the income and reduce the amount of income tax<br />

that needs to be paid.<br />

– The income tax rates differ by the type of business and<br />

the provincial residency of the corporation.<br />

– The rates that would be used in a capital budget project<br />

would be made available by the Finance Department.<br />

©2012, Varmelous Ind. Inc. -- Slide 25

Discounted Cash Flow –<br />

Net Present Value (NPV)<br />

• Present Value Tax Shield<br />

• This item appears as part of the capital budget process. The<br />

information would be provided by the Finance Department.<br />

• Present Value Tax Shield —<br />

Lost on Salvage Value<br />

• This item appears as part of the capital budget process. The<br />

information would be provided by the Finance Department.<br />

©2012, Varmelous Ind. Inc. -- Slide 26

Discounted Cash Flow –<br />

Net Present Value (NPV)<br />

• Cash Flows Diverted from Existing Projects<br />

• Do not include cash flows achieved that could have also been<br />

earned under the previous scenario. Again, this takes us back<br />

to the concept of thinking incrementally.<br />

• Incidental or Synergistic Effects<br />

• In certain situations, a new effort may actually bring<br />

additional sales to the existing product line. When analyzing<br />

the firm’s bottom line, we should consider any cash flow that<br />

may find its way into another part of the company as a result<br />

of adopting the new project.<br />

©2012, Varmelous Ind. Inc. -- Slide 27

Discounted Cash Flow –<br />

Net Present Value (NPV)<br />

• Account for Opportunity Costs<br />

• Opportunity costs cause negative cash flows because the<br />

firm’s existing assets are being diverted from existing projects<br />

to the newly implemented project. The firm loses the cash<br />

flows that would have been obtained from the previous<br />

projects.<br />

• Consider Incremental Expenses<br />

• Just as cash in-flows from a new project are measured on an<br />

incremental basis, expenses should also be measured on an<br />

incremental basis.<br />

©2012, Varmelous Ind. Inc. -- Slide 28

Discounted Cash Flow –<br />

Net Present Value (NPV)<br />

• Sunk Costs Are Not Incremental Cash Flows<br />

• The NPV method requires that we concern ourselves with<br />

cash flows that are affected by the decision making at the<br />

moment. If the cash flow happens regardless whether the<br />

project is accepted or rejected, than it has no bearing on the<br />

NPV decision.<br />

©2012, Varmelous Ind. Inc. -- Slide 29

Discounted Cash Flow –<br />

Net Present Value (NPV)<br />

• Include Working-Capital Requirements<br />

• Working-capital requirements are considered a cash out-flow.<br />

For example, an additional investment in inventory is<br />

considered a cash out-flow when the goods are held because,<br />

while the goods are kept inside the stock room, the firm does<br />

not have access to the inventory’s cash value. The firm loses<br />

the opportunity to use the money for other investments<br />

during the life of the project. Upon termination of the project,<br />

there may be a partial recovery of the initial amount invested<br />

in working-capital.<br />

©2012, Varmelous Ind. Inc. -- Slide 30

Discounted Cash Flow –<br />

Net Present Value (NPV)<br />

• Cash Flows from Changes in Overhead<br />

• The NPV method requires that we include any incremental<br />

cash flow that causes a change in overhead expenses.<br />

• However, one must take care in ensuring that this is a truly<br />

incremental cash flow. Quite often, overhead expenses are<br />

fixed and are incurred whether or not a project is<br />

implemented.<br />

• An example of a cash flow that would be included is if the<br />

new machinery actually reduces the direct labour costs and its<br />

associated costs, e.g. employee benefits, i.e. fewer machine<br />

operators.<br />

©2012, Varmelous Ind. Inc. -- Slide 31

Discounted Cash Flow –<br />

Net Present Value (NPV)<br />

• Example Problem<br />

• The following business case will be used to develop a capital<br />

budgeting worksheet in Excel that will quickly calculate the<br />

NPV for this investment proposal.<br />

• The K. WattsaVolt Inc. Company, a manufacturer of electronic<br />

components is considering the purchase of a new fully<br />

automated machine, called the Eddison, to replace an older,<br />

manually operated one.<br />

• The following is the relevant information obtained:<br />

©2012, Varmelous Ind. Inc. -- Slide 32

Discounted Cash Flow –<br />

Net Present Value (NPV)<br />

• Example Problem<br />

• The required rate of return on projects of this kind is 20%.<br />

• The company is in the 40% combined corporate tax-bracket,<br />

• Both machines belong to an asset class which Revenue<br />

Canada requires that they use the declining balance method<br />

CCA (Capital Cost Allowance) at a rate of 30%.<br />

• The project life has been set at 5 years.<br />

• The salvage value of this new machine is expected to be<br />

$12,000 after five years, and the asset class will continue to<br />

remain open.<br />

©2012, Varmelous Ind. Inc. -- Slide 33

Discounted Cash Flow –<br />

Net Present Value (NPV)<br />

• Example Problem<br />

• In addition, an increase in raw materials and goods-in-process<br />

inventories would be required of $6,000. This increase in<br />

inventories would be recovered at the end of five years.<br />

• Inflation is estimated at the rate of 2% per year for wages,<br />

benefits, maintenance and defects.<br />

• It took three employees to operate the old machine, and they<br />

earned a combined total of $90,000 per year in wages.<br />

• The new machine will require only two more skilled<br />

employees for a total wage expense of $74,000 per year.<br />

• The fringe benefits are estimated at 25% of the wages.<br />

©2012, Varmelous Ind. Inc. -- Slide 34

Discounted Cash Flow –<br />

Net Present Value (NPV)<br />

• Example Problem<br />

• The annual cost of maintenance and defects associated with<br />

the old machine were $10,000.<br />

• The annual costs of maintenance and defects on the new<br />

machine would be $3,500.<br />

• The replacement machine being considered has a purchase<br />

price of $70,000.<br />

• Shipping installation and testing of new machine is estimated<br />

at $8,350.<br />

• The old machine can now be sold for $25,000.<br />

©2012, Varmelous Ind. Inc. -- Slide 35

Discounted Cash Flow –<br />

Net Present Value (NPV)<br />

NPV DCF Example – Input criteria<br />

©2012, Varmelous Ind. Inc. -- Slide 36

Discounted Cash Flow –<br />

Net Present Value (NPV)<br />

NPV DCF Example – Present Value of Cash Flow<br />

©2012, Varmelous Ind. Inc. -- Slide 37

Discounted Cash Flow –<br />

Net Present Value (NPV)<br />

NPV DCF Example – NPV of Cash Flow<br />

©2012, Varmelous Ind. Inc. -- Slide 38

Discounted Cash Flow –<br />

(IRR)<br />

IRR DCF Example – NPV = $0 of Cash Flow<br />

©2012, Varmelous Ind. Inc. -- Slide 39

Discounted Cash Flow –<br />

(IRR)<br />

IRR DCF Example – NPV = $0 of Cash Flow<br />

Since the IRR of 25.9% is greater than the RRR of 20%,<br />

the project would be accepted.<br />

©2012, Varmelous Ind. Inc. -- Slide 40

About the presenter<br />

• Michel has developed and co-authored a Finance workbook<br />

for an Ontario college’s School of Business which is updated<br />

annually. He is also the author and provides instruction to the<br />

<strong>CITT</strong> association’s students on a senior level Web Based<br />

Distance Education Logistics Decision Modeling course. He has<br />

recently joined the School of Business Commerce and<br />

Business Administration at Vanier College in Montreal,<br />

Quebec. Michel can be reached by emailing him at;<br />

– bauermichel@hotmail.com<br />

©2012, Varmelous Ind. Inc. -- Slide 41