Anti-Fraud Plan - Louisiana Department of Insurance

Anti-Fraud Plan - Louisiana Department of Insurance

Anti-Fraud Plan - Louisiana Department of Insurance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

THE LOUISIANA DEPARTMENT OF INSURANCE<br />

FRAUD SECTION PROCEDURES<br />

August 12, 2011<br />

Presented by:<br />

Paul Boudreaux, Jr., Director, <strong>Insurance</strong> <strong>Fraud</strong> Section<br />

Warren E. Byrd, II, Executive Counsel<br />

1

2011 Filing & Compliance Seminar<br />

WHAT IS THE FRAUD SECTION<br />

• FRAUD Section was established by statute in 1993- LSA-R.S. 22:<br />

1921, et seq, as an INVESTIGATORY BODY. We do not have<br />

any arrest or prosecutorial authority.<br />

• FRAUD Section is part <strong>of</strong> a three-agency <strong>Insurance</strong> <strong>Fraud</strong> Task<br />

Force that was established in 1999 to begin Jan 1, 2000, which<br />

includes the <strong>Louisiana</strong> State Police <strong>Insurance</strong> <strong>Fraud</strong>/Auto Theft<br />

Unit and the <strong>Louisiana</strong> <strong>Department</strong> <strong>of</strong> Justice (Attorney<br />

General) <strong>Fraud</strong> Unit<br />

2

2011 Filing & Compliance Seminar<br />

• Because <strong>of</strong> the sensitive nature <strong>of</strong> fraud reports and<br />

investigations, all fraud complaints are Confidential.<br />

• The FRAUD Section records are exempt from public<br />

inspection, and FRAUD Section records and personnel<br />

are exempt from subpoena in all civil proceedings.<br />

LSA-R.S. 22:1927 & 1929.<br />

• Criminal background information is confidential and<br />

shall not be disclosed outside the FRAUD Section<br />

Office. LSA-R.S. 22:1929.<br />

3

2011 Filing & Compliance Seminar<br />

THE FRAUD SECTION PERSONNEL<br />

• FRAUD Section is a part <strong>of</strong> the Legal Division <strong>of</strong> the<br />

<strong>Insurance</strong> <strong>Department</strong>.<br />

• FRAUD Section consists <strong>of</strong> a Director, Assistant<br />

Director, Senior Investigator, Six Investigators,<br />

Secretary and two Student Workers<br />

4

2011 Filing & Compliance Seminar<br />

MANDATORY REPORTS OF SUSPECTED<br />

FRAUD BY LICENSED ENTITIES<br />

• LSA-R.S. 22: 1926 & LSA-R.S. 40:1424<br />

• Any person, company or legal entity involved in the<br />

business <strong>of</strong> insurance<br />

• Within 60 days <strong>of</strong> receipt <strong>of</strong> a suspected fraudulent<br />

claim<br />

• Must report the suspected fraud to the FRAUD Section<br />

5

2011 Filing & Compliance Seminar<br />

• LSA-R.S. 22:1928 & LSA-R.S. 40:1425<br />

• Civil Immunity from lawsuit for insurers, employees<br />

and agents for libel, slander (defamation <strong>of</strong><br />

character) or other relevant tort<br />

• All persons (licensed entities) covered by LSA-R.S.<br />

22: 1926 can recover attorney’s fees and costs if sued<br />

and the suit is determined to be without substantial<br />

justification.<br />

6

2011 Filing & Compliance Seminar<br />

THE BUSINESS OF THE FRAUD SECTION<br />

• ANSWERS ALL QUESTIONS RELATIVE TO<br />

SUSPECTED FRAUD<br />

• FRAUD Section responds to QUESTIONS as to<br />

whether a certain activity may constitute fraud and,<br />

if applicable, how to file a formal fraud complaint.<br />

7

2011 Filing & Compliance Seminar<br />

• FRAUD Section responds to suspected fraud reports from<br />

individuals. GENERAL PUBLIC FRAUD COMPLAINT.<br />

It can be filled anonymously or by an identified person.<br />

• FRAUD Section conducts investigations <strong>of</strong> suspected fraud<br />

reports from insurance companies, producers, agents,<br />

adjusters and bail bondsmen. DETAILED INDUSTRY<br />

FRAUD COMPLAINT.<br />

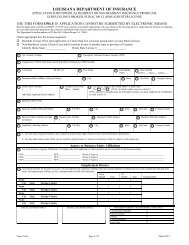

• Both forms are on the LDI Webpage under “Report<br />

<strong>Insurance</strong> <strong>Fraud</strong>.<br />

8

2011 Filing & Compliance Seminar<br />

PROCEDURE UPON RECEIPT OF<br />

SUSPECTED FRAUD REPORT<br />

• Be sure to be specific as to why this is fraudulent and<br />

the amount <strong>of</strong> money involved, even if the claim was<br />

denied. Attach or send to FRAUD Section ASAP the<br />

file’s summary or outline and any documents that<br />

support the allegations <strong>of</strong> suspected fraud.<br />

9

2011 Filing & Compliance Seminar<br />

• FRAUD Section reviews the suspected fraud report<br />

and all supporting documents.<br />

• After review <strong>of</strong> the documents and investigation thru<br />

our data bases, a decision is made whether to:<br />

• Refer for “criminal” investigation and prosecution,<br />

or<br />

• Retain in “inactive” folder pending additional<br />

information.<br />

10

2011 Filing & Compliance Seminar<br />

• Referred for Criminal Investigation and Prosecution<br />

• Regular meetings with the :<br />

• <strong>Louisiana</strong> State Police (LSP)<br />

• <strong>Department</strong> <strong>of</strong> Justice (DOJ)<br />

• National Information Crime Bureau (NICB)<br />

• The files are accepted for criminal referral, rejected for<br />

criminal referral, or deferred.<br />

11

2011 Filing & Compliance Seminar<br />

ISSUANCE OF CEASE & DESIST<br />

ORDER WITH CIVIL FINE<br />

• If fraud, crime or unauthorized activity is determined<br />

to have occurred BY A LICENSED ENTITY, (or an<br />

unlicensed entity that it attempting to sell insurance)<br />

then the LDI may issue a CEASE & DESIST ORDER,<br />

accompanied with an appropriated CIVIL FINE.<br />

• LSA-R.S. 22:1969.<br />

12

2011 Filing & Compliance Seminar<br />

A CEASE AND DESIST ORDER AND FINE CAN BE SERVED ON A LICENSED ENTITY<br />

(OR AN UNLICENSED ENTITY ENGAGED IN INSURANCE BUSINESS)<br />

• Not all C&D’s stop the insurance business<br />

• For a Summary Suspension, we must show that the public health, safety, or welfare<br />

imperatively requires emergency action to immediately stop the alleged activity<br />

• LSA-R.S. 49:961 & LSA-R.S. 22:1969 & 1970<br />

• Most C&D’s are served with a Notice <strong>of</strong>: CIVIL FINE<br />

LICENSE SUSPENSION<br />

and/or<br />

LICENSE REVOCATION<br />

• All C&D’s are served with information as to how to request a HEARING TO APPEAL<br />

the action <strong>of</strong> the LDI<br />

13

2011 Filing & Compliance Seminar<br />

NUMBER OF SUSPECTED FRAUD COMPLAINTS<br />

• In 2005 2,384<br />

• In 2006 1,466<br />

• In 2007 1,328<br />

• In 2008 1,427<br />

• In 2009 1,729<br />

• In 2010 2,944<br />

• In 2011 1,446 (thru June 30, 2011)<br />

14

2011 Filing & Compliance Seminar<br />

INVESTIGATES APPLICATIONS FOR<br />

18 USC SEC. 1033 CONSENT<br />

• FRAUD Section conducts investigations into<br />

applications for consent under 18 USC SECTION 1033.<br />

This federal statute provides a means for a person with<br />

a felony conviction involving dishonesty or breach<br />

<strong>of</strong> trust or who has been convicted under that<br />

section to apply for a consent from 18 USC SECTION 1033<br />

prohibition from working in the business <strong>of</strong> insurance.<br />

15

2011 Filing & Compliance Seminar<br />

INVESTIGATES COMPANIES AND PERSONS<br />

SEEKING A LOUISIANA INSURANCE LICENSE<br />

• FRAUD Section investigates criminal backgrounds and<br />

administrative actions against persons and companies applying<br />

for a license or license renewal.<br />

• FRAUD Section conducts investigations <strong>of</strong> BIOGRAPHICAL<br />

AFFIDAVITS for Company and Third Party Administrator<br />

Licensing. Any company which applies for a license to sell<br />

insurance or manage insurance in <strong>Louisiana</strong> has to provide<br />

Biographical Affidavits for each OFFICER, DIRECTOR and<br />

OWNER <strong>of</strong> 10% or more <strong>of</strong> the ownership <strong>of</strong> the company.<br />

16

2011 Filing & Compliance Seminar<br />

INVESTIGATES COMPANIES SEEKING TO<br />

REGISTER TO DO BUSINESS IN LOUISIANA<br />

• FRAUD Section conducts investigations <strong>of</strong><br />

Risk Purchasing Groups, Risk Retention Groups and<br />

Discount Medical <strong>Plan</strong>s desiring to REGISTER its<br />

company to do business in <strong>Louisiana</strong>.<br />

• FRAUD Section examines and investigates the affidavit <strong>of</strong><br />

each person, conducts a background check and<br />

recommends an APPROVAL or DISAPPROVAL.<br />

17

2011 Filing & Compliance Seminar<br />

INVESTIGATES “YES” FILES<br />

• License applications or notices that reveal criminal or<br />

administrative activity , securities violations, <strong>Louisiana</strong><br />

income tax debt or child support arrearage.<br />

• Recommends Approval or Disapproval.<br />

18

2011 Filing & Compliance Seminar<br />

HOW CAN SOMEONE CONTACT<br />

THE LDI FRAUD SECTION?<br />

• By WEBSITE: www.ldi.state.la.us<br />

Click on the “Report <strong>Insurance</strong> <strong>Fraud</strong>” Link<br />

Click on the “General Public <strong>Fraud</strong> Report Form”<br />

Or, the “Detailed Industry <strong>Fraud</strong> Report Form”<br />

19

2011 Filing & Compliance Seminar<br />

• By FACSIMILE: (225) 342-7393<br />

• By U. S. MAIL:<br />

<strong>Louisiana</strong> <strong>Department</strong> <strong>of</strong> <strong>Insurance</strong><br />

FRAUD SECTION<br />

P.O. Box 3096<br />

Baton Rouge, LA 70821<br />

20

2011 Filing & Compliance Seminar<br />

• By HAND DELIVERY OR PAID COURIER:<br />

<strong>Louisiana</strong> <strong>Department</strong> <strong>of</strong> <strong>Insurance</strong><br />

Poydras Building<br />

1702 N. Third Street<br />

Baton Rouge, LA 70802<br />

ATTENTION: FRAUD SECTION<br />

• By TELEPHONE: (225) 342-4956<br />

(800) 259-5300 or 5301<br />

(Toll free only in <strong>Louisiana</strong>)<br />

21

2011 Filing & Compliance Seminar<br />

• QUESTIONS!<br />

22