VIDYASAGAR UNIVERSITY JOURNAL OF COMMERCE

VIDYASAGAR UNIVERSITY JOURNAL OF COMMERCE

VIDYASAGAR UNIVERSITY JOURNAL OF COMMERCE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

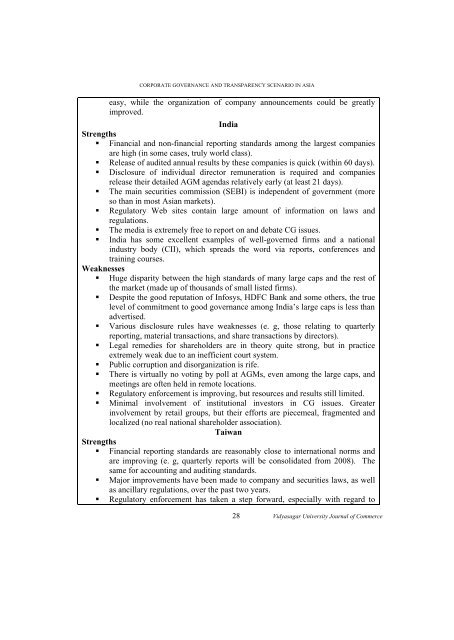

CORPORATE GOVERNANCE AND TRANSPARENCY SCENARIO IN ASIA<br />

easy, while the organization of company announcements could be greatly<br />

improved.<br />

India<br />

Strengths<br />

• Financial and non-financial reporting standards among the largest companies<br />

are high (in some cases, truly world class).<br />

• Release of audited annual results by these companies is quick (within 60 days).<br />

• Disclosure of individual director remuneration is required and companies<br />

release their detailed AGM agendas relatively early (at least 21 days).<br />

• The main securities commission (SEBI) is independent of government (more<br />

so than in most Asian markets).<br />

• Regulatory Web sites contain large amount of information on laws and<br />

regulations.<br />

• The media is extremely free to report on and debate CG issues.<br />

• India has some excellent examples of well-governed firms and a national<br />

industry body (CII), which spreads the word via reports, conferences and<br />

training courses.<br />

Weaknesses<br />

• Huge disparity between the high standards of many large caps and the rest of<br />

the market (made up of thousands of small listed firms).<br />

• Despite the good reputation of Infosys, HDFC Bank and some others, the true<br />

level of commitment to good governance among India’s large caps is less than<br />

advertised.<br />

• Various disclosure rules have weaknesses (e. g, those relating to quarterly<br />

reporting, material transactions, and share transactions by directors).<br />

• Legal remedies for shareholders are in theory quite strong, but in practice<br />

extremely weak due to an inefficient court system.<br />

• Public corruption and disorganization is rife.<br />

• There is virtually no voting by poll at AGMs, even among the large caps, and<br />

meetings are often held in remote locations.<br />

• Regulatory enforcement is improving, but resources and results still limited.<br />

• Minimal involvement of institutional investors in CG issues. Greater<br />

involvement by retail groups, but their efforts are piecemeal, fragmented and<br />

localized (no real national shareholder association).<br />

Taiwan<br />

Strengths<br />

• Financial reporting standards are reasonably close to international norms and<br />

are improving (e. g, quarterly reports will be consolidated from 2008). The<br />

same for accounting and auditing standards.<br />

• Major improvements have been made to company and securities laws, as well<br />

as ancillary regulations, over the past two years.<br />

• Regulatory enforcement has taken a step forward, especially with regard to<br />

28 Vidyasagar University Journal of Commerce