You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

PRESS RELEASE<br />

19 October <strong>2006</strong> 2 (15)<br />

OLLI-PEKKA KALLASVUO, NOKIA CEO:<br />

“<strong>Nokia</strong> delivered 20% net sales growth year on year, with excellent market share gains in our device<br />

business. We saw impressive share gains in the fast growing emerging markets, where we continued to<br />

build on our clear number one position. Catering mostly to the emerging markets, our entry-level device<br />

business performed extremely well, driven by outstanding volume growth and a solid product portfolio. The<br />

strong growth in the entry-level coupled with a lower percentage of sales in higher end products impacted<br />

our margins.<br />

In our multimedia business, we continued to perform well, with 45% year on year net sales growth in the<br />

third quarter. In infrastructure, Networks net sales grew faster than the market and we remain focused on<br />

improving profitability. <strong>Nokia</strong> and Siemens have made good progress toward the merger of <strong>Nokia</strong>’s<br />

Networks business group and Siemens’ carrier-related operations and continue to expect that operations<br />

will start in January.”<br />

INDUSTRY AND NOKIA OUTLOOK FOR THE FOURTH QUARTER AND FULL YEAR <strong>2006</strong><br />

• <strong>Nokia</strong> expects industry mobile device volumes in the fourth quarter <strong>2006</strong> to grow by 15% or more<br />

sequentially.<br />

• We expect <strong>Nokia</strong>’s device market share in the fourth quarter <strong>2006</strong> to be approximately at the same level<br />

sequentially.<br />

• Sales in our networks business are expected to grow sequentially in the fourth quarter, but at a rate less<br />

than previous years.<br />

• <strong>Nokia</strong> expects that the mobile device market volume will be approximately 970 million units in <strong>2006</strong>, while<br />

our estimate for 2005 was approximately 795 million units.<br />

• We continue to expect the device industry to experience value growth in <strong>2006</strong>, but expect some decline in<br />

industry ASPs, primarily reflecting the increasing impact of the emerging markets and competitive factors<br />

in general.<br />

• <strong>Nokia</strong> continues to expect moderate growth in the mobile infrastructure market in euro terms in <strong>2006</strong>.<br />

• <strong>Nokia</strong> continues to target an increase in its <strong>2006</strong> market share in mobile devices and infrastructure.<br />

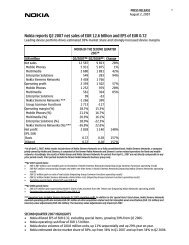

Q3 <strong>2006</strong> FINANCIAL HIGHLIGHTS<br />

(Comparisons are given to the third quarter 2005 results, unless otherwise indicated.)<br />

<strong>Nokia</strong> Group<br />

<strong>Nokia</strong>'s third quarter <strong>2006</strong> net sales increased 20% to EUR 10.1 billion, compared with EUR 8.4 billion in the<br />

third quarter 2005. At constant currency, group net sales would have increased 18%.<br />

<strong>Nokia</strong>'s third quarter <strong>2006</strong> operating profit decreased 4% to EUR 1 100 million (including the negative<br />

impact of EUR 128 million in special items), compared with EUR 1 149 million in the third quarter 2005<br />

(including the positive impact of EUR 87 million in special items). <strong>Nokia</strong>’s third quarter <strong>2006</strong> operating<br />

margin was 10.9% (13.7%), including the impact of the respective special items, and 12.2% (12.6%)<br />

excluding the special items.<br />

Operating cash flow for the third quarter <strong>2006</strong> was EUR 1.0 billion, compared with EUR 1.2 billion for the<br />

third quarter 2005, and total combined cash and other liquid assets were EUR 7.9 billion, compared with<br />

EUR 9.9 billion at December 31, 2005. As of September 30, <strong>2006</strong>, our net debt-equity ratio (gearing) was<br />

-67%, compared with -77% at December 31, 2005.