Download - Jindal Group of Companies

Download - Jindal Group of Companies

Download - Jindal Group of Companies

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

17TH ANNUAL REPORT 2004-2005<br />

Expanding horizon through the pursuit <strong>of</strong> perfection.<br />

MAHARASHTRA SEAMLESS LIMITED<br />

AN ISO 9001:2000 COMPANY

MAHARASHTRA SEAMLESS LIMITED<br />

BOARD OF DIRECTORS<br />

D.P. <strong>Jindal</strong> Chairman<br />

Saket <strong>Jindal</strong> Managing Director<br />

U.C. Agarwal<br />

D.K. Parikh<br />

S.D. Sharma<br />

H.K. Khanna<br />

AUDIT COMMITTEE<br />

U.C. Agarwal Chairman<br />

D.P. <strong>Jindal</strong><br />

H.K. Khanna<br />

COMPANY SECRETARY<br />

Praveen Mudgal<br />

AUDITORS<br />

Kanodia Sanyal & Associates<br />

Chartered Accountants<br />

New Delhi<br />

BANKERS<br />

State Bank <strong>of</strong> Patiala<br />

State Bank <strong>of</strong> Bikaner & Jaipur<br />

Standard Chartered Bank<br />

HDFC Bank Limited<br />

REGISTERED OFFICE<br />

Pipe Nagar, Village-Sukeli,<br />

N.H.17, B.K.G. Road, Taluka Roha,<br />

Distt. Raigad - 402 126,<br />

Maharashtra<br />

CORPORATE OFFICE<br />

Plot No. 30, Institutional Sector 44,<br />

Gurgaon – 122 002,<br />

Haryana<br />

HEAD OFFICE<br />

106, Nilgiri Apartments,<br />

9, Barakhamba Road,<br />

New Delhi-110 001<br />

MUMBAI OFFICE<br />

402, Sarjan Plaza,<br />

100, Dr. Annie Besant Road,<br />

Opp. TELCO Showroom,<br />

Worli, Mumbai - 400 018<br />

KOLKATA OFFICE<br />

Sukhsagar Apartment,<br />

Flat No. 8A, 8th Floor,<br />

2/5, Sarat Bose Road,<br />

Kolkata - 700 020<br />

CHENNAI OFFICE<br />

3A, Royal Court,<br />

44, Venkatanarayan Road,<br />

T. Nagar,<br />

Chennai - 600 017<br />

WORKS:<br />

1. SEAMLESS & ERW PIPES:<br />

Pipe Nagar, Village - Sukeli,<br />

N.H.17, B.K.G. Road,<br />

Taluka Roha,<br />

Distt. Raigad - 402 126<br />

Maharashtra<br />

2. WIND POWER:<br />

Village Nivkane, Taluka Patan,<br />

District Satara,<br />

Maharashtra<br />

Website: www.jindal.com

MAHARASHTRA SEAMLESS LIMITED<br />

CONTENTS<br />

Page No.<br />

Chairman’s Statement 3<br />

Message from the Managing Director 5<br />

Selected Financial Indicators <strong>of</strong> last 10 Year 6<br />

Notice 7-9<br />

Directors’ Report 10-14<br />

Corporate Governance Report 15-18<br />

Shareholders’ Information 18-20<br />

Management Discussion & Analysis 22-24<br />

Auditors’ Report 25-27<br />

Balance Sheet 28<br />

Pr<strong>of</strong>it & Loss Account 29<br />

Schedules & Notes on Accounts 30-46<br />

Cash Flow Statement 47<br />

Proxy Form & Attendance Slip<br />

Annexed<br />

1

“ With our established product range upto 7” dia.<br />

<strong>of</strong> Seamless Pipes and Tubes, we are now all set<br />

to accept all requirements upto 14” dia.”<br />

2

Chairman's<br />

Statement<br />

Dear Shareholders,<br />

The world economy has seen lots <strong>of</strong> turnarounds in various sectors. In the last one<br />

year steel industry has witnessed the heights and also the changed trend. Maharashtra<br />

Seamless continued its path on the progress with the Gross Turnover <strong>of</strong> Rs.879 crores<br />

in the financial year 2004-05.<br />

With our established product range upto 7” <strong>of</strong> Seamless Pipes and Tubes we are now<br />

all set to accept all requirements upto 14” in Seamless as our new mill has already<br />

gone into production in this higher dia range. Now we would meet the requirements <strong>of</strong><br />

the entire range <strong>of</strong> Pipes in all alloy and non-alloy grades. With the committed teamwork<br />

we are confident to meet the challenges in the times to come in any market scenario.<br />

However, we will not stop here. We are fully committed to enhance the scale,<br />

competitiveness, efficiency and the productivity at all levels and in all areas. With this<br />

motive only we have already decided to setup our own steel plant in Orissa, which will<br />

basically feed all <strong>of</strong> the raw material requirements <strong>of</strong> Maharashtra Seamless Ltd.<br />

In line with the growth <strong>of</strong> the Indian Economy, your Company is also on its way to<br />

achieve its mission <strong>of</strong> growth and prosperity. The track record <strong>of</strong> consistent & impressive<br />

performance posted by the company year after year speaks about such growth.<br />

Total Quality Management (TQM), Cost Control and aggressive marketing have become<br />

integral part <strong>of</strong> the systems <strong>of</strong> your company. Currently, the market for Seamless &<br />

ERW Pipes is growing at a rapid pace. With more emphasis being given on exploration,<br />

drilling and laying <strong>of</strong> cross country Line pipes, pipe Industry is having a very promising<br />

future outlook. The company is confident that with the combination <strong>of</strong> market growth<br />

and the expansion project, the company would be able to garner the major chunk <strong>of</strong><br />

the growth in Pipe Industry.<br />

There is competition from International players like China and East European countries.<br />

Reduction in Import Duty on pipes and tubes may pose some threat to Indian<br />

manufacturers in the coming years as Government may go for lower tariff structure in<br />

the future. Your company is ready to face this challenge. When the competition intensifies<br />

with price playing a major role, cost management which we are practicing continuously<br />

can contribute effectively to pr<strong>of</strong>itability. The ultimate challenge will be to manage intense<br />

competition and optimize the benefits <strong>of</strong> productivity and pr<strong>of</strong>itability improvement<br />

measures.<br />

Our long-term goal is to maximize returns on shareholders' wealth for our esteemed<br />

shareholders, which is reflected in the financial performance achieved by the Company.<br />

We hope to receive the continued support and patronage <strong>of</strong> all <strong>of</strong> our associates, which<br />

will add to our determination to achieve spectacular results in the coming years.<br />

3<br />

D.P. <strong>Jindal</strong>

“The recent discoveries in the country by oil<br />

exploration companies both in the public and<br />

private domain have thrown in a substantial<br />

demand for both seamless and ERW pipes.”<br />

4

Message<br />

from the<br />

Managing Director<br />

Dear Shareholders,<br />

Maharashtra Seamless Limited believes in attaining new frontiers <strong>of</strong> success and<br />

making its vision transform into reality. The commissioning <strong>of</strong> the 14” seamless mill is<br />

in line with the corporate philosophy <strong>of</strong> unparalleled growth and consolidation <strong>of</strong> our<br />

core competence. The appreciation <strong>of</strong> our stock on the bourses is a true reflection <strong>of</strong><br />

our performance in the last financial year and we wish to continue this trend in the near<br />

future by diversifying into billet manufacturing as a measure <strong>of</strong> backward integration<br />

and to absorb the fluctuation <strong>of</strong> steel prices.<br />

The oil & gas sector is particularly booming and showing a promising growth. The oil<br />

price breaking the $60 per barrel barrier and the appreciation in the rig count worldwide<br />

is a true reflection <strong>of</strong> the immense potential <strong>of</strong> this industry.<br />

The recent discoveries in the country by oil exploration companies both in the public<br />

and private domain have thrown in a substantial demand for both seamless and ERW<br />

pipes. We wish to fulfill this demand by gearing up our facilities and by debottlenecking<br />

and benchmarking our systems and process.<br />

Our new corporate <strong>of</strong>fice in Gurgaon shall have a state-<strong>of</strong>-the-art environment with the<br />

best conferencing & networking facilities and shall improve the productivity <strong>of</strong> our<br />

employees and raise their motivation levels.<br />

Our Joint Venture with Hydril, USA shall provide us a platform<br />

to market premium connections for high-pressure applications<br />

in the oil & gas sector.<br />

We believe in growing with all our stakeholders and have<br />

thus declared a dividend <strong>of</strong> 50% for the last financial year.<br />

Lastly, I would like to acknowledge & appreciate the support; we have received from<br />

our customers, bankers, suppliers and all our employees who have put in sincere efforts<br />

in their respective fields.<br />

Thank you,<br />

Saket <strong>Jindal</strong><br />

5

MAHARASHTRA SEAMLESS LIMITED<br />

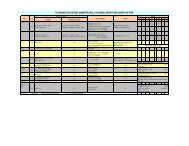

SELECTED FINANCIAL INDICATORS OF LAST 10 YEARS<br />

Particulars 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005<br />

Gross Turnover (Rs. Lacs) 10758 13781 15094 18555 19243 26541 37272 43563 55529 86724<br />

(Times) 1.00 1.28 1.40 1.72 1.79 2.47 3.46 4.05 5.16 8.06<br />

EBIDTA (Rs. Lacs) 1832 1341 1208 1887 2682 4218 7468 8406 10031 12851<br />

(Times) 1.00 0.73 0.66 1.03 1.46 2.30 4.08 4.59 5.48 7.01<br />

PBT (Rs. Lacs) 1809 805 899 1405 2415 4042 7186 9007 10507 12624<br />

(Times) 1.00 0.44 0.50 0.78 1.33 2.23 3.97 4.98 5.81 6.98<br />

PAT (Rs. Lacs) 1809 700 801 1037 1756 3196 5001 6209 7146 8488<br />

(Times) 1.00 0.39 0.44 0.57 0.97 1.77 2.76 3.43 3.95 4.69<br />

Gross Block (Rs. Lacs) 6493 7361 7555 8171 8789 10594 14119 16064 26709 32768<br />

(including WIP) (Times) 1.00 1.13 1.16 1.26 1.35 1.63 2.17 2.47 4.11 5.05<br />

Net Block (Rs. Lacs) 5321 5893 5778 6057 6324 7734 10743 12023 21970 26992<br />

(Times) 1.00 1.11 1.09 1.14 1.19 1.45 2.02 2.26 4.13 5.07<br />

Equity Share Capital (Rs. Lacs) 2550 2550 2550 2550 2550 2882 2882 2882 2882 2882<br />

(Times) 1.00 1.00 1.00 1.00 1.00 1.13 1.13 1.13 1.13 1.13<br />

Reserves & Surplus (Rs. Lacs) 3480 3858 4334 5043 6416 9086 12239 15994 21527 28399<br />

(Times) 1.00 1.11 1.25 1.45 1.84 2.61 3.52 4.60 6.19 8.16<br />

Net Worth (Rs. Lacs) 6362 6740 7216 7925 9298 11968 15121 20317 24409 31281<br />

(Times) 1.00 1.06 1.13 1.25 1.46 1.88 2.38 3.19 3.84 4.92<br />

Book Value (Rs.) 24 25 27 30 35 42 52 65 85 109<br />

(Times) 1.00 1.04 1.13 1.25 1.46 1.75 2.17 2.71 3.54 4.54<br />

EPS (Rs.) 7.09 2.75 2.96 3.89 6.58 11.94 17.37 21.98 23.72 29.54<br />

(Times) 1.00 0.39 0.42 0.55 0.93 1.68 2.45 3.10 3.35 4.17<br />

Equity Dividend<br />

- Amount (Rs. Lacs) 255 255 255 255 306 384 576 1009 1153 1441<br />

- Percentage (%) 10% 10% 10% 10% 12% 15% 20% 35% 40% 50%<br />

6

MAHARASHTRA SEAMLESS LIMITED<br />

NOTICE<br />

Notice is hereby given that the 17th Annual General Meeting <strong>of</strong> the Members <strong>of</strong> Maharashtra Seamless Limited will be held on Friday,<br />

the 9th September, 2005 at 11.30 A.M. at the Registered Office <strong>of</strong> the Company at Pipe Nagar, Village - Sukeli, N.H.17, B.K.G. Road,<br />

Taluka Roha, Distt. Raigad-402 126, Maharashtra to transact the following busines :<br />

ORDINARY BUSINESS<br />

1. To receive, consider and adopt the Audited Accounts for the year ended 31st March, 2005 and the Reports <strong>of</strong> Directors and Auditors<br />

thereon.<br />

2. To declare dividend.<br />

3. To appoint a Director in place <strong>of</strong> Shri D. P. <strong>Jindal</strong>, who retires by rotation and being eligible, <strong>of</strong>fers himself for reappointment.<br />

4. To appoint a Director in place <strong>of</strong> Shri S. D. Sharma, who retires by rotation and being eligible, <strong>of</strong>fers himself for reappointment.<br />

5. To appoint Auditors who shall hold <strong>of</strong>fice from the conclusion <strong>of</strong> this Annual General Meeting until the conclusion <strong>of</strong> next Annual<br />

General Meeting and to fix their remuneration. The retiring auditors M/s Kanodia Sanyal & Associates, New Delhi are eligible for<br />

reappointment.<br />

SPECIAL BUSINESS<br />

6. To consider and, if thought fit, to pass with or without modifications, the following Resolution as a Special Resolution.<br />

RESOLVED THAT pursuant to Clause 49 <strong>of</strong> the Listing Agreement, Section 309, 310 and all other applicable provisions <strong>of</strong> the<br />

<strong>Companies</strong> Act, if any, the Board <strong>of</strong> Directors <strong>of</strong> the Company be and is hereby authorized to decide the payment <strong>of</strong> sitting fees<br />

along with any other compensation and / or expenditure in that connection to its non executive directors within the limits as may<br />

be notified by the Central Government from time to time.<br />

By order <strong>of</strong> the Board<br />

Place : Gurgaon<br />

Dated : 15th June, 2005<br />

Praveen Mudgal<br />

Company Secretary<br />

Regd. Office:<br />

Pipe Nagar, Village Sukeli, N.H.17,<br />

B.K.G. Road, Taluka - Roha,<br />

Distt. Raigad - 402 126,<br />

Maharashtra<br />

7

MAHARASHTRA SEAMLESS LIMITED<br />

NOTES:<br />

1. An Explanatory Statement pursuant to Section 173(2) <strong>of</strong> the <strong>Companies</strong> Act, 1956 in relation to the Special Business <strong>of</strong> the Meeting<br />

is annexed hereto and forms part <strong>of</strong> this Notice.<br />

2. A MEMBER ENTITLED TO ATTEND AND VOTE AT THE MEETING IS ENTITLED TO APPOINT A PROXY TO ATTEND AND<br />

VOTE INSTEAD OF HIMSELF AND A PROXY NEED NOT BE A MEMBER OF THE COMPANY. FORM OF PROXY IS SEPARATELY<br />

ANNEXED. THE PROXY FORM MUST BE DEPOSITED AT THE REGISTERED OFFICE OF THE COMPANY NOT LESS THAN<br />

48 HOURS BEFORE THE COMMENCEMENT OF THE MEETING.<br />

3. Members / Proxies should bring the attendance slip duly filled in for attending the meeting.<br />

4. Members are requested to notify immediately any change in their address to the Registrar & Transfer Agent quoting their Folio<br />

Number to the following address:<br />

Alankit Assignments Ltd.<br />

Alankit House,<br />

2E/21, Jhandewalan Extension,<br />

New Delhi – 110 055<br />

5. Members who have multiple ledger folios in identical names or joint names in same order are requested to intimate/send the<br />

concerned share certificates quoting their ledger folios <strong>of</strong> such accounts to enable the Registrar & Transfer Agent to consolidate<br />

all such shareholdings into one folio.<br />

6. The Register <strong>of</strong> Members and Share Transfer Books <strong>of</strong> the Company will remain closed from Thursday, 1st September, 2005 to<br />

Friday, the 9th September, 2005 (both days inclusive).<br />

7. Members intending to seek any information on the Annual Accounts at the meeting are requested to inform the company in writing<br />

at least one week prior to the date <strong>of</strong> the meeting.<br />

8. In accordance with the provisions <strong>of</strong> the <strong>Companies</strong> Act, 1956, the amount <strong>of</strong> dividend which remains<br />

unpaid or unclaimed for a period <strong>of</strong> 7 years from the date <strong>of</strong> transfer to Unpaid Dividend Account<br />

<strong>of</strong> the Company are transferred to the Investor Education and Protection Fund constituted by the<br />

Central Government and shareholders are not able to claim any amount <strong>of</strong> dividend so transferred<br />

to the fund.<br />

As such, shareholders who have not yet encashed their dividend warrants are requested in their own<br />

interest to claim the outstanding dividend before it falls due for transfer to the aforesaid Fund.<br />

9. Electronic Clearing Service (ECS) Facility:<br />

(a) Members holding shares in physical form who wish to avail ECS facility, may authorize the Company with their ECS mandate<br />

in the prescribed form, which can be downloaded from the Company’s website (www.jindal.com) or can be obtained from the<br />

Corporate Office <strong>of</strong> the Company. Requests for payment <strong>of</strong> dividend through ECS should be lodged latest by 25th August,<br />

2005 to the Company Secretary at Plot No. 30 Institutional Sector - 44, Gurgaon – 122001 Haryana.<br />

(b) Members holding shares in demat form who wish to avail ECS facility, may send ECS mandate in the prescribed form to their<br />

respective depository participant.<br />

10. Reappointment <strong>of</strong> Directors:<br />

Shri D.P. <strong>Jindal</strong> and Shri S. D. Sharma retire by rotation at the Annual General Meeting and being eligible <strong>of</strong>fer themselves for<br />

reappointment. Brief resumes <strong>of</strong> the said directors are as under :-<br />

Name<br />

Age<br />

Expertise in specific functional area<br />

Date <strong>of</strong> appointment as Director<br />

<strong>of</strong> the Company<br />

Directorship <strong>of</strong> other companies<br />

Chairman / Member <strong>of</strong> Committees<br />

<strong>of</strong> other <strong>Companies</strong><br />

Shri D. P. <strong>Jindal</strong><br />

55 Years<br />

Prominent Industrialist having<br />

wide business experience<br />

10.05.1988<br />

<strong>Jindal</strong> Pipes Limited<br />

<strong>Jindal</strong> Drilling & Industries Limited<br />

<strong>Jindal</strong> Aluminium Limited<br />

Pragaun JAL Educational Organistion<br />

Chairman - Shareholders / Investors Share<br />

Transfer cum Grievance Committee<br />

Of <strong>Jindal</strong> Drilling & Industries Limited<br />

Shri S. D. Sharma<br />

65 Years<br />

Retired Senior Executive having vast<br />

experience in commercial areas<br />

24.03.1995<br />

--<br />

--<br />

8

MAHARASHTRA SEAMLESS LIMITED<br />

ANNEXURE TO THE NOTICE<br />

EXPLANATORY STATEMENT UNDER SECTION 173(2) OF THE COMPANIES ACT, 1956.<br />

ITEM NO. 6<br />

In terms <strong>of</strong> the revised clause 49 <strong>of</strong> the Listing Agreement with the Stock Exchanges, all fees / compensation to be paid to Non- Executive<br />

directors are to be fixed by the Board and require the prior approval <strong>of</strong> the shareholders in the general meeting.<br />

For the purpose <strong>of</strong> administrative expediency, members are requested to authorize Board <strong>of</strong> Directors to decide the quantum <strong>of</strong> sitting<br />

fee / any other compensation payable to the Non- Executive directors up to the maximum limit prescribed under the <strong>Companies</strong> Act, 1956,<br />

as may be amended from time to time, after taking into consideration the expertise and wisdom they bring to the company and their<br />

contribution towards the performance <strong>of</strong> the company.<br />

The Board recommends the resolution for your approval.<br />

All the Non- Executive Directors <strong>of</strong> the company are deemed to be concerned or interested in passing <strong>of</strong> this resolution.<br />

By order <strong>of</strong> the Board<br />

Place : Gurgaon<br />

Dated : 15th June, 2005<br />

Praveen Mudgal<br />

Company Secretary<br />

Regd. Office :<br />

Pipe Nagar, Village Sukeli, N.H.17,<br />

B.K.G. Road, Taluka - Roha,<br />

Distt. Raigad - 402 126,<br />

Maharashtra<br />

9

MAHARASHTRA SEAMLESS LIMITED<br />

DIRECTORS' REPORT<br />

To the Members,<br />

Your Directors are pleased to present the Company’s 17th Annual Report alongwith Audited Accounts <strong>of</strong> the Company for the year ended<br />

31st March, 2005.<br />

FINANCIAL RESULTS<br />

During the year, Gross Turnover <strong>of</strong> the company increased to Rs. 879 crore from Rs. 569 crore in the previous year - a growth <strong>of</strong> 54%<br />

over previous year. The highlights <strong>of</strong> the financial results are as under :-<br />

(Rs. in crores)<br />

Gross Turnover 879.28 569.01<br />

Pr<strong>of</strong>it before Depreciation 136.74 112.06<br />

Depreciation 10.50 6.98<br />

Pr<strong>of</strong>it Before Tax 126.24 105.08<br />

Provision for Taxation<br />

- Current 32.77 33.31<br />

- Deferred 8.59 0.31<br />

Pr<strong>of</strong>it after Tax 84.88 71.46<br />

Prior Period Adjustments/ Tax provision written back 0.27 0.29<br />

Pr<strong>of</strong>it After Tax & Adjustments 85.15 71.75<br />

Balance brought forward from previous year 13.20 12.28<br />

Pr<strong>of</strong>it available for appropriations 98.35 84.03<br />

Appropriations:<br />

Transfer to Capital Redemption Reserve - 14.41<br />

Dividends<br />

- Interim (Declared subsequent to the year end) - 7.21<br />

-10% Redeemable Cum. Pref.shares (paid / proposed) - 1.37<br />

- Proposed on Equity shares 14.41 4.32<br />

Tax on Dividend<br />

Year Ended<br />

Year Ended<br />

31.03.2005 31.03.2004<br />

- Interim - 0.93<br />

- 10% Redeemable Cum. Pref.shares (paid / proposed) - 2.02<br />

- Proposed on Equity Shares 2.02 0.57<br />

Transfer to General Reserve 65.00 40.00<br />

Balance carried to Balance Sheet 16.92 13.20<br />

98.35 84.03<br />

10

MAHARASHTRA SEAMLESS LIMITED<br />

DIVIDEND<br />

Your directors are pleased to recommend a dividend @ 50% on the paid up share capital <strong>of</strong> the company for the year 2004 - 2005.<br />

The proposed dividend including dividend tax will absorb Rs.16.43 crore.<br />

RESULTS OF OPERATIONS<br />

Your Directors are pleased to inform that the company’s performance has been commendable during the year. The healthy growth for<br />

the Company’s products and its operating and cost efficiencies have led to a steady increase in turnover and pr<strong>of</strong>its. The pr<strong>of</strong>it before<br />

tax for the year was Rs.126 crore as against Rs.105 crore in the previous year showing a growth <strong>of</strong> 20 % over previous year. The pr<strong>of</strong>it<br />

after tax & adjustments for the year had been Rs.85 crore as against Rs.72 crore in the previous year.<br />

Seamless Pipes Division has major contribution constituting 65% <strong>of</strong> turnover <strong>of</strong> the Company. This Division has contributed around 78%<br />

<strong>of</strong> the Pr<strong>of</strong>its Before Tax <strong>of</strong> the Company.<br />

STATUS OF EXPANSION PROJECT<br />

During the year under review your company has completed an expansion project to manufacture seamless pipes <strong>of</strong> higher diameter from<br />

7” to 14”OD . The expansion project has lead to an increased installed capacity by further one lac tonne. The company now would be<br />

able to get major share <strong>of</strong> higher dia seamless pipes market which is currently being regulated by imports. This would not only increase<br />

its overall market share in Seamless Pipes & Tubes Industry but would also lead to an improved financial performance in the coming years.<br />

BACKWARD INTEGRATION PROJECT<br />

The Company is implementing a strategic Backward Integration Project at Orissa to manufacture Billets, the main raw material for Seamless<br />

Pipes having a capacity <strong>of</strong> 5,00,000 TPA. The Project would be completed in two phases by the end <strong>of</strong> year 2007 at an aggregate capital<br />

outlay <strong>of</strong> Rs.550 crore and would be meeting its captive requirement fully. Requisite Land for the project has been allotted by the<br />

Government <strong>of</strong> Orissa. Project Enginnering Consultant has been appointed and various applications to the Govt. Authorities for various<br />

infrastructure needs have been filed. The Project, on implementation will further improve its competitive position as a low cost producer<br />

<strong>of</strong> seamless pipes and have a positive impact on pr<strong>of</strong>itability in the long run and ensure smooth availability <strong>of</strong> raw material<br />

JOINT VENTURE<br />

During the year the company has entered into a Joint Venture with USA based Hydril LP to manufacture Premium Joint Connections.<br />

The Joint Venture is likely to commence operations during the year and will exclusively source Seamless Pipes from Maharashtra<br />

Seamless. The Joint Venture will facilitate Company’s consolidation in both Domestic and International market <strong>of</strong> Seamless Pipes by<br />

going into new export avenues. Your company’s presence in the seamless business would consolidate on global basis which would have<br />

a positive bearing on the improved financials and margins.<br />

CREDIT RATING<br />

Your Directors are pleased to inform the members that your company has been assigned AA Credit Rating by the Credit Rating Agency,<br />

CRISIL Limited and `AA (ind)’ by Fitch Rating India Pvt. Ltd. in relation to Rs. 150 million Long Term Debt Program <strong>of</strong> the Company.<br />

FCCB ISSUE<br />

Your Company is planning to Launch an FCCB issue <strong>of</strong> USD 75 million in the current year to part finance the backward integration steel<br />

billet project. The necessary shareholders approval for the issue was obtained in the Extra Ordinary General Meeting dated 22.03.2005.<br />

Your company has also appointed Deutsche Bank as Lead Bank and Sole book runner for the issue.<br />

INCREASE IN AUTHORISED SHARE CAPITAL<br />

The Authorised Share capital <strong>of</strong> the company has been increased from Rs. 55 crore to Rs. 60 crore by addition <strong>of</strong> 50 lacs Equity Shares<br />

<strong>of</strong> Rs. 10 each. The necessary shareholder’s approval for the increase was obtained in the Extra Ordinary General Meeting held on 22nd<br />

March, 2005.<br />

DIRECTORS<br />

Shri D.P. <strong>Jindal</strong> and Shri S.D. Sharma, Directors <strong>of</strong> the Company, retire by rotation at the ensuing Annual General Meeting and being<br />

eligible, <strong>of</strong>fer themselves for reappointment.<br />

DIRECTORS' RESPONSIBILITY STATEMENT<br />

As required under Section 217(2AA) <strong>of</strong> the <strong>Companies</strong> Act, 1956, your Directors state :<br />

(i) that in the preparation <strong>of</strong> the Annual Accounts, the applicable accounting standards have been followed;<br />

(ii) that the accounting policies selected and applied are consistent and the judgements and estimates made are reasonable and<br />

prudent so as to give a true and fair view <strong>of</strong> the state <strong>of</strong> affairs <strong>of</strong> the Company at the end <strong>of</strong> financial year and <strong>of</strong> the pr<strong>of</strong>it <strong>of</strong> the<br />

Company for that period;<br />

11

MAHARASHTRA SEAMLESS LIMITED<br />

(iii) that proper and sufficient care has been taken for the maintenance <strong>of</strong> adequate accounting records in accordance with the provisions<br />

<strong>of</strong> the <strong>Companies</strong> Act, 1956 for safeguarding the assets <strong>of</strong> the Company and for preventing and detecting fraud and other irregularities;<br />

and<br />

(iv) that the Annual Accounts have been prepared on a going concern basis.<br />

CORPORATE GOVERNANCE<br />

As per the requirement <strong>of</strong> Clause 49 <strong>of</strong> the Listing Agreement with the Stock Exchanges, a Compliance Report on Corporate Governance<br />

has been annexed as part <strong>of</strong> the Annual Report.<br />

AUDITORS<br />

M/s. Kanodia Sanyal & Associates, Chartered Accountants, the auditors <strong>of</strong> the Company are retiring at the conclusion <strong>of</strong> the ensuing<br />

Annual General Meeting and are eligible for reappointment.<br />

FIXED DEPOSITS<br />

There are no overdue or unclaimed deposits with the Company at the close <strong>of</strong> the year.<br />

CONSERVATION OF ENERGY, TECHNOLOGY ABSORPTION, FOREIGN EXCHANGE EARNINGS<br />

AND OUTGO<br />

The information in accordance with the provisions <strong>of</strong> Section 217(1)(e) <strong>of</strong> the <strong>Companies</strong> Act, 1956, read with the <strong>Companies</strong> (Disclosure<br />

<strong>of</strong> Particulars in the Report <strong>of</strong> Board <strong>of</strong> Directors) Rules, 1988 is Annexed hereto.<br />

PARTICULARS OF EMPLOYEES<br />

There is no employee in the Company drawing remuneration more than the limits prescribed under Section 217 (2A) <strong>of</strong> the <strong>Companies</strong><br />

Act, 1956 read with the <strong>Companies</strong> (Particulars <strong>of</strong> Employees) Rules, 1975.<br />

ACKNOWLEDGEMENT<br />

The Board expresses its grateful appreciation <strong>of</strong> the assistance and co-operation received from Central Government, State Government<br />

<strong>of</strong> Maharashtra, SICOM, MSEB all other Government agencies, ONGCL, OIL, Banks and Shareholders.<br />

Your Directors wish to place on record their deep sense <strong>of</strong> appreciation for the devoted contribution made by the employees at all levels.<br />

For & on behalf <strong>of</strong> the Board<br />

Place : Gurgaon D. P. JINDAL<br />

Dated : 15th June, 2005<br />

Chairman<br />

ANNEXURE TO DIRECTORS' REPORT<br />

INFORMATION AS PER SECTION 217(1)(e) OF THE COMPANIES ACT, 1956 READ WITH THE COMPANIES (DISCLOSURE OF<br />

PARTICULARS IN THE REPORT OF BOARD OF DIRECTORS) RULES, 1988 AND FORMING PART OF THE DIRECTORS' REPORT<br />

FOR THE YEAR ENDED 31ST MARCH, 2005.<br />

A. CONSERVATION OF ENERGY<br />

a) Energy Conservation measures taken.<br />

1. Effective measures have been taken for reduction <strong>of</strong> fuel consumption by implementing change in operating parameters<br />

and recovering more heat from the furnace by changing the material loading pattern.<br />

2. The energy meters have been installed at different locations to improve the general awareness regarding power consumption<br />

at respective locations. The capacitor banks were splitted in zones for reducing power wastages in capacitor banks.<br />

3. Frequency variable drives have been introduced wherever motors are not fully loaded resulting reduction in power<br />

consumption.<br />

4. Furnace capacity has been properly utilized by bunching the Heat Treatment cycle tanks, loading pattern <strong>of</strong> furnace resulting<br />

increase in output & reduction <strong>of</strong> power and fuel consumption.<br />

5. Energy conservation in the form <strong>of</strong> using furnace oil instead <strong>of</strong> LDO to reduce the cost is already implemented at 14” mill<br />

and 7” mill.<br />

b) Additional investments and proposals, if any, being implemented for reduction <strong>of</strong> consumption<br />

<strong>of</strong> energy.<br />

Continuous measures are being taken for reduction <strong>of</strong> consumption <strong>of</strong> energy. The Company is using the alternate fuel LDO / FO<br />

which is an alternative source <strong>of</strong> fuel in place <strong>of</strong> HSD. During the year, no specific investment has been earmarked<br />

12

MAHARASHTRA SEAMLESS LIMITED<br />

c) Impact <strong>of</strong> measures at a&b above for reduction <strong>of</strong> energy consumption and consequent impact<br />

on the cost <strong>of</strong> production <strong>of</strong> the goods.<br />

The measures taken by the Company have resulted in substantial reduction <strong>of</strong> power and fuel consumption.<br />

d) Total energy consumption and energy consumption per unit <strong>of</strong> production.<br />

As per Form-A annexed.<br />

B. TECHNOLOGY ABSORPTION<br />

e) Efforts made in technology absorption are given as per Form - B annexed.<br />

C. FOREIGN EXCHANGE EARNINGS AND OUTGO<br />

f) Activities relating to exports; initiatives taken to increase exports; development <strong>of</strong> new export<br />

markets for products and services; and export plans.<br />

The Company's business does not directly result in physical exports but results in import substitution and conservation <strong>of</strong><br />

valuable foreign exchange.<br />

g) Total foreign exchange used and earned<br />

Used - Rs. 127.38 crore<br />

Earned * - Rs. 84.05 crore<br />

* Supplies to Oil Sector by the Company result in import substitution & consequent saving <strong>of</strong> substantial Foreign Exchange for<br />

the country.<br />

FORM A<br />

FORM FOR DISCLOSURE OF PARTICULARS WITH RESPECT TO :<br />

CONSERVATION OF ENERGY<br />

A. POWER AND FUEL CONSUMPTION<br />

Particulars Year Ended Year Ended<br />

31.03.2005 31.03.2004<br />

1. Electricity Purchased<br />

Units (KWH in lacs)* 414.82 365.85<br />

Total Amount (Rs. in lacs) 1787.03 1605.71<br />

Rate Per Unit (Rs.) 4.31 4.39<br />

* Includes 100.82 lacs (previous year 93.49 lacs) units<br />

generated by Wind Power Project <strong>of</strong> the Company.<br />

2. Fuel Consumption<br />

a) LDO<br />

Quantity (KL) 15433.72 13263.00<br />

Total Amount (Rs.in lacs) 3146.64 2248.72<br />

Average Rate per KL (Rs.) 20388.07 16954.80<br />

b) HSD<br />

Quantity (KL) 279.40 275.67<br />

Total Amount (Rs. in lacs) 68.43 62.63<br />

Average Rate per KL (Rs.) 24491.35 22718.48<br />

c) LPG<br />

Quantity (MT) 692.26 526.74<br />

Total Amount (Rs. in lacs) 181.92 124.04<br />

Average Rate Per MT (Rs.) 26279.40 23549.39<br />

d) FURNACE OIL<br />

Quantity (MT) 890.46 -<br />

Total Amount (Rs. in lacs) 100.69 -<br />

Average Rate Per MT (Rs.) 11307.30 -<br />

3. Other / Internal generation / Wind Power<br />

(Kwh in lakhs) 108.77 96.79<br />

13

MAHARASHTRA SEAMLESS LIMITED<br />

B. CONSUMPTION PER UNIT OF PRODUCTION<br />

a) SEAMLESS PIPES (MT)<br />

Electricity (Units) 287.560 272.071<br />

LDO (KL) 0.126 0.117<br />

HSD (KL) 0.002 0.002<br />

LPG (MT) 0.006 0.005<br />

b) ERW PIPES (MT)<br />

Electricity (Units) 73.726 78.972<br />

HSD (KL) 0.001 0.001<br />

FORM B<br />

FORM FOR DISCLOSURE OF PARTICULARS WITH RESPECT TO :<br />

RESEARCH AND DEVELOPMENT (R&D)<br />

1. Specific areas in which R&D carried out by the Company<br />

i) To improve the pipe quality a new concept <strong>of</strong> quencing by immersion type is under implementation.<br />

ii) R&D activities <strong>of</strong> the Company remained centered around the development <strong>of</strong> new products, improvement <strong>of</strong> existing products<br />

and processes, problem solving, cost reduction, pollution control, energy conservation.<br />

2. Benefits derived as a result <strong>of</strong> above R&D<br />

As a result <strong>of</strong> the R&D activities, new products were developed, existing products and process were improved and costs were<br />

reduced through energy conservation and savings in the use <strong>of</strong> materials.<br />

3. Future plan <strong>of</strong> action<br />

Concentration will remain in the development <strong>of</strong> new sizes and upgradation <strong>of</strong> the quality. The high priority will be given to the<br />

upgradation <strong>of</strong> technology, energy conservation, cost reduction and commission and establish the sizes for 14” Pipe Mill.<br />

4. Expenditure on R&D<br />

Expenditure on R&D is not separately allocated and identified.<br />

TECHNOLOGY ABSORPTION, ADAPTATION AND INNOVATION<br />

1. Efforts in brief made towards technology absorption, adaptation and innovation.<br />

The production / Quality Control department absorbs the technology received from the collaborators, adopting the same to local<br />

conditions and uses its own experience to effect improvements to the product and manufacturing process.<br />

2. Benefits derived as a result <strong>of</strong> the above efforts etc.<br />

Through above measures, the Company has continued to achieve product improvement / development, process improvement /<br />

development, commercialisation <strong>of</strong> technology, cost reduction, import substitution etc.<br />

3. In case <strong>of</strong> imported technology (Imported during the last 5 years reckoned from the beginning <strong>of</strong><br />

the financial year) prescribed information may be furnished:<br />

Sl. Technology Imported Year <strong>of</strong> Import Has Technolog If not fully absorbed,<br />

No. been fully areas where this<br />

absorbed has not taken place<br />

1 Technical know-how for machining, testing 2000 - 01 Yes Not applicable<br />

& otherwise forming threaded connections<br />

from M/s Hydril Company, USA.<br />

2 Technical know-how and process 2003 - 04 Implemented during 14” Hot Mill<br />

detail for plug mill and classical rellers<br />

the year<br />

were received from USA<br />

14

MAHARASHTRA SEAMLESS LIMITED<br />

CORPORATE GOVERNANCE REPORT<br />

The report on Corporate Governance as per requirement under Clause 49 <strong>of</strong> the Listing Agreement is given below :<br />

A. MANDATORY REQUIREMENTS<br />

1. COMPANY’S PHILOSOPHY ON CODE OF GOVERNANCE<br />

The Company’s philosophy on the code <strong>of</strong> Corporate Governance is:<br />

(i) to ensure that adequate control systems exist to enable the Board to effectively discharge its responsibilities to all the stakeholders<br />

<strong>of</strong> the Company;<br />

(ii) to ensure that the decision making process is systematic rational;<br />

(iii) to ensure full commitment <strong>of</strong> the Management to maximize <strong>of</strong> shareholders value;<br />

(iv) to ensure that the employees <strong>of</strong> the Company subscribe to the corporate values and apply them in their conduct.<br />

2. BOARD OF DIRECTORS<br />

COMPOSITION AND CATEGORY<br />

The present strength <strong>of</strong> Board <strong>of</strong> Directors is 6 whose composition is given below :-<br />

- 1 Promoter, Executive Director<br />

- 1 Promoter, Non-executive Director<br />

- 4 Non-promoter, Independent, Non-executive Directors.<br />

The composition <strong>of</strong> Board <strong>of</strong> Directors and also number <strong>of</strong> other Board <strong>of</strong> Directors or Committees <strong>of</strong> the Board in which he is a<br />

member or Chairman are as under :-<br />

Name <strong>of</strong> Director Category <strong>of</strong> Directorship No. <strong>of</strong> Other No. <strong>of</strong> Other<br />

Directorships Committee <strong>of</strong> Board<br />

(other than Maharashtra<br />

Seamless Limited)<br />

Sh. D.P. <strong>Jindal</strong> Promoter, Non-executive 4 1<br />

Chairman<br />

Sh. Saket <strong>Jindal</strong> Promoter, Executive 2 -<br />

Managing Director<br />

Sh. U.C. Agarwal Independent, Non-executive 1 1<br />

Sh. D.K. Parikh Independent, Non-executive - -<br />

Sh. S.D. Sharma Independent, Non-executive - -<br />

Sh. H.K. Khanna Independent, Non-executive 2 2<br />

ATTENDANCE OF DIRECTORS AT THE BOARD MEETINGS AND LAST ANNUAL GENERAL MEETING<br />

During the financial year ended 31st March, 2005, seven Board Meetings were held on 20th April, 2004, 27th May, 2004, 22nd July,<br />

2004, 20th September, 2004, 26th October, 2004, 20th January, 2005 and 11th February, 2005.<br />

15

MAHARASHTRA SEAMLESS LIMITED<br />

The attendance <strong>of</strong> each Director at the Board Meetings and the last Annual General Meeting was as under:<br />

Name <strong>of</strong> the Directors Board Meetings Attended Attendance at the last<br />

AGM held on 20.09.2004<br />

Sh. D.P. <strong>Jindal</strong> 5 Yes<br />

Sh. Saket <strong>Jindal</strong> 5 No<br />

Sh. U.C. Agarwal 6 No<br />

Sh. D.K. Parikh 6 Yes<br />

Sh. S.D. Sharma 6 No<br />

Sh. H.K. Khanna 7 Yes<br />

3. AUDIT COMMITTEE<br />

BROAD TERMS OF REFERENCE<br />

The terms <strong>of</strong> reference <strong>of</strong> this Committee covers the matters specified for Audit Committee under Clause 49 <strong>of</strong> the Listing Agreement<br />

as well as in Section 292A <strong>of</strong> the <strong>Companies</strong> Act, 1956.<br />

The terms <strong>of</strong> reference <strong>of</strong> Audit Committee include inter-alia the following:-<br />

- to review the quarterly, half-yearly and annual financial statements before submission to the Board for approval;<br />

- to discuss with Auditors about Internal Control System and to consider their observations and follow-up;<br />

- to ensure compliance <strong>of</strong> Internal Control System;<br />

- to investigate on any matter referred by the Board;<br />

- to make recommendation to the Board on any matter relating to the financial management <strong>of</strong> the Company, including the<br />

Audit Report.<br />

COMPOSITION<br />

The Audit Committee <strong>of</strong> the Company comprises 3 Directors <strong>of</strong> which all are Non-executive Directors, 2 are Independent Directors<br />

and 1 Promoter, Non-executive Director. All these Directors possess knowledge <strong>of</strong> Corporate Finance, Accounts and Company Law.<br />

The Chairman <strong>of</strong> the Committee is a Non-executive Independent Director nominated by the Board. The Statutory Auditors and<br />

Internal Auditors are also invitees to the meetings. The Company Secretary acts as a Secretary to the Committee.<br />

The minutes <strong>of</strong> the Audit Committee Meetings are noted by the Board <strong>of</strong> Directors at the subsequent Board Meeting.<br />

The constitution <strong>of</strong> the Audit Committee is as follows:<br />

Name <strong>of</strong> the Members<br />

Sh. U.C. Agarwal<br />

Sh. D.P. <strong>Jindal</strong><br />

Sh. H.K. KHANNA (w.e.f. 27.04.2005)<br />

Category<br />

Chairman, Independent, Non-executive<br />

Member, Promoter, Non-executive<br />

Member, Independent, Non-executive<br />

MEETINGS AND ATTENDANCE<br />

During the financial year ended 31st March, 2005, four Audit Committee Meetings were held on 20th April, 2004, 22nd July, 2004,<br />

26th October, 2004 and 20th January, 2005.<br />

The attendance at Audit Committee Meetings was as under :-<br />

Name <strong>of</strong> the Members<br />

INTERNAL AUDITORS<br />

The Company has appointed a firm <strong>of</strong> Chartered Accountants as Internal Auditors to review the internal control systems <strong>of</strong> the<br />

Company and to report thereon. The reports <strong>of</strong> the Internal Auditors are reviewed by the Audit Committee.<br />

16<br />

No. <strong>of</strong> Meetings Attended<br />

Sh. U.C. Agarwal 4<br />

Sh. D.P. <strong>Jindal</strong> 3<br />

Sh. S.D. Sharma (upto 27.04.2005) 4

MAHARASHTRA SEAMLESS LIMITED<br />

4. REMUNERATION OF DIRECTORS<br />

Details <strong>of</strong> remuneration paid to the Directors during the financial year ended 31st March, 2005<br />

(Rs.)<br />

Sl. No. Name <strong>of</strong> the Directors Salary Perquisites and Sitting Fee Total<br />

other benefits<br />

1 Sh. D.P. <strong>Jindal</strong> - - 20,000 20,000<br />

2 Sh. Saket <strong>Jindal</strong> 4,80,000 1,80,000 - 6,60,000<br />

3 Sh. U.C. Agarwal - - 25,000 25,000<br />

4 Sh. D.K. Parikh - - 15,000 15,000<br />

5 Sh. S.D. Sharma - - 25,000 25,000<br />

6 Sh. H.K. Khanna - - 17,500 17,500<br />

5. SHAREHOLDERS / INVESTORS SHARE TRANSFER CUM GRIEVANCE COMMITTEE<br />

FUNCTIONS<br />

The Board has constituted a Committee <strong>of</strong> three members under the Chairmanship <strong>of</strong> a Non-executive Director. The Committee<br />

meets generally twice a month, to approve inter-alia, transfer / transmission <strong>of</strong> shares, issue <strong>of</strong> duplicate share certificates and<br />

reviews the status <strong>of</strong> investors’ grievances and redressal mechanism and recommend measures to improve the level <strong>of</strong> investor<br />

services. Details <strong>of</strong> shares transfers/transmissions approved by the Committee are placed at the Board Meetings from time to time.<br />

COMPOSITION<br />

The constitution <strong>of</strong> the Committee <strong>of</strong> Directors is as under:-<br />

Name <strong>of</strong> the Members<br />

Sh. D.P. <strong>Jindal</strong><br />

Sh. Saket <strong>Jindal</strong><br />

Sh. H.K. Khanna (w.e.f.27.04.2005)<br />

Category<br />

Chairman, Promoter, Non-executive<br />

Member, Promoter, Executive<br />

Member, Independent, Non-executive<br />

Mr. S.D. Sharma was a member <strong>of</strong> the above Committee up to 27.04.2005<br />

COMPLIANCE OFFICER<br />

The Board has designated Shri Praveen Mudgal, Company Secretary as Compliance Officer.<br />

DETAILS OF SHAREHOLDERS’ COMPLAINTS RECEIVED & REPLIED TO THE SATISFACTION OF SHAREHOLDERS<br />

The Company received 208 complaints <strong>of</strong> shareholders through SEBI and Stock Exchanges, which were duly replied & attended.<br />

6. GENERAL BODY MEETINGS<br />

Location and time, where last three Annual General Meetings were held is given below:-<br />

Financial year Date Location <strong>of</strong> the Meeting Time<br />

2001-02 23rd September, 2002 Registered Office <strong>of</strong> the Company 12.30 P.M.<br />

at Pipe Nagar, Raigad<br />

2002-03 8th September, 2003 Registered Office <strong>of</strong> the Company 12.30 P.M.<br />

at Pipe Nagar, Raigad<br />

2003-04 20th September, 2004 Registered Office <strong>of</strong> the Company 11.30 A.M.<br />

at Pipe Nagar, Raigad<br />

An Extra Ordinary General Meeting was held on 22nd March, 2005 at 1.00 P.M. at the Registered Office <strong>of</strong> the Company at Pipe<br />

Nagar, Raigad.<br />

No Special Resolutions were put through postal ballot last year.<br />

17

MAHARASHTRA SEAMLESS LIMITED<br />

7. DISCLOSURES<br />

a. The Company has not entered into any transaction <strong>of</strong> material nature with the Promoters, Directors or Management, their<br />

subsidiaries or relatives that may have potential conflict with the interest <strong>of</strong> the Company at large. Transactions with related<br />

parties are being disclosed separately in the Annual Report.<br />

b. During the last three years, there were no strictures or penalties imposed either by SEBI or Stock Exchanges or any statutory<br />

authority for non-compliance <strong>of</strong> any matter related to the capital markets.<br />

8. MEANS OF COMMUNICATION<br />

The company’s financial results are forthwith communicated to all the Stock Exchanges with whom the Company has listing<br />

arrangements as soon as they are approved and taken on record by the Board <strong>of</strong> Directors <strong>of</strong> the Company. Thereafter the results<br />

are published in the leading newspapers, namely, Financial Express, Business Standard and Tarun Bharat.<br />

9. GENERAL SHAREHOLDERS INFORMATION<br />

Detailed information in this regard provided in the shareholders information section forms part <strong>of</strong> this Report.<br />

B<br />

NON-MANDATORY REQUIREMENTS<br />

1) CHAIRMAN OF THE BOARD<br />

The Company has a Non-executive Chairman and expenses incurred in performance <strong>of</strong> his duties are paid by the Company.<br />

2) REMUNERATION COMMITTEE<br />

The Company does not have any Remuneration Committee. There are six members in the Board and only Managing Director<br />

gets remuneration which is being approved by the Board <strong>of</strong> Directors and shareholders.<br />

3) SHAREHOLDERS RIGHTS<br />

As the Company’s Financial results are published in English newspapers having circulation all over India and in a Marathi<br />

newspaper widely circulated in Maharashtra, the same are not sent to each household <strong>of</strong> shareholders.<br />

4) POSTAL BALLOT<br />

The provisions relating to Postal Ballot will be complied with in respect <strong>of</strong> matters wherever applicable.<br />

SHAREHOLDERS INFORMATION<br />

Registered Office<br />

Date <strong>of</strong> Book Closure<br />

Dividend Payment Date<br />

: Pipe Nagar, Village Sukeli, N.H.17, B.K.G. Road,<br />

Taluka - Roha, Distt. Raigad, Maharashtra – 402 126<br />

Annual General Meeting : Date and Time : 9th September, 2005 at 11.30 A.M.<br />

Venue : Registered Office <strong>of</strong> the Company at<br />

Pipe Nagar, Village Sukeli, N.H.17, B.K.G. Road,<br />

Taluka-Roha, Distt.Raigad, Maharashtra – 402 126<br />

Financial Calendar (Tentative):<br />

* Financial reporting for the quarter ended 30th June, 2005 : July, 2005<br />

* Financial reporting for the quarter ending 30th September, 2005 : October, 2005<br />

* Financial reporting for the quarter ending 31st December, 2005 : January, 2006<br />

* Financial reporting for the quarter ending 31st March, 2006 : April, 2006<br />

: 1st September, 2005 to 9th September 2005 (both days inclusive)<br />

: 15th September, 2005 onwards<br />

Listing on Stock Exchanges :<br />

Equity Shares <strong>of</strong> the Company are listed on Stock Exchanges at Mumbai, NSE, Kolkata, Delhi and Chennai.<br />

Stock Code : BSE - 500265<br />

NSE - MAHSEAMLES<br />

NSDL / CDSL – ISIN - INE 271B01017<br />

BLOOMBERG - MHS@IN<br />

REUTERS - MHSM.BO<br />

18

MAHARASHTRA SEAMLESS LIMITED<br />

Stock Market Data<br />

The monthly high and low quotations <strong>of</strong> equity shares traded on BSE & NSE are as under :-<br />

B S E<br />

N S E<br />

MONTH HIGH (Rs) LOW (Rs) HIGH (Rs) LOW (Rs)<br />

April 2004 227.00 165.00 228.50 167.70<br />

May, 2004 218.00 172.25 220.00 167.10<br />

June 2004 200.00 182.75 200.00 180.00<br />

July 2004 213.90 190.85 212.00 189.10<br />

August 2004 249.00 195.00 220.00 194.50<br />

September 2004 236.50 202.05 250.00 202.00<br />

October 2004 264.00 217.05 264.00 218.25<br />

November 2004 275.00 230.10 272.00 236.00<br />

December 2004 340.00 253.50 345.00 254.10<br />

January 2005 323.35 263.10 323.00 265.00<br />

February 2005 375.00 297.00 367.85 297.10<br />

March 2005 365.00 312.00 353.80 312.50<br />

Share Performance Chart<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

500<br />

APR,04<br />

MAY,04<br />

JUNE,04<br />

JULY,04<br />

AUG,04<br />

SEP,04<br />

OCT,04<br />

NOV,04<br />

DEC,04<br />

JAN,05<br />

Price on BSE on the closing day <strong>of</strong> month<br />

FEB,05<br />

MAR,05<br />

Registrar and Share Transfer Agents:<br />

The Company has appointed Alankit Assignments Limited having its <strong>of</strong>fice at Alankit House, 2E/21, Jhandewalan Extension, New Delhi<br />

– 110 055 as Registrars & Transfer Agent for physical transfer and demat segment.<br />

Share Transfer System:<br />

Share transfer request received in physical form are registered within 15 days from the date <strong>of</strong> receipt and demat requests are normally<br />

confirmed within prescribed time on the date <strong>of</strong> receipt.<br />

Distribution <strong>of</strong> shareholding as on 31st March, 2005<br />

No.<strong>of</strong> Equity No.<strong>of</strong> % <strong>of</strong> No.<strong>of</strong> % <strong>of</strong><br />

Shares held Shareholders shareholders Shares held Shareholding<br />

Upto 500 21904 97.00 2634515 9.14<br />

501 to 1000 347 1.54 280374 0.97<br />

1001 to 2000 132 0.59 193292 0.67<br />

2001 to 3000 40 0.18 105532 0.37<br />

3001 to 4000 16 0.07 58153 0.20<br />

4001 to 5000 21 0.09 101533 0.35<br />

5001 to 10000 45 0.20 348534 1.21<br />

10001 and above 75 0.33 25100627 87.09<br />

GRAND TOTAL 22580 100.00 28822560 100.00<br />

19

MAHARASHTRA SEAMLESS LIMITED<br />

Shareholding Pattern as on 31st March, 2005<br />

CATEGORY No.<strong>of</strong> Shares held % Age <strong>of</strong> Holding<br />

A. Promoter’s holding 13,129,135 45.55<br />

B. Non-Promoters holding<br />

1. Institutional Investors<br />

Mutual Funds, UTI and Banks 2,169,765 7.53<br />

2. Others<br />

i. Private Corporate Bodies 9,408,047 32.64<br />

ii. Indian Public 3,594,199 12.47<br />

iii. NRIs / OCBs 521,414 1.81<br />

Sub-Total (B) 15,693,425 54.45<br />

Grand Total 28,822,560 100.00<br />

Dematerialisation <strong>of</strong> Shares and Liquidity<br />

About 31% <strong>of</strong> the shares have been dematerialized as on 31st March, 2005. The Company’s shares are compulsorily traded in dematerialized<br />

form.<br />

The equity shares <strong>of</strong> the Company are actively traded on BSE and NSE.<br />

Outstanding GDR / Warrants and Convertible Bonds, conversion date and likely impact on equity:<br />

There is no outstanding GDR / Warrants and Convertible Bonds etc.<br />

Plant Locations:<br />

1. Seamless & ERW Pipes : Pipe Nagar, Village Sukeli,<br />

N.H.17, B.K.G. Road, Taluka-Roha,<br />

Distt.Raigad – 402 126, Maharashtra<br />

2. Wind Power : Village Nivkane, Taluka Patan,<br />

District Satara, Maharashtra<br />

For any assistance regarding dematerialisation <strong>of</strong> shares, share transfers, transmissions, change <strong>of</strong> address and any other query relating<br />

to the shares <strong>of</strong> the Company, please write to Company or Registrar and Transfer Agent at :<br />

Alankit Assignments Limited,<br />

Alankit House,<br />

2E/21, Jhandewalan Extension, New Delhi- 110 055<br />

Phone : 011-51540060 – 63<br />

Fax : 011-51540064<br />

E-mail : rta@alankit.com<br />

Shareholders holding shares in electronic mode should address all their correspondence to their respective Depository Participant.<br />

20

AUDITORS’ CERTIFICATE<br />

To The Members <strong>of</strong><br />

Maharashtra Seamless Limited<br />

We have examined the compliance <strong>of</strong> conditions <strong>of</strong> Corporate Governance by Maharashtra Seamless Limited, for the year ended on<br />

31st march 2005, as stipulated in Clause 49 <strong>of</strong> the Listing Agreement <strong>of</strong> the said company with stock exchange(s).<br />

The compliance <strong>of</strong> conditions <strong>of</strong> the Corporate Governance is the responsibility <strong>of</strong> the management. Our examination was limited to<br />

procedures and implementation there<strong>of</strong>, adopted by the Company for ensuring the compliance <strong>of</strong> the conditions <strong>of</strong> the Corporate<br />

Governance. It is neither an audit nor an expression <strong>of</strong> opinion on the financial statements <strong>of</strong> the Company.<br />

In our opinion and to the best <strong>of</strong> our information and according to the explanation given to us, we certify that the Company has complied<br />

with the conditions <strong>of</strong> Corporate Governance as stipulated in Clause 49 <strong>of</strong> the said Listing Agreement.<br />

As required by the Guidance Note issued by the Institute <strong>of</strong> Chartered Accountants <strong>of</strong> India we have to state that in respect <strong>of</strong> investor<br />

grievances received during the year ended 31st march 2005, no investor grievance are pending against the Company exceeding one<br />

month as per record maintained by the Company which are presented to the shareholder / investor Grievance Committee.<br />

We further state that such compliance is neither an assurance as to the future viability <strong>of</strong> the Company, nor the efficiency or effectiveness<br />

with which the management has conducted the affairs <strong>of</strong> the Company.<br />

For KANODIA SANYAL & ASSOCIATES<br />

Chartered Accountants<br />

Place : New Delhi<br />

Dated : 15th June, 2005<br />

R.K Kanodia<br />

Partner<br />

Membership No. 16121<br />

21

MAHARASHTRA SEAMLESS LIMITED<br />

MANAGEMENT DISCUSSION AND ANALYSIS<br />

Maharashtra Seamless enjoys leadership in Seamless Pipe industry, a higher and Capital intensive and technology driven industry. The<br />

company enjoys enviable position in all segments <strong>of</strong> Seamless and ERW Pipes industry with a limited domestic competition.<br />

Both Seamless and Higher Dia ERW Pipes find major applications in Hydrocarbon and Infrastructure sectors. Besides, the products also<br />

find applications in various other Industries such as Fertilizers, Boilers, Automotives and General Engineering.<br />

The company also has 20 Wind Mills aggregating to 7 MW capacity for captive consumption, which accounts for 26% <strong>of</strong> its total power requirement.<br />

Oil & Gas Sector is heading for robust growth in both domestic as well as international market, which would result in substantial growth<br />

for Pipes and Tubes Industry. Besides, the spurt in infrastructure sector would further augment demand for Seamless and ERW Pipes.<br />

In Oil & Gas Sector, apart from laying Cross Country Linepipes, Exploration and Drilling activities are witnessing an unprecedented growth<br />

in both domestic as well as international market. Recent discoveries <strong>of</strong> Natural Gas on East Coast will necessitate laying <strong>of</strong> pipe lines<br />

from the East Coast to major demand centers in rest <strong>of</strong> the country. It is expected that the country’s pipes line net work will get doubled<br />

from the one existing over the next five years. Pipelines are the most cost effective mode <strong>of</strong> transportation, globally, for petroleum products.<br />

Further domestic refining capacity is also expected to increase, which will boost the demand for pipes. Strong growth expected in<br />

Infrastructure and Power sectors would also be one <strong>of</strong> the growth driver for seamless pipes industry. The boom witnessed in construction<br />

and housing sector will further lead to substantial demand for the ERW Pipes.<br />

Besides catering to Indian market, the products <strong>of</strong> the Company are being exported to USA, Kuwait, Bangladesh, Singapore, Australia, Indonesia,<br />

Dubai, Myanmar, Mauritius, Iran, Saudi Arabia and African Region among others. The trend <strong>of</strong> growth in international markets is likely to go up further.<br />

Healthy cash accruals coming from steady growth in business and increase in revenues with conservative debt policies have enabled<br />

the company to have one <strong>of</strong> the highest credit ratings that are amongst the best in the Industry. Both Credit Rating agencies viz. CRISIL<br />

and FITCH have awarded AA Rating with a positive stable outlook to the company for its long term debt programme.<br />

OPPORTUNITIES & THREATS<br />

With more focus being given to Oil & Gas sector by the Govt. <strong>of</strong> India, the demand from this sector is likely to boost further. Apart from<br />

that, there is also huge export potential <strong>of</strong> seamless pipes in the global market. With the completion <strong>of</strong> expansion project, the company<br />

has rightly poised itself to meet growing demand <strong>of</strong> its product in both India and International Market. The strong growth expected in<br />

Infrastructure and other allied sectors would also push up and provide substantial boost to Seamless Pipes industry. Boom in Power,<br />

Water supply, Construction and Housing sector will further lead to substantial demand for the Company’s Seamless and ERW Pipes.<br />

Competition from international players may pose some pricing pressures for the company’s products. Reduction in Import Duty on pipes<br />

and tubes may also affect margins for the Company.<br />

Company’s margins are dependent on steel price movements. Any steep increase in Input costs may affect operating margins adversely.<br />

The company is currently implementing its backward integration project <strong>of</strong> manufacturing round steel billets. This would not only insulate<br />

the company against any price escalation risk on its input, but would also assure regular supplies <strong>of</strong> right quality <strong>of</strong> billets for its seamless plant.<br />

FUTURE OUTLOOK<br />

Hydrocarbon Sector is one <strong>of</strong> the largest consumer <strong>of</strong> Seamless Pipes in India as well as in international market. The outlook for the sector is<br />

strongly linked to growth in Exploration and Production (E&P) activities in both domestic and international market which is being driven up by<br />

strong crude oil prices. The company expects crude oil prices to remain high in the near future, which will push up the demand for its products.<br />

Demand in domestic market is, however, relatively insulated from crude oil price movements, as there is currently significant low levels <strong>of</strong> domestic<br />

production <strong>of</strong> oil and gas. This has prompted GOI to focus on self reliance in Oil and Gas sector by inviting private players as well.<br />

Apart from E&P activity, there is also significant interest in deep sea drilling. Continuous high crude oil prices are spurring players like<br />

ONGC, Reliance industries etc. to make substantial investments in deepwater drilling. Moreover, strong growth expected in Infrastructure,<br />

power, construction and housing sector will only lead to substantial demand. With the completion <strong>of</strong> its higher dia seamless plant, the<br />

Company is well positioned to meet the growing requirement <strong>of</strong> the market.<br />

SEGMENT-WISE PERFORMANCE<br />

The Company has primarily three segments – Seamless, ERW and Wind Power. All the three segments contribute positively to the<br />

pr<strong>of</strong>itability. Seamless Pipes Division constitutes 65% <strong>of</strong> turnover <strong>of</strong> the Company. The contribution <strong>of</strong> the Seamless Pipes Division is<br />

over 78% <strong>of</strong> the total Pr<strong>of</strong>it Before Tax. ERW Division, constitutes around 34% <strong>of</strong> turnover <strong>of</strong> the company. 7 MW Wind Power Project<br />

<strong>of</strong> the Company is meeting around 26% <strong>of</strong> Power requirement and has helped in reducing over all cost <strong>of</strong> power. The company is also<br />

enjoying various fiscal incentives from the state <strong>of</strong> Maharashtra.<br />

22

MAHARASHTRA SEAMLESS LIMITED<br />

FINANCIAL PERFORMANCE<br />

During the year the company has shown commendable growth. Turnover <strong>of</strong> the company increased to Rs. 879 crore from Rs. 569 crore in<br />

the previous year – a growth <strong>of</strong> 54%. The pr<strong>of</strong>it before tax for the year was Rs. 126 crore as against Rs. 105 crore in the previous year<br />

showing a growth <strong>of</strong> 20%. The pr<strong>of</strong>it after tax & adjustments for the year had been Rs. 85 crore as against Rs. 72 crore in the previous year.<br />

FINANCE COST<br />

The interest and finance charges for the year ended 31st March, 2005 were Rs. 3.81 crore as against Rs. 1.97 crore in the previous years.<br />

SHARE CAPITAL<br />

Share Capital <strong>of</strong> the company comprises Equity Share Capital <strong>of</strong> Rs. 28.82 crore. The Authorised share capital <strong>of</strong> the Company has been<br />

increased form Rs. 55 Crore to Rs. 60 Crore by addition <strong>of</strong> 50 lac equity shares <strong>of</strong> Rs.10/- each.<br />

RESERVES & SURPLUS<br />

Reserves & Surplus <strong>of</strong> the Company were Rs. 284 crore as on 31st March, 2005 as against Rs. 215 crore as on 31st March, 2004.<br />

EARNING PER SHARE<br />

Earning per share for the financial year 2004-05 improved to Rs. 29.54 from Rs 23.72 in the previous year.<br />

MAHARASHTRA SEAMLESS’S APPROACH TO BUSINESS<br />

MSL’s Vision is to;<br />

* Maintain & strengthen leadership position in Seamless Industry with continued focus on innovation and value addition.<br />

* A highly respected industry leader with which all stakeholders are proud to be associated. Constantly endeavour to make all its<br />

stakeholders and customers to be proud <strong>of</strong> their association with the company.<br />

All manufacturers provide some form <strong>of</strong> value to their customers – MSL aspires to be the partner <strong>of</strong> choice for its Seamless and ERW<br />

pipe customers through adding extra value to its customers than other competitors.<br />

MSL has a wide range <strong>of</strong> stakeholders including its shareholders, the investment community, customers, suppliers, employees & their<br />

families and the local community within which its operation are situated. MSL always strives to make all its stakeholders proud <strong>of</strong> their<br />

relationship with the company.<br />

Business strategy that will take the company towards its Vision is :<br />

* Deliver better value products to customers<br />

* “Solution partnership strategy” through proactive approach towards customers<br />

* Constant upgradation <strong>of</strong> technology so as to expand product applications and highest quality standards. The only true and ultimate<br />

measure <strong>of</strong> MSL’s success is the extent to which it improves the business performance <strong>of</strong> its customers. The way in which MSL<br />

strives to achieve this is through its “Solutions Partner strategy” wherein MSL and its customers:<br />

* Work in partnership to address performance improvement opportunities <strong>of</strong> highest priority to the customer.<br />

* Combine customer’s expertise with MSL’s proprietary technology, process and product application knowledge.<br />

In addition to its Vision and Business Strategy , at the core <strong>of</strong> MSL’s approach to business is:<br />

AN ORGANISATONAL CULTURE BASED ON KEY VALUES<br />

All MSL employees strive to “live’ the company’s set <strong>of</strong> values :<br />

1. Customer Always First – everyone owns customer satisfaction and strives to deliver it.<br />

2. High Performance – an ambitious organization in which everyone aspires for excellence.<br />

3. Employee Focus – an organization that provides fulfillment, stretch and development for its employees.<br />

4. Responsiveness – employees respond with speed, proactiveness and a sense <strong>of</strong> urgency to satisfy external and internal customers.<br />

5. Team- working – our collective knowledge and experience when harnessed through strong team-working results in higher<br />

performance and customer satisfaction.<br />

6. Empowerment – decentralization and delegation supports faster and better decision making.<br />

23

MAHARASHTRA SEAMLESS LIMITED<br />

7. Lead by Example – set standards and bench mark for the industry .<br />

8. Deliver the Promise - a commitment made is a personal promise to be delivered on-time and first-time right.<br />

9. Continuous Improvement – pursuit <strong>of</strong> excellence and highest standards <strong>of</strong> quality through learning, innovation and the search<br />

for best practice is a journey without end.<br />

10. Safety, Health and the Environment – protection <strong>of</strong> the health and safety <strong>of</strong> all people who have a relationship with MSL<br />

is critical. MSL must ensure that its activities have no negative impact on the environment in which its products are manufactured<br />

or used. Infact through various local community programmes MSL continues to provide better quality <strong>of</strong> life to surroundings.<br />

TOTAL QUALITY MANAGEMENT<br />

The very foundation <strong>of</strong> MSL’s activities is Total Quality Management. TQM means that all employees strive for excellence in every aspect <strong>of</strong><br />

the company’s operations. MSL is an organization constantly seeking better ways <strong>of</strong> doing things to improve quality, efficiency and to reduce<br />

cost and thereby ultimately to provide greater customer satisfaction. TQM will be part <strong>of</strong> every activity and every process that the company<br />

operates, an integral part <strong>of</strong> the way that every employee works. The Company is accredited to the international ISO :9001 :2000 standards.<br />

KEY FEATURES OF THE COMPANY’S PERFORMANCE DURING THE YEAR WERE:<br />

* Record turnover and pr<strong>of</strong>its.<br />

* Continued focus on cost effectiveness<br />

* Prudent management <strong>of</strong> working capital.<br />

* Strong cash generation, thereby making sufficient provision for future capital investments, enabled the company to reward its<br />

shareholders with record dividends.<br />

INTERNAL CONTROL SYSTEMS<br />

The company has strong systems <strong>of</strong> internal controls and procedures commensurate with the size and nature <strong>of</strong> its business. These<br />

procedures are designed to ensure the following :<br />

* that all assets and resources are optimized, used efficiently and are adequately protected.<br />

* that all internal policies and statutory guidelines are complied with.<br />

* Transparency and timely reporting <strong>of</strong> financial reports and management information.<br />

All internal audit reports and progress in implementing any matters arising from them are reviewed by the Audit Committee <strong>of</strong> the Board.<br />

HUMAN RESOURCES<br />

During the year company has added new qualified pr<strong>of</strong>essionals and also maintained high motivation through teamwork, collaboration<br />

and multi skill development opportunities i.e. being able to contribute to all parts <strong>of</strong> the production process.<br />

At the very heart <strong>of</strong> MSL’s success and its ability to deliver customer satisfaction is the considerable skill and motivation <strong>of</strong> its employees.<br />

On behalf <strong>of</strong> all the company’s stakeholders who benefit from the hard work <strong>of</strong> the employees, the Board would like to express its sincere<br />

appreciation and gratitude.<br />

ENVIRONMENT CONSCIOUSNESS<br />

The Company is conscious <strong>of</strong> its responsibility towards creating, maintaining and ensuring a safe and clean environment. Strict adherence<br />

to all regulatory requirements and guidelines is maintained continuously. The Company stresses strict compliance with all applicable rules<br />

and regulations and therefore takes measures on continuous basis for effective implementation <strong>of</strong> environment management system with<br />

focus on minimization <strong>of</strong> water resource utilization, reduction in energy consumption & waste generation and other environment friendly<br />

measures. The Company also takes continuous measures for social development by catering to the basic needs <strong>of</strong> health, education,<br />

supply <strong>of</strong> water to nearby villages, housing for staff and labour and creating employment opportunities.<br />

24

AUDITORS’ REPORT<br />

To The Members <strong>of</strong><br />

Maharashtra Seamless Limited<br />

We have audited the attached Balance Sheet <strong>of</strong> M/S MAHARASHTRA SEAMLESS LIMITED as at 31st March 2005 and also the annexed<br />

Pr<strong>of</strong>it and Loss Account and the Cash Flow Statement for the year ended on that date (together referred to as ‘financial statements’).<br />

These financial statements are the responsibility <strong>of</strong> the Company’s management. Our responsibility is to express an opinion on these<br />

financial statements based on our audit.<br />

We have conducted our audit in accordance with the auditing standards generally accepted in India. These standards require that we<br />

plan and perform the audit to obtain reasonable assurance about whether the financial statements are free <strong>of</strong> material misstatement.<br />

An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also<br />

includes assessing the accounting principles used and significant estimates made by the management, as well as evaluating the overall<br />

financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.<br />

As required by the <strong>Companies</strong> (Auditor’s Report) Order, 2003, issued by the Central Government <strong>of</strong> India in terms <strong>of</strong> Section 227(4A),<br />

<strong>of</strong> the <strong>Companies</strong> Act 1956, we enclose in the Annexure a statement on the matters specified in paragraphs 4 & 5 <strong>of</strong> the said order.<br />

Further to our comments in the Annexure referred to above, we report that :<br />

a) We have obtained all the information and explanations which to the best <strong>of</strong> our knowledge and belief were necessary for the purposes<br />

<strong>of</strong> our audit.<br />

b) In our opinion proper books <strong>of</strong> account as required by law have been kept by the Company so far as appears from our examination<br />

<strong>of</strong> such books.<br />

c) The Balance Sheet, Pr<strong>of</strong>it & Loss Account and Cash Flow Statement dealt with by this report are in agreement with the books <strong>of</strong><br />

account.<br />

d) In our opinion, the Balance Sheet, Pr<strong>of</strong>it and Loss Account and Cash flow Statement dealt with by this report have been prepared<br />

in compliance with the Accounting standards referred to in Sub Section (3C) <strong>of</strong> Section 211 <strong>of</strong> the <strong>Companies</strong> Act, 1956.<br />

e) On the basis <strong>of</strong> the written representations received from the directors and taken on record by the Board <strong>of</strong> Directors, we report<br />

that none <strong>of</strong> the said directors are disqualified as on 31st March 2005, from being appointed as directors in terms <strong>of</strong> clause (g) <strong>of</strong><br />

sub-section (1) <strong>of</strong> Section 274 <strong>of</strong> the <strong>Companies</strong> Act, 1956.<br />

f) In our opinion and to the best <strong>of</strong> our information and according to the explanations given to us, the said financial statements read<br />

together with significant accounting policies and notes thereon in Schedule ‘20’ give the information required by the <strong>Companies</strong> Act,<br />

1956 in the manner so required and give a true and fair view in conformity with the accounting principles generally accepted in India:<br />