Payroll Deduction AVC Life Cover Plan Change Request Form

Payroll Deduction AVC Life Cover Plan Change Request Form

Payroll Deduction AVC Life Cover Plan Change Request Form

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

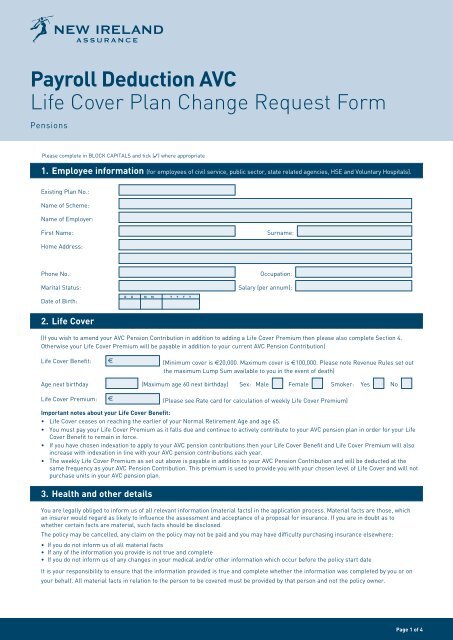

<strong>Payroll</strong> <strong>Deduction</strong> <strong>AVC</strong><br />

<strong>Life</strong> <strong>Cover</strong> <strong>Plan</strong> <strong>Change</strong> <strong>Request</strong> <strong>Form</strong><br />

Pensions<br />

Please complete in BLOCK CAPITALS and tick (3) where appropriate<br />

1. Employee information (for employees of civil service, public sector, state related agencies, HSE and Voluntary Hospitals).<br />

Existing <strong>Plan</strong> No.:<br />

Name of Scheme:<br />

Name of Employer:<br />

First Name:<br />

Surname:<br />

Home Address:<br />

Phone No.:<br />

Marital Status:<br />

Occupation:<br />

Salary (per annum):<br />

Date of Birth:<br />

D D M M Y Y Y Y<br />

2. <strong>Life</strong> <strong>Cover</strong><br />

(If you wish to amend your <strong>AVC</strong> Pension Contribution in addition to adding a <strong>Life</strong> <strong>Cover</strong> Premium then please also complete Section 4.<br />

Otherwise your <strong>Life</strong> <strong>Cover</strong> Premium will be payable in addition to your current <strong>AVC</strong> Pension Contribution)<br />

<strong>Life</strong> <strong>Cover</strong> Benefit: _ (Minimum cover is €20,000. Maximum cover is €100,000. Please note Revenue Rules set out<br />

the maximum Lump Sum available to you in the event of death)<br />

Age next birthday (Maximum age 60 next birthday) Sex: Male Female Smoker: Yes No<br />

<strong>Life</strong> <strong>Cover</strong> Premium: _ (Please see Rate card for calculation of weekly <strong>Life</strong> <strong>Cover</strong> Premium)<br />

Important notes about your <strong>Life</strong> <strong>Cover</strong> Benefit:<br />

• <strong>Life</strong> <strong>Cover</strong> ceases on reaching the earlier of your Normal Retirement Age and age 65.<br />

• You must pay your <strong>Life</strong> <strong>Cover</strong> Premium as it falls due and continue to actively contribute to your <strong>AVC</strong> pension plan in order for your <strong>Life</strong><br />

<strong>Cover</strong> Benefit to remain in force.<br />

• If you have chosen indexation to apply to your <strong>AVC</strong> pension contributions then your <strong>Life</strong> <strong>Cover</strong> Benefit and <strong>Life</strong> <strong>Cover</strong> Premium will also<br />

increase with indexation in line with your <strong>AVC</strong> pension contributions each year.<br />

• The weekly <strong>Life</strong> <strong>Cover</strong> Premium as set out above is payable in addition to your <strong>AVC</strong> Pension Contribution and will be deducted at the<br />

same frequency as your <strong>AVC</strong> Pension Contribution. This premium is used to provide you with your chosen level of <strong>Life</strong> <strong>Cover</strong> and will not<br />

purchase units in your <strong>AVC</strong> pension plan.<br />

3. Health and other details<br />

You are legally obliged to inform us of all relevant information (material facts) in the application process. Material facts are those, which<br />

an insurer would regard as likely to influence the assessment and acceptance of a proposal for insurance. If you are in doubt as to<br />

whether certain facts are material, such facts should be disclosed.<br />

The policy may be cancelled, any claim on the policy may not be paid and you may have difficulty purchasing insurance elsewhere:<br />

• If you do not inform us of all material facts<br />

• If any of the information you provide is not true and complete<br />

• If you do not inform us of any changes in your medical and/or other information which occur before the policy start date<br />

It is your responsibility to ensure that the information provided is true and complete whether the information was completed by you or on<br />

your behalf. All material facts in relation to the person to be covered must be provided by that person and not the policy owner.<br />

Page 1 of 4

3. Health and other details (continued)<br />

If you proceed with the application, the resulting policy will be based on the information provided:<br />

• as set out on this form containing your application details,<br />

• as set out in any other form related to your application,<br />

• as set out in any communication from you notifying us of any changes required in advance of the policy start date, and<br />

• as set out in any questionnaire completed by you or by a medical examiner and signed by you.<br />

You may submit answers to any medical questions, if you have not already done so, direct to the Chief Medical Officer, New Ireland<br />

Assurance, 11-12 Dawson Street, Dublin 2.<br />

Please indicate in your letter your name and the application number to which the information applies. All information will be treated in<br />

strictest confidence.<br />

We may not necessarily contact your doctor(s). Even if we do, you must still disclose all material facts. We may ask you to have a medical<br />

examination with a nurse or a doctor.<br />

Any changes to the information provided in the application process which occur before the policy start date must be notified immediately<br />

in writing to New Ireland Assurance.<br />

Material Facts Exemption in Relation to Genetic Tests<br />

You are not required to disclose any genetic tests you may have had and we will not have any regard to any genetic tests, which may come<br />

into our possession. You are however required to provide us with full details (other than genetic tests) in answer to all the health and<br />

lifestyle questions including full medical details about your family history.<br />

Please answer the following questions.<br />

1. Within the last 10 years have you had medical advice for any of the following illnesses, or been referred<br />

for tests or investigation for any of these conditions;<br />

• Stroke, heart valve surgery, heart attack, angina, angioplasty, heart by-pass, cardiomyopathy or any other disease<br />

or disorder of the heart or blood vessels?<br />

• Alzheimer’s Disease, Parkinson’s Disease, Motor Neurone Disease or any other disease or disorder of or injury<br />

to the brain?<br />

• Any form of cancer including Leukaemia or Lymphoma?<br />

• Diabetes or kidney disease or disorder (other than kidney stones)?<br />

• HIV infection, Hepatitis B or C or any other disease or disorder of the liver?<br />

• Drug abuse or alcohol abuse where reduction has been recommended by a medical advisor?<br />

• Multiple sclerosis or any other neurological disease or disorder?<br />

• Ulcerative colitis, Crohn’s disease, blood clotting disorder or haemophilia?<br />

• Schizophrenia, bipolar affective disorder, manic depression, psychosis, paranoia or mania, or any other mental<br />

health conditions for which you have been hospitalised?<br />

• Any lung disease or disorder (other than asthma) which has required oral steroids or hospital admission?<br />

Yes<br />

No<br />

If you have answered yes to any of the above questions then for each condition disclosed please give details of a) exact nature of condition<br />

b) date of diagnosis c) treatment received d) date of last symptoms e) if you have made a full recovery?<br />

2. Are you currently awaiting any medical referral, medical investigation, test results<br />

or surgical procedure not disclosed above? Y: N:<br />

If you have answered yes to the above question please give details of a) reason b) appointment date c) nature and severity of any<br />

current symptoms<br />

3. Have you ever had an application for life cover on your life declined, postponed<br />

or accepted at an increased premium? Y: N:<br />

If you have answered yes to the above question please give details of a) date b) reason for this c) name of insurance company<br />

Page 2 of 4

3. Health and other details (continued)<br />

4. Have you smoked cigarettes, cigars or pipe tobacco in the last 12 months? Y: N:<br />

5. What is your height and weight? ft ins st lbs<br />

6. Please provide the name and address of your doctor. (If none please write “None”)<br />

4. <strong>AVC</strong> Pension Top-up only<br />

(Only complete this section if you wish to amend your <strong>AVC</strong> pension contribution. The <strong>Life</strong> <strong>Cover</strong> Premium should be inserted in Section 2).<br />

Date increase to take effect from:<br />

D D M M Y Y Y Y<br />

01<br />

(No need to be completed if the increase is to take effect from the next possible date)<br />

I wish to increase the regular <strong>AVC</strong> Pension Contribution to this policy by the following: By _ per<br />

Any top-up to your regular <strong>AVC</strong> Pension Contributions will be invested in the same fund(s) as your current regular <strong>AVC</strong> Pension<br />

Contributions.<br />

5. Employee’s declaration and application<br />

1. I agree to be bound by the rules of the scheme and authorise deductions from my earnings in respect of any contributions or premiums<br />

required from me under the rules of the scheme.<br />

2. I have read through all the replies to the questions in this application and I declare that the statements in this application including any<br />

statements written at my request are true and complete and shall be the basis of the proposed contract.<br />

3. I understand that I must be actively at work in order to be entitled to apply for <strong>Life</strong> <strong>Cover</strong> and that if I cease payment of my <strong>Life</strong> <strong>Cover</strong><br />

Premium or my <strong>AVC</strong> Pension Contributions my <strong>Life</strong> <strong>Cover</strong> Benefit will cease with immediate effect.<br />

4. I agree to New Ireland seeking information from any doctor who has attended me and from any insurance company to which an<br />

application for insurance of any kind on my life or health has been made and I authorise them to give New Ireland such information. I<br />

agree that this authority will remain in force after my death.<br />

5. I have read and understand the notes in relation to material facts and understand that if I do not tell you all material facts this contract<br />

could be void.<br />

6. I understand that in certain circumstances the <strong>Life</strong> <strong>Cover</strong> Benefit paid in the event of death may have to be restricted to ensure that<br />

Revenue limits are not exceeded.<br />

7. I understand that the <strong>Life</strong> <strong>Cover</strong> Benefit is subject to underwriting and acceptance by New Ireland Assurance Company plc and that I am<br />

only on cover for the <strong>Life</strong> <strong>Cover</strong> Benefit from the date of notification of acceptance.<br />

@<br />

Signature of<br />

Employee:<br />

Date<br />

Signed:<br />

D D M M Y Y Y Y<br />

Page 3 of 4

New Ireland Assurance Company plc.,<br />

11-12 Dawson Street, Dublin 2.<br />

T: (01) 617 2000 F: (01) 617 2075.<br />

E: info@newireland.ie W: www.newireland.ie<br />

New Ireland Assurance Company plc is regulated by the Central Bank of Ireland. A member of Bank of Ireland Group.<br />

301453 V3.05.12<br />

Page 4 of 4