Summary of Currently Applicable GASB Statements GASB 60 ...

Summary of Currently Applicable GASB Statements GASB 60 ...

Summary of Currently Applicable GASB Statements GASB 60 ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

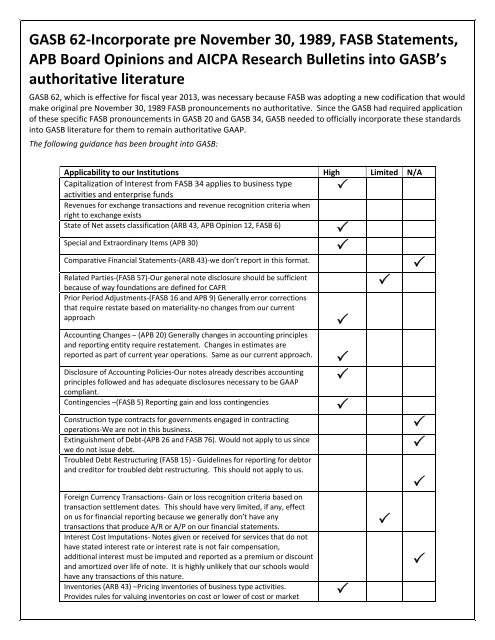

<strong>GASB</strong> 62‐Incorporate pre November 30, 1989, FASB <strong>Statements</strong>,<br />

APB Board Opinions and AICPA Research Bulletins into <strong>GASB</strong>’s<br />

authoritative literature<br />

<strong>GASB</strong> 62, which is effective for fiscal year 2013, was necessary because FASB was adopting a new codification that would<br />

make original pre November 30, 1989 FASB pronouncements no authoritative. Since the <strong>GASB</strong> had required application<br />

<strong>of</strong> these specific FASB pronouncements in <strong>GASB</strong> 20 and <strong>GASB</strong> 34, <strong>GASB</strong> needed to <strong>of</strong>ficially incorporate these standards<br />

into <strong>GASB</strong> literature for them to remain authoritative GAAP.<br />

The following guidance has been brought into <strong>GASB</strong>:<br />

Applicability to our Institutions High Limited N/A<br />

Capitalization <strong>of</strong> Interest from FASB 34 applies to business type<br />

activities and enterprise funds<br />

<br />

Revenues for exchange transactions and revenue recognition criteria when<br />

right to exchange exists<br />

State <strong>of</strong> Net assets classification (ARB 43, APB Opinion 12, FASB 6)<br />

Special and Extraordinary Items (APB 30)<br />

Comparative Financial <strong>Statements</strong>‐(ARB 43)‐we don’t report in this format.<br />

Related Parties‐(FASB 57)‐Our general note disclosure should be sufficient<br />

because <strong>of</strong> way foundations are defined for CAFR<br />

Prior Period Adjustments‐(FASB 16 and APB 9) Generally error corrections<br />

that require restate based on materiality‐no changes from our current<br />

approach<br />

Accounting Changes – (APB 20) Generally changes in accounting principles<br />

and reporting entity require restatement. Changes in estimates are<br />

reported as part <strong>of</strong> current year operations. Same as our current approach.<br />

Disclosure <strong>of</strong> Accounting Policies‐Our notes already describes accounting<br />

principles followed and has adequate disclosures necessary to be GAAP<br />

compliant.<br />

Contingencies –(FASB 5) Reporting gain and loss contingencies<br />

Construction type contracts for governments engaged in contracting<br />

operations‐We are not in this business.<br />

Extinguishment <strong>of</strong> Debt‐(APB 26 and FASB 76). Would not apply to us since<br />

we do not issue debt.<br />

Troubled Debt Restructuring (FASB 15) ‐ Guidelines for reporting for debtor<br />

and creditor for troubled debt restructuring. This should not apply to us.<br />

Foreign Currency Transactions‐ Gain or loss recognition criteria based on<br />

transaction settlement dates. This should have very limited, if any, effect<br />

on us for financial reporting because we generally don’t have any<br />

transactions that produce A/R or A/P on our financial statements.<br />

Interest Cost Imputations‐ Notes given or received for services that do not<br />

have stated interest rate or interest rate is not fair compensation,<br />

additional interest must be imputed and reported as a premium or discount<br />

and amortized over life <strong>of</strong> note. It is highly unlikely that our schools would<br />

have any transactions <strong>of</strong> this nature.<br />

Inventories (ARB 43) –Pricing inventories <strong>of</strong> business type activities.<br />

Provides rules for valuing inventories on cost or lower <strong>of</strong> cost or market