Summary of Currently Applicable GASB Statements GASB 60 ...

Summary of Currently Applicable GASB Statements GASB 60 ...

Summary of Currently Applicable GASB Statements GASB 60 ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

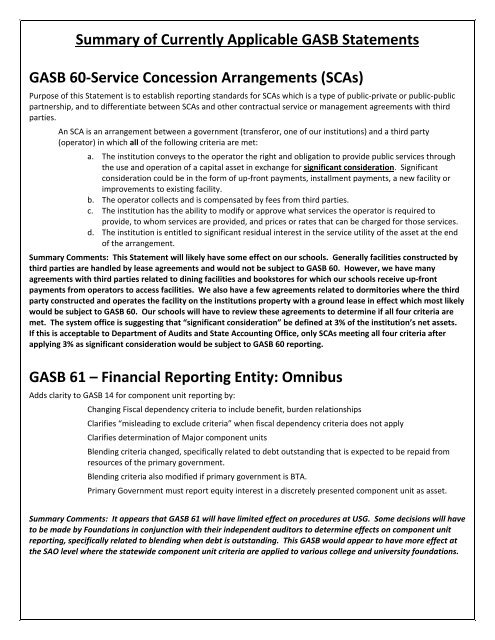

<strong>Summary</strong> <strong>of</strong> <strong>Currently</strong> <strong>Applicable</strong> <strong>GASB</strong> <strong>Statements</strong><br />

<strong>GASB</strong> <strong>60</strong>‐Service Concession Arrangements (SCAs)<br />

Purpose <strong>of</strong> this Statement is to establish reporting standards for SCAs which is a type <strong>of</strong> public‐private or public‐public<br />

partnership, and to differentiate between SCAs and other contractual service or management agreements with third<br />

parties.<br />

An SCA is an arrangement between a government (transferor, one <strong>of</strong> our institutions) and a third party<br />

(operator) in which all <strong>of</strong> the following criteria are met:<br />

a. The institution conveys to the operator the right and obligation to provide public services through<br />

the use and operation <strong>of</strong> a capital asset in exchange for significant consideration. Significant<br />

consideration could be in the form <strong>of</strong> up‐front payments, installment payments, a new facility or<br />

improvements to existing facility.<br />

b. The operator collects and is compensated by fees from third parties.<br />

c. The institution has the ability to modify or approve what services the operator is required to<br />

provide, to whom services are provided, and prices or rates that can be charged for those services.<br />

d. The institution is entitled to significant residual interest in the service utility <strong>of</strong> the asset at the end<br />

<strong>of</strong> the arrangement.<br />

<strong>Summary</strong> Comments: This Statement will likely have some effect on our schools. Generally facilities constructed by<br />

third parties are handled by lease agreements and would not be subject to <strong>GASB</strong> <strong>60</strong>. However, we have many<br />

agreements with third parties related to dining facilities and bookstores for which our schools receive up‐front<br />

payments from operators to access facilities. We also have a few agreements related to dormitories where the third<br />

party constructed and operates the facility on the institutions property with a ground lease in effect which most likely<br />

would be subject to <strong>GASB</strong> <strong>60</strong>. Our schools will have to review these agreements to determine if all four criteria are<br />

met. The system <strong>of</strong>fice is suggesting that “significant consideration” be defined at 3% <strong>of</strong> the institution’s net assets.<br />

If this is acceptable to Department <strong>of</strong> Audits and State Accounting Office, only SCAs meeting all four criteria after<br />

applying 3% as significant consideration would be subject to <strong>GASB</strong> <strong>60</strong> reporting.<br />

<strong>GASB</strong> 61 – Financial Reporting Entity: Omnibus<br />

Adds clarity to <strong>GASB</strong> 14 for component unit reporting by:<br />

Changing Fiscal dependency criteria to include benefit, burden relationships<br />

Clarifies “misleading to exclude criteria” when fiscal dependency criteria does not apply<br />

Clarifies determination <strong>of</strong> Major component units<br />

Blending criteria changed, specifically related to debt outstanding that is expected to be repaid from<br />

resources <strong>of</strong> the primary government.<br />

Blending criteria also modified if primary government is BTA.<br />

Primary Government must report equity interest in a discretely presented component unit as asset.<br />

<strong>Summary</strong> Comments: It appears that <strong>GASB</strong> 61 will have limited effect on procedures at USG. Some decisions will have<br />

to be made by Foundations in conjunction with their independent auditors to determine effects on component unit<br />

reporting, specifically related to blending when debt is outstanding. This <strong>GASB</strong> would appear to have more effect at<br />

the SAO level where the statewide component unit criteria are applied to various college and university foundations.

<strong>GASB</strong> 62‐Incorporate pre November 30, 1989, FASB <strong>Statements</strong>,<br />

APB Board Opinions and AICPA Research Bulletins into <strong>GASB</strong>’s<br />

authoritative literature<br />

<strong>GASB</strong> 62, which is effective for fiscal year 2013, was necessary because FASB was adopting a new codification that would<br />

make original pre November 30, 1989 FASB pronouncements no authoritative. Since the <strong>GASB</strong> had required application<br />

<strong>of</strong> these specific FASB pronouncements in <strong>GASB</strong> 20 and <strong>GASB</strong> 34, <strong>GASB</strong> needed to <strong>of</strong>ficially incorporate these standards<br />

into <strong>GASB</strong> literature for them to remain authoritative GAAP.<br />

The following guidance has been brought into <strong>GASB</strong>:<br />

Applicability to our Institutions High Limited N/A<br />

Capitalization <strong>of</strong> Interest from FASB 34 applies to business type<br />

activities and enterprise funds<br />

<br />

Revenues for exchange transactions and revenue recognition criteria when<br />

right to exchange exists<br />

State <strong>of</strong> Net assets classification (ARB 43, APB Opinion 12, FASB 6)<br />

Special and Extraordinary Items (APB 30)<br />

Comparative Financial <strong>Statements</strong>‐(ARB 43)‐we don’t report in this format.<br />

Related Parties‐(FASB 57)‐Our general note disclosure should be sufficient<br />

because <strong>of</strong> way foundations are defined for CAFR<br />

Prior Period Adjustments‐(FASB 16 and APB 9) Generally error corrections<br />

that require restate based on materiality‐no changes from our current<br />

approach<br />

Accounting Changes – (APB 20) Generally changes in accounting principles<br />

and reporting entity require restatement. Changes in estimates are<br />

reported as part <strong>of</strong> current year operations. Same as our current approach.<br />

Disclosure <strong>of</strong> Accounting Policies‐Our notes already describes accounting<br />

principles followed and has adequate disclosures necessary to be GAAP<br />

compliant.<br />

Contingencies –(FASB 5) Reporting gain and loss contingencies<br />

Construction type contracts for governments engaged in contracting<br />

operations‐We are not in this business.<br />

Extinguishment <strong>of</strong> Debt‐(APB 26 and FASB 76). Would not apply to us since<br />

we do not issue debt.<br />

Troubled Debt Restructuring (FASB 15) ‐ Guidelines for reporting for debtor<br />

and creditor for troubled debt restructuring. This should not apply to us.<br />

Foreign Currency Transactions‐ Gain or loss recognition criteria based on<br />

transaction settlement dates. This should have very limited, if any, effect<br />

on us for financial reporting because we generally don’t have any<br />

transactions that produce A/R or A/P on our financial statements.<br />

Interest Cost Imputations‐ Notes given or received for services that do not<br />

have stated interest rate or interest rate is not fair compensation,<br />

additional interest must be imputed and reported as a premium or discount<br />

and amortized over life <strong>of</strong> note. It is highly unlikely that our schools would<br />

have any transactions <strong>of</strong> this nature.<br />

Inventories (ARB 43) –Pricing inventories <strong>of</strong> business type activities.<br />

Provides rules for valuing inventories on cost or lower <strong>of</strong> cost or market

Applicability to our Institutions High Limited N/A<br />

basis consistent with what our schools are currently doing.<br />

Investments in Common Stock‐Accounting use cost vs. equity methods. No<br />

change in application vs. current practice.<br />

<br />

Leases (FASB 13, 22, 98 and FASB Interpretations 23, 26 and 27) ‐<br />

Establishes standards for lessor and lessee reporting. <strong>Applicable</strong> to capital<br />

and operating leases. This is consistent with methodology that our schools<br />

already use.<br />

Nonmonetary Transactions‐Generally relates to nonmonetary exchanges <strong>of</strong><br />

assets or liabilities between a government and another entity (does not<br />

include transactions between reporting units in the same reporting entity<br />

which is covered in <strong>GASB</strong> 48). It is unlikely that our institutions would have<br />

transactions <strong>of</strong> this nature.<br />

Sales <strong>of</strong> Real Estate (FASB 66)‐Recognizing gain or loss on sale <strong>of</strong> real estate<br />

based on whether sales are retail land sales or “other than retail land”<br />

sales. Our institutions are not in the business <strong>of</strong> buying or selling real<br />

estate, so this would have very limited applicability.<br />

Applicability to our institutions<br />

High Limited N/A<br />

<br />

<br />

<br />

Real Estate Projects‐(FASB 67) ‐ Reporting Standards for costs associated<br />

with real estate projects developed or acquired for sale or rental. It does<br />

not apply to projects developed for the government’s own operations or to<br />

projects with lease rules apply. This would not be applicable for our schools<br />

because our projects are handled under lease rules.<br />

Broadcasters (FASB 63) ‐ Standards for reporting broadcast license<br />

agreements and bartering transactions. This would have very limited<br />

applicability to USG institutions. Those with radio and/or television stations<br />

would be subject to reporting for these agreements.<br />

Cable Television Systems‐(FASB 51) ‐ standards for government entities<br />

operating cable television systems. Should not apply to USG institutions.<br />

Insurance Entities other than Risk Pools‐(FASB <strong>60</strong>) ‐ Establishes standards<br />

for short‐term insurance contracts written underwritten by insurance<br />

entities. USG institutions are not insurance entities.<br />

Lending Activities‐(FASB 91) ‐ Establishes standards for accounting and<br />

reporting <strong>of</strong> nonrefundable fees associated with lending activities and loan<br />

purchases. This should not apply to USG institutions.<br />

Mortgage Banking Activities (FASB 65)‐standards for mortgage loan<br />

activities held for sale. This would not be applicable for our institutions.<br />

Regulated Operations (FASB 71, 90 and 101) Standard applies to Business<br />

Type Activities that have regulated operations. Our institutions do not have<br />

regulated operations subject to rate actions from a regulator, so this section<br />

would not apply.<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<strong>Summary</strong> Comments: This is a voluminous <strong>GASB</strong> codification, but it really shouldn’t change anything that we are<br />

already doing. The main point <strong>of</strong> this <strong>GASB</strong> statement is to incorporate FASB and AICPA guidance into existing <strong>GASB</strong><br />

literature. This wouldn’t create new reporting standards because it would only change the hierarchical makeup for<br />

applying GAAP. As stated, this <strong>GASB</strong> statement should not change how our institutions report financials. It may have<br />

some effect on related party/component unit reporting for the State Accounting Office.

<strong>GASB</strong> 63 ‐ Financial Reporting for Deferred Outflows, Deferred<br />

Outflows and Net Position<br />

This Statement, which is effective for fiscal year 2013, establishes standards for reporting deferred inflows, outflows and<br />

net position consistent based on guidance provided in <strong>GASB</strong> Concept Statement No. 4:<br />

Deferred outflows‐consumption <strong>of</strong> Net Assets applicable to future reporting period<br />

Deferred inflow‐acquisition <strong>of</strong> Net Assets applicable to a future period<br />

Net Position‐residual <strong>of</strong> all other elements in financial statements which is presented as (Assets + deferred<br />

inflows ‐ liabilities ‐ deferred outflows)<br />

<strong>Summary</strong> Comments: This Statement effectively changes the presentation <strong>of</strong> the balance sheet for fiscal year ended<br />

June 30, 2013. The Statement <strong>of</strong> Net Assets will become the Statement <strong>of</strong> Net Position, with Deferred Outflows<br />

reported below assets but before liabilities and Deferred Inflows reported after liabilities but before Net Position.<br />

<strong>Currently</strong>, the reporting <strong>of</strong> deferred inflows and outflows only apply to transactions addressed in two <strong>GASB</strong><br />

pronouncements, Statement 53 concerning derivatives and Statement <strong>60</strong> on concession arrangements. <strong>GASB</strong> 65,<br />

which will be discussed later, provides additional guidance on other transactions subject to this format.<br />

<strong>GASB</strong> 64‐Application <strong>of</strong> Hedge Accounting Termination<br />

Provisions<br />

This Statement was effective in fiscal year 2012. It clarifies existing requirements for the termination <strong>of</strong> hedge<br />

accounting first addressed in <strong>GASB</strong> 53.<br />

<strong>Summary</strong> Comments: This Statement should not affect USG institution’s reporting because our schools are not<br />

allowed to invest in derivative type instruments. It may have some effect on Foundation reporting and the schools<br />

would need to work with the foundation accountants and auditors to ensure proper reporting.

<strong>GASB</strong> 65‐Items Previously Reported as Liabilities<br />

This Statement, which is effective in fiscal year 2014, builds on the reporting requirements for deferred outflows and<br />

deferred inflows that were discussed in <strong>GASB</strong> Statement 63 above and <strong>GASB</strong> Concept Statement No. 4.<br />

This statement will require that certain items previously reported as assets or liabilities now be classified as deferred<br />

inflows or outflows.<br />

Key components <strong>of</strong> <strong>GASB</strong> Concept Statement 4 affecting classification <strong>of</strong> transactions:<br />

Assets are considered to be resources with present service capacity that the government presently controls.<br />

Liabilities are present obligations to sacrifice resources that the government has little or no discretion to avoid.<br />

Deferred outflows <strong>of</strong> resources are a consumption <strong>of</strong> assets applicable to a future period.<br />

Deferred inflows <strong>of</strong> resources are the acquisition <strong>of</strong> resources that are applicable to future periods.<br />

Items currently reported as assets that will continue to be reported as assets based on <strong>GASB</strong> 65 because they<br />

meet the present service capacity and governmental control and items currently reported as liabilities because<br />

they are present obligations that government has little or no ability to avoid are:<br />

Assets<br />

Prepayments<br />

Resources advanced to another government that<br />

are considered a Government mandated nonexchange<br />

transactions (normally grants where<br />

provider government requires lower level<br />

government to undertake some mandated action)<br />

or voluntary non‐exchange transactions (grants or<br />

donations which are the result <strong>of</strong> contractual<br />

agreements) where eligibility requirements, other<br />

than time requirements, have not been met.<br />

The purchase <strong>of</strong> future revenues from a<br />

government outside the financial reporting entity.<br />

Example would be sales <strong>of</strong> receivables.<br />

Initial subscriber costs for cable television systems.<br />

Capitalized costs related to regulated activities.<br />

Liabilities<br />

Derived Tax non‐exchange revenues (income tax,<br />

sales tax) received in advance.<br />

Resources received in advance for government<br />

mandated non‐exchange transaction or a<br />

voluntary non‐exchange transaction when<br />

eligibility requirements other than time<br />

requirements have not been met. Liability side <strong>of</strong><br />

item 2 listed under assets.<br />

Resources received in advance <strong>of</strong> exchange<br />

transactions.<br />

Excess <strong>of</strong> initial hook up revenues over direct<br />

selling costs for cable television systems.<br />

Premium revenues for insurance entities and<br />

public entity risk pools.<br />

Commitment fees related to acquiring loans.<br />

Fees related to guaranteeing mortgages.<br />

Fees received for arranging a commitment<br />

between investor and borrower.

<strong>GASB</strong> Board had determined that the following transactions should be reported as deferred inflows or deferred<br />

outflows:<br />

Deferred Outflows<br />

Resources advanced to another<br />

government for government mandated<br />

non exchange transactions or voluntary<br />

non‐exchange transactions when time<br />

requirements are the only eligibility<br />

requirement that have not been met.<br />

<strong>GASB</strong> decided this relates to future<br />

periods because provider no longer<br />

maintains control <strong>of</strong> the present service<br />

capacity. Examples are “reimbursement<br />

type” or “expenditure driven grants”.<br />

Deferred debit amounts resulting from<br />

debt refunding<br />

Purchase <strong>of</strong> future revenues within the<br />

same reporting entity<br />

Losses resulting from a sale‐leaseback<br />

transaction represent a consumption <strong>of</strong><br />

resources related to a future period<br />

Loan origination costs incurred prior to<br />

sale for mortgages held for resale should<br />

be deferred if sale occurs in future period<br />

Resources received in advance from another<br />

government for government mandated non<br />

exchange transactions or voluntary non‐exchange<br />

transactions when time requirements are the<br />

only eligibility requirement that have not been<br />

met. <strong>GASB</strong> determined this relates to future<br />

period because recipient doesn’t have a present<br />

obligation to sacrifice resources. Examples are<br />

“reimbursement type” or “expenditure driven<br />

grants”.<br />

Deferred credit amounts resulting from debt<br />

refunding<br />

Proceeds from the sale <strong>of</strong> future revenues<br />

Gains resulting from a sale‐leaseback transaction<br />

represent acquisition <strong>of</strong> net assets related to a<br />

future period<br />

Loan origination fees received prior to sale for<br />

mortgages held for resale should be deferred if<br />

sale occurs in future period<br />

Resources received in advance related to<br />

imposed non‐exchange transactions. An example<br />

would be property taxes imposed on individuals<br />

and non‐governmental entities.<br />

Receipt <strong>of</strong> payment for points on loan transaction<br />

that reduces interest rate or future interest is<br />

deferred inflow that should be recognized over<br />

duration <strong>of</strong> loan<br />

Regulated operations which receive resources<br />

from rate‐payers based on current rates for<br />

services that will be provided in the future<br />

Gains or other reductions <strong>of</strong> net allowable costs<br />

for regulated business type activities. An<br />

example would be early extinguishment <strong>of</strong> debt<br />

for an amount less than net carrying value for<br />

regulated business type activity<br />

Resources received in governmental funds that<br />

do not meet revenue recognition criteria for<br />

governmental fund reporting<br />

Deferred Inflows<br />

<strong>Summary</strong> Comments: This Statement does not go into effect until fiscal year ended June 30, 2014, but<br />

it will likely have a significant impact on how we report certain activity on the balance sheet and the<br />

timing as to when that activity is reported on the income statement. This <strong>GASB</strong> clarifies and expands<br />

on reporting activity previously discussed is <strong>GASB</strong> 63.