Summary of Currently Applicable GASB Statements GASB 60 ...

Summary of Currently Applicable GASB Statements GASB 60 ...

Summary of Currently Applicable GASB Statements GASB 60 ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

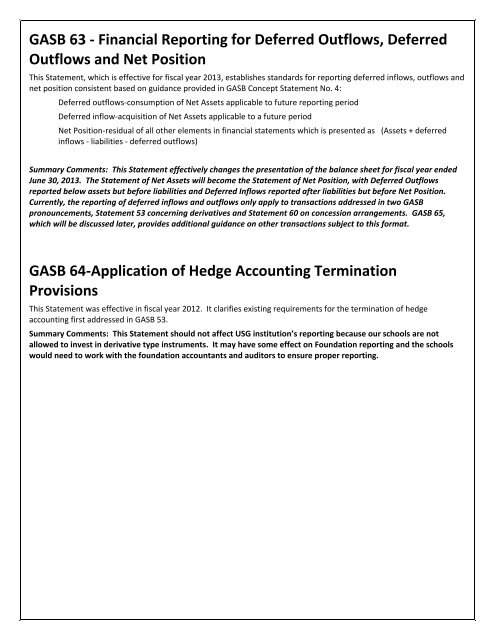

<strong>GASB</strong> 63 ‐ Financial Reporting for Deferred Outflows, Deferred<br />

Outflows and Net Position<br />

This Statement, which is effective for fiscal year 2013, establishes standards for reporting deferred inflows, outflows and<br />

net position consistent based on guidance provided in <strong>GASB</strong> Concept Statement No. 4:<br />

Deferred outflows‐consumption <strong>of</strong> Net Assets applicable to future reporting period<br />

Deferred inflow‐acquisition <strong>of</strong> Net Assets applicable to a future period<br />

Net Position‐residual <strong>of</strong> all other elements in financial statements which is presented as (Assets + deferred<br />

inflows ‐ liabilities ‐ deferred outflows)<br />

<strong>Summary</strong> Comments: This Statement effectively changes the presentation <strong>of</strong> the balance sheet for fiscal year ended<br />

June 30, 2013. The Statement <strong>of</strong> Net Assets will become the Statement <strong>of</strong> Net Position, with Deferred Outflows<br />

reported below assets but before liabilities and Deferred Inflows reported after liabilities but before Net Position.<br />

<strong>Currently</strong>, the reporting <strong>of</strong> deferred inflows and outflows only apply to transactions addressed in two <strong>GASB</strong><br />

pronouncements, Statement 53 concerning derivatives and Statement <strong>60</strong> on concession arrangements. <strong>GASB</strong> 65,<br />

which will be discussed later, provides additional guidance on other transactions subject to this format.<br />

<strong>GASB</strong> 64‐Application <strong>of</strong> Hedge Accounting Termination<br />

Provisions<br />

This Statement was effective in fiscal year 2012. It clarifies existing requirements for the termination <strong>of</strong> hedge<br />

accounting first addressed in <strong>GASB</strong> 53.<br />

<strong>Summary</strong> Comments: This Statement should not affect USG institution’s reporting because our schools are not<br />

allowed to invest in derivative type instruments. It may have some effect on Foundation reporting and the schools<br />

would need to work with the foundation accountants and auditors to ensure proper reporting.