How To Read Your Statement Brochure

How To Read Your Statement Brochure

How To Read Your Statement Brochure

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Asset Allocation Valuation at a Glance Purchasing Power Summary Customer Service Information Portfolio Holdings Transactions<br />

Accrued Interest Summary Money Market Fund Detail Schedule of Realized Gains and Losses Year-to-Date Open Orders Securities<br />

Cash Not Yet Received Fixed Income Bond Maturity Schedule Bond Quality Annuities Financing Holdings Retirement Account<br />

Asset Allocation Valuation at a Glance Purchasing Power Summary Customer Service Information Portfolio Holdings Transactions<br />

Accrued Interest Summary Money Market Fund Detail Schedule of Realized Gains and Losses Year-to-Date Open Orders Securities<br />

Cash Not Yet Received Fixed Income Bond Maturity Schedule Bond Quality Annuities Financing Holdings Retirement Account<br />

Asset Allocation Valuation at a Glance Purchasing Power Summary Customer Service Information Portfolio Holdings Transactions<br />

Accrued Interest Summary Money Market Fund Detail Schedule of Realized Gains and Losses Year-to-Date Open Orders Securities<br />

Cash Not Yet Received Fixed Income Bond Maturity Schedule Bond Quality Annuities Financing Holdings Retirement Account<br />

Asset Allocation Valuation at a Glance Purchasing Power Summary Customer Service Information Portfolio Holdings Transactions<br />

Accrued Interest Summary Money Market Fund Detail Schedule of Realized Gains and Losses Year-to-Date Open Orders Securities<br />

Cash Not Yet Received Fixed Income Bond Maturity Schedule Bond Quality Annuities Financing Holdings Retirement Account<br />

Asset Allocation Valuation at a Glance Purchasing Power Summary Customer Service Information Portfolio Holdings Transactions<br />

Accrued Interest Summary Money Market Fund Detail Schedule of Realized Gains and Losses Year-to-Date Open Orders Securities<br />

Cash Not Yet Received Fixed Income Bond Maturity Schedule Bond Quality Annuities Financing Holdings Retirement Account<br />

Asset Allocation Valuation at a Glance Purchasing Power Summary Customer Service Information Portfolio Holdings Transactions<br />

Accrued Interest Summary Money Market Fund Detail Schedule of Realized Gains and Losses Year-to-Date Open Orders Securities<br />

Cash Not Yet Received Fixed Income Bond Maturity Schedule Bond Quality Annuities Financing Holdings Retirement Account<br />

Asset Allocation Valuation at a Glance Purchasing Power Summary Customer Service Information Portfolio Holdings Transactions

INTRODUCTION<br />

<strong>Your</strong> brokerage account statement is a powerful<br />

tool that enables you to make informed investment<br />

decisions and helps you to effectively manage and<br />

maintain a balanced portfolio. Presenting information in<br />

easy-to-review sections, your brokerage account statement provides<br />

you with a concise, comprehensive picture of your financial status.<br />

At a glance, you can easily track your investments, monitor your<br />

account activity, evaluate your asset allocation, and view any changes<br />

that occur in your account value. In addition, you will receive an<br />

annual Form 1099 that summarizes your taxable financial activity<br />

for the year, making it simple to accurately report your investments<br />

at tax time.<br />

Please take a moment and review this brochure to familiarize yourself<br />

with the features and benefits your statement has to offer. <strong>Your</strong><br />

personal statement is customized to meet your specific financial<br />

reporting needs—including only the sections that are relevant to<br />

your account; therefore, your statement may not include all of the<br />

sections described in this brochure. The contents of this sample<br />

brokerage statement are designed to reflect a large number of<br />

potential situations. It is not intended to recommend any specific<br />

securities or asset allocation. If you have any questions or comments,<br />

please contact your investment professional or financial organization.<br />

CONTENTS<br />

ACCOUNT INFORMATION 3<br />

VALUATION AT A GLANCE 3<br />

ASSET ALLOCATION 3<br />

FOR YOUR INFORMATION 4<br />

CUSTOMER SERVICE INFORMATION 4<br />

PORTFOLIO HOLDINGS 5<br />

TRANSACTIONS 5<br />

INCOME SUMMARY 6<br />

ACCRUED INTEREST SUMMARY 6<br />

OPEN ORDERS 7<br />

CASH NOT YET RECEIVED 7<br />

SECURITIES NOT YET RECEIVED 7<br />

FIXED INCOME SECTIONS 8<br />

ANNUITY SECTIONS 9<br />

RETIREMENT ACCOUNT SECTION 10<br />

ASSET MANAGEMENT ACCOUNT SECTIONS 11<br />

PORTFOLIO EVALUATION SERVICE (PES ® ) SECTIONS 12<br />

CONSOLIDATED ACCOUNT SECTIONS 13<br />

MONEY MARKET FUND DETAIL 6

JOHN Q. PUBLIC<br />

1234 TOWNLINE STREET<br />

APT. #1234<br />

SOMEWHERE, MA 00000-0000<br />

<strong>Your</strong> Investment Professional:<br />

Investment Professional Name<br />

(999) 999-9999<br />

Asset Allocation<br />

Value Value Percent<br />

Last Period This Period Allocation<br />

Cash and Cash Equivalents 99,999,999,999.99 99,999,999,999.99 999%<br />

Fixed Income 99,999,999,999.99 99,999,999,999.99 999%<br />

Equities 99,999,999,999.99 99,999,999,999.99 999%<br />

Mutual Funds 99,999,999,999.99 99,999,999,999.99 999%<br />

Annuities 99,999,999,999.99 99,999,999,999.99 999%<br />

Other 99,999,999,999.99 99,999,999,999.99 999%<br />

Global Account Cash Balance 99,999,999,999.99 99,999,999,999.99 999%<br />

Global Account Securities 99,999,999,999.99 99,999,999,999.99 999%<br />

Account <strong>To</strong>tal $99,999,999,999.99 $99,999,999,999.99 100%<br />

Account Number: 999-999999<br />

<strong>Statement</strong> Period: 02/28/200X– 03/31/200X<br />

Valuation at a Glance<br />

This Period<br />

Beginning Account Value $99,999,999,999.99<br />

Cash Deposits 99,999,999,999.99<br />

Cash Withdrawals -99,999,999,999.99<br />

Dividends/Interest 99,999,999,999.99<br />

Fees -99,999,999,999.99<br />

Change in Account Value 99,999,999,999.99<br />

Ending Account Value $99,999,999,999.99<br />

Asset allocation percentages are<br />

rounded to the nearest whole<br />

percentage.<br />

Pie chart allocation excludes all<br />

asset classes which net to a liability.<br />

Account Information<br />

At the top of the first page of your statement, you will find information identifying your<br />

account. <strong>Your</strong> account number and the period covered by your statement appear on the top<br />

right. <strong>Your</strong> name and address, as well as your investment professional’s information, appear<br />

on the top left.<br />

Valuation at a Glance<br />

This section provides you with an explanation of the changes in the value of your account.<br />

It offers a high-level overview of account activity, including cash deposits, cash withdrawals,<br />

dividends and interest, fees, and change in account value, to help you identify the inflow and<br />

outflow of assets in your account. Beginning and ending account values for the current<br />

statement period are also provided.<br />

Asset Allocation<br />

This section provides a summary of your portfolio holdings, segregated by asset class. This<br />

information can be used to determine the approximate value of the various asset types held in<br />

your account as of the statement date. These asset classes are consolidated Portfolio Holdings<br />

summarized in one, easy-to-read section. For each asset class that you hold, the market value<br />

(based on prices as of the last day of the statement period) is displayed along with the percentage<br />

of the account that the asset class represents. These totals are added together to give you the net<br />

value of your portfolio. If two or more asset classes are held in your account, you may find a pie<br />

chart illustrating the allocations of each asset class by percentage. 1<br />

1 At least two asset classes must be equal to 2.5 percent or greater of the total account value for a pie chart to appear.<br />

3<br />

For <strong>Your</strong> Information<br />

This message area would be reserved for your financial organization. This message area would be<br />

reserved for your financial organization. This message area would be reserved for your financial<br />

organization. This message area would be reserved for your financial organization. This message area<br />

would be reserved for your financial organization. This message area would be reserved for your<br />

financial organization. This message area would be reserved for your financial organization. This<br />

message area would be reserved for your financial organization. This message area would be reserved<br />

for your financial organization. This message area would be reserved for your financial organization.<br />

Customer Service Information<br />

Investment Professional:<br />

Identification Number: 999<br />

Investment Professional Name<br />

Address<br />

Address<br />

Address<br />

Address<br />

Address<br />

Telephone Number: (999) 999-9999<br />

Fax Number: (999) 999-9999<br />

E-Mail Address:<br />

As you requested, copies of this statement have been sent to:<br />

Interested Party Information<br />

Interested Party Information<br />

Interested Party Information<br />

Interested Party Information<br />

Interested Party Information<br />

Interested Party Information<br />

Call your investment professional for additional information about other interested<br />

parties not listed above.<br />

This message area would be reserved for your financial organization. This message area would be<br />

reserved for your financial organization. This message area would be reserved for your financial<br />

organization. This message area would be reserved for your financial organization. This message area<br />

would be reserved for your financial organization. This message area would be reserved for your<br />

financial organization. This message area would be reserved for your financial organization. This<br />

message area would be reserved for your financial organization. This message area would be reserved<br />

for your financial organization. This message area would be reserved for your financial organization.<br />

Service Hours: Monday - Friday 8:00 a.m. - 5:00 p.m.(ET)<br />

Saturday 12:00 p.m. - 4:00 p.m.(ET)<br />

Customer Service Telephone Number: (999) 999-9999<br />

Web Site: www.yourwebsite.com<br />

<strong>To</strong> report a lost or stolen MasterCard ® or check call (800) 888-8888, 24 hours a day, 7 days a week.<br />

Date of Birth: 99/99/9999<br />

NOTE: Please verify the accuracy of your personal information. If incorrect, notify your financial<br />

organization.<br />

Prior Year-End Fair Market Value: -$99,999,999,999.99<br />

For <strong>Your</strong> Information<br />

Here you will find important messages and notices from your financial organization regarding<br />

your account. These messages may include industry related topics and regulatory announcements.<br />

In addition, you may find information regarding new products and services available to you.<br />

Customer Service Information<br />

This section provides specific contact information regarding your financial organization, as<br />

well as account-related details. <strong>Your</strong> investment professional’s name and address, interested<br />

party information, service hours, your financial organization’s web site address, and other<br />

information may appear here. For retirement products, your prior year-end fair market value<br />

is displayed at the end of this section.<br />

Account Number: 999–999999<br />

John Q. Public<br />

4

Portfolio Holdings<br />

United States (Dollar)<br />

Current Opening Closing Accrued Income 30-day<br />

Quantity Description Yield Balance Balance Income This Year Yield<br />

Cash and Cash Equivalents – 99.99% of Portfolio<br />

Cash Balance -99,999,999,999.99 -99,999,999,999.99<br />

Margin Balance -99,999,999,999.99 -99,999,999,999.99<br />

Short Account Balance -99,999,999,999.99 -99,999,999,999.99<br />

Money Market Funds<br />

-99,999,999,999.99 999.99% -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99 999.99%<br />

<strong>To</strong>tal Money Market Funds -$99,999,999,999.99 -$99,999,999,999.99-$99,999,999,999.99-$99,999,999,999.99<br />

<strong>To</strong>tal Cash and Cash Equivalents -$99,999,999,999.99 -$99,999,999,999.99-$99,999,999,999.99-$99,999,999,999.99<br />

Transactions in Date Sequence<br />

Process/ Trade/<br />

Settlement Transaction<br />

Date Date Activity Type Description Quantity Price Accrued Interest Amount<br />

United States (Dollar)<br />

99/99/99 99/99/99 Funds Received Into <strong>Your</strong> Account ARGENTINIAN PESO 99,999,999,999.99<br />

99/99/99 99/99/99 Foreign Currency Exchange US DOLLAR -99,999,999,999.99 9,999,999.9999 -99,999,999,999.99<br />

Commission: 99,999,999,999.99 USD<br />

99/99/99 99/99/99 Money Market Fund Income Received DIVIDENDS 99,999,999,999.99<br />

99/99/99 99/99/99 Money Market Fund Income Reinvested REINVESTMENT OF DIVIDEND PAID -99,999,999,999.99<br />

99/99/99 99/99/99 Funds Received Into <strong>Your</strong> Account CANADIAN DOLLAR 99,999,999,999.99<br />

99/99/99 99/99/99 Foreign Currency Exchange US DOLLAR -99,999,999,999.99 9,999,999.9999 -99,999,999,999.99<br />

Commission: 99,999,999,999.99 USD<br />

<strong>To</strong>tal Transactions in United States Dollar $99,999,999,999.99-$99,999,999,999.99<br />

Portfolio Holdings<br />

This section provides comprehensive details regarding your portfolio’s holdings. Organized<br />

into subsections and by investment type, this section indicates the quantity, description, market<br />

price (if available), market value, dividend and capital gain options, and other information on<br />

each security position as of the close of business on the last day of the statement period. In<br />

addition, the subsections display the opening and closing cash, margin, short, and money<br />

market fund balances.<br />

Transactions<br />

This section provides a detailed list of transactions that were posted to your account since<br />

the last statement period. Transactions can be displayed in any one of three ways: by date, by<br />

security identification, or by transaction type. The process/settlement date is the date on<br />

which a transaction was posted to your account. The date that you initiated either the sale or<br />

the purchase of a security also appears in this section.<br />

Account Number: 999–999999<br />

John Q. Public<br />

5<br />

Income Summary<br />

Current Period<br />

Year-to-Date<br />

Taxable Non Taxable Taxable Non Taxable<br />

Dividends and Interest<br />

Corporate Bond Interest -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99<br />

Municipal Bond Interest -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99<br />

Cash Dividends on Equities -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99<br />

Money Fund Income -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99<br />

Other Dividends and Interest -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99<br />

<strong>To</strong>tal Dividends and Interest -$99,999,999,999.99 -$99,999,999,999.99 -$99,999,999,999.99 -$99,999,999,999.99<br />

Distributions<br />

Principal Distributions -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99<br />

Short Term Capital Gain Distributions - Current Year -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99<br />

Other Distributions -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99<br />

<strong>To</strong>tal Distributions -$99,999,999,999.99 -$99,999,999,999.99 -$99,999,999,999.99 -$99,999,999,999.99<br />

Accrued Interest Summary<br />

Current Period<br />

Year-to-Date<br />

Taxable Non Taxable Taxable Non Taxable<br />

Accrued Interest Paid<br />

Corporate Bond 99,999,999,999.99 99,999,999,999.99 99,999,999,999.99 99,999,999,999.99<br />

Municipal Bond 99,999,999,999.99 99,999,999,999.99 99,999,999,999.99 99,999,999,999.99<br />

U.S. Treasury Bond 99,999,999,999.99 99,999,999,999.99 99,999,999,999.99 99,999,999,999.99<br />

<strong>To</strong>tal Accrued Interest Paid 99,999,999,999.99 99,999,999,999.99 99,999,999,999.99 99,999,999,999.99<br />

Accrued Interest Received<br />

Corporate Bond 99,999,999,999.99 99,999,999,999.99 99,999,999,999.99 99,999,999,999.99<br />

Municipal Bond 99,999,999,999.99 99,999,999,999.99 99,999,999,999.99 99,999,999,999.99<br />

U.S. Treasury Bond 99,999,999,999.99 99,999,999,999.99 99,999,999,999.99 99,999,999,999.99<br />

<strong>To</strong>tal Accrued Interest Received 99,999,999,999.99 99,999,999,999.99 99,999,999,999.99 99,999,999,999.99<br />

Money Market Fund Detail<br />

Date Activity type Description Amount Share Balance<br />

Income Summary<br />

A summary of dividend, interest, or distribution income posted during the current statement<br />

period, and the year-to-date total for each type of income appears in this section. For your<br />

convenience, the income is categorized as taxable or nontaxable and summarized by the type<br />

of income. For retirement accounts, the income is tax deferred.<br />

Accrued Interest Summary<br />

This section provides the sum of the accrued interest paid or received when you purchased<br />

or sold fixed income securities during the current statement period and year-to-date.<br />

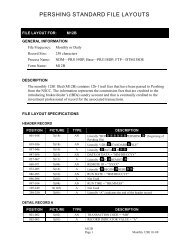

Money Market Fund Detail<br />

This section provides information about balances and daily money market fund transactions<br />

in date sequence. Opening and closing balances and all purchases and redemptions of your<br />

money market funds appear here. If you hold more than one money market fund, each fund’s<br />

activity is listed separately.<br />

Sweep Money Market Fund<br />

ABC Money Market Fund<br />

Account Number: 999999999999999 Current Yield: 99.99% Activity Ending: 99/99/99<br />

99/99/99 Opening Balance 99,999,999,999.99<br />

99/99/99 Deposit SHARES PURCHASED BY WIRE 99,999,999,999.99 99,999,999,999.99<br />

99/99/99 Withdrawal SAME DAY WIRE REDEMPTION -99,999,999,999.99 99,999,999,999.99<br />

99/99/99 Deposit INCOME REINVEST 99,999,999,999.99 99,999,999,999.99<br />

99/99/99 Closing Balance $99,999,999,999.99<br />

Account Number: 999–999999<br />

John Q. Public<br />

6

Open Orders<br />

Date Entered Buy/Sell Type of Order Security Quantity Limit Price Current Price Special Instructions<br />

99/99/99 Buy Limit SCUDDER NEW ASIA FD 99,999,999,999.99 9,999,999.9999 9,999,999.9999 Next day settlement<br />

99/99/99 Buy Contingency ORACLE CORP FORMERLY ORACLE SYSTEMS CORP. 99,999,999,999.99 9,999,999.9999 9,999,999.9999 # days for settlement<br />

Type Order<br />

99/99/99 Sell Stop WXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWX -99,999,999,999.99 9,999,999.9999 9,999,999.9999 XWXWXWXWXWXWX<br />

WXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWX<br />

WXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWX<br />

99/99/99 Sell Stop Limit WXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWX -99,999,999,999.99 9,999,999.9999 9,999,999.9999 Price discretion<br />

Cash Not Yet Received<br />

Security Record Date Payable Date Quantity Held Rate Amount of Payment Dividend Option<br />

Dividends<br />

DISNEY WALT CO. 99/99/99 99/99/99 99,999,999,999.99 999.999999 99,999,999,999.99 <strong>To</strong> be reinvested<br />

FEDERAL NATL MTG ASSN 99/99/99 99/99/99 99,999,999,999.99 999.999999 99,999,999,999.99 <strong>To</strong> be reinvested<br />

Interest<br />

PHILADELPHIA ELEC CO 1ST & REF MTG 99/99/99 99/99/99 99,999,999,999.99 999.999999 99,999,999,999.99 <strong>To</strong> be reinvested<br />

7.750% 01/01/23 REG<br />

Distribution<br />

INSURED MUNICIPALS INCOME TR UNIT 99/99/99 99/99/99 99,999,999,999.99 999.999999 99,999,999,999.99 <strong>To</strong> be reinvested<br />

SER 168 MONTHLY<br />

<strong>To</strong>tal Cash Not Yet Received $99,999,999,999.99<br />

Securities Not Yet Received<br />

Security Ex-Dividend Date Distribution Date Quantity Held Rate Quantity of Payment Current Price Market Value<br />

Security Dividends and Stock Splits<br />

CIRCUS CIRCUS ENTERPRISES INC 99/99/99 99/99/99 99,999,999,999.99 999.999999 99,999,999,999.99 9,999,999.9999 -99,999,999,999.99<br />

AMERICAN INTL GROUP 99/99/99 99/99/99 99,999,999,999.99 999.999999 99,999,999,999.99 9,999,999.9999 -99,999,999,999.99<br />

ABC COMPANY 99/99/99 99/99/99 99,999,999,999.99 999.999999 99,999,999,999.99 9,999,999.9999 -99,999,999,999.99<br />

<strong>To</strong>tal Value of Securities Not Yet Received -$99,999,999,999.99<br />

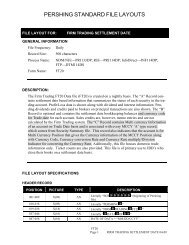

Open Orders<br />

This section details open equity and option orders. These are orders that were not fully executed<br />

as of the close of business on the last day of the statement period. Limit and current price, as<br />

well as additional information for each security, are shown as of the statement date.<br />

Cash Not Yet Received<br />

This section details pending payments for dividends, interest, and other cash distributions<br />

not yet posted to your account. For instance, an entry displayed here could represent a<br />

dividend of record during the current statement period that is not payable until a future<br />

statement period. The record date, payable date, rate per share, and dividend option for<br />

each distribution also appear here.<br />

Securities Not Yet Received<br />

This section details pending stock distributions that are not yet posted to your account.<br />

For instance, an entry displayed here could represent a stock split or stock dividend of<br />

record during the current statement period that is not payable until a future statement<br />

period. The ex-dividend date, distribution date, rate per share, price, and market value<br />

for each stock distribution also appear here.<br />

Account Number: 999–999999<br />

John Q. Public<br />

7<br />

Bond Maturity Schedule<br />

Percentage of Bond<br />

Bond Maturity Market Value Market Value<br />

Within 1 month 99,999,999,999.99 999%<br />

1 to 6 months 99,999,999,999.99 999%<br />

7 to 12 months 99,999,999,999.99 999%<br />

1 to 5 years 99,999,999,999.99 999%<br />

6 to 10 years 99,999,999,999.99 999%<br />

Over 10 years 99,999,999,999.99 999%<br />

<strong>To</strong>tal $99,999,999,999.99 100%<br />

Bond Quality<br />

Percentage of Bond<br />

Bond Quality Market Value Market Value<br />

AAA 99,999,999,999.99 999%<br />

AA 99,999,999,999.99 999%<br />

A 99,999,999,999.99 999%<br />

BAA 99,999,999,999.99 999%<br />

BA/Lower 99,999,999,999.99 999%<br />

Not Rated 99,999,999,999.99 999%<br />

<strong>To</strong>tal $99,999,999,999.99 100%<br />

Bonds that are in default are not included. Please refer to your Portfolio Holdings section.<br />

Percentages of bond market values<br />

are rounded to the nearest whole<br />

percentage.<br />

Percentages of bond market values<br />

are rounded to the nearest whole<br />

percentage.<br />

FIXED INCOME SECTIONS<br />

Bond Maturity Schedule (With Pie Chart)<br />

This section provides numeric and graphic detail of the maturity schedule of your bond<br />

investments. Negative values are not included in the pie chart. 2<br />

Bond Quality (With Pie Chart)<br />

This section provides a breakdown of your fixed income securities as rated by Moody’s<br />

Investor Service. 2<br />

Called Bonds<br />

This section provides a list of bonds that have already been called—on a full or partial basis.<br />

Called Bonds<br />

Eligible Called Call Type Redemption<br />

Call Date Security Description Quantity Quantity Price of Call Proceeds<br />

99/99/9999 SEARIVER MARITIME FINL HLDGS INC GTD DEFB INT DEB 0.000% 9,999,999,999.999 9,999,999,999.999 9,999,999.9999 Full 99,999,999.999.99<br />

09/01/12 REG DTD 09/01/82 CALLABLE<br />

MOODY RATING AAA<br />

99/99/9999 SEARIVER MARITIME FINL HLDGS INC GTD DEFB INT DEB 0.000% 9,999,999,999.999 9,999,999,999.999 9,999,999.9999 Partial 99,999,999.999.99<br />

09/01/12 REG DTD 09/01/82 CALLABLE<br />

MOODY RATING AAA99/99/9999<br />

99/99/9999 SEARIVER MARITIME FINL HLDGS INC GTD DEFB INT DEB 0.000% 9,999,999,999.999 9,999,999,999.999 9,999,999.9999 Partial 99,999,999.999.99<br />

09/01/12 REG DTD 09/01/82 CALLABLE<br />

MOODY RATING AAA<br />

Account Number: 999–999999<br />

John Q. Public<br />

2 This section is available to account holders who have a minimum of five fixed income securities.<br />

8

Annuities<br />

Quantity Description Market Price Market Value % Allocation<br />

Variable Annuities<br />

ABC INSURANCE COMPANY<br />

ABC VARIABLE ANNUITY PRODUCT<br />

Contract Number: A009733008XXXXX Security Identification: PRO0000001<br />

99,999,999,999.99 GROWTH 9,999,999.9999 99,999,999,999.99 99.99%<br />

99,999,999,999.99 MONEY FUND II 9,999,999.9999 99,999,999,999.99 99.99%<br />

99,999,999,999.99 OTHER SUBACCOUNT 9,999,999.9999 99,999,999,999.99 99.99%<br />

<strong>To</strong>tal ABC VARIABLE ANNUITY PRODUCT Account Valuation as of 99/99/99 $99,999,999,999.99 100.00%<br />

<strong>To</strong>tal of All Variable Annuity $99,999,999,999.99<br />

Pending Annuities<br />

Transaction Date Activity Type Description Purchase Price Identification<br />

ABC VARIABLE ANNUITY PRODUCT<br />

99/99/99 XWXWXWXWXWXWXWXWXWXW XWXWXWXWXWXWXWXWXWXW 9,999,999.9999 XWXWXWXWX<br />

99/99/99 XWXWXWXWXWXWXWXWXWXW XWXWXWXWXWXWXWXWXWXW 9,999,999.9999<br />

99/99/99 XWXWXWXWXWXWXWXWXWXW XWXWXWXWXWXWXWXWXWXW 9,999,999.9999<br />

XWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXW<br />

XWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXW<br />

XWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXW<br />

<strong>To</strong>tal ABC VARIABLE ANNUITY PRODUCT $9,999,999.9999<br />

<strong>To</strong>tal of All Pending Annuities $9,999,999.9999<br />

ANNUITY SECTIONS<br />

Annuities<br />

This section details all of the fixed and variable annuities held in your account. A product<br />

description, contract number, valuation date, and the account value of each annuity are<br />

displayed here. <strong>Your</strong> subaccount investments are also displayed for variable annuities,<br />

including: quantity, description, market price, market value, and allocation percentage.<br />

Pending Annuities<br />

This section lists annuities purchased through your brokerage account that are awaiting<br />

acknowledgement by the appropriate annuity providers. The transaction date, annuity<br />

description, and purchase price appear in this section.<br />

Account Number: 999–999999<br />

John Q. Public<br />

9<br />

Tax Year - 2002 Tax Year - 2001<br />

Retirement Account Transactions<br />

This Period Year-to-Date This Period Year-to-Date<br />

Contributions<br />

Participant 99,999,999,999.99 99,999,999,999.99 99,999,999,999.99 99,999,999,999.99<br />

Employer 99,999,999,999.99 99,999,999,999.99 99,999,999,999.99 99,999,999,999.99<br />

Employer - Prior Year 99,999,999,999.99 99,999,999,999.99 99,999,999,999.99 99,999,999,999.99<br />

Rollover 99,999,999,999.99 99,999,999,999.99 99,999,999,999.99 99,999,999,999.99<br />

Roth Conversion 99,999,999,999.99 99,999,999,999.99 99,999,999,999.99 99,999,999,999.99<br />

Recharacterization 99,999,999,999.99 99,999,999,999.99 99,999,999,999.99 99,999,999,999.99<br />

<strong>To</strong>tal Contributions $99,999,999,999.99 $99,999,999,999.99 $99,999,999,999.99 $99,999,999,999.99<br />

Distributions<br />

Early -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99<br />

Normal -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99<br />

Disability -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99<br />

Excess Contribution -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99<br />

Education IRA -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99<br />

Roth IRA -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99<br />

Direct Rollover to IRA -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99<br />

Direct Rollover to QRP -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99<br />

<strong>To</strong>tal Distributions -$99,999,999,999.99 -$99,999,999,999.99 -$99,999,999,999.99 -$99,999,999,999.99<br />

RETIREMENT ACCOUNT SECTION<br />

Retirement Account Transactions<br />

If you have a retirement account for which Pershing LLC serves as the Custodian or servicing<br />

agent, this section provides information for this period and year-to-date. Specific contribution<br />

and distribution transactions are displayed by type. <strong>To</strong>tal contributions and distributions, as<br />

well as federal and state taxes withheld, are displayed for the various retirement account types.<br />

For tax reporting requirements, the year-to-date totals are also featured along with the previous<br />

tax year’s activity.<br />

Federal Tax Withheld on Distributions<br />

Early -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99<br />

Normal -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99<br />

Disability -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99<br />

Death -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99<br />

Roth IRA -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99<br />

<strong>To</strong>tal Federal Tax Withheld -$99,999,999,999.99 -$99,999,999,999.99 -$99,999,999,999.99 -$99,999,999,999.99<br />

State Tax Withheld on Distributions<br />

State Tax Withheld -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99<br />

<strong>To</strong>tal State Tax Withheld -$99,999,999,999.99 -$99,999,999,999.99 -$99,999,999,999.99 -$99,999,999,999.99<br />

<strong>To</strong>tal Tax Withheld on Distributions -$99,999,999,999.99 -$99,999,999,999.99 -$99,999,999,999.99 -$99,999,999,999.99<br />

Account Number: 999–999999<br />

John Q. Public<br />

10

Daily Transactions Summary<br />

Settlement/ Transaction<br />

Process Date Date Activity Type Description Quantity Price Amount Balance<br />

99/99/99 Combined Opening Balances $99,999,999,999.99<br />

99/99/99 Foreign Currency Exchange SOLD ARS @ 9,999,999.9999 99,999,999,999.99 99,999,999,999.99<br />

99/99/99 99/99/99 Purchased AMERICAN EXPRESS COMPANY 99,999,999,999.99 9,999,999.9999 -99,999,999,999.99 99,999,999,999.99<br />

Commission: 99,999,999,999.99 USD A DLJ CO MAKES A MKT<br />

IN THIS SEC & ACTED AS PRINCIPAL<br />

99/99/99 Money Market Fund Income Received ALLIANCE CAP RESERVE 99,999,999,999.99 99,999,999,999.99<br />

99/99/99 Cash Dividend Received 99,999,999,999 SHARES 99,999,999,999.99 99,999,999,999.99<br />

AMERICAN EXPRESS COMPANY<br />

RD 99/99 PD 99/99/99<br />

99/99/99 Activity Within <strong>Your</strong> Account AMERICAN EXPRESS COMPANY -99,999,999,999.99 99,999,999,999.99 99,999,999,999.99<br />

MOVED FROM CASH A/C<br />

INTO MARGIN A/C<br />

99/99/99 Asset Management Check CHECK NUMBER - 9999 -99,999,999,999.99 99,999,999,999.99<br />

99/99/99 MasterCard ® Transaction MASTERCARD TRANSACTION<br />

ATM WITHDRAWAL<br />

NEW YORK NY GREENPOINT BANK<br />

99/99/99 Combined Closing Balances $99,999,999,999.99$99,999,999,999.99<br />

Checking Activity<br />

Process Date Check<br />

Date Written Number Payee Check Category Amount<br />

ASSET MANAGEMENT ACCOUNT SECTIONS<br />

Daily Transactions Summary<br />

For asset management accounts, transactions are presented in date order with a running<br />

cash balance for each entry. Checking and debit card activity, deposits and withdrawals,<br />

and brokerage transactions are listed here.<br />

Checking Activity<br />

This section displays checking activity for asset management account holders only, and is<br />

presented in sequential check number order.<br />

Debit Card Activity<br />

For asset management accounts, investors can use this section to keep track of debit card<br />

usage for the month.<br />

99/99/99 99/99/99 9999 XWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXW Charitable Contributions -99,999,999,999.99<br />

99/99/99 99/99/99 9999 XWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXW Fees/Dues/Subscriptions -99,999,999,999.99<br />

<strong>To</strong>tal Checking Activity -$99,999,999,999.99<br />

MasterCard ® Activity<br />

Process Transaction<br />

Date Date Vendor Location Reference Number Amount<br />

99/99/99 99/99/99 GREENVILLE HOTEL NEW YORK, NY -99,999,999,999.99<br />

99/99/99 99/99/99 ATM WITHDRAWAL NEW YORK, NY -99,999,999,999.99<br />

<strong>To</strong>tal MasterCard Activity -$99,999,999,999.99<br />

Account Number: 999–999999<br />

John Q. Public<br />

11<br />

Portfolio Holdings<br />

Activity Opening Closing Accrued Income 30-Day Current<br />

Quantity Opening Date Account Number Ending Balance Balance Income This Year Yield Yield<br />

Cash and Cash Equivalents – 99.99% of Portfolio<br />

Cash Balance 99,999,999,999.99 99,999,999,999.99<br />

Margin Balance 99,999,999,999.99 99,999,999,999.99<br />

Short Account Balance 99,999,999,999.99 99,999,999,999.99<br />

Money Market Funds<br />

99,999,999,999.99 99/99/99 99999999999 99/99/9999 99,999,999,999.99 99,999,999,999.99 99,999,999,999.99 99,999,999,999.99 999.99% 999.99%<br />

<strong>To</strong>tal Money Market Funds $99,999,999,999.99 $99,999,999,999.99 $99,999,999,999.99 $99,999,999,999.99<br />

<strong>To</strong>tal Cash and Cash Equivalents $99,999,999,999.99 $99,999,999,999.99 $99,999,999,999.99 $99,999,999,999.99<br />

Adjusted Unrealized Accrued Estimated Estimated<br />

Quantity Acquisition Date Unit Cost Cost Basis Market Price Market Value Gain/Loss Interest Annual Income Yield<br />

Municipal Bonds<br />

XWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXW<br />

99,999,999,999 99/99/99 9,999,999.9999 -99,999,999,999.99 9,999,999.9999 -99,999,999,999.99 -99,999,999,999.99 99,999,999,999.99 99,999,999,999.99 999.99%<br />

Original Cost Basis: $99,999,999,999.99<br />

<strong>To</strong>tal Municipal Bonds -$99,999,999,999.99 -$99,999,999,999.99 -$99,999,999,999.99 $99,999,999,999.99 $99,999,999,999.99<br />

U.S. Treasury Securities<br />

XWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXW<br />

99,999,999,999 99/99/99 9,999,999.9999 -99,999,999,999.99 9,999,999.9999 -99,999,999,999.99 -99,999,999,999.99 99,999,999,999.99 99,999,999,999.99 999.99%<br />

Original Cost Basis: $99,999,999,999.99<br />

<strong>To</strong>tal U.S. Treasury Securities -$99,999,999,999.99 -$99,999,999,999.99-$99,999,999,999.99 $99,999,999,999.99 $99,999,999,999.99<br />

<strong>To</strong>tal Fixed Income -$99,999,999,999.99 -$99,999,999,999.99 -$99,999,999,999.99 $99,999,999,999.99 $99,999,999,999.99<br />

Schedule of Realized Gains and Losses Year-to-Date<br />

Disposition Acquisition Closing<br />

Date Date Transaction Description Security ID Quantity Cost Basis Proceeds Realized Gain/Loss<br />

Short Term<br />

99/99/99 99/99/99 Buy CISCO SYSTEMS INC CSCO -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99<br />

99/99/99 99/99/99 Sell MCI COMMUNICATIONS MCIC -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99<br />

<strong>To</strong>tal Short Term -$99,999,999,999.99 -$99,999,999,999.99 $99,999,999,999.99<br />

Long Term<br />

99/99/99 99/99/99 Sell NORTEL NETWORKS CORP *N/C* EFF 5/1/00 656569100 -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99<br />

99/99/99 99/99/99 Buy MCI COMMUNICATIONS MCIC -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99 -99,999,999,999.99<br />

<strong>To</strong>tal Long Term -$99,999,999,999.99 -$99,999,999,999.99 -$99,999,999,999.99<br />

<strong>To</strong>tal Short Term and Long Term -$99,999,999,999.99 -$99,999,999,999.99 -$99,999,999,999.99<br />

PORTFOLIO EVALUATION SERVICE SECTIONS<br />

Portfolio Holdings<br />

For investors who subscribe to PES, tax-lot information is provided for easy tracking of gains<br />

and losses. Monthly statements include an enhanced Portfolio Holdings section indicating<br />

dates acquired, original cost basis, current price, and unrealized gains and losses for all current<br />

holdings. For bonds, the statement reflects both original and adjusted cost basis (adjusted for<br />

principal paydowns and any accretion or amortization on premium or discounted bonds).<br />

Additionally, the average unit cost for mutual funds is available, and annuities appear in their<br />

own subsection.<br />

Schedule of Realized Gains and Losses Year-to-Date<br />

In this section, you can review the details of all positions closed out year-to-date. Buy<br />

transactions, sell transactions, instruments that mature, and option expirations are displayed,<br />

among other transaction types. While the Portfolio Holdings section includes all settled<br />

positions, the quarterly Schedule of Realized Gains and Losses includes all closed positions<br />

as of the trade date.<br />

Account Number: 999–999999<br />

John Q. Public<br />

12

JOHN Q. PUBLIC<br />

1234 TOWNLINE STREET<br />

APT. #1234<br />

SOMEWHERE, MA 00000-0000<br />

Primary Account Number: 999-999999<br />

Investor Identification: 999999999999<br />

Period Ending: 03/31/200X<br />

CONSOLIDATED ACCOUNT SECTIONS<br />

Summary of Accounts<br />

This section lists each of the linked accounts, including the account description, the account<br />

number, and the registration of each account. This section also provides the value of each<br />

account, the percentage of total assets for each account, and the entire market value (or net<br />

worth) of all accounts included in the Consolidated Account Summary.<br />

Summary of Accounts<br />

This Period<br />

Last Period<br />

Description Account Number Name Value % of Assets Value % of Assets<br />

Retirement/Trust Account 999-999999 XWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXW 99,999,999,999.99 999% 99,999,999,999.99 999%<br />

XWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXW<br />

Asset Management Account 999-999999 XWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXW 99,999,999,999.99 999% 99,999,999,999.99 999%<br />

XWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXW<br />

Brokerage Account 999-999999 XWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXW 99,999,999,999.99 999% 99,999,999,999.99 999%<br />

XWXWXWXWXWXWXWXWXWXWXWXWXWXWXWXW<br />

<strong>To</strong>tal $99,999,999,999.99 100% $99,999,999,999.99 100%<br />

Summary of Asset Allocation<br />

This section summarizes the value of each type of investment held in the linked accounts,<br />

along with the percentage that each asset category represents.<br />

Summary of Asset Allocation<br />

Value Value Percent<br />

Last Period This Period Allocation<br />

Fixed Income 99,999,999,999.99 99,999,999,999.99 999%<br />

Mutual Funds 99,999,999,999.99 99,999,999,999.99 999%<br />

Annuities 99,999,999,999.99 99,999,999,999.99 999%<br />

Other 99,999,999,999.99 99,999,999,999.99 999%<br />

Global Account Cash Balance 99,999,999,999.99 99,999,999,999.99 999%<br />

Global Account Securities 99,999,999,999.99 99,999,999,999.99 999%<br />

Pie Chart <strong>To</strong>tal $99,999,999,999.99 $99,999,999,999.99 100%<br />

Cash and Cash Equivalents -99,999,999,999.99 -99,999,999,999.99<br />

Equities -99,999,999,999.99 -99,999,999,999.99<br />

Account <strong>To</strong>tal $99,999,999,999.99 $99,999,999,999.99<br />

Asset allocation percentages are<br />

rounded to the nearest whole<br />

percentage.<br />

Pie chart allocation excludes all<br />

asset classes which net to a liability.<br />

13

BRO HOWSTMT 1-04