ACCT/ACCF-Customer Account Information-11/09

ACCT/ACCF-Customer Account Information-11/09

ACCT/ACCF-Customer Account Information-11/09

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

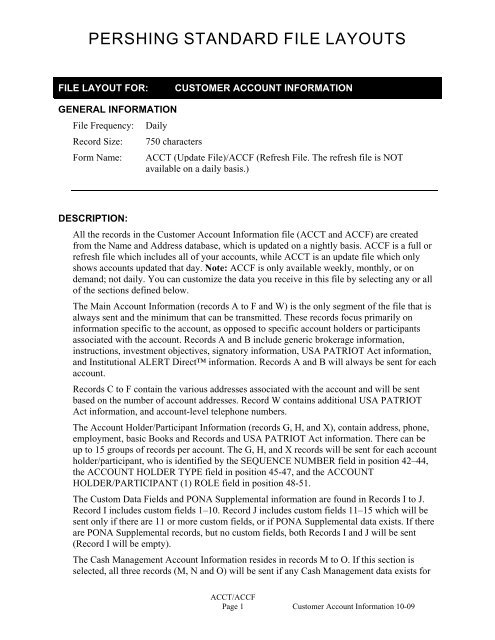

PERSHING STANDARD FILE LAYOUTSFILE LAYOUT FOR:CUSTOMER ACCOUNT INFORMATIONGENERAL INFORMATIONFile Frequency:Record Size:Form Name:Daily750 characters<strong>ACCT</strong> (Update File)/<strong>ACCF</strong> (Refresh File. The refresh file is NOTavailable on a daily basis.)DESCRIPTION:All the records in the <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> file (<strong>ACCT</strong> and <strong>ACCF</strong>) are createdfrom the Name and Address database, which is updated on a nightly basis. <strong>ACCF</strong> is a full orrefresh file which includes all of your accounts, while <strong>ACCT</strong> is an update file which onlyshows accounts updated that day. Note: <strong>ACCF</strong> is only available weekly, monthly, or ondemand; not daily. You can customize the data you receive in this file by selecting any or allof the sections defined below.The Main <strong>Account</strong> <strong>Information</strong> (records A to F and W) is the only segment of the file that isalways sent and the minimum that can be transmitted. These records focus primarily oninformation specific to the account, as opposed to specific account holders or participantsassociated with the account. Records A and B include generic brokerage information,instructions, investment objectives, signatory information, USA PATRIOT Act information,and Institutional ALERT Direct information. Records A and B will always be sent for eachaccount.Records C to F contain the various addresses associated with the account and will be sentbased on the number of account addresses. Record W contains additional USA PATRIOTAct information, and account-level telephone numbers.The <strong>Account</strong> Holder/Participant <strong>Information</strong> (records G, H, and X), contain address, phone,employment, basic Books and Records and USA PATRIOT Act information. There can beup to 15 groups of records per account. The G, H, and X records will be sent for each accountholder/participant, who is identified by the SEQUENCE NUMBER field in position 42–44,the ACCOUNT HOLDER TYPE field in position 45-47, and the ACCOUNTHOLDER/PARTICIPANT (1) ROLE field in position 48-51.The Custom Data Fields and PONA Supplemental information are found in Records I to J.Record I includes custom fields 1–10. Record J includes custom fields <strong>11</strong>–15 which will besent only if there are <strong>11</strong> or more custom fields, or if PONA Supplemental data exists. If thereare PONA Supplemental records, but no custom fields, both Records I and J will be sent(Record I will be empty).The Cash Management <strong>Account</strong> <strong>Information</strong> resides in records M to O. If this section isselected, all three records (M, N and O) will be sent if any Cash Management data exists for<strong>ACCT</strong>/<strong>ACCF</strong>Page 1 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSthe account. Due to an Automated Cash Management (ACAM) system upgrade, startingFebruary 23,20<strong>09</strong>, these records will no longer be populated on a same-day basis. They willcontinue to be populated, but a day later, similar to other fields fed by our ACAM systemtoday. You can still receive this information on a same-day basis in the new Asset MovementStanding Instructions (AMSI) file.The COD <strong>Account</strong> Settlement <strong>Information</strong> is found in record P.The Retirement <strong>Account</strong> information is contained in Records R to S. Beneficiary <strong>Information</strong>is contained in Records T to V. Record R will always be sent for retirement accounts and ifretirement records are requested. Record S will be sent only if the participant has three ormore phone numbers. There can be up to 20 beneficiaries (10 primary and 10 contingent).Records T and U will be repeated per beneficiary. Record U is sent only if there are morethan three phone numbers for the beneficiary and/or there is at least one beneficiary trustee.Record V is present only if a beneficiary is coded as a trustee and there are two or morebeneficiary trustees. A beneficiary can have a maximum of six beneficiary trustees.Note: If data is not available or not applicable, fields will be populated with spaces ( ). All“TRANSACTION TYPE CODE” fields and their variations will be spaces on <strong>ACCF</strong>.FILE LAYOUT SPECIFICATIONSHEADER RECORDPOSITION PICTURE TYPE DESCRIPTION001-018 X(18) AN Literally “BOF PERSHING ” (beginning ofPershing file)019-036 X(18) AN Literally “CUSTOMER <strong>ACCT</strong> INFO”037-046 X(10) AN Literally “ DATA OF ”047-056 X(10) AN DATE OF DATA = “MM/DD/CCYY”057-067 X(<strong>11</strong>) AN Literally “ TO REMOTE ”068-071 X(04) AN REMOTE ID = “XXXX”072-085 X(14) AN Literally “ BEGINS HERE ”086-<strong>09</strong>5 X(10) AN RUN DATE = “MM/DD/CCYY”<strong>09</strong>6-<strong>09</strong>6 X(01) AN Not Used<strong>09</strong>7-104 X(08) AN RUN TIME = “HH:MM:SS”105-<strong>11</strong>8 X(14) AN Not Used<strong>11</strong>9-127 X(<strong>09</strong>) AN Indicates if the file is REFRESHED/UPDATED/NOTAPPLICABLE – literally “REFRESHED”,“UPDATED ”, or “ ”128-749 X(622) AN Not Used750-750 X(01) AN Literally “A”; indicates the end of the header record<strong>ACCT</strong>/<strong>ACCF</strong>Page 2 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSDETAIL RECORD A – MAIN ACCOUNT INFORMATIONPOSITION PICTURE TYPE DESCRIPTION001-002 X(02) AN TRANSACTION CODE = “CI”003-003 X(01) AN RECORD INDICATOR VALUE = “A”004-0<strong>11</strong> 9(08) N RECORD ID SEQUENCE NUMBER; begins with“00000001”012-020 X(<strong>09</strong>) AN ACCOUNT NUMBER INCLUDING OFFICE(3); BASEACCOUNT(5); CHECK DIGIT (1)021-023 X(03) AN INTRODUCING BROKER DEALER NUMBER024-024 X(01) AN Not Used025-027 X(03) AN INVESTMENT PROFESSIONAL NUMBER028-028 X(01) AN Not Used029-038 X(10) AN ACCOUNT SHORT NAME039-040 X(02) AN Not Used041-041 X(01) AN TRANSACTION TYPE; acceptable values include:“X” or “ ”= Unchanged account“A” = Add new account“C” = Change to existing record042-042 X(01) AN AUTO-TITLED or USER-TITLED ACCOUNT; acceptablevalues include:“F” = Auto-Titled“S” = User-Titled (opened in PONA or through conversion)043-043 X(01) AN ACCOUNT TYPE CODE; acceptable values include:“C” = DVP/RVP“R” = Retail“T” = Retirement“3” = Third Party as Custodian“4” = 401(k) Self-Directed044-047 X(04) AN REGISTRATION TYPE; for <strong>Account</strong> Services only; seeAppendix Q, “<strong>ACCT</strong> Codes and Values”048-048 X(01) AN NUMBERED ACCOUNT INDICATOR; acceptable valuesinclude:“Y” = Numbered <strong>Account</strong>“N” = Not a Numbered <strong>Account</strong>049-049 X(01) AN NUMBER OF ACCOUNT TITLE LINES INREGISTRATION LINES (values 1, 2, 3, 4)050-081 X(32) AN ACCOUNT REGISTRATION LINE 1082-<strong>11</strong>3 X(32) AN ACCOUNT REGISTRATION LINE 2<strong>11</strong>4-145 X(32) AN ACCOUNT REGISTRATION LINE 3146-177 X(32) AN ACCOUNT REGISTRATION LINE 4178-2<strong>09</strong> X(32) AN ACCOUNT REGISTRATION LINE 5210-241 X(32) AN ACCOUNT REGISTRATION LINE 6<strong>ACCT</strong>/<strong>ACCF</strong>Page 3 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSPOSITION PICTURE TYPE DESCRIPTIONJNTN, TODJ, CUST AND TRST INFORMATION;If the Registration Type field in Record A, Positions 44-47 is not one of these values, then the fields in Record A,Positions 242-262 will not be populated.JNTN and TODJ ACCOUNTS242-242 X(01) AN US RESIDENT INDICATOR; acceptable values include:“N” = No (not a US Resident)“Y” = Yes (is a US Resident)243-243 X(01) AN MARRIED INDICATOR; acceptable values include:“N” = No (is not married)“Y” = Yes (is married)“ ” = Not applicable244-245 X(02) AN TENANCY STATE; see Appendix Q, “<strong>ACCT</strong> Codes andValues”246-249 X(04) AN JOINT TENANCY CLAUSE; acceptable values include:“CMPP” = Community Property“CMRS” = Community Property with Right of Survivorship“JTTN” = Joint Tenants with Right of Survivorship“TNCM” = Tenants in Common“TNET” = Tenants by Entirety“USFT” = USUFRUCT“ ” = Not applicable250-257 9(08) N AGREEMENT EXECUTION DATE = “CCYYMMDD”258-259 X(02) AN NUMBER OF TENANTS260-262 X(03) AN Not UsedCUSTODIAN INFORMATION (CUST)242-243 X(02) AN STATE GIFT GIVEN; see Appendix Q, “<strong>ACCT</strong> Codes andValues”244-251 9(08) N DATE GIFT GIVEN = “CCYYMMDD”252-253 9(02) N AGE TO TERMINATE254-261 9(08) N MINOR’S BIRTHDATE = “CCYYMMDD”262-262 X(01) AN MANNER OF GIFT; acceptable values include:“C” = Created by Gift“E” = Exercise by Appointment“R” = Trust“T” = Transfer by Fiduciary Order“W” = Will“ ” = Not applicableTRUST (TRST)242-242 X(01) AN TYPE OF TRUST; acceptable values include:“F” = Family Trust“I” = Irrevocable“L” = Living(cont.)<strong>ACCT</strong>/<strong>ACCF</strong>Page 4 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSPOSITION PICTURE TYPE DESCRIPTION“R” = Revokable“T” = Testamentary“ ” = Not applicable243-250 9(08) N DATE TRUST ESTABLISHED = “CCYYMMDD”251-258 9(08) N AMENDED DATE = “CCYYMMDD”259-259 X(01) AN TRUSTEE INDEPENDENT ACTION; values include:“N” = Cannot act independently“Y” = Can act independently260-262 X(03) AN Not UsedACCOUNT OPEN/UPDATE/CLOSE DATES263-270 9(08) N DATE ACCOUNT OPENED = “CCYYMMDD”271-278 9(08) N DATE ACCOUNT INFORMATION UPDATED =“CCYYMMDD”279-279 X(01) AN ACCOUNT STATUS INDICATOR; values include:“O” = Open“P” = Pending Close“C” = Closed280-287 9(08) N PENDING CLOSED DATE = “CCYYMMDD”288-295 9(08) N DATE ACCOUNT CLOSED = “CCYYMMDD”296-303 9(08) N Not Used304-3<strong>11</strong> 9(08) N ACCOUNT RE-ACTIVATED DATE = “CCYYMMDD”312-319 9(08) N DATE ACCOUNT RE-OPENED = “CCYYMMDD”INSTRUCTIONS320-320 X(01) AN PROCEEDS; acceptable values include:“1” = Remit (send)“2” = Hold“3” = COD (hold)321-321 X(01) AN TRANSFER INSTRUCTIONS; acceptable values include:“1” = Register with Issuer“2” = Transfer to client and hold in safekeeping“3” = COD Street Name“4” = Hold in Street Name322-322 X(01) AN INCOME INSTRUCTIONS; acceptable values include:“2” = Pay Monthly (send)“3” = Credit <strong>Account</strong> (hold)“4” = COD323-324 X(02) AN NUMBER OF CONFIRMS FOR THIS ACCOUNT325-326 X(02) AN NUMBER OF STATEMENTS FOR THIS ACCOUNTINVESTMENT OBJECTIVE DETAILS327-327 X(01) AN INVESTMENT OBJECTIVE TRANSACTION CODE,acceptable values include:“X” or “ ” = Unchanged record (cont.)<strong>ACCT</strong>/<strong>ACCF</strong>Page 5 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSPOSITION PICTURE TYPE DESCRIPTION“A” = Added record“C” = Changed record328-353 X(26) AN COMMENTS; (free-form text)354-368 X(15) AN EMPLOYER SHORTNAME (previously “EMPLOYER”)369-377 X(<strong>09</strong>) AN EMPLOYER’S CUSIP®378-386 X(<strong>09</strong>) AN EMPLOYER’S SYMBOL387-387 X(01) AN MARGIN PRIVILEGES REVOKED; values include:“N” = No“Y” = Yes“ ” = Not applicable388-395 9(08) N STATEMENT REVIEW DATE = “CCYYMMDD”396-396 X(01) AN MARGIN PAPERS ON FILE; acceptable values include:“Y” = Margin Papers on File“N” = No Margin Papers on File397-397 X(01) AN OPTION PAPERS ON FILE; acceptable values include:“Y” = Option Papers on File“N” = No Option Papers on File398-399 X(02) AN Not UsedDISCRETION400-400 X(01) AN INVESTMENT PROFESSIONAL DISCRETIONGRANTED; acceptable values include:“N” = No“Y” = Yes401-401 X(01) AN INVESTMENT ADVISOR DISCRETION GRANTED; valuesinclude:“N” = No“Y” = Yes402-402 X(01) AN THIRD PARTY DISCRETION GRANTED; values include:“N” = No“Y” = Yes403-417 X(15) AN THIRD PARTY NAME (free-form text)418-418 X(01) AN RISK FACTOR CODE; acceptable values include:“L” = Low“M” = Moderate“S” = Speculation“H” = High419-422 X(04) AN INVESTMENT OBJECTIVE CODE; values are eithercustomer- or Pershing-defined; Pershing defined values:“I ” = Income“L ” = Long-Term Growth“S ” = Short-Term Growth“ ” = Not applicable<strong>ACCT</strong>/<strong>ACCF</strong>Page 6 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSPOSITION PICTURE TYPE DESCRIPTIONOPTION TRADING423-423 X(01) AN OPTION – EQUITIES; acceptable values include:“N” = No“Y” = Yes424-424 X(01) AN OPTION – INDEX; acceptable values include:“N” = No“Y” = Yes425-425 X(01) AN OPTION – DEBT; acceptable values include:“N” = No“Y” = Yes426-426 X(01) AN OPTION – CURRENCY; acceptable values include:“N” = No“Y” = YesOPTION LEVELS: Only the highest level will be populated427-427 X(01) AN OPTION LEVEL 1; acceptable values include:“O” = Covered Only“ ” = Not applicable428-428 X(01) AN OPTION LEVEL 2; acceptable values include:“L” = Covered/Long“ ” = Not applicable429-429 X(01) AN OPTION LEVEL 3; acceptable values include:“S” = Covered/Long/Spreads“ ” = Not applicable430-430 X(01) AN OPTION LEVEL 4; acceptable values include:“A” = All“ ” = Not applicable431-440 9(10) N OPTION – CALL LIMITS441-450 9(10) N OPTION – PUT LIMITS451-460 9(10) N OPTION – TOTAL LIMITS OF PUTS AND CALLSBROKERAGE INFORMATIONThe following field also appears in Record W, position 042, for ease of use461-461 X(01) AN NON-US DOLLAR TRADING; acceptable values include:“Y” = <strong>Account</strong> approved for trading in non-US Dollars“N” = Not eligible to trade non-US Dollars (default)462-464 X(03) AN Not Used (Reserved for future use)465-465 X(01) AN NON-CUSTOMER INDICATOR; acceptable values include:“ ” = <strong>Customer</strong> <strong>Account</strong>“N” = Firm <strong>Account</strong>“P” = Principal/Office <strong>Account</strong>“S” = Commission <strong>Account</strong>466-467 X(02) AN THIRD PARTY FEE INDICATOR; values include: (cont.)<strong>ACCT</strong>/<strong>ACCF</strong>Page 7 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSPOSITION PICTURE TYPE DESCRIPTION“Y ” = Yes“N ” = No468-475 9(08) N THIRD PARTY FEE APPROVAL DATE = “CCYYMMDD”476-476 X(01) AN Not Used477-478 X(02) AN COMMISSION SCHEDULE; acceptable values include:“ ” = Standard“C ” = Discount479-483 X(05) AN GROUP INDEX484-486 X(03) AN MONEY MANAGER ID; Money Manager code from oldACCOUNT MNEMONIC field487-489 X(03) AN MONEY MANAGER OBJECTIVE ID; Investment Objectivecode from old ACCOUNT MNEMONIC field490-494 X(05) AN DTC ID CONFIRM NUMBER FOR NON-COD ACCOUNT495-503 X(<strong>09</strong>) AN CAPS MASTER MNEMONIC; legacy field, no longer used.Contains previously populated data for customers who haveused it before. It cannot be updated.504-5<strong>11</strong> X(08) AN EMPLOYEE ID512-512 X(01) AN PRIME BROKER/FREE FUND INDICATOR; acceptablevalues include:“ ” = Not applicable“B” = Pershing LLC as Prime Broker“C” = Broker/Dealer Credit“F” = Free Fund Letter (COD accounts only)“T” = Broker/Dealer Trust (COD accounts only)“X” = Execution for Prime Broker (COD accounts only)513-513 X(01) AN FEE BASED ACCOUNT INDICATOR; values include:“Y” = Yes; account is Fee Based“N” = No; account is not Fee Based514-516 X(03) AN BILLING TYPE; acceptable values include:“ ” = Standard“FC ” = Fee Based517-524 9(08) N FEE BASED TERMINATION DATE = “CCYYMMDD”525-525 X(01) AN EQUIFAX/CREDIT CHECK INDICATOR; values include:“N” = Credit check not requested“Y” = Credit check requested526-557 X(32) AN SELF-DIRECTED 401(k) PLAN NAME558-589 X(32) AN SELF-DIRECTED 401(k) ACCOUNT TYPE590-591 X(02) AN PLAN TYPE; see Appendix D, “Plan Types”592-601 X(10) AN PLAN NUMBER602-605 X(04) AN EMPLOYEE/EMPLOYEE RELATIVE INDICATOR;acceptable values include:“ ” = Not applicable (cont.)<strong>ACCT</strong>/<strong>ACCF</strong>Page 8 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSPOSITION PICTURE TYPE DESCRIPTION“E ” = Employee“ER ” = Employee Related606-623 9(<strong>09</strong>)v9(<strong>09</strong>) N COMMISSION PERCENT DISCOUNT; actual percentdiscounted624-624 X(01) AN 12b-1 FEE-BLOCKING INDICATOR; acceptable valuesinclude:“D” = Use the Default Set at the Introducing Broker/Dealer(IBD) Level (redefined)“B” = Block 12b-1 Fees when the IBD Level Default is to NotBlock“N” = Do not Block 12b-1 Fees when the IBD Level Default isto Block“C” = Credit 12b-1 Fee to <strong>Customer</strong> <strong>Account</strong>“ ” = No Value Entered/Not applicableNEW ACCOUNT FORM SIGNATORY INFORMATION625-639 X(15) AN NAME OF INVESTMENT PROFESSIONAL WHO SIGNEDNEW ACCOUNT FORM640-647 9(08) N DATE INVESTMENT PROFESSIONAL SIGNED NEWACCOUNT FORM = “CCYYMMDD”648-662 X(15) AN NAME OF PRINCIPAL WHO SIGNED NEW ACCOUNTFORM663-670 9(08) N DATE PRINCIPAL SIGNED NEW ACCOUNT FORM =“CCYYMMDD”ACCOUNT LEVEL INFORMATION FOR USA PATRIOT ACTThe following field also appears in Record W, position 062671-671 X(01) AN POLITICALLY EXPOSED PERSON INDICATOR;acceptable values include:“Y” = Politically Exposed Person“N” = Not a Politically Exposed Person“U” = Unknown672-672 X(01) AN PRIVATE BANKING ACCOUNT INDICATOR;acceptable values include:“Y” = Private Banking <strong>Account</strong>“N” = Not a Private Banking <strong>Account</strong>“U” = UnknownThe following field also appears in Record W, position 154673-673 X(01) AN FOREIGN BANK ACCOUNT INDICATOR; acceptablevalues include:“Y” = <strong>Account</strong> is a Foreign Bank“N” = <strong>Account</strong> is not a Foreign Bank“U” = Unknown674-677 X(04) AN INITIAL SOURCE OF FUNDS; acceptable values include:“EINC” = Income from Earnings“GIFT” = Gift(cont.)<strong>ACCT</strong>/<strong>ACCF</strong>Page 9 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSPOSITION PICTURE TYPE DESCRIPTION“INPR” = Investment Proceeds“SALE” = Sale of Business“INHT” = Inheritance“LSET” = Legal Settlement“RSAV” = Pension/IRA/Retirement Savings“RLTN” = Spouse/Parent“GAME” = Lottery/Gaming Proceeds“INSR” = Insurance Proceeds“OTHR” = Other“UNKN” = Unknown678-681 X(04) AN USA PATRIOT ACT EXEMPT REASON; valid valuesinclude:“NOEX” = Not Exempt“CONV” = Conversion“ERSA” = ERISA“PEAC” = Pre-existing <strong>Account</strong>“PTRD” = Publicly Traded Company“RBNK” = Regulated Bank“GVTI” = Government Institution“UNKN” = Unknown“IBEX” = IBD Exempt682-683 X(02) AN COUNTRY OF CITIZENSHIP; see Appendix Q, “<strong>ACCT</strong>Codes and Values”684-685 X(02) AN COUNTRY OF RESIDENCE; see Appendix Q, “<strong>ACCT</strong> Codesand Values”686-693 9(08) N BIRTH DATE = “CCYYMMDD”694-703 X(10) AN Not Used704-7<strong>09</strong> X(06) AN Internal Use (IMS/Prime Broker Code)710-7<strong>11</strong> X(02) AN Internal Use (Payout Code)712-714 X(03) AN Internal Use (Trader Number)715-718 X(04) AN Internal Use (Product Code)719-722 X(04) AN Internal Use (<strong>Customer</strong> Type)723-726 X(04) AN Internal Use (<strong>Account</strong> Plan Type)727-730 X(04) AN Internal Use (Promotion Type)731-734 X(04) AN Internal Use (Inv Obj)735-738 X(04) AN Internal Use (Inv Obj)739-742 X(04) AN Internal Use (Inv Obj)743-746 X(04) AN FULFILLMENT METHOD; acceptable values include:“GPDF” = Generate PDF“BPKG” = Branded Package“ESIG” = eSignature (paperless)“ ” = Not applicable<strong>ACCT</strong>/<strong>ACCF</strong>Page 10 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSPOSITION PICTURE TYPE DESCRIPTION747-747 X(01) AN CREDIT INTEREST INDICATOR; valid values include:“Y” = Earns Credit Interest“N” = Does not earn Credit Interest“ ” = Not applicable or available748-748 X(01) AN AMA INDICATOR, valid values include:“1” = AMA Cash <strong>Account</strong>“2” = AMA Margin <strong>Account</strong>“3” = Pending AMA“4” = Basic AMA“5” = Pending Basic AMA“7” = Sweep“8” = Banklink“ ” = Not applicable749-749 X(01) AN For Pershing Internal Use Only750-750 X(01) AN Literally “X”; indicates the end of record A<strong>ACCT</strong>/<strong>ACCF</strong>Page <strong>11</strong> <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSDETAIL RECORD B– MAIN ACCOUNT INFORMATIONPOSITION PICTURE TYPE DESCRIPTION001-002 X(02) AN TRANSACTION CODE = “CI”003-003 X(01) AN RECORD INDICATOR VALUE = “B”004-0<strong>11</strong> 9(08) N RECORD ID SEQUENCE NUMBER; begins with“00000001”012-020 X(<strong>09</strong>) AN ACCOUNT NUMBER INCLUDING OFFICE(3); BASEACCOUNT(5); CHECK DIGIT (1)021-023 X(03) AN INTRODUCING BROKER DEALER NUMBER024-024 X(01) AN Not Used025-027 X(03) AN INVESTMENT PROFESSIONAL NUMBER028-028 X(01) AN Not Used029-038 X(10) AN ACCOUNT SHORT NAME039-040 X(02) AN Not UsedTAX INFORMATION041-041 X(01) AN TAX ID TYPE; acceptable values include:“N” = Not applicable“T” = Taxpayer ID Number“A” = Applied For“S” = Social Security Number042-050 X(<strong>09</strong>) AN TAX ID NUMBER051-058 9(08) N DATE TAX ID APPLIED FOR = “CCYYMMDD”059-060 X(02) AN W8-W9 NONE INDICATOR; acceptable values include:“ ” = Not applicable“W8”“W9”061-068 9(08) N W8-W9 DATE = “CCYYMMDD”069-076 9(08) N W8-W9 EFFECTIVE DATE = “CCYYMMDD”077-080 X(04) AN W8-W9 DOCUMENT TYPE; acceptable values include:“W8 ” = Foreign Tax Form W8“W8BE” = Foreign Status Beneficial Owner“W8CO” = W8 IBD“W8D” = Original IRS Form W8“W8E ” = Expired Foreign Tax Form“W8EC” = Foreign with effectively connected U.S.Business/Trade“W8EX” = Foreign Status for Government/Organization“W8IM” = Foreign Status for Intermediary“W9 ” = U.S. Tax Form W9“W9DT” = Add W9 Per Tax Reporting“W9WH” = W9 but Subject to Backup Withholding<strong>ACCT</strong>/<strong>ACCF</strong>Page 12 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSPOSITION PICTURE TYPE DESCRIPTION081-081 X(01) AN TAX STATUS; acceptable values include:“ ” = Non-Exempt“B” = Exempt“A” = Approved Exempt Retail or Exempt COD accounts082-082 X(01) AN B NOTICE REASON CODE; acceptable values include“1” = Missing TIN“2” = Not Currently Issued TIN“3” = Incorrect Name/TIN“5” = TIN/Name without Backup Withholding“6” = TIN/Name with Backup Withholding“ ” = Not applicable083-102 X(20) AN FIRST B NOTICE STATUS; acceptable values include:“ACTIVE”“INACTIVE”“SATISFIED”103-<strong>11</strong>0 9(08) N DATE FIRST B NOTICE STATUS ISSUED/ENFORCED =“CCYYMMDD”<strong>11</strong>1-<strong>11</strong>8 X(08) AN Not Used<strong>11</strong>9-126 9(08) N DATE FIRST B NOTICE STATUS SATISFIED =“CCYYMMDD”127-146 X(20) AN SECOND B NOTICE STATUS; acceptable values include:“ACTIVE”“INACTIVE”“SATISFIED”147-154 9(08) N DATE SECOND B NOTICE STATUS ISSUED/ENFORCED= “CCYYMMDD”155-162 X(08) AN Not Used163-170 9(08) N DATE SECOND B NOTICE STATUS SATISFIED =“CCYYMMDD”171-190 X(20) AN C NOTICE STATUS; acceptable values include:“ACTIVE”“INACTIVE”“SATISFIED”191-198 9(08) N DATE C NOTICE STATUS ISSUED/ENFORCED =“CCYYMMDD”199-206 9(08) N DATE C NOTICE STATUS SATISFIED = “CCYYMMDD”OLD ACCOUNT INFORMATION207-226 X(20) AN OLD ACCOUNT NUMBER227-234 9(08) N ORIGINAL ACCOUNT OPEN DATE = “CCYYMMDD”235-346 X(<strong>11</strong>2) AN Not UsedSPECIAL ACCOUNT-LEVEL ROUTING CODES347-349 X(03) AN ACCOUNT-LEVEL ROUTING CODE; values include“ADV” = Advent(cont.)<strong>ACCT</strong>/<strong>ACCF</strong>Page 13 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSPOSITION PICTURE TYPE DESCRIPTION“APL” = Security APL“BCS” = Security APL - Individual Strategies“BNY” = BNY Trust - Lockwood“CON” = Concord Equity“DVP” = BNY Trust - APL“FQI” = CUSO/Fundquest for APL“HSA” = Bank Health Savings <strong>Account</strong>“LKW” = Lockwood business going to Lockwood“MIL” = Millennium Trust Health Savings <strong>Account</strong>s“MTV” = Metavante Trust Service“PRM” = WP Stewart“WAD” = World Advisors“ ” = No Value Entered/Not applicable350-352 X(03) AN ACCOUNT-LEVEL ROUTING CODE; (see position 347-349, above, for values)353-355 X(03) AN ACCOUNT-LEVEL ROUTING CODE; (see position 347-349, above, for values)356-358 X(03) AN ACCOUNT-LEVEL ROUTING CODE; (see position 347-349, above, for values)359-370 X(12) AN Not Used371-373 X(03) AN PRIMARY INVESTMENT PROFESSIONAL374-376 X(03) AN SECONDARY INVESTMENT PROFESSIONAL377-400 X(24) AN Not Used401-408 X(08) AN ALERT IM ACRONYM; identifies the buy-side entity, e.g., anInvestment Manager4<strong>09</strong>-424 X(16) AN ALERT IM ACCESS CODE; identifies the specific account atthe Institution425-432 X(08) AN BROKER ACRONYM; identifies the sell-side entity, e.g., theBroker Dealer433-433 X(01) AN CROSS-REFERENCED INDICATOR; indicates if account iscross-referenced with ALERT Direct; values include:“Y” = <strong>Account</strong> is cross-referenced with ALERT Direct“N” = <strong>Account</strong> is not cross-referenced with ALERT Direct434-434 X(01) AN BNY TRUST INDICATOR; acceptable values include:“N” = Not a BNY Trust <strong>Account</strong>“Y” = Valid BNY Trust <strong>Account</strong>435-436 X(02) AN SOURCE OF ASSETS AT ACCOUNT OPENING; valuesinclude:“E” = Existing Assets“P” = Partially New Assets“N” = New Assets“R” = Default“ ” = No value entered/Not applicable<strong>ACCT</strong>/<strong>ACCF</strong>Page 14 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSPOSITION PICTURE TYPE DESCRIPTION437-437 X(01) AN COMMISSION DISCOUNT CODE; freeform, legacy field438-457 X(20) AN EXTERNAL ACCOUNT NUMBER; freeform text (“ ” is anallowable value)458-458 X(01) AN CONFIRMATION SUPPRESSION INDICATOR; acceptablevalues include:“Y” = Suppress confirmations“N” = Do not suppress confirmations“ ” = Not applicable459-464 9(06) N LAST MONTH BOOKS AND RECORDS/INVESTMENTOBJECTIVE INFORMATION WAS MAILED TOCUSTOMER = CCYYMM465-470 9(06) N LAST MONTH BOOKS AND RECORDS/INVESTMENTOBJECTIVE INFORMATION WAS PROVIDED TOCUSTOMER OUTSIDE THE PERSHING SYSTEM =CCYYMM471-471 X(01) AN Reserved for Future Use472-472 X(01) AN FULLY PAID LENDING AGREEMENT INDICATOR473-480 9(08) N FULLY PAID LENDING AGREEMENT DATE =“CCYYMMDD”481-484 X(04) AN CUSTODIAN ACCOUNT TYPE (for custodian accountsonly); acceptable values include:“UGMA” = Uniform Gifts to Minors Act“UTMA” = Uniform Transfers to Minors Act“ ” = Not applicable485-488 X(04) AN MARKETS IN FINANCIAL INSTRUMENTS DIRECTIVE(MiFID) CLIENT CATEGORIZATION; values include:“RETL” = Retail Client“RETP” = Retail Client opting down from Professional“RETE” = Retail Client opting down from EligibleCounterparty“PROF” = Professional Client“PROR” = Professional Client opting up from Retail Client“PROE” = Professional Client opting down from EligibleCounterparty“ELIG” = Eligible CounterpartyThe following fields have been moved from Record M:489-489 X(01) AN CASH MANAGEMENT TRANSACTION CODE; acceptablevalues include:“X” or “ ” = Unchanged record“A” = Add“C” = Change490-493 X(04) AN SWEEP STATUS INDICATOR; acceptable values include:“A ” = Active Sweep“C ” = Closed Sweep (cont.)<strong>ACCT</strong>/<strong>ACCF</strong>Page 15 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSPOSITION PICTURE TYPE DESCRIPTION“I ” = Inactive Sweep“N ” = Non-Participant or No Sweep494-501 9(08) N DATE SWEEP ACTIVATED = “CCYYMMDD”502-5<strong>09</strong> 9(08) N DATE SWEEP DETAILS CHANGED = “CCYYMMDD”510-510 X(01) AN COVER MARGIN DEBIT INDICATOR; acceptable valuesinclude:“Y” = Yes; sweep to cover margin debt“N” = No; do not sweep to cover margin debt5<strong>11</strong>-5<strong>11</strong> X(01) AN Not UsedFIRST FUND SWEEP INFORMATION512-518 X(07) AN FIRST FUND SWEEP ACCOUNT ID519-536 9(<strong>09</strong>)v9(<strong>09</strong>) N FIRST FUND SWEEP ACCOUNT PERCENT537-537 X(01) AN FIRST FUND SWEEP ACCOUNT REDEMPTIONPRIORITY; acceptable values include:“ ” = When Sweep Status is blank“1” = Redeem this Fund first“2” = Redeem this Fund secondSECOND FUND SWEEP INFORMATION538-544 X(07) AN SECOND FUND SWEEP ACCOUNT ID545-562 9(<strong>09</strong>)v9(<strong>09</strong>) N SECOND FUND SWEEP ACCOUNT PERCENT563-563 X(01) AN SECOND FUND SWEEP ACCOUNT REDEMPTIONPRIORITY; acceptable values include:“ ” = When Sweep Status is blank“1” = Redeem this Fund first“2” = Redeem this Fund secondBANKLINK SWEEP INFORMATION564-564 X(01) AN TYPE OF BANK ACCOUNT; acceptable values include:“C” = Checking“S” = Saving“N” = Not applicable565-573 X(<strong>09</strong>) AN BANKLINK ABA NUMBER574-590 X(17) AN BANKLINK DDA NUMBER591-593 X(03) AN Not UsedThe following field has been moved from Record O594-594 X(01) AN FUND BANK INDICATOR; acceptable values include:“F” = Fund“B” = Bank595-749 X(155) AN Not Used750-750 X(01) AN Literally “X”; indicates the end of record B<strong>ACCT</strong>/<strong>ACCF</strong>Page 16 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSDETAIL RECORD C – MAIN ACCOUNT INFORMATION, ADDRESS 1-2POSITION PICTURE TYPE DESCRIPTION001-002 X(02) AN TRANSACTION CODE = “CI”003-003 X(01) AN RECORD INDICATOR VALUE = “C”004-0<strong>11</strong> 9(08) N RECORD ID SEQUENCE NUMBER; begins with“00000001”012-020 X(<strong>09</strong>) AN ACCOUNT NUMBER INCLUDING OFFICE(3); BASEACCOUNT(5); CHECK DIGIT (1)021-023 X(03) AN INTRODUCING BROKER DEALER NUMBER024-024 X(01) AN Not Used025-027 X(03) AN INVESTMENT PROFESSIONAL NUMBER028-028 X(01) AN Not Used029-038 X(10) AN ACCOUNT SHORT NAME039-040 X(02) AN Not UsedACCOUNT ADDRESS #1041-041 X(01) AN ADDRESS (1) TRANSACTION CODE; values include:“X” or “ ” = Unchanged record“A” = Add new address“C” = Change existing address information042-042 X(01) AN SPECIAL HANDLING INDICATOR (1); values include:“N” = No special handling required for this address“Y” = Special handling required for this address043-043 X(01) AN DELIVERY IDENTIFIER (1) defines the address type thatfollows; acceptable values include:“L” = Mailing“M” = Legal Address“D” = Legal and Mailing Addresses are the same and displayedonce on the file“2” = Legal Address (for COD <strong>Account</strong>s only)“O” = Business 1“P” = Business 2“S” = Seasonal 1“T” = Seasonal 2“U” = Seasonal 3044-047 X(04) AN ATTENTION LINE PREFIX (1); acceptable values include:“ATTN” = Attention of“C/O” = Care of“ ” = May be blank in user-titled accounts048-075 X(28) AN ATTENTION LINE DETAIL (1)076-107 X(32) AN ADDRESS (1) LINE <strong>11</strong>08-139 X(32) AN ADDRESS (1) LINE 2<strong>ACCT</strong>/<strong>ACCF</strong>Page 17 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSPOSITION PICTURE TYPE DESCRIPTION140-171 X(32) AN ADDRESS (1) LINE 3; only if ATTENTION LINE is spaces172-203 X(32) AN ADDRESS (1) LINE 4; only if country is not US or Canada204-218 X(15) AN CITY (1); for US/Canada addresses only219-220 X(02) AN STATE (1); for US/Canada addresses only; see Appendix Q,“<strong>ACCT</strong> Codes and Values”221-235 X(15) AN ZIP (1); for US/Canada addresses only236-237 X(02) AN COUNTRY CODE (1); see Appendix Q, “<strong>ACCT</strong> Codes andValues”238-238 X(01) AN Not Used239-246 9(08) N FIRST MAIL RETURN DATE (1) = “CCYYMMDD”247-271 X(25) AN FIRST MAIL RETURN REASON (1)272-279 9(08) N SECOND MAIL RETURN DATE (1) = “CCYYMMDD”280-304 X(25) AN SECOND MAIL RETURN REASON (1)305-312 9(08) N THIRD MAIL RETURN DATE (1) = “CCYYMMDD”313-337 X(25) AN THIRD MAIL RETURN REASON (1)ACCOUNT ADDRESS #2338-338 X(01) AN ADDRESS (2) TRANSACTION CODE; values include:“X” or “ ” = Unchanged record“A” = Add new address“C” = Change existing address information339-339 X(01) AN SPECIAL HANDLING INDICATOR (2); values include:“N” = No special handling required for this address“Y” = Special handling required for this address340-340 X(01) AN DELIVERY IDENTIFIER (2) defines the address type thatfollows; see DELIVERY IDENTIFIER (1), position 43, forvalues341-344 X(04) AN ATTENTION LINE PREFIX (2); acceptable values include:“ATTN” = Attention of“C/O ” = Care of“ ” = May be blank in user-titled accounts345-372 X(28) AN ATTENTION LINE DETAIL (2)373-404 X(32) AN ADDRESS (2) LINE 1405-436 X(32) AN ADDRESS (2) LINE 2437-468 X(32) AN ADDRESS (2) LINE 3; only if ATTENTION LINE is spaces469-500 X(32) AN ADDRESS (2) LINE 4; only if country is not US or Canada501-515 X(15) AN CITY (2); for US/Canada addresses only516-517 X(02) AN STATE (2); for US/Canada addresses only; see Appendix Q,“<strong>ACCT</strong> Codes and Values”518-532 X(15) AN ZIP (2); for US/Canada addresses only533-534 X(02) AN COUNTRY CODE (2); see Appendix Q, “<strong>ACCT</strong> Codes andValues”535-535 X(01) AN Not Used<strong>ACCT</strong>/<strong>ACCF</strong>Page 18 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSPOSITION PICTURE TYPE DESCRIPTION536-543 9(08) N FIRST MAIL RETURN DATE (2) = “CCYYMMDD”544-568 X(25) AN FIRST MAIL RETURN REASON (2)569-576 9(08) N SECOND MAIL RETURN DATE (2) = “CCYYMMDD”577-601 X(25) AN SECOND MAIL RETURN REASON (2)602-6<strong>09</strong> 9(08) N THIRD MAIL RETURN DATE (2) = “CCYYMMDD”610-634 X(25) AN THIRD MAIL RETURN REASON (2)SEASONAL ADDRESS DATES635-635 X(01) AN SEASONAL ADDRESS IDENTIFIER; acceptable valuesinclude:“S” = Seasonal 1“T” = Seasonal 2“U” = Seasonal 3636-643 9(08) N FROM DATE = “CCYYMMDD”644-651 9(08) N TO DATE = “CCYYMMDD”652-652 X(01) AN SEASONAL ADDRESS IDENTIFIER; see position 635 forvalues653-660 9(08) N FROM DATE = “CCYYMMDD”661-668 9(08) N TO DATE = “CCYYMMDD”669-669 X(01) AN SEASONAL ADDRESS IDENTIFIER; see position 635 forvalues670-677 9(08) N FROM DATE = “CCYYMMDD”678-685 9(08) N TO DATE = “CCYYMMDD”686-749 X(64) AN Not Used750-750 X(01) AN Literally “X”; indicates the end of record C<strong>ACCT</strong>/<strong>ACCF</strong>Page 19 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSDETAIL RECORD D – MAIN ACCOUNT INFORMATION, ADDRESS 3-4POSITION PICTURE TYPE DESCRIPTION001-002 X(02) AN TRANSACTION CODE = “CI”003-003 X(01) AN RECORD INDICATOR VALUE = “D”004-0<strong>11</strong> 9(08) N RECORD ID SEQUENCE NUMBER; begins with“00000001”012-020 X(<strong>09</strong>) AN ACCOUNT NUMBER INCLUDING OFFICE(3); BASEACCOUNT(5); CHECK DIGIT (1)021-023 X(03) AN INTRODUCING BROKER DEALER NUMBER024-024 X(01) AN Not Used025-027 X(03) AN INVESTMENT PROFESSIONAL NUMBER028-028 X(01) AN Not Used029-038 X(10) AN ACCOUNT SHORT NAME039-040 X(02) AN Not UsedACCOUNT ADDRESS #3041-041 X(01) AN ADDRESS (3) TRANSACTION CODE; values include:“X” or “ ” = Unchanged record“A” = Add new address“C” = Change existing address information042-042 X(01) AN SPECIAL HANDLING INDICATOR (3); values include:“N” = No special handling required for this address“Y” = Special handling required for this address043-043 X(01) AN DELIVERY IDENTIFIER (3) defines the address type thatfollows; see DELIVERY IDENTIFIER (1), Record C, position43, for values044-047 X(04) AN ATTENTION LINE PREFIX (3); acceptable values include:“ATTN” = Attention of“C/O ” = Care of“ ” = May be blank in user-titled accounts048-075 X(28) AN ATTENTION LINE DETAIL (3)076-107 X(32) AN ADDRESS (3) LINE <strong>11</strong>08-139 X(32) AN ADDRESS (3) LINE 2140-171 X(32) AN ADDRESS (3) LINE 3; only if ATTENTION LINE is spaces172-203 X(32) AN ADDRESS (3) LINE 4; only if country is not US or Canada204-218 X(15) AN CITY (3); for US/Canada addresses only219-220 X(02) AN STATE (3); for US/Canada addresses only; see Appendix Q,“<strong>ACCT</strong> Codes and Values”221-235 X(15) AN ZIP (3); for US/Canada addresses only236-237 X(02) AN COUNTRY CODE (3); see Appendix Q, “<strong>ACCT</strong> Codes andValues”238-238 X(01) AN Not Used239-246 9(08) N FIRST MAIL RETURN DATE (3) = “CCYYMMDD”<strong>ACCT</strong>/<strong>ACCF</strong>Page 20 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSPOSITION PICTURE TYPE DESCRIPTION247-271 X(25) AN FIRST MAIL RETURN REASON (3)272-279 9(08) N SECOND MAIL RETURN DATE (3) = “CCYYMMDD”280-304 X(25) AN SECOND MAIL RETURN REASON (3)305-312 9(08) N THIRD MAIL RETURN DATE (3) = “CCYYMMDD”313-337 X(25) AN THIRD MAIL RETURN REASON (3)ACCOUNT ADDRESS #4338-338 X(01) AN ADDRESS (4) TRANSACTION CODE; values include:“X” or “ ” = Unchanged record“A” = Add new address“C” = Change existing address information339-339 X(01) AN SPECIAL HANDLING INDICATOR (4); values include:“N” = No special handling required for this address“Y” = Special handling required for this address340-340 X(01) AN DELIVERY IDENTIFIER (4) defines the address that follows;type of address; see DELIVERY IDENTIFIER (1), Record C,position 43, for values341-344 X(04) AN ATTENTION LINE PREFIX (4); acceptable values include:“ATTN” = Attention of“C/O” = Care of“ ” = May be blank in user-titled accounts345-372 X(28) AN ATTENTION LINE DETAIL (4)373-404 X(32) AN ADDRESS (4) LINE 1405-436 X(32) AN ADDRESS (4) LINE 2437-468 X(32) AN ADDRESS (4) LINE 3; only if ATTENTION LINE is spaces469-500 X(32) AN ADDRESS (4) LINE 4; only if country is not US or Canada501-515 X(15) AN CITY (4); for US/Canada addresses only516-517 X(02) AN STATE (4); for US/Canada addresses only; see Appendix Q,“<strong>ACCT</strong> Codes and Values”518-532 X(15) AN ZIP (4); for US/Canada addresses only533-534 X(02) AN COUNTRY CODE (4); see Appendix Q, “<strong>ACCT</strong> Codes andValues”535-535 X(01) AN Not Used536-543 9(08) N FIRST MAIL RETURN DATE (4) = “CCYYMMDD”544-568 X(25) AN FIRST MAIL RETURN REASON (4)569-576 9(08) N SECOND MAIL RETURN DATE (4) = “CCYYMMDD”577-601 X(25) AN SECOND MAIL RETURN REASON (4)602-6<strong>09</strong> 9(08) N THIRD MAIL RETURN DATE (4) = “CCYYMMDD”610-634 X(25) AN THIRD MAIL RETURN REASON (4)635-749 X(<strong>11</strong>5) AN Not Used750-750 X(01) AN Literally “X”; indicates the end of record D<strong>ACCT</strong>/<strong>ACCF</strong>Page 21 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSDETAIL RECORD E – MAIN ACCOUNT INFORMATION, ADDRESS 5-6POSITION PICTURE TYPE DESCRIPTION001-002 X(02) AN TRANSACTION CODE = “CI”003-003 X(01) AN RECORD INDICATOR VALUE = “E”004-0<strong>11</strong> 9(08) N RECORD ID SEQUENCE NUMBER; begins with“00000001”012-020 X(<strong>09</strong>) AN ACCOUNT NUMBER INCLUDING OFFICE(3); BASEACCOUNT(5); CHECK DIGIT (1)021-023 X(03) AN INTRODUCING BROKER DEALER NUMBER024-024 X(01) AN Not Used025-027 X(03) AN INVESTMENT PROFESSIONAL NUMBER028-028 X(01) AN Not Used029-038 X(10) AN ACCOUNT SHORT NAME039-040 X(02) AN Not UsedACCOUNT ADDRESS #5041-041 X(01) AN ADDRESS (5) TRANSACTION CODE; values include:“X” or “ ” = Unchanged record“A” = Add new address“C” = Change existing address information042-042 X(01) AN SPECIAL HANDLING INDICATOR (5); values include:“N” = No special handling required for this address“Y” = Special handling required for this address043-043 X(01) AN DELIVERY IDENTIFIER (5) defines the address type thatfollows; see DELIVERY IDENTIFIER (1), Record C, position43, for values044-047 X(04) AN ATTENTION LINE PREFIX (5); acceptable values include:“ATTN” = Attention of“C/O ” = Care of“ ” = May be blank in user-titled accounts048-075 X(28) AN ATTENTION LINE DETAIL (5)076-107 X(32) AN ADDRESS (5) LINE <strong>11</strong>08-139 X(32) AN ADDRESS (5) LINE 2140-171 X(32) AN ADDRESS (5) LINE 3; only if ATTENTION LINE is spaces172-203 X(32) AN ADDRESS (5) LINE 4; only if country is not US or Canada204-218 X(15) AN CITY (5); for US/Canada addresses only219-220 X(02) AN STATE (5); for US/Canada addresses only; see Appendix Q,“<strong>ACCT</strong> Codes and Values”221-235 X(15) AN ZIP (5); for US/Canada addresses only236-237 X(02) AN COUNTRY CODE (5); see Appendix Q, “<strong>ACCT</strong> Codes andValues”238-238 X(01) AN Not Used239-246 9(08) N FIRST MAIL RETURN DATE (5) = “CCYYMMDD”<strong>ACCT</strong>/<strong>ACCF</strong>Page 22 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSPOSITION PICTURE TYPE DESCRIPTION247-271 X(25) AN FIRST MAIL RETURN REASON (5)272-279 9(08) N SECOND MAIL RETURN DATE (5) = “CCYYMMDD”280-304 X(25) AN SECOND MAIL RETURN REASON (5)305-312 9(08) N THIRD MAIL RETURN DATE (5) = “CCYYMMDD”313-337 X(25) AN THIRD MAIL RETURN REASON (5)ACCOUNT ADDRESS #6338-338 X(01) AN ADDRESS (6) TRANSACTION CODE; values include:“X” or “ ” = Unchanged record“A” = Add new address“C” = Change existing address information339-339 X(01) AN SPECIAL HANDLING INDICATOR (6); values include:“N” = No special handling required for this address“Y” = Special handling required for this address340-340 X(01) AN DELIVERY IDENTIFIER (6) defines the type of address thatfollows; see DELIVERY IDENTIFIER (1), Record C, position43, for values341-344 X(04) AN ATTENTION LINE PREFIX (6); acceptable values include:“ATTN” = Attention of“C/O ” = Care of“ ” = May be blank in user-titled accounts345-372 X(28) AN ATTENTION LINE DETAIL (6)373-404 X(32) AN ADDRESS (6) LINE 1405-436 X(32) AN ADDRESS (6) LINE 2437-468 X(32) AN ADDRESS (6) LINE 3; only if ATTENTION LINE is spaces469-500 X(32) AN ADDRESS (6) LINE 4; only if country is not US or Canada501-515 X(15) AN CITY (6); for US/Canada addresses only516-517 X(02) AN STATE (6); for US/Canada addresses only; see Appendix Q,“<strong>ACCT</strong> Codes and Values”518-532 X(15) AN ZIP (6); for US/Canada addresses only533-534 X(02) AN COUNTRY CODE (6); see Appendix Q, “<strong>ACCT</strong> Codes andValues”535-535 X(01) AN Not Used536-543 9(08) N FIRST MAIL RETURN DATE (6) = “CCYYMMDD”544-568 X(25) AN FIRST MAIL RETURN REASON (6)569-576 9(08) N SECOND MAIL RETURN DATE (6) = “CCYYMMDD”577-601 X(25) AN SECOND MAIL RETURN REASON (6)602-6<strong>09</strong> 9(08) N THIRD MAIL RETURN DATE (6) = “CCYYMMDD”610-634 X(25) AN THIRD MAIL RETURN REASON (6)635-749 X(<strong>11</strong>5) AN Not Used750-750 X(01) AN Literally “X”; indicates the end of record E<strong>ACCT</strong>/<strong>ACCF</strong>Page 23 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSDETAIL RECORD F – MAIN ACCOUNT INFORMATION, ADDRESS 7POSITION PICTURE TYPE DESCRIPTION001-002 X(02) AN TRANSACTION CODE = “CI”003-003 X(01) AN RECORD INDICATOR VALUE = “F”004-0<strong>11</strong> 9(08) N RECORD ID SEQUENCE NUMBER; begins with“00000001”012-020 X(<strong>09</strong>) AN ACCOUNT NUMBER INCLUDING OFFICE(3); BASEACCOUNT(5); CHECK DIGIT (1)021-023 X(03) AN INTRODUCING BROKER DEALER NUMBER024-024 X(01) AN Not Used025-027 X(03) AN INVESTMENT PROFESSIONAL NUMBER028-028 X(01) AN Not Used029-038 X(10) AN ACCOUNT SHORT NAME039-040 X(02) AN Not UsedACCOUNT ADDRESS #7041-041 X(01) AN ADDRESS (7) TRANSACTION CODE; values include:“X” or “ ” = Unchanged record“A” = Add new address“C” = Change existing address information042-042 X(01) AN SPECIAL HANDLING INDICATOR (7); values include:“N” = No special handling required for this address“Y” = Special handling required for this address043-043 X(01) AN DELIVERY IDENTIFIER (7) defines the address type thatfollows; see DELIVERY IDENTIFIER (1), Record C, position43, for values044-047 X(04) AN ATTENTION LINE PREFIX (7); acceptable values include:“ATTN” = Attention of“C/O ” = Care of“ ” = May be blank in user-titled accounts048-075 X(28) AN ATTENTION LINE DETAIL (7)076-107 X(32) AN ADDRESS (7) LINE <strong>11</strong>08-139 X(32) AN ADDRESS (7) LINE 2140-171 X(32) AN ADDRESS (7) LINE 3; only if ATTENTION LINE containsspaces172-203 X(32) AN ADDRESS (7) LINE 4; only if the country is not the US orCanada204-218 X(15) AN CITY (7); for US/Canada addresses only219-220 X(02) AN STATE (7); for US/Canada addresses only; see Appendix Q,“<strong>ACCT</strong> Codes and Values”221-235 X(15) AN ZIP (7); for US/Canada addresses only236-237 X(02) AN COUNTRY CODE (7); see Appendix Q, “<strong>ACCT</strong> Codes andValues”<strong>ACCT</strong>/<strong>ACCF</strong>Page 24 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSPOSITION PICTURE TYPE DESCRIPTION238-238 X(01) AN Not Used239-246 9(08) N FIRST MAIL RETURN DATE (7) = “CCYYMMDD”247-271 X(25) AN FIRST MAIL RETURN REASON (7)272-279 9(08) N SECOND MAIL RETURN DATE (7) = “CCYYMMDD”280-304 X(25) AN SECOND MAIL RETURN REASON (7)305-312 9(08) N THIRD MAIL RETURN DATE (7) = “CCYYMMDD”313-337 X(25) AN THIRD MAIL RETURN REASON (7)338-749 X(412) AN Not Used750-750 X(01) AN Literally “X”; indicates the end of record F<strong>ACCT</strong>/<strong>ACCF</strong>Page 25 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSDETAIL RECORD W – ADDITIONAL ACCOUNT-LEVEL INFORMATIONPOSITION PICTURE TYPE DESCRIPTION001-002 X(02) AN TRANSACTION CODE = “CI”003-003 X(01) AN RECORD INDICATOR VALUE = “W”004-0<strong>11</strong> 9(08) N RECORD ID SEQUENCE NUMBER; begins with“00000001”012-020 X(<strong>09</strong>) AN ACCOUNT NUMBER INCLUDING OFFICE(3); BASEACCOUNT(5); CHECK DIGIT (1)021-023 X(03) AN INTRODUCING BROKER DEALER NUMBER024-024 X(01) AN Not Used025-027 X(03) AN INVESTMENT PROFESSIONAL NUMBER028-028 X(01) AN Not Used029-038 X(10) AN ACCOUNT SHORT NAME039-040 X(02) AN Not UsedNEW ACCOUNT-LEVEL INFORMATION041-041 X(01) AN RECORD TRANSACTION CODE; acceptable values include:“X” or “ ”= Unchanged record“A” = Added account“C” = Change to existing recordCURRENCY / LANGUAGE INFORMATIONBELOW FIELD COPIED FROM RECORD A, position 461042-042 X(01) AN NON-US DOLLAR TRADING; acceptable values include:“Y” = <strong>Account</strong> approved for trading in non-US Dollars“N” = Not eligible to trade non-US Dollars (default)043-045 X(03) AN BASE CURRENCY; see Appendix N, “Currency Codes”046-048 X(03) AN INCOME CURRENCY; see Appendix N, “Currency Codes,”for values, as well as additional acceptable values:“ISS” = Issue Currency; the currency in which Pershingreceives payment“POS” = Position Currency; the currency in which thecustomer is holding the underlying position“ ” = Not applicable049-051 X(03) AN STATEMENT LANGUAGE; effective 03/2010; valuesinclude:“ENG” = English“SPA” = Spanish“N/A” = Not available052-054 X(03) AN Not Used055-055 X(01) AN MSRB Statement Indicator; effective 03/2010; values include:“Y” = Send Statements“N” = Do not send Statements“ ” = Not applicable<strong>ACCT</strong>/<strong>ACCF</strong>Page 26 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSPOSITION PICTURE TYPE DESCRIPTION056-061 X(06) AN Not UsedNEW ACCOUNT-LEVEL INFORMATION BELOW FIELD COPIED FROM RECORD A, position 671-671062-062 X(01) AN POLITICALLY EXPOSED PERSON INDICATOR;acceptable values include:“Y” = Politically Exposed Person“N” = Not a Politically Exposed Person“U” = Unknown063-087 X(25) AN FIRST NAME OF POLITICALLY EXPOSED PERSON088-<strong>11</strong>2 X(25) AN LAST NAME OF POLITICALLY EXPOSED PERSON<strong>11</strong>3-<strong>11</strong>6 X(04) AN SUFFIX OF POLITICALLY EXPOSED PERSON<strong>11</strong>7-151 X(35) AN POLITICAL OFFICE HELD152-153 X(02) AN COUNTRY OF OFFICE; see Appendix Q, “<strong>ACCT</strong> Codes andValues”COPIED FROM RECORD A, position 673-673154-154 X(01) AN FOREIGN BANK ACCOUNT INDICATOR; acceptablevalues include:“Y” = <strong>Account</strong> is a foreign bank“N” = <strong>Account</strong> is not a foreign bank“U” = Unknown155-162 9(08) N FOREIGN BANK CERTIFICATION DATE =“CCYYMMDD”163-170 9(08) N FOREIGN BANK CERTIFICATION EXPIRATION DATE =“CCYYMMDD”171-171 X(01) AN CENTRAL BANK INDICATOR; acceptable values include:“Y” = <strong>Account</strong> is a foreign central bank“N” = <strong>Account</strong> is not a foreign central bank“U” = UnknownThe following field applies to Foreign Financial Institutions172-172 X(01) AN ACCOUNT FOR FOREIGN FINANCIAL INSTITUTION(non US Bank, non-US branch of US bank, broker dealer,futures merchant, commodities introducing broker, mutualfund, money transmitter or currency exchanger); valid valuesinclude:“Y” = Yes“N” = No“ ” = Not applicableThe following four fields apply to Foreign Banking173-173 X(01) AN FOREIGN BANK ACCOUNT OPERATING UNDEROFFSHORE BANKING LICENSE; acceptable values include:“Y” = Yes“N” = No“ ” = Not applicable174-174 X(01) AN FOREIGN BANK ACCOUNT OPERATING UNDER ABANKING LICENSE ISSUED BY A(cont.)<strong>ACCT</strong>/<strong>ACCF</strong>Page 27 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSPOSITION PICTURE TYPE DESCRIPTIONNON-COOPERATIVE COUNTRY OR TERRITORY;values include:“Y” = Yes“N” = No“ ” = Not applicable175-175 X(01) AN FOREIGN BANK ACCOUNT OPERATING UNDER ABANKING LICENSE ISSUED BY A JURISDICTIONSUBJECT TO SECTION 3<strong>11</strong> MEASURES; values include:“Y” = Yes“N” = No“ ” = Not applicable176-177 9(02) N NUMBER OF PEOPLE OR ENTITIES THAT OWN 10% ORMORE OF THE BANK (IF THE BANK IS NOT PUBLICLYTRADED); acceptable values are 00 - 15178-181 X(04) AN Not UsedACCOUNT-LEVEL TELEPHONE NUMBERNote: Telephone numbers will appear in alphabetical order based on TELEPHONE TYPE ID.TELEPHONE NUMBER <strong>11</strong>82-182 X(01) AN TELEPHONE 1 TRANSACTION CODE; values include:“X” or “ ” = Unchanged record“A” = Add telephone number“C” = Change existing telephone number183-183 X(01) AN US/INTERNATIONAL INDICATOR (1); (N/A for userdefinedaccounts); acceptable values include:“U” = US/Canada“F” = International184-184 X(01) AN TELEPHONE TYPE ID (1); acceptable values include:“B” = Business“C” = Cellular“E” = Beeper“F” = Fax“H” = Home“S” = Seasonal“T” = Telex“V” = Voice Mail185-232 X(48) AN TELEPHONE NUMBER (1)233-239 X(07) AN TELEPHONE EXTENSION (1) (N/A for user-definedaccounts)TELEPHONE NUMBER 2240-240 X(01) AN TELEPHONE 2 TRANSACTION CODE; values include:“X” or “ ” = Unchanged record“A” = Add telephone number“C” = Change existing telephone number<strong>ACCT</strong>/<strong>ACCF</strong>Page 28 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSPOSITION PICTURE TYPE DESCRIPTION241-241 X(01) AN US/INTERNATIONAL INDICATOR (2); (N/A for userdefinedaccounts); acceptable values include“U” = US/Canada“F” = International242-242 X(01) AN TELEPHONE TYPE ID (2); see TELEPHONE TYPE ID (1),position 184, for values243-290 X(48) AN TELEPHONE NUMBER (2)291-297 X(07) AN TELEPHONE EXTENSION (2)TELEPHONE NUMBER 3298-298 X(01) AN TELEPHONE 3 TRANSACTION CODE; values include:“X” or “ ” = Unchanged record“A” = Add telephone number“C” = Change existing telephone number299-299 X(01) AN US/INTERNATIONAL INDICATOR (3); acceptable valuesinclude:“U” = US/Canada“F” = International300-300 X(01) AN TELEPHONE TYPE ID (3); see TELEPHONE TYPE ID (1),position 184, for values301-348 X(48) AN TELEPHONE NUMBER (3)349-355 X(07) AN TELEPHONE EXTENSION (3)TELEPHONE NUMBER 4356-356 X(01) AN TELEPHONE 4 TRANSACTION CODE; values include:“X” or “ ” = Unchanged record“A” = Add telephone number“C” = Change existing telephone number357-357 X(01) AN US/INTERNATIONAL INDICATOR (4); acceptable valuesinclude“U” = US/Canada“F” = International358-358 X(01) AN TELEPHONE TYPE ID (4); see TELEPHONE TYPE ID (1),position 184, for values359-406 X(48) AN TELEPHONE NUMBER (4)407-413 X(07) AN TELEPHONE EXTENSION (4)TELPEHONE NUMBER 5414-414 X(01) AN TELEPHONE 5 TRANSACTION CODE; values include:“X” or “ ” = Unchanged record“A” = Add telephone number“C” = Change existing telephone number415-415 X(01) AN US/INTERNATIONAL INDICATOR (5); acceptable valuesinclude“U” = US/Canada“F” = International<strong>ACCT</strong>/<strong>ACCF</strong>Page 29 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSPOSITION PICTURE TYPE DESCRIPTION416-416 X(01) AN TELEPHONE TYPE ID (5); see TELEPHONE TYPE ID (1),position 184, for values417-464 X(48) AN TELEPHONE NUMBER (5)465-471 X(07) AN TELEPHONE EXTENSION (5)TELEPHONE NUMBER 6472-472 X(01) AN TELEPHONE 6 TRANSACTION CODE; values include:“X” or “ ” = Unchanged record“A” = Add telephone number“C” = Change existing telephone number473-473 X(01) AN US/INTERNATIONAL INDICATOR (6); values include“U” = US/Canada“F” = International474-474 X(01) AN TELEPHONE TYPE ID (6); see TELEPHONE TYPE ID (1),position 184, for values475-522 X(48) AN TELEPHONE NUMBER (6)523-529 X(07) AN TELEPHONE EXTENSION (6)TELEPHONE NUMBER 7530-530 X(01) AN TELEPHONE 7 TRANSACTION CODE; values include:“X” or “ ” = Unchanged record“A” = Add telephone number“C” = Change existing telephone number531-531 X(01) AN US/INTERNATIONAL INDICATOR (7); values include“U” = US/Canada“F” = International532-532 X(01) AN TELEPHONE TYPE ID (7); see TELEPHONE TYPE ID (1),position 184, for values533-580 X(48) AN TELEPHONE NUMBER (7)581-587 X(07) AN TELEPHONE EXTENSION (7)TELEPHONE NUMBER 8588-588 X(01) AN TELEPHONE 8 TRANSACTION CODE; values include:“X” or “ ” = Unchanged record“A” = Add telephone number“C” = Change existing telephone number589-589 X(01) AN US/INTERNATIONAL INDICATOR (8); acceptable valuesinclude“U” = US/Canada“F” = International590-590 X(01) AN TELEPHONE TYPE ID (8); see TELEPHONE TYPE ID (1),position 184, for values591-638 X(48) AN TELEPHONE NUMBER (8)639-645 X(07) AN TELEPHONE EXTENSION (8)646-695 X(50) AN E-MAIL ADDRESS<strong>ACCT</strong>/<strong>ACCF</strong>Page 30 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSPOSITION PICTURE TYPE DESCRIPTION696-696 X(01) AN SHELL ACCOUNT INDICATOR; effective 01/2010;values include:“Y” = <strong>Account</strong> is a Shell <strong>Account</strong>“N” = <strong>Account</strong> is not a Shell <strong>Account</strong> (default)697-697 X(01) AN PURGE ELIGIBLE INDICATOR; effective 01/2010;values include:“Y” = <strong>Account</strong> is Purge Eligible (default)“N” = <strong>Account</strong> is not Purge Eligible698-749 X(52) AN Not Used750-750 X(01) AN Literally “X”; indicates the end of record W<strong>ACCT</strong>/<strong>ACCF</strong>Page 31 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSDETAIL RECORD G – ACCOUNT HOLDER/PARTICIPANT INFORMATIONPOSITION PICTURE TYPE DESCRIPTION001-002 X(02) AN TRANSACTION CODE = “CI”003-003 X(01) AN RECORD INDICATOR VALUE = “G”004-0<strong>11</strong> 9(08) N RECORD ID SEQUENCE NUMBER; begins with“00000001”012-020 X(<strong>09</strong>) AN ACCOUNT NUMBER INCLUDING OFFICE(3); BASEACCOUNT(5); CHECK DIGIT (1)021-023 X(03) AN INTRODUCING BROKER DEALER NUMBER024-024 X(01) AN Not Used025-027 X(03) AN INVESTMENT PROFESSIONAL NUMBER028-028 X(01) AN Not Used029-038 X(10) AN ACCOUNT SHORT NAME039-040 X(02) AN Not Used041-041 X(01) AN ACCOUNT HOLDER/PARTICIPANT TRANSACTIONCODE; acceptable values include:“X” or “ ” = Unchanged record“A” = Add <strong>Account</strong> Holder/Participant“C” = Change existing <strong>Account</strong> Holder/ParticipantACCOUNT HOLDER/PARTICIPANT SECONDARY IDENTIFIERS042-044 X(03) AN SEQUENCE NUMBER; valid values are 001 through 015045-047 X(03) AN ACCOUNT HOLDER TYPE; acceptable values include:“AH ” = <strong>Account</strong> Holder“B&R” = Books and Records participant“IPP” = Interested Party participant048-051 X(04) AN ACCOUNT HOLDER/PARTICIPANT (1) ROLE; for<strong>Account</strong> Holder Roles and Participant Roles , see Appendix Q,“<strong>ACCT</strong> Codes and Values”ACCOUNT HOLDER/PARTICIPANT NAME AREA052-052 X(01) AN ACCOUNT HOLDER/PARTICIPANT (1) NAME TYPE;acceptable values include:“I” = Individual (Formatted)“E” = Entity (Free-form text or no name on file)“M” = Memo (for Interested Party Type only – free-form text)053-084 X(32) AN ACCOUNT HOLDER/PARTICIPANT (1) PREFIX/SUFFIXor ENTITY NAME / MEMO FREE-FORM LINE 1; if NAMETYPE = “I,” then one of the following values using the first 4characters of the field will be used; the second 4 characters canbe used for a suffix, and remaining 24 characters will be blank;acceptable values include:“ ”“DR ” (cont.)<strong>ACCT</strong>/<strong>ACCF</strong>Page 32 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSPOSITIONPICTURETYPEDESCRIPTION“MDM ”“MR ”“MS ”“MRS ”“SIR ”If NAME TYPE = “E” OR “M” then it will be free-form textand can be blank085-<strong>11</strong>6 X(32) AN ACCOUNT HOLDER/PARTICIPANT (1) FIRST NAME orENTITY NAME / MEMO FREE-FORM LINE 2; if NAMETYPE = “I” then this field will contain the first name; ifNAME TYPE = “E” or “M” then, it will be free-form text andcan be blank<strong>11</strong>7-148 X(32) AN ACCOUNT HOLDER/PARTICIPANT (1) MIDDLEINITIAL/NAME or ENTITY NAME / MEMO FREE-FORMLINE 3; if NAME TYPE = “I,” then this field will contain themiddle initial/name; if NAME TYPE = “E” or “M” then it willbe free-form text and can be blank149-180 X(32) AN ACCOUNT HOLDER/PARTICIPANT (1) LAST NAME orENTITY NAME / MEMO FREE-FORM LINE 4; if NAMETYPE = “I,” then this field will contain the last name; ifNAME TYPE = “E” or “M” then it will be free-form text andcan be blankACCOUNT HOLDER/PARTICIPANT ADDRESS AREA (FIRST)181-181 X(01) AN DELIVERY IDENTIFIER; defines the type of address thatfollows; acceptable values include:“M” = Legal“L” = Mailing“D” = Dual (Legal and Mailing addresses are the same for thisparticipant and are displayed for this iteration only)182-182 X(01) AN SPECIAL HANDLING INDICATOR; acceptable valuesinclude:“N” = No special handling (default value)“Y” = Special handling required (mandatory for internationaladdresses)183-186 X(04) AN ATTENTION LINE PREFIX; acceptable values include:“ATTN” = Attention of“C/O ” = Care of“ ” = May be blank in user-titled accounts187-214 X(28) AN ATTENTION LINE DETAIL215-246 X(32) AN STREET ADDRESS LINE 1 or MEMO FREE-FORM LINE 5247-278 X(32) AN STREET ADDRESS LINE 2 or MEMO FREE-FORM LINE 6279-310 X(32) AN STREET ADDRESS LINE 3; only if ATTENTION LINE isspaces3<strong>11</strong>-342 X(32) AN STREET ADDRESS LINE 4; only if country is not US orCanada<strong>ACCT</strong>/<strong>ACCF</strong>Page 33 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSPOSITION PICTURE TYPE DESCRIPTION343-357 X(15) AN CITY; for US/Canada addresses only358-359 X(02) AN STATE; for US/Canada addresses only see Appendix Q,“<strong>ACCT</strong> Codes and Values”360-374 X(15) AN ZIP/POSTAL CODE; for US/Canada addresses only375-376 X(02) AN COUNTRY CODE; see Appendix Q, “<strong>ACCT</strong> Codes andValues”377-378 X(02) AN Not UsedACCOUNT HOLDER/PARTICIPANT ADDRESS AREA (SECOND)379-379 X(01) AN DELIVERY IDENTIFIER; defines the type of address thatfollows; acceptable values include:“M” = Legal“L” = Mailing380-380 X(01) AN SPECIAL HANDLING INDICATOR; acceptable valuesinclude:“N” = No special handling (default value)“Y” = Special handling required (mandatory for internationaladdresses)381-384 X(04) AN ATTENTION LINE PREFIX; acceptable values include:“ATTN” = Attention of“C/O” = Care of“ ” = May be blank in user-titled accounts385-412 X(28) AN ATTENTION LINE DETAIL413-444 X(32) AN STREET ADDRESS LINE 1445-476 X(32) AN STREET ADDRESS LINE 2477-508 X(32) AN STREET ADDRESS LINE 3; only if ATTENTION LINE isspaces5<strong>09</strong>-540 X(32) AN STREET ADDRESS LINE 4; only if country is not US orCanada541-555 X(15) AN CITY; for US/Canada addresses only556-557 X(02) AN STATE; for US/Canadian addresses only; see Appendix Q,“<strong>ACCT</strong> Codes and Values”558-572 X(15) AN ZIP/POSTAL CODE; for US/Canada addresses only573-574 X(02) AN COUNTRY CODE; see Appendix Q, “<strong>ACCT</strong> Codes andValues”575-576 X(02) AN Not UsedACCOUNT HOLDER/PARTICIPANT INFORMATION (includes USA PATRIOT ACT account information)577-577 X(01) AN NATURAL/NON-NATURAL INDICATOR; acceptablevalues include:“I” = Individual/Person\“E” = Entity/Business/Nonperson“U” = Unknown“M” = Memo578-578 X(01) AN CONFIRMATION RECEIPT INDICATOR; (cont.)<strong>ACCT</strong>/<strong>ACCF</strong>Page 34 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSPOSITION PICTURE TYPE DESCRIPTIONacceptable values include:“Y” = Receives Confirmations“N” = Does Not Receive Confirmations579-579 X(01) AN STATEMENT RECEIPT INDICATOR; acceptable valuesinclude:“Y” = Receives Statements“N” = Does Not Receive Statements580-581 9(02) N YEARS OF INVESTMENT EXPERIENCE; values 00-99582-582 X(01) AN GENDER; acceptable values include:“F” = Female“M” = Male“N” = Not applicable (i.e., <strong>Account</strong> Holder is Corporate Entity)“U” = Unknown/Undetermined583-583 X(01) AN PROXY INDICATOR; acceptable values include:“Y” = Yes“N” = No584-591 9(08) N ACCOUNT HOLDER/PARTICIPANT’S BIRTH DATE =“CCYYMMDD”592-593 X(02) AN ACCOUNT HOLDER/PARTICIPANT COUNTRY OFCITIZENSHIP; see Appendix Q, “<strong>ACCT</strong> Codes and Values”594-595 X(02) AN ACCOUNT HOLDER/PARTICIPANT COUNTRY OFRESIDENCE; see Appendix Q, “<strong>ACCT</strong> Codes and Values”596-599 X(04) AN IDENTITY VERIFICATION METHOD; values include:“ ”= <strong>Information</strong> not Provided to Pershing“CDCR” = Compliance Data Center Inc. Report“RDCR” = Regulatory Data Corporation Report“INVR” = Internal Review“OTHR” = Other Identification VendorID VERIFICATION COMMENTS CAN BE FOUND IN RECORD X, position 519-568600-600 X(01) AN TAX ID TYPE; acceptable values include:“A” = Applied for“N” = Not applicable“S” = Social Security Number“T” = Taxpayer Identification Number601-6<strong>09</strong> X(<strong>09</strong>) AN TAX ID NUMBER610-610 X(01) AN TAX EXEMPTION INDICATOR; acceptable values include:“Y” = Yes“N” = No6<strong>11</strong>-6<strong>11</strong> X(01) AN W9 ON FILE; acceptable values include:“Y” = Yes“N” = No612-615 X(04) AN CUSTOMER BANK CODE; for third-party custodian; IBDdriven<strong>ACCT</strong>/<strong>ACCF</strong>Page 35 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSPOSITION PICTURE TYPE DESCRIPTION616-647 X(32) AN CORPORATE/BUSINESS ID; for non-natural person only648-649 X(02) AN COUNTRY OF THE FORMATION ORGANIZATION; fornon-natural person only; see Appendix Q, “<strong>ACCT</strong> Codes andValues”650-651 X(02) AN STATE OF INCORPORATION/ORGANIZATION; for nonnaturalperson only; see Appendix Q, “<strong>ACCT</strong> Codes andValues”EMPLOYMENT INFORMATION (NEXT FOUR FIELDS COPIED TO RECORD X FOR EASE OF USE)652-652 X(01) AN EMPLOYEE OF THIS IBD; acceptable values include:“Y” = Yes; the holder/participant is an employee of this IBD“N” = No; the holder/participant is not an employee of thisIBD“U” = Unknown653-653 X(01) AN RELATED TO EMPLOYEE OF THIS IBD; acceptable valuesinclude:“Y” = Yes; the holder/participant is related to anemployee of this IBD“N” = No; the holder/participant is not related to anemployee of this IBD“U” = Unknown654-654 X(01) AN EMPLOYEE OF ANOTHER IBD; acceptable values include:“ ” = Not applicable“Y” = Yes; the holder/participant is an employee of anotherIBD“N” = No; the holder/participant is not an employeeanother of IBD“U” = Unknown655-655 X(01) AN RELATED TO EMPLOYEE OF ANOTHER IBD; acceptablevalues include:“ ” = Not applicable“Y” = Yes; the holder/participant is related to an employee ofanother IBD“N” = No; the holder/participant is not related to an employeeof another IBD“U” = Unknown656-659 X(04) AN EMPLOYMENT STATUS CODE; acceptable values include:“ ” = Not applicable“EMPL” = Employed“SEMP” = Self-Employed“RETD” = Retired“UEMP” = Unemployed“HOME” = Homemaker“STDT” = Student<strong>ACCT</strong>/<strong>ACCF</strong>Page 36 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSPOSITION PICTURE TYPE DESCRIPTION660-674 X(15) AN OCCUPATION; free-form field; can be blank675-678 X(04) AN TAX BRACKET; acceptable values include:“ ” = Not applicable“LWTB” = 0-15%“MDTB” = 15.1-32%“HITB” = 32.1-50%“TPTB” = 50.1%+679-680 9(02) N YEARS EMPLOYED681-715 X(35) AN TYPE OF BUSINESS716-747 X(32) AN EMPLOYER NAME748-748 X(01) AN Not Used749-749 X(01) AN MARITAL STATUS; acceptable values include:“M” = Married“S” = Unmarried“N” = Not applicable (i.e., the <strong>Account</strong> Holder is a CorporateEntity) or Not Available (Marital Status is notAvailable on Interested Party) (<strong>Account</strong> Holder Type,Pos. 45 = “IPP” data)“U” = Unknown/Undetermined750-750 X(01) AN Literally “X”; indicates the end of record G<strong>ACCT</strong>/<strong>ACCF</strong>Page 37 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSDETAIL RECORD H – ACCOUNT HOLDER/PARTICIPANT INFORMATIONPOSITION PICTURE TYPE DESCRIPTION001-002 X(02) AN TRANSACTION CODE = “CI”003-003 X(01) AN RECORD INDICATOR VALUE = “H”004-0<strong>11</strong> 9(08) N RECORD ID SEQUENCE NUMBER; begins with“00000001”012-020 X(<strong>09</strong>) AN ACCOUNT NUMBER INCLUDING OFFICE(3); BASEACCOUNT(5); CHECK DIGIT (1)021-023 X(03) AN INTRODUCING BROKER DEALER NUMBER024-024 X(01) AN Not Used025-027 X(03) AN INVESTMENT PROFESSIONAL NUMBER028-028 X(01) AN Not Used029-038 X(10) AN ACCOUNT SHORT NAME039-040 X(02) AN Not Used041-041 X(01) AN ACCOUNT HOLDER/ PARTICIPANT TRANSACTIONCODE; values include:“X” or “ ” = Unchanged record“A” = Add <strong>Account</strong> Holder/Participant“C” = Change existing <strong>Account</strong> Holder/ParticipantACCOUNT HOLDER/PARTICIPANT SECONDARY IDENTIFIERS042-044 X(03) AN SEQUENCE NUMBER; valid values are 001 through 015045-047 X(03) AN ACCOUNT HOLDER TYPE; values include:“AH ” = <strong>Account</strong> Holder“B&R” = Books and Records participant“IPP” = Interested Party participantBOOKS AND RECORDS DETAILS048-048 X(01) AN JOINT ACCOUNT INCOME/NET WORTH INDICATOR;values include:“Y” = Combined and reported on account level; displayed onfirst <strong>Account</strong> Holder/Participant only“N” = Reported on individual <strong>Account</strong> Holder/Participant level049-066 9(16)v9(02) N MINIMUM ANNUAL INCOME AMOUNT067-084 9(16)v9(02) N MAXIMUM ANNUAL INCOME AMOUNT085-102 9(16)v9(02) N MINIMUM NET WORTH AMOUNT103-120 9(16)v9(02) N MAXIMUM NET WORTH AMOUNTTELEPHONE NUMBER (UP TO 7 TIMES)Note: Telephone numbers will appear in alphabetical order based on TELEPHONE TYPE IDTELEPHONE NUMBER <strong>11</strong>21-121 X(01) AN TELEPHONE 1 TRANSACTION CODE; values include:“X” or “ ” = Unchanged record“A” = Add telephone number“C” = Change existing telephone number<strong>ACCT</strong>/<strong>ACCF</strong>Page 38 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSPOSITION PICTURE TYPE DESCRIPTION122-122 X(01) AN US/INTERNATIONAL INDICATOR (1); values include:“U” = US/Canada“F” = International123-123 X(01) AN TELEPHONE TYPE ID (1); values include:“B” = Business“C” = Cellular“E” = Beeper“F” = Fax“H” = Home“S” = Seasonal“T” = Telex“V” = Voice Mail124-171 X(48) AN TELEPHONE NUMBER (1)172-178 X(07) AN TELEPHONE EXTENSION (1)TELEPHONE NUMBER 2179-179 X(01) AN TELEPHONE 2 TRANSACTION CODE; values include:“X” or “ ” = Unchanged record“A” = Add telephone number“C” = Change existing telephone number180-180 X(01) AN US/INTERNATIONAL INDICATOR (2); values include:“U” = US/Canada“F” = International181-181 X(01) AN TELEPHONE TYPE ID (2); see TELEPHONE TYPE ID (1),position 123, for values182-229 X(48) AN TELEPHONE NUMBER (2)230-236 X(07) AN TELEPHONE EXTENSION (2)TELEPHONE NUMBER 3237-237 X(01) AN TELEPHONE 3 TRANSACTION CODE; values include:“X” or “ ” = Unchanged record“A” = Add telephone number“C” = Change existing telephone number238-238 X(01) AN US/INTERNATIONAL INDICATOR (3); values include:“U” = US/Canada“F” = International239-239 X(01) AN TELEPHONE TYPE ID (3); see TELEPHONE TYPE ID (1),position 123, for values240-287 X(48) AN TELEPHONE NUMBER (3)288-294 X(07) AN TELEPHONE EXTENSION (3)TELEPHONE NUMBER 4295-295 X(01) AN TELEPHONE 4 TRANSACTION CODE; values include:“X” or “ ” = Unchanged record“A” = Add telephone number(cont.)<strong>ACCT</strong>/<strong>ACCF</strong>Page 39 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSPOSITION PICTURE TYPE DESCRIPTION“C” = Change existing telephone number296-296 X(01) AN US/INTERNATIONAL INDICATOR (4); values include:“U” = US/Canada“F” = International297-297 X(01) AN TELEPHONE TYPE ID (4); see TELEPHONE TYPE ID (1),position 123, for values298-345 X(48) AN TELEPHONE NUMBER (4)346-352 X(07) AN TELEPHONE EXTENSION (4)TELEPHONE NUMBER 5353-353 X(01) AN TELEPHONE 5 TRANSACTION CODE; values include:“X” or “ ” = Unchanged record“A” = Add telephone number“C” = Change existing telephone number354-354 X(01) AN US/INTERNATIONAL INDICATOR (5); values include:“U” = US/Canada“F” = International355-355 X(01) AN TELEPHONE TYPE ID (5); see TELEPHONE TYPE ID (1),position 123, for values356-403 X(48) AN TELEPHONE NUMBER (5)404-410 X(07) AN TELEPHONE EXTENSION (5)TELEPHONE NUMBER 64<strong>11</strong>-4<strong>11</strong> X(01) AN TELEPHONE 6 TRANSACTION CODE; values include:“X” or “ ” = Unchanged record“A” = Add telephone number“C” = Change existing telephone number412-412 X(01) AN US/INTERNATIONAL INDICATOR (6); values include:“U” = US/Canada“F” = International413-413 X(01) AN TELEPHONE TYPE ID (6); see TELEPHONE TYPE ID (1),position 123, for values414-461 X(48) AN TELEPHONE NUMBER (6)462-468 X(07) AN TELEPHONE EXTENSION (6)TELEPHONE NUMBER 7469-469 X(01) AN TELEPHONE 7 TRANSACTION CODE; values include:“X” or “ ” = Unchanged record“A” = Add telephone number“C” = Change existing telephone number470-470 X(01) AN US/INTERNATIONAL INDICATOR (7); values include:“U” = US/Canada“F” = International471-471 X(01) AN TELEPHONE TYPE ID (7); see TELEPHONE TYPE ID (1),position 123, for values<strong>ACCT</strong>/<strong>ACCF</strong>Page 40 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSPOSITION PICTURE TYPE DESCRIPTION472-519 X(48) AN TELEPHONE NUMBER (7)520-526 X(07) AN TELEPHONE EXTENSION (7)527-527 X(01) AN CONSOLIDATED LIQUID NET WORTH INDICATOR;values include:“Y” = Combined and report on <strong>Account</strong> level; displayed onfirst <strong>Account</strong> Holder/Participant only“N” = Reported on Individual <strong>Account</strong> Holder/Participant level528-545 9(16)v9(02) N MINIMUM LIQUID NET WORTH AMOUNT546-563 9(16)v9(02) N MAXIMUM LIQUID NET WORTH AMOUNT564-568 X(05) AN Not Used569-572 X(04) AN ACCOUNT HOLDER/PARTICIPANT ROLE CODE; for<strong>Account</strong> Holder Roles and Participant Roles, see Appendix Q,“<strong>ACCT</strong> Codes and Values”573-584 X(12) AN Not UsedE-MAIL INFORMATION585-634 X(50) AN E-MAIL ADDRESSADDITIONAL PATRIOT ACT INFORMATION635-638 X(04) AN TYPE OF UNEXPIRED PHOTO GOVERNMENT ID (1);acceptable values include:“ ” = <strong>Information</strong> not provided to Pershing“DRVR” = Driver’s License“PASS” = Passport“ALEN” = Alien Registration Number“STID” = State Identification Card“NATL” = National Identification Card“MLTY” = Military Card“GREN” = Green Card“VISA” = VISA ® Number“CDLA” = Cedula Card“INSI” = INS Card“OGVT” = Other Government Identification“CORP” = Corporate Identification639-670 X(32) AN UNEXPIRED PHOTO GOVERNMENT ID NUMBER (1)671-672 X(02) AN COUNTRY OF UNEXPIRED PHOTO GOVERNMENT ID(1); see Appendix Q, “<strong>ACCT</strong> Codes and Values”673-674 X(02) AN STATE/PROVINCE OF UNEXPIRED PHOTOGOVERNMENT ID (1); see Appendix Q, “<strong>ACCT</strong> Codes andValues”675-682 9(08) N EXPIRATION DATE OF UNEXPIRED GOVERNMENTPHOTO ID (1) = “CCYYMMDD”683-690 9(08) N ISSUANCE DATE OF UNEXPIRED GOVERNMENTPHOTO ID/CORPORATE BUSINESS ID (1) =“CCYYMMDD”<strong>ACCT</strong>/<strong>ACCF</strong>Page 41 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSPOSITION PICTURE TYPE DESCRIPTION691-694 X(04) AN TYPE OF UNEXPIRED PHOTO GOVERNMENT ID (2 seeTYPE OF UNEXPIRED PHOTO GOVERNMENT ID (1),position 635-638, for values695-726 X(32) AN UNEXPIRED PHOTO GOVERNMENT ID NUMBER (2)727-728 X(02) AN COUNTRY OF UNEXPIRED PHOTO GOVERNMENT ID(2); see Appendix Q, “<strong>ACCT</strong> Codes and Values”729-730 X(02) AN STATE/PRIMARY SUBDIVISION OF UNEXPIREDPHOTO GOVERNMENT ID (2); see Appendix Q, “<strong>ACCT</strong>Codes and Values”731-738 9(08) N EXPIRATION DATE OF UNEXPIRED GOVERNMENTPHOTO ID (2) = “CCYYMMDD”739-746 9(08) N ISSUANCE DATE OF UNEXPIRED GOVERNMENTPHOTO ID (2) = “CCYYMMDD”747-749 X(03) AN Not Used750-750 X(01) AN Literally “X”; indicates the end of record H<strong>ACCT</strong>/<strong>ACCF</strong>Page 42 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSDETAIL RECORD X – ADDITIONAL ACCOUNT HOLDER/PARTICIPANT-LEVELINFORMATIONPOSITION PICTURE TYPE DESCRIPTION001-002 X(02) AN TRANSACTION CODE = “CI”003-003 X(01) AN RECORD INDICATOR VALUE = “X”004-0<strong>11</strong> 9(08) N RECORD ID SEQUENCE NUMBER; begins with“00000001”012-020 X(<strong>09</strong>) AN ACCOUNT NUMBER INCLUDING OFFICE(3); BASEACCOUNT(5); CHECK DIGIT (1)021-023 X(03) AN INTRODUCING BROKER DEALER NUMBER024-024 X(01) AN Not Used025-027 X(03) AN INVESTMENT PROFESSIONAL NUMBER028-028 X(01) AN Not Used029-038 X(10) AN ACCOUNT SHORT NAME039-040 X(02) AN Not UsedNEW ACCOUNT HOLDER INFORMATION041-041 X(01) AN RECORD TRANSACTION CODE; acceptable values include:“X” or “ ”= Unchanged record“A” = Add <strong>Account</strong> Holder/Participant“C” = Change existing <strong>Account</strong> Holder/ParticipantACCOUNT HOLDER/PARTICIPANT SECONDARY IDENTIFIERS042-044 X(03) AN SEQUENCE NUMBER; valid values are 001 through 015045-047 X(03) AN ACCOUNT HOLDER TYPE; acceptable values include:“AH ” = <strong>Account</strong> Holder“B&R” = Books and Records participant“IPP” = Interested Party participantEMPLOYER ADDRESS AREA048-049 X(02) AN Not Used050-053 X(04) AN ATTENTION LINE PREFIX; acceptable values include:“ATTN” = Attention of“C/O” = Care of“ ” = May be blank in user-titled accounts054-081 X(28) AN ATTENTION LINE DETAIL082-<strong>11</strong>3 X(32) AN ADDRESS LINE <strong>11</strong>14-145 X(32) AN ADDRESS LINE 2146-177 X(32) AN ADDRESS LINE 3; only if ATTENTION LINE is spaces178-2<strong>09</strong> X(32) AN ADDRESS LINE 4; only if country is not US or Canada210-224 X(15) AN CITY; for US/Canada addresses only225-226 X(02) AN STATE; for US/Canada addresses only; see Appendix Q,“<strong>ACCT</strong> Codes and Values”227-241 X(15) AN ZIP/POSTAL CODE; for US/Canada addresses only<strong>ACCT</strong>/<strong>ACCF</strong>Page 43 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSPOSITION PICTURE TYPE DESCRIPTION242-243 X(02) AN COUNTRY CODE; see Appendix Q, “<strong>ACCT</strong> Codes andValues”244-245 X(02) AN Not UsedEMPLOYMENT and AFFILIATION INFORMATIONCOPIED FROM RECORD G, position 652-652 – EMPLOYEE/THIS IBD246-246 X(01) AN EMPLOYEE OF THIS IBD; acceptable values include:“Y” = the holder/participant is an employee of this IBD“N” = the holder/participant is not an employee of this IBD“U” = UnknownCOPIED FROM RECORD G, position 653-653 – RELATED TO EMPLOYEE/THIS IBD247-247 X(01) AN RELATED TO EMPLOYEE OF THIS IBD; acceptable valuesinclude:“Y” = the holder/participant is related to an employee ofthis IBD“N” = the holder/participant is not related to an employeeof this IBD“U” = Unknown248-272 X(25) AN EMPLOYEE FIRST NAME273-297 X(25) AN EMPLOYEE LAST NAME298-301 X(04) AN EMPLOYEE SUFFIX302-305 X(04) AN RELATIONSHIP TO EMPLOYEE; acceptable values include:“A ” = Aunt“B ” = Brother“D ” = Daughter“DP” = Domestic partner“F ” = Father“FL“GF“GM“GD“GS” = Father-in-law” = Grandfather” = Grandmother” = Granddaughter” = Grandson“M ” = Mother“ML“NE“NI“OI“SI“SO“SP” = Mother-in-law” = Nephew” = Niece” = Other Individual” = Sister” = Son” = Spouse“U ” = UncleCOPIED FROM RECORD G, position 654-654 – EMPLOYEE/ANOTHER IBD<strong>ACCT</strong>/<strong>ACCF</strong>Page 44 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSPOSITION PICTURE TYPE DESCRIPTION306-306 X(01) AN EMPLOYEE OF ANOTHER IBD; acceptable values include:307-326 X(20) AN IBD NAME“ ” = Not applicable“Y” = the holder/participant is an employee of another IBD“N” = the holder/participant is not an employee of another IBD“U” = UnknownCOPIED FROM RECORD G, position 655-655 – RELATED TO EMPLOYEE/ANOTHER IBD327-327 X(01) AN RELATED TO EMPLOYEE OF ANOTHER IBD; acceptablevalues include:328-347 X(20) AN IBD NAME348-372 X(25) AN EMPLOYEE FIRST NAME373-397 X(25) AN EMPLOYEE LAST NAME398-401 X(04) AN EMPLOYEE SUFFIX“ ” = Not applicable“Y” = the holder/participant is related to an employee ofanother IBD“N” = the holder/participant is not related to an employeeof another IBD“U” = Unknown402-405 X(04) AN RELATIONSHIP TO EMPLOYEE OF ANOTHER IBD; seeRELATIONSHIP TO EMPLOYEE, position 302-305, forvalues406-406 X(01) AN OTHER BROKERAGE ACCOUNTS; values include:“ ” = Not applicable or available“Y” = the holder/participant maintains other brokerageaccounts“N” = the holder/participant does not maintain otherbrokerage accounts407-426 X(20) AN NAME OF IBD WHERE ACCOUNT HELD427-427 X(01) AN HOLDER/PARTICIPANT or IMMEDIATE FAMILYMEMBER AFFILIATED WITH or EMPLOYED BYMEMBER OF STOCK EXCHANGE or NASD; acceptablevalues include:“ ” = Not applicable or available“Y” = is affiliated or employed“N” = is not affiliated or employed428-472 X(45) AN AFFILIATION473-473 X(01) AN HOLDER/PARTICIPANT A SENIOR OFFICER,DIRECTOR, or 10%+ SHAREHOLDER OF A PUBLICCOMPANY; acceptable values include:“ ” = Not applicable or available“Y” = the holder/participant is a senior officer, (cont.)director, or 10%+ shareholder of a public company<strong>ACCT</strong>/<strong>ACCF</strong>Page 45 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>

PERSHING STANDARD FILE LAYOUTSPOSITION PICTURE TYPE DESCRIPTION“N” = the holder/participant is not a senior officer,director, or 10%+ shareholder of a public company474-518 X(45) AN NAME OF PUBLIC COMPANYACCOUNT HOLDER/PARTICIPANT- LEVEL PATRIOT ACT ID VERIFICATION COMMENTS519-568 X(50) AN ID VERIFICATION COMMENTS (FREEFORM)569-572 X(04) AN ACCOUNT HOLDER/PARTICIPANT ROLE CODE; for<strong>Account</strong> Holder Roles and Participant Roles , see Appendix Q,“<strong>ACCT</strong> Codes and Values”573-590 9(<strong>09</strong>)v9(<strong>09</strong>) N BENEFICIARY PERCENT ALLOCATION (applicable onlyto beneficiaries on TODI and TODJ accounts); effective01/2010591-749 X(159) AN Not Used750-750 X(01) AN Literally “X”; indicates the end of record “X”<strong>ACCT</strong>/<strong>ACCF</strong>Page 46 <strong>Customer</strong> <strong>Account</strong> <strong>Information</strong> 10-<strong>09</strong>