Empower for the Month of February 2013 - Birla Sun Life Mutual Fund

Empower for the Month of February 2013 - Birla Sun Life Mutual Fund

Empower for the Month of February 2013 - Birla Sun Life Mutual Fund

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

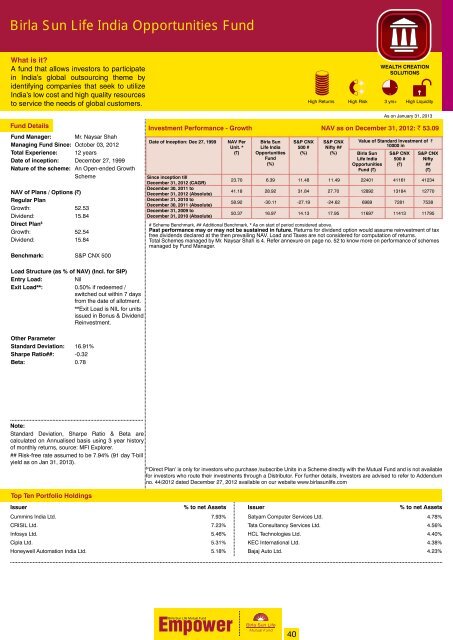

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> India Opportunities <strong>Fund</strong><br />

What is it?<br />

A fund that allows investors to participate<br />

in India’s global outsourcing <strong>the</strong>me by<br />

identifying companies that seek to utilize<br />

India’s low cost and high quality resources<br />

to service <strong>the</strong> needs <strong>of</strong> global customers.<br />

WEALTH CREATION<br />

SOLUTIONS<br />

High Returns High Risk 3 yrs+ High Liquidity<br />

<strong>Fund</strong> Details<br />

<strong>Fund</strong> Manager: Mr. Naysar Shah<br />

Managing <strong>Fund</strong> Since: October 03, 2012<br />

Total Experience: 12 years<br />

Date <strong>of</strong> inception: December 27, 1999<br />

Nature <strong>of</strong> <strong>the</strong> scheme: An Open-ended Growth<br />

Scheme<br />

NAV <strong>of</strong> Plans / Options (`)<br />

Regular Plan<br />

Growth:<br />

52.53<br />

Dividend:<br />

15.84<br />

Direct Plan $<br />

Growth:<br />

52.54<br />

Dividend:<br />

15.84<br />

Benchmark:<br />

S&P CNX 500<br />

Date <strong>of</strong> Inception: Dec 27, 1999<br />

Since inception till<br />

December 31, 2012 (CAGR)<br />

December 30, 2011 to<br />

December 31, 2012 (Absolute)<br />

December 31, 2010 to<br />

December 30, 2011 (Absolute)<br />

December 31, 2009 to<br />

December 31, 2010 (Absolute)<br />

NAV Per<br />

Unit. *<br />

(`)<br />

<strong>Birla</strong> <strong>Sun</strong><br />

<strong>Life</strong> India<br />

Opportunities<br />

<strong>Fund</strong><br />

(%)<br />

S&P CNX<br />

500 #<br />

(%)<br />

S&P CNX<br />

Nifty ##<br />

(%)<br />

As on January 31, <strong>2013</strong><br />

Investment Per<strong>for</strong>mance - Growth NAV as on December 31, 2012: ` 53.09<br />

Value <strong>of</strong> Standard Investment <strong>of</strong> `<br />

10000 in<br />

<strong>Birla</strong> <strong>Sun</strong><br />

<strong>Life</strong> India<br />

Opportunities<br />

<strong>Fund</strong> (`)<br />

S&P CNX<br />

500 #<br />

(`)<br />

S&P CNX<br />

Nifty<br />

##<br />

(`)<br />

23.70 6.39 11.48 11.49 22401 41161 41234<br />

41.18 28.92 31.84 27.70 12892 13184 12770<br />

58.92 -30.11 -27.19 -24.62 6989 7281 7538<br />

50.37 16.97 14.13 17.95 11697 11413 11795<br />

# Scheme Benchmark, ## Additional Benchmark, * As on start <strong>of</strong> period considered above.<br />

Past per<strong>for</strong>mance may or may not be sustained in future. Returns <strong>for</strong> dividend option would assume reinvestment <strong>of</strong> tax<br />

free dividends declared at <strong>the</strong> <strong>the</strong>n prevailing NAV. Load and Taxes are not considered <strong>for</strong> computation <strong>of</strong> returns.<br />

Total Schemes managed by Mr. Naysar Shah is 4. Refer annexure on page no. 52 to know more on per<strong>for</strong>mance <strong>of</strong> schemes<br />

managed by <strong>Fund</strong> Manager.<br />

Load Structure (as % <strong>of</strong> NAV) (Incl. <strong>for</strong> SIP)<br />

Entry Load:<br />

Nil<br />

Exit Load**: 0.50% if redeemed /<br />

switched out within 7 days<br />

from <strong>the</strong> date <strong>of</strong> allotment.<br />

**Exit Load is NIL <strong>for</strong> units<br />

issued in Bonus & Dividend<br />

Reinvestment.<br />

O<strong>the</strong>r Parameter<br />

Standard Deviation: 16.91%<br />

Sharpe Ratio##: -0.32<br />

Beta: 0.78<br />

Note:<br />

Standard Deviation, Sharpe Ratio & Beta are<br />

calculated on Annualised basis using 3 year history<br />

<strong>of</strong> monthly returns, source: MFI Explorer.<br />

## Risk-free rate assumed to be 7.94% (91 day T-bill<br />

yield as on Jan 31, <strong>2013</strong>).<br />

$<br />

‘Direct Plan’ is only <strong>for</strong> investors who purchase /subscribe Units in a Scheme directly with <strong>the</strong> <strong>Mutual</strong> <strong>Fund</strong> and is not available<br />

<strong>for</strong> investors who route <strong>the</strong>ir investments through a Distributor. For fur<strong>the</strong>r details, Investors are advised to refer to Addendum<br />

no. 44/2012 dated December 27, 2012 available on our website www.birlasunlife.com<br />

Top Ten Portfolio Holdings<br />

Issuer % to net Assets Issuer % to net Assets<br />

Cummins India Ltd. 7.93% Satyam Computer Services Ltd. 4.78%<br />

CRISIL Ltd. 7.23% Tata Consultancy Services Ltd. 4.56%<br />

Infosys Ltd. 5.46% HCL Technologies Ltd. 4.40%<br />

Cipla Ltd. 5.31% KEC International Ltd. 4.38%<br />

Honeywell Automation India Ltd. 5.18% Bajaj Auto Ltd. 4.23%<br />

40