Empower for the Month of February 2013 - Birla Sun Life Mutual Fund

Empower for the Month of February 2013 - Birla Sun Life Mutual Fund

Empower for the Month of February 2013 - Birla Sun Life Mutual Fund

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Index<br />

All About <strong>Mutual</strong> <strong>Fund</strong>s 01<br />

Investment Outlook 02<br />

Savings Solutions 04<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Cash Plus 05<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Cash Manager 06<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Savings <strong>Fund</strong> 07<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Ultra Short Term <strong>Fund</strong> 08<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Dynamic Bond <strong>Fund</strong> 09<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Medium Term Plan 10<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Income Plus 11<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Short Term <strong>Fund</strong> 12<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Floating Rate <strong>Fund</strong> - Long Term Plan 13<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Floating Rate <strong>Fund</strong> - Short Term Plan 14<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Gilt Plus 15<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Government Securities <strong>Fund</strong> 16<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Short Term Opportunities <strong>Fund</strong> 17<br />

Regular Income Solutions 18<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> <strong>Month</strong>ly Income 19<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> MIP 20<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> MIP II - Wealth 25 Plan 21<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> MIP II - Savings 5 Plan 22<br />

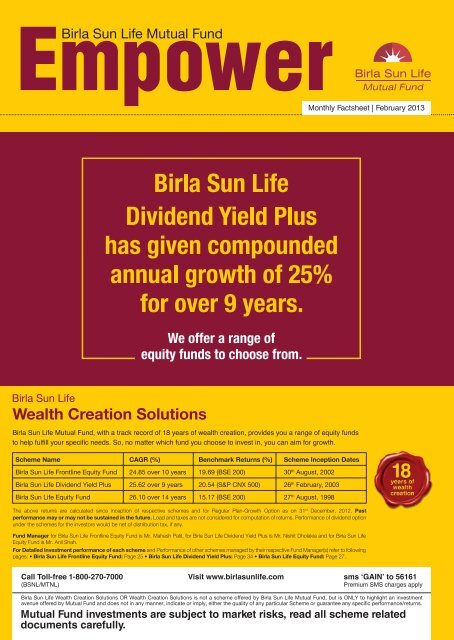

Wealth Creation Solutions 23<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> ‘95 <strong>Fund</strong> 24<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Frontline Equity <strong>Fund</strong> 25<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Top 100 <strong>Fund</strong> 26<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Equity <strong>Fund</strong> 27<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Advantage <strong>Fund</strong> 28<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Pure Value <strong>Fund</strong> 30<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Midcap <strong>Fund</strong> 31<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Small & Midcap <strong>Fund</strong> 32<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> MNC <strong>Fund</strong> 33<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Dividend Yield Plus 34<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Infrastructure <strong>Fund</strong> 35<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> India Re<strong>for</strong>ms <strong>Fund</strong> 36<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> India GenNext <strong>Fund</strong> 37<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Buy India <strong>Fund</strong> 38<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Special Situations <strong>Fund</strong> 39<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> India Opportunities <strong>Fund</strong> 40<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> New Millennium <strong>Fund</strong> 41<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Asset Allocation <strong>Fund</strong> 42<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Enhanced Arbitrage <strong>Fund</strong> 43<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Commodity Equities <strong>Fund</strong> 44<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> International Equity <strong>Fund</strong> - Plan A 45<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> International Equity <strong>Fund</strong> - Plan B 46<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Index <strong>Fund</strong> 47<br />

Tax Savings Solutions 48<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Tax Relief ‘96 49<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Tax Plan 50<br />

Close Ended Scheme Per<strong>for</strong>mance 51<br />

<strong>Fund</strong> Manager Wise Scheme Per<strong>for</strong>mance 52<br />

<strong>Fund</strong>s at A Glance 53<br />

Investment Objective 57<br />

Dividend History 59<br />

Industry Allocation 61<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Long Term Advantage <strong>Fund</strong> 29

All About <strong>Mutual</strong> <strong>Fund</strong>s<br />

Rising expenses, children’s education,<br />

unexpected emergencies and finally retirement<br />

– <strong>the</strong> demands on people’s money seem to<br />

be ever-rising. And savings alone may not<br />

prove to be enough to meet <strong>the</strong>m all. Making<br />

judicious investments though can make <strong>the</strong>ir<br />

money work harder. However, most people are<br />

reluctant to invest as <strong>the</strong>y find it very puzzling.<br />

More so, <strong>the</strong>y don’t have <strong>the</strong> time to monitor<br />

<strong>the</strong> stock markets.<br />

What is <strong>the</strong> way <strong>the</strong>n to help you achieve<br />

your financial needs and goals? The<br />

answer can be mutual funds. Here are<br />

a few things about mutual funds that<br />

you must know in order to benefit from<br />

<strong>the</strong>m:<br />

What are mutual funds?<br />

A mutual fund is a pr<strong>of</strong>essionally managed collective<br />

investment scheme that pools money from many investors.<br />

This money is <strong>the</strong>n invested in stocks, bonds, short-term<br />

money market instruments, and/or o<strong>the</strong>r securities.<br />

Types <strong>of</strong> mutual funds<br />

<strong>Mutual</strong> funds can broadly be classified as open ended<br />

or close ended. While open ended funds are available <strong>for</strong><br />

subscription and repurchase on a continuous basis and<br />

do not have a fixed maturity period, close ended funds are<br />

open <strong>for</strong> subscription only during a specified period at <strong>the</strong><br />

time <strong>of</strong> launch <strong>of</strong> <strong>the</strong> scheme and have a stipulated maturity<br />

period. The funds can fur<strong>the</strong>r be classified according to <strong>the</strong><br />

investment objective as:<br />

• Growth or equity funds: The aim <strong>of</strong> growth funds is to<br />

provide capital appreciation over medium to long term.<br />

Such schemes normally invest a major part <strong>of</strong> <strong>the</strong>ir<br />

corpus in equities and have comparatively high risks.<br />

• Debt funds: The objective <strong>of</strong> debt funds is to generate<br />

steady returns while aiming to preserve your capital.<br />

They invest only in fixed income instruments like<br />

company bonds, debentures, government securities etc.<br />

• Balanced funds: These funds invest in both equity and<br />

debt in varying proportions. So, <strong>the</strong>ir average returns and<br />

risk pr<strong>of</strong>ile also fall some where in between growth and<br />

debt funds.<br />

How do mutual funds score over equities?<br />

Unlike equity Investments, mutual fund investments do not<br />

require you to analyze and track companies and <strong>the</strong> ways<br />

<strong>of</strong> <strong>the</strong> market. Also <strong>the</strong>y can help <strong>the</strong>m stay less affected by<br />

<strong>the</strong> fall in <strong>the</strong> prices <strong>of</strong> one particular stock as <strong>the</strong>ir returns<br />

are derived by overall per<strong>for</strong>mance <strong>of</strong> various stocks that <strong>the</strong><br />

<strong>Mutual</strong> <strong>Fund</strong> invests in.<br />

What’s <strong>the</strong> right time to buy and sell mutual funds?<br />

The right time to buy mutual funds is when <strong>the</strong> prices <strong>of</strong> <strong>the</strong><br />

funds are low or falling. However, <strong>the</strong> holding period should be<br />

determined by <strong>the</strong> market conditions ideally. For eg. in growth<br />

funds a greater holding period can <strong>of</strong>fer greater chance to<br />

benefit.<br />

What are SIPs?<br />

A systematic investment plan allows you to invest in a fund<br />

at regular intervals ra<strong>the</strong>r than a lump sum one time amount.<br />

SIPs are based on <strong>the</strong> principle <strong>of</strong> rupee cost averaging<br />

which can help make a fall in scheme’s NAV work to <strong>the</strong><br />

investor’s advantage. When <strong>the</strong> NAV falls because <strong>of</strong> a fall<br />

in <strong>the</strong> market, SIP can help accumulate more units at lower<br />

rates while restraining <strong>the</strong>m from going overboard in a rising<br />

market by giving fewer units at those higher levels. Fur<strong>the</strong>r,<br />

by staying invested <strong>for</strong> a long period <strong>of</strong> time, <strong>the</strong>y may also<br />

pr<strong>of</strong>it from <strong>the</strong> appreciation in equities tend to show over <strong>the</strong><br />

long term.<br />

How do I select <strong>the</strong> right mutual funds?<br />

While choosing a mutual fund, it’s important to keep your<br />

objectives, risk appetite and investment budget in mind. You<br />

should also keep in mind <strong>the</strong> per<strong>for</strong>mance <strong>of</strong> <strong>the</strong> fund over<br />

<strong>the</strong> last couple <strong>of</strong> years and check <strong>the</strong> exit load charged by a<br />

particular scheme which is charged as a percentage <strong>of</strong> NAV<br />

and has <strong>the</strong> effect <strong>of</strong> reducing returns by that amount.<br />

By keeping <strong>the</strong>se simple things in mind,<br />

you can make mutual fund investments<br />

that can work to your advantage and<br />

help in realizing your financial goals.<br />

01

Investment Outlook<br />

Equity Investment Outlook<br />

The benchmark indices, Sensex and Nifty rose 2.4% and 2.20% respectively over <strong>the</strong> last<br />

month. This was aided by gains in sectors such as IT, Oil & Gas, Realty and Banking. On<br />

<strong>the</strong> o<strong>the</strong>r hand, Metals, Auto, Pharma, Capital Goods and Infrastructure bore <strong>the</strong> brunt <strong>of</strong><br />

investor selling. Broader market indices were little subdued with BSE500 gaining by 1.1%<br />

only. This was mainly on account <strong>of</strong> poor show by mid caps which fell by 1.7% (CNX Mid<br />

cap Index).<br />

FIIs started <strong>the</strong> year with stepped up pace <strong>of</strong> buying in Jan with net purchases to <strong>the</strong> tune<br />

<strong>of</strong> $4.1bn. Note that we had finished CY12 with $25bn <strong>of</strong> FII inflows into equities. Domestic<br />

Institutional Investors (DIIs) once again remained firmly positioned on <strong>the</strong> o<strong>the</strong>r side <strong>of</strong> <strong>the</strong><br />

trade, notching up ano<strong>the</strong>r $3.2bn in net selling. Among <strong>the</strong> DIIs, Insurance companies<br />

were by far <strong>the</strong> bigger sellers ($2.3bn) with <strong>the</strong> <strong>Mutual</strong> <strong>Fund</strong>s adding ano<strong>the</strong>r $870mn.<br />

Key point to note is <strong>the</strong> continuation <strong>of</strong> re<strong>for</strong>ms with announcements on fuel subsidy<br />

reduction by tackling contentious issue <strong>of</strong> diesel price deregulation – allowing Oil Marketing<br />

Companies (OMCs) to raise diesel prices in small steps every month. Controversial<br />

tax proposals under GAAR were also deferred by 2 years and will be implemented on<br />

prospective basis, increasing railway passenger fares etc. The FM has been on a roadshow<br />

meeting <strong>for</strong>eign investors across geographies and sending a categorical message that<br />

fiscal prudence would be maintained. To this end, we expect <strong>the</strong> divestment activity to<br />

continue following stake sale in Oil India. We expect policy action would continue in <strong>for</strong>m <strong>of</strong><br />

project clearances coming through (Cabinet Committee on Investments to play key role in<br />

this), establishment <strong>of</strong> coal price pooling mechanism to enable supply <strong>of</strong> imported imports<br />

to stranded power plants, implementation <strong>of</strong> State Electricity Board (SEB) re<strong>for</strong>ms etc.<br />

As <strong>the</strong> earnings reporting season is progressing, we are witnessing more positive surprises<br />

than negative ones, leading to net positive revision in earnings. This is in line with our view<br />

that earnings growth is likely to see an upward trajectory going <strong>for</strong>ward. Fur<strong>the</strong>r, RBI’s<br />

decision to reduce Repo rate and CRR by 25 bps each should also help lower interest rates<br />

<strong>for</strong> borrowers and eventually provide some relief on corporates’ bottom lines.<br />

Ano<strong>the</strong>r important point is that equity deals have started picking up as we saw deals<br />

totaling $1.1bn during <strong>the</strong> month. This includes fresh equity raising as well as stake sales.<br />

As per media reports <strong>the</strong>re is a strong deals pipeline <strong>for</strong> <strong>the</strong> next 2 months. We think this<br />

would help repair some <strong>of</strong> <strong>the</strong> broken balance sheets and provide capital <strong>for</strong> growth to <strong>the</strong><br />

corporate sector.<br />

We maintain our positive stance in equity markets <strong>for</strong> <strong>the</strong> year and beyond. The returns<br />

would be governed by earnings growth revival. The trajectory is unlikely to be linear as<br />

market sentiments may oscillate with policy actions or events. As we have seen any such<br />

volatility presents opportunity to pick up stocks at attractive levels, investors should allocate<br />

incremental capital to equities in such situations. This is part <strong>of</strong> market psyche where <strong>the</strong><br />

effect <strong>of</strong> such transient issues diminishes over medium term and <strong>the</strong> market eventually<br />

resumes its trajectory towards underlying earnings growth.<br />

Debt Investment Outlook<br />

Domestic Growth Outlook<br />

As we complete <strong>the</strong> first month <strong>of</strong> <strong>2013</strong>, our base case remains that GDP growth in <strong>2013</strong><br />

will pick-up to 6.5% from <strong>the</strong> 5-5.5% GDP growth we expect in 2012. The biggest com<strong>for</strong>t<br />

we draw in this conclusion is that India’s industrial growth as reflected by IIP seems<br />

to have bottomed out. After averaging close to 0% in <strong>the</strong> Mar’12-Sep’12 (on a 3mma<br />

basis), 3mma IIP has picked up to 2.4% in Nov’12. Moreover, we expect <strong>the</strong> re<strong>for</strong>ms<br />

initiative started by <strong>the</strong> current finance minister in Sep’12 to fur<strong>the</strong>r boost <strong>the</strong> industrial<br />

cycle. According to us, <strong>the</strong> most important re<strong>for</strong>m in <strong>the</strong> last few months from a growth<br />

perspective is <strong>the</strong> <strong>for</strong>mation <strong>of</strong> a Cabinet Committee on Investments (CCI) which can help<br />

resolve <strong>the</strong> almost 8 trillion rupees worth <strong>of</strong> large projects (based on CMIE data) that have<br />

been stalled due to environmental and regulatory clearances.<br />

On a fundamental level, <strong>the</strong>re are 2 key reasons why we expect growth to pick-up in CY<br />

<strong>2013</strong>. Firstly, <strong>the</strong> re<strong>for</strong>ms momentum initiated by <strong>the</strong> government which can help restart<br />

<strong>the</strong> investment cycle <strong>of</strong> <strong>the</strong> country and resolve <strong>the</strong> backlog <strong>of</strong> stalled projects. Secondly,<br />

we believe RBI will be cutting rates by 50-75bps in CY <strong>2013</strong>. And this will have a positive<br />

effect on GDP growth by boosting consumption. RBI has already started this cycle by a<br />

25bps rate cut in January <strong>2013</strong>. Un<strong>for</strong>tunately, if <strong>the</strong> CAD (current account deficit) and<br />

fiscal deficit <strong>of</strong> <strong>the</strong> country were not in such a bad state, <strong>the</strong> central bank could have taken<br />

much more stronger steps in re-invigorating growth.<br />

That said, we remain cognizant <strong>of</strong> incoming data and are always on <strong>the</strong> look-out <strong>for</strong><br />

data that might challenge our above view. For example, some <strong>of</strong> <strong>the</strong> recent data points<br />

such as January PMI data and December credit growth are concerning from a growth<br />

perspective. Moreover, RBI in its latest monetary policy talked about continued slowdown<br />

in <strong>the</strong> services sector – a key reason RBI has downgraded FY13 GDP growth to 5.5% from<br />

its earlier estimate <strong>of</strong> 5.8%. Finally, we are closely watching <strong>the</strong> fiscal consolidation ef<strong>for</strong>ts<br />

by <strong>the</strong> government which also have a short term negative effect on growth.<br />

Overall, we retain our view that growth can recover to 6.5% in <strong>2013</strong> but are closely<br />

watching <strong>the</strong> economic trends that might change our <strong>for</strong>ecast.<br />

Domestic Inflation Outlook<br />

One <strong>of</strong> <strong>the</strong> key economic puzzles <strong>for</strong> us in 2012 was <strong>the</strong> stubbornness in India’s inflation.<br />

Despite a dramatic slowdown in growth from <strong>the</strong> 9.3% in FY11 to 5.3-5.4% in first 6<br />

months <strong>of</strong> FY13, our wholesale price index (WPI) remained pretty range bound in 7.5-8%<br />

range <strong>for</strong> <strong>the</strong> first 9 months <strong>of</strong> <strong>the</strong> year. But finally, <strong>the</strong>re are some positive signs emerging<br />

on <strong>the</strong> inflation picture. WPI has moderated to 7.18% in Dec’12 after averaging 7.63% in<br />

<strong>the</strong> first 9 months <strong>of</strong> 2012. Moreover, we expect inflation to moderate fur<strong>the</strong>r to ~6.5% by<br />

Mar <strong>2013</strong> and average 6.5-7% <strong>for</strong> CY <strong>2013</strong>.<br />

Historically, India’s inflation has had a very strong correlation with global commodity<br />

prices. In this regard, <strong>the</strong> fact that global commodity prices have remained range-bound<br />

despite <strong>the</strong> significant quantitative easing programs announced by western central banks<br />

(US federal reserve has committed itself to expand its balance sheet by ~$1 trillion in<br />

<strong>2013</strong>) is a significant positive <strong>for</strong> our inflation picture. Ano<strong>the</strong>r big positive is that <strong>the</strong><br />

growth slowdown should have resulted in excess capacity In <strong>the</strong> economy – thus mitigating<br />

inflationary <strong>for</strong>ces in <strong>the</strong> economy.<br />

One key point to note here is that increase in diesel prices (<strong>the</strong> steps announced by<br />

government recently) are a significant positive <strong>for</strong> <strong>the</strong> economy even though <strong>the</strong>re may be<br />

a 50-75bps incremental impact on inflation <strong>of</strong> <strong>the</strong> diesel price hikes in <strong>the</strong> short run. Diesel<br />

price hikes are a significant positive because it releases our suppressed inflation and thus<br />

removes one <strong>of</strong> RBI’s key concerns regarding lowering interest rates.<br />

Debt Market Outlook<br />

After WPI printed 7.18% in mid January <strong>2013</strong>, significantly lower than market consensus<br />

and much below RBI’s own fan chart on inflation, gilts rallied and 10 year benchmark<br />

briefly touched 7.80% in expectation that RBI may cut repo rate by 50 bps. However after<br />

this brief euphoria, market woke up to <strong>the</strong> hawkish comments from RBI governor on still<br />

elevated level <strong>of</strong> inflation in <strong>the</strong> economy. These comments spooked <strong>the</strong> bond markets and<br />

reduced <strong>the</strong> possibility <strong>of</strong> RBI doing anymore cut than 25 bps on repo. In <strong>the</strong> monetary<br />

policy, <strong>the</strong> RBI did stick to only 25 bps cut in repo and also delivered 25 bps cut in CRR.<br />

In its post policy con-call and post policy interaction with media, RBI expressed its<br />

discom<strong>for</strong>t on <strong>the</strong> level <strong>of</strong> current account deficit (CAD) <strong>of</strong> <strong>the</strong> country, something that had<br />

made us equally worried in <strong>the</strong> recent past especially after seeing 5.4% CAD in Q2FY13<br />

especially at a time when domestic growth has slowed down significantly. With CAD ruling<br />

very high, inflation expected to hover around 6.5%-7% in <strong>2013</strong> and domestic growth<br />

bottoming out, we feel it is a highly unlikely that <strong>the</strong> RBI will deliver aggressive rate cuts in<br />

this cycle something that was seen during 2001-03 and 2009-10.<br />

We believe that terminal repo rate in this interest cycle, may at best be 7.25% and that this<br />

repo rate will be visible not be<strong>for</strong>e H2CY13. The anomaly is that by <strong>the</strong> time <strong>the</strong> terminal<br />

repo rate will drop to 7.25% <strong>the</strong> worries on fiscal account due to nearing General Election<br />

would begin to resurface. We may see <strong>the</strong> ruling party being aggressive on social spending<br />

(e.g. a big push on food security bill) going into election, we may see some <strong>of</strong> <strong>the</strong> current<br />

re<strong>for</strong>ms being halted (e,g, a halt in monthly Diesel price hikes) or even unwound.<br />

Overall CY13 will be a year <strong>of</strong> 2 halves. In <strong>the</strong> first half we will have lot <strong>of</strong> good news on<br />

fiscal front, on re<strong>for</strong>ms front and bit on monetary policy front but it is difficult to say how<br />

many <strong>of</strong> <strong>the</strong>se fiscal measures will stay as <strong>the</strong> General election approaches.<br />

In <strong>the</strong> last 1 year, 10yr gilt has rallied by almost 100 bps. We were at 8.78% in April 2012<br />

and touched 7.80% in Jan <strong>2013</strong>. Of this 100 bps, almost 40 bps rally was witnessed in<br />

Dec-Jan itself. If you can recall, we had given a call in <strong>the</strong> month <strong>of</strong> August when 10 year<br />

Gsec was hovering at around 8.25%, that 10 yr yield will go to 7.50%. Of <strong>the</strong> 75 bps rally<br />

that we had talked about, 45bps panned out by Jan <strong>2013</strong>. In all our duration portfolios,<br />

viz; Dynamic Bond <strong>Fund</strong> (DBF), Income Plus (BIP) and Govt. Securities <strong>Fund</strong> – LT we<br />

played this rally with a very high level <strong>of</strong> conviction. At peak our exposure to gilts/ SDLs<br />

(SLR securities) across our duration funds was much higher compared to many <strong>of</strong> our<br />

competitors. In DBF we had a peak exposure <strong>of</strong> 23%, in Income Plus <strong>the</strong> exposure was<br />

86% and in our gilt funds <strong>the</strong> exposure was 95% to SLR securities. We also played this rally<br />

chiefly through gilts than through SDLs.<br />

We reduced our exposure to gilts across our funds in 7.80-84% yield band. This is because<br />

with sharp rally already behind us, quantum <strong>of</strong> balance rate cut being small and timing <strong>of</strong><br />

rate cuts being well spaced out, we believe it may not be possible <strong>for</strong> 10 year to go near<br />

7.50% anytime soon. From here till April, we do not see any great triggers that may result<br />

into ano<strong>the</strong>r 20-40 bps rally. At best <strong>the</strong> market may stay range bound between 7.80-8%<br />

till April <strong>2013</strong>.<br />

Going <strong>for</strong>ward, increase in duration in our funds will be based on evolving macro-economic<br />

developments and market technicalities. In our DBF, Short Term <strong>Fund</strong> (STF) and our o<strong>the</strong>r<br />

ultra short term funds, we are readying ourselves to play yield curve inversion going into<br />

March. We will play this opportunity in BIP too, while taking tactical calls in GOIs/ SDLs/<br />

Corporate bonds as and when <strong>the</strong> opportunity arises.<br />

Our advice to investors would be to stay invested in duration funds at this point <strong>of</strong> time<br />

as we believe ano<strong>the</strong>r 25-50 bps repo cut is a good possibility; however we would like<br />

to caution our investors that <strong>the</strong> past per<strong>for</strong>mance, especially <strong>the</strong> recent one may not be<br />

repeated as we pass through a tumultuous period going ahead.<br />

02

Savings Solutions<br />

What are Saving Solutions?<br />

Our Savings Solutions are aimed at<br />

preserving your money, providing you<br />

with liquidity and giving you superior<br />

tax-efficient returns compared to bank<br />

accounts and FDs.<br />

Who can benefit from Saving Solutions?<br />

This is an ideal solution <strong>for</strong> investors who<br />

have low - medium propensity <strong>for</strong> risk and<br />

high liquidity. These can be ideal <strong>for</strong> first time<br />

investors in mutual funds.<br />

Regular Income Solutions<br />

What are Regular Income Solutions?<br />

Our Regular Income Solutions aim<br />

to preserve your money and provide<br />

regular income.<br />

Who can benefit from Regular Income<br />

Solutions?<br />

This is an ideal solutions <strong>for</strong> investors who<br />

are interested in alternative modes <strong>of</strong> regular<br />

income, ei<strong>the</strong>r in present <strong>of</strong> after retirement<br />

stage, and have low propensity <strong>for</strong> risk.<br />

(Regular income is not assured & is subject to<br />

availability <strong>of</strong> distributable surplus.)<br />

Wealth Creation Solutions<br />

What are Wealth Creation Solutions?<br />

Our Wealth Creation Solutions aim to<br />

grow your money through equity/gold<br />

investments and are available in a range<br />

<strong>of</strong> conservative to aggressive options.<br />

Who can benefit from Wealth Creation<br />

Solutions?<br />

These solutions can be ideal <strong>for</strong> investors<br />

who are planning <strong>for</strong> future expenses, like<br />

higher education <strong>of</strong> children, marriage, buying<br />

a home etc.These solutions are available<br />

in <strong>the</strong> range <strong>of</strong> aggressive to conservative<br />

options to suit <strong>the</strong> needs <strong>of</strong> <strong>the</strong> investor.<br />

Tax Savings Solutions<br />

What are Tax Savings Solutions?<br />

Our Tax Savings Solutions help to<br />

reduce your tax burden and at <strong>the</strong> same<br />

time, aim to grow your money through<br />

equity investments.<br />

Who can benefit from Tax Savings<br />

Solutions?<br />

Tax saving is important, especially when<br />

investors can save up to ` 30,900 in taxes!<br />

Section 80C <strong>of</strong> <strong>the</strong> Income Tax Act, 1961<br />

provides options to save tax by reducing <strong>the</strong><br />

taxable income by up to ` 1 lakh.<br />

But, wealth creation is also important. Isn’t it?<br />

That’s why this solution is ideal <strong>for</strong> investors<br />

who would like to create wealth along with<br />

tax saving.<br />

Tax savings <strong>of</strong> ` 30,900 is calculated assuming qualifying amount <strong>of</strong><br />

deduction is ` 1 lakh & investor falls in <strong>the</strong> top income tax slab <strong>of</strong> 30% &<br />

includes applicable cess. Investors are advised to consult <strong>the</strong>ir tax advisor<br />

in view <strong>of</strong> individual nature <strong>of</strong> tax benefits.<br />

Fur<strong>the</strong>r, Tax deduction(s) available u/s 80C <strong>of</strong> <strong>the</strong> Income Tax Act, 1961 is<br />

subject to conditions specified <strong>the</strong>rein. Investors are requested to note that<br />

fiscal laws may change from time to time and <strong>the</strong>re can be no guarantee<br />

that <strong>the</strong> current tax position may continue in <strong>the</strong> future.<br />

The Financial Solution(s) stated above is ONLY <strong>for</strong> highlighting <strong>the</strong> many advantages perceived from investments in <strong>Mutual</strong> <strong>Fund</strong>s but does not in any manner,<br />

indicate or imply, ei<strong>the</strong>r <strong>the</strong> quality <strong>of</strong> any particular Scheme or guarantee any specific per<strong>for</strong>mance/returns.<br />

03

Savings Solutions<br />

What are Saving Solutions?<br />

Our Savings Solutions are aimed at<br />

preserving your money, providing you<br />

with liquidity and giving you superior<br />

tax-efficient returns compared to bank<br />

accounts and FDs.<br />

Who can benefit from Saving<br />

Solutions?<br />

This is an ideal solution <strong>for</strong> investors<br />

who have low - medium propensity <strong>for</strong><br />

risk and high liquidity. These can be<br />

ideal <strong>for</strong> first time investors in mutual<br />

funds.<br />

Benefits <strong>of</strong> Savings Solutions:<br />

Make Inflation work in your favour: Inflation affects your returns from any investment including mutual funds. But, in case <strong>of</strong> savings<br />

solutions, you can use it to your advantage - through indexation - which can help you reduce <strong>the</strong> amount on which you have to pay tax. You can<br />

benefit from indexation, if investing <strong>for</strong> more than 1 year. Please consult your tax advisor on how to take advantage <strong>of</strong> indexation.<br />

Aim to preserve your money: These schemes generally invest in instruments like bonds <strong>of</strong> reputed Indian companies and securities (bonds)<br />

issued by <strong>the</strong> Government <strong>of</strong> India which are considered relatively safe.<br />

Aim to provide Liquidity: If you need to withdraw your money, all you have to do is submit a redemption slip and your money is normally<br />

credited to your bank account within one working day. You may also opt <strong>for</strong> an online redemption facility <strong>of</strong>fered by many fund houses <strong>for</strong> added<br />

convenience.<br />

Tax-efficient returns: You can earn returns in <strong>the</strong> <strong>for</strong>m <strong>of</strong> monthly / quarterly dividends etc. which are completely tax-free in your hands. A<br />

dividend distribution tax <strong>of</strong> 13.519% is applicable and is deducted by <strong>the</strong> fund house.<br />

There are various savings solutions available depending on <strong>the</strong> time period that you would like to invest <strong>for</strong>: a. 1 day to 3 months b. 3 to 6<br />

months c. 6 months to 1 year d. 1 year +<br />

Investors are advised to consult <strong>the</strong>ir tax advisor in view <strong>of</strong> individual nature <strong>of</strong> tax benefits.<br />

The Financial Solution (Savings Solution) stated above is ONLY <strong>for</strong> highlighting <strong>the</strong> many advantages perceived from investments in <strong>Mutual</strong> <strong>Fund</strong>s but does not in any<br />

manner, indicate or imply, ei<strong>the</strong>r <strong>the</strong> quality <strong>of</strong> any particular Scheme or guarantee any specific per<strong>for</strong>mance/returns.<br />

04

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Cash Plus<br />

What is it?<br />

A fund that aims to provide <strong>the</strong> convenience<br />

<strong>of</strong> a savings account with <strong>the</strong> opportunity<br />

to earn higher post-tax returns. (Investors<br />

are advised to consult <strong>the</strong>ir tax advisor in<br />

view <strong>of</strong> individual nature <strong>of</strong> tax benefits.)<br />

SAVINGS SOLUTIONS<br />

Conservative Returns Low Risk 1 day + High Liquidity<br />

<strong>Fund</strong> Details<br />

<strong>Fund</strong> Manager: Mr. Kaustubh Gupta &<br />

Ms. <strong>Sun</strong>aina Da Cunha<br />

Managing <strong>Fund</strong> Since: July 15, 2011<br />

Total Experience: 5 years & 7 years<br />

Date <strong>of</strong> inception: June 16, 1997<br />

Nature <strong>of</strong> <strong>the</strong> scheme: An Open-ended Liquid<br />

Scheme<br />

NAV <strong>of</strong> Plans / Options (`)^<br />

Retail Plan<br />

Growth: 302.4945<br />

Dividend: 163.6940<br />

Institutional Plan<br />

Growth: 309.6756<br />

Dividend: 108.0230<br />

Weekly Dividend: 108.1397<br />

Regular Plan $<br />

Growth: 185.2987<br />

Daily Dividend: 100.1950<br />

Weekly Dividend: 100.2936<br />

Direct Plan $<br />

Growth: 185.3065<br />

Daily Dividend: 100.1950<br />

Weekly Dividend: 100.2940<br />

^The Face Value per unit <strong>of</strong> all <strong>the</strong> plans/ options<br />

under <strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Cash Plus has been changed<br />

from `.10/- to `.100/- effective from October 07,<br />

2011<br />

Benchmark:<br />

Load Structure (as % <strong>of</strong> NAV)<br />

Entry Load:<br />

Nil<br />

Exit Load:<br />

Nil<br />

CRISIL Liquid <strong>Fund</strong><br />

Index<br />

O<strong>the</strong>r Parameter<br />

Modified Duration : 0.09 years<br />

Yield to Maturity: 8.52%<br />

Standard Deviation<br />

Retail Plan: 0.56%<br />

Institutional Plan: 0.56%<br />

Regular Plan: 0.53%<br />

29.81%<br />

Rating Pr<strong>of</strong>ile <strong>of</strong> Portfolio<br />

AAA<br />

Date <strong>of</strong> Inception: June 16, 1997<br />

Since inception till<br />

December 31, 2012 (CAGR)<br />

December 30, 2011 to<br />

December 31, 2012 (Absolute)<br />

December 31, 2010 to<br />

December 30, 2011 (Absolute)<br />

December 31, 2009 to<br />

December 31, 2010 (Absolute)<br />

Cash & Current Assets<br />

NAV Per<br />

Unit. *<br />

(`)<br />

70.19%<br />

<strong>Birla</strong> <strong>Sun</strong><br />

<strong>Life</strong> Cash<br />

Plus (%)<br />

CRISIL<br />

Liquid<br />

<strong>Fund</strong> Index<br />

# (%)<br />

CRISIL 1<br />

Year T-Bill<br />

Index ##<br />

(%)<br />

As on January 31, <strong>2013</strong><br />

Investment Per<strong>for</strong>mance - Retail Plan - Growth NAV as on December 31, 2012: ` 300.4877<br />

Value <strong>of</strong> Standard Investment <strong>of</strong> `<br />

10000 in<br />

<strong>Birla</strong> <strong>Sun</strong><br />

<strong>Life</strong> Cash<br />

Plus (`)<br />

CRISIL<br />

Liquid<br />

<strong>Fund</strong> Index<br />

# (`)<br />

CRISIL 1<br />

Year T-Bill<br />

Index ## (`)<br />

100.0000 7.32 N/A N/A 30049 N/A N/A<br />

275.6025 9.03 8.54 8.11 10903 10854 10811<br />

254.2290 8.41 8.15 6.42 10841 10815 10642<br />

242.8390 4.69 5.12 2.81 10469 10512 10281<br />

# Scheme Benchmark, ## Additional Benchmark, * As on start <strong>of</strong> period considered above.<br />

Past per<strong>for</strong>mance may or may not be sustained in future. Returns <strong>for</strong> dividend option would assume reinvestment <strong>of</strong> dividends<br />

declared, net <strong>of</strong> dividend distribution tax, if any, at <strong>the</strong> <strong>the</strong>n prevailing NAV. Load and Taxes are not considered <strong>for</strong> computation <strong>of</strong> returns. When<br />

scheme/additional benchmark returns are not available, <strong>the</strong>y have not been shown.<br />

Total Schemes Co-Managed by <strong>Fund</strong> Managers is 4. Total Schemes managed by Mr. Kaustubh Gupta is 71. Total Schemes managed by Ms.<br />

<strong>Sun</strong>aina Da Cunha is 5. Refer annexure on page no. 52 to know more on per<strong>for</strong>mance <strong>of</strong> schemes managed by <strong>Fund</strong> Managers.<br />

Note:<br />

$<br />

These Plan/Options continue <strong>for</strong> fresh subscriptions under <strong>the</strong> scheme. ‘Direct Plan’ is only <strong>for</strong> investors who purchase /<br />

Standard Deviation is calculated on annualised basis subscribe Units in a Scheme directly with <strong>the</strong> <strong>Mutual</strong> <strong>Fund</strong> and is not available <strong>for</strong> investors who route <strong>the</strong>ir investments through<br />

using 1 year history <strong>of</strong> monthly returns, source: MFI a Distributor. For fur<strong>the</strong>r details, Investors are advised to refer to Addendum no. 44/2012 dated December 27, 2012 available<br />

Explorer.<br />

on our website www.birlasunlife.com<br />

Top Ten Portfolio Holdings<br />

Issuer % to net Assets Rating Issuer % to net Assets Rating<br />

Housing Development Finance Corporation Ltd. 13.45% [ICRA] A1+ IndusInd Bank Ltd. 2.19% CRISIL A1+<br />

Punjab National Bank 7.28% CARE A1+ Indian Oil Corporation Ltd. 2.09% [ICRA] A1+<br />

Canara Bank 5.27% CRISIL A1+ L&T Finance Ltd. 1.88% CARE A1+<br />

Sterlite Energy Ltd. 3.65% CRISIL A1+ State Bank <strong>of</strong> Patiala 1.72% [ICRA] A1+<br />

Axis Bank Ltd. 2.56% CRISIL A1+ Kotak Mahindra Bank Ltd. 1.58% CRISIL A1+<br />

05

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Cash Manager<br />

What is it?<br />

A fund that aims to provide <strong>the</strong> convenience<br />

<strong>of</strong> a savings account with <strong>the</strong> opportunity<br />

to earn higher post-tax returns. (Investors<br />

are advised to consult <strong>the</strong>ir tax advisor in<br />

view <strong>of</strong> individual nature <strong>of</strong> tax benefits.)<br />

<strong>Fund</strong> Details<br />

<strong>Fund</strong> Manager: Mr. Kaustubh Gupta &<br />

Ms. <strong>Sun</strong>aina Da Cunha<br />

Managing <strong>Fund</strong> Since: July 15, 2011<br />

Total Experience: 5 years & 7 years<br />

Date <strong>of</strong> inception:<br />

Retail Plan: May 14, 1998<br />

Institutional Plan: September 27, 2004<br />

Nature <strong>of</strong> <strong>the</strong> scheme: An Open-ended Income<br />

Scheme<br />

Rating Pr<strong>of</strong>ile <strong>of</strong> Portfolio<br />

24.11%<br />

1.96%<br />

73.94%<br />

AAA Cash & Current Assets AA<br />

SAVINGS SOLUTIONS<br />

Conservative Returns Low Risk 1 day + High Liquidity<br />

As on January 31, <strong>2013</strong><br />

NAV <strong>of</strong> Plans / Options (`)^<br />

Regular Plan $<br />

Growth: 279.2450<br />

Daily Dividend: 100.1158<br />

Weekly Dividend: 100.0456<br />

Institutional Plan<br />

Growth: 194.2503<br />

Daily Dividend: 100.0681<br />

Weekly Dividend: 100.0511<br />

Direct Plan $<br />

Growth: 279.4830<br />

Daily Dividend: 100.1575<br />

Weekly Dividend: 100.0845<br />

^The Face Value per unit <strong>of</strong> all <strong>the</strong> plans/ options<br />

under <strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Cash Manager has been<br />

changed from `.10/- to `.100/- effective from<br />

October 07, 2011<br />

Benchmark:<br />

CRISIL Short Term Bond<br />

<strong>Fund</strong> Index<br />

Load Structure (as % <strong>of</strong> NAV) (Incl. <strong>for</strong> SIP)<br />

Entry Load:<br />

Nil<br />

Exit Load:<br />

Nil<br />

Investment Per<strong>for</strong>mance - Regular Plan - Growth NAV as on December 31, 2012: ` 277.3418<br />

Date <strong>of</strong> Inception: May 14, 1998<br />

Since inception till<br />

December 31, 2012 (CAGR)<br />

December 30, 2011 to<br />

December 31, 2012 (Absolute)<br />

December 31, 2010 to<br />

December 30, 2011 (Absolute)<br />

December 31, 2009 to<br />

December 31, 2010 (Absolute)<br />

NAV Per<br />

Unit. *<br />

(`)<br />

<strong>Birla</strong> <strong>Sun</strong><br />

<strong>Life</strong> Cash<br />

Manager (%)<br />

CRISIL<br />

Short Term<br />

Bond <strong>Fund</strong><br />

Index #<br />

(%)<br />

CRISIL 1<br />

Year T-Bill<br />

Index ##<br />

(%)<br />

Value <strong>of</strong> Standard Investment <strong>of</strong> `<br />

10000 in<br />

<strong>Birla</strong> <strong>Sun</strong><br />

<strong>Life</strong> Cash<br />

Manager<br />

(`)<br />

CRISIL<br />

Short Term<br />

Bond <strong>Fund</strong><br />

Index # (`)<br />

CRISIL 1<br />

Year<br />

T-Bill Index<br />

## (`)<br />

100.0000 7.21 N/A N/A 27734 N/A N/A<br />

254.1938 9.11 9.15 8.11 10911 10915 10811<br />

233.9360 8.66 7.84 6.42 10866 10784 10642<br />

222.4970 5.14 4.70 2.81 10514 10470 10281<br />

# Scheme Benchmark, ## Additional Benchmark, * As on start <strong>of</strong> period considered above.<br />

Past per<strong>for</strong>mance may or may not be sustained in future. Returns <strong>for</strong> dividend option would assume reinvestment <strong>of</strong> dividends<br />

declared, net <strong>of</strong> dividend distribution tax, if any, at <strong>the</strong> <strong>the</strong>n prevailing NAV. Load and Taxes are not considered <strong>for</strong> computation <strong>of</strong> returns. When<br />

scheme/additional benchmark returns are not available, <strong>the</strong>y have not been shown.<br />

Total Schemes Co-Managed by <strong>Fund</strong> Managers is 4. Total Schemes managed by Mr. Kaustubh Gupta is 71. Total Schemes managed by Ms.<br />

<strong>Sun</strong>aina Da Cunha is 5. Refer annexure on page no. 52 to know more on per<strong>for</strong>mance <strong>of</strong> schemes managed by <strong>Fund</strong> Managers.<br />

O<strong>the</strong>r Parameter<br />

Modified Duration: 0.13 years<br />

Yield to Maturity: 8.64%<br />

Standard Deviation:<br />

Regular Plan: 0.53%<br />

Institutional Plan: 0.54%<br />

Note:<br />

Standard Deviation is calculated on annualised basis $<br />

These Plan/Options continue <strong>for</strong> fresh subscriptions under <strong>the</strong> scheme. ‘Direct Plan’ is only <strong>for</strong> investors who purchase /<br />

using 1 year history <strong>of</strong> monthly returns, source: MFI subscribe Units in a Scheme directly with <strong>the</strong> <strong>Mutual</strong> <strong>Fund</strong> and is not available <strong>for</strong> investors who route <strong>the</strong>ir investments through<br />

Explorer.<br />

a Distributor. For fur<strong>the</strong>r details, Investors are advised to refer to Addendum no. 44/2012 dated December 27, 2012 available<br />

on our website www.birlasunlife.com<br />

Top Ten Portfolio Holdings<br />

Issuer % to net Assets Rating Issuer % to net Assets Rating<br />

Housing Development Finance Corporation Ltd. 10.29% [ICRA] A1+<br />

Standard Chartered Investments<br />

And Loans (India) Ltd.<br />

3.68% CRISIL A1+<br />

Canara Bank 4.88% CRISIL A1+ Indiabulls Financial Services Ltd. 3.08% CRISIL A1+<br />

State Bank Of Patiala 4.58% [ICRA] A1+ L&T Fincorp Ltd. 3.06% CARE A1+<br />

Bank <strong>of</strong> India 4.57% CRISIL A1+ Ratnakar Bank 3.04% [ICRA] A1+<br />

Steel Authority <strong>of</strong> India Ltd. 3.96% FITCH A1+ Tata Teleservices Ltd. 3.04% CARE A1+<br />

06

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Savings <strong>Fund</strong><br />

What is it?<br />

A fund that aims to provide <strong>the</strong> convenience<br />

<strong>of</strong> a savings account with <strong>the</strong> opportunity to<br />

earn higher post-tax returns. (Investors are<br />

advised to consult <strong>the</strong>ir tax advisor in view <strong>of</strong><br />

individual nature <strong>of</strong> tax benefits.)<br />

SAVINGS SOLUTIONS<br />

Conservative Returns Low Risk 1 day + High Liquidity<br />

<strong>Fund</strong> Details<br />

<strong>Fund</strong> Manager: Mr. Kaustubh Gupta<br />

Managing <strong>Fund</strong> Since: July 15, 2011<br />

Total Experience: 5 years<br />

Date <strong>of</strong> inception<br />

Retail Plan: November 27, 2001<br />

Institutional Plan: April 16, 2003<br />

Nature <strong>of</strong> <strong>the</strong> scheme: An Open-ended Short<br />

Term Income Scheme<br />

NAV <strong>of</strong> Plans / Options (`)^<br />

Retail Plan<br />

Growth: 214.2100<br />

Daily Dividend: 100.0948<br />

Weekly Dividend: 100.0777<br />

Regular Plan $<br />

Growth: 220.7499<br />

Daily Dividend: 100.0948<br />

Weekly Dividend: 100.0807<br />

Direct Plan $<br />

Growth: 220.7681<br />

Daily Dividend: 100.0948<br />

Weekly Dividend: 100.0816<br />

^The Face Value per unit <strong>of</strong> all <strong>the</strong> plans/ options<br />

under <strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Savings <strong>Fund</strong> has been<br />

changed from `.10/- to `.100/- effective from<br />

October 07, 2011<br />

Benchmark:<br />

CRISIL Short Term<br />

Bond <strong>Fund</strong> Index<br />

Load Structure (as % <strong>of</strong> NAV) (Incl. <strong>for</strong> SIP)<br />

Entry Load:<br />

Nil<br />

Exit Load:<br />

Nil<br />

22.92%<br />

Rating Pr<strong>of</strong>ile <strong>of</strong> Portfolio<br />

10.57%<br />

Date <strong>of</strong> Inception: Nov 27, 2001<br />

Since inception till<br />

December 31, 2012 (CAGR)<br />

December 30, 2011 to<br />

December 31, 2012 (Absolute)<br />

December 31, 2010 to<br />

December 30, 2011 (Absolute)<br />

December 31, 2009 to<br />

December 31, 2010 (Absolute)<br />

NAV Per<br />

Unit. *<br />

(`)<br />

66.51%<br />

AAA Cash & Current Assets AA<br />

<strong>Birla</strong> <strong>Sun</strong><br />

<strong>Life</strong> Savings<br />

<strong>Fund</strong> (%)<br />

CRISIL<br />

Short Term<br />

Bond <strong>Fund</strong><br />

Index #<br />

(%)<br />

CRISIL 1<br />

Year T-Bill<br />

Index ##<br />

(%)<br />

As on January 31, <strong>2013</strong><br />

Investment Per<strong>for</strong>mance - Retail Plan - Growth NAV as on December 31, 2012: ` 212.5884<br />

Value <strong>of</strong> Standard Investment <strong>of</strong> `<br />

10000 in<br />

<strong>Birla</strong><br />

<strong>Sun</strong> <strong>Life</strong><br />

Savings<br />

<strong>Fund</strong> (`)<br />

CRISIL<br />

Short Term<br />

Bond <strong>Fund</strong><br />

Index # (`)<br />

CRISIL 1<br />

Year T-Bill<br />

Index ## (`)<br />

100.0000 7.04 N/A N/A 21259 N/A N/A<br />

194.1840 9.48 9.15 8.11 10948 10915 10811<br />

178.2830 8.92 7.84 6.42 10892 10784 10642<br />

169.3980 5.25 4.70 2.81 10525 10470 10281<br />

# Scheme Benchmark, ## Additional Benchmark, * As on start <strong>of</strong> period considered above.<br />

Past per<strong>for</strong>mance may or may not be sustained in future. Returns <strong>for</strong> dividend option would assume reinvestment <strong>of</strong> dividends<br />

declared, net <strong>of</strong> dividend distribution tax, if any, at <strong>the</strong> <strong>the</strong>n prevailing NAV. Load and Taxes are not considered <strong>for</strong> computation <strong>of</strong> returns. When<br />

scheme/additional benchmark returns are not available, <strong>the</strong>y have not been shown.<br />

Total Schemes managed by Mr. Kaustubh Gupta is 71. Refer annexure on page no. 52 to know more on per<strong>for</strong>mance <strong>of</strong> schemes managed by<br />

<strong>Fund</strong> Manager.<br />

O<strong>the</strong>r Parameter<br />

Modified Duration: 0.15 years<br />

Yield to Maturity: 8.70%<br />

Standard Deviation<br />

Retail Plan: 0.55%<br />

Regular Plan: 0.52%<br />

Note:<br />

$<br />

These Plan/Options continue <strong>for</strong> fresh subscriptions under <strong>the</strong> scheme. ‘Direct Plan’ is only <strong>for</strong> investors who purchase /<br />

Standard Deviation is calculated on annualised basis<br />

subscribe Units in a Scheme directly with <strong>the</strong> <strong>Mutual</strong> <strong>Fund</strong> and is not available <strong>for</strong> investors who route <strong>the</strong>ir investments through<br />

using 1 year history <strong>of</strong> monthly returns, source: MFI<br />

a Distributor. For fur<strong>the</strong>r details, Investors are advised to refer to Addendum no. 44/2012 dated December 27, 2012 available<br />

Explorer.<br />

on our website www.birlasunlife.com<br />

Top Ten Portfolio Holdings<br />

Issuer % to net Assets Rating Issuer % to net Assets Rating<br />

Housing Development Finance Corporation Ltd. 8.82% [ICRA] A1+ Kotak Mahindra Bank Ltd. 4.04% CRISIL A1+<br />

Shriram Transport Finance Company Ltd. 4.76% CRISIL AA Bharat Aluminium Company Ltd. 3.86% CRISIL A1+<br />

ICICI Bank Ltd. 4.74% [ICRA] A1+ IL&FS Financial Services Ltd. 3.44% FITCH A1+<br />

Housing Development Finance Corporation Ltd. 4.71% CRISIL AAA Andhra Bank 3.09% CARE A1+<br />

Axis Bank Ltd. 4.16% CRISIL A1+ Indian Oil Corporation Ltd. 2.93% [ICRA] A1+<br />

07

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Ultra Short Term <strong>Fund</strong><br />

What is it?<br />

A fund that aims to provide <strong>the</strong> convenience<br />

<strong>of</strong> parking your savings with an opportunity<br />

to earn higher post-tax returns. (Investors<br />

are advised to consult <strong>the</strong>ir tax advisor in<br />

view <strong>of</strong> individual nature <strong>of</strong> tax benefits)<br />

SAVINGS SOLUTIONS<br />

Conservative Returns Low-Medium Risk 1 month + High Liquidity<br />

<strong>Fund</strong> Details<br />

<strong>Fund</strong> Manager: Mr. Kaustubh Gupta &<br />

Mr. Lokesh Mallya<br />

Managing <strong>Fund</strong> Since: September 29, 2009<br />

Total Experience: 5 years & 5 years<br />

Date <strong>of</strong> inception: April 19, 2002<br />

Nature <strong>of</strong> <strong>the</strong> scheme: An Open-ended Short<br />

Term Income Scheme<br />

NAV <strong>of</strong> Plans / Options (`)^<br />

Retail Plan<br />

Growth: 208.5888<br />

Daily Dividend: 100.0550<br />

Fortnightly Dividend: 103.8308<br />

Regular Plan $<br />

Growth: 138.4539<br />

Daily Dividend: 100.0550<br />

Weekly Dividend: 101.7464<br />

Fortnightly Dividend: 102.9766<br />

Direct Plan $<br />

Growth: 138.4652<br />

Daily Dividend: 100.0550<br />

Weekly Dividend: 101.7470<br />

Fortnightly Dividend: 102.9778<br />

^The Face Value per unit <strong>of</strong> all <strong>the</strong> plans/ options<br />

under <strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Ultra Short Term <strong>Fund</strong> has<br />

been changed from `.10/- to `.100/- effective<br />

from October 07, 2011<br />

Benchmark:<br />

CRISIL Short Term<br />

Bond <strong>Fund</strong> Index<br />

Load Structure (as % <strong>of</strong> NAV) (Incl. <strong>for</strong> SIP)<br />

Entry Load :<br />

Nil<br />

Exit Load :<br />

Nil<br />

Rating Pr<strong>of</strong>ile <strong>of</strong> Portfolio<br />

32.93%<br />

AAA<br />

Date <strong>of</strong> Inception: April 19, 2002<br />

Since inception till<br />

December 31, 2012 (CAGR)<br />

December 30, 2011 to<br />

December 31, 2012 (Absolute)<br />

December 31, 2010 to<br />

December 30, 2011 (Absolute)<br />

December 31, 2009 to<br />

December 31, 2010 (Absolute)<br />

Cash & Current Assets<br />

NAV Per<br />

Unit. *<br />

(`)<br />

67.07%<br />

<strong>Birla</strong> <strong>Sun</strong><br />

<strong>Life</strong> Ultra<br />

Short Term<br />

<strong>Fund</strong> (%)<br />

CRISIL<br />

Short Term<br />

Bond <strong>Fund</strong><br />

Index #<br />

(%)<br />

CRISIL 1<br />

Year T-Bill<br />

Index ##<br />

(%)<br />

As on January 31, <strong>2013</strong><br />

Investment Per<strong>for</strong>mance - Retail Plan - Growth NAV as on December 31, 2012: ` 207.0603<br />

Value <strong>of</strong> Standard Investment <strong>of</strong> `<br />

10000 in<br />

<strong>Birla</strong> <strong>Sun</strong><br />

<strong>Life</strong> Ultra<br />

Short Term<br />

<strong>Fund</strong> (`)<br />

CRISIL<br />

Short Term<br />

Bond <strong>Fund</strong><br />

Index # (`)<br />

CRISIL 1<br />

Year<br />

T-Bill Index<br />

## (`)<br />

100.0000 7.03 6.57 5.41 20706 19759 17581<br />

189.0928 9.50 9.15 8.11 10950 10915 10811<br />

173.5050 8.98 7.84 6.42 10898 10784 10642<br />

164.5850 5.42 4.70 2.81 10542 10470 10281<br />

# Scheme Benchmark, ## Additional Benchmark, * As on start <strong>of</strong> period considered above.<br />

Past per<strong>for</strong>mance may or may not be sustained in future. Returns <strong>for</strong> dividend option would assume reinvestment <strong>of</strong> dividends<br />

declared, net <strong>of</strong> dividend distribution tax, if any, at <strong>the</strong> <strong>the</strong>n prevailing NAV. Load and Taxes are not considered <strong>for</strong> computation <strong>of</strong> returns.<br />

Total Schemes Co-Managed by <strong>Fund</strong> Managers is 1. Total Schemes managed by Mr. Kaustubh Gupta is 71. Total Schemes managed by Mr.<br />

Lokesh Mallya is 2. Refer annexure on page no. 52 to know more on per<strong>for</strong>mance <strong>of</strong> schemes managed by <strong>Fund</strong> Managers.<br />

O<strong>the</strong>r Parameter<br />

Modified Duration: 0.11 years<br />

Yield to Maturity: 8.37%<br />

Standard Deviation: 0.52%<br />

Note:<br />

Standard Deviation is calculated on annualised basis $<br />

These Plan/Options continue <strong>for</strong> fresh subscriptions under <strong>the</strong> scheme. ‘Direct Plan’ is only <strong>for</strong> investors who purchase /<br />

using 1 year history <strong>of</strong> monthly returns, source: MFI subscribe Units in a Scheme directly with <strong>the</strong> <strong>Mutual</strong> <strong>Fund</strong> and is not available <strong>for</strong> investors who route <strong>the</strong>ir investments through<br />

Explorer.<br />

a Distributor. For fur<strong>the</strong>r details, Investors are advised to refer to Addendum no. 44/2012 dated December 27, 2012 available<br />

on our website www.birlasunlife.com<br />

Top Ten Portfolio Holdings<br />

Issuer % to net Assets Rating Issuer % to net Assets Rating<br />

Vijaya Bank 13.77% CARE A1+ ICICI Bank Ltd. 3.49% CRISIL AAA<br />

Housing Development Finance Corporation Ltd. 12.49% [ICRA] A1+ State Bank Of Patiala 3.03% [ICRA] A1+<br />

Axis Bank Ltd. 6.59% CRISIL A1+ IndusInd Bank Ltd. 3.02% CRISIL A1+<br />

Ratnakar Bank 6.03% [ICRA] A1+ Indian Bank 3.01% FITCH A1+<br />

IDBI Bank Ltd. 6.00% CRISIL A1+ Punjab National Bank 3.00% CARE A1+<br />

08

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Dynamic Bond <strong>Fund</strong><br />

What is it?<br />

An income solution that aims to generate optimal<br />

returns through active management by capturing<br />

positive price and credit spread movements.<br />

SAVINGS SOLUTIONS<br />

Conservative Returns Low-Medium Risk 9 month + High Liquidity<br />

<strong>Fund</strong> Details<br />

<strong>Fund</strong> Manager: Mr. Maneesh Dangi<br />

Managing <strong>Fund</strong> Since: September 12, 2007<br />

Total Experience: 11 years<br />

Date <strong>of</strong> inception: September 27, 2004<br />

Nature <strong>of</strong> <strong>the</strong> scheme: An Open-ended Income<br />

Scheme<br />

NAV <strong>of</strong> Plans / Options (`)<br />

Regular Plan<br />

Growth: 19.5868<br />

<strong>Month</strong>ly Dividend: 10.5324<br />

Quarterly Dividend: 11.5105<br />

Direct Plan $<br />

Growth: 19.5932<br />

<strong>Month</strong>ly Dividend: 10.5359<br />

Quarterly Dividend: 11.5143<br />

Benchmark:<br />

CRISIL Composite Bond<br />

<strong>Fund</strong> Index<br />

Load Structure (as % <strong>of</strong> NAV) (Incl. <strong>for</strong> SIP)<br />

Entry Load:<br />

Nil<br />

Exit Load**:<br />

O<strong>the</strong>r Parameter<br />

Modified Duration: 1.64 years<br />

Yield to Maturity: 8.94%<br />

Standard Deviation: 1.09%<br />

For redemption / switch-out<br />

<strong>of</strong> units within 180 days<br />

from <strong>the</strong> date <strong>of</strong> allotment:<br />

0.50% <strong>of</strong> applicable NAV.<br />

For redemption / switch-out<br />

<strong>of</strong> units after 180 days from<br />

<strong>the</strong> date <strong>of</strong> allotment: Nil.<br />

**Exit Load is NIL <strong>for</strong> units<br />

issued in Bonus & Dividend<br />

Reinvestment.<br />

Rating Pr<strong>of</strong>ile <strong>of</strong> Portfolio<br />

8.06%<br />

20.92%<br />

6.35% 2.32%<br />

AAA<br />

Cash & Current Assets<br />

Below AA<br />

Date <strong>of</strong> Inception: Sept 27, 2004<br />

Since inception till<br />

December 31, 2012 (CAGR)<br />

December 30, 2011 to<br />

December 31, 2012 (Absolute)<br />

December 31, 2010 to<br />

December 30, 2011 (Absolute)<br />

December 31, 2009 to<br />

December 31, 2010 (Absolute)<br />

AA<br />

Sovereign<br />

NAV Per<br />

Unit. *<br />

(`)<br />

62.35%<br />

<strong>Birla</strong> <strong>Sun</strong><br />

<strong>Life</strong> Dynamic<br />

Bond <strong>Fund</strong><br />

(%)<br />

CRISIL<br />

Composite<br />

Bond <strong>Fund</strong><br />

Index #<br />

(%)<br />

CRISIL 10<br />

Year Gilt<br />

Index<br />

## (%)<br />

As on January 31, <strong>2013</strong><br />

Investment Per<strong>for</strong>mance - Retail Plan - Growth NAV as on December 31, 2012: ` 19.3974<br />

Value <strong>of</strong> Standard Investment <strong>of</strong> ` 10000 in<br />

<strong>Birla</strong><br />

<strong>Sun</strong> <strong>Life</strong><br />

Dynamic<br />

Bond <strong>Fund</strong><br />

(`)<br />

CRISIL<br />

Composite<br />

Bond <strong>Fund</strong><br />

Index # (`)<br />

CRISIL 10<br />

Year Gilt<br />

Index<br />

## (`)<br />

10.0000 8.35 6.04 5.45 19397 16235 15502<br />

17.5496 10.53 9.38 10.67 11053 10938 11067<br />

16.0653 9.24 6.90 1.91 10924 10690 10191<br />

15.2199 5.55 4.96 3.11 10555 10496 10311<br />

# Scheme Benchmark, ## Additional Benchmark, * As on start <strong>of</strong> period considered above.<br />

Past per<strong>for</strong>mance may or may not be sustained in future. Returns <strong>for</strong> dividend option would assume reinvestment <strong>of</strong> dividends<br />

declared, net <strong>of</strong> dividend distribution tax, if any, at <strong>the</strong> <strong>the</strong>n prevailing NAV. Load and Taxes are not considered <strong>for</strong> computation <strong>of</strong> returns.<br />

Total Schemes managed by Mr. Maneesh Dangi is 2. Refer annexure on page no. 52 to know more on per<strong>for</strong>mance <strong>of</strong> schemes managed by<br />

<strong>Fund</strong> Manager.<br />

Note:<br />

Standard Deviation is calculated on annualised basis<br />

using 1 year history <strong>of</strong> monthly returns, source: MFI $<br />

‘Direct Plan’ is only <strong>for</strong> investors who purchase /subscribe Units in a Scheme directly with <strong>the</strong> <strong>Mutual</strong> <strong>Fund</strong> and is not available<br />

Explorer.<br />

<strong>for</strong> investors who route <strong>the</strong>ir investments through a Distributor. For fur<strong>the</strong>r details, Investors are advised to refer to Addendum<br />

no. 44/2012 dated December 27, 2012 available on our website www.birlasunlife.com<br />

Top Ten Portfolio Holdings<br />

Issuer % to net Assets Rating Issuer % to net Assets Rating<br />

Power Finance Corporation Ltd. 7.78%<br />

[ICRA] AAA,<br />

CRISIL AAA<br />

Oriental Bank <strong>of</strong> Commerce 3.58% CRISIL A1+<br />

National Bank <strong>for</strong> Agriculture & Rural<br />

Development<br />

6.86% CRISIL AAA Indian Oil Corporation Ltd. 2.86% [ICRA] A1+<br />

Housing Development Finance Corporation Ltd. 5.59% CRISIL AAA Shriram Transport Finance Company Ltd. 2.84% CRISIL AA<br />

LIC Housing Finance Ltd. 4.15% CRISIL AAA IDBI Bank Ltd. 2.78% CRISIL AA+<br />

Andhra Bank 4.14% CARE A1+ Power Finance Corporation Ltd. 2.65% CRISIL A1+<br />

09

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Medium Term Plan<br />

What is it?<br />

An income scheme that aims to optimize<br />

returns by identifying mispriced credit<br />

opportunities in medium term securities in <strong>the</strong><br />

market and <strong>the</strong>n selectively investing in <strong>the</strong>m.<br />

SAVINGS SOLUTIONS<br />

Conservative Returns Low-Medium Risk 2 yrs+ High Liquidity<br />

<strong>Fund</strong> Details<br />

Rating Pr<strong>of</strong>ile <strong>of</strong> Portfolio<br />

As on January 31, <strong>2013</strong><br />

<strong>Fund</strong> Manager: Rohit Murarka<br />

Managing <strong>Fund</strong> Since: January 02, <strong>2013</strong><br />

Total Experience: 7 years<br />

Date <strong>of</strong> inception: March 25, 2009<br />

Nature <strong>of</strong> <strong>the</strong> scheme: An Open-ended Income<br />

Scheme<br />

22.16%<br />

12.72%<br />

36.04%<br />

NAV <strong>of</strong> Plans / Options (`)<br />

Regular Plan $<br />

Growth: 13.5623<br />

Quarterly Dividend: 10.2781<br />

Half Yearly Dividend: 10.6824<br />

Dividend: 10.8396<br />

Institutional Plan<br />

Growth: 13.1665<br />

Quarterly Dividend: 10.2523<br />

Half Yearly Dividend: 10.6844<br />

Direct Plan $<br />

Growth: 13.5656<br />

Quarterly Dividend: 10.2806<br />

Half Yearly Dividend: 10.6845<br />

Dividend: 10.8423<br />

Benchmark:<br />

CRISIL Short Term Bond<br />

<strong>Fund</strong> Index<br />

Load Structure (as % <strong>of</strong> NAV) (Incl. <strong>for</strong> SIP)<br />

Entry Load:<br />

Nil<br />

Exit Load**:<br />

For redemption / switch-out<br />

<strong>of</strong> units within 365 days<br />

from <strong>the</strong> date <strong>of</strong> allotment:<br />

2.00% <strong>of</strong> applicable NAV.<br />

For redemption / switchout<br />

<strong>of</strong> units after 365 days<br />

but be<strong>for</strong>e 730 days from<br />

<strong>the</strong> date <strong>of</strong> allotment: 1.00%<br />

<strong>of</strong> applicable NAV. For<br />

redemption / switch-out <strong>of</strong><br />

units after 730 days from <strong>the</strong><br />

date <strong>of</strong> allotment: Nil.<br />

**Exit Load is NIL <strong>for</strong><br />

units issued in Bonus &<br />

Dividend Reinvestment.<br />

O<strong>the</strong>r Parameter<br />

Modified Duration: 0.80 years<br />

Yield to Maturity: 10.12%<br />

Standard Deviation:<br />

Institutional Plan: 1.09%<br />

Date <strong>of</strong> Inception: Mar 25, 2009<br />

Since inception till<br />

December 31, 2012 (CAGR)<br />

29.08%<br />

AAA AA Below AA Cash & Current Assets<br />

Investment Per<strong>for</strong>mance - Regular Plan - Growth NAV as on December 31, 2012: ` 13.4487<br />

December 30, 2011 to<br />

December 31, 2012 (Absolute)<br />

December 31, 2010 to<br />

December 30, 2011 (Absolute)<br />

December 31, 2009 to<br />

December 31, 2010 (Absolute)<br />

NAV Per<br />

Unit. *<br />

(`)<br />

<strong>Birla</strong> <strong>Sun</strong><br />

<strong>Life</strong> Medium<br />

Term Plan<br />

(%)<br />

CRISIL<br />

Short Term<br />

Bond <strong>Fund</strong><br />

Index #<br />

(%)<br />

CRISIL 10<br />

Year Gilt<br />

Index ##<br />

(%)<br />

Value <strong>of</strong> Standard Investment <strong>of</strong> `<br />

10000 in<br />

<strong>Birla</strong><br />

<strong>Sun</strong> <strong>Life</strong><br />

Medium<br />

Term Plan<br />

(`)<br />

CRISIL<br />

Short Term<br />

Bond <strong>Fund</strong><br />

Index # (`)<br />

CRISIL 10<br />

Year Gilt<br />

Index ## (`)<br />

10.0000 8.17 6.98 4.60 13449 12898 11848<br />

12.1065 11.09 9.15 10.67 11109 10915 11067<br />

11.0697 9.37 7.84 1.91 10937 10784 10191<br />

10.4505 5.93 4.70 3.11 10593 10470 10311<br />

# Scheme Benchmark, ## Additional Benchmark, * As on start <strong>of</strong> period considered above.<br />

Past per<strong>for</strong>mance may or may not be sustained in future. Returns <strong>for</strong> dividend option would assume reinvestment <strong>of</strong> dividends<br />

declared, net <strong>of</strong> dividend distribution tax, if any, at <strong>the</strong> <strong>the</strong>n prevailing NAV. Load and Taxes are not considered <strong>for</strong> computation <strong>of</strong> returns.<br />

Total Schemes managed by Mr. Maneesh Dangi is 2. Refer annexure on page no. 52 to know more on per<strong>for</strong>mance <strong>of</strong> schemes managed by<br />

<strong>Fund</strong> Manager.<br />

Note:<br />

Standard Deviation is calculated on annualised basis<br />

using 1 year history <strong>of</strong> monthly returns, source: MFI<br />

Explorer.<br />

Top Portfolio Holdings<br />

$<br />

These Plan/Options continue <strong>for</strong> fresh subscriptions under <strong>the</strong> scheme. ‘Direct Plan’ is only <strong>for</strong> investors who purchase /<br />

subscribe Units in a Scheme directly with <strong>the</strong> <strong>Mutual</strong> <strong>Fund</strong> and is not available <strong>for</strong> investors who route <strong>the</strong>ir investments through<br />

a Distributor. For fur<strong>the</strong>r details, Investors are advised to refer to Addendum no. 44/2012 dated December 27, 2012 available<br />

on our website www.birlasunlife.com<br />

Issuer % to net Assets Rating Issuer % to net Assets Rating<br />

Andhra Bank 13.27% CARE A1+<br />

Floreat Investments Ltd(backed by<br />

guarantee <strong>of</strong> Shapoorji Pallonji & Co)<br />

5.84% [ICRA] AA+<br />

TRIL Infopark Ltd. 10.51% BWR A(SO) Tata Motors Finance Ltd. 5.56% CRISIL AA-<br />

Shapoorji Pallonji Infra Capital Co. Ltd 10.16% [ICRA] A1+ Piramal Enterprises Ltd. 4.54% [ICRA] A1+<br />

Jay Properties Ltd. 9.18% BWR A-(SO) Power Finance Corporation Ltd. 4.53% CRISIL A1+<br />

RHC Holding Private Ltd. 8.58% BWR A1(SO) Shriram Transport Finance Company Ltd. 4.09% CRISIL AA<br />

10

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Income Plus<br />

What is it?<br />

A fund that invests in a combination <strong>of</strong><br />

bonds and Government securities <strong>of</strong><br />

varying maturities from time to time with<br />

an aim to optimize returns.<br />

SAVINGS SOLUTIONS<br />

Moderate Returns Medium Risk 1 yr + High Liquidity<br />

<strong>Fund</strong> Details<br />

<strong>Fund</strong> Manager: Mr. Prasad Dhonde<br />

Managing <strong>Fund</strong> Since: January 11, 2010<br />

Total Experience: 11 years<br />

Date <strong>of</strong> inception: October 21, 1995<br />

Nature <strong>of</strong> <strong>the</strong> scheme: An Open-ended Income<br />

Scheme<br />

41.56%<br />

Rating Pr<strong>of</strong>ile <strong>of</strong> Portfolio<br />

2.14% 0.89%<br />

As on January 31, <strong>2013</strong><br />

NAV <strong>of</strong> Plans / Options (`)<br />

Regular Plan<br />

Growth: 52.5955<br />

Quarterly Dividend: 12.6953<br />

Direct Plan $<br />

Growth: 52.6081<br />

Quarterly Dividend: 12.6984<br />

Benchmark:<br />

CRISIL Composite Bond<br />

<strong>Fund</strong> Index<br />

Load Structure (as % <strong>of</strong> NAV) (Incl. <strong>for</strong> SIP)<br />

Entry Load:<br />

Nil<br />

Exit Load:<br />

O<strong>the</strong>r Parameter<br />

Modified Duration: 3.56 years<br />

Yield to Maturity: 8.12%<br />

Standard Deviation: 2.16%<br />

For redemption / switch-out<br />

<strong>of</strong> units within 365 days<br />

from <strong>the</strong> date <strong>of</strong> allotment:<br />

1.00% <strong>of</strong> applicable NAV.<br />

For redemption / switch-out<br />

<strong>of</strong> units after 365 days from<br />

<strong>the</strong> date <strong>of</strong> allotment: Nil.<br />

Date <strong>of</strong> Inception: Oct 21, 1995<br />

Since inception till<br />

December 31, 2012 (CAGR)<br />

December 30, 2011 to<br />

December 31, 2012 (Absolute)<br />

December 31, 2010 to<br />

December 30, 2011 (Absolute)<br />

December 31, 2009 to<br />

December 31, 2010 (Absolute)<br />

NAV Per<br />

Unit. *<br />

(`)<br />

55.40%<br />

Sovereign AAA AA Cash & Current Assets<br />

Investment Per<strong>for</strong>mance - Growth NAV as on December 31, 2012: ` 51.6035<br />

<strong>Birla</strong> <strong>Sun</strong><br />

<strong>Life</strong> Income<br />

Plus (%)<br />

CRISIL<br />

Composite<br />

Bond <strong>Fund</strong><br />

Index #<br />

(%)<br />

CRISIL 10<br />

Year Gilt<br />

Index<br />

## (%)<br />

Value <strong>of</strong> Standard Investment <strong>of</strong> `<br />

10000 in<br />

<strong>Birla</strong><br />

<strong>Sun</strong> <strong>Life</strong><br />

Income<br />

Plus (`)<br />

CRISIL<br />

Composite<br />

Bond <strong>Fund</strong><br />

Index # (`)<br />

CRISIL 10<br />

Year Gilt<br />

Index<br />

## (`)<br />

10.0000 10.01 N/A N/A 51604 N/A N/A<br />

46.6158 10.70 9.38 10.67 11070 10938 11067<br />

43.0259 8.34 6.90 1.91 10834 10690 10191<br />

41.6981 3.18 4.96 3.11 10318 10496 10311<br />

# Scheme Benchmark, ## Additional Benchmark, * As on start <strong>of</strong> period considered above.<br />

Past per<strong>for</strong>mance may or may not be sustained in future. Returns <strong>for</strong> dividend option would assume reinvestment <strong>of</strong> dividends<br />

declared, net <strong>of</strong> dividend distribution tax, if any, at <strong>the</strong> <strong>the</strong>n prevailing NAV. Load and Taxes are not considered <strong>for</strong> computation <strong>of</strong> returns. When<br />

additional benchmark returns are not available, <strong>the</strong>y have not been shown.<br />

Total Schemes managed by Mr. Prasad Dhonde is 16. Refer annexure on page no. 52 to know more on per<strong>for</strong>mance <strong>of</strong> schemes managed by<br />

<strong>Fund</strong> Manager.<br />

Note:<br />

Standard Deviation is calculated on annualised basis<br />

using 1 year history <strong>of</strong> monthly returns, source: MFI<br />

Explorer.<br />

Top Ten Portfolio Holdings<br />

$<br />

‘Direct Plan’ is only <strong>for</strong> investors who purchase /subscribe Units in a Scheme directly with <strong>the</strong> <strong>Mutual</strong> <strong>Fund</strong> and is not available<br />

<strong>for</strong> investors who route <strong>the</strong>ir investments through a Distributor. For fur<strong>the</strong>r details, Investors are advised to refer to Addendum<br />

no. 44/2012 dated December 27, 2012 available on our website www.birlasunlife.com<br />

Issuer % to net Assets Rating Issuer % to net Assets Rating<br />

Government Of India 42.68% Sovereign 8.60% Kerala SDL 23-Jan-2023 4.61% Sovereign<br />

Indian Oil Corporation Ltd. 12.75% [ICRA] A1+ Corporation Bank 4.56% CRISIL A1+<br />

8.59% Andhra Pradesh SDL 23-Jan-2023 8.11% Sovereign ING Vysya Bank Ltd. 3.69% CRISIL A1+<br />

Bank <strong>of</strong> India 7.30% CRISIL A1+ Oriental Bank <strong>of</strong> Commerce 2.75% CRISIL A1+<br />

Bharat Petroleum Corporation Ltd. 5.47% CRISIL A1+ Tata Sons Ltd. 1.91% CRISIL AAA<br />

11